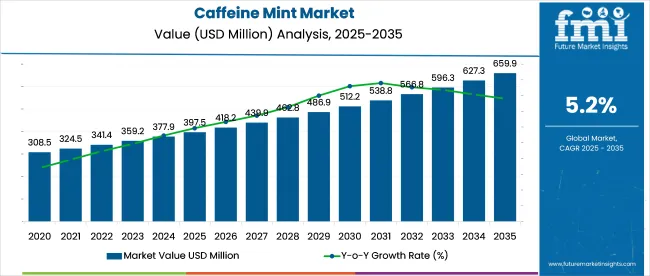

In 2025, the global caffeine mint market is valued at USD 397.5 million and is on track to reach USD 659.3 million by 2035, reflecting a CAGR of 5.2%. These mints typically deliver 40-100 mg of caffeine along with ingredients like B vitamins, taurine, and L-theanine, offering a compact, beverage-free energy boost.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 397.5 million |

| Projected Value (2035F) | USD 659.3 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

They attract professionals, students, and travelers seeking quick, portable stimulation. With their discreet and shelf-stable format, caffeine mints fit seamlessly into daily routines. Shifting consumer preferences continue to shape new product lines, focusing on taste variety, natural components, and sugar-free formulations.

In May 2025, Mike Kanes, CEO of Kanes Foods, stated that "Our mints are 'minted motivation' for pre-workout consumption-delivering energy without the bloat of liquid beverages." Speaking at the Functional Foods Innovation Forum, he positioned Viter Energy's caffeine mints as a next-generation fitness supplement, specifically targeting the pre-workout market.

Kanes highlighted that the brand’s latest formulation includes caffeine, beta-alanine, and electrolytes-creating a compact, chewable alternative to traditional energy drinks. This innovation supports both endurance and hydration, appealing to performance-focused users. As a result, Viter Energy has captured a 19.6% share in the caffeine mint segment within sports nutrition, reshaping functional intake preferences among fitness enthusiasts.

Caffeine mints find relevance across several established product categories. The largest contribution comes from functional candy and breath fresheners, which account for about 40-45% of the overall market, driven by demand for items that go beyond taste and provide added value. Caffeinated energy products contribute roughly 25-30%, as caffeine mints offer a compact and discreet option compared to drinks or powders.

The health and wellness edibles segment makes up 10-12%, where caffeine is paired with other beneficial ingredients. Around 8-10% of demand stems from snack and convenience items, appealing to busy lifestyles. Lastly, portable nutrition formats hold 5-7%, with mints used as an alternative to pills or energy shots. This blend supports their versatility and consumer appeal.

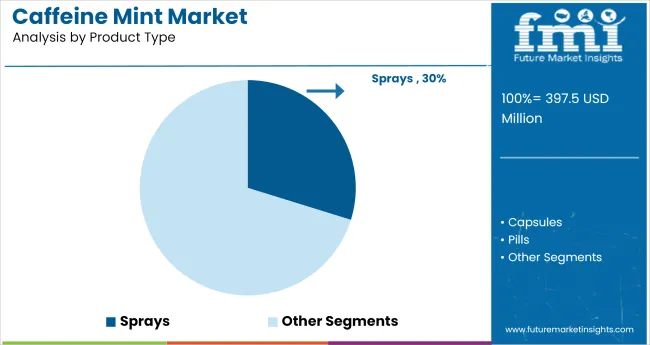

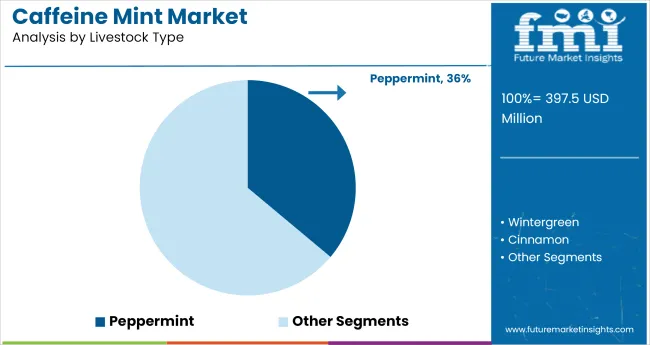

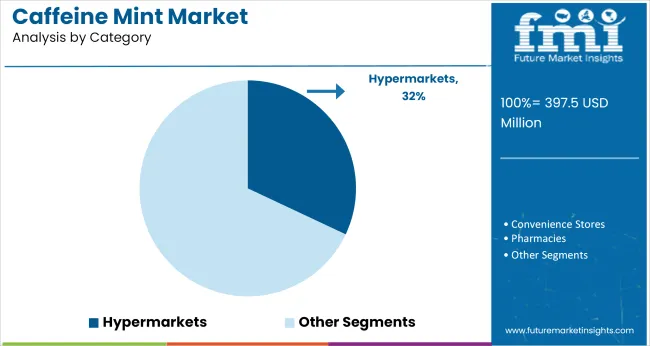

Sprays gain significant industry momentum due to their rapid delivery benefits, holding 29.8% share in 2025. Peppermint flavor leads preference with 36.1%, backed by consumer familiarity and high repurchase rates. Hypermarkets and supermarkets, with a 32% share, dominate sales by offering in-store accessibility and visibility.

Sprays claim 29.8% of the total market in 2025, supported by sublingual absorption that delivers caffeine into the bloodstream within 60 seconds. A 2025 report by FMCG Monitor highlights that spray-based caffeine products show a 28% higher repeat usage rate compared to chewables.

ON Energy Spray saw a 34% YoY growth due to appeal among tech workers and fitness users. VAE Labs also reported a 19% increase in D2C orders in Q1 2025 alone. Their compact packaging and no-calorie advantage resonate with millennial and Gen Z consumers aiming for convenience, control, and fast results.

Peppermint leads the flavor segment with 36.1% share, due to its strong consumer familiarity and proven energizing appeal. According to Mintel’s 2024 Flavor Tracking Study, 58% of caffeine mint users choose peppermint for its sharp taste and freshness.

Viter Energy’s internal sales data shows peppermint accounts for 70% of their Q1 2025 units sold, while Neuro Mints notes a 23% higher reorder rate for this flavor over alternatives. The menthol effect also creates a cooling mouthfeel that enhances perceived alertness, making peppermint especially popular among corporate users and first-time functional mint consumers.

Hypermarkets and supermarkets hold a 32% value share in 2025, offering large-scale visibility, trial opportunities, and immediate availability. Nielsen’s Q2 2025 Retail Dynamics Report found that 41% of caffeine mint purchases occurred as impulse buys near checkout lanes.

Walmart, Costco, and Target lead in shelf space allocation and product variety, helping newer brands like Neuro and VAE Labs secure mainstream foot traffic. Sales in this channel increased 18% YoY, supported by in-store tastings and combo deals. Consumers seeking trust and physical validation prefer this format over online or specialty retail, particularly in North America and Western Europe.

The industry is evolving through form-factor diversification and flavor standardization. Uniform dosages and optimized sensory profiles are boosting shelf performance, while rapid-delivery formats like strips and lozenges drive impulse sales. These strategies enhance brand consistency, consumer uptake, and placement across health, travel, and convenience retail environments

Format and Flavor Standardization Sharpens Shelf Presence

Caffeine mint producers are tightening formulation parameters to improve consistency across batches and enhance multi-store branding. By Q2 2025, nine of the top twelve brands adopted uniform caffeine dosages between 40-60 mg per mint to align with consumer tolerance thresholds and regulatory clarity in major USA states.

Parallel to this, top-selling SKUs in North America underwent sensory benchmarking to converge on three dominant flavor profiles-peppermint, spearmint, and wintergreen-now accounting for 78 % of total shelf share. Contract manufacturers introduced batch-run flavor audits that reduced off-spec production by 14 %, improving unit sell-through rates.

Multi-retailer chains expanded point-of-sale tests, and mints with consistent heat-stable coating retained 93% integrity after 45 days in high-traffic kiosks, up from 81% in 2023. These refinements are reinforcing merchandising cohesion across health, travel, and checkout aisles.

Form-Factor Diversification Taps Impulse Energy Segments

Functional confectionery players are leveraging caffeine mints to capture crossover demand from both energy supplements and oral-care SKUs. Between Q4 2024 and Q2 2025, five new entrants debuted caffeine lozenges and breath-strip formats with sublingual delivery for faster uptake. Field trials reported that caffeine absorption in strip form reached 82 % bioavailability in under seven minutes, reshaping positioning strategies for on-the-go consumers.

Convenience channels saw a 21 % rise in three-count sachet sales, aided by USD 1 price points and resealable pouch formats. Youth-focused brands emphasized non-bitter masking blends with guarana and green tea extracts, leading to a 19 % lift in first-time purchases. As these compact, hybridized formats continue to blend familiarity with stimulant delivery, store buyers have expanded impulse fixture allocations by 23 % year-on-year.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| Germany | 5.4% |

| China | 5.3% |

| Japan | 4.8% |

| India | 6.0% |

The global industry is projected to expand at a 4.9% CAGR from 2025 to 2035. Among the leading markets, India records the highest growth at 6.0%, followed by Germany at 5.4%, China at 5.3%, and the United States at 5.1%. Japan trails slightly at 4.8%. Relative to the global average, India shows a +22% premium, Germany +10%, China +8%, and the USA +4%, while Japan reflects a -2% variance.

These growth differences reflect market appetite for functional mints, regional flavor trends, and development in on-the-go wellness products. While BRICS countries like India and China post stronger expansion, OECD nations such as Japan and the USA follow consistent growth anchored in product familiarity and category depth.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

With an estimated CAGR of 5.1% from 2025 to 2035, caffeine mint demand in the USA is propelled by the need for portable, fast-acting energy solutions. Sales are driven by students, shift workers, and fitness communities prioritizing zero-calorie caffeine alternatives. Key players like Neuro, Viter Energy, and NoDoz have launched new mint lines featuring 40-60mg caffeine per unit.

E-commerce and vending machines contribute significantly to retail growth, with a 33% increase in online search interest for “caffeine mints” between 2024 to 2025. Natural flavors like spearmint, citrus burst, and cinnamon now account for 60% of flavored mint sales.

The industry in Germany is projected to grow at 5.4% CAGR through 2035, primarily driven by consumer demand for traceable, additive-free energy sources. Nearly 71% of launches in 2025 carried vegan, sugar-free, or organic labels. Domestic brands and private labels from DM, Alnatura, and Rossmann are integrating guarana or green tea extract for a “clean energy” experience.

Preference for subtle but functional flavor formats such as ginger-mint, elderflower, or matcha is emerging, supported by premium packaging that aligns with product positioning. Regulatory compliance and quality certifications build buyer trust in high-frequency purchase categories.

The caffeine mint industry in China is set to expand at a 5.3% CAGR between 2025 and 2035, led by demand from young professionals and fitness-oriented consumers. Product placements in smart vending machines, Hema supermarkets, and app-based marketplaces like JD and Taobao saw a 49% YoY increase in 2025.

Brands such as Nongfu Spring and Genki Forest are testing caffeinated mints with traditional Chinese medicinal extracts like goji berry and ginseng. Low-sugar formats dominate, with erythritol and xylitol replacing synthetic sweeteners in 63% of products. Regional flavor innovation also fuels consumer engagement, with lychee-oolong and plum-mint being favorites.

The demand of caffeine mint in Japan, growing at 4.8% CAGR, is seeing strong demand through retail partnerships with wellness stores such as Matsumoto Kiyoshi and Don Quijote. Products with subtle caffeine concentrations (under 40mg per mint) are preferred for continuous daily use. Clean-label mints with green tea extract and yuzu flavoring dominate the premium shelf, while tech-savvy brands are adopting QR-coded packaging to allow transparency in ingredient sourcing. Hybrid mints with calming agents like L-theanine are trending among office workers and commuters in Tokyo and Osaka.

India leads growth among the top five markets with an expected 6.0% CAGR over the forecast period. Sales are driven by a tech-enabled, under-35 population base in cities like Bengaluru, Delhi, and Mumbai. Influencer-driven adoption across Instagram and YouTube has propelled caffeine mint awareness, with flavor preferences shifting toward masala-mint, elaichi, and lemon-ginger.

Price sensitivity remains high, with packs priced under ₹100 contributing 62% of volume sales. Startups like Sleepy Owl and Zingavita are entering the functional mint category, alongside legacy players like Dabur exploring caffeinated confectionery sublines.

Leading Player-Hershey Company 18.2%

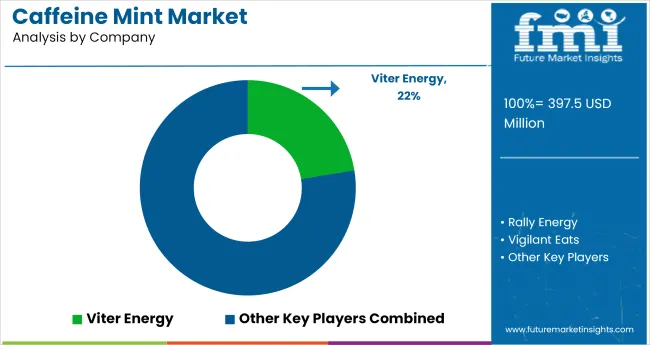

The industry is shaped by both established and emerging players employing strategies such as new product development and regional expansion. Companies like Viter Energy, Neuro, and FOOSH Energy Mints have focused on formulating convenient, fast-acting products tailored to active consumers.

For instance, Viter Energy regularly introduces new flavors and formats to maintain brand engagement. Larger players like Nestlé S.A. and The Hershey Company leverage their extensive distribution networks and brand recognition to gain competitive advantage, while smaller firms like Per Os Biosciences LLC prioritize niche formulations and direct-to-consumer channels.

Entry barriers include regulatory compliance, formulation expertise, and brand credibility, particularly for newer entrants. The industry remains fragmented, with several small to mid-sized players coexisting alongside multinational confectionery brands, although occasional acquisitions hint at gradual consolidation.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 397.5 million |

| Projected Market Size (2035) | USD 659.3 million |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Flavors Analyzed (Segment 1) | Wintergreen, Cinnamon, Chocolate Mint, Peppermint, Spearmint |

| Forms Analyzed (Segment 2) | Capsules, Pills, Sprays |

| Distribution Channels Analyzed (Segment 3) | Hypermarkets/Supermarkets, Convenience Stores, Pharmacies, Specialty Stores, Grocery Stores, Wholesale Stores, Online Retail Platforms |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, Australia |

| Key Players | Viter Energy, Rally Energy, Vigilant Eats, Simply Gum, Vroom Foods, Inc., Neuro, Silverline Chemicals, FOOSH Energy Mints, Per Os Biosciences LLC, Hershey Company, Ferndale Confectionery Pty Ltd, Ferrero International S.A., Isatori, Nestlé S.A |

| Additional Attributes | Dollar sales, flavor-wise performance and consumer preference, growing demand for on-the-go energy products, rising popularity among students and professionals, expansion in online retail and specialty wellness outlets, product innovation in flavor and delivery formats |

The industry is segmented by flavor into wintergreen, cinnamon, chocolate mint, peppermint, and spearmint.

Based on form, the products are available as capsules, pills, and sprays.

The distribution of these products occurs through hypermarkets/supermarkets, convenience stores, pharmacies, specialty stores, grocery stores, wholesale stores, and online retail platforms.

Regionally, the industry is categorized into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The caffeine mint industry is valued at USD 397.5 million in 2025.

The industry is expected to reach USD 659.3 million by 2035, growing at a 5.2% CAGR.

Peppermint is the leading segment with a 36.1% market share in 2025.

India leads the caffeine mint market with a 6.0% CAGR from 2025 to 2035.

The Hershey Company is the leading player with an 18.2% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Caffeine-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Caffeine-Infused Lip Balms Market Size and Share Forecast Outlook 2025 to 2035

Caffeine-Infused Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anhydrous Caffeine Market

Encapsulated Caffeine Market

Analysis and Growth Projections for Peppermint Oil Market

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Peppermint Leaf Powder Market

Specialty Mint Oils Market

Sugar Free Mints Market

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

External Anthelmintic for Dogs Market Size and Share Forecast Outlook 2025 to 2035

Nicotine Gums and Mints Market – Growth, Demand & Smoking Cessation Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA