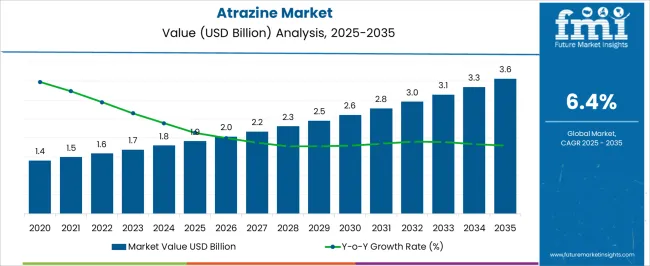

The atrazine market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. The atrazine market is projected to generate an absolute dollar opportunity of USD 1.7 billion over the forecast period. This growth is supported by a CAGR of 6.4%, driven by the rising demand for effective herbicides in agriculture to control broadleaf weeds in crops such as corn and sugarcane. In the first five-year phase (2025–2030), the market is expected to grow from USD 1.9 billion to USD 2.8 billion, adding USD 0.9 billion, which accounts for 52.9% of the total incremental growth, driven by increasing agricultural practices, demand for higher crop yield, and advances in pesticide formulation.

The second phase (2030–2035) will contribute USD 0.8 billion, representing 47.1% of the total growth, as the global adoption of efficient herbicide solutions continues. Annual increments will rise from USD 0.1 billion in early years to USD 0.2 billion by 2035, driven by technological advancements in agrochemicals, regulatory developments, and the growing need for crop protection solutions in emerging economies. Manufacturers focusing on effective, sustainable, and environmentally friendly formulations will capture the largest share of this USD 1.7 billion opportunity.

| Metric | Value |

|---|---|

| Atrazine Market Estimated Value in (2025 E) | USD 1.9 billion |

| Atrazine Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The compound's affordability, long residual action, and compatibility with various cropping systems have made it a staple in integrated weed management strategies. Regulatory acceptance in several major farming regions and the need to ensure yield stability in staple crops are supporting continued demand. Moreover, the growing emphasis on efficient herbicide use, especially in conservation tillage and no-till farming practices, is reinforcing atrazine's market presence.

As food security concerns intensify and farmers seek cost-effective solutions to protect crop output, the market is expected to remain robust across both developed and developing agricultural economies.

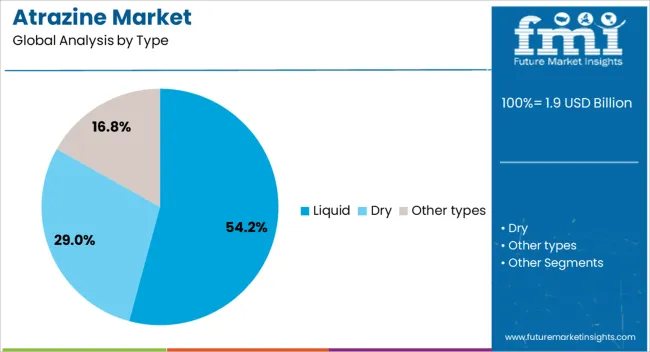

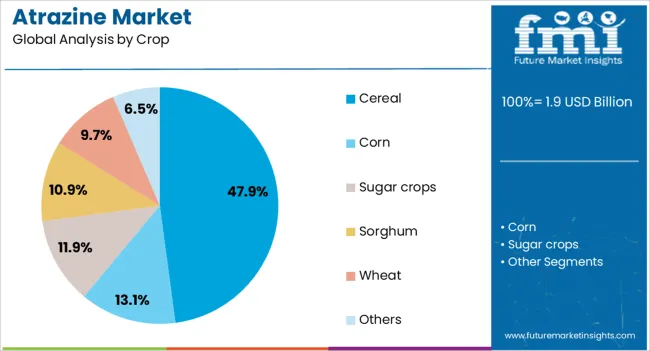

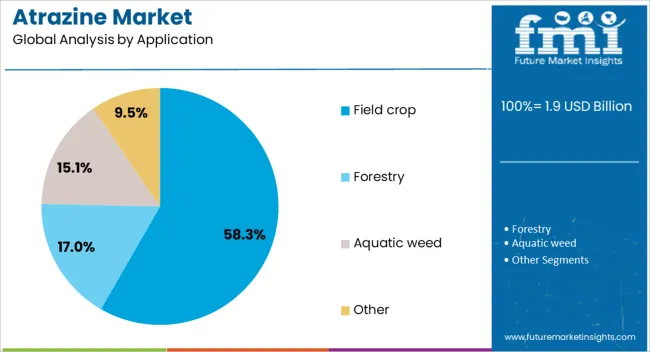

The atrazine market is segmented by type, crop, application, and geographic regions. By type, the atrazine market is divided into Liquid, Dry, and Other types. In terms of crop, the atrazine market is classified into Cereal, Corn, Sugar crops, Sorghum, Wheat, and Others. Based on application, the atrazine market is segmented into Field crop, Forestry, Aquatic weed, and Other. Regionally, the atrazine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid segment is expected to account for 54.20% of the total market by 2025 within the type category, emerging as the leading form of atrazine. This is due to its ease of handling, faster absorption, and superior dispersion in field applications.

Liquid formulations offer better coverage, reduced preparation time, and compatibility with modern spray equipment, making them preferred in large-acreage farms. Additionally, liquid atrazine allows for more precise dosage control, reducing environmental runoff risks and enhancing application efficiency.

The convenience and operational advantages provided by liquid atrazine have contributed significantly to its strong market positioning across various geographies.

The cereal crop segment is projected to capture 47.90% of the total market revenue by 2025 under the crop category, making it one of the most prominent areas of atrazine use. Cereal production, including crops like maize and sorghum, faces high weed pressure that directly impacts yield potential.

Atrazine's pre-emergence and post-emergence effectiveness in these crops has made it an essential input for growers aiming to maximize productivity. Its use has been widely adopted due to its reliability, broad spectrum efficacy, and cost efficiency.

As cereal crops continue to form the backbone of global food security, the consistent demand for targeted weed control solutions is supporting this segment’s leadership.

The field crop segment is expected to represent 58.30% of total market revenue by 2025 under the application category, making it the dominant area of use. Atrazine’s broad utility in open field conditions, particularly in row crops and extensive farming systems, has driven its widespread acceptance.

The herbicide’s ability to control diverse weed types in varying soil and climate conditions supports its versatility in field crop scenarios. Moreover, its compatibility with other herbicides in tank mix applications enhances its value in resistance management programs.

The high acreage and recurrent need for effective weed suppression across field crops such as corn and sugarcane contribute to the segment’s strong market share and continued dominance.

The atrazine market is driven by rising demand for effective herbicides, particularly in agriculture, and expanding opportunities in developing regions. Emerging trends in regulatory pressure and the shift toward sustainable agricultural practices are reshaping the market, while challenges related to environmental concerns and restrictions remain significant. By 2025, overcoming these challenges through innovation in sustainable formulations and compliance with stricter regulations will be crucial for maintaining market growth and ensuring atrazine's role in agricultural productivity.

The atrazine market is witnessing growth due to the increasing demand for effective herbicides in agricultural applications. Atrazine is widely used for weed control in crops such as corn, sugarcane, and sorghum. With the need to enhance crop yield and protect against invasive weed species, atrazine remains a key solution for farmers. As global agricultural production intensifies to meet food demands, the market for herbicides like atrazine is projected to grow. By 2025, the demand for atrazine-based herbicides will continue to rise as more regions expand their agricultural activities.

Opportunities in the atrazine market are growing with the expansion of agricultural practices in developing regions. As emerging markets in Asia, Africa, and Latin America experience increased agricultural activity, the need for herbicides like atrazine is expected to rise. The adoption of modern farming techniques and the growing emphasis on maximizing crop yield will drive demand for effective weed control solutions. By 2025, the market will see significant growth in these regions, offering substantial opportunities for atrazine suppliers to expand their reach.

Emerging trends in the atrazine market include increasing regulatory pressure and the shift toward sustainable agricultural practices. Governments worldwide are focusing on reducing the environmental impact of chemical herbicides, which has led to stricter regulations on the use of atrazine. This has prompted manufacturers to innovate and develop more environmentally friendly formulations. By 2025, the trend toward sustainable farming and regulatory compliance will drive demand for atrazine alternatives, although atrazine's effectiveness in controlling weeds ensures its continued presence in many agricultural markets.

Despite growth, the atrazine market faces challenges from environmental concerns and regulatory restrictions. The persistence of atrazine in soil and water has raised concerns about its potential impact on ecosystems and human health. Several countries have imposed restrictions on its use, limiting its availability and application. As environmental regulations become more stringent, manufacturers are under pressure to adapt to these restrictions. By 2025, finding alternatives and addressing these regulatory concerns will be crucial for the future of the atrazine market.

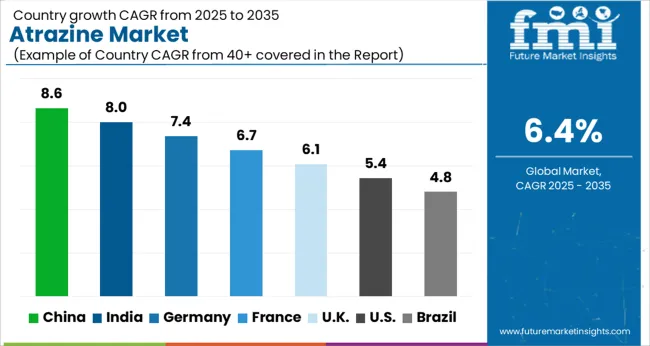

The global atrazine market is projected to grow at a 6.4% CAGR from 2025 to 2035. China leads with a growth rate of 8.6%, followed by India at 8%, and Germany at 7.4%. The United Kingdom records a growth rate of 6.1%, while the United States shows the slowest growth at 5.4%. These varying growth rates are driven by factors such as increasing demand for crop protection solutions in the agriculture sector, the need for effective herbicides, and rising awareness about agricultural productivity and food security. Emerging markets like China and India are experiencing higher growth due to their expanding agricultural sectors, increasing food production needs, and government support for crop protection chemicals, while more mature markets like the USA and the UK see steady growth due to advancements in agronomic practices, regulatory standards, and sustainable agricultural practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The atrazine market in China is growing rapidly, with a projected CAGR of 8.6%. China’s massive agricultural sector, driven by increasing food production needs, is fueling the demand for effective herbicides like atrazine. The country’s focus on improving crop yields, reducing pest damage, and enhancing food security is contributing to the adoption of atrazine in various crop protection applications. China’s government policies supporting agricultural modernization, along with rising investments in crop protection technologies, are accelerating market growth. Additionally, the growing focus on sustainable farming practices and the adoption of precision agriculture techniques are contributing to the market expansion.

The atrazine market in India is projected to grow at a CAGR of 8%. India’s rapidly growing agricultural sector, fueled by the increasing need for higher crop yields and protection from weeds, is driving the demand for herbicides like atrazine. The country’s expanding agricultural base, combined with rising investments in crop protection technologies, is further contributing to market growth. Additionally, government policies that focus on improving agricultural productivity, reducing crop losses, and ensuring food security are accelerating the adoption of effective herbicides. India’s growing population and increasing demand for food also contribute to the rising need for crop protection solutions.

The atrazine market in Germany is projected to grow at a CAGR of 7.4%. Germany’s well-established agricultural industry, along with increasing demand for crop protection solutions in both conventional and organic farming, is driving steady market growth. The country’s focus on sustainability, integrated pest management, and the need for effective herbicides is contributing to the demand for atrazine. Additionally, Germany’s regulatory standards that promote the use of safe and environmentally friendly crop protection solutions further accelerate the adoption of atrazine. Investments in precision farming and the increasing need to address agricultural challenges also support the market’s growth.

The atrazine market in the United Kingdom is projected to grow at a CAGR of 6.1%. The UK’s growing agricultural sector, combined with the rising demand for effective herbicides to protect crops from weeds, is driving steady market growth. The country’s strong emphasis on sustainability and integrated pest management, along with its focus on reducing chemical use in farming, is encouraging the adoption of eco-friendly herbicides like atrazine. Additionally, the UK’s regulatory environment supporting the safe use of crop protection chemicals, coupled with growing interest in organic farming and sustainable agriculture, accelerates the demand for atrazine.

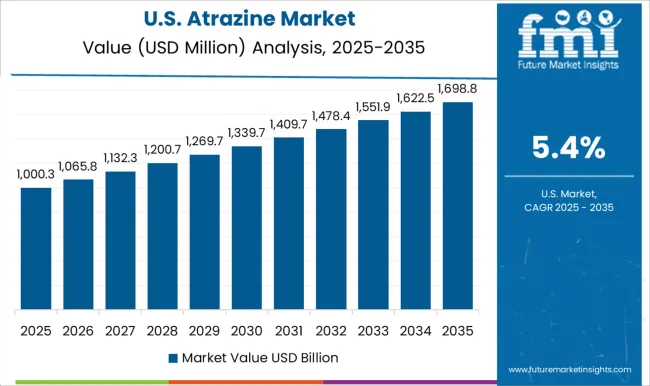

The atrazine market in the United States is expected to grow at a CAGR of 5.4%. The USA agricultural sector, which remains one of the largest globally, continues to drive the demand for crop protection solutions, particularly herbicides like atrazine. The country’s strong focus on food security, higher crop yields, and effective pest control contributes to the steady demand for atrazine. Additionally, the USA market benefits from advanced farming technologies, such as precision agriculture, which increase the efficiency of herbicide application. Regulatory policies that ensure the safe use of herbicides further support the market’s growth, while the growing shift towards sustainable and organic farming practices presents opportunities for environmentally friendly crop protection solutions.

The atrazine market is dominated by Syngenta, which leads with its advanced atrazine-based herbicide products widely used in agriculture to control broadleaf weeds and grasses in crops like corn, sorghum, and sugarcane. Syngenta’s dominance is supported by its extensive product portfolio, strong R&D capabilities, and global distribution network, ensuring widespread adoption of its products in large-scale agricultural applications. Key players such as BASF, Corteva Agriscience, and Bayer CropScience maintain significant market shares by offering effective atrazine formulations designed to enhance crop yields, improve weed control, and increase farming efficiency. These companies focus on providing high-performance herbicides that meet both regulatory standards and the needs of modern farming. Emerging players like Adama Agricultural Solutions, Albaugh LLC, and AMVAC Chemical Corporation are expanding their market presence by offering specialized atrazine formulations tailored for niche agricultural applications, such as organic farming, crop protection in different climates, and herbicide resistance management. Their strategies include improving product efficiency, enhancing sustainability, and developing innovative packaging solutions to appeal to eco-conscious farmers. Market growth is driven by the increasing global demand for food production, the need for efficient weed control solutions, and the rising focus on sustainable agricultural practices. Innovations in herbicide formulations, integrated pest management systems, and eco-friendly alternatives are expected to continue shaping competitive dynamics and fuel further growth in the global atrazine market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Liquid, Dry, and Other types |

| Crop | Cereal, Corn, Sugar crops, Sorghum, Wheat, and Others |

| Application | Field crop, Forestry, Aquatic weed, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adama Agricultural Solutions, Albaugh LLC, AMVAC Chemical Corporation, Arysta LifeScience Corporation, BASF, Bayer CropScience, Corteva Agriscience, FMC Corporation, Gowan Company LLC, Nippon Soda Co., Ltd., Nissan Chemical Corporation, Nufarm Limited, Sipcam Oxon, Syngenta, and UPL Limited |

| Additional Attributes | Dollar sales by application type and sector, demand dynamics across agriculture, horticulture, and pest control industries, regional trends in atrazine adoption, innovation in herbicide formulations and application technologies, impact of regulatory standards on environmental safety and residue limits, and emerging use cases in integrated pest management and sustainable farming practices. |

The global atrazine market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the atrazine market is projected to reach USD 3.6 billion by 2035.

The atrazine market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in atrazine market are liquid, dry and other types.

In terms of crop, cereal segment to command 47.9% share in the atrazine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA