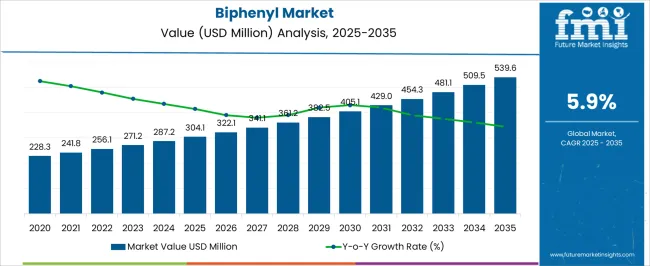

The biphenyl market, valued at USD 304.1 million in 2025 and expected to reach USD 539.6 million by 2035 at a CAGR of 5.9%, demonstrates distinct regional growth imbalances when comparing Asia Pacific, Europe, and North America. Asia Pacific is positioned as the most dynamic growth region, driven by rising chemical manufacturing capacity, expanding agrochemical demand, and the scale of industrial intermediates production.

Continuous investments in chemical value chains and relatively lower production costs are ensuring that the Asia Pacific will lead in both volume and revenue growth. Europe, by contrast, is experiencing moderate expansion, with growth influenced by stringent regulatory oversight surrounding chemical safety and environmental standards. While the region benefits from strong research capabilities and established specialty chemical markets, compliance costs and substitution pressures limit faster expansion. However, demand from niche applications, including heat transfer fluids and pharmaceutical intermediates, maintains steady market contribution.

North America exhibits balanced but slower growth relative to Asia Pacific, driven by technological advancements in chemical processing and steady requirements from agrochemicals and polymers. The high operational costs and environmental compliance frameworks temper rapid scaling. Asia Pacific emerges as the growth leader, Europe secures stable but regulation-driven expansion, and North America maintains innovation-led yet comparatively slower progression.

| Metric | Value |

|---|---|

| Biphenyl Market Estimated Value in (2025 E) | USD 304.1 million |

| Biphenyl Market Forecast Value in (2035 F) | USD 539.6 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The biphenyl market is identified as a specialized chemical segment with established applications across multiple industries. It contributes around 0.9% to the global organic chemicals market, while 1.4% is attributed to specialty chemicals due to its role as an intermediate. In the heat transfer fluids industry, a higher share of 4.2% is observed, as biphenyl is used in eutectic mixtures for high-temperature operations.

Within agrochemical intermediates, it accounts for nearly 2.6%, supporting the production of crop protection chemicals. A further 1.1% share is associated with pharmaceutical intermediates, where biphenyl derivatives are utilized. Recent industry trends show growing adoption of biphenyl blends in advanced heat transfer applications, particularly in concentrated solar power plants and chemical processing facilities. Groundbreaking strategies have focused on producing high-purity biphenyl for electronic and pharmaceutical uses, with investments in refining and purification technologies.

Companies are also expanding production through environmentally efficient processes to reduce emissions during synthesis. Partnerships with downstream industries have been emphasized, particularly in the agrochemical sector, to develop novel biphenyl-based formulations with improved efficacy. The regulatory trends regarding safer handling and greener chemistry are shaping strategies, encouraging bio-based and low-emission alternatives.

The biphenyl market is experiencing steady growth, supported by its diverse industrial applications and consistent demand from chemical, energy, and specialty manufacturing sectors. Market expansion is being driven by the increasing use of biphenyl in heat transfer fluids, dyes, and as an intermediate in the production of various organic compounds.

Supply stability is reinforced by established petrochemical production infrastructure, while ongoing technological advancements are enabling higher purity levels and improved performance characteristics. Regulatory compliance, particularly regarding safety and environmental impact, is shaping production practices and encouraging the adoption of cleaner, more efficient manufacturing methods.

Additionally, the growing emphasis on process efficiency in high-temperature industrial applications is supporting increased biphenyl consumption. Over the forecast period, rising industrial activity in emerging economies, combined with targeted product innovation and strategic supply chain optimization, is expected to sustain market momentum and broaden global market penetration.

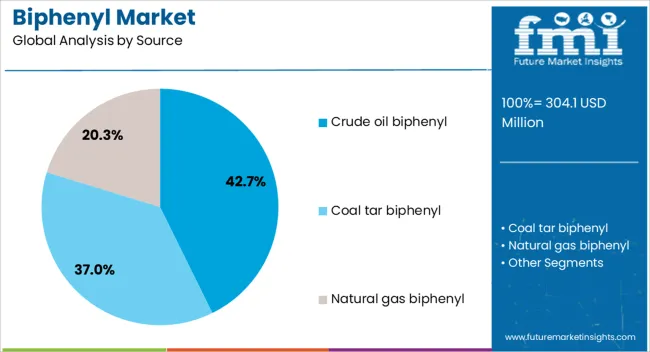

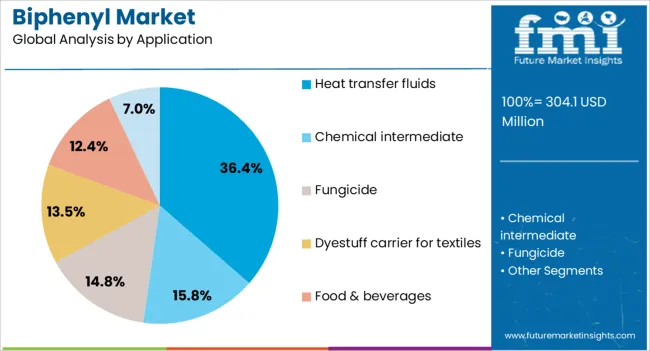

The biphenyl market is segmented by source, application, and geographic regions. By source, the biphenyl market is divided into Crude oil biphenyl, Coal tar biphenyl, and Natural gas biphenyl. In terms of application, the biphenyl market is classified into Heat transfer fluids, Chemical intermediates, fungicides, Dyestuff carriers for textiles, Food & beverages, and Solvents for pharmaceutical production.

Regionally, the biphenyl industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The crude oil biphenyl segment, holding 42.70% of the source category, dominates the market due to its large-scale availability, cost-effectiveness, and established production processes within the petrochemical industry. Its consistent quality and compatibility with downstream processing requirements have reinforced its position as the preferred raw material for various industrial applications.

Supply security is supported by extensive crude oil refining networks and integrated petrochemical complexes, ensuring reliable access for manufacturers. Technological advancements in refining and extraction methods are enhancing yield efficiency while reducing impurities, improving the performance of crude oil-derived biphenyl in specialized applications.

Furthermore, its competitive pricing structure relative to synthetic alternatives strengthens its adoption in cost-sensitive markets.

The heat transfer fluids segment, accounting for 36.40% of the application category, leads the market due to its critical role in maintaining thermal stability and operational efficiency in high-temperature industrial processes. Biphenyl-based heat transfer fluids are widely used in sectors such as chemical manufacturing, power generation, and food processing, where precise temperature control is essential.

The segment’s leadership is supported by biphenyl’s high thermal stability, low volatility, and excellent heat transfer properties, which reduce energy loss and extend equipment life. The expansion of concentrated solar power plants, polymer production facilities, and other heat-intensive industries is reinforcing demand growth.

Additionally, regulatory pressures for improved energy efficiency and lower emissions are driving the adoption of advanced heat transfer systems, further supporting this segment’s prominence in the global biphenyl market.

The market has gained relevance across multiple industrial applications, driven by its role as an intermediate in chemical production and as a heat transfer fluid component. Used in organic synthesis, agrochemicals, pharmaceuticals, and dye manufacturing, biphenyl provides versatility to industries with rising global demand. It also serves in heat transfer fluids, particularly in high temperature systems, which has reinforced its value in industrial operations.

The market is influenced by chemical industry expansion, environmental and safety regulations, raw material pricing, and technological advancements. Strategic adoption has been observed in regions with strong chemical manufacturing bases, making biphenyl an essential yet highly regulated material.

Biphenyl has established itself as a critical intermediate in the production of organic compounds, including dyes, resins, and polymers. Its role in agrochemical and pharmaceutical synthesis has made it indispensable for industries with expanding demand. Growth in specialty chemicals, coating materials, and additive formulations has further supported wider use of biphenyl derivatives. The increasing need for chemical intermediates in Asia Pacific and European manufacturing hubs has accelerated production and supply chains. Due to its multifunctional utility, biphenyl has transitioned into a material of strategic importance for downstream industries, supporting consistent market demand despite regulatory constraints in certain applications.

Biphenyl, often blended with diphenyl oxide, is widely used in heat transfer fluids, particularly in high-temperature industrial processes. Power generation, chemical manufacturing, and oil refining rely heavily on efficient heat transfer systems, where biphenyl-based fluids ensure stable performance. As industries move toward high-capacity and continuous operations, the need for reliable heat transfer solutions has increased. With thermal stability and efficiency being key requirements, biphenyl blends have maintained strong demand in energy-intensive sectors. This application has ensured that biphenyl remains resilient to cyclical fluctuations in other downstream uses, making it a vital enabler of industrial thermal processes.

The biphenyl market operates under strict environmental and occupational safety regulations due to its toxicological profile and classification as a hazardous substance. Regulations concerning exposure limits, safe handling, and permissible application areas have significantly shaped production and use. While restrictions in food preservation and direct consumer use have reduced older applications, controlled industrial applications remain stable. Chemical manufacturers are adapting production practices and waste management systems to comply with evolving environmental rules. Stricter compliance costs and monitoring obligations are influencing regional competitiveness, with certain producers gaining an advantage through advanced safety and environmental management systems.

The production of biphenyl is dependent on benzene availability and price, making the market vulnerable to petrochemical feedstock fluctuations. Volatility in crude oil markets and refinery operations has a direct impact on biphenyl production costs. In addition, global trade policies, transportation costs, and supply chain disruptions influence availability and pricing across regions. Producers are increasingly focusing on long-term supply agreements, backward integration, and optimization of logistics to reduce risks. The competitive environment is shaped by both cost management and reliable supply, factors that significantly affect the positioning of producers in the global biphenyl market.

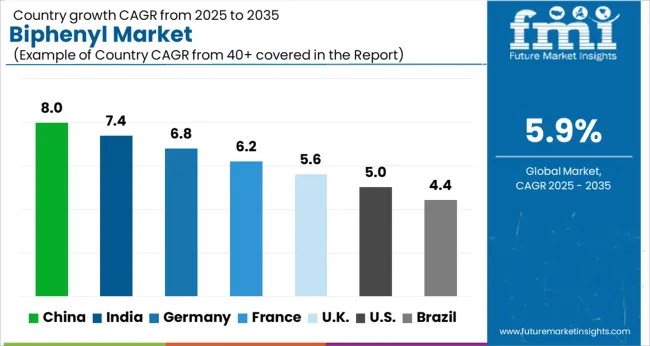

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

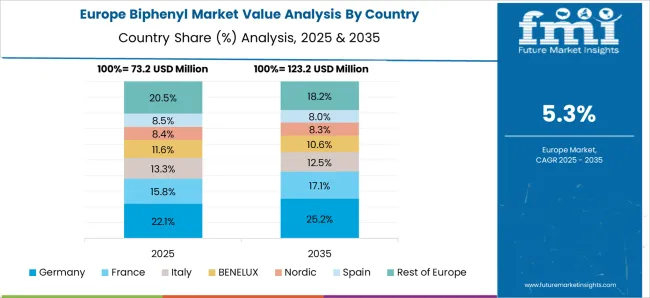

China led the market with a forecast CAGR of 8.0%, supported by its extensive chemical manufacturing base and strong demand from polymer processing and heat transfer fluid applications. India followed with 7.4%, where growth was sustained by expansion in agrochemicals and pharmaceutical intermediates production. Germany recorded 6.8%, influenced by established industrial chemical infrastructure and focus on specialty chemical innovations. The United Kingdom stood at 5.6%, driven by rising demand in coatings and performance materials. The United States registered 5.0%, with market expansion associated with adoption in chemical synthesis and niche applications. Collectively, these markets highlight a diversified demand pattern where biphenyl plays an essential role across multiple end use sectors including chemicals, pharmaceuticals, and advanced materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 8.0% in the market, supported by its extensive chemical manufacturing base and increasing demand for heat transfer fluids in industrial applications. The growth of the agrochemical sector, particularly in pesticide formulations, further strengthens market prospects. Local producers are focusing on cost-efficient production methods, enhancing supply availability across diverse applications. Rising investments in polymer industries also contribute to biphenyl utilization in chemical intermediates. As environmental regulations evolve, domestic manufacturers are exploring safer and more sustainable production approaches. The combination of industrial diversification and policy support positions China as a leading player in the global biphenyl market.

India is projected to witness a CAGR of 7.4% in the market, driven by the expansion of the agrochemical and pharmaceutical sectors. Demand for biphenyl as a chemical intermediate in the production of pesticides and other specialty chemicals is a key growth factor. Local manufacturing capabilities are improving, supported by government incentives for chemical production and research activities. Industrial applications in heat transfer fluids are gaining traction with the growth of power generation and processing industries. With growing regulatory oversight on chemical safety, domestic companies are adopting advanced production technologies to meet international standards. The market outlook remains positive with increasing domestic consumption and export opportunities.

Germany is anticipated to grow at a CAGR of 6.8% in the biphenyl market, supported by advanced research initiatives and strong demand from chemical processing industries. The country’s regulatory framework promotes safe and efficient utilization of biphenyl, especially in high-quality heat transfer applications. With its leadership in specialty chemicals and polymer production, Germany ensures consistent demand for biphenyl as a chemical intermediate. Efforts to enhance sustainability and reduce environmental impact are encouraging the use of cleaner production technologies. Growing collaborations between industrial producers and research institutes are expected to introduce innovative applications that reinforce Germany’s role in the European biphenyl market.

The United Kingdom is forecasted to expand at a CAGR of 5.6% in the market, supported by its steady demand in chemical intermediates and niche industrial applications. Biphenyl utilization in heat transfer fluids remains essential in processing industries, while agrochemical demand also contributes to market stability. The country’s emphasis on compliance with environmental and chemical safety standards ensures controlled market growth. Imports play an important role in maintaining supply stability, with partnerships between global producers and UK distributors shaping the competitive landscape. A gradual shift toward sustainable alternatives is likely to influence long-term production and consumption patterns.

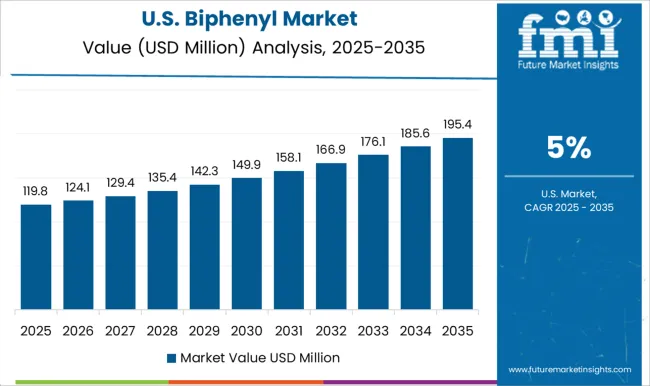

The United States is expected to record a CAGR of 5.0% in the market, driven by industrial applications in heat transfer systems, agrochemicals, and specialty chemicals. Large-scale industrial operations in petrochemicals and polymers are key contributors to biphenyl demand. Domestic manufacturers focus on advanced processing technologies to enhance safety and efficiency in production. Regulatory guidelines encourage the adoption of sustainable practices, creating opportunities for eco-friendly formulations. With ongoing investments in research and innovation, the United States is expected to diversify biphenyl applications across multiple industrial domains, sustaining demand over the long term.

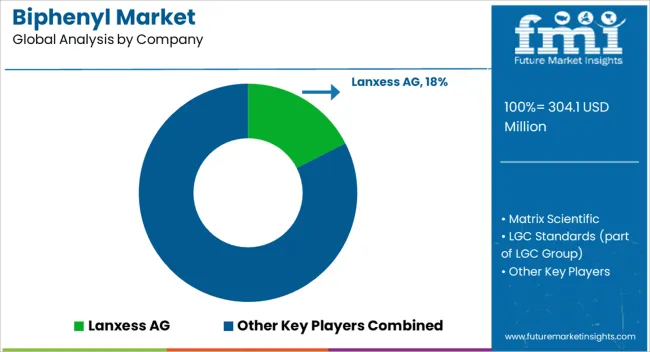

The market is shaped by a mix of specialty chemical producers, pharmaceutical suppliers, and research-focused organizations that drive availability and application diversity. Lanxess AG is one of the leading companies, leveraging its chemical expertise to provide biphenyl for industrial applications, particularly in polymers and coatings. Matrix Scientific and LGC Standards support the market by supplying high-quality biphenyl compounds for laboratories and analytical purposes, contributing significantly to research and development sectors. Taj Pharmaceuticals Ltd demonstrates strong involvement by offering biphenyl derivatives for pharmaceutical intermediates, ensuring its utility in drug formulation. Biosynth Carbosynth has enhanced its presence with extensive catalog offerings targeted toward life sciences and organic synthesis.

Huntsman remains an influential player with its chemical manufacturing base serving multiple industries, including plastics and performance materials. ABCR GmbH and AK Scientific, Inc. provide laboratory-grade biphenyl compounds to research institutions worldwide, while Eastman Chemical Company emphasizes industrial-scale production to serve the coatings and specialty chemical industries. Thermo Fisher Scientific and Merck KGaA are major suppliers to laboratories and research centers, ensuring consistent quality and global availability. Tokyo Chemical Industry Co., Ltd. and Santa Cruz Biotechnology strengthen the academic and pharmaceutical research ecosystem with their product ranges. Clearsynth Labs focuses on custom synthesis and high-purity derivatives of biphenyl for specialized needs. Debye Scientific Co., Ltd. has positioned itself in the Asian market, catering to both academic and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 304.1 Million |

| Source | Crude oil biphenyl, Coal tar biphenyl, and Natural gas biphenyl |

| Application | Heat transfer fluids, Chemical intermediate, Fungicide, Dyestuff carrier for textiles, Food & beverages, and Solvents for pharmaceutical production |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lanxess AG, Matrix Scientific, LGC Standards (part of LGC Group), Taj Pharmaceuticals Ltd, Biosynth Carbosynth, Huntsman, ABCR GmbH, AK Scientific, Inc., Eastman Chemical Company, Thermo Fisher Scientific, Merck KgaA, Tokyo Chemical Industry Co., Ltd., Santa Cruz Biotechnology, Clearsynth Labs, and Debye Scientific Co., Ltd. |

| Additional Attributes | Dollar sales by biphenyl grade and application, demand dynamics across chemical, pharmaceutical, and agricultural sectors, regional trends in industrial chemical adoption, innovation in synthesis methods and purity levels, environmental impact of production and waste management, and emerging use cases in heat transfer fluids and specialty chemical formulations. |

The global biphenyl market is estimated to be valued at USD 304.1 million in 2025.

The market size for the biphenyl market is projected to reach USD 539.6 million by 2035.

The biphenyl market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in biphenyl market are crude oil biphenyl, coal tar biphenyl and natural gas biphenyl.

In terms of application, heat transfer fluids segment to command 36.4% share in the biphenyl market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Biphenyl Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA