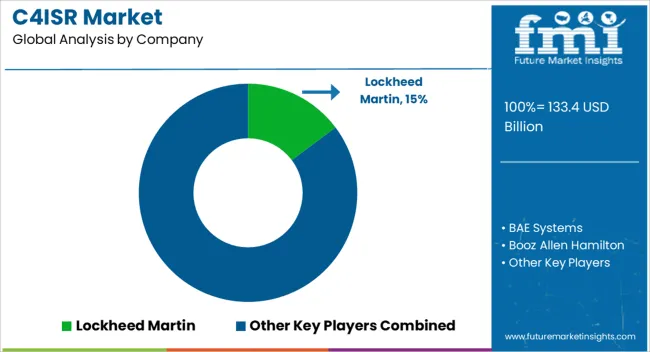

The C4ISR market is projected to grow from USD 133.4 billion in 2025 to USD 232.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7%. The market trajectory indicates a steady rise, with annual values expected to reach USD 157.5 billion by 2028 and USD 176 billion by 2030. The increasing deployment of integrated command, control, communications, computers, intelligence, surveillance, and reconnaissance systems across defense and security sectors is driving this growth.

From an industry perspective, the adoption of advanced situational awareness solutions, real-time data management, and decision-support platforms is being emphasized to improve operational efficiency and mission effectiveness. The market’s steady expansion reflects a clear preference for systems that enhance strategic coordination, operational readiness, and tactical response capabilities. By 2035, with the market projected to reach USD 232.2 billion, it is evident that C4ISR systems are becoming central to modern defense operations and national security strategies. The growth curve suggests that stakeholders focusing on integrated system solutions, secure communication networks, and advanced sensor technologies are likely to capture substantial market share.

The market dynamics indicate that continuous upgrades, interoperability with existing platforms, and scalable solutions will define competitive advantage, making the C4ISR segment a critical area for both government procurement and private sector defense contractors seeking long-term strategic relevance.

| Metric | Value |

|---|---|

| C4ISR Market Estimated Value in (2025 E) | USD 133.4 billion |

| C4ISR Market Forecast Value in (2035 F) | USD 232.2 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The C4ISR market holds a significant share within its parent markets, driven by its critical role in modern defense operations. Within the defense electronics market, C4ISR systems constitute approximately 20–25% of the total market share, reflecting their integral function in communication, navigation, and surveillance systems. In the military communications market, C4ISR represents about 30–35%, as it encompasses advanced communication networks essential for command and control.

The surveillance and reconnaissance systems market sees C4ISR comprising around 40–45%, highlighting its dominance in providing real-time intelligence and situational awareness. In the command and control systems market, C4ISR holds a share of approximately 50%, underscoring its foundational role in strategic decision-making processes. The electronic warfare systems market has C4ISR, constituting about 15–20%, due to its contribution to electronic defense and countermeasure capabilities. These figures illustrate the pervasive influence of C4ISR across various defense sectors, driven by its ability to integrate and streamline complex military operations. Despite challenges such as cybersecurity threats and interoperability issues, the market share distribution indicates a clear trend towards the adoption and expansion of C4ISR systems in modern military frameworks. The ongoing demand for enhanced operational efficiency and real-time decision-making continues to propel the growth of the C4ISR market within its parent markets.

The C4ISR market is experiencing robust expansion, underpinned by increased defense modernization programs, technological convergence, and rising geopolitical tensions necessitating advanced intelligence and command systems. Governments and defense organizations are investing heavily in integrated platforms to enhance situational awareness, decision-making speed, and operational efficiency. Current growth momentum is being supported by the integration of artificial intelligence, advanced sensors, and real-time data analytics into C4ISR frameworks, enabling greater automation and precision.

Procurement cycles are being influenced by both national security imperatives and interoperability requirements among allied forces. In emerging economies, rising defense budgets and strategic capability building are accelerating adoption, while mature markets are focused on upgrading legacy systems to address evolving threats.

Vendor strategies are centered on innovation, modularity, and lifecycle support to ensure system adaptability and cost efficiency Over the forecast period, the market is expected to maintain a positive trajectory driven by persistent global security challenges, expanding military alliances, and technological advancements enhancing multi-domain operational capabilities.

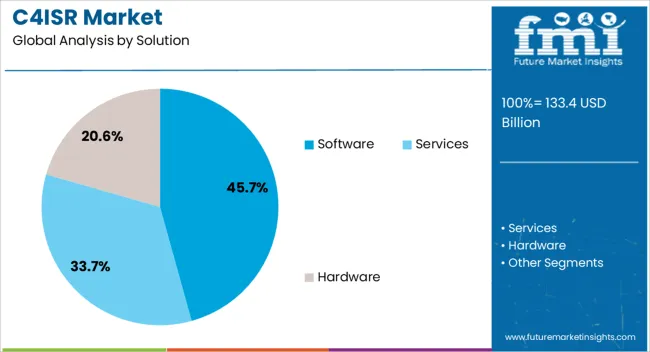

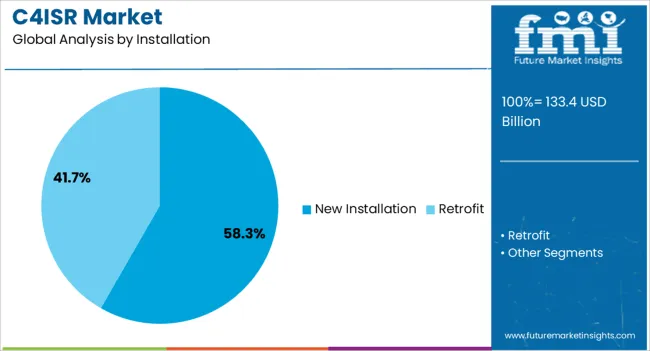

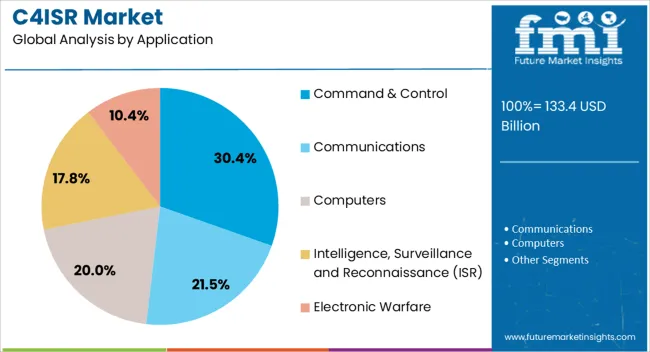

The C4ISR market is segmented by solution, installation, application, platform, end use, and geographic regions. By solution, C4ISR market is divided into Software, Services, and Hardware. In terms of installation, C4ISR market is classified into New Installation and Retrofit. Based on application, C4ISR market is segmented into Command & Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (ISR), and Electronic Warfare.

By platform, C4ISR market is segmented into Land, Naval, Airborne, and Space. By end use, C4ISR market is segmented into Defense & Military, Government, and Commercial. Regionally, the C4ISR industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment, commanding 45.70% of the solution category, has maintained dominance due to its pivotal role in integrating diverse C4ISR components into cohesive, mission-ready systems. Software platforms are essential for enabling real-time data fusion, threat analysis, and command execution across multiple operational domains. The segment’s growth is being reinforced by the shift towards cloud-enabled and AI-driven solutions, which enhance system agility and reduce decision latency.

Continuous upgrades to meet evolving cybersecurity requirements are ensuring long-term adoption by defense agencies. Procurement strategies favor software with modular architecture, allowing rapid adaptation to mission-specific needs and interoperability with allied systems.

Lifecycle support and scalability are driving sustained contracts, while emerging technologies such as predictive analytics and machine learning are expanding the functional scope. The segment’s share is expected to remain resilient as digital transformation becomes central to modern defense strategies, ensuring its critical role in the overall C4ISR ecosystem.

The new installation segment, holding 58.30% of the installation category, has been leading the market as defense organizations prioritize the deployment of advanced C4ISR systems over retrofits to address contemporary operational requirements. This dominance is supported by large-scale procurement programs in both developed and emerging markets, aimed at replacing outdated infrastructure with high-capacity, integrated solutions. The segment’s growth is driven by strategic initiatives to enhance multi-domain coordination, real-time intelligence sharing, and operational readiness.

Budget allocations favoring complete system overhauls are accelerating adoption, particularly in regions experiencing heightened security challenges. The integration of advanced communication networks, AI-based analytics, and satellite-based reconnaissance in new systems ensures higher performance standards and adaptability.

Collaborative defense agreements and multinational joint operations are further encouraging investment in new installations to ensure compatibility and interoperability. Over the forecast period, sustained defense spending and the necessity for modern infrastructure are projected to keep the segment at the forefront of market expansion.

The command & control segment, representing 30.40% of the application category, has secured its position as the leading application area due to its critical function in orchestrating military operations and ensuring coordinated decision-making. Its prominence is reinforced by the need for centralized, high-speed processing of intelligence to support real-time battlefield management. Continuous upgrades to command & control centers, integrating AI, big data analytics, and secure communication protocols, are enhancing operational efficiency and strategic responsiveness.

The growing complexity of modern warfare is fueling demand, requiring robust command frameworks capable of managing multi-domain operations. Military modernization programs are prioritizing investment in command & control capabilities to ensure faster, more informed decision cycles.

The segment benefits from strong alignment with network-centric warfare doctrines, ensuring interoperability and secure data exchange across allied forces. Over the coming years, advancements in automation and predictive analytics are expected further to strengthen this segment’s role within the C4ISR framework.

The C4ISR market is growing due to rising demand for integrated defense command systems and real-time intelligence capabilities. Opportunities exist in next-generation sensors, AI-driven analytics, and network-centric operations. Trends are shifting toward AI-enhanced, automated, and interconnected platforms, while high costs and integration complexity pose challenges. Overall, the market is expected to expand steadily as defense forces invest in modern, scalable, and secure C4ISR solutions to strengthen situational awareness, decision-making, and multi-domain operational capabilities globally.

The C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market is driven by increasing demand for integrated defense systems that enhance situational awareness and decision-making. Armed forces globally are investing in advanced platforms to coordinate operations across land, sea, air, and space domains. Rising geopolitical tensions, modernization of military infrastructure, and focus on real-time intelligence are key factors contributing to adoption. This demand is reinforced by the need for rapid information sharing, interoperability between allied forces, and efficient command and control networks, making C4ISR systems critical for modern defense operations.

Opportunities in the C4ISR market arise from the integration of advanced sensor networks, unmanned platforms, and AI-driven intelligence analytics. Innovations in satellite communication, radar systems, and cybersecurity solutions allow for enhanced battlefield visibility and rapid threat assessment. Emerging defense contracts and government modernization programs in regions such as North America, Asia-Pacific, and the Middle East provide lucrative growth avenues. Vendors offering interoperable, scalable, and modular C4ISR solutions can capture new business segments, including tactical, strategic, and cyber defense applications, strengthening market positioning and revenue potential.

A notable trend shaping the market is the adoption of AI, machine learning, and network-centric approaches to improve operational efficiency and predictive intelligence. Automation in threat detection, mission planning, and decision support is increasingly integrated into C4ISR platforms. Cloud-based architectures and secure communication networks enable seamless data sharing among distributed forces. Additionally, the rise of unmanned aerial and ground vehicles equipped with real-time sensing capabilities is transforming battlefield operations. These trends demonstrate a shift toward smarter, faster, and more connected defense systems capable of supporting multi-domain operations.

The C4ISR market faces challenges related to high procurement costs, complex system integration, and evolving cyber threats. Advanced systems require significant investment in hardware, software, and specialized training, limiting adoption for smaller defense budgets. Interoperability between legacy platforms and modern systems remains a technical hurdle, while cybersecurity vulnerabilities pose operational risks. Moreover, frequent updates and compliance with international defense standards increase program complexity.

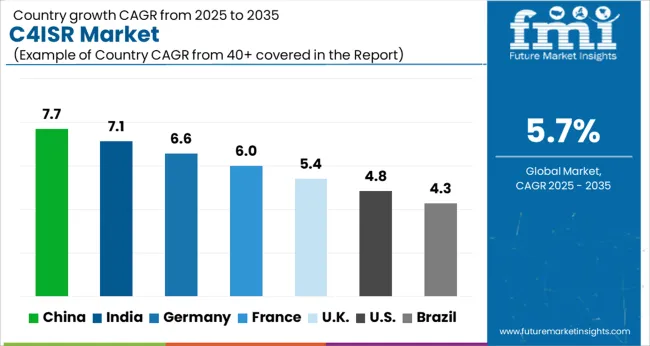

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

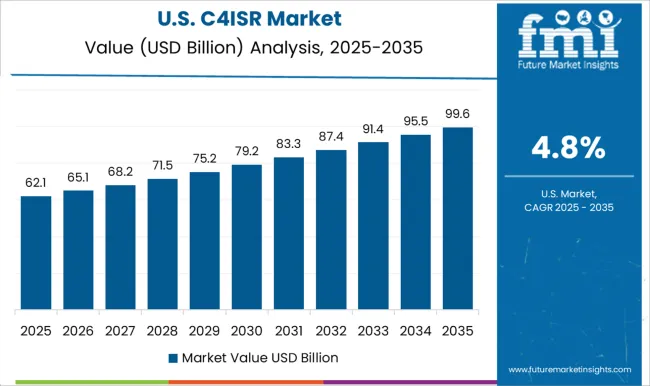

| USA | 4.8% |

| Brazil | 4.3% |

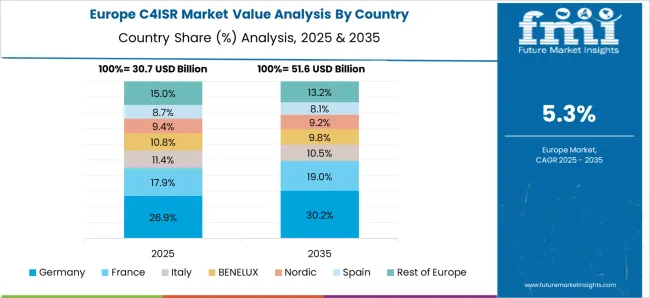

The global C4ISR market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with a growth rate of 7.7%, followed by India at 7.1% and Germany at 6.6%. The United Kingdom is expected to expand at 5.4%, while the United States shows steady growth at 4.8%. Increasing demand for advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance systems in military and defense applications is driving market expansion. Emerging markets like China and India are experiencing rapid defense modernization, increased defense budgets, and strong technology adoption. Mature markets such as the USA, UK, and Germany focus on upgrading existing systems, improving operational efficiency, and ensuring interoperability. Overall, global defense modernization and rising strategic requirements underpin C4ISR adoption across regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The C4ISR market in China is projected to grow at a CAGR of 7.7%. The country is expanding its military capabilities with advanced command, control, communications, and surveillance systems. Increased defense budgets and modernization programs drive procurement of high-tech C4ISR solutions. Domestic defense manufacturers are collaborating with global technology providers to enhance system performance and integration. Focus on unmanned systems, satellite communication, and intelligence platforms further boosts adoption. China’s strategic initiatives to strengthen national security and technological self-reliance are key factors supporting market expansion. Rapid deployment of advanced systems across land, air, and naval forces positions China as the leading growth market globally.

The C4ISR market in India is expected to grow at a CAGR of 7.1%. India is modernizing its defense infrastructure and expanding surveillance, intelligence, and command systems. Investments in advanced radar, communication networks, and reconnaissance platforms drive market demand. Domestic defense production and international collaborations enhance technology transfer and system efficiency. Adoption of integrated C4ISR platforms across army, navy, and air force operations ensures operational readiness. Rising defense budgets and strategic initiatives to improve situational awareness and battlefield efficiency further support market growth. India’s growing defense industry and technological adoption highlight its position as a high-growth market in the Asia-Pacific region.

The C4ISR market in Germany is projected to grow at a CAGR of 6.6%. German defense forces are modernizing command, control, communications, and surveillance systems to ensure interoperability and operational efficiency. Investments in high-performance intelligence, surveillance, and reconnaissance platforms support adoption. Collaboration with international defense technology providers ensures integration of advanced systems. Germany’s focus on cybersecurity, precision operations, and efficient data management strengthens market demand. Existing infrastructure upgrades and deployment of unmanned and autonomous systems further drive market growth. The country’s emphasis on reliable, high-quality systems ensures steady adoption of C4ISR solutions in European defense operations.

The C4ISR market in the United Kingdom is forecast to grow at a CAGR of 5.4%. The country is upgrading its defense systems with advanced command, control, communications, and intelligence capabilities. Investments in integrated surveillance, reconnaissance platforms, and battlefield management systems enhance operational readiness. Collaboration with global technology providers supports the introduction of high-performance C4ISR solutions. The UK’s focus on rapid deployment, system interoperability, and data-driven decision-making ensures market adoption. While growth is moderate compared to Asia, continuous investment in modern defense infrastructure and technology upgrades maintains steady expansion in the C4ISR market.

The C4ISR market in the United States is expected to expand at a CAGR of 4.8%. USA defense forces are modernizing command, control, communications, and intelligence systems to maintain technological superiority. High-performance surveillance, reconnaissance, and data management solutions are increasingly adopted across army, navy, and air force operations. Investments focus on advanced analytics, unmanned systems, and integrated battlefield platforms to enhance situational awareness and decision-making. Strong industrial base, R&D capabilities, and established defense supply chains support steady market growth. Although growth is slower than in Asia, the USA continues to be a key contributor to the global C4ISR market due to mature infrastructure and large-scale defense deployment.

The C4ISR market is being defined by leading defense and aerospace companies focusing on integrated command, control, communications, computers, intelligence, surveillance, and reconnaissance systems. Lockheed Martin, BAE Systems, and Northrop Grumman lead by providing advanced platforms that combine real-time battlefield intelligence with secure communications and decision-support tools. Brochures emphasize interoperability, rapid data processing, and situational awareness for military operations. Raytheon, Elbit Systems, and General Dynamics differentiate through sensor integration, radar technologies, and electronic warfare capabilities, targeting both land and naval defense segments.

L3Harris, Cubic Corporation, and Kratos Defense focus on networked solutions and tactical systems that enhance operational coordination and mission effectiveness. Other key players, including Airbus, Leonardo, Thales, and Rafael, provide comprehensive C4ISR solutions for multi-domain operations, emphasizing modularity, secure communications, and real-time intelligence. IAI Group, Indra Sistemas, Curtiss-Wright, Rheinmetall, Saab, and Systematic complement the market with specialized platforms for surveillance, reconnaissance, and command systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 133.4 Billion |

| Solution | Software, Services, and Hardware |

| Installation | New Installation and Retrofit |

| Application | Command & Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (ISR), and Electronic Warfare |

| Platform | Land, Naval, Airborne, and Space |

| End Use | Defense & Military, Government, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, BAE Systems, Booz Allen Hamilton, Cubic Corporation, Curtiss-Wright, Elbit Systems, General Dynamics, IAI Group, Indra Sistemas, Kratos Defense, L3harris, Leonardo, Airbus, Northrop Grumman, Rafael, Raytheon, Rheinmetall, Saab, Systematic, and Thales |

| Additional Attributes | Dollar sales by system type (command and control, communication, intelligence, surveillance, reconnaissance) and platform (land, air, naval) are key metrics. Trends include rising demand for integrated defense solutions, adoption of advanced sensor and communication technologies, and growth in military modernization programs. Regional adoption, technological advancements, and geopolitical factors are driving market growth. |

The global C4ISR market is estimated to be valued at USD 133.4 billion in 2025.

The market size for the C4ISR market is projected to reach USD 232.2 billion by 2035.

The C4ISR market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in C4ISR market are software, services and hardware.

In terms of installation, new installation segment to command 58.3% share in the C4ISR market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air-Based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA