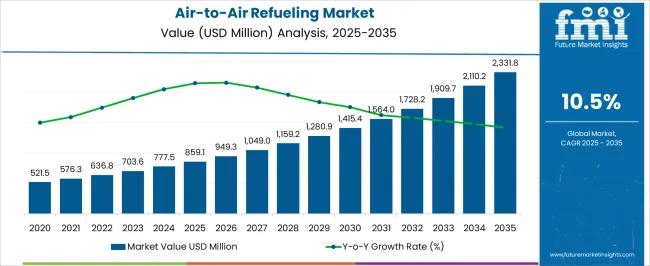

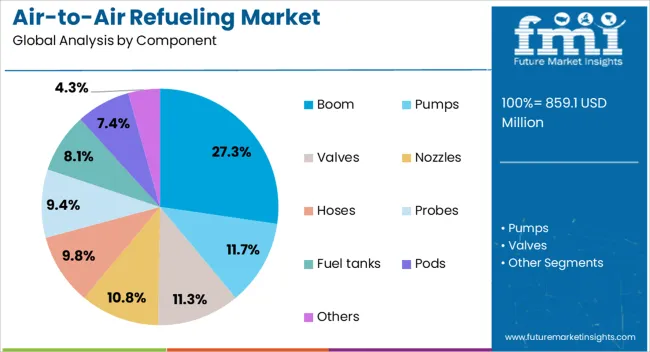

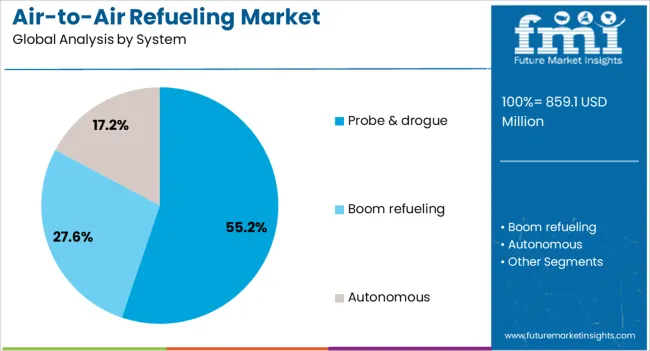

The global air-to-air refueling market is expected to expand from USD 859.1 million in 2025 to USD 2,331.8 million by 2035, reflecting a CAGR of 10.5%. Within this space, boom systems are projected to account for 27.3% of demand, while probe & drogue will remain the leading system type, capturing 55.2% of the market.

The absolute dollar opportunity in the air-to-air refueling market is expected to witness significant growth, with revenue projected to rise from USD 859.1 million in 2025 to USD 2,331.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 10.5%. This market expansion is largely driven by increasing demand for advanced air mobility solutions, particularly within military and defense sectors. As global defense budgets continue to grow and strategic defense collaborations become more prominent, air-to-air refueling is likely to be increasingly regarded as a critical capability. The expansion of this market is expected to be fueled by the rising need for enhanced operational range and combat readiness.

In the next decade, the demand for air-to-air refueling systems is projected to grow substantially. This growth is expected to stem from the rise in defense initiatives, geopolitical tensions, and the ongoing emphasis on improving military aircraft performance and endurance. Countries are anticipated to prioritize long-range mission capabilities, thus leading to more investments in aerial refueling systems. By 2035, air-to-air refueling is expected to be a vital component in both defense strategy and global military operations. This market, with its projected growth, underscores the importance of long-term strategic investments for aerospace and defense contractors in order to capitalize on the increasing demand for advanced aerial support technologies.

| Metric | Value |

|---|---|

| Air-to-Air Refueling Market Estimated Value in (2025 E) | USD 859.1 million |

| Air-to-Air Refueling Market Forecast Value in (2035 F) | USD 2331.8 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

The air-to-air refueling market is witnessing significant expansion, driven by the increasing demand for extended operational ranges and mission endurance in modern air forces. Rising geopolitical tensions, coupled with the need for rapid deployment capabilities, are pushing defense agencies to invest in advanced refueling systems. The growing use of multi-role aircraft and the modernization of legacy fleets are further increasing adoption rates.

Technological advancements in refueling systems, including automation, improved safety mechanisms, and compatibility with next-generation aircraft, are enhancing operational efficiency and reducing maintenance requirements. Global military alliances and joint exercises are boosting interoperability requirements, leading to the adoption of standardized refueling systems across multiple platforms.

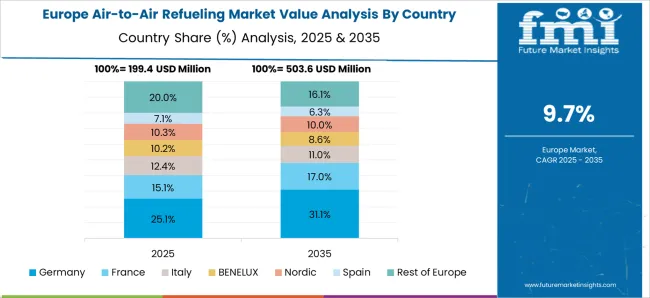

Procurement programs in regions such as North America, Europe, and Asia-Pacific are focused on improving in-flight refueling capabilities to support long-range missions without reliance on ground refueling infrastructure As airspace operations become more complex and mission profiles extend, the demand for reliable and adaptable air-to-air refueling solutions is set to grow steadily, supported by sustained defense budgets and strategic modernization initiatives.

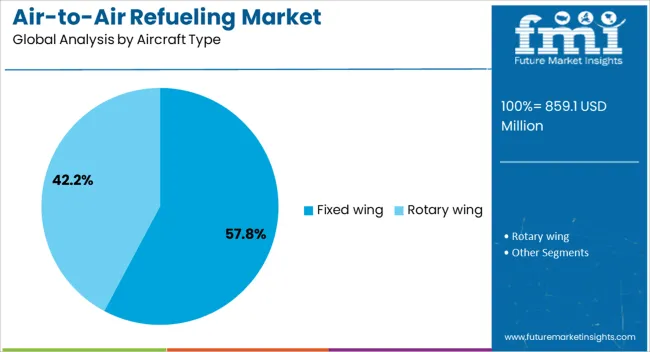

The air-to-air refueling market is segmented by component, system, aircraft type, type, end-use, and geographic regions. By component, air-to-air refueling market is divided into Boom, Pumps, Valves, Nozzles, Hoses, Probes, Fuel tanks, Pods, and Others. In terms of system, air-to-air refueling market is classified into Probe & drogue, Boom refueling, and Autonomous. Based on aircraft type, air-to-air refueling market is segmented into Fixed wing and Rotary wing. By type, air-to-air refueling market is segmented into Manned and Unmanned. By end-use, air-to-air refueling market is segmented into OEM and Aftermarket. Regionally, the air-to-air refueling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The boom component segment is projected to account for 27.3% of the air-to-air refueling market revenue share in 2025, securing its position as a critical segment within the industry. This dominance is being supported by its ability to deliver higher fuel transfer rates compared to alternative systems, enabling rapid refueling of large aircraft during missions. The boom’s precision-guided operation reduces the time required for in-flight refueling, enhancing operational efficiency and mission readiness.

Its design supports a wide range of fixed-wing aircraft, making it essential for air forces seeking rapid turnaround and extended flight duration capabilities. Modern booms are being equipped with advanced fly-by-wire controls and enhanced stability features, improving safety and ease of operation.

Increased investments in aerial tanker programs, especially for strategic transport and long-range bomber fleets, are contributing to the segment’s sustained demand As air operations become more reliant on rapid fuel delivery systems to support high-tempo missions, the boom segment is expected to remain a vital component in air-to-air refueling capabilities globally.

The probe and drogue system segment is expected to hold 55.2% of the air-to-air refueling market revenue share in 2025, making it the leading system type. This leadership is being driven by its versatility, ease of installation, and lower operational costs compared to boom systems. The probe and drogue method is widely used by both rotary-wing and fixed-wing aircraft, offering flexibility for diverse mission profiles and aircraft classes.

Its compact design allows for integration on smaller platforms, expanding refueling capabilities beyond large tanker aircraft. The system’s ability to operate under various environmental conditions, combined with its compatibility across multiple aircraft types, has reinforced its adoption in many air forces worldwide. Additionally, the probe and drogue system supports simultaneous refueling of multiple aircraft, enhancing operational tempo during combat and training missions.

Ongoing upgrades, such as stronger hose materials, improved reel systems, and advanced stabilization controls, are further boosting performance The cost-effectiveness, adaptability, and proven reliability of this system are expected to sustain its market dominance over the coming years.

The fixed wing aircraft type segment is anticipated to represent 57.8% of the air-to-air refueling market revenue share in 2025, maintaining its status as the dominant aircraft category. This segment’s leadership is supported by the critical role fixed wing platforms play in strategic and tactical missions, requiring extended range and endurance. Refueling capability allows these aircraft to operate over greater distances without landing, enhancing mission flexibility and effectiveness.

Military transport, surveillance, and fighter aircraft within this category benefit significantly from air-to-air refueling in terms of increased payload capacity and reduced dependency on forward operating bases. Modernization of existing fleets, coupled with procurement of advanced multi-role aircraft, is further driving demand for compatible refueling systems.

Technological advancements in receiver integration and compatibility across various tanker platforms are improving operational readiness The high utilization rate of fixed wing aircraft in both peacetime patrol and combat missions ensures sustained demand for air-to-air refueling capabilities, positioning this segment as a central contributor to market growth over the forecast period.

The air-to-air refueling market is growing, primarily driven by increasing demand from military aviation for extended operational ranges and enhanced endurance. Opportunities are emerging in the commercial sector, where refueling capabilities could optimize long-haul flights and autonomous operations. Technological advancements in automation and fuel management are enhancing system efficiency, but high costs and complex integration remain challenges. As defense budgets grow and technological innovations continue, the market outlook for air-to-air refueling systems remains optimistic, with new developments likely to expand the range of applications.

The air-to-air refueling market is experiencing steady growth driven by the increasing demand for military aviation operations that require extended range and endurance. Military forces globally are focusing on enhancing operational reach, especially for fighter jets, bombers, and surveillance aircraft. As geopolitical tensions rise, defense budgets are being allocated toward improving aerial refueling capabilities. Additionally, the shift toward more advanced aircraft that require complex refueling systems is expected to further drive market growth as nations invest in enhancing their military fleets.

Though traditionally associated with military applications, there is growing potential in the commercial and civil aviation sectors for air-to-air refueling systems. Commercial aircraft could leverage refueling capabilities for long-haul flights, especially for cargo aircraft, to reduce fuel consumption and operational costs. Additionally, the rise of autonomous aircraft for cargo and surveillance could create a new segment for air-to-air refueling. Developing these systems for commercial use offers significant growth opportunities as airlines and operators look to optimize fuel efficiency and expand operational flexibility.

Technological advancements in air-to-air refueling systems are driving the market forward. Developments in automated refueling systems, such as boom-based and probe-and-drogue technologies, are enhancing efficiency and reducing human error. Moreover, the integration of AI and machine learning to monitor refueling operations in real time is improving system safety and reducing downtime. The market is also witnessing innovations in fuel management and transfer systems, making it easier to operate under different environmental conditions. These advancements are expected to shape the future of aerial refueling.

The high cost of air-to-air refueling systems and the complexity of integration with existing aircraft platforms remain significant challenges in the market. Developing and maintaining such systems requires substantial investment, which may limit adoption, especially among smaller or less advanced military forces. Additionally, the integration of refueling systems with newer aircraft models requires sophisticated engineering and testing, leading to potential delays and added costs. Overcoming these barriers through cost-effective solutions and standardization will be crucial to making air-to-air refueling systems more accessible and efficient.

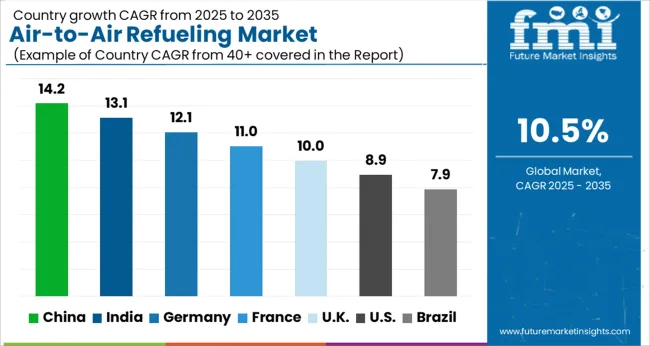

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

The global air-to-air refueling market is projected to grow at a 10.5% CAGR from 2025 to 2035. China leads with a growth rate of 14.2%, followed by India at 13.1%, and France at 11%. The United Kingdom records a growth rate of 10%, while the United States shows the slowest growth at 8.9%. These varying growth rates reflect the strategic defense priorities and technological advancements in each country. Emerging markets like China and India are experiencing higher growth due to military modernization and regional security concerns. Meanwhile, more developed markets like the USA and the UK are seeing steady growth supported by continued investments in military readiness and long-range operational capabilities. This report includes insights on 40+ countries; the top markets are shown here for reference.

The air-to-air refueling market in China is projected to grow at an impressive CAGR of 14.2%. China’s rapid advancements in military aviation and defense capabilities are key drivers of this growth. The increasing focus on enhancing the capabilities of China’s air force, along with its strategic efforts to extend the operational range of fighter jets and bombers, is creating strong demand for air-to-air refueling systems. China’s growing defense budget and the modernization of its military infrastructure, along with its increasing geopolitical interests, further contribute to the expansion of the air-to-air refueling market. Additionally, China’s efforts to develop indigenous refueling aircraft and systems are positioning the country as a leader in the regional market.

The air-to-air refueling market in India is projected to grow at a CAGR of 13.1%. India’s expanding defense budget and modernization of its military fleet, particularly its air force, are major factors contributing to the market growth. As India aims to enhance the operational capability of its fighter jets and extend the range of its military aircraft, the demand for air-to-air refueling systems is expected to rise. The country’s focus on securing strategic defense interests, along with its increasing collaboration with global defense manufacturers, is further boosting the demand for refueling technology. With regional security concerns and the need to improve defense readiness, India is expected to continue investing heavily in air-to-air refueling capabilities.

The air-to-air refueling market in France is projected to grow at a CAGR of 11%. France has long been a leader in defense technology, and its continued investments in military aviation modernization are driving demand for air-to-air refueling systems. The French air force's efforts to extend the range of its fighter jets, bombers, and reconnaissance aircraft are contributing to the growth of this market. France’s strategic defense initiatives, including its focus on enhancing its military capabilities for both national and NATO defense, are expected to further fuel the adoption of air-to-air refueling technology. Additionally, France’s role as a key player in European defense collaborations is strengthening its position in the global air-to-air refueling market.

The air-to-air refueling market in the United Kingdom is projected to grow at a CAGR of 10%. The UK is focusing on enhancing its military aviation capabilities and operational readiness, which is contributing to the growing demand for air-to-air refueling systems. As the UK strengthens its global defense posture and works within NATO frameworks, its need for long-range combat and surveillance aircraft continues to drive the adoption of refueling technologies. Furthermore, the UK's commitment to maintaining a competitive and technologically advanced military is expected to continue supporting growth in this sector, with particular focus on multi-role refueling aircraft.

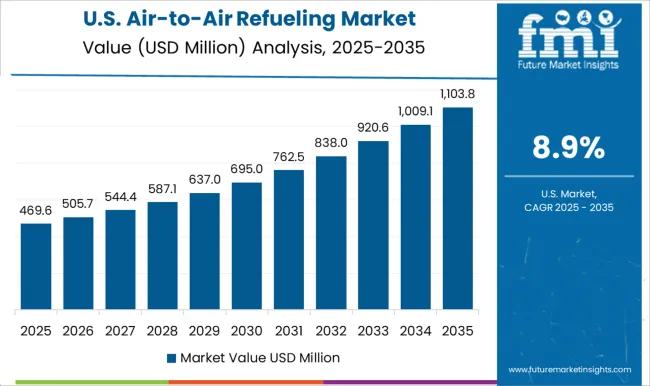

The air-to-air refueling market in the United States is projected to grow at a CAGR of 8.9%. The USA has the largest and most technologically advanced air force in the world, and the demand for air-to-air refueling systems remains strong as the military seeks to extend the operational range and combat effectiveness of its aircraft. The USA Air Force’s modernization plans, including the development of next-generation refueling aircraft, continue to fuel the growth of the air-to-air refueling market. Although the growth rate is slightly slower compared to emerging markets, the USA market remains a key player due to the sheer scale and technological sophistication of its air force.

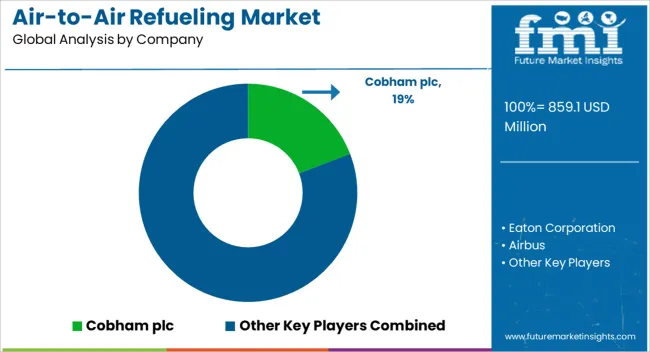

Leading companies in the air-to-air refueling market, such as Cobham plc, Eaton Corporation, and Airbus, have solidified their presence by providing advanced systems that enhance operational efficiency and safety for military and commercial aircraft. These players offer cutting-edge refueling solutions, focusing on the reliability and performance required for seamless fuel transfer during flight. Airbus and Boeing, with their global aviation leadership, have expanded their portfolios to include next-generation refueling technologies integrated into their aircraft, ensuring compatibility with various military and civilian platforms. By leveraging their extensive R&D capabilities and vast industry networks, these companies are setting the standard for air-to-air refueling systems, catering to a broad range of defense applications across the world.

Companies like GE Aviation, Parker Hannifin Corporation, and Safran have become key contributors to the market by developing fuel transfer systems, pumps, and nozzles that meet the rigorous demands of both military and commercial air operations. Their innovations in lightweight, high-performance components ensure higher fuel efficiency and operational readiness. These suppliers are focusing on improving system reliability, reducing maintenance costs, and extending service life to meet the strategic needs of air forces and other governmental entities. As defense spending continues to rise, particularly in regions with growing security concerns, these companies are positioned to capture significant market share. Despite increasing competition, maintaining leadership in air-to-air refueling will rely on ongoing advancements in technology, strong collaboration with defense contractors, and adaptability to evolving aerospace industry standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 859.1 Million |

| Component | Boom, Pumps, Valves, Nozzles, Hoses, Probes, Fuel tanks, Pods, and Others |

| System | Probe & drogue, Boom refueling, and Autonomous |

| Aircraft Type | Fixed wing and Rotary wing |

| Type | Manned and Unmanned |

| End-use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cobham plc, Eaton Corporation, Airbus, Boeing, GE Aviation, Parker Hannifin Corporation, and Safran |

| Additional Attributes | Dollar sales by system type (boom, hose-and-drogue) and platform (military, commercial) are key metrics. Trends include growing demand for advanced refueling technologies, increasing defense budgets, and expanding military fleets. Regional adoption patterns, geopolitical factors, and advancements in automation and safety systems are shaping the market's evolution. |

The global air-to-air refueling market is estimated to be valued at USD 859.1 million in 2025.

The market size for the air-to-air refueling market is projected to reach USD 2,331.8 million by 2035.

The air-to-air refueling market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in air-to-air refueling market are boom, pumps, valves, nozzles, hoses, probes, fuel tanks, pods and others.

In terms of system, probe & drogue segment to command 55.2% share in the air-to-air refueling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Refueling Hose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA