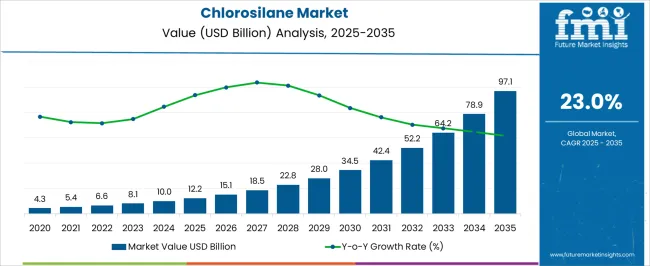

The Chlorosilane Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 97.1 billion by 2035, registering a compound annual growth rate (CAGR) of 23.0% over the forecast period. In 2025, the market is expected to grow steadily from USD 4.3 billion in 2020, with an annual increase of around USD 1–2 billion during the early adoption phase (2020–2024) as production capacities scale and downstream industries adopt chlorosilane-based technologies. Entering the scaling phase from 2025–2030, the market demonstrates significant acceleration, rising from USD 12.2 billion in 2025 to approximately USD 28.0 billion by 2030, supported by the global expansion of solar PV installations, electronics, and chemical intermediates. Each year during this period sees double-digit growth, reflecting the technology’s integration into high-demand applications.

From 2030–2035, the market enters a consolidation phase, with growth moderating yet remaining strong, reaching USD 97.1 billion in 2035. Year-over-year gains continue but at slightly tempered rates as market penetration matures, production capacity stabilizes, and key regions optimize supply chains.

| Metric | Value |

|---|---|

| Chlorosilane Market Estimated Value in (2025 E) | USD 12.2 billion |

| Chlorosilane Market Forecast Value in (2035 F) | USD 97.1 billion |

| Forecast CAGR (2025 to 2035) | 23.0% |

The Chlorosilane market is experiencing steady expansion due to its critical role in the production of semiconductors, solar-grade silicon, and chemical intermediates. The current market scenario is being shaped by rising investments in solar photovoltaic infrastructure and expanding demand for high-purity electronics-grade materials. This growth is supported by technological advancements in silicon processing and the global transition toward renewable energy sources.

Industry news and corporate disclosures have highlighted the increasing reliance on chlorosilanes as foundational chemicals in solar cell manufacturing and fiber optics production. Additionally, the ongoing globalization of electronics manufacturing and strategic capacity expansions by leading chemical producers have further contributed to market momentum.

Future prospects remain strong, with emerging markets increasing their domestic production capacity and government-backed energy transition policies promoting the use of solar technologies These factors, along with innovations in downstream applications and integrated manufacturing capabilities, are expected to strengthen the Chlorosilane market’s trajectory over the coming years.

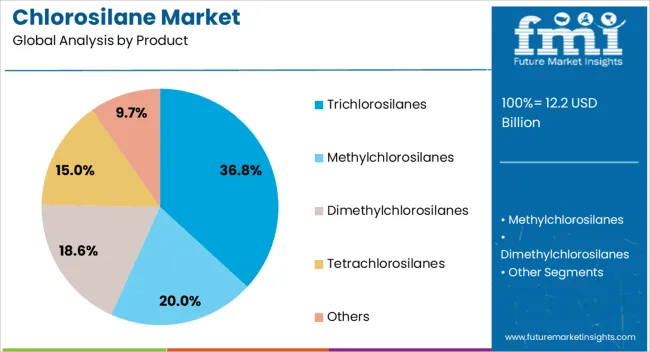

The chlorosilane market is segmented by product and geographic regions. By product, the chlorosilane market is divided into Trichlorosilanes, Methylchlorosilanes, Dimethylchlorosilanes, Tetrachlorosilanes, and Others. Regionally, the chlorosilane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trichlorosilanes segment is projected to hold 36.8% of the Chlorosilane market revenue share in 2025, making it the leading product segment. This position has been established through its extensive application in the production of high-purity silicon for photovoltaic cells and semiconductors. Demand has been reinforced by the growing shift toward renewable energy, particularly solar power, where trichlorosilanes serve as a crucial intermediate.

Corporate communications and manufacturing updates have identified trichlorosilanes as essential in chemical vapor deposition processes, further increasing their adoption in precision electronics. Additionally, industry journals have reported that the efficiency of trichlorosilanes in purification and deposition has made it the preferred choice in silicon-based manufacturing chains.

Its availability at scale and cost-effective synthesis routes have contributed to its widespread use. These technical and economic advantages, along with rising government support for clean energy initiatives, have ensured that trichlorosilanes remain the dominant product segment in the Chlorosilane market through 2025.

The chlorosilane market is growing steadily due to its widespread use in silicone production, semiconductors, and specialty chemical applications. Chlorosilanes serve as essential intermediates for silicone polymers, adhesives, sealants, and coatings. Demand is rising from electronics, automotive, construction, and personal care sectors. Manufacturers are emphasizing high-purity production, consistent supply, and process efficiency. Asia-Pacific dominates the market with strong chemical manufacturing infrastructure and expanding end-use industries. The market benefits from increasing industrialization, growing demand for advanced materials, and the expansion of high-performance applications in diverse sectors.

Chlorosilanes are indispensable in producing silicone-based materials, including resins, elastomers, and oils. They react with water or alcohol to form various silicones used in coatings, adhesives, sealants, and personal care formulations. Consistent purity and controlled reaction parameters are critical to ensure the performance and stability of downstream silicone products. Manufacturers focusing on optimized production processes, quality control, and by-product management enhance yield and minimize defects. High-quality chlorosilanes support specialty applications, such as high-temperature coatings, flexible electronics, and medical-grade silicones, creating a strong link between raw material quality and end-product performance.

Purity and consistent specifications are crucial for chlorosilane users, particularly in electronics and pharmaceutical applications. Impurities can affect polymerization, coating uniformity, and device reliability. Suppliers invest in precise synthesis techniques, stringent purification, and analytical monitoring to meet tight quality requirements. Standardization of production methods and compliance with regulatory guidelines enhance customer trust. Traceable raw material sourcing and controlled storage conditions further preserve chemical integrity. Companies excelling in delivering high-purity chlorosilanes gain a competitive edge, particularly for applications demanding exact chemical performance, reliability, and long-term stability in advanced materials and electronic components.

Chlorosilanes serve multiple industries beyond silicone production, including semiconductors, glass treatment, and chemical intermediates. In electronics, they are used for wafer surface modification and high-purity coatings. In construction, they improve water repellency and durability of concrete and glass. Automotive and aerospace sectors utilize silicones derived from chlorosilanes for lightweight, heat-resistant, and flexible components. Companies aligning product grades with specific industrial needs, offering technical support, and ensuring supply reliability expand their market reach. Diversification across industries reduces dependency on single sectors and enhances growth prospects amid fluctuating demand cycles.

The chlorosilane market is competitive, with global and regional producers competing on product quality, reliability, and cost. Supply chains are sensitive to raw material availability, energy costs, and environmental regulations. Manufacturers investing in efficient production facilities, regional distribution hubs, and robust logistics networks ensure uninterrupted supply. Strategic partnerships with end-users, particularly in high-tech industries, facilitate long-term contracts and market stability. Companies emphasizing process optimization, customer support, and adherence to regulatory standards strengthen market positioning. Market growth depends on balancing production efficiency with quality and meeting evolving industrial demands.

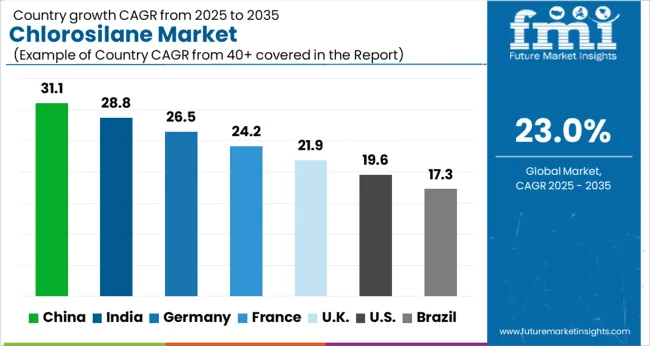

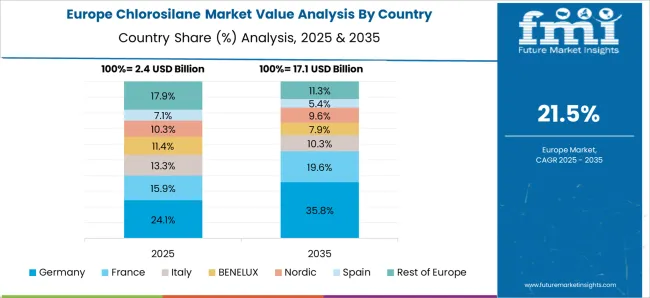

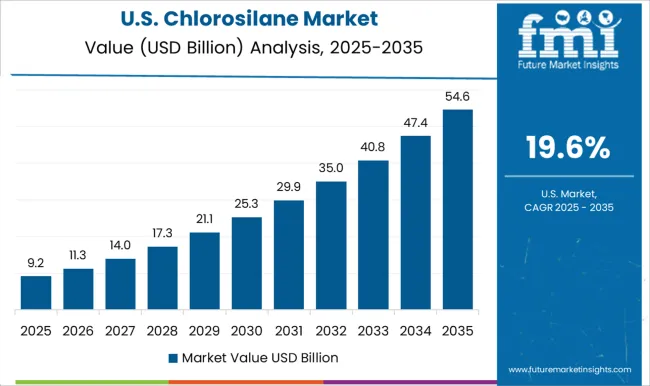

The global chlorosilane market is projected to grow at a CAGR of 23.0%, driven by rising demand in electronics, silicone production, and chemical manufacturing. China leads the market with a 31.1% growth rate, supported by large-scale industrial production and expansion in the electronics sector. India follows at 28.8%, fueled by increasing chemical manufacturing and infrastructure development. Germany shows steady growth at 26.5%, leveraging advanced industrial processes and high-value chemical applications. The UK and USA record moderate growth rates of 21.9% and 19.6%, respectively, reflecting stable demand in manufacturing and specialty chemical industries. This report includes insights on 40+ countries; the top countries are shown here for reference.

The chlorosilane market in China is witnessing rapid growth at 31.1%, driven by the country’s robust chemical, electronics, and solar industries. Chlorosilanes are essential intermediates in producing silicones, high-purity silicon for semiconductors, and photovoltaic materials. China’s investment in renewable energy projects, especially solar panel manufacturing, is a major factor propelling demand. The increasing use of chlorosilanes in specialty chemicals, sealants, adhesives, and coatings further supports market expansion. Leading domestic and international manufacturers are enhancing production capacities and adopting advanced synthesis technologies to meet quality and supply requirements. Government incentives for green energy and high-tech manufacturing contribute to the strong market momentum. With continuous technological innovation and a focus on high-purity applications, the demand for chlorosilanes in China is expected to remain robust, providing opportunities for both established and emerging chemical producers.

The chlorosilane market in India is expanding at 28.8%, fueled by the growing chemical, electronics, and renewable energy sectors. Chlorosilanes are widely used in producing silicones, adhesives, coatings, and high-purity silicon for solar applications. India’s focus on solar energy deployment and electronics manufacturing has led to a surge in demand for these intermediates. Domestic and global manufacturers are investing in production facilities and advanced technologies to meet the rising requirements of various end-use industries. The adoption of high-performance chlorosilanes in specialty chemical applications further strengthens market growth. Supportive government policies promoting renewable energy, industrial chemical manufacturing, and technological innovation are expected to sustain the positive trajectory. As industries continue to expand and high-purity applications gain prominence, India presents a lucrative market for chlorosilane producers seeking long-term growth.

Chlorosilane market in Germany is growing at 26.5%, propelled by the country’s strong chemical, automotive, and renewable energy industries. Chlorosilanes are crucial intermediates for producing silicones, coatings, sealants, and high-purity silicon for electronic applications. Germany’s focus on green energy and advanced manufacturing technologies contributes to steady demand. Research and development in chlorosilane synthesis and purification techniques enhances product quality and efficiency, supporting industrial adoption. Leading chemical companies are expanding production capacities and offering specialty solutions tailored to specific end-use sectors. The country’s emphasis on sustainability, environmental compliance, and innovation further strengthens the market outlook. With ongoing investments in solar energy, electronics, and specialty chemical production, Germany remains a key market for chlorosilane, attracting both domestic and global manufacturers.

The chlorosilane market in the United Kingdom is expanding at 21.9%, supported by the chemical, electronics, and renewable energy sectors. Chlorosilanes are critical for producing silicones, adhesives, coatings, and high-purity silicon used in solar and semiconductor applications. Growing investments in green energy, particularly solar power, and advanced manufacturing technologies are driving market demand. Domestic and international manufacturers are investing in production facilities and research to offer high-performance chlorosilane products. Government policies supporting renewable energy adoption and industrial modernization further enhance market growth. As the UK focuses on clean energy initiatives and technological innovation, the demand for chlorosilanes in both specialty chemical and high-purity applications is expected to remain strong, presenting opportunities for established and emerging manufacturers.

The chlorosilane market in the United States is growing at 19.6%, supported by chemical manufacturing, electronics, and renewable energy industries. Chlorosilanes serve as key intermediates for silicones, adhesives, coatings, and high-purity silicon for solar and semiconductor applications. The USA focus on renewable energy infrastructure, industrial modernization, and advanced electronics manufacturing is fueling demand. Leading manufacturers are expanding production capabilities and investing in research to enhance efficiency and product quality. Government incentives and initiatives for clean energy deployment and industrial innovation further strengthen market adoption. With continued growth in high-purity applications, solar energy, and specialty chemicals, the United States represents a significant market for chlorosilane producers seeking sustainable, long-term expansion opportunities.

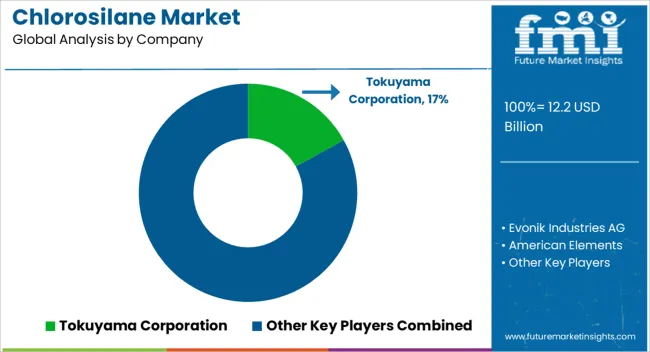

Leading players in the market include Tokuyama Corporation, known for its high-quality chlorosilane production and advanced semiconductor-grade silicon materials. Evonik Industries AG and Dow Chemical Company offer extensive chemical solutions with robust manufacturing capabilities. American Elements provides specialty chemicals tailored to high-tech applications, while PCC Group delivers industrial-scale chlorosilane products for diverse chemical processes. Hemlock Semiconductor (HSC) Operations is a major contributor to the solar-grade polysilicon industry, leveraging chlorosilane intermediates in its production processes. SIAD and Mitsubishi Polycrystalline Silicon America Corporation also play key roles, focusing on high-purity materials for both industrial and photovoltaic applications.

The market is poised for steady growth due to rising solar energy adoption, expanding semiconductor manufacturing, and increasing demand for silicone-based products across automotive, construction, and healthcare industries. Technological advancements in purification, production efficiency, and environmentally sustainable processes are expected to strengthen the chlorosilane market further, positioning it as a cornerstone of the global silicon and chemical supply chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.2 Billion |

| Product | Trichlorosilanes, Methylchlorosilanes, Dimethylchlorosilanes, Tetrachlorosilanes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tokuyama Corporation, Evonik Industries AG, American Elements, PCC Group, Hemlock Semiconductor (HSC) Operations, Dow Chemical Company, SIAD, and Mitsubishi Polycrystalline Silicon America Corporation |

| Additional Attributes | Dollar sales by type including trichlorosilane, dichlorosilane, and monochlorosilane, application across semiconductor manufacturing, silicone production, and chemical intermediates, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for high-purity silicon, expanding electronics and solar industries, and rising adoption in specialty chemical production. |

The global chlorosilane market is estimated to be valued at USD 12.2 billion in 2025.

The market size for the chlorosilane market is projected to reach USD 97.1 billion by 2035.

The chlorosilane market is expected to grow at a 23.0% CAGR between 2025 and 2035.

The key product types in chlorosilane market are trichlorosilanes, methylchlorosilanes, dimethylchlorosilanes, tetrachlorosilanes and others.

In terms of , segment to command 0.0% share in the chlorosilane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Leading Trichlorosilane Providers

Dimethyldichlorosilane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA