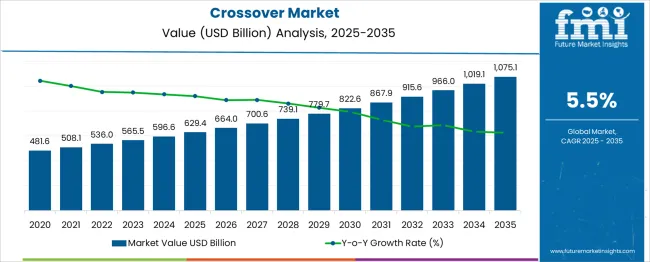

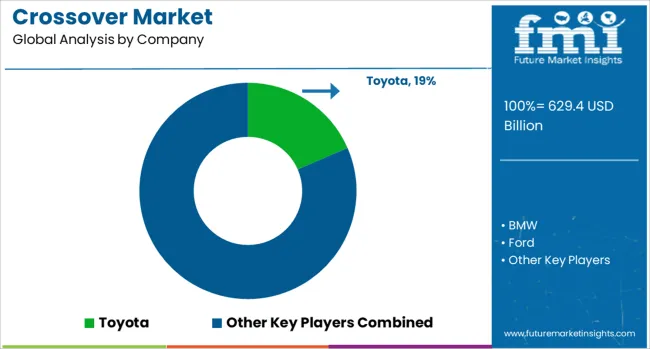

The Crossover Market is estimated to be valued at USD 629.4 billion in 2025 and is projected to reach USD 1075.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Crossover Market Estimated Value in (2025 E) | USD 629.4 billion |

| Crossover Market Forecast Value in (2035 F) | USD 1075.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

Industry trends have shown that mid-size crossovers are increasingly popular due to their balanced size, offering both spacious interiors and manageable dimensions for urban driving. Advances in fuel efficiency and engine performance have enhanced the appeal of gasoline-powered crossovers as they provide a familiar fueling infrastructure and cost-effectiveness. Front-wheel drive configurations are preferred for their improved fuel economy and lower manufacturing costs, making them attractive to a broad range of buyers.

The increasing availability of mid-size gasoline crossovers with front-wheel drive in global markets is expected to continue fueling demand. Segmental expansion is expected to be led by mid-size vehicles in the vehicle segment, gasoline fuel type, and front-wheel drive systems.

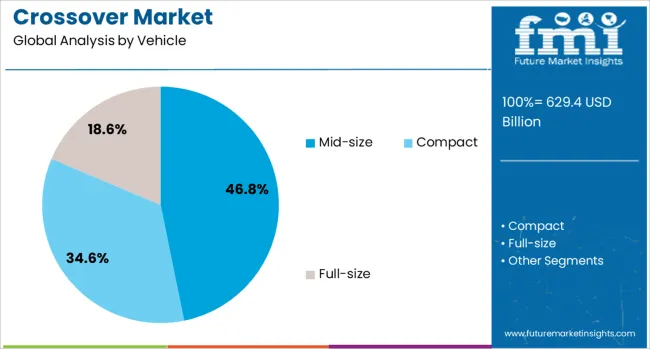

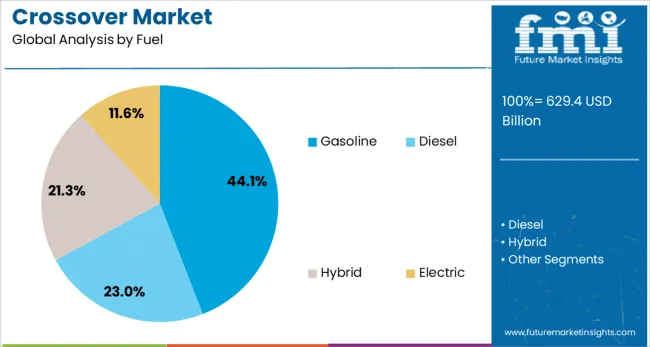

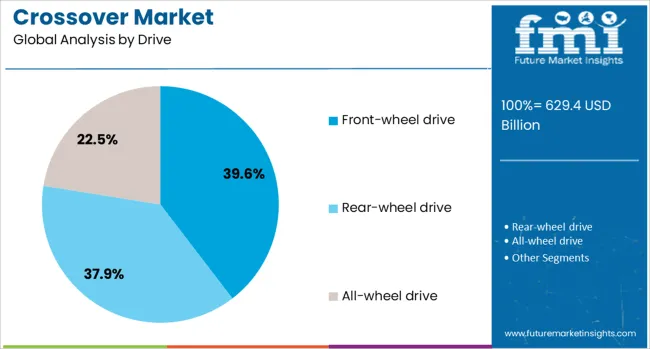

The crossover market is segmented by vehicle, fuel, drive, and application and geographic regions. By vehicle of the crossover market is divided into Mid-size, Compact, and Full-size. In terms of fuel of the crossover market is classified into Gasoline, Diesel, Hybrid, and Electric. Based on drive of the crossover market is segmented into Front-wheel drive, Rear-wheel drive, and All-wheel drive. By application of the crossover market is segmented into Personal and Commercial. Regionally, the crossover industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mid-size crossover segment is expected to hold 46.8% of the market revenue in 2025, leading the vehicle category. This segment’s growth has been driven by its ability to meet the needs of consumers seeking spacious interiors and practical cargo capacity without the bulk of larger SUVs. Buyers appreciate mid-size crossovers for their balanced combination of comfort, performance, and maneuverability.

The segment appeals to families and individuals who require versatility for daily commutes as well as leisure activities. Continuous improvements in safety features and technology integration have further boosted consumer confidence in mid-size crossovers.

Given the evolving consumer preference for vehicles that adapt to multiple lifestyles, this segment is poised to maintain its dominance.

The gasoline fuel segment is projected to represent 44.1% of the crossover market revenue in 2025, maintaining its position as the leading fuel type. Gasoline engines continue to be favored due to their widespread availability, ease of refueling, and established maintenance infrastructure. This fuel type offers a balance between performance and cost which appeals to a large portion of crossover buyers globally.

Additionally, recent improvements in engine technology have enhanced fuel efficiency and reduced emissions, addressing some environmental concerns while maintaining the convenience of gasoline.

Although alternative fuel vehicles are gaining traction, gasoline-powered crossovers remain a reliable and accessible choice for many consumers, especially in regions with limited electric vehicle infrastructure.

The front-wheel drive segment is anticipated to account for 39.6% of the crossover market revenue in 2025, leading the drive system category. This preference stems from front-wheel drive vehicles’ better fuel economy, lighter weight, and lower production costs compared to all-wheel or rear-wheel drive alternatives.

Front-wheel drive configurations offer sufficient traction and handling for most urban and highway conditions, aligning well with the typical usage patterns of crossover buyers. Manufacturers have optimized front-wheel drive systems to deliver smooth driving experiences while maximizing interior space efficiency.

The segment also benefits from competitive pricing, making front-wheel drive crossovers accessible to a broader audience. As demand for practical and economical vehicles grows, front-wheel drive is expected to sustain its leading role in the crossover market.

Crossover demand has increased due to practicality, comfort, and flexible financing options, making them a preferred choice over sedans and SUVs. Automakers are leveraging pricing strategies, feature differentiation, and digital platforms to boost accessibility and strengthen brand loyalty.

Demand for crossovers has gained strength due to their perceived practicality and versatility. These vehicles have been positioned as an alternative to sedans and full-size SUVs, creating interest among consumers seeking comfort and higher ground clearance without compromising fuel efficiency. Manufacturers have concentrated on expanding product lines with multiple trims and powertrain choices to capture different income groups. Marketing strategies have been heavily based on premium interior features, safety enhancements, and strong warranty programs. Dealership networks are witnessing an increase in test drive conversions, attributed to aggressive financing schemes and attractive trade-in offers. This approach has made crossovers a mainstream choice in developed and emerging economies, particularly among families and young professionals.

Pricing strategies have played a major role in shaping crossover adoption, as buyers often weigh affordability against luxury features. Automakers have adopted flexible leasing models, zero down payment options, and extended credit periods to improve accessibility. Entry-level variants are being introduced with essential features to maintain affordability, while higher trims focus on comfort and entertainment systems. Partnerships with ride-hailing companies and corporate fleets have provided an additional demand channel, ensuring consistent production utilization. Sales incentives combined with digital booking platforms have reduced purchase friction, helping brands improve customer retention. With evolving consumer expectations, companies have been compelled to strike a balance between cost competitiveness and differentiated product attributes to maintain brand loyalty and pricing power

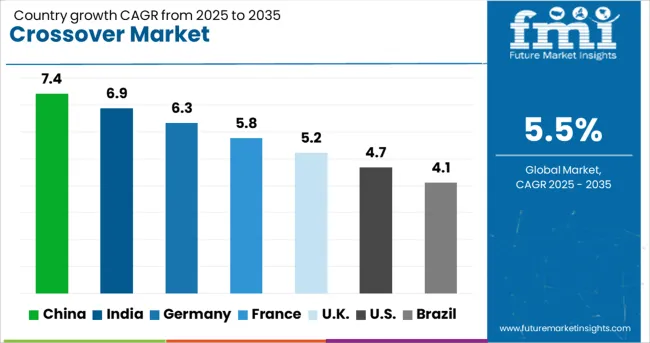

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The crossover segment, projected to grow at a global CAGR of 5.5% between 2025 and 2035, is exhibiting strong momentum across major economies. China, a BRICS member, is leading with a 7.4% CAGR, supported by increasing demand for mid-sized vehicles and competitive pricing strategies. India, also part of BRICS, follows with a 6.9% CAGR, where preference for fuel-efficient and compact designs is influencing consumer behavior. Germany, an OECD member, is posting a 6.3% CAGR due to robust demand for premium crossovers and the adoption of hybrid variants. The United Kingdom, part of the OECD, is projected to expand at a 5.2% CAGR, driven by consumer preference for family-oriented crossovers and efficient financing schemes. The United States, another OECD member, is witnessing a 4.7% CAGR, characterized by strong interest in luxury trims and feature-rich designs. Emerging economies like China and India are fueling rapid growth, while mature markets such as the US and UK maintain steady adoption through product diversification. The report provides detailed insights into over 40 countries, with the top five listed as a reference.

The CAGR for the crossover market in the United Kingdom stood at about 3.4% during 2020–2024 and moved up to nearly 5.2% for 2025–2035. The earlier period was marked by economic uncertainty and supply disruptions, limiting model launches and slowing retail conversions. Post-2025, growth accelerated as financing schemes became more accessible and hybrid-powered crossovers gained traction among families seeking cost efficiency and enhanced comfort features. Dealer incentives and flexible subscription ownership models attracted younger buyers. Consumer preference shifted from conventional sedans to compact utility vehicles, aided by better digital booking systems and doorstep delivery. This transformation reinforced the UK market’s competitive positioning.

China registered a CAGR of around 6.1% from 2020–2024, which increased to about 7.4% for 2025–2035. The earlier phase saw consistent sales within metropolitan clusters, driven largely by mid-tier brands, while premium demand remained limited. Growth in the later period came from deeper penetration into Tier-2 and Tier-3 cities, combined with competitive pricing and targeted finance plans. Local OEMs emphasized fuel-efficient variants with upgraded infotainment, while global players launched hybrid and EV-based crossovers under joint ventures. Policy-backed support for alternative drivetrains also played a role in reinforcing this segment. Direct-to-consumer digital sales platforms gained scale after 2026, boosting affordability and market visibility.

Demand Outlook for Crossover Market in India

The CAGR in India improved from roughly 5.2% during 2020–2024 to nearly 6.9% in 2025–2035. Earlier growth was restrained by affordability concerns and limited financing penetration outside major cities. Post-2025, accelerated credit availability and rising interest in compact utility vehicles drove significant volume gains. Indian automakers emphasized localized production to control prices while enhancing interiors and safety features to appeal to urban families. Marketing strategies focused on aspirational branding coupled with accessible pricing. The adoption of subscription-based ownership and multi-brand online retail platforms improved accessibility. Aggressive expansion in rural showrooms helped bridge the demand gap, broadening the addressable consumer base.

Germany experienced a CAGR of about 4.8% during 2020–2024, which strengthened to nearly 6.3% between 2025 and 2035. Initial years saw cautious growth tied to regulatory tightening and a preference for sedans in urban areas. The momentum shifted post-2025 as German consumers displayed stronger interest in premium crossover trims with electrified drivetrains. Domestic brands introduced advanced connectivity packages and semi-autonomous driving features, making crossovers highly attractive among professionals and families. Fleet operators in leasing markets increased crossover procurement, driven by tax incentives for low-emission variants. Dealer inventory digitization reduced procurement cycles and expanded omni-channel engagement strategies, lifting purchase intent.

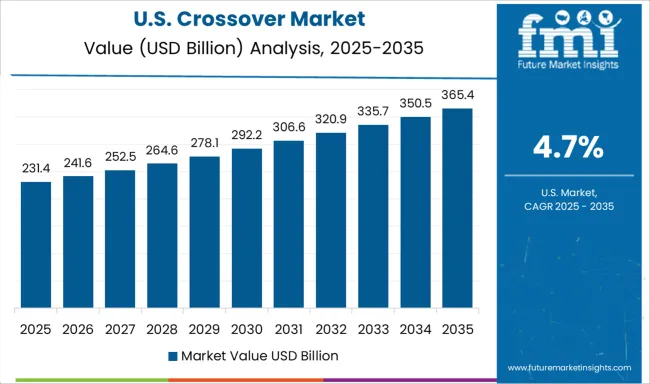

The United States market registered a CAGR of 3.8% from 2020–2024 and advanced to around 4.7% for 2025–2035. The earlier period reflected sluggish momentum caused by elevated financing costs and delayed inventory availability during chip shortages. After 2025, rising demand for tech-integrated trims and performance-driven models supported steady gains. Automakers expanded direct-to-consumer delivery options and emphasized loyalty programs tied to bundled maintenance packages. Pickup-inspired crossover models catered to lifestyle buyers, while EV variants brought incremental growth under state incentive programs. Shared mobility operators adopted crossovers in fleet operations, adding volume stability in corporate leasing channels.

In the crossover segment, dominant automakers are focusing on expanding product portfolios, introducing electrified powertrains, and leveraging modular platforms to meet evolving consumer preferences. Companies such as Toyota, BMW, and Ford are prioritizing hybrid and EV-based crossovers to strengthen their foothold in urban and suburban markets. General Motors and Honda are investing in digital retail strategies and flexible ownership models, creating seamless buying experiences through online platforms and subscription services. Manufacturers like Hyundai, Mercedes-Benz, and Mitsubishi are improving premium interiors, safety features, and connected technologies to capture demand in both mature and emerging economies. Nissan, Stellantis N.V., and Volkswagen are concentrating on cost competitiveness while scaling production in multiple regions through strategic alliances and localization initiatives. These companies are driving innovation in design, performance, and affordability, shaping global crossover adoption trends.

In December 2024, Ford launches the Ford Puma Gen-E electric crossover in Europe, with a 376 km range and 0–100 km/h in 8 s; deliveries are set for spring 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 629.4 Billion |

| Vehicle | Mid-size, Compact, and Full-size |

| Fuel | Gasoline, Diesel, Hybrid, and Electric |

| Drive | Front-wheel drive, Rear-wheel drive, and All-wheel drive |

| Application | Personal and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota, BMW, Ford, General Motors, Honda, Hyundai, Mercedes-Benz, Mitsubishi, Nissan, Stellantis N.V., and Volkswagen |

| Additional Attributes | Dollar sales, share by region, consumer preferences for hybrid and EV trims, pricing benchmarks, competitive positioning, production forecasts, supply chain risks, and emerging trends shaping future demand. |

The global crossover market is estimated to be valued at USD 629.4 billion in 2025.

The market size for the crossover market is projected to reach USD 1,075.1 billion by 2035.

The crossover market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in crossover market are mid-size, compact and full-size.

In terms of fuel, gasoline segment to command 44.1% share in the crossover market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA