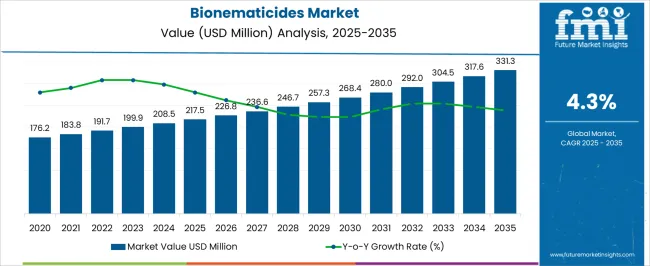

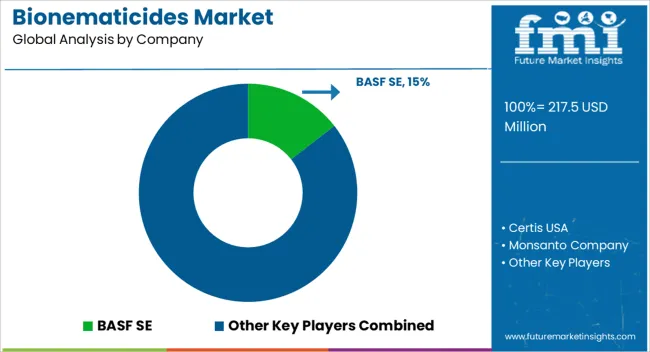

The bionematicides market is estimated to be valued at USD 217.5 million in 2025 and is projected to reach USD 331.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

This growth is being influenced by the rising adoption of eco-friendly pest management solutions across agriculture and horticulture sectors. Market dynamics are being shaped as formulations are optimized for improved efficacy against nematodes, and supply chains are being strengthened to ensure reliable availability. The demand for bionematicides is being further driven by their integration into crop protection strategies that aim to maintain yield and quality under varying field conditions. During the 2025–2030 period, the bionematicides market is being guided by increased acceptance in commercial farming practices and targeted crop protection programs. Applications are being expanded across key crops to address soil-borne nematode infestations, and product portfolios are being diversified to cater to different climatic and soil conditions.

In opinion, the market is being positioned as an essential component of integrated pest management frameworks, with growth supported by strategic distribution networks and product refinements. The focus on performance consistency, formulation stability, and regulatory compliance is being emphasized to reinforce market competitiveness and strengthen adoption among end-users.

| Metric | Value |

|---|---|

| Bionematicides Market Estimated Value in (2025 E) | USD 217.5 million |

| Bionematicides Market Forecast Value in (2035 F) | USD 331.3 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The bionematicides market has established a meaningful position across its parent industries, driven by its effectiveness in controlling nematode infestations while reducing chemical pesticide dependency. Within the biological crop protection market, bionematicides account for approximately 18–20% share, reflecting their growing adoption among farmers seeking targeted solutions for soil-borne pests. In the broader pesticides market, the segment contributes around 10–12%, as bionematicides are increasingly incorporated into integrated pest management programs alongside conventional chemical treatments. Within the agricultural chemicals market, bionematicides represent nearly 12–15% share, given their application in improving crop health and yield through eco-compatible approaches. In the plant growth and health solutions market, the share stands at about 15–18%, since these products not only suppress nematode populations but also support soil fertility and plant vigor.

Within the organic farming inputs market, bionematicides hold close to 8–10% share, driven by the rising demand for certified organic produce and natural crop protection methods. While challenges such as variable field efficacy and formulation stability persist, the market remains resilient due to increasing awareness, regulatory support, and integration into precision farming practices. In my opinion, the bionematicides market has moved from a niche solution to a critical segment within modern crop protection strategies, reinforcing its influence across biological, chemical, and organic agricultural ecosystems while shaping future pest management approaches.

The bionematicides market is gaining momentum, supported by the shift toward sustainable agricultural practices and the rising global concern over chemical pesticide residues in food. Developments in biological pest control technologies and increased acceptance of microbial and biochemical products have significantly influenced market expansion.

Regulatory frameworks in many countries have promoted the use of bio-based crop protection agents, encouraging adoption among both commercial and small-scale farmers. Investments from agri-biotech companies and collaborations between research institutions and industry players have accelerated product innovation, leading to improved formulations with higher efficacy and longer shelf life.

Rising awareness about soil health preservation and the impact of nematode infestations on crop yields has further propelled market demand. Looking ahead, the integration of precision agriculture tools with biological control strategies is expected to strengthen adoption, particularly in high-value crop categories where yield loss prevention is critical.

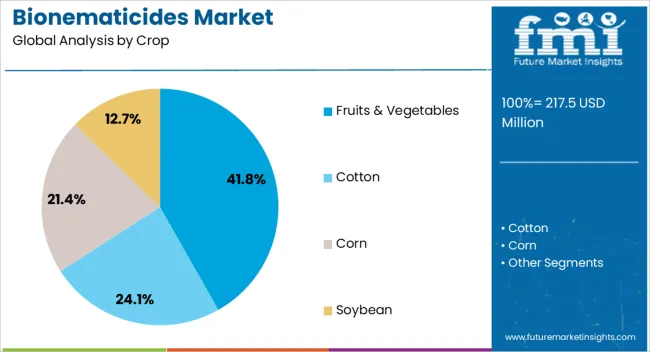

The bionematicides market is segmented by crop, and geographic regions. By crop, bionematicides market is divided into fruits & vegetables, cotton, corn, and soybean. Regionally, the bionematicides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fruits & vegetables segment is projected to account for 41.8% of the bionematicides market revenue in 2025, maintaining its position as the leading crop segment. This dominance is attributed to the high economic value and perishability of fruits and vegetables, which makes effective nematode control a priority for growers.

These crops are particularly susceptible to nematode-induced yield and quality losses, necessitating targeted and sustainable management practices. Bionematicides have been favored in this segment due to their residue-free nature, compliance with export regulations, and compatibility with integrated pest management programs.

Farmers cultivating fruits and vegetables have also shown greater willingness to invest in advanced crop protection solutions to safeguard profitability. Additionally, the growing demand for organic produce has supported the use of biological nematicides, as they align with organic farming certifications and consumer expectations. With continued emphasis on food safety, quality standards, and sustainable farming, the Fruits & Vegetables segment is expected to retain its market leadership in the coming years.

The bionematicides market is expanding due to increasing demand for eco-friendly crop protection and rising adoption in organic and specialty crops. Opportunities exist in high-value agricultural segments, while trends emphasize microbial innovations and integrated bio-formulations. Regulatory barriers, awareness gaps, and field performance limitations remain challenges. Overall, the market outlook is favorable as manufacturers focus on effective, environmentally compliant, and crop-specific bionematicide solutions to enhance agricultural productivity and promote sustainable farming practices globally.

The bionematicides market is witnessing rising demand as farmers and agribusinesses increasingly adopt eco-friendly solutions to control nematode infestations in crops. With conventional chemical nematicides facing restrictions due to environmental and health concerns, bionematicides are preferred for their low toxicity and compatibility with integrated pest management programs. Rising awareness about soil health, crop yield protection, and regulatory approvals for bio-based products are further driving adoption. Key crop segments such as vegetables, cereals, and horticulture are increasingly treated with bionematicides, highlighting their essential role in sustainable and efficient agricultural production.

Significant opportunities are arising in organic and high-value crop sectors where chemical usage is limited. Bionematicides offer an attractive solution for vegetables, fruits, and greenhouse crops in emerging and developed markets. Expanding demand for organic produce globally and increasing adoption of precision agriculture techniques allow manufacturers to introduce crop-specific formulations. Partnerships between product developers and distributors facilitate localized access and farmer training, enhancing market penetration. Companies providing high-efficiency, environmentally compliant, and cost-effective bionematicides are well-positioned to capitalize on growing agricultural modernization trends and the shift toward bio-based crop protection solutions.

A key trend in the bionematicides market is the development of microbial and bio-formulation-based solutions that offer targeted nematode control with minimal environmental impact. Innovations in strain selection, fermentation processes, and carrier technologies improve stability, shelf life, and field efficacy. Integration with seed treatments and soil amendment products is becoming more common to enhance crop protection outcomes. Digital agriculture tools are also being leveraged to optimize application timing and dosage. These trends underscore the industry’s focus on functional, reliable, and sustainable solutions, encouraging farmers to adopt bionematicides as a key component of modern crop protection strategies.

The market faces challenges due to stringent regulatory approval processes across regions, which can delay product commercialization and increase costs. Limited awareness among smallholder farmers about bio-based nematode control solutions restricts adoption, particularly in emerging markets. Inconsistent field performance compared to chemical nematicides may also deter widespread use. Additionally, supply chain limitations and formulation stability issues present operational hurdles. To overcome these challenges, companies are investing in farmer education, robust field trials, and regulatory compliance initiatives to ensure confidence, efficacy, and accessibility of bionematicides across diverse agricultural landscapes.

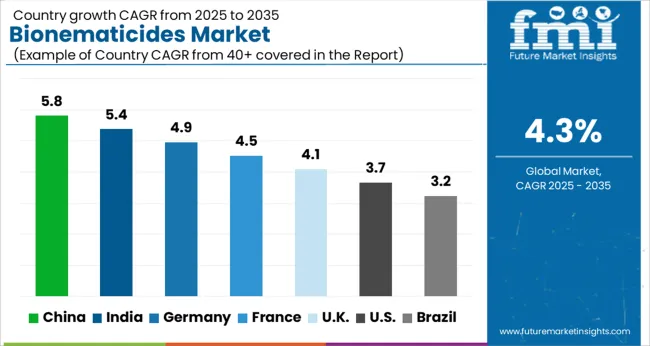

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

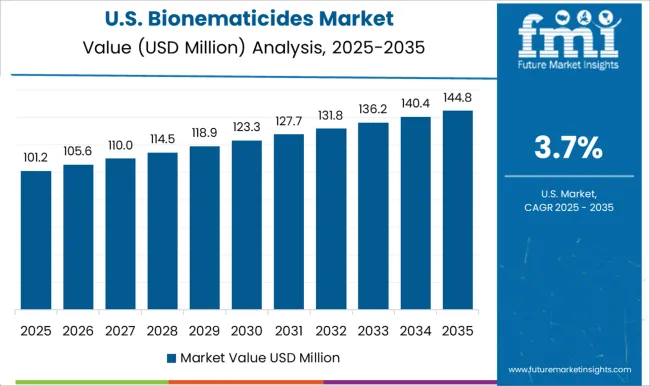

| USA | 3.7% |

| Brazil | 3.2% |

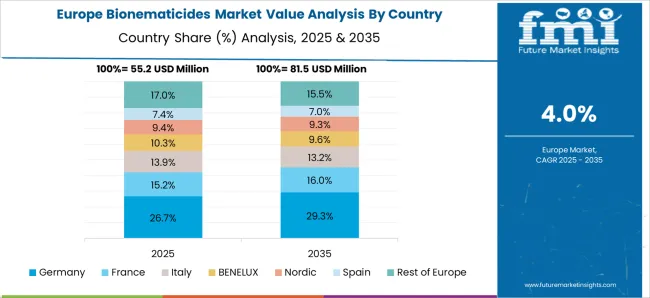

The global bionematicides market is projected to grow at a CAGR of 4.3% from 2025 to 2035. China leads with a growth rate of 5.8%, followed by India at 5.4% and France at 4.5%. The United Kingdom records a growth rate of 4.1%, while the United States shows the slowest growth at 3.7%. Growth is supported by rising demand for sustainable crop protection solutions, increasing adoption of eco-friendly farming practices, and expansion of agricultural production in emerging markets. China and India experience higher growth due to expanding arable land, government incentives for bio-based products, and rising awareness among farmers. Developed markets such as France, the UK, and the USA see steady growth driven by regulatory frameworks, increasing organic farming, and integration of bionematicides in integrated pest management programs. This report includes insights on 40+ countries; the top markets are shown here for reference.

The bionematicides market in China is projected to grow at a CAGR of 5.8%. Demand is driven by rising agricultural production, adoption of sustainable farming practices, and increased cultivation of high-value crops. Farmers are increasingly using bio-based nematicides to reduce chemical residues and improve soil health. Government initiatives promoting eco-friendly agricultural inputs and research programs supporting biopesticide development further enhance market growth. Additionally, growing awareness of crop yield optimization and pest resistance management fuels adoption of bionematicides across various regions in China.

The bionematicides market in India is expected to grow at a CAGR of 5.4%. Demand is fueled by increasing use in high-value crops, growing awareness of organic farming, and government incentives for bio-based crop protection solutions. Farmers are adopting bionematicides to reduce dependence on chemical nematicides and improve soil fertility. Expansion of agricultural land and rising horticulture and vegetable cultivation further support market growth. Research programs and partnerships between biopesticide manufacturers and agricultural institutes enhance product efficacy and adoption across the Indian market.

The bionematicides market in France is projected to grow at a CAGR of 4.5%. Demand is driven by increasing organic farming practices, regulatory encouragement for reduced chemical pesticide use, and adoption of integrated pest management. Manufacturers are providing high-quality, certified bionematicides to meet industry standards. Rising interest in sustainable agriculture and reduction of chemical residues in crops supports market growth. Additionally, research and innovation initiatives focus on improving nematicide effectiveness and promoting widespread adoption across different farming segments.

The bionematicides market in the United Kingdom is expected to grow at a CAGR of 4.1%. Expansion is supported by adoption in sustainable and organic farming, increasing awareness of bio-based crop protection solutions, and compliance with European Union agricultural regulations. Farmers are integrating bionematicides into pest management programs to reduce chemical dependence and maintain soil health. Government incentives, training programs, and industry initiatives contribute to steady adoption. Research collaborations between biopesticide manufacturers and academic institutions further enhance efficacy and market confidence.

The bionematicides market in the United States is projected to grow at a CAGR of 3.7%. Demand is fueled by increasing adoption of organic farming, sustainable crop protection solutions, and regulatory encouragement for reducing chemical pesticide use. Farmers are using bionematicides to improve soil health and crop productivity. Growth is also supported by awareness campaigns, industry partnerships, and R&D programs for product optimization. Expanding use in high-value crops such as vegetables, fruits, and specialty crops continues to drive market adoption in the USA

The bionematicides market is driven by agrochemical and biocontrol companies competing on efficacy, formulation stability, and environmental safety. BASF SE, Monsanto Company, and FMC Corporation lead with brochures highlighting broad-spectrum nematode control, field trial data, and integration with crop protection programs. Certis USA, Valent Biosciences, and others differentiate through biological formulations, emphasizing microbial activity, plant compatibility, and reduced chemical load. Marketing materials stress consistent performance across soil types and climates, providing growers with reliable options for high-value crops. Andermatt Biocontrol AG and T. Stanes & Company Limited focus on region-specific solutions, with brochures showcasing organic approvals, application flexibility, and safe handling practices. Brochures serve as essential tools for demonstrating efficacy, regulatory compliance, and agronomic benefits to distributors and farmers.

Other suppliers, including Protection AG, Nufarm, UPL Limited, and Isagro Group, leverage global networks and localized production to ensure supply consistency and tailored formulations. Brochures emphasize ease of application, crop safety, and compatibility with integrated pest management systems. Competition is shaped by the ability to combine high biological activity with cost-effectiveness and operational reliability. Marketing strategies rely on brochure-driven narratives to convey technical expertise, product differentiation, and sustainable crop protection benefits. Across the market, brochures play a central role in building trust, reinforcing credibility, and positioning suppliers as partners in effective nematode management solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 217.5 million |

| Crop | Fruits & Vegetables, Cotton, Corn, and Soybean |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Certis USA, Monsanto Company, Valent Biosciences, Andermatt Biocontrol AG, T. Stanes & Company Limited, FMC Corporation, Nufarm, UPL Limited, and Isagro Group |

| Additional Attributes | Dollar sales by product type (microbial, biochemical, plant extract) and application (vegetables, fruits, cereals, ornamentals) are key metrics. Trends include rising demand for eco-friendly pest control solutions, growth in sustainable agriculture practices, and increasing adoption in high-value crops. Regional adoption, regulatory approvals, and technological advancements are driving market growth. |

The global bionematicides market is estimated to be valued at USD 217.5 million in 2025.

The market size for the bionematicides market is projected to reach USD 331.3 million by 2035.

The bionematicides market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in bionematicides market are fruits & vegetables, tomato, pepper, cotton, corn and soybean.

In terms of crop, the fruits & vegetables segment is set to command 41.8% share in the bionematicides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA