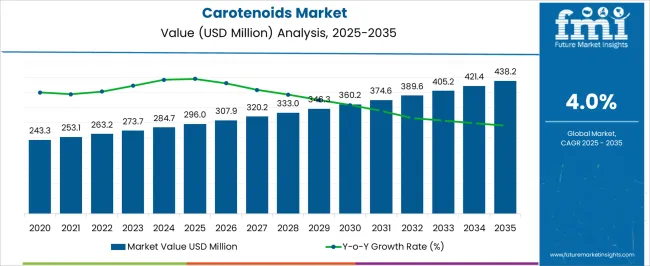

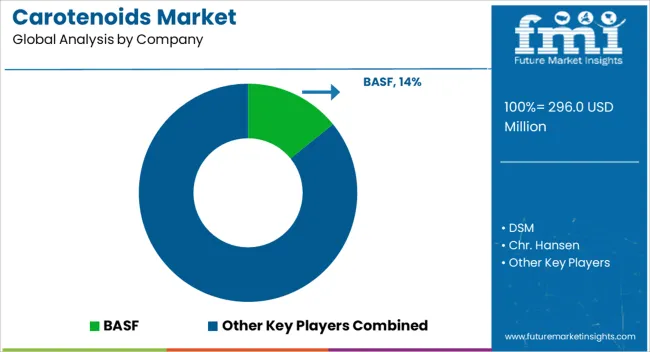

The carotenoids market is estimated to be valued at USD 296.0 million in 2025 and is projected to reach USD 438.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

Natural extraction technologies, primarily from sources such as algae, fruits, and vegetables, continue to account for a significant portion of market value due to growing consumer preference for naturally derived ingredients in food, nutraceuticals, and cosmetic applications. The incremental value contribution from natural extraction is reinforced by advancements in solvent-based, supercritical fluid, and enzymatic extraction techniques, which improve yield, purity, and scalability while maintaining regulatory compliance. Synthetic production technologies, including chemical synthesis and microbial fermentation, represent another key contributor to overall market growth. These methods provide cost efficiency, high purity, and consistency, particularly for industrial-scale applications where standardized carotenoid content is essential.

Formulation technologies, involving encapsulation, stabilization, and delivery mechanisms, also contribute materially to the market, enhancing bioavailability, shelf life, and compatibility with diverse end-use products. Over the forecast period, the proportional contribution from microbial fermentation and advanced formulation methods is expected to increase, driven by innovations aimed at reducing production costs and enhancing functional performance. The technology-based contributions underpin the market expansion from USD 296.0 million in 2025 to USD 438.2 million by 2035, highlighting the critical role of production and processing technologies in shaping the competitive and operational landscape of the market.

| Metric | Value |

|---|---|

| Carotenoids Market Estimated Value in (2025 E) | USD 296.0 million |

| Carotenoids Market Forecast Value in (2035 F) | USD 438.2 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The carotenoids market represents a specialized segment within the natural pigments and nutraceutical ingredients industry, emphasizing health benefits, coloration, and antioxidant properties. Within the overall natural colorants market, it accounts for about 6.3%, driven by demand in food and beverages, dietary supplements, and animal feed. In the nutraceutical and functional foods segment, it holds nearly 5.7%, reflecting usage for vision support, immunity, and antioxidant supplementation. Across the feed additives and aquaculture market, the segment captures 4.5%, supporting pigmentation and nutritional enrichment. Within the cosmetics and personal care category, it represents 3.8%, highlighting incorporation in skincare, anti-aging, and UV protection products.

In the pharmaceutical and healthcare ingredients sector, it secures 3.2%, emphasizing applications in preventive health and therapeutic formulations. Recent developments in this market have focused on natural extraction, bioavailability, and formulation stability. Innovations include microencapsulation and nanocarrier technologies to enhance absorption, stability, and shelf life. Key players are collaborating with food, feed, and cosmetic manufacturers to develop clean label and high potency carotenoid formulations. The research into algae, bacterial, and fungal sources is expanding to meet demand for sustainable and scalable production. Synthetic carotenoid alternatives continue to evolve with cost optimization and regulatory compliance. These trends demonstrate how health functionality, sustainability, and formulation innovation are shaping the carotenoids market.

The carotenoids market is on a steady growth path, supported by rising demand for natural and synthetic colorants in food, beverages, dietary supplements, and cosmetics. Industry publications and ingredient manufacturer reports have emphasized carotenoids’ dual role as both functional additives and health-promoting compounds due to their antioxidant properties. Consumer interest in products that deliver both visual appeal and nutritional benefits has intensified, encouraging food and beverage producers to integrate carotenoids into product formulations.

Synthetic carotenoids continue to play a significant role due to their consistent quality, stability, and cost-effectiveness, while technological advancements have improved their bioavailability. The expansion of fortified foods, functional beverages, and nutraceutical products has further widened market reach.

Additionally, regulatory approvals and supportive guidelines for carotenoid use in various applications have encouraged broader industry adoption. Looking ahead, demand is expected to remain strong as consumer health awareness grows, with product innovation in stable, highly bioavailable carotenoid formulations and increased utilization in emerging markets fueling future expansion.

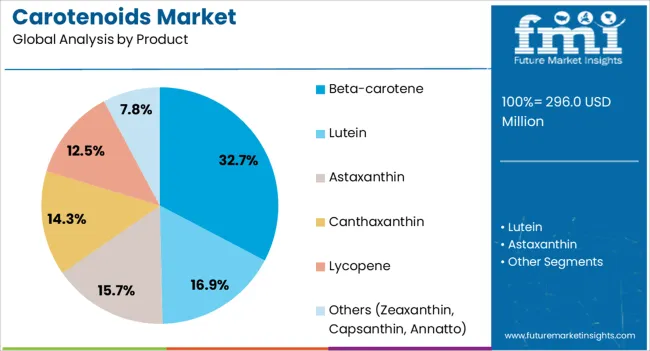

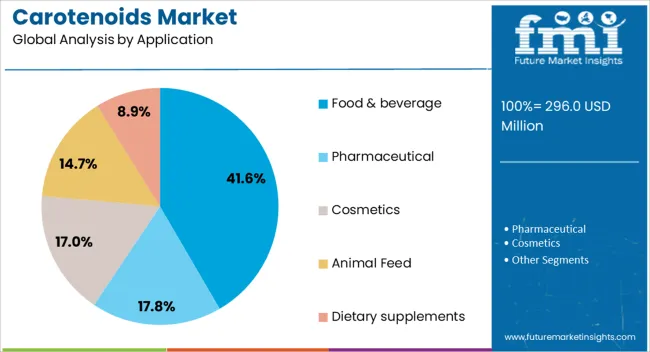

The carotenoids market is segmented by source, product, application, and geographic regions. By source, carotenoids market is divided into synthetic and natural. In terms of product, carotenoids market is classified into beta-carotene, lutein, astaxanthin, canthaxanthin, lycopene, and others (Zeaxanthin, Capsanthin, Annatto). Based on application, carotenoids market is segmented into food & beverage, pharmaceutical, cosmetics, animal Feed, and dietary supplements. Regionally, the carotenoids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

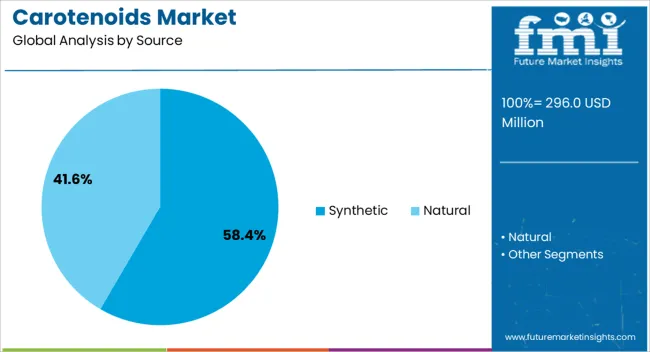

The synthetic segment is projected to account for 58.4% of the carotenoids market revenue in 2025, maintaining its lead due to advantages in cost efficiency, stability, and scalability. Manufacturers have favored synthetic production methods to ensure a consistent supply unaffected by seasonal or agricultural fluctuations that impact natural sources. Synthetic carotenoids offer standardized color intensity and stability under processing conditions such as heat and light, making them highly suitable for industrial-scale food and beverage manufacturing. Industry developments have shown that synthetic production enables competitive pricing and controlled purity levels, enhancing safety compliance in regulated markets. Additionally, advancements in synthesis processes have reduced production costs and improved pigment performance. As global demand for fortified products grows, the synthetic segment is expected to retain its dominance, particularly in high-volume applications requiring predictable quality and shelf-life stability.

The beta-carotene segment is projected to contribute 32.7% of the carotenoids market revenue in 2025, securing its position as the leading product type. This growth is driven by beta-carotene’s widespread use as both a natural colorant and a provitamin A source, offering nutritional and functional benefits. Food and beverage companies have increasingly incorporated beta-carotene for its vibrant orange to yellow coloration and antioxidant properties, which enhance product appeal while supporting health claims. Clinical literature has highlighted its role in supporting immune function and eye health, further driving consumer demand. Beta-carotene’s versatility allows its application across diverse product categories, including dairy, bakery, beverages, and dietary supplements. Its stability in both synthetic and natural forms has also supported consistent product quality across processing environments. With health-conscious consumer trends and functional ingredient innovation on the rise, beta-carotene is expected to remain the most in-demand carotenoid type in the market.

The food and beverage segment is projected to account for 41.6% of the carotenoids market revenue in 2025, holding the largest application share due to increasing consumer demand for visually appealing and nutritionally enriched products. Carotenoids have been adopted widely in the sector as natural and synthetic colorants, as well as functional additives that support wellness positioning. Industry reports have noted that food and beverage companies are reformulating products to replace artificial dyes with carotenoids, aligning with clean-label trends and regulatory pressures. Additionally, the expansion of functional foods and drinks fortified with carotenoids for their antioxidant and provitamin A properties has strengthened this segment’s growth. The ability of carotenoids to deliver stable coloration and health benefits in a wide range of products, from beverages to snacks, has ensured their broad acceptance. With consumer preferences shifting toward products that combine sensory appeal with health functionality, the food and beverage segment is poised to sustain its leadership in carotenoid applications.

The market has been witnessing substantial growth due to their increasing applications in food, feed, pharmaceuticals, and cosmetic industries. Carotenoids are naturally occurring pigments with antioxidant properties that provide color, nutritional value, and health benefits. Their use in functional foods, dietary supplements, and fortified beverages has expanded as consumers demand natural, clean-label ingredients. The market is driven by awareness of health benefits such as immune support, eye health, and skin protection. Industrial production through natural extraction from algae, fruits, and vegetables, as well as microbial fermentation, has improved availability.

Carotenoids are widely used in nutraceuticals and dietary supplements due to their antioxidant and provitamin Some properties. Ingredients like beta-carotene, lutein, and astaxanthin are incorporated into capsules, soft gels, powders, and functional drinks. These compounds help reduce oxidative stress, support immune function, and promote eye and skin health. Increasing health consciousness, aging populations, and preventive healthcare trends have driven demand in this sector. Production of carotenoids via microbial fermentation and algae cultivation ensures a consistent supply of high-purity ingredients. Integration into personalized nutrition and functional food products is further expanding applications. Regulatory approvals and clinical validation studies have strengthened consumer trust and market acceptance, driving sustained growth in nutraceutical applications.

The food and beverage industry is a key driver of carotenoid consumption, where these compounds are used as natural colorants, preservatives, and nutritional enhancers. Carotenoids improve visual appeal and provide added health benefits in beverages, dairy products, baked goods, confectionery, and snacks. Clean-label trends and restrictions on synthetic colorants have encouraged manufacturers to adopt carotenoids for natural coloring solutions. Encapsulation and stabilization technologies have enhanced carotenoid shelf-life and thermal stability, enabling inclusion in processed and fortified foods. The growing global demand for functional and health-oriented food products has created strong opportunities for carotenoid integration across diverse food categories. Supply agreements with ingredient producers ensure consistent availability for large-scale industrial usage.

Carotenoids are increasingly used in cosmetic and personal care products due to their antioxidant, photoprotective, and anti-aging properties. Ingredients such as beta-carotene, lycopene, and lutein are incorporated into skin creams, serums, sunscreens, and hair care formulations. These compounds help neutralize free radicals, reduce UV-induced skin damage, and improve complexion. Growing consumer preference for natural, plant-derived, and clean-label ingredients has promoted carotenoid adoption in premium personal care products. Encapsulation techniques and stabilization methods allow long-term efficacy in cosmetic formulations. Market expansion is further supported by research demonstrating the skin health benefits of carotenoids, enabling product differentiation and value addition in the competitive beauty and personal care sector.

Despite increasing demand, the carotenoids market faces challenges related to high production costs, stability concerns, and regulatory compliance. Natural extraction processes from algae, fruits, and vegetables require significant energy, solvents, and processing time. Carotenoids are sensitive to light, heat, and oxygen, which can reduce efficacy during storage and processing. Synthetic production offers cost advantages but faces consumer resistance in clean-label markets. Regulatory requirements for food, supplement, and cosmetic applications vary by region, requiring certifications and safety assessments. Supply chain limitations and price volatility of raw materials can affect market growth. Overcoming these challenges through advanced stabilization, fermentation technologies, and sustainable sourcing is crucial to meeting global demand and supporting widespread adoption of carotenoids.

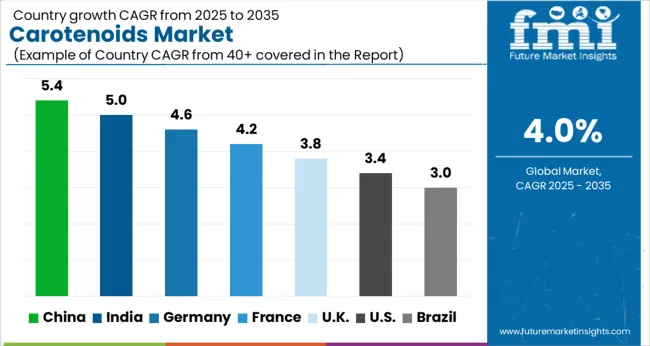

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

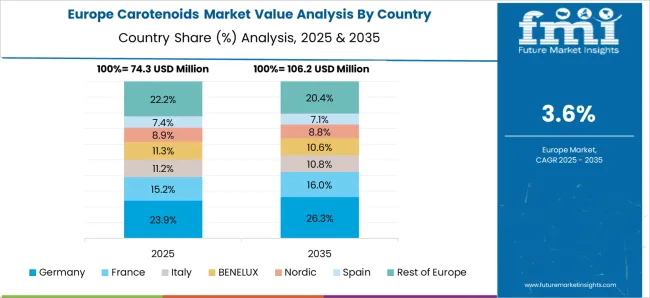

China leads the market with a forecast growth rate of 5.4%, fueled by increased production for dietary supplements, food colorants, and nutraceutical applications. India follows at 5.0%, driven by rising demand in fortified foods and pharmaceutical formulations. Germany records 4.6%, supported by strong research and development in natural pigment extraction and functional food applications. The United Kingdom maintains 3.8%, with growth aided by increasing adoption in health-focused consumer products. The United States registers 3.4%, where steady demand across food, cosmetics, and dietary supplement sectors sustains market activity. Together, these countries reflect a diverse environment of production, innovation, and consumption that shapes the global carotenoids market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 5.4%, driven by increasing applications in the food, beverage, and nutraceutical industries. Rising consumer preference for natural colors and antioxidants is boosting demand in processed foods and dietary supplements. The market is also supported by government regulations promoting safe and natural food additives, along with a growing focus on preventive health and wellness. Manufacturers are investing in R&D to produce carotenoids with higher stability, solubility, and bioavailability. Expansion of production facilities and strategic partnerships with food and beverage companies further enhance market penetration. Adoption in pharmaceuticals and cosmetics adds additional revenue streams for domestic and international producers.

India’s market is projected to grow at a CAGR of 5.0%, fueled by the rising consumption of functional foods, nutraceuticals, and fortified products. The demand is driven by growing awareness about the health benefits of carotenoids, including antioxidant properties and eye health support. Manufacturers are expanding production capacity to meet the increasing industrial demand and are focusing on sustainable extraction methods. Government initiatives promoting nutritional health and clean-label food products support market growth. Integration of carotenoids in dietary supplements, food additives, and cosmetic formulations is gaining traction, with domestic and international players leveraging strategic collaborations and partnerships to capture market share.

Germany is anticipated to expand at a CAGR of 4.6%, owing to the increasing use of carotenoids in natural food colorants, dietary supplements, and personal care products. Consumers are prioritizing health-focused and natural ingredients, driving industrial adoption. European Union regulations promoting clean-label and safe additive usage support market growth. Manufacturers emphasize product stability, improved bioavailability, and eco-friendly extraction methods. Germany’s strong pharmaceutical and nutraceutical industries also provide significant opportunities for carotenoid applications. Strategic alliances, research investments, and technological innovations enhance product differentiation and market competitiveness. Overall, demand for carotenoids continues to rise due to health-conscious consumer behavior and expanding applications in multiple industries.

The market in the United Kingdom is projected to grow at a CAGR of 3.8%, driven by rising demand for natural food additives, dietary supplements, and cosmetic products. Health-conscious consumers are increasingly seeking antioxidants and naturally sourced colorants, boosting market adoption. Manufacturers are focusing on advanced extraction techniques and product formulations that enhance stability and bioavailability. The UK government’s emphasis on nutritional health and regulatory compliance for food additives ensures safe utilization across industries. Integration of carotenoids in functional foods, beverages, and personal care products is providing new revenue streams. Strategic partnerships between carotenoid producers and end-use industries strengthen distribution channels and market reach across the country.

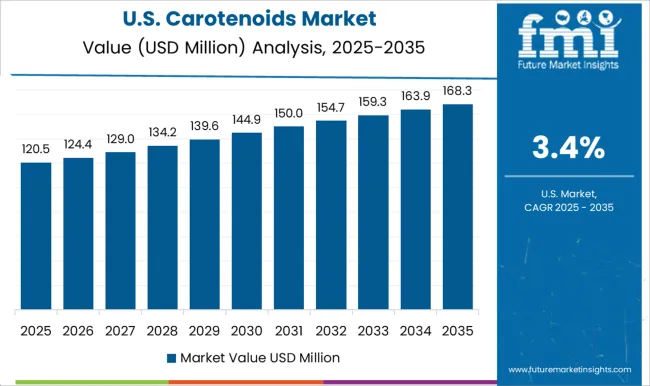

The United States is expected to grow at a CAGR of 3.4%, supported by increasing applications in dietary supplements, functional foods, beverages, and cosmetics. Consumers are prioritizing antioxidants and naturally sourced ingredients for improved health and wellness. Manufacturers are developing innovative carotenoid formulations with enhanced solubility, stability, and bioavailability to cater to diverse industrial requirements. Regulatory compliance and safety standards ensure high-quality production and product reliability. Strategic collaborations between carotenoid producers and major food, beverage, and cosmetic companies are expanding market reach. Growth is further supported by research investments, technological advancements, and rising adoption in nutraceutical and personal care industries.

The market is witnessing robust growth driven by rising consumer demand for natural colorants, antioxidants, and health-promoting ingredients across food, beverage, and nutraceutical applications. BASF and DSM lead the market with extensive carotenoid portfolios, offering high-purity compounds that cater to global industrial requirements and regulatory standards. Chr. Hansen and FMC Corporation focus on innovative natural carotenoid formulations that enhance product stability, color intensity, and nutritional value. Dohler Group and Lycored emphasize plant-based and microbial production methods, providing sustainable carotenoid solutions for functional foods and supplements.

Kemin Industries, Cyanotech Corporation, and Divis Laboratories deliver specialized carotenoids for targeted applications, including aquaculture, animal feed, and pharmaceuticals, combining efficacy with compliance. Allied Biotech, D.D. Williamson, and Naturex extend market reach by offering both synthetic and natural carotenoid blends, enabling manufacturers to balance performance, cost, and consumer appeal. These providers are advancing carotenoid innovation, supporting industry trends toward clean-label ingredients, nutritional enrichment, and functional food development.

| Item | Value |

|---|---|

| Quantitative Units | USD 296.0 million |

| Source | Synthetic and Natural |

| Product | Beta-carotene, Lutein, Astaxanthin, Canthaxanthin, Lycopene, and Others (Zeaxanthin, Capsanthin, Annatto) |

| Application | Food & beverage, Pharmaceutical, Cosmetics, Animal Feed, and Dietary supplements |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, DSM, Chr. Hansen, FMC Corporation, Dohler Group, Lycored, Kemin Industries, Inc, Cyanotech Corporation, Divis Laboratories, Allied Biotech Corporation, D.D. Williamson & Co., Inc, and Naturex |

| Additional Attributes | Dollar sales by carotenoid type and application, demand dynamics across food, beverage, nutraceutical, and cosmetic sectors, regional trends in natural pigment adoption, innovation in extraction methods, stability, and bioavailability, environmental impact of sourcing and processing, and emerging use cases in functional foods, dietary supplements, and natural colorants. |

The global carotenoids market is estimated to be valued at USD 296.0 million in 2025.

The market size for the carotenoids market is projected to reach USD 438.2 million by 2035.

The carotenoids market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in carotenoids market are synthetic and natural.

In terms of product, beta-carotene segment to command 32.7% share in the carotenoids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carotenoids Pigment Market Trends - Natural Colorants & Industry Growth 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA