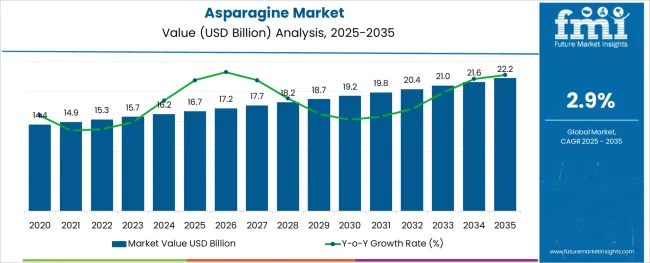

The Asparagine Market is estimated to be valued at USD 16.7 billion in 2025 and is projected to reach USD 22.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

The asparagine market is witnessing stable growth as industries seek amino acid-based solutions for nutritional and functional applications. A noticeable rise in demand from the food and beverage sector has been driving the usage of asparagine in flavor enhancement and protein enrichment processes. Research publications and product developments have reflected the expanding application of asparagine in baked goods, nutritional formulations, and dietary supplements.

Additionally, manufacturers are developing asparagine products that align with clean-label trends and plant-based ingredient preferences. With the growing emphasis on food safety and quality, the use of purified forms of amino acids like asparagine is steadily increasing across global markets.

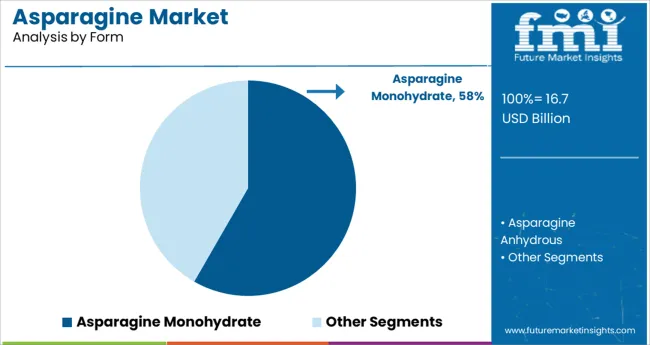

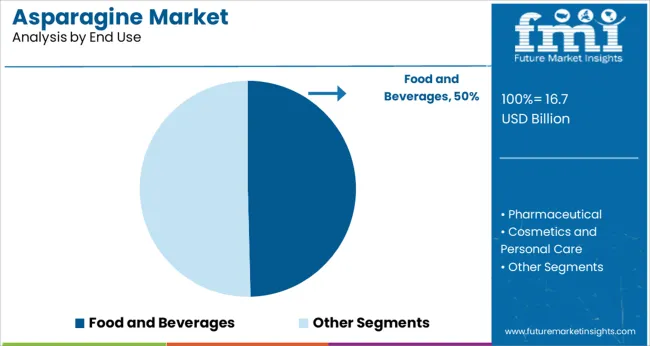

Future growth is expected to be supported by further expansion in processed food categories and innovations in specialty nutrition segments. Segmental demand is forecasted to be dominated by Asparagine Monohydrate in form and the Food and Beverages sector in end use, reflecting the growing integration of amino acids in mainstream food production and formulation processes.

The market is segmented by Form and End Use and region. By Form, the market is divided into Asparagine Monohydrate and Asparagine Anhydrous. In terms of End Use, the market is classified into Food and Beverages, Pharmaceutical, Cosmetics and Personal Care, and Dietary Supplements.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Asparagine Monohydrate segment is projected to contribute 58.3% of the asparagine market revenue in 2025, positioning itself as the leading form. This growth has been attributed to the high solubility and stability of asparagine monohydrate, which makes it suitable for a wide range of food and pharmaceutical formulations. Manufacturers have widely adopted this form due to its ease of handling and efficient incorporation into liquid and solid product formats.

Nutritional studies have highlighted its functional role in protein synthesis and energy metabolism, further supporting its application in health and wellness products. Additionally, as consumer interest in amino acid-enriched food products grows, the demand for asparagine monohydrate has expanded across different product categories.

As the food and pharma industries continue to prioritize ingredient efficiency and formulation compatibility, the Asparagine Monohydrate segment is expected to maintain its leadership in the market.

The Food and Beverages segment is projected to hold 49.6% of the asparagine market revenue in 2025, reinforcing its leadership as the key end use sector. This segment has seen rapid expansion due to the increasing utilization of amino acids in flavor enhancement, nutritional fortification, and functional ingredient applications. Food manufacturers have incorporated asparagine into bakery products, ready-to-eat meals, and beverages to improve protein content and overall nutritional profiles.

As consumer preferences shift toward health-conscious eating, the use of asparagine in plant-based foods and protein supplements has gained momentum. Additionally, ongoing product innovation in sports nutrition and functional foods has further expanded its application scope.

With continued growth in the processed food sector and increasing consumer awareness of functional ingredients, the Food and Beverages segment is expected to remain the primary driver of asparagine market demand.

The global asparagine market is positively influenced by several factors such as increasing demand for asparagine in food and beverages industry. In Asia and Middle East and Africa there is a rapid increase in use of cosmetics and personal care products.

The asparagine market growth factors include increasing demand from pharmaceutical industry, food and beverage industry, and dietary supplement owing to its use in several applications such as emulsifiers and flavour enhancers. Besides, there is an increasing demand for asparagine application in beverage products is also boosting the growth of the global market.

Asparagine has a significant role in the metabolic control of cell functions in the brain tissues and nerve cells. The demand for asparagine is surging as it is one of the crucial compounds for producing enzymes, proteins, and muscle tissues. Asparagine supplements are said to stabilize and balance our nervous system.

Asparagine is also a crucial diuretic and is used in treating premenstrual water, rheumatism, and swelling. Considering the several health benefits from consuming supplements, the demand for dietary and health supplements in significantly increasing. The global asparagine marker is constantly growing due to its application in such health supplements.

The growth rate of asparagine is supported by its use as an additive in the food products. The demand for asparagine as a food additive is primarily observed in Japan. Higher consumption of processed food and beverage products across the world is resulting in increased demand for preservative and food additives in the market. This leads to better market opportunities for asparagine as a food additive and thus propels the global asparagine market.

Parallelly, market manufacturers face challenges such as stringent regulations on additives and ingredients that are used in the manufacturing process. This could force them to reduce their production capacities and/or stop the complete process.

Of all the key regions, North America is anticipated to dominate with a huge market share of asparagine and will continue to sustain during the forecast period. Greater consumption of dietary and health supplements in North America is leading to more consumption of asparagine. Following North America is the Europe region to gain market dominance owing to a greater health-conscious population.

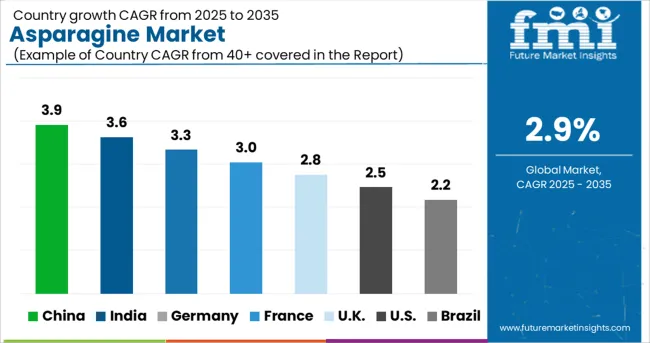

The Asia Pacific is said to experience the highest growth rate in the global asparagine market share. Globally, China is presently one of the leading countries that produce asparagine due to the availability of raw materials such as corn starch on a large scale.

Chinese companies that manufacture asparaginase enzymes are witnessing higher demand on a huge scale, offering low prices. Furthermore, rising income in the middle-class population and increasing GDP lead to the rising demand for consumer products, thereby creating a lucrative prospect in the global asparagine market.

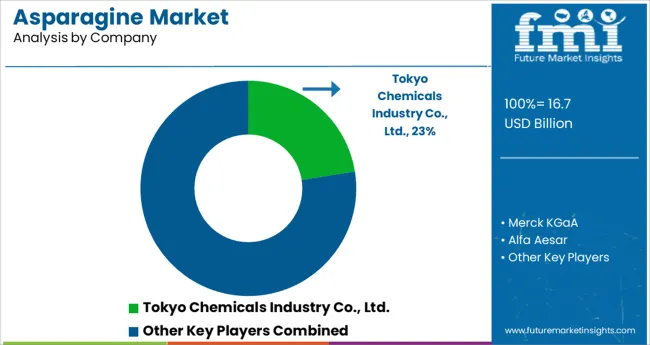

A few of the key players in the asparagine market include Tokyo Chemicals Industry Co., Ltd., Merck KGaA, Alfa Aesar, Angus Chemical Company, Avantor Inc., Evonik Industries AG, LGC Limited, MP Biomedicals, Duchefa Biochemie, Jiangsu Jiecheng Bioengineering Co., Ltd., Wuhan Soleado Technology Co., Ajinomoto Group, and Amino GmbH.

In June 2025, Evonik invested USD 220 million in partnership with the United States government to build a new pharmaceutical lipid production facility for mRNA-based therapies in the USA

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Form, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Tokyo Chemicals Industry Co., Ltd.; Merck KGaA; Alfa Aesar; Angus Chemical Company; Avantor Inc.; Evonik Industries AG; LGC Limited; MP Biomedicals; Duchefa Biochemie; Jiangsu Jiecheng Bioengineering Co., Ltd.; Wuhan Soleado Technology Co.; Ajinomoto Group; Amino GmbH |

| Customization | Available Upon Request |

The global asparagine market is estimated to be valued at USD 16.7 billion in 2025.

It is projected to reach USD 22.2 billion by 2035.

The market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types are asparagine monohydrate and asparagine anhydrous.

food and beverages segment is expected to dominate with a 49.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA