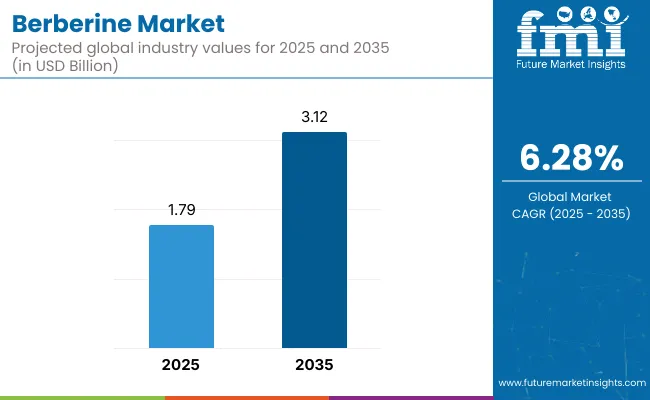

The Global Berberine Market is expected to record a valuation of USD 1.79 billion in 2025 and USD 3.12 billion in 2035, with an increase of USD 1.33 billion, which equals a growth of 74% over the decade. The overall expansion represents a CAGR of 6.28% and a 1.74X increase in market size.

Berberine Market Key Takeaways

| Metric | Value |

|---|---|

| Berberine Market Estimated Value in (2025E) | USD 1.79 billion |

| Berberine Market Forecast Value in (2035F) | USD 3.12 billion |

| Forecast CAGR (2025 to 2035) | 6.28% |

Between 2025 and 2030, the global berberine market is projected to expand from USD 1.79 billion to approximately USD 2.28 billion, representing a cumulative increase of USD 493 million accounting for nearly 37% of the total decade-long value growth. This initial phase of expansion is expected to be shaped by growing clinical recognition of berberine’s metabolic efficacy and its integration into emerging wellness protocols.

Demand is anticipated to be strengthened by rising consumer preference for non-pharmaceutical interventions across blood sugar and lipid management, supported by consistent uptake in personalized supplement delivery formats. Greater emphasis on bioavailability optimization is forecasted to shift innovation toward novel formulation technologies, especially within experiential wellness categories.

From 2030 to 2035, a sharper acceleration is projected, with the market expected to grow from USD 2.28 billion to nearly USD 3.12 billion, adding USD 844 million equivalent to 63% of total projected growth over the decade.

This latter growth phase is likely to be underpinned by the mainstreaming of multi-functional combination products, growing traction across direct-to-consumer (DTC) and e-commerce-led nutraceutical platforms, and expanded applications in cardiovascular and weight management routines. By 2035, next-generation berberine salts are anticipated to emerge as key differentiators in the competitive landscape, driven by superior absorption kinetics and alignment with clinical personalization trends.

Between 2020 and 2024, the global berberine market was observed to have expanded considerably, with total value rising from below USD 1.4 billion to approximately USD 1.7 billion. This growth was primarily attributed to heightened consumer awareness of plant-based metabolic health solutions, especially in response to the global uptick in lifestyle-related chronic conditions.

A significant portion of this expansion was driven by the widespread adoption of capsule-based formulations, valued for their dosing precision, stability, and clinical familiarity. The Asia-Pacific and North American regions were identified as key contributors to this phase of market growth. During this period, Chinese ingredient manufacturers captured a commanding share of the supply landscape, owing to their direct access to botanical raw materials and adherence to standardized extract protocols.

As the market transitions into 2025, demand is projected to reach USD 1.79 billion, supported by increased adoption of bioavailability-enhanced berberine formulations, the growing popularity of combination nutraceuticals, and the rapid rise of direct-to-consumer (DTC) wellness platforms. Competitive differentiation is expected to pivot toward fully integrated solutions where delivery innovation, digital engagement strategies, and practitioner-led protocols converge.

Market share is anticipated to be consolidated among companies that prioritize clinical validation, supply chain transparency, and multi-channel distribution strategies, as the industry moves from a commodity-based supply model toward value-centric, personalized health interventions.

The global berberine market is being driven by sustained growth, as rising consumer awareness around natural health solutions for chronic conditions such as type 2 diabetes, high cholesterol, and metabolic syndrome has been observed. Clinical studies supporting berberine’s efficacy in blood sugar and lipid regulation have allowed it to be positioned as a powerful botanical alternative to pharmaceutical interventions, especially within preventive health regimens.

Additionally, the expansion of the nutraceutical and functional foods sector has been accelerating demand for enhanced formulations such as bioavailability-boosted complexes (phytosome, cyclodextrin-based) and combination blends with other botanicals and nutraceuticals. Technological innovations in delivery formats like gummies, tinctures, and functional beverages have expanded appeal across diverse consumer segments.

Access to premium berberine products is being streamlined globally through online retail, direct-to-consumer brands, and practitioner-based channels. Furthermore, a broader shift towards plant-based therapeutics and clean-label supplements has been boosting the use of sources such as Goldenseal, Chinese Goldthread, and Oregon Grape. Through these trends, the long-term trajectory of the berberine market is being anchored in holistic wellness preferences and evidence-driven functional health applications.

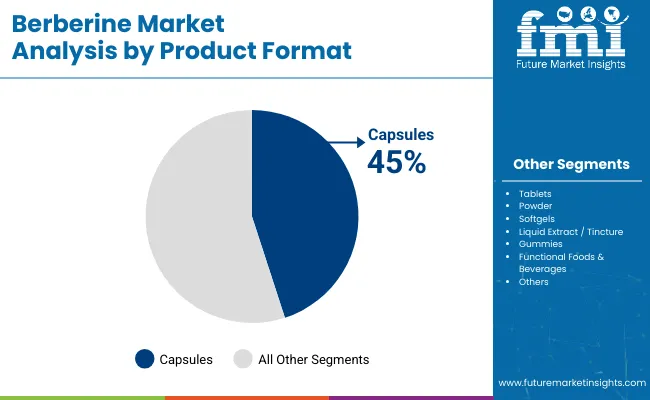

The global berberine market has been comprehensively segmented across multiple dimensions, including product format, chemical form, application, source, formulation type, and sales channel. This structure has been designed to reflect the diversity of berberine’s utilization across health and wellness sectors, where increasing demand for targeted metabolic support is being observed. In the area of product format, delivery innovations such as capsules, softgels, and gummies have been enabling improved compliance and consumer appeal.

From the perspective of chemical form, varying salt compositions such as hydrochloride, citrate, and sulfate have been shown to influence both bioavailability and formulation strategy. Within application categories, blood sugar regulation, lipid management, and weight control have continued to lead the landscape, driven by the widespread prevalence of metabolic disorders. Through this segmentation, critical insights into shifting demand dynamics, evolving growth levers, and innovation-led differentiation strategies are being provided across the global berberine value chain.

| Product Format | Format Market Share (%) |

|---|---|

| Capsules | 45% |

| Tablets | 20% |

| Powder | 15% |

| Softgels | 10% |

| Liquid Extract / Tincture | 7% |

| Gummies | 2% |

| Functional Foods & Beverages | 1% |

Capsules have been identified as the dominant product format in the global berberine market, contributing 45% of total market share in 2025. Their widespread use has been attributed to ease of formulation, precise dosage delivery, and high consumer trust across both clinical and OTC environments. Superior protection of berberine compounds from oxidation and stomach acid degradation has also been ensured through this format.

As demand increases for science-backed botanical interventions, capsule delivery is being maintained as the industry benchmark. Meanwhile, formats such as tinctures, gummies, and softgels are being adopted in experiential wellness niches, particularly within DTC and digital-first ecosystems. Powder-based delivery has also been favored for its adaptability in functional food innovations and custom supplement blends, underscoring broader shifts toward formulation flexibility and personalized nutrition.

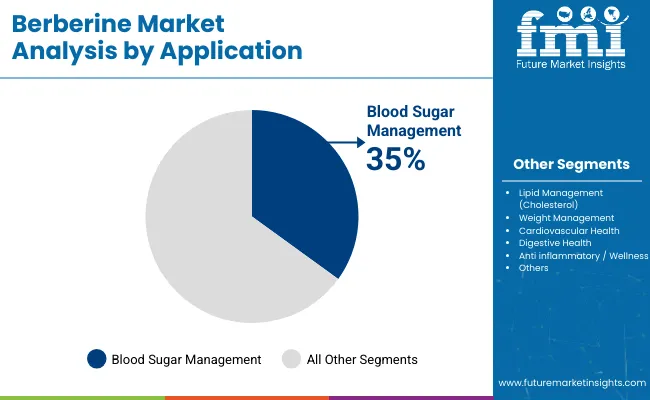

| Application | Market Share (%) |

|---|---|

| Blood Sugar Management | 35% |

| Lipid Management (Cholesterol) | 25% |

| Weight Management | 20% |

| Cardiovascular Health | 10% |

| Digestive Health | 5% |

| Anti inflammatory / Wellness | 5% |

Blood sugar management has been recognized as the leading application in the global berberine market, accounting for 35% of total application share in 2025. Berberine’s role as an insulin-sensitizing and glucose-lowering agent has been increasingly adopted by pre-diabetic and diabetic populations as a complementary solution. This positioning has been reinforced by a growing volume of clinical literature supporting its therapeutic efficacy. Applications in lipid regulation and weight management have also been expanding, driven by rising demand for multi-functional metabolic health interventions.

In parallel, cardiovascular and anti-inflammatory use cases are being explored more actively, particularly among aging consumer segments and those pursuing preventive wellness strategies. With chronic disease burdens rising globally and preference shifting toward botanical, low-side-effect options, demand across all core application areas is expected to be sustained, while therapeutic diversification continues to shape product innovation and market segmentation.

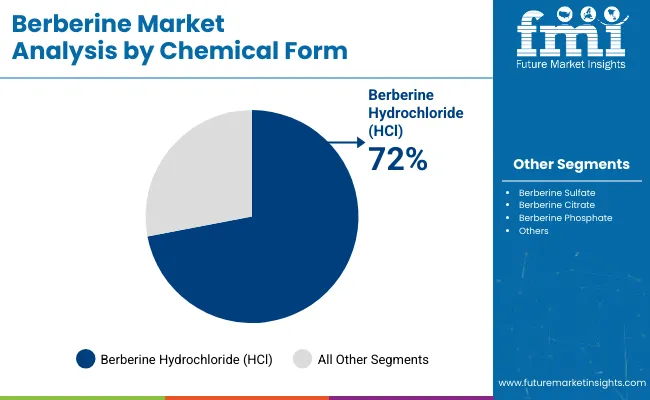

| Chemical Form | 2025 Market Share (%) |

|---|---|

| Berberine Hydrochloride ( HCl ) | 72% |

| Berberine Sulfate | 12% |

| Berberine Citrate | 7% |

| Berberine Phosphate | 5% |

| Other Berberine Salts | 4% |

Berberine Hydrochloride (HCl) has been identified as the most commercially dominant chemical form, comprising 72% of the global market in 2025. Its strong performance has been attributed to high bioavailability, chemical stability, and broad regulatory acceptance across major markets. This form has been widely used in both standalone supplements and blended nutraceuticals due to its favorable pharmacokinetic profile and compatibility with multiple delivery formats.

Meanwhile, alternative salts such as berberine citrate and berberine sulfate have been gaining interest, particularly for their potential to enhance absorption and drive novel combinations in metabolic formulations. “Other berberine salts” are projected to register a CAGR exceeding 9.5%, reflecting robust innovation pipelines focused on improved absorption, differentiated dosing profiles, and premium product positioning. These shifts in formulation preferences are expected to support greater personalization and performance-driven product segmentation in the years ahead.

Limited bioavailability and lack of standardized dosing challenge berberine adoption, even as demand surges across metabolic health, cardiovascular care, and clean-label supplements, driven by rising lifestyle disorders and growing interest in plant-based, clinically validated nutraceutical alternatives.

Clinical Legitimacy and Therapeutic Diversification Are Reshaping Berberine’s Competitive Profile

A growing body of human clinical trials is enabling berberine to be positioned beyond traditional herbal use, accelerating its inclusion in practitioner-grade and evidence-based supplement protocols. As of 2025, over 100 published studies have evaluated berberine’s effects on glycemic control, lipid profiles, and metabolic syndrome markers.

This clinical validation is being increasingly cited by DTC brands and functional medicine practitioners to differentiate their offerings and justify premium pricing. Moreover, therapeutic diversification is unfolding rapidly berberine is now being studied in adjunct protocols for PCOS, gut microbiota modulation, and neuroinflammation, expanding its addressable market.

Regulatory scrutiny, such as EFSA’s 2025 Article 8 safety evaluation, is also prompting standardized dosage frameworks, which will ultimately improve physician confidence and support OTC expansion in Europe. These dynamics are solidifying berberine’s transition from a niche botanical to a clinically substantiated nutraceutical platform ingredient.

Supply-Side Vulnerability and Adulteration Risks Threaten Brand Trust and Ingredient Integrity

Despite rising demand, the global berberine supply chain remains heavily concentrated in select provinces of China and parts of India, where wild harvesting of key plant sources exposes the market to climate shocks, yield inconsistency, and biodiversity degradation. As demand has outpaced sustainable sourcing, instances of adulteration and mislabeling have increased particularly in the online retail environment.

In December 2023, NOW Foods’ market surveillance revealed that over 50% of berberine supplements purchased via Amazon and Walmart contained less than 50% of the labeled dosage, raising serious concerns over quality assurance. Such findings are eroding consumer and practitioner trust, especially among premium buyers who rely on verified potency.

Brands that fail to demonstrate third-party testing, traceability, and ingredient origin transparency are likely to lose market share. Moving forward, sustainable cultivation, vertical integration, and DNA-based authentication technologies will be critical in mitigating supply-side risk and reinforcing market credibility.

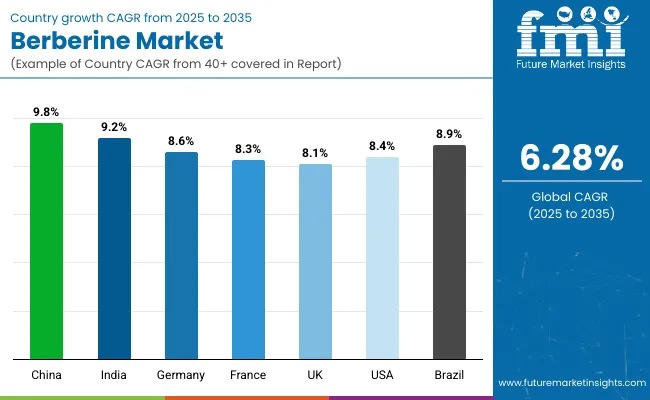

| Countries | CAGR |

|---|---|

| China | 9.80% |

| India | 9.20% |

| Germany | 8.60% |

| France | 8.30% |

| UK | 8.10% |

| USA | 8.40% |

| Brazil | 8.90% |

The global berberine market has demonstrated pronounced regional divergence in growth momentum, shaped by disparities in healthcare infrastructure, regulatory pathways, and integration of traditional medicine systems. The Asia-Pacific region has been identified as the fastest-growing, led by China (9.80% CAGR) and India (9.20%), where berberine is deeply embedded in Traditional Chinese Medicine (TCM) and Ayurvedic practices, respectively.

In China, this growth has been supported by widespread cultivation of Coptischinensis and Phellodendronamurense, combined with the strength of domestic nutraceutical manufacturing and distribution networks. India’s momentum has been attributed to the proliferation of Ayurvedic formulations, rising practitioner-led recommendations, and e-commerce-enabled access to metabolic health supplements in urban centers.

In Latin America, demand has been expanding rapidly, with Brazil (8.90%) emerging as a key contributor, supported by growing interest in botanical alternatives and the scaling of retail health chains focused on functional wellness. In Europe, countries such as Germany (8.60%), France (8.30%), and the UK (8.10%) have been driving growth through cardiometabolic wellness initiatives and increased regulatory scrutiny favoring clean-label, clinically supported supplements.

In the United States (8.40%), market expansion has been propelled by the rise of direct-to-consumer (DTC) brands, functional medicine integration, and consumer education around bioavailability-enhanced berberine. Regulatory stability and clinical substantiation continue to support berberine’s mainstream adoption across North America.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 350 |

| 2026 | 379 |

| 2027 | 411 |

| 2028 | 445 |

| 2029 | 482 |

| 2030 | 522 |

| 2031 | 565 |

| 2032 | 612 |

| 2033 | 663 |

| 2034 | 663 |

| 2035 | 779 |

The berberine market in the United States is projected to expand at a CAGR of 8.40% between 2025 and 2035, supported by growing adoption across personalized nutrition protocols, cardiometabolic health applications, and a rapidly evolving direct-to-consumer (DTC) landscape.

Clinical usage has been steadily increasing, particularly within functional medicine and integrative care settings, where berberine is being recommended for blood glucose regulation, lipid balance, and weight management. Formulations incorporating bioavailability-enhanced technologies, such as phytosome and liposomal delivery systems, are being deployed to improve compliance, particularly among aging consumers and health-conscious millennials.

The berberine market in the United Kingdom is forecasted to expand at a CAGR of 8.10% between 2025 and 2035, supported by rising consumer preference for plant-based interventions targeting metabolic and cardiovascular health.

Growth has been further enabled by the UK’s advanced regulatory landscape, which has encouraged the adoption of clean-label, clinically validated supplements, including standardized berberine extracts. E-commerce platforms and specialty health retailers have been established as leading distribution channels, with elevated demand observed for vegan, gluten-free, and allergen-free product formats. Notable momentum has been recorded in combination products addressing multi-functional concerns such as cholesterol management, blood sugar control, and inflammation.

| Countries | 2025 Market Share (%) |

|---|---|

| UK | 12% |

| Germany | 18% |

| Italy | 10% |

| France | 14% |

| Spain | 8% |

| BENELUX | 7% |

| Nordic | 6% |

| Rest of Europe | 25% |

| Countries | 2035 Market Share (%) |

|---|---|

| UK | 13% |

| Germany | 17% |

| Italy | 10% |

| France | 14% |

| Spain | 9% |

| BENELUX | 7% |

| Nordic | 7% |

| Rest of Europe | 23% |

The berberine market in India is projected to expand at a CAGR of 9.20% between 2025 and 2035, supported by the country’s increasing diabetes prevalence and deep-rooted cultural orientation toward plant-based therapeutic systems. Berberine has been progressively integrated into Ayurvedic and polyherbal formulations, gaining acceptance across both modern clinical settings and traditional healthcare practices.

Domestic nutraceutical brands have been addressing demand through retail pharmacy chains, digital health platforms, and direct-to-consumer wellness kits. High adoption has been particularly observed among urban middle-class populations, where blood sugar and weight control remain top health concerns.

China’s berberine market is projected to expand at a CAGR of 9.80% between 2025 and 2035, positioning it as the fastest-growing national market worldwide. Berberine has been long established within Traditional Chinese Medicine (TCM) and is widely acknowledged for its efficacy in managing digestive and metabolic disorders.

Current demand is being driven by both historical usage patterns and the rise of modern supplement innovations, particularly in capsules, tinctures, and bioavailability-enhanced delivery systems. Strong regulatory support for evidence-backed botanical actives, coupled with China’s robust domestic production infrastructure, has enabled the country to operate as a self-sufficient and globally competitive supplier.

| Application Segment | Japan Market Share, 2025 |

|---|---|

| Blood Sugar Management | 38% |

| Lipid Management (Cholesterol) | 24% |

| Weight Management | 15% |

| Cardiovascular Health | 10% |

| Digestive Health | 7% |

| Anti inflammatory / Wellness | 6% |

The berberine market in Japan is projected to reach approximately USD 123.16 million in 2025, with demand primarily concentrated in blood sugar management (38%) and lipid regulation (24%), together comprising over 60% of total national consumption.

This demand has been largely driven by Japan’s aging population and the growing prevalence of metabolic syndrome, both of which have increased interest in clinically validated botanical interventions. Berberine’s incorporation into self-medication products and over-the-counter (OTC) supplements has been aligned with widespread consumer preference for non-pharmaceutical health solutions.

Further support has been provided by Japan’s longstanding preference for precision-formulated supplements, particularly capsules and softgels, which are often backed by clinical documentation. Regulatory clarity surrounding botanical ingredients and a well-developed retail pharmacy network have helped to reinforce product accessibility and consumer confidence. Additionally, local formulators have been leveraging berberine in combination with CoQ10 and curcumin, extending its utility in cardiovascular and anti-inflammatory applications.

| Chemical Form | South Korea Market Share, 2025 |

|---|---|

| Berberine Hydrochloride ( HCl ) | 70% |

| Berberine Sulfate | 12% |

| Berberine Citrate | 8% |

| Berberine Phosphate | 6% |

| Other Berberine Salts | 4% |

The berberine market in South Korea is projected to reach approximately USD 85.27 million in 2025, contributing an estimated 5.02% to the global market. Market leadership is held by Berberine Hydrochloride (HCl), which commands 70% of national consumption, attributed to its cost efficiency, stability, and broad acceptance among formulators. However, increasing interest in berberine citrate and sulfate has been observed, driven by growing emphasis on absorption enhancement and product differentiation.

The South Korean market has been shaped by a robust nutraceutical R&D ecosystem and high consumer receptivity to biofunctional ingredients. Domestic brands have been actively developing combination formulations that integrate berberine with ingredients such as ginseng, milk thistle, and probiotics, targeting digestive and metabolic health. The growth of retail pharmacy networks and the expansion of cross-border e-commerce with Japan and Southeast Asia have been instrumental in amplifying berberine’s regional footprint.

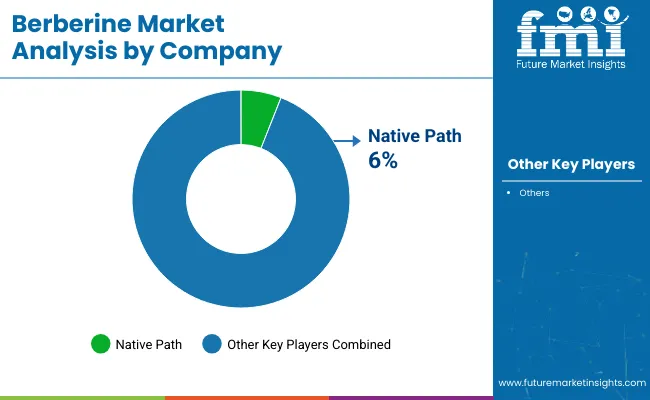

| Company | Global Value Share 2025 |

|---|---|

| Native Path | 6% |

| Others | 94% |

The global berberine market has been characterized as moderately fragmented, with competition occurring across botanical sourcing, formulation advancement, and consumer-focused innovation. Dominance in ingredient supply has been primarily maintained by Chinese bulk extractors such as Sichuan Benepure Pharm, Chengdu Chenlv Biological Tech, and Sunriver Biotech, owing to their access to high-yield botanical sources and production capacity for berberine hydrochloride and emerging salts. These firms have been recognized for ensuring pharma-grade quality, international regulatory certifications (USP, EP, GMP), and readiness for global functional and pharmaceutical markets.

Mid-sized Indian contract manufacturers, including Alpspure Lifesciences, Quad Lifesciences, and Inga Pharmaceuticals, have been focused on delivering customized formulations, incorporating berberine with complementary botanicals or nutraceutical co-actives. Growth in this segment has been supported by clean-label compliance, regional botanical integration, and private-label partnerships with international supplement brands.

Western nutraceutical brands such as NativePath and Science Natural Supplements have led the DTC segment, using e-commerce, personalization tools, and subscription models to reach health-conscious consumers. Competitive differentiation has been shifting from raw purity and cost efficiency toward bioavailability enhancement, clinical substantiation, and condition-specific claims (e.g., glucose, lipids, inflammation). Future market leadership is expected to rely on scientific delivery systems, clinical trials, and omnichannel retail strategies.

Key Developments in Berberine Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.79 Billion |

| Source | Barberry (Berberis vulgaris), Goldenseal (Hydrastis canadensis), Oregon Grape (Mahonia aquifolium), Chinese Goldthread (Coptis chinensis), Tree Turmeric (Berberis aristata), Phellodendron Bark (Phellodendron amurense), Others |

| Chemical Form | Berberine Hydrochloride ( HCl ), Berberine Sulfate, Berberine Citrate, Berberine Phosphate, Other Berberine Salts |

| Formulation Type | Standard Extract, Enhanced Bioavailability Complex (Phytosome, Cyclodextrin, Liposomal), Combination Formulas (With Botanicals, With Nutraceuticals) |

| Product Format | Capsules, Tablets, Softgels, Powder, Liquid Extract / Tincture, Gummies, Functional Foods & Beverages |

| Application | Blood Sugar Management, Lipid Management (Cholesterol, Triglycerides), Weight Management, Cardiovascular Health, Digestive Health, Anti-inflammatory / General Wellness |

| Sales Channels | Pharmacies & Drugstores, Health & Nutrition Stores, Online Retail, Direct-to-Consumer (DTC) Brands, Mass Market Retailers, Practitioner / Clinic Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

The global Berberine Market is estimated to be valued at USD 1.79 billion in 2025.

The market size for the global Berberine Market is projected to reach approximately USD 3.12 billion by 2035.

The Berberine Market is expected to grow at a CAGR of 6.28% between 2025 and 2035.

The key product formats in the Berberine Market include Capsules, Tablets, Softgels, Powders, Liquid Extracts/Tinctures, Gummies, and Functional Foods & Beverages.

In terms of application, the Blood Sugar Management segment is expected to command the largest share at 35% of the Berberine Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA