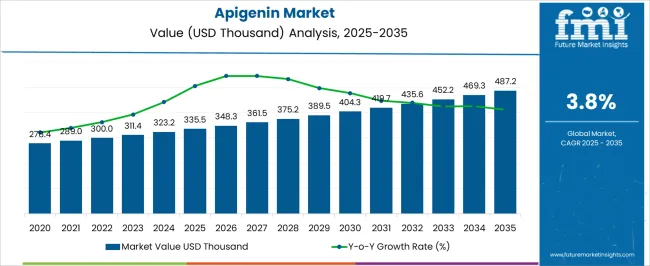

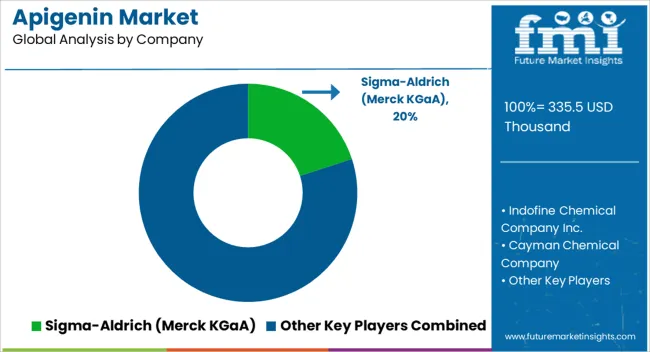

The apigenin market, valued at USD 335.5 thousand in 2025 and projected to reach USD 487.2 thousand by 2035 at a CAGR of 3.8%, is subject to strong regulatory influence across pharmaceuticals, nutraceuticals, and food applications. Given its bioactive properties, apigenin is closely monitored under frameworks governing natural compounds, botanical extracts, and dietary supplements. Regulatory approval processes such as GRAS (Generally Recognized as Safe) status in the United States and EFSA guidelines in Europe play a central role in shaping adoption, with compliance costs contributing to moderate but steady growth. The gradual rise from USD 335.5 thousand in 2025 to USD 389.5 thousand in 2029 reflects how early adoption is guided by well-defined safety parameters.

Stricter quality standards for purity, toxicity thresholds, and labeling requirements influence manufacturing practices, pushing producers to invest in validated extraction and standardization processes. Regional variation also impacts growth, with North America benefiting from a relatively clear nutraceutical regulatory pathway, while Europe applies more rigorous scrutiny that may slow adoption. By 2035, reaching USD 487.2 thousand, regulatory clarity is expected to encourage broader utilization in functional food and therapeutic formulations, though expansion remains controlled. The market trajectory is less about demand limitation and more about regulatory-driven compliance shaping industry pace and innovation pathways.

| Metric | Value |

|---|---|

| Apigenin Market Estimated Value in (2025 E) | USD 335.5 thousand |

| Apigenin Market Forecast Value in (2035 F) | USD 487.2 thousand |

| Forecast CAGR (2025 to 2035) | 3.8% |

The apigenin market represents a focused segment within the global nutraceuticals, pharmaceuticals, and plant-derived bioactive compounds industry, emphasizing health benefits, natural extraction, and therapeutic applications. Within the broader flavonoid and polyphenol compounds sector, it accounts for about 5.1%, driven by demand in dietary supplements and herbal formulations. In the pharmaceutical ingredients and natural therapeutics segment, it holds nearly 4.6%, reflecting applications in anti-inflammatory, antioxidant, and anticancer research. Across the functional food and beverage additives market, the share is 4.0%, supporting integration into fortified products for health-conscious consumers.

Within the cosmetic and personal care bioactive category, it represents 3.5%, highlighting use in anti-aging, skin protection, and hair care formulations. In the agricultural and botanical extracts sector, it secures 3.2%, emphasizing use as a plant-derived compound for wellness and preventive healthcare applications. Recent developments in this market have focused on extraction efficiency, formulation enhancement, and clinical validation. Innovations include advanced extraction techniques such as supercritical fluid extraction and enzymatic hydrolysis, enabling higher purity and yield. Key players are collaborating with pharmaceutical firms, nutraceutical brands, and cosmetic manufacturers to expand product portfolios and clinical applications.

Adoption of encapsulation technologies for improved bioavailability, standardized formulations for consistent efficacy, and natural product certifications is gaining traction. The research initiatives on apigenin’s role in cardiovascular health, neuroprotection, and metabolic regulation are strengthening its scientific foundation.

The demand for natural flavonoids like Apigenin is rising, driven by growing consumer preference for plant-based bioactive compounds with antioxidant and anti-inflammatory properties. In addition, ongoing research highlighting Apigenin’s potential therapeutic benefits is influencing market expansion.

Investments in nutraceuticals and functional foods, along with rising awareness about preventive healthcare, are shaping the future outlook of the market. Furthermore, improvements in extraction and formulation technologies are enabling higher purity and better bioavailability, supporting broader applications.

The market is also influenced by regulatory support for natural ingredients in wellness products. As consumers globally continue to seek safer and more natural alternatives to synthetic compounds, Apigenin is anticipated to maintain strong demand across pharmaceutical, cosmetic, and healthcare sectors, creating promising growth opportunities.

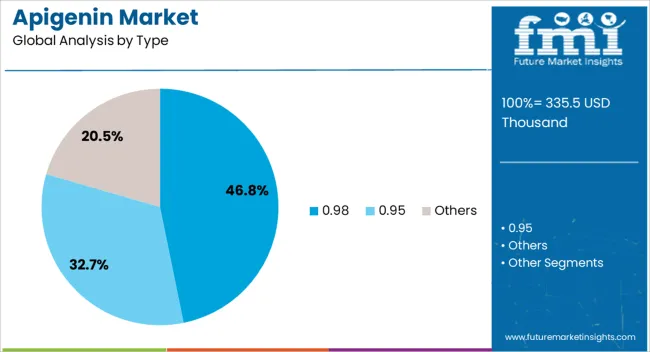

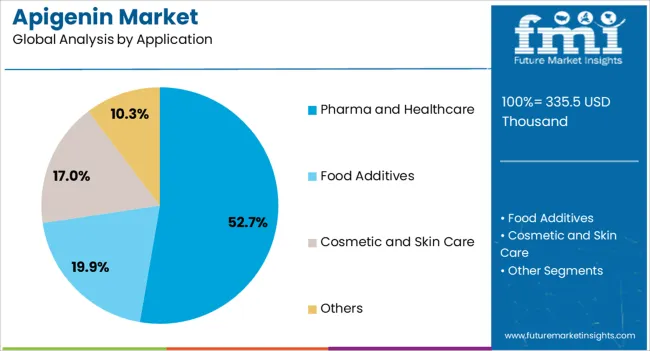

The apigenin market is segmented by type, application, and geographic regions. By type, apigenin market is divided into 0.98, 0.95, and Others. In terms of application, apigenin market is classified into Pharma and Healthcare, Food Additives, Cosmetic and Skin Care, and Others. Regionally, the apigenin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the Apigenin market, the segment representing pure Apigenin is projected to hold approximately 46.8% of revenue share in 2025. This leading position is attributed to the high demand for Apigenin in its pure form, which allows for precise dosing and efficacy in pharmaceutical formulations.

The pure type is preferred in healthcare applications where controlled bioactive content is critical. The growth of this segment is supported by advancements in extraction and purification methods that increase product consistency and safety.

Additionally, the use of pure Apigenin in clinical research and drug development contributes to its dominance. The ability to incorporate pure Apigenin into supplements and topical products without compromising stability further strengthens this segment’s market share.

The Pharma and Healthcare application segment is expected to hold the largest share at approximately 52.7% in 2025. This dominance is driven by the expanding use of Apigenin in pharmaceutical formulations targeting inflammation, cancer, and neurodegenerative diseases.

The segment’s growth is fueled by rising interest in natural compounds with therapeutic potential and minimal side effects. Increasing clinical studies supporting Apigenin’s efficacy in disease prevention and management have heightened its acceptance in healthcare.

Additionally, growing investments in research and development, along with demand for natural ingredients in preventive medicine, are further stimulating this segment. The integration of Apigenin into various healthcare products, including nutraceuticals, dietary supplements, and topical treatments, supports its leading market position and future growth potential.

The market has been shaped by its rising recognition as a plant-derived flavonoid with notable health benefits. Apigenin, found in chamomile, parsley, celery, and other natural sources, has been studied for its anti-inflammatory, antioxidant, and anticancer properties. Increasing interest in natural dietary supplements and plant-based therapeutic ingredients has strengthened their application in pharmaceuticals, nutraceuticals, cosmetics, and functional foods.

Consumer demand for chemical-free and biologically active compounds continues to fuel expansion. The growing research on apigenin’s role in chronic disease management and wellness solutions has positioned it as a compound of interest for industries seeking innovative natural alternatives.

The demand for nutraceuticals and functional foods has encouraged wider adoption of apigenin as a bioactive compound. Manufacturers of dietary supplements incorporate apigenin due to its potential to support immune health, cardiovascular function, and anti-inflammatory response. Functional food products, including beverages, health bars, and fortified cereals, are increasingly being enriched with plant flavonoids, among which apigenin stands out for its natural origins and research-backed benefits. Rising consumer inclination toward preventive healthcare has accelerated interest in such compounds. The preference for natural extracts over synthetic additives reinforces apigenin’s role in functional nutrition, where its combination of safety and efficacy makes it attractive to both producers and end users.

Pharmaceutical research has highlighted apigenin’s potential in cancer therapy, neuroprotection, and metabolic disorder treatment. Studies indicate that apigenin may inhibit tumor growth, improve neuronal health, and regulate blood sugar levels, making it a candidate for novel drug formulations. Clinical investigations have encouraged pharmaceutical companies to explore apigenin as an adjunct to conventional therapies or as a base for innovative treatments. Its natural origin supports its appeal in drug discovery efforts focused on plant-derived compounds. Regulatory bodies are showing greater acceptance of bioactive plant extracts, further expanding their medical relevance. This focus on pharmaceutical applications is expected to remain a critical driver of market growth.

Cosmetic manufacturers have integrated apigenin into skincare and personal care products due to its antioxidant and anti-aging properties. Topical formulations containing apigenin are valued for their ability to reduce oxidative stress, protect against UV-induced skin damage, and improve overall skin health. Rising consumer demand for herbal and plant-based cosmetics supports this trend, as brands promote natural extracts for safe and effective skin solutions. Apigenin is used in creams, serums, sunscreens, and anti-inflammatory products targeting sensitive skin. The clean-label and natural beauty movement has accelerated the incorporation of botanical ingredients, positioning apigenin as a promising component in modern cosmetic innovations.

The growth of the market faces challenges linked to raw material sourcing, extraction processes, and cost efficiency. Natural sources such as chamomile and parsley provide limited yields, necessitating advanced extraction and purification techniques to achieve commercial-scale production. High costs associated with processing and standardization limit affordability for large-scale applications. Variability in raw material quality due to agricultural conditions also impacts supply consistency.

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

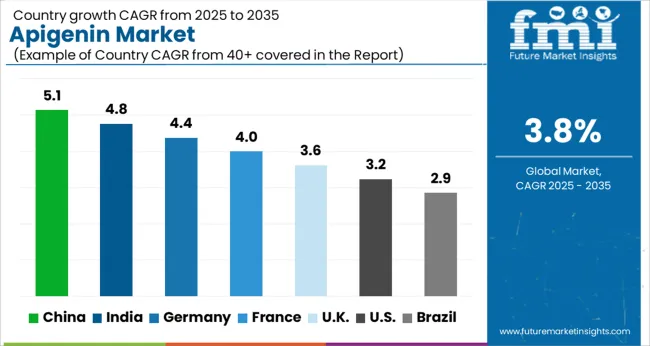

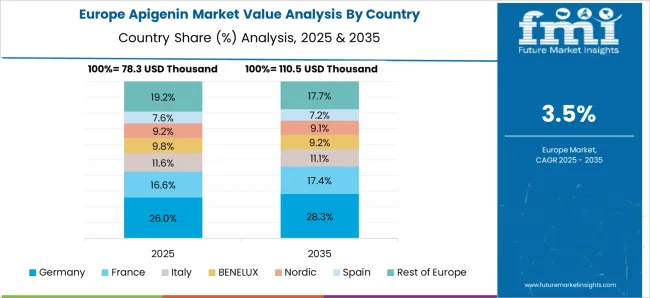

The market is forecast to register a CAGR of 3.8% between 2025 and 2035, shaped by its growing application in nutraceuticals, pharmaceuticals, and functional food formulations. India reported 4.8% CAGR, supported by rising herbal supplement production and pharmaceutical integration. Germany followed with 4.4% CAGR, where strong research focus on flavonoid applications enhanced adoption. China led globally at 5.1%, driven by large-scale botanical extraction facilities and strong demand in traditional medicine and health products. The United Kingdom recorded 3.6%, supported by increasing consumer interest in natural health compounds, while the United States stood at 3.2%, reflecting steady uptake across dietary supplements and wellness products. These regions demonstrate how diverse adoption strategies and production strengths are shaping the trajectory of the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 5.1%, supported by increasing demand for plant derived flavonoids in pharmaceuticals, nutraceuticals, and cosmetic applications. Adoption has been reinforced by rising investments in herbal extracts, research into antioxidant benefits, and expanding use in dietary supplements. Domestic producers focus on cost efficient extraction techniques using chamomile and parsley sources, while export opportunities continue to strengthen due to global demand. Market expansion is further aided by supportive regulations favoring plant based bioactive compounds.

India is projected to expand at a CAGR of 4.8%, driven by demand for natural flavonoids in Ayurvedic medicines, dietary supplements, and skincare products. Adoption has been reinforced by increasing awareness of apigenin’s anti-inflammatory and antioxidant properties. Local producers focus on extraction from plant sources like chamomile, celery, and parsley, catering to both domestic consumption and export. Market prospects are also supported by government encouragement of herbal ingredients and growing popularity of plant based therapies across health and wellness sectors.

Germany is estimated to grow at a CAGR of 4.4%, supported by advanced research in flavonoid applications and rising adoption in functional foods, cosmetics, and pharmaceuticals. Adoption has been reinforced by consumer demand for plant based active ingredients and regulatory acceptance of bioactive compounds in supplements. Domestic companies focus on high purity extraction technologies and clinical studies validating apigenin benefits. The country also remains an important hub for imports of apigenin from China and India to meet rising domestic demand.

The United Kingdom market is forecast to grow at a CAGR of 3.6%, influenced by increased integration of apigenin in nutraceuticals, herbal supplements, and cosmetic formulations. Adoption has been reinforced by consumer interest in natural antioxidants and demand for preventive health solutions. Imports from China and India play a central role in meeting local requirements, as domestic production remains limited. Market prospects are strengthened by the trend toward clean label products and preference for natural plant extracts across the wellness industry.

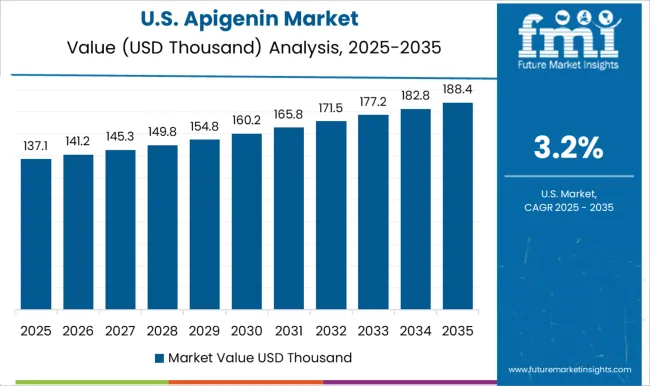

The market in the United States is anticipated to grow at a CAGR of 3.2%, driven by consumer preference for natural bioactive compounds in dietary supplements, functional beverages, and skincare products. Adoption has been reinforced by ongoing clinical studies on apigenin’s health benefits, including anti-inflammatory and antioxidant properties. Market demand is met by imports from China and India, while local companies focus on distribution, formulation, and branding. Growth is expected to remain steady as natural flavonoids continue to gain wider acceptance in preventive healthcare.

The market features a moderately consolidated structure with a mix of global chemical suppliers, specialized phytochemical producers, and research-oriented companies. Sigma-Aldrich (Merck KGaA) remains a leading force with its wide distribution network, high-quality analytical-grade compounds, and integration into global research supply chains. Indofine Chemical Company Inc., Cayman Chemical Company, and TCI Chemicals play important roles in providing apigenin for pharmaceutical research, nutraceutical applications, and biochemical studies, leveraging strong catalog portfolios and technical expertise.

Companies such as ChemFaces, Extrasynthese, BioBioPha Co., Ltd., and Ark Pharm, Inc. focus on botanical extracts, natural compound isolation, and custom synthesis services. These firms maintain competitiveness through specialization in natural flavonoids, high-purity compounds, and tailored solutions for drug discovery and nutraceutical industries. Their strategies often include expanding extraction capabilities, offering flexible quantities for laboratory and commercial use, and maintaining compliance with stringent research standards. The competitive outlook is shaped by growing demand for apigenin in functional foods, dietary supplements, and oncology research, which has encouraged players to prioritize innovation, cost-efficient production, and partnerships with pharmaceutical and nutraceutical developers. Companies that can balance scalability with product quality and research-grade precision are expected to achieve stronger positioning in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 335.5 Thousand |

| Type | 0.98, 0.95, and Others |

| Application | Pharma and Healthcare, Food Additives, Cosmetic and Skin Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sigma-Aldrich (Merck KGaA), Indofine Chemical Company Inc., Cayman Chemical Company, TCI Chemicals, ChemFaces, Extrasynthese., BioBioPha Co., Ltd., and Ark Pharm, Inc. |

| Additional Attributes | Dollar sales by apigenin grade and application, demand dynamics across pharmaceuticals, nutraceuticals, and cosmetics sectors, regional trends in flavonoid ingredient adoption, innovation in extraction methods, formulation stability, and bioavailability, environmental impact of plant sourcing and processing, and emerging use cases in anti-inflammatory therapies, dietary supplements, and skin health products. |

The global apigenin market is estimated to be valued at USD 335.5 thousand in 2025.

The market size for the apigenin market is projected to reach USD 487.2 thousand by 2035.

The apigenin market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in apigenin market are 0.98, 0.95 and others.

In terms of application, pharma and healthcare segment to command 52.7% share in the apigenin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA