The cresols market is estimated to be valued at USD 456.9 million in 2025 and is projected to reach USD 614.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

A 10-year growth comparison highlights a steady yet moderate expansion trajectory across the forecast horizon. Between 2021 and 2025, the market grows from USD 394.2 million to 456.9 million, adding around USD 62.7 million in absolute terms. This early phase is driven by demand in disinfectants, resins, antioxidants, and agrochemical intermediates, although growth remains limited due to regulatory restrictions on phenolic compounds. The subsequent period, 2026 to 2030, shows a balanced progression as values increase from 456.9 million to 529.7 million, contributing approximately USD 72.8 million. This stage reflects higher adoption in industrial applications, such as chemical intermediates for pharmaceuticals, fragrances, and herbicides, alongside increased integration into specialty polymers and coatings.

In contrast, the final block, 2031 to 2035, delivers a more significant rise, from USD 529.7 million to 614.1 million, accounting for an incremental USD 84.4 million. This acceleration is supported by ongoing industrialization, expanding chemical processing capacities in Asia, and technology improvements in purification and synthesis methods. When comparing the 10-year blocks, the incremental gain rises in each phase, from USD 62.7 million to 72.8 million and then to 84.4 million, signaling a compounding trend where long-term growth is stronger despite a modest CAGR.

| Metric | Value |

|---|---|

| Cresols Market Estimated Value in (2025 E) | USD 456.9 million |

| Cresols Market Forecast Value in (2035 F) | USD 614.1 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

The cresols market is driven by five parent markets that collectively define its growth, applications, and demand across industrial and specialty chemical sectors. The chemical intermediates market contributes the largest share of about 28-32%, as cresols serve as key feedstocks for the synthesis of resins, phenolic antioxidants, and other chemical derivatives essential for coatings, adhesives, and industrial formulations. The pharmaceuticals market adds approximately 20-24%, where cresols are employed as antiseptics, disinfectants, and precursors in the production of certain active pharmaceutical ingredients, supporting both medicinal and hygiene applications. The agrochemicals market contributes around 15-18%, as cresol-based derivatives are utilized in herbicides, pesticides, and fungicides that enhance crop protection and agricultural productivity.

The polymer and plastics market accounts for roughly 12-15%, with cresols used in specialty polymers, stabilizers, and coating formulations to improve material durability, thermal resistance, and performance characteristics. Lastly, the dyes and pigments market represents about 8-10%, leveraging cresols as intermediates in producing colorants, inks, and specialty pigments for textiles, industrial applications, and printing technologies. Collectively, these parent markets emphasize the versatility and critical importance of cresols as industrial building blocks, highlighting their role in enhancing product performance, supporting regulatory compliance in pharmaceuticals and agriculture, and enabling innovation in polymers, coatings, and specialty chemicals.

The cresols market is experiencing consistent growth, supported by their widespread use as essential intermediates in chemical manufacturing and industrial applications. Industry publications and company disclosures have indicated rising demand for cresols in producing resins, antioxidants, and disinfectants.

Advances in refining and synthesis technologies have enhanced production efficiency and purity levels, enabling broader use in high-value applications. Increasing demand from the agrochemical and pharmaceutical sectors has also contributed to market expansion, as cresols serve as key inputs for active ingredients and specialty chemicals.

Regulatory compliance and quality standards have become integral to supply chain operations, driving investment in sustainable and low-emission production processes. Looking forward, demand is expected to remain strong as industrial output expands globally and research initiatives explore new specialty applications for cresols in advanced materials and performance chemicals.

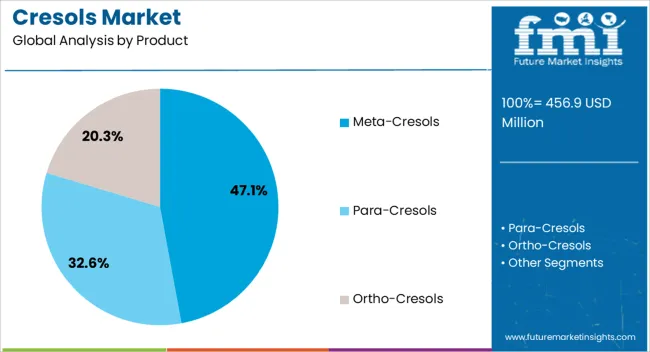

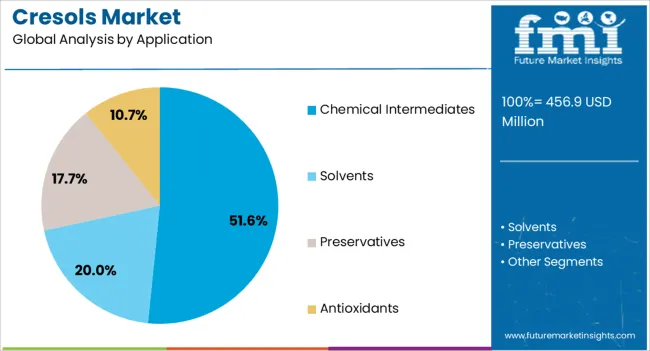

The cresols market is segmented by product, application, and geographic regions. By product, cresols market is divided into meta-cresols, para-cresols, and ortho-cresols. In terms of application, cresols market is classified into chemical intermediates, solvents, preservatives, and antioxidants. Regionally, the cresols industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The meta-cresols segment is projected to hold 47.1% of the cresols market revenue in 2025, maintaining its leadership among product types. Growth in this segment has been driven by its critical role as a chemical precursor in manufacturing herbicides, antioxidants, and fragrance agents. The segment benefits from stable demand across multiple end-use industries, particularly agrochemicals and pharmaceuticals. Production advancements have enabled high-purity meta-cresol manufacturing, aligning with strict regulatory and quality requirements. Its chemical versatility and functional properties have positioned it as a preferred choice in applications where stability and performance are paramount. Expanding industrial infrastructure in emerging markets has also contributed to sustained demand. With ongoing R&D exploring new derivatives and formulation methods, the Meta-Cresols segment is expected to retain its strong market position.

The chemical intermediates segment is projected to account for 51.6% of the cresols market revenue in 2025, making it the dominant application area. This segment’s growth is supported by cresols’ role as foundational building blocks in synthesizing a wide array of industrial chemicals. Their extensive use in producing resins, coatings, and specialty polymers has ensured consistent demand from manufacturing sectors. Industrial production trends indicate that chemical intermediates derived from cresols are critical for downstream applications in automotive, construction, and electronics industries. Manufacturers have focused on optimizing processing techniques to improve yield and minimize environmental impact, further strengthening the segment’s appeal. As global demand for advanced materials and performance chemicals grows, the Chemical Intermediates segment is expected to remain the largest and most stable driver of cresols market consumption.

The cresols market is expanding due to increasing demand from agrochemicals, pharmaceuticals, resins, and specialty chemicals. Their application in herbicides, vitamin E production, and disinfectants strengthens industrial adoption. However, producers face challenges from volatile raw material prices, stringent regulations, and safety concerns. Growth opportunities lie in pharmaceutical intermediates, agricultural expansions, and high-purity cresol grades for electronics and healthcare. Manufacturers focusing on process efficiency, compliance, and technical collaboration with downstream users can gain a competitive advantage. Rising industrialization in Asia-Pacific and strong demand in North America are expected to drive future market expansion.

The cresols market is experiencing strong demand due to their wide use as intermediates in agrochemicals, pharmaceuticals, antioxidants, resins, and fragrances. Industries are adopting cresols for herbicide production, vitamin E synthesis, and as stabilizers in plastics and lubricants. Their role as raw materials in disinfectants and personal care products further drives market penetration. Growth in agriculture, automotive, and healthcare sectors supports expansion, particularly in Asia-Pacific and North America. Manufacturers prioritize efficiency, high purity, and consistent supply to meet diverse industrial needs. Increasing demand for chemical intermediates and expanding end-use industries are key growth contributors.

Despite robust demand, cresol producers face challenges from volatile feedstock prices, particularly petroleum derivatives. Supply chain fluctuations and dependence on petrochemical availability can impact cost structures. Manufacturers must comply with strict regulatory frameworks governing toxicity, emissions, and environmental safety. Stringent handling requirements for ortho-, meta-, and para-cresols add operational complexities. Fluctuating demand from agrochemicals and pharmaceuticals creates planning uncertainty. Buyers increasingly demand cresols with verified safety certifications, consistent quality, and secure delivery schedules. To remain competitive, suppliers must invest in efficient production processes, robust quality control, and close alignment with regulatory standards across different markets.

The rising use of cresols in herbicides, antioxidants, and pharmaceutical intermediates presents significant growth opportunities. Expanding agricultural activities in emerging economies increases demand for cresol-based agrochemicals. In pharmaceuticals, cresols serve as essential intermediates in producing vitamin E and active ingredients. Specialty chemical applications, including resins, coatings, and disinfectants, further broaden the market scope. Companies offering high-purity cresols with application-specific support are well-positioned to gain market share. Expansion in Asia-Pacific, driven by industrialization and rising chemical consumption, creates strong growth prospects. Collaborative partnerships with downstream users and investment in production technologies can enhance profitability and market presence.

Technological advancements in cresol production focus on improving yield, reducing waste, and minimizing environmental impact. Manufacturers are adopting continuous production techniques and advanced separation technologies to optimize efficiency. Increasing focus on high-purity grades for pharmaceutical and electronic applications is shaping product development. Partnerships between chemical producers and end-users foster innovation in formulation and new application areas. Enhanced distribution networks and regional capacity expansion are addressing global demand more effectively. Producers providing certified, reliable, and customizable cresols are likely to dominate. Growing emphasis on value-added services, technical support, and supply chain reliability reinforces long-term market growth.

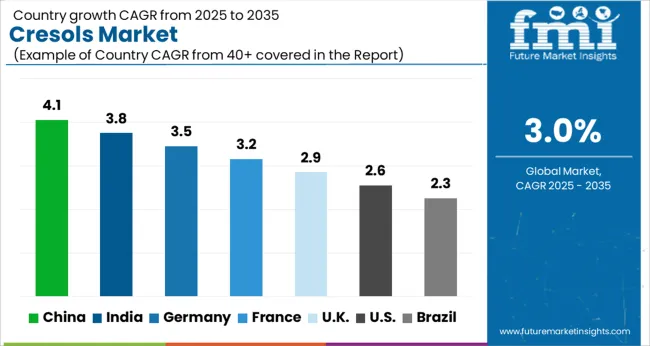

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

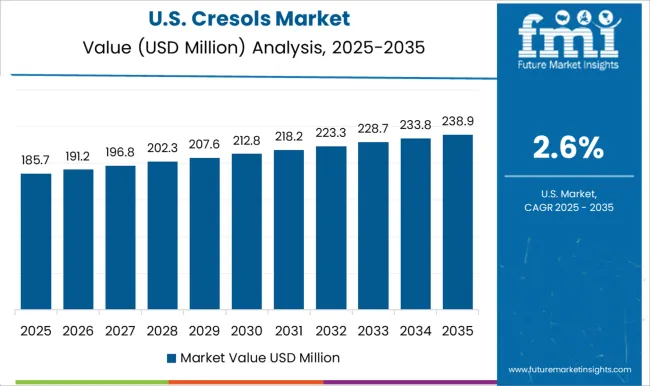

| U | 2.6% |

| Brazil | 2.3% |

The global cresols market is projected to expand at a CAGR of 3.0% from 2025 to 2035. China (4.1%) and India (3.8%) are the fastest-growing markets, supported by rising demand from agrochemicals, antioxidants, and resin production. Germany (3.5%) emphasizes high-purity cresols for specialty chemicals and pharmaceutical intermediates. The UK (2.9%) experiences moderate growth driven by coatings and preservative applications, while the USA (2.6%) reflects stable demand across industrial chemicals and plastics. Growth drivers include expanding applications in disinfectants, fragrance ingredients, and polymers, alongside stricter environmental compliance shaping production. The analysis spans 40+ countries, with leading markets profiled below.

The cresols market is projected to grow at a CAGR of 4.1% from 2025 to 2035. The market is primarily driven by increasing demand from agrochemical formulations, antioxidant intermediates, and resin production for paints and coatings. Industrial expansion and rapid urbanization are also boosting chemical consumption, providing a steady demand base. The growing pharmaceutical and disinfectant industries further support market adoption. Local chemical manufacturers are expanding production capacity while incorporating advanced refining technologies to meet high-purity cresol requirements. China’s strong export-oriented chemical sector increases the need for consistent quality standards and regulatory compliance, encouraging investment in modern production facilities. The market is also seeing innovations in derivatives for specialty chemicals and polymers, enhancing application diversity.

The cresols market in India is expected to register a CAGR of 3.8% during 2025–2035. Demand is driven by rapid growth in pharmaceuticals, agrochemicals, and industrial chemicals. The paint, coatings, and polymer sectors are increasingly using cresol derivatives, while the rise in disinfectant and cleaning product manufacturing further fuels consumption. Local manufacturers are scaling up production capacities to meet domestic and export requirements. India’s increasing industrialization and expansion of chemical clusters provide a supportive ecosystem for market growth. Government initiatives to strengthen chemical infrastructure and ensure safety compliance are positively influencing adoption. The demand for high-purity cresols for pharmaceutical intermediates is also rising due to stricter quality standards.

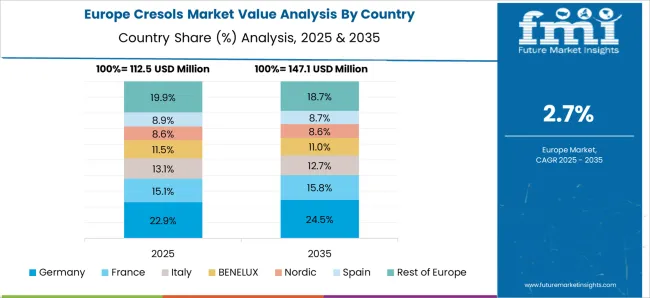

The cresols market in Germany is projected to grow at a CAGR of 3.5% from 2025 to 2035. The country emphasizes high-purity cresols for specialty chemicals, pharmaceutical intermediates, and fine chemical production. Stringent regulatory standards and focus on product quality are shaping manufacturing processes. Germany’s chemical sector is investing in cleaner, efficient production methods and derivative innovations to meet industrial demands. The automotive, coatings, and polymer industries also contribute to steady demand. Research and development initiatives are creating new cresol-based formulations for industrial and consumer applications. Market growth is moderate due to established supply chains and stringent environmental regulations, but demand for niche, high-value applications continues to rise.

The UK cresols market is forecast to grow at a CAGR of 2.9% from 2025 to 2035. Growth is moderate, primarily driven by applications in coatings, resins, disinfectants, and adhesives. The pharmaceutical industry uses cresols as intermediates for high-purity chemical production, supporting steady adoption. Increasing hygiene and sanitation awareness is driving disinfectant-related demand. The market is competitive, with domestic manufacturers and international suppliers catering to industrial and pharmaceutical needs. R&D in derivatives and efficient production methods is enabling better yield and product quality. While growth is slower compared to Asia, niche applications and specialized chemicals maintain a consistent market presence.

The USA cresols market is expected to expand at a CAGR of 2.6% from 2025 to 2035. The market is primarily supported by applications in industrial chemicals, polymers, disinfectants, and pharmaceutical intermediates. Strict regulatory frameworks influence production standards, promoting high-purity outputs. Adoption in coatings, adhesives, and resins remains steady, while specialty chemicals contribute to incremental growth. Local and international manufacturers focus on optimized processes and derivative products to improve yield and reduce environmental impact. Market growth is moderate due to established chemical infrastructure, but demand from pharmaceuticals, hygiene products, and industrial manufacturing provides consistent opportunities.

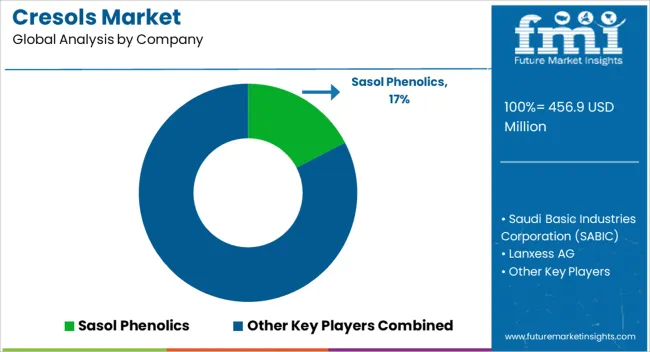

Competition in the cresols market is driven by production scale, feedstock integration, and the ability to supply both bulk and specialty derivatives across industrial applications. Sasol Phenolics maintains a strong position with its high-capacity phenol and cresol facilities, catering to resins, agrochemical intermediates, and pharmaceutical sectors. Saudi Basic Industries Corporation (SABIC) leverages integrated petrochemical operations to provide cost-competitive cresols for plastics, coatings, and industrial chemicals, emphasizing supply reliability and global reach. Lanxess AG competes through high-purity cresols and derivatives used in antioxidants, UV stabilizers, and specialty coatings, targeting performance-critical applications.

Dakota Gasification Company differentiates with cresols produced as by-products from coal gasification, supplying niche industrial demand. RÜTGERS Group, with coal tar distillation expertise, focuses on resins and chemical intermediates. Mitsui Chemicals, Inc. integrates cresols into diversified portfolios for electronics, industrial resins, and healthcare applications, while Atul Ltd. serves the Indian market with cresol-based agrochemical intermediates and fine chemicals. Nanjing Datang Chemical Co., Ltd. competes in Asia with large-scale, cost-effective supply for adhesives, coatings, and stabilizers. VDH Chemtech Pvt. Ltd. and Ardisons Oils & Electricals (P) Ltd. target niche domestic segments with customized cresol formulations, while Xiamen Hisunny Chemical Co., LTD. strengthens the Chinese supply chain with export-focused offerings for coatings, plastics, and fine chemicals.

Strategies across the sector emphasize capacity expansion, feedstock security, and development of high-value derivatives for electronics, automotive, and pharmaceutical sectors. Product brochures highlight ortho-, meta-, and para-cresols used in antioxidants, preservatives, dyes, resins, disinfectants, and vitamin E intermediates. Emphasis is placed on purity, consistency, and compliance with environmental regulations. Growth is underpinned by increasing demand from agrochemicals, polymers, and healthcare, while competitiveness is reinforced through supply reliability, global distribution, and the ability to offer specialized derivatives tailored to end-use applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 456.9 million |

| Product | Meta-Cresols, Para-Cresols, and Ortho-Cresols |

| Application | Chemical Intermediates, Solvents, Preservatives, and Antioxidants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sasol Phenolics, Saudi Basic Industries Corporation (SABIC), Lanxess AG, Dakota Gasification Company, RÜTGERS Group, Mitsui Chemicals, Inc., Atul Ltd., Nanjing Datang Chemical Co., Ltd, VDH Chemtech Pvt. Ltd., Ardisons Oils & Electricals (P) Ltd., and Xiamen Hisunny Chemical Co., LTD. |

| Additional Attributes | Dollar sales by cresol type (ortho-cresol, meta-cresol, para-cresol, mixed cresols), application (agrochemicals, resins, antioxidants, pharmaceuticals, solvents), and purity grade (standard, high-purity). Demand dynamics are driven by growth in agrochemicals, polymer resins, and specialty chemicals. Regional trends highlight strong production and consumption in Asia-Pacific, with North America and Europe focusing on specialty and high-purity applications. |

The global cresols market is estimated to be valued at USD 456.9 million in 2025.

The market size for the cresols market is projected to reach USD 614.1 million by 2035.

The cresols market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in cresols market are meta-cresols, para-cresols and ortho-cresols.

In terms of application, chemical intermediates segment to command 51.6% share in the cresols market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA