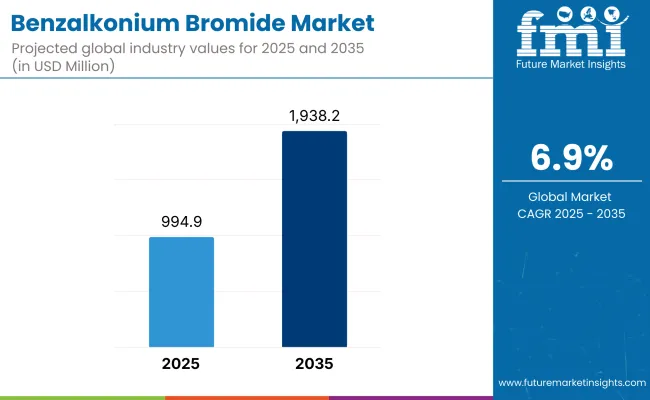

The benzalkonium bromide market is expected to reach USD 994.9 million in 2025 and expand to approximately USD 1,938.2 million by 2035, progressing at a CAGR of 6.9%. The United States is set to remain the most lucrative market globally, while South Korea emerges as the fastest-growing country with a CAGR of 6.5% between 2025 and 2035.

Growth is predominantly driven by heightened usage in personal care, pharmaceuticals, and industrial disinfectants due to its non-alcoholic, broad-spectrum antimicrobial properties. Demand is bolstered by its inclusion in ophthalmic and nasal formulations, sanitizers, and eco-friendly surface disinfectants. The market also benefits from increasing applications in water treatment, veterinary hygiene, and food processing.

However, growth is challenged by concerns over antimicrobial resistance (AMR) and tightening regulations on quaternary ammonium compounds (QACs). Regulatory bodies like the EPA, FDA, and ECHA impose stringent rules on toxicity and environmental persistence.

Looking forward to 2035, manufacturers are expected to innovate biodegradable, low-toxicity BZK formulations in response to green chemistry trends. Technological advancements such as nano-antimicrobial coatings, AI-optimized biocidal testing, and blockchain supply chain transparency are set to revolutionize the industry. Opportunities lie in sustainable water treatment, hospital disinfection, and pharmaceutical-grade preservatives. A shift toward smart biocides and environmentally compliant solutions will fuel market expansion across sectors, particularly in Asia-Pacific and Europe.

The benzalkonium bromide market is comprehensively segmented by grade into pharma grade and industrial grade; by function into preservative, cationic surfactant, cosmetic, and others (including veterinary biocides and agricultural disinfectants); by application into personal care, fabric care, pharmaceuticals, and others (such as food processing, institutional cleaning, and electronics sanitation); and by region into North America, Latin America, Western Europe, Eastern Europe, South Asia Pacific, and Middle East & Africa.

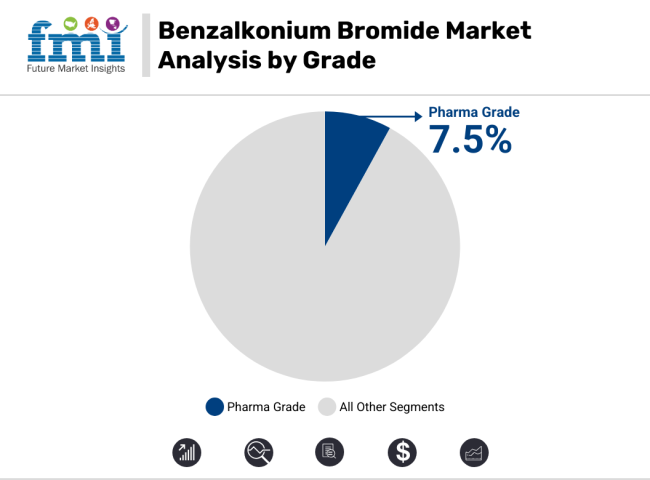

The pharma grade segment is expected to be the most lucrative in the market between 2025 and 2035, expanding at a CAGR of 7.5%. The rising regulatory standards and demand for high-purity formulations in ophthalmic, nasal, and topical pharmaceuticals, this segment will capitalize on robust pharmaceutical expansion in both developed and emerging markets. Increased investment in biopharmaceutical manufacturing and the rising adoption of preservative agents in multi-dose containers are further reinforcing demand.

Additionally, the push for antimicrobial stewardship is increasing reliance on proven, safe compounds like benzalkonium bromide in hospital settings globally. This growth is driven by hospital-acquired infection prevention mandates, increased prescriptions of multi-dose eye and nasal drugs, and expanded use in surgical antiseptics. The segment is also positioned to benefit from stricter FDA/ECHA quality norms, necessitating pharmaceutical compliance and documentation, which discourages switching to lower-grade alternatives.

Meanwhile, the Industrial Grade segment will remain essential for large-volume applications in cleaning agents, textiles, and surface disinfectants. However, price sensitivity and lower margin use cases will restrain its pace of expansion compared to the pharma-grade segment.

The preservative segment is projected to be the most lucrative function category in the benzalkonium bromide market from 2025 to 2035, accounting for a CAGR of 7.4%. This dominance stems from widespread adoption in pharmaceutical, personal care, and ophthalmic applications that require strict microbial control and extended shelf life. The pharmaceutical formulations using benzalkonium bromide as a preservative in multi-dose packaging,

particularly in nasal sprays, eye drops, and dermatological solutions, and the demand surge is strongly tied to healthcare infrastructure growth, especially in Asia and North America. In contrast, the surfactant segment will grow at a moderate pace. While it is widely used in textile care and surface cleaners for its antistatic and emulsifying properties, its market share is smaller due to the availability of cheaper alternatives. However, the niche use in biodegradable and specialty hygiene products may offer future gains.

Other segments, such as Cationic Surfactant, Cosmetic, and Others (including agricultural disinfectants, veterinary hygiene, and industrial odor control) will see steady demand, but their functional dependence is narrower and more price-sensitive, limiting their share in value terms.

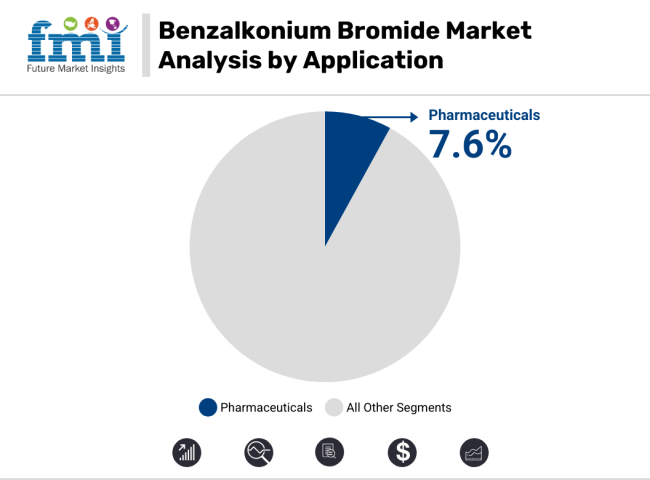

The pharmaceuticals segment is expected to be the most lucrative application area for benzalkonium bromide between 2025 and 2035, at a strong CAGR of 7.6%. This growth is anchored in its indispensable use as a preservative and antimicrobial agent in multi-dose eye drops, nasal sprays, wound care products, and surgical disinfectants. Hospital-grade antiseptics and topical formulations now require benzalkonium bromide for its proven efficacy and compatibility with biologics and delicate tissue-contact drugs.

Pharmaceutical regulatory shifts, particularly from the FDA, EMA, and PMDA, increasingly favor benzalkonium bromide for its stability, lower irritation profile, and absence of alcohol, making it ideal for sensitive applications. Additionally, the post-pandemic surge in hospital hygiene protocols and the rise in chronic disease management, especially diabetes and ophthalmic disorders, are driving greater consumption in both developed and emerging markets.

Other application segments like personal care, fabric care, and others (e.g., institutional sanitation, electronics cleaning, veterinary health) remain essential, but their growth is either consumer-driven or cost-limited, and thus, comparatively moderate in value contribution.

Sourcing and Supply Chain Challenges for Benzalkonium Bromide

A significant market challenge for Benzalkonium Bromide (BZK) is to maintain a stable and reliable supply chain. Often, the production of BZK, which is a chemical compound, will primarily depend on the availability of raw materials and specific manufacturing processes. This is a common risk taker of supply disruptions.

The fast changes in the price and the quantity of raw materials, such as alkylamines, can lead to the rescheduling of production, which in turn brings about possible delays or extra costs for the manufacturers. Besides, international political confrontations or trade sanctions can affect the distribution of BZK, making it scarce in some geographic areas.

This Supply Chain disruption which leads to potential shortages in certain areas should be addressed by Actions to deal with it. Securing multiple suppliers and the maintenance of inventory buffers and planning of counter measures to mitigate supply chain disruptions are valid points to discuss.

Regulatory Compliance and Antimicrobial Resistance (AMR) Concerns

One other key challenge for market players, apart from the scrutiny of quaternary ammonium compounds (QACs) because of their possible environmental risk and antimicrobial resistance (AMR) is the increasing concern of AMR diseases.

Institutional organizations that take care of public health such as EPA, FDA, and European Chemicals Agency (ECHA) have set strict guidelines on biocidal products in relation to prescription, toxins levels, and how to get rid of them. These measures are to contain the long-term adverse effects that disinfectants and antimicrobial agents have on the environment.

In other words, continuous exposure to benzalkonium bromide in hospitals and other surfaces people use/handle in daily life are found to be key contributors for the development of bacterial resistance, infections of which are now difficult to treat. As a reaction, the governments and related agencies are stimulating the invention of other types of biocides and the initiation of antimicrobial stewardship programs to overcome these problems.

The common problems with the evolving environmental and safety regulations are also increasing the cost of production. Producers are mainly required to use more environmentally friendly formulations, comprehensive testing of products, and innovative methods of application. Additionally, the medical and pharmaceutical applications merit an extensive assessment of safety and therefore longer approval cycles for new products that may be introduced to the market.

In bum these issues, it is a must for the manufacturers to target the task of producing low-toxicity, biodegradable benzalkonium bromide formulations while these must be ensured with maintain universal safety standards and chemical residue limits.

The co-operations with regulatory agencies, R&D institutions, and other industry partners would be the backbone of staying the product's efficacy and safety profile while widening its applications.

Expanding Applications in Pharmaceutical Preservatives and Biodegradable Disinfectants

Benzalkonium bromide is becoming more widely used in pharmaceuticals, as more hospitals are requiring it in the courses of treatment and as a result of the demand for the antiseptics that do not contain alcohol; it is found in more and more applications such as in the case of fortified nasal sprays and in the anti-infection formulae.

Together with its ability to give long-lasting antimicrobial actions and to be non-irritating, benzalkonium bromide is the first choice as a preservative in multi-dose eye drops, nasal sprays, and dermatological products.

The stepping stone toward medication without preservatives or with mild preservatives is symbolically the low-irritation, the however-in-no-way boost shelflife e.g. benzalkonium bromide that the high-antimicrobial agent formulations can offer.

In addition, as the cleaning/disinfecting solution without toxic substances has become a slogan of eco-friendliness, the benzalkonium bromide-based disinfectants have gained niches in the market for the treatment of surfaces, warehouse and industrial areas, as well as for environmental protection in agriculture.

The fungicides in this area are made of vegetable oil surfactants, including biodegradable nanostructured antimicrobial agents encapsulated with pepper fruits, and slow-release disinfectants, which assist in increasing the safety and efficacy of benzalkonium bromide through the wide applicability of the product.

The surge in the manufacturing of biopharmaceuticals, the introduction of medical sterilization equipment, and the rise in demand for hospital hygiene solutions are all adding to the need for high-purity, pharmaceutical-class, benzalkonium bromide. This is especially so in Europe and North America where strict regulations for healthcare are the key factors driving product development.

Growth in Water Treatment and Industrial Hygiene Solutions

The progress in the water treatment utility and industrial hygiene project sectors in less developed regions is one of the causes for the extensive use of benzalkonium bromide in algae control, pipeline disinfection, and wastewater treatment.

Government spending on water initiatives founded on the principal of sustainability beyond the existent sanitation programs leads to increased demand for antimicrobial agents that are both durable and effective.

Benzalkonium bromide one of the most frequently used formulations for biocides in oil & gas, food processing, and textiles is for microbial growth control, contaminant control, and sterilizing of equipment especially when they move towards environmental-friendly solutions.

The manufacturers also put a focus on biodegradable solutions for water treatment, which brings together benzalkonium bromide as a safe vehicle along with the use of biodegradable stabilizers and dispersants.

The easement of waste discharge through small factories as a result of rapidly spreading urbanization and industrial escalation in the Asia-Pacific and Latin America is likely to add fuel to the fire and spur the demand for wastewater treatment and industrial disinfection solutions.

The sector is looking for alternatives that are both environmentally friendly and cost-efficient like KD-4000 which is a benzalkonium bromide-based formulation with the ability to disintegrate without leaving any toxic residues.

Disinfection technology is constantly getting better, which is a result of the development of nanostructured antimicrobial coatings and biofilm-resistant formulations, and this, in its turn, will stir the interest of new applications and more customers in other industries like the semiconductor manufacturing, aerospace coatings, and cleaning of precision electronics.

The manufacturers that will turn the focus to pure-grade solutions, green production, and new applications will be able to sustain continuous growth and also gain market share.

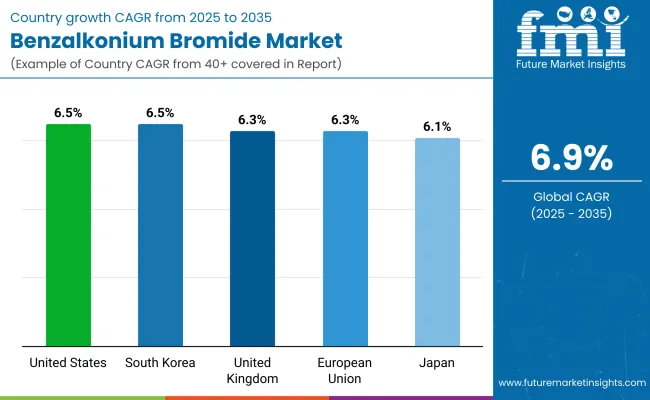

The USA holds an essential place in the Benzalkonium Bromide sector as it constitutes a 6.5% market growth. This expansion is backed by a sound regulatory framework as well as an escalating need for antimicrobial solutions.

The Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) work together with strict regulations that guarantee safe and effective application in disinfectants and pharmaceuticals. The healthcare sector, dominated by hospitals and laboratories, makes a substantial added-demand contribution.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The Benzalkonium Bromide market in the UK is on a path of consistent growth, demonstrating a compound annual growth rate (CAGR) of 6.3%. The progress of this expansion is aided by the UK Biocidal Products Regulation (UK BPR), which mandates that the products fulfill rigorous safety and environmental criteria. Benzalkonium Bromide, as a result of being an effective disinfectant and preservative, has a larger market share in healthcare, food processing and industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The EU Benzalkonium Bromide market is projected to grow at a steady compound annual growth rate (CAGR) of 6.3%, fueled by the implementation of REACH guidelines that emphasize the adoption of safer and more environmentally friendly solutions.

These regulations encourage manufacturers to produce biocidal products with reduced environmental impact, boosting the market for substances like Benzalkonium Bromide. The demand for this compound is particularly strong in the pharmaceuticals, food processing, and water treatment sectors, where it is valued for its antimicrobial and preservative properties.

In pharmaceuticals, it is used as a disinfectant, while in food processing, it helps maintain hygiene and extend shelf life. Additionally, its application in water treatment ensures effective disinfection, especially in industrial and municipal systems. As the EU continues to focus on health, safety, and environmental sustainability, the market for Benzalkonium Bromide is expected to maintain its positive growth trajectory.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan market for Benzalkonium Bromide is expected to increase at an annual compound growth rate of 6.1%, owing to the well-established regulatory mechanisms and constant progress in the antimicrobial products sector. The stringent safety and environmental regulations of the Japanese government are the major driving forces behind the technology development and market penetration of biocidal products.

Also, the substantial budget for research and innovation is promoting the developement of novel formulations which in turn, result in the increasing demand for benzalkonium bromide in various industries. It is a common practice in healthcare, production of food, and water treatment facilities to use it as a disinfectant agent, which is the major reason for the adding of this product to the Japanese market thus promoting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

South Korea's Benzalkonium Bromide market is expanding at a 6.5% CAGR, driven by advancements in both industrial and healthcare sectors. The growing demand for effective disinfectants in industries such as food processing, pharmaceuticals, and water treatment is a key factor supporting this growth.

South Korea’s strong focus on technological innovation and industrial modernization has increased the adoption of antimicrobial solutions like Benzalkonium Bromide. Additionally, the country’s strict healthcare regulations and emphasis on hygiene and infection control further boost the demand for this versatile biocidal product, ensuring continued market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The global benzalkonium bromide market is a highly specialized and regulated industry, primarily driven by its applications in pharmaceuticals, disinfectants, biocides, preservatives, and industrial chemicals. Benzalkonium bromide (BZK-Br) is widely used in antiseptics, personal care products, water treatment chemicals, and coatings, with increasing demand from healthcare, agriculture, and food processing industries.

The market is shaped by stringent regulatory approvals, rising demand for disinfectants in medical applications, and the growing need for non-toxic antimicrobial agents. Key manufacturers focus on high-purity production, eco-friendly formulations, and expanding their supply chain reach to cater to pharmaceutical, industrial, and consumer applications.

BASF SE

BASF SE stands as one of the leading suppliers of benzalkonium bromide worldwide. They are supplying their pharmaceutical and industrial grade formulations that also focus on regulatory compliance and sustainability. The company, therefore, makes sure that its BZK-Br complies with the international standards, environmental standards, and pharmaceutical standards measure. The company is setting up its production capacity in Asia and North America, which are being targeted into addressing the increased demand from industries such as health care and personal care.

Merck KGaA

Merck KGaA, the other important specialty chemicals manufacturer, produces benzalkonium bromide for use in medical, industrial, and personal care applications. The company emphasizes purity in production so that it can ensure excellent quality standards with disinfectants, ophthalmic solutions, and biocidal formulations delivered by Merck. Due to Merck's distribution network that spans the entire globe, it is able to serve the pharmaceutical and industrial customers across the world.

Kao Corporation

Kao Corporation operates biocide and disinfectant businesses, which BZK-Br supplies in surface hygiene, water treatment, and industrial sanitation. Kao's high-performance antimicrobial formulations find applications in medical disinfectants, personal care products, and food safety applications. Together with Kao's strong presence in Japan, which includes markets in Southeast Asia, it is a major player in both the region and the global BZK-Br market.

Novo Nordisk Pharmatech A/S

Novo Nordisk Pharmatech is one of the renowned suppliers of pharmaceutical-grade benzalkonium bromide, mainly serving the ophthalmic, dermatological, and antiseptic spaces.

The compliance with international pharmaceutical regulations is paramount for the company, which ensures high standards of efficacy and purity. In response to the increasing demand from the pharmaceutical industry, Novo Nordisk Pharmatech is scaling up its production capacity.

Quat-Chem Ltd.

Quat-Chem specializes in applications of benzalkonium bromide in biocides and disinfectants, including for veterinary, food hygiene, and agricultural applications. The company possesses specialization in antimicrobial chemistry, enabling it to produce and offer custom BZK-Br formulations for different hygiene and sanitation industries.

Other Key Players (40-50% Combined)

Pharma Grade and Industrial Grade

Preservative, Cationic Surfactant, Cosmetic and Other

Personal care, Fabric care, Pharmaceuticals and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA).

The global Benzalkonium Bromide Market is projected to reach USD 994.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.9% over the assessment period.

By 2035, the Benzalkonium Bromide Market is expected to reach USD 1,938.2 million.

The Grade segment is expected to hold a significant market share due to its high demand in Energy harvesting.

Major companies operating in the Benzalkonium Bromide Market include Shandong Taihe, Water Treatment Technologies Co., Ltd., Qingdao Zhonghui Chemical Co., Ltd., Tokyo Chemical Industry Co., Ltd., and Jiangsu Denoir Specialty Chemicals Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Application , 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Application , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 21: Global Market Attractiveness by Grade, 2023 to 2033

Figure 22: Global Market Attractiveness by Function, 2023 to 2033

Figure 23: Global Market Attractiveness by Application , 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 45: North America Market Attractiveness by Grade, 2023 to 2033

Figure 46: North America Market Attractiveness by Function, 2023 to 2033

Figure 47: North America Market Attractiveness by Application , 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 69: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Function, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application , 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Function, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application , 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Function, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application , 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Function, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application , 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 165: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Function, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application , 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Application , 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application , 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Benzalkonium Chloride Market Growth – Trends & Forecast 2024-2034

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Bromide Market

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Cetrimonium Bromide Market Trend Analysis Based on Purity, End-Use, and Region 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA