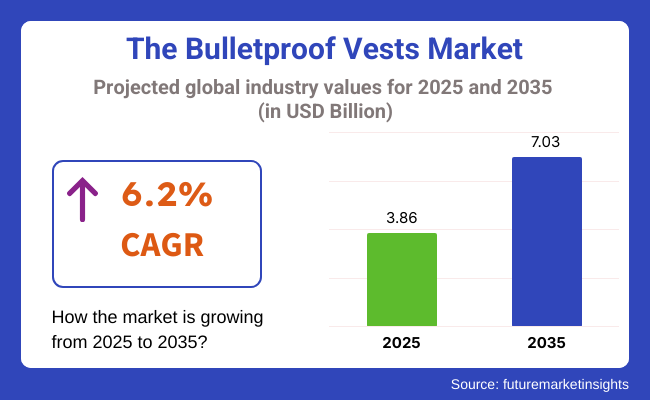

The bulletproof vests market size was USD 3.86 billion in 2025 and will increase at a CAGR of 6.2% from 2025 to 2035. The industry valuation is expected to be USD 7.03 billion in 2035. One of the key drivers is the increasing demand for personal protective equipment by armed forces, law enforcement agencies, and private security personnel in the wake of increased geopolitical tensions and urban crime.

Increased government expenditure on defense upgrading, particularly in developing nations, has spurred the use of advanced ballistic armor technology. Improved bulletproof vests are more secure yet offer better comfort and mobility because of composite material innovation and ergonomic design. Law enforcement units globally are increasingly employing lightweight vests for better tactical response effectiveness.

Advances in textile technology, such as the incorporation of ultra-high-molecular-weight polyethylene and Kevlar derivatives, are enhancing protection-to-weight ratios, and next-generation vests are becoming more convenient for prolonged field deployment. Smart vests, with sensors and health-monitoring capabilities, are also being introduced, consistent with the overall trend towards defense digitalization.

Urbanization and growing instances of civil unrest in high-density urban regions are also compelling civilian security industries to invest in reliable protective gear. Demand is spilling over from the national defense sector, moving into private sector applications, such as VIP protection and riot control units, which is fueling ongoing revenue growth in developed and emerging regions.

High costs for cutting-edge bulletproof technologies and also logistical and supply chain challenges in the sourcing of materials are major hindrances. Nonetheless, with continuous regional wars and evolving security threats, consistent product development and cross-border defense alliances are expected to sustain growth over the forecast period.

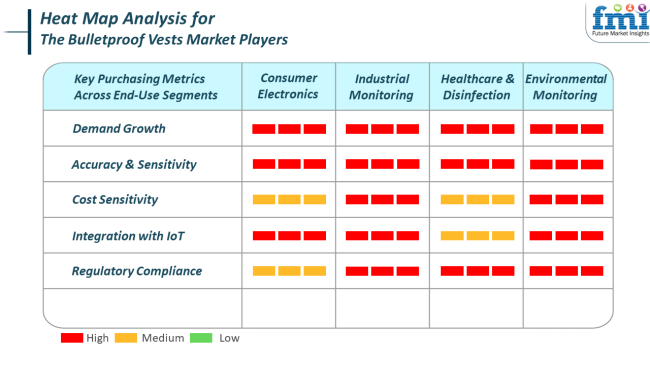

Whereas bulletproof vests fall largely within the defense and security category, end-use segment analysis models reveal crucial information about buying behaviors. Under industrial tracking, there is an increasingly high demand for ballistic vests with IoT and risk detection due to improved security protocols and industry automation in hostile environments. The solutions are becoming more integrated with remote monitoring and environmental sensing capabilities.

In medical and disinfection use, particularly in war zones or unstable areas, a steady demand exists for light, compliant protective clothing for physicians and other medical personnel who work in risk areas. High mobility and affordability are crucial purchasing factors in this instance, but levels of protection are not sacrificed. In environmental monitoring, on the other hand, protective gear that can withstand harsh conditions and offer moderate ballistic protection is gaining popularity, especially among field operatives in politically unstable regions.

Wearable tech integration trends are influenced by consumer electronics just as much as an ancillary industry segment as they are. Body temperature regulation, real-time location sharing, and health diagnostics smart features are embedded in vests using wearable consumer tech advancements. Such inter-industry trends are gradually reshaping next-generation bulletproof vest buying standards.

The industry is vulnerable to defense spending movements, particularly among the advanced economies in which budget reallocations to social programs can limit procurement windows. Delays in government tenders and multi-tiered bureaucracy in defense contracting also contribute to revenue uncertainty, particularly among smaller players who seek protection under institutional contracting.

Abrupt technological progress, while a growth promoter, also has risks of obsolescence. Firms are compelled to continue revising materials and specifications to remain competitive, which can increase R&D costs and compress profit margins. The lack of international standard safety regulations also complicates entry into the industry and slows international trade for most suppliers.

Geopolitical tensions impose a two-faced situation. Even as conflict might enhance short-run demand, it is also poised to disrupt production and export functions in major zones. In addition, growing issues regarding police militarization within certain zones might be reflected as more stringent regulative oversight and lower levels of funding for non-military acquisition that would hamper long-term civilian industry growth.

The bulletproof vests industry saw vast transformationfrom 2020 to 2024 due to a greater focus on self-protection based on a growth in security risks. Law enforcement units, the military, and government authorities were the foremost consumers of bulletproof vests, triggering progress toward producing lighter yet softer material.

Technological improvements in aramid fibers and other high-strength polymers allowed manufacturers to create vests with enhanced protection while maintaining flexibility and comfort. In addition, technology integration and customization, including smart materials that respond to environmental stimuli, emerged as the major trends.

For the period 2025 to 2035, there would be a trend towards more customization and incorporation of technology for the bulletproof vests industry. The incorporation of intelligent technologies like real-time monitoring of health, GPS tracking, and body temperature sensors will make bulletproof vests more functional.

In addition, the development of sustainable materials, along with the development of lighter yet stronger composites, will drive innovation in product designs. Future bulletproof vests will also be more ergonomic for increased mobility, making them more appropriately applicable in a broader range of applications, including civilian use in high-risk zones. Improved regulatory requirements will ensure continued enhancement in safety and performance.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stepped-up requirements from the law enforcement, military, and private security markets. | Expanding demand for civilian protective apparel and evolving technology in vests. |

| Use of aramid fibers and high-strength polymers in designing protective but light vests. | Smart technologies like health sensors and temperature sensors should be incorporated into the design process to create light but protective vests. |

| Invention of eco-friendly, light, and effective composite materials for enhanced protection. | Sophisticated incorporation of smart technologies like real-time tracking, GPS, and threat analysis. |

| Improved fit and comfort with key protective functionality as standard. | Very personalized design, with improved ergonomics and mobility for expanded use scenarios. |

| Regulatory protection and performance standards to date. | Stricter regulations lead to improved-quality products and standardized safety features. |

| Primarily military, law enforcement, and civilian private security. | Greater use among high-risk civilian environments, such as by journalists, activists, and bodyguards. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| UK | 5.8% |

| France | 5.6% |

| Germany | 5.9% |

| Italy | 5.3% |

| South Korea | 6.1% |

| Japan | 5.5% |

| China | 6.7% |

| Australia-NZ | 5.2% |

The USA is projected to witness a growth rate of 6.4% CAGR throughout the study. Growth in the USA is propelled by the consistent requirement for state-of-the-art personal protective equipment in all law enforcement, military, and homeland security domains.

Increased focus on public safety coupled with increasing incidence rates of mass shootings have made governments and private institutions place increased focus on the protection of personnel. High defense spending paired with enhanced procurement of improved armor systems is likely to fuel steady growth.

There is a swift innovation, with American manufacturers dominating the integration of high-strength, lightweight composite materials and modular structures. Furthermore, the use of advanced technologies like graphene-reinforced fibers and flexible armor systems aids mobility as well as protection and hence finds popularity with tactical units.

Federal and state government financing programs for police modernization and military preparedness further fuel demand. Existent military contracts, as well as R&D expenditures, further support industry prospects. Demand for ergonomically designed and custom-fit vests for women in service is increasing, giving rise to niche industries. Having top-tier global manufacturers based in the USA provides the region with a competitive advantage in technological innovation and product diversification.

The UK is expected to grow at 5.8% CAGR during the study period. Rising internal security threats, organized crime, and evolving terrorism risks continue to drive the demand for modern protective gear. Bulletproof vests are a critical component of frontline defense for armed forces, special units, and police departments.

Government investment in defense modernization programs and police restructuring initiatives has reinforced spending on body armor systems. The focus on wearability and lightweight materials addresses the increasing demand for prolonged operational comfort, particularly for urban enforcement teams and mobile response units. UK defense contractors are developing capabilities in ballistic protection through product innovation and research partnerships.

There is a significant trend toward standardizing armor performance across different applications, which drives demand for high-specification, certified vests. Furthermore, there are increasing opportunities for exports to NATO-aligned nations, where there is a standing reputation for British-built armor systems to be superior in quality.

Moreover, peacekeeping roles undertaken by the military and the deployments of special operation units enhance the demand for unobtrusive and lightweight security solutions. Solution developments in protection against multi-threats, including stabs and spikes, are further experiencing increased demand from law enforcers.

French demand is anticipated to expand at a 5.6% Compound Annual Growth Rate throughout the investigation. Emphasis on domestic protection, particularly because of terror-associated attacks and civic unrest, has increased the prioritization of ballistic vests in state defense and public security forces.

Government-inspired modernization initiatives for military and gendarmerie equipment, as well as persistent involvement in multinational peacekeeping operations, fuel steady buys of sophisticated body armor solutions. Focusing on sustainability and local production also benefits local industry expansion, as France is looking to avoid over-reliance on imports.

Research and development within the nation have started integrating lighter, airier materials into vest constructions to improve mobility and comfort, particularly for employment in city fighting conditions. Greater cooperation between research centers and defense contractors has spurred the refinement of adaptive armor for specialized mission sets.

In addition, the private security sector is growing, with the increasing use of ballistic vests among corporate security services and critical infrastructure protection staff. France's participation in EU-wide defense programs creates funding and cross-border technology transfer, enabling its regional competitiveness.

Germany will grow at 5.9% CAGR over the study period. Germany's strong industrial sector and emphasis on innovation enable a dynamic and changing bulletproof vests market. A strong focus on soldier modernization initiatives and the incorporation of composite materials has resulted in consistently upgrading product features for the Bundeswehr and law enforcement agencies. Strategic procurement strategies emphasize durability, mobility, and multilevel protection in body armor systems.

There is an increasing participation of German troops in EU and NATO operations overseas, necessitating deployment-capable protective solutions. Technical capabilities in materials science in Germany have enabled the creation of multi-layered ballistic systems tailored for threat responsiveness and modularity.

Country-based defense OEMs have robust supply chains and relationships with European allies, boosting production capacity and export potential. Additionally, the police sector increasingly adopts soft armor systems designed for routine patrols and crowd control situations, where quick-response protection is vital. The industry is also witnessing growth in smart armor applications, integrating sensors for health and situational awareness, indicating a move toward next-generation wearable defense technologies.

Italy is expected to grow at 5.3% CAGR during the study period. Italy's bulletproof vests market is mainly fueled by defense industry modernization and increasing demand for personal protection gear in civil policing. The past few years have seen increased government investments towards enhancing national security infrastructure, leading to greater procurement of ballistic equipment.

Italian defense vendors are increasingly developing armor technology through the utilization of composite materials and sophisticated fabrication methods to attain both lightweight and high resistance. The growth in urban security threats and counterterrorism efforts has encouraged wider application of concealable armor solutions by plainclothes as well as tactical law enforcement units.

Military preparedness and assistance to overseas operations also require dependable and long-lasting body armor, particularly for special operations forces. Italy's established textile and design industries help in creating ergonomic, form-fitting armor solutions for long-duration wear. In addition, European defense partnerships enable Italian companies to embed advanced technologies by way of co-development partnerships, enhancing innovation and competitiveness.

South Korea is forecast to register a 6.1% CAGR during the study period. South Korea's defense is influenced by the ongoing geopolitical tensions in the country, especially with its northern neighbor. This security context requires ongoing expenditure on sophisticated military equipment, including bulletproof vests.

The administration's commitment to force modernization and soldier survivability finds expression in persistent demand for enhanced personal protective systems. The local defense industry, sponsored by major conglomerates, is concentrating on making lightweight and high-performance ballistic vests to boost combat readiness.

Growing defense exportsopen up greater opportunities in the industry, with armor systems becoming more adaptable to varied terrain and operational demands. South Korea is also working on nanotechnology and smart materials to enhance ballistic protection without diminishing flexibility.

Policymakers are promoting cooperation among academia and defense companies to spearhead indigenous growth while adapting to international standards of armor certification. The increasing demand for wearable electronics and embedded sensors to monitor field conditions is likely to influence the future of bulletproof vest development in the nation.

Japan will grow at 5.5% CAGR over the study period. Japan's bulletproof vests market is influenced by its strategic emphasis on self-defense capacity and assistance to international peacekeeping missions. Although its internal threat level is fairly low, escalating international tensions and the necessity of preparedness for humanitarian and disaster relief have resulted in renewed interest in protective equipment for security forces.

The Self-Defense Forces and Coast Guard have important requirements for armor systems that are rugged, modular, and appropriate for maritime and amphibious environments. Japan's sophisticated manufacturing infrastructure facilitates innovation in light, energy-absorbing materials like aramid fibers and thermoplastic composites.

Local firms are increasingly focusing on environmental resistance, ergonomic fit, and multi-threat protection. With a cultural focus on quality and accuracy, Japanese manufacturers concentrate on high-performance gear that complies with rigorous safety standards.

Sales growth is also facilitated by increasing private sector demand, particularly in corporate security and critical infrastructure protection. Further investment in dual-use technologies will be expected to lead to enhanced flexibility of bulletproof vests between civilians and defense users.

China is anticipated to expand at 6.7% CAGR through the period of research. China is one of the most profitable markets for bulletproof jackets due to massive military modernization and domestic security programs. The federal government continues to invest heavily in defense infrastructure and personnel security, driving impressive demand for sophisticated protection systems.

Urbanization and increased public security operations further drive demand from domestic police forces and paramilitary units. China's domestic production infrastructure facilitates mass production of bulletproof vests at affordable prices.

Focusing on technological independence has given rise to the integration of in-house armor materials and wearable systems into one. Studies in graphene composites, self-healing polymers, and intelligent fabrics are shaping the future of bulletproof technologies. Export-driven production also allows Chinese companies to address global demand, especially in emerging economies. Customization opportunities and flexibility of armor designs attract a broad user base.

The Australia-New Zealand region will record a 5.2% CAGR throughout the study period. Consistent defense expenditures and robust emphasis on homeland security underpin the industry in this region. Australia's strategic position and involvement in international peacekeeping and defense alliances require effective protective gear for military and law enforcement agents. New Zealand also spends on personal protective equipment as a component of comprehensive public security and disaster relief policies. Growing focus on sustainability and domestic production further promotes growth.

Local manufacturers are adding green materials and ergonomic design elements to the armors. With border security and counterterrorism as utmost policy priorities, officials are investing in upgraded protective equipment for field operatives.

The private sector for security is also growing, with increased demand for high-performance bulletproof vests. Advances in modular armor kits and gender-specific designs guarantee inclusive use and operational comfort. Ongoing cooperation with allied countries makes it easier to transfer high technology and meet standards.

Soft bulletproof vests are the major sub-segment, with an estimated 55-60% global revenue share. Flexible and comfortable to wear, they are used extensively by police, private security personnel, and civilians. Made of fabrics such as Kevlar and UHMWPE, they protect from handgun threats without hindering movement. Industry giants like DuPont, Safariland, and Teijin Aramid are constantly working on lighter, breathable materials.

Their usage is large in North America and Europe, aided by uniform officer safety mandates and growing urban law enforcement preparedness demand. Hard vests comprise the secondary sub-segment, used mainly in military use as they can sustain rifle fire and high-impact velocities.

They account for about 40-45% of the share, with demand propelled by international defense procurement cycles. Major players such as BAE Systems, Point Blank Enterprises, and 3M Ceradyne manufacture modular systems with ceramic or composite plates designed to maximize combat performance. Growth is strongest in Asia-Pacific and the Middle East, where increasing geopolitical tensions are inducing defense upgrades. Although heavier and less comfortable, hard vests are still vital in high-threat situations.

The defense segment holds 58-62% of worldwide revenue. Military modernization programs, higher defense spending, and global tensions are drivers of growth. Industry leaders, including Safariland, Revision Military, and BAE Systems, dominate this segment, investing in modularity and high-tech materials. Second-tier suppliers MKU and DRDO provide regional military requirements, particularly in Asia and Africa, with localized and affordable solutions.

Law enforcement accounts for the second-largest segment, with a 28-32% industry share, driven by increasing crime rates and urban security requirements. Companies such as Point-Blank Enterprises and Armor Express are top players that produce lightweight and ergonomic vests designed for everyday patrol. Regional players supply small police units in developing economies, boosted by foreign funding and expanding public safety programs.

The civilian segment, smaller at 5-8%, is expanding swiftly. Demand is most robust in the USA and Latin America, where individual safety needs are great. Businesses like MC Armor and Premier Body Armor service professionals, reporters, and individual citizens with discrete, practical styles. Fashion trends aid expansion in tactical gear and rising legal availability of protective equipment.

The bulletproof vests market is characterized by competition from legacy defense suppliers, specialized armor firms, and tactical gear brands as these firms attempt to respond to the increasing demand from military, law enforcement, private security, and civilian segments.

Point Blank Enterprises, AR500 Armor, and Black Hawk remain the dominant players based on contract wins, scalable production capacity, and brand equity. However, PPSS Group and Survival Armor have started gaining ground with their niche offerings and innovations in lightweight, ergonomic, and stab-resistant solutions.

Point Blank Enterprises is the winner in this category because it has had relationships with USA federal and state agencies for several decades, offering a wide range of products alongside constant innovations in modular and mission-specific armor.

AR500 Armor is doing fantastically well in the DTC segment and sells affordable, quickly shipped armor kits to a growing base of customers, mainly preppers and private security professionals. Black Hawk, a Vista Outdoor company, is integrating its tactical gear with body armor to attract military and law enforcement users.

PPSS Group is now fast emerging as a primary supplier for high-risk environments like corrections, where spike and stab-resistant vests provide added value over ballistic-only options. On the other hand, Survival Armor manufactures NIJ-certified vests for frontline officers, keeping comfort and wearability at the forefront without sacrificing protection. New technologies on the rise, such as ceramic-composite hybrids, nanomaterials, and modular carriers, shake loudly in favor of relatively best pricing. The impact was not the same with users in cities and high mobility.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Point Blank Enterprises | 18-22% |

| AR500 Armor | 14-17% |

| Black Hawk | 11-14% |

| PPSS Group | 9-12% |

| Survival Armor | 8-11% |

| Other Key Players | 26-34% |

| Company Name | Offerings & Activities |

|---|---|

| Point Blank Enterprises | Modular ballistic vests, scalable systems for police and military, and long-term government contracts. |

| AR500 Armor | Steel and composite plate armor for civilian and tactical buyers; affordable and DTC-focused. |

| Black Hawk | Tactical armor integrated with combat and gear lines; leverages brand under Vista Outdoor. |

| PPSS Group | Spike- and stab-resistant body armor; expanding in corrections and private security globally. |

| Survival Armor | Ergonomic, NIJ-certified ballistic vests; lightweight customization for police and tactical forces. |

Key Company Insights

Point Blank Enterprises (18-22%)

Industry leader with expansive government contracts and advanced modular body armor technology; primary supplier to USA law enforcement.

AR500 Armor (14-17%)

Commands strong DTC and civilian market share; known for durable steel plates and budget-conscious tactical kits.

Black Hawk (11-14%)

Maintains relevance via gear-armor synergy and military heritage; appeals to professionals and tactical enthusiasts alike.

PPSS Group (9-12%)

An innovator in non-ballistic armor, recognized in Europe, as well as correctional facilities for stab and spike protection.

Survival Armor (8-11%)

Known for user-centric design and regulatory compliance; stronghold in domestic law enforcement sectors seeking wearable protection.

Other Key Players

The segmentation is into soft and hard body armor types.

The segmentation is into end users, including defense, law enforcement agencies, and civilians.

The regions covered include North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 3.86 billion in 2025.

The industry is predicted to reach a size of USD 7.03 billion by 2035.

Key companies include Point Blank Enterprises, AR500 Armor, Black Hawk, PPSS Group, Survival Armor, BulletBlocker, U.S. Armor Corporation, Imperial Armour, VestGuard UK Ltd., Canadian Armour Ltd., and Under Armour.

China, slated to grow at 6.7% CAGR during the forecast period, is poised for the fastest growth.

Soft bulletproof vests are being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bulletproof Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA