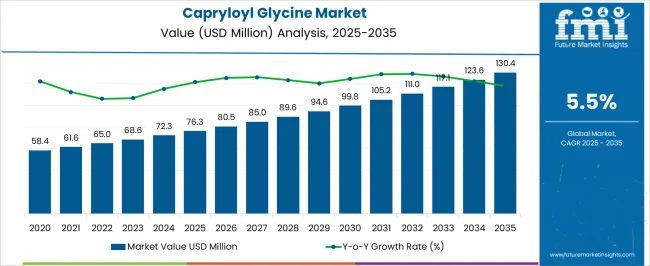

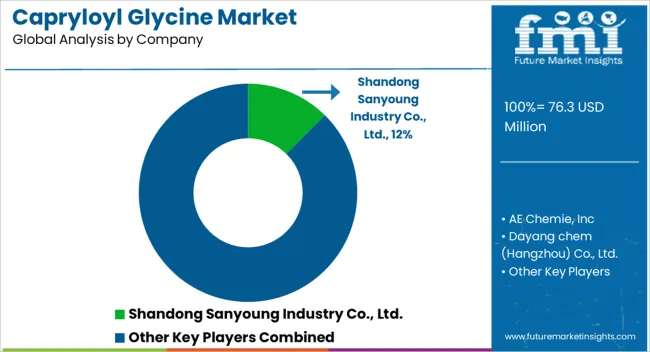

The capryloyl glycine market, estimated at USD 76.3 million in 2025 and projected to reach USD 130.4 million by 2035 at a CAGR of 5.5%, demonstrates a moderate yet steady growth trajectory shaped significantly by regulatory frameworks. Regulatory compliance in cosmetic and personal care product applications, where Capryloyl Glycine is primarily utilized for its antimicrobial and skin-conditioning properties, plays a central role in defining market dynamics.

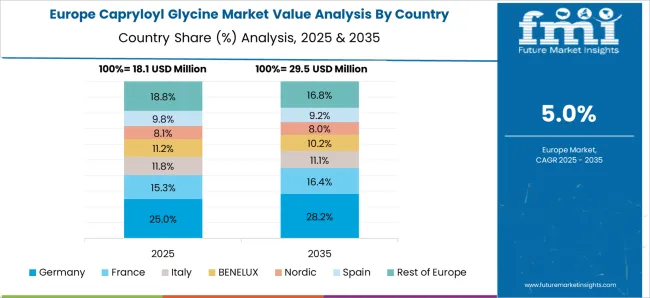

Stringent safety evaluations, ingredient registration requirements, and restrictions on allowable concentrations in finished products across key markets such as the European Union, North America, and Asia-Pacific influence both production practices and market adoption. In Europe, REACH regulations impose rigorous testing and documentation protocols, ensuring only compliant manufacturers can supply Capryloyl Glycine to the cosmetics industry. This regulatory rigor ensures product safety but may limit entry for smaller producers, indirectly shaping supply chains and pricing structures.

In North America, FDA oversight and labeling requirements govern formulation claims and permissible use, fostering transparency and consumer trust while impacting product development timelines. The emerging markets in Asia-Pacific adopt a gradually harmonizing framework, influenced by both local standards and global guidelines, which encourages market growth but requires adherence to evolving compliance measures. The regulatory oversight not only safeguards end-user safety but also drives innovation in production processes and derivative formulations. Compliance costs, approval lead times, and regional regulatory discrepancies collectively influence market expansion, emphasizing the criticality of proactive regulatory strategies for manufacturers aiming to optimize market penetration and sustain long-term growth in the market.

| Metric | Value |

|---|---|

| Capryloyl Glycine Market Estimated Value in (2025 E) | USD 76.3 million |

| Capryloyl Glycine Market Forecast Value in (2035 F) | USD 130.4 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The capryloyl glycine market represents a specialized segment within the personal care and specialty ingredients industry, emphasizing antimicrobial, skin conditioning, and cosmetic functionality. Within the overall cosmetic active ingredients market, it accounts for about 4.8%, driven by demand in deodorants, skincare, and hair care formulations. In the personal care and hygiene products segment, it holds nearly 5.3%, reflecting adoption in body washes, lotions, and shampoos for odor control and skin protection. Across the specialty amino acid derivatives market, the segment captures 3.9%, supporting formulation stability and multifunctional benefits.

Within the natural and bio-based ingredients category, it represents 3.2%, highlighting interest in gentle and dermatologically safe compounds. In the cosmeceuticals and therapeutic personal care sector, it secures 3.7%, emphasizing applications in antimicrobial and anti-inflammatory skincare products. Recent developments in this market have focused on formulation versatility, natural sourcing, and performance enhancement. Innovations include combination with other amino acid derivatives and mild surfactants to improve antimicrobial efficacy and skin tolerance.

Key players are collaborating with cosmetic brands and dermatological research institutes to develop multifunctional formulations that address odor control, skin microbiome balance, and hydration. Microencapsulation and controlled release technologies are gaining traction to enhance stability and efficacy. The regulatory compliance with safety and bioavailability standards is driving adoption in global markets.

The capryloyl glycine market is experiencing steady expansion, driven by rising demand for multifunctional cosmetic ingredients with antimicrobial and sebum-regulating properties. Industry announcements and product formulation updates from personal care brands have highlighted capryloyl glycine’s role as a skin-conditioning and preservative-boosting agent, aligning with the clean beauty and minimal-ingredient formulation trends.

Growing consumer awareness of skin health, combined with increasing product launches in the premium and natural cosmetics segment, has accelerated adoption. Manufacturers have invested in refining production processes to achieve higher purity grades, ensuring product stability and efficacy in diverse formulations.

Additionally, the shift toward sustainable sourcing and biodegradable cosmetic ingredients has positioned capryloyl glycine as a preferred option for eco-conscious brands. The market outlook remains positive, supported by expanding applications in personal care and dermatology, with strong potential in emerging markets where the beauty and skincare industries are rapidly growing.

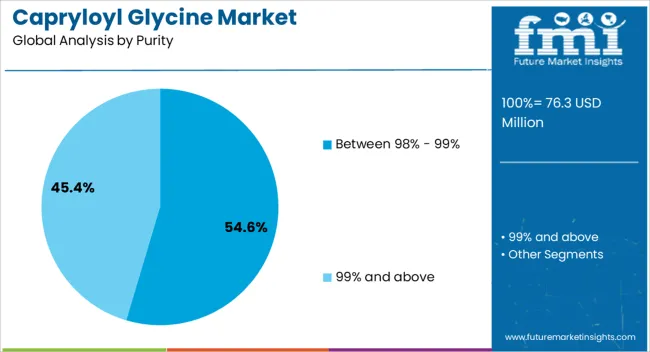

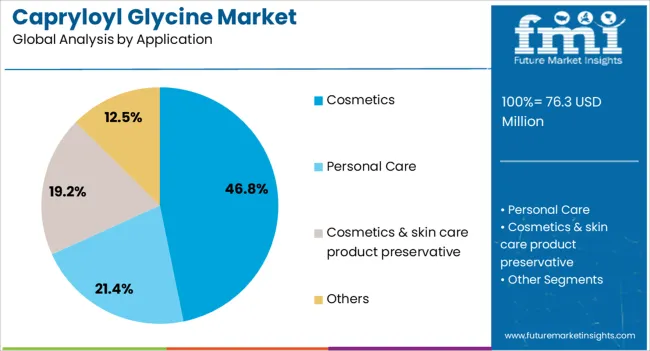

The capryloyl glycine market is segmented by purity, application, and geographic regions. By purity, capryloyl glycine market is divided into Between 98% - 99% and 99% and above. In terms of application, capryloyl glycine market is classified into Cosmetics, Personal Care, Cosmetics & skin care product preservative, and Others. Regionally, the capryloyl glycine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The between 98% - 99% purity segment is projected to contribute 54.6% of the capryloyl glycine market revenue in 2025, maintaining its leading position due to its balance of high quality and cost efficiency.

This purity range has been widely adopted in cosmetics and personal care formulations as it offers effective antimicrobial and skin-regulating properties while being economically viable for large-scale production. Manufacturers have optimized synthesis processes to achieve this purity level consistently, ensuring compliance with regulatory standards for cosmetic-grade ingredients.

Product stability at this purity range has been particularly valued for formulations in skincare, haircare, and cleansing products. Additionally, cosmetic formulators have favored this grade for its compatibility with both water-based and oil-based systems, making it versatile for diverse product types. The segment’s leadership is expected to persist as demand for reliable, cost-effective, and high-performing cosmetic actives continues to grow globally.

The cosmetics segment is projected to account for 46.8% of the capryloyl glycine market revenue in 2025, establishing itself as the primary application area.

Growth in this segment has been driven by the increasing incorporation of capryloyl glycine into facial cleansers, anti-acne treatments, shampoos, and anti-aging formulations. Its dual function as a skin-conditioning agent and antimicrobial booster has met consumer demand for multifunctional ingredients, particularly in clean-label and preservative-free product lines.

Cosmetic brands have highlighted capryloyl glycine’s ability to regulate sebum production, improve skin texture, and maintain the skin’s natural pH balance, making it highly suitable for sensitive and oily skin types. Marketing trends in the beauty industry have emphasized these benefits, fueling broader adoption across mass-market and premium product ranges. With growing innovation in natural and eco-friendly cosmetics and increased consumer interest in dermatologically tested formulations, the cosmetics segment is expected to remain the dominant application for capryloyl glycine in the forecast period.

The market has been witnessing growth due to its increasing use in personal care, cosmetic, and dermatological applications. This naturally derived amino acid derivative is valued for its sebum-regulating, antimicrobial, and skin-conditioning properties, making it ideal for acne care, cleansers, moisturizers, and anti-inflammatory formulations. Rising consumer awareness of clean, safe, and multifunctional cosmetic ingredients has driven demand.

Manufacturers are leveraging Capryloyl Glycine to formulate eco-friendly, hypoallergenic, and dermatologically tested products. Growth is further supported by advancements in sustainable extraction processes and regulatory approvals for topical applications. Challenges include supply limitations, price fluctuations of raw glycine and fatty acids, and the need for stringent quality control. The expanding focus on functional skincare and preventive dermatology is positioning Capryloyl Glycine as a critical ingredient in modern cosmetic formulations.

Capryloyl Glycine has been increasingly incorporated into personal care products due to its ability to control sebum production, reduce microbial activity on the skin, and maintain a balanced skin barrier. Acne-prone skin, oily complexions, and sensitive skin types benefit from formulations containing this active ingredient. Cleansers, facial creams, lotions, and toners are designed to leverage its antimicrobial and anti-inflammatory properties. The trend toward multifunctional and natural-based skincare products have further encouraged its adoption. Cosmetic manufacturers are using Capryloyl Glycine to meet consumer demand for products that are both effective and gentle. Its compatibility with other active ingredients allows for synergistic formulations, increasing efficacy in dermatological applications. Rising awareness of safe cosmetic ingredients is expected to continue driving market growth.

In dermatology, Capryloyl Glycine has found use in treating mild inflammatory skin conditions, regulating excessive sebum production, and preventing bacterial proliferation. Dermatologists are recommending formulations containing Capryloyl Glycine for acne management, oily skin care, and sensitive skin treatment. Its mechanism to inhibit bacterial growth without harsh chemical preservatives makes it suitable for long-term use and pediatric applications. Pharmaceutical and cosmeceutical companies are investing in R&D to develop creams, gels, and serums containing this ingredient. Clinical trials and dermatological studies supporting its efficacy have enhanced market acceptance. Integration into preventive skin care regimens and therapeutic cosmetic formulations reinforces its position as a multifunctional ingredient bridging cosmetic and health-oriented applications.

Advancements in extraction, purification, and stabilization technologies have improved the quality and efficiency of Capryloyl Glycine production. Green chemistry processes, enzyme-assisted synthesis, and solvent-free extraction methods have reduced environmental impact and enhanced sustainability credentials. Stabilized formulations allow compatibility with various cosmetic bases, maintaining activity over an extended shelf life. Manufacturers are also exploring encapsulation and controlled-release technologies to enhance ingredient efficacy in topical applications. Digital monitoring and automation in production facilities have improved consistency, safety, and scalability. These technological developments have enabled broader adoption in high-value cosmetic and dermatological formulations while meeting stringent regulatory standards and consumer demand for sustainable, high-quality ingredients.

Despite its benefits, the market faces challenges in raw material availability, production cost, and regulatory compliance. The supply of high-purity glycine and fatty acid precursors can be limited, influencing pricing and production planning. Manufacturers must adhere to stringent cosmetic ingredient regulations across regions, including safety, labeling, and efficacy claims. Shelf-life stability and compatibility with diverse formulation matrices also pose technical challenges. The market growth is influenced by competition from alternative sebum-regulating or antimicrobial ingredients. Companies are addressing these constraints through strategic partnerships, vertical integration, and investment in sustainable, scalable production processes.

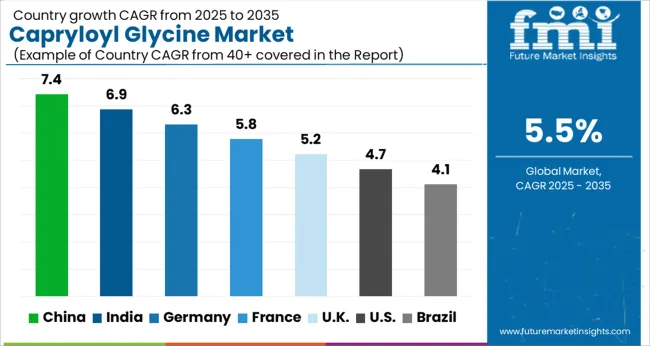

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

China leads the market with a forecast growth rate of 7.4%, driven by rising applications in personal care, cosmetic formulations, and antimicrobial products. India follows at 6.9%, where increasing adoption in skincare and hygiene products supports market expansion. Germany registers 6.3%, supported by integration in high-performance cosmetic and pharmaceutical applications. The United Kingdom records 5.2%, with research initiatives and product development contributing to steady growth. The United States maintains 4.7%, where demand in specialty cosmetic and personal care applications sustains consistent activity. Collectively, these countries shape a diversified and evolving landscape influencing global production, application, and technological advancements in capryloyl glycine. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 7.4%, driven by rising demand in personal care, skincare, and cosmetic applications. Manufacturers are increasingly incorporating Capryloyl Glycine in formulations for its antimicrobial and moisturizing properties. Growth is supported by rising urban populations, increased disposable income, and a surge in cosmetic product consumption. Domestic production capacity is expanding with technological advancements, and innovation in formulation techniques is enhancing product efficiency. The market benefits from supportive regulatory frameworks promoting safe and effective cosmetic ingredients, which boosts adoption across multiple personal care segments in China.

India is expected to grow at a CAGR of 6.9%, propelled by expanding personal care and cosmetic industries. Rising awareness of skin health and demand for functional ingredients are boosting adoption. Capryloyl Glycine is increasingly used in anti-acne creams, moisturizers, and cleansing products due to its effective antimicrobial properties. Local manufacturers are improving production capacity and innovating formulations to enhance product efficiency. Government regulations promoting safe cosmetic ingredients and initiatives supporting domestic manufacturing are facilitating market growth. Increasing penetration of international cosmetic brands in India further fuels demand for Capryloyl Glycine in diverse applications.

Germany is anticipated to grow at a CAGR of 6.3%, supported by high adoption in premium personal care and cosmetic products. Rising consumer focus on skin health, antimicrobial efficacy, and natural ingredient-based formulations is driving growth. Cosmetic manufacturers are leveraging Capryloyl Glycine in creams, serums, and lotions for its multifunctional properties. Investment in R&D and advanced formulation technologies is enhancing product performance and market penetration. Stringent regulatory compliance ensures ingredient safety and encourages adoption across personal care, skincare, and dermatological applications, sustaining steady growth in Germany.

The market in the United Kingdom is projected to grow at a CAGR of 5.2%, fueled by rising demand for functional cosmetic and skincare ingredients. Capryloyl Glycine is utilized in products for its antimicrobial, anti-inflammatory, and skin-conditioning properties. The market benefits from a growing health-conscious population, increased awareness of active cosmetic ingredients, and investment in research-driven product development. Regulatory initiatives supporting safe cosmetic ingredients and product innovation are encouraging adoption. Premium cosmetic brands and niche personal care manufacturers are incorporating Capryloyl Glycine to differentiate products, enhancing consumer trust and broadening market reach in the UK.

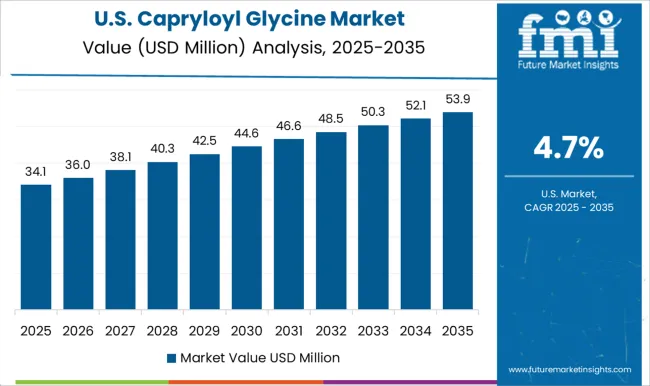

The United States is expected to grow at a CAGR of 4.7%, driven by the personal care and cosmetic industries. Capryloyl Glycine is increasingly integrated into moisturizers, cleansers, and acne treatment products for its antimicrobial and skin-conditioning benefits. Rising consumer awareness regarding ingredient efficacy and demand for clean-label cosmetic products are key growth factors. Innovation in production technologies and formulation methods is enhancing performance, while regulatory frameworks ensure ingredient safety. The market is further supported by high consumer spending on premium skincare products and the growing influence of dermatological recommendations, promoting consistent adoption of Capryloyl Glycine across diverse applications in the United States.

The market is expanding steadily, driven by growing demand in personal care, cosmetics, and dermatological formulations. Shandong Sanyoung Industry Co., Ltd. and AE Chemie, Inc. are notable for their consistent production quality and broad distribution networks, supplying raw materials to both domestic and international cosmetic manufacturers. Dayang Chem (Hangzhou) Co., Ltd. and Shandong Chuang Ying Chemical focus on optimizing synthesis processes to deliver high-purity Capryloyl Glycine suitable for sensitive skin formulations, catering to a rising consumer preference for mild and natural ingredients. Xiamen Hisunny Chemical Co., Ltd. and TNJ Chemical are investing in research and development to enhance bioavailability and efficacy, allowing their products to integrate seamlessly into anti-aging creams, moisturizers, and acne care solutions. Zley Holdings (Suzhou) Co., Ltd. and Sinerga S.p.A. emphasize environmentally friendly manufacturing practices, aligning with regulatory requirements and sustainability trends. Additional players, including Minasolve, Seppic, and Euro-Kemical S.R.L., contribute to market growth by offering tailored product grades and reliable supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.3 Million |

| Purity | Between 98% - 99% and 99% and above |

| Application | Cosmetics, Personal Care, Cosmetics & skin care product preservative, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shandong Sanyoung Industry Co., Ltd., AE Chemie, Inc, Dayang chem (Hangzhou) Co., Ltd., Shandong Chuang Ying Chemical, Xiamen Hisunny Chemical. Co., Ltd., TNJ Chemical, Zley Holdings (Suzhou) Co., Ltd., Sinerga S.p.A., Minasolve, Seppic, and Euro-Kemical S.R.L |

| Additional Attributes | Dollar sales by ingredient type and application, demand dynamics across personal care, cosmetics, and skincare sectors, regional trends in bioactive ingredient adoption, innovation in formulation stability, efficacy, and multifunctionality, environmental impact of sourcing and production, and emerging use cases in anti-aging, antimicrobial, and skin-soothing products. |

The global capryloyl glycine market is estimated to be valued at USD 76.3 million in 2025.

The market size for the capryloyl glycine market is projected to reach USD 130.4 million by 2035.

The capryloyl glycine market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in capryloyl glycine market are between 98% - 99% and 99% and above.

In terms of application, cosmetics segment to command 46.8% share in the capryloyl glycine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycine Market Trends - Sales & Industry Analysis

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA