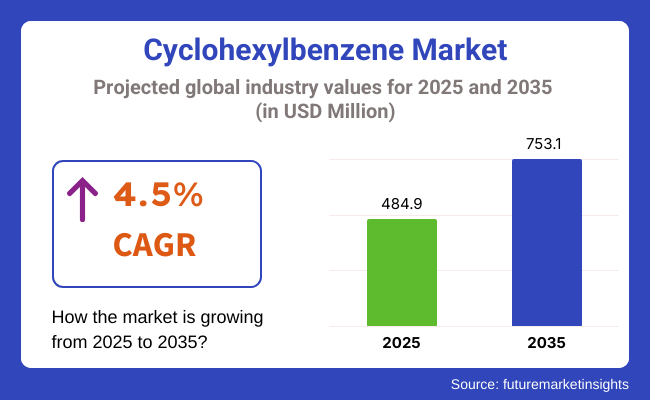

The global cyclohexylbenzene market is estimated at USD 484.9 million in 2025. By 2035, the market is anticipated to reach USD 753.1 million, growing at a CAGR of 4.5% from 2025 to 2035. This upward trajectory is supported by increasing demand in high-performance applications, especially in electronics and polymer industries.

Cyclohexylbenzene is being used as a key intermediate in synthesizing phenol and cyclohexanol. These compounds are essential in producing polycarbonate resins and nylon precursor caprolactam. In 2024, Showa Denko Materials Co., Ltd. confirmed the compound’s application in LCD materials due to its thermal and oxidative stability. According to Akihiro Arai, Senior Technical Officer at the company, “Cyclohexylbenzene enables enhanced performance under elevated temperature conditions in integrated electronic assemblies.” This has been outlined in the company’s February 2024 product bulletin shared during the Tokyo Functional Materials Expo.

Expanded use in resins and adhesives has further intensified market penetration. The compound’s low volatility and strong solvency have been highlighted by Kureha Corporation in its March 2025 technical circular. The update noted that “dielectric-grade cyclohexylbenzene derivatives are under evaluation for insulation polymers used in miniaturized grid systems.” This focus aligns with the transition to energy-efficient materials in smart electronics manufacturing.

Pharmaceutical-grade applications have also emerged as a secondary growth axis. In late 2024, Nippon Shokubai’s formulation R&D team disclosed that cyclohexylbenzene-based compounds were being tested for hydrophobic drug encapsulation. In the company’s internal R&D update, it was stated that “derivatives are demonstrating formulation compatibility with targeted-release drug systems,” enhancing drug delivery design.

Regionally, the Asia Pacific market has shown significant demand surge for cyclohexylbenzene due to the concentration of chemical infrastructure. In its 2025 investor report, Asahi Kasei outlined expansion plans for Jiangsu province, China. The project aims to support increased demand for high-purity cyclohexylbenzene needed for polymer exports across Southeast Asia.

Environmental challenges remain, particularly concerning aromatic hydrocarbon regulation. In response, Tosoh Corporation initiated emission-reduction pilot programs in early 2025. The company’s green chemistry whitepaper released in April 2025 reported deployment of closed-loop solvent recovery and catalytic hydrogenation systems in trial stages. These efforts were introduced to reduce VOC emissions while retaining compound integrity during production.

With structural demand supported by electronics, pharmaceuticals, and polymers, cyclohexylbenzene consumption is expected to expand steadily through 2035. Continued investment in regional capacity and sustainability solutions is being prioritized by key producers to maintain competitiveness and regulatory compliance.

The global cyclohexylbenzene market is anticipated to witness an upsurge in demand due to its unique properties that make it suitable for a variety of applications, particularly in the manufacturing of plastics, coatings, and adhesives. Cyclohexylbenzene is commonly used as a solvent, precursor and stabilizer in the synthesis of polymers, incorporation into resin formulations and for use within industrial coatings.

Manufacturers are targeting quality-driven production processes, compliance with regulatory requirements and eco-friendly alternatives in response to the increasing demand for specialty chemicals, high-purity solvents, and advanced material formulations. The market is divided by Product Type (Standard, High Purity) and by Application (Plastics, Paints & Coatings, and Adhesives).

The high purity cyclohexylbenzene segment dominates the cyclohexylbenzene market, with industries requiring high-consistency chemical compounds for specialty applications, polymer formulated contents and electronic-grade materials.

High purity variants are extensively used as raw materials in pharmaceutical synthesis, high-performance plastics, and semiconductor materials, where stringent quality control, low levels of impurities, and homogeneous composition are paramount.

In addition, high-purity cyclohexylbenzene is gaining ground in high-tech industries and specialized coatings applications with the growing demand for advanced polymers, electronic chemicals and pharmaceutical intermediates. This increases the demand in this segment as biocompatible materials, ultra-pure solvents, and high-performance polymer has expanded.

The typical cyclohexylbenzene moiety continues to be a key component of the market, notably in the general industrial sector, as well as for bulk resin development and coatings formulations. General-purpose cyclohexylbenzene is commonly employed as an economical solvent and intermediate in adhesives, synthetic lubricants, and non-high-performance polymer resins, making it appropriate for bulk production and more relaxed performance specifications.

Plastics segment represents the largest share of the cyclohexylbenzene market, as the compound acts as a key chemical intermediate for polymer manufacturing, resin formulations, and engineering plastics production. In polycarbonates, epoxy resins, and thermosetting polymers, cyclohexylbenzene improves mechanical properties, thermal stability, and impact resistance.

As high-performance plastics are used increasingly in automotive, electronics, and industrial segments, the need for cyclohexylbenzene as a polymer precursor is projected to increase. This segment is additionally stimulated by the introduction of lightweight materials, bio-based polymer substitutes, and high-strength thermoplastics.

The paints & coatings segment is increasingly witnessing a strong market adoption due to its extensive use of cyclohexylbenzene as a solvent, stabilizer, and viscosity thickening agent in industrial coatings, specialty paints, and corrosion-resistant formulations. Cyclohexylbenzene has applications in coatings and paints, laminates and adhesives, and electronics and sealants.

Manufacturers are emphasizing sustainable solvent replacements and high-purity derivatives to meet tough environmental legislation, as industries move toward low-VOC and eco-friendly coatings.

North America accounts for a large share in the cyclohexylbenzene market, supported by a developed chemical industry and rising usage of high-performance materials in varied applications owing to its heat and chemical resistance properties along with a cyclical demand in automotive and electronic sectors.

The USA, in particular, has experienced steady growth as a result of advances in specialty resin production as well as the development of lightweight durable components for industrial applications.

Europe, with a strong chemical manufacturing base, increasing interest in sustainable materials and a track record of top quality industrial processes. Germany, France and the United Kingdom are among the major consumers of cyclohexylbenzene for manufacturing specialization resins, coatings and advanced polymers. Europe's emphasis on innovation and demanding quality standards also bolsters market growth.

On the basis of region, the Asia-Pacific market is projected to witness the fastest growth for cyclohexylbenzene due to the rapid industrialization, growing manufacturing activities, and increased demand from automotive and electronics sectors in this region.

With the strong chemical production backbone of these countries, their growing focuses on advanced material development makes the low-friction materials market likely to be dominated by countries like China, Japan, and South Korea. Cyclohexylbenzene demand in this region is driven by the increasing middle-class population and investments in high-performance products.

Challenges

High Production Costs, Regulatory Restrictions, and Competition from Alternative Solvents

There are challenges in terms of high production costs due to the use of petroleum-based feedstocks and complex synthesis processes in the cyclohexylbenzene market. Cyclohexylbenzene is a widely adopted intermediate for the synthesis of advanced chemicals such as phenol, epoxy resins, and specialty polymers, but its reliance on crude oil derivatives makes it susceptible to pricing commoditization.

Moreover, varying regulations related to volatile organic compounds (VOCs), as well as environmental impact assessments, elevate the level of compliance required from the EPA, REACH (in the EU), and OSHA. Competing with alternative solvents and chemical intermediates like tert-butylbenzene and linear alkyl benzenes presents additional obstacles, as they often provide superior performance and are less expensive.

Opportunities

Growth in Specialty Chemicals, Electronic Applications, and Sustainable Alternatives

Despite these challenges the cyclohexylbenzene market remains on the growth path, with rising demand for specialty chemical manufacturing, high-performance lubricants, and electronic applications driving growth. One important domain of cyclohexylbenzene is as a precursor to high-purity phenol production, a crucial component for epoxy resins, adhesives and high-strength coatings.

In particular, its expanding use as a heat transfer fluid in next-generation electronics and semiconductor manufacturing is growing as the world scales to 5G and AI-based computing systems. Bio-based cyclohexylbenzene synthesis and green chemical processes are also paving the way for sustainable alternatives, providing the industry with potential non-fossil fuel-based sources.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with REACH, EPA, and industrial safety regulations. |

| Consumer Trends | Growing demand for high-performance solvents, specialty chemicals, and polymer precursors. |

| Industry Adoption | Use in epoxy resins, adhesives, and lubricant additives. |

| Supply Chain and Sourcing | Dependence on petroleum-based raw materials and refinery byproducts. |

| Market Competition | Dominated by petrochemical firms, industrial chemical manufacturers, and solvent producers. |

| Market Growth Drivers | Growth fueled by high-performance polymer production, lubricant advancements, and electronics expansion. |

| Sustainability and Environmental Impact | Moderate adoption of waste-reduction initiatives and cleaner production methods. |

| Integration of Smart Technologies | Early adoption of automated production monitoring and AI-driven chemical synthesis optimization. |

| Advancements in Chemical Engineering | Development of high-purity cyclohexylbenzene for advanced coatings and electronics. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter VOC emission controls, circular economy initiatives, and low-carbon production mandates. |

| Consumer Trends | Expansion into biodegradable chemical applications, bio-based intermediates, and advanced electronic coatings. |

| Industry Adoption | Widespread adoption in AI-driven semiconductor cooling solutions, smart coatings, and nanotechnology applications. |

| Supply Chain and Sourcing | Shift toward bio-based chemical synthesis, green chemistry techniques, and low-carbon chemical processing. |

| Market Competition | Entry of sustainable chemical innovators, AI-driven material science firms, and green polymer developers. |

| Market Growth Drivers | Accelerated by sustainable chemistry innovations, AI-powered material formulations, and carbon-neutral solvents. |

| Sustainability and Environmental Impact | Large-scale shift toward renewable feedstocks, carbon capture integration, and green solvent technologies. |

| Integration of Smart Technologies | Expansion into real-time VOC emission monitoring, blockchain-based supply chain transparency, and predictive quality control systems. |

| Advancements in Chemical Engineering | Evolution toward next-gen bio-based cyclohexylbenzene, AI-optimized molecular engineering, and sustainable resin formulations. |

USA cyclohexylbenzene market growing at steady pace on account of growing usage of cyclohexylbenzene as an intermediate in the synthesis of specialty chemicals, resins, and high-performance lubricants. Moreover, the increasing need for enhanced materials in electronics and automotive sectors is driving market growth. Furthermore, improving and developing effective synthesis methods and sustainable production is fueling R&D activities in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The UK cyclohexylbenzene market is growing as manufacturers emerge to fulfill the demand for high-purity intermediates used in coatings, adhesives, and polymer systems. Market growth can be attributed to an increase in the demand for specialty chemicals in the pharmaceuticals and electronics sectors. Moreover, product development and regulatory compliance are also driven by sustainable chemical manufacturing practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

The cyclohexylbenzene market is burgeoning across the European Union on account of its rising usage in high-performance plastics, specialty coatings and advanced manufacturing. The implementation of stricter environmental regulations is compelling companies to integrate more sustainable efforts into their production approaches, playing a significant role in market trends. Moreover, the increase in demand for industrial solvents and polymer modifiers is contributing to growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

In Japan, demand for cyclohexylbenzene is moderate and is backed by the relatively large chemical and electronics industries in the country. High demand is driven by growing consumption of cyclohexylbenzene in high-performance liquid crystal displays (LCDs), semiconductor coatings, and specialty lubricants. Also, progress in chemical processing and material innovation is aiding the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

South Korea cyclohexylbenzene market is poised to continue growth driven by increased usage in electronic, automotive and polymer sectors. Demand is coming from the country’s strong semiconductor manufacturing and specialty chemical production. Moreover, government measures focused on promoting sustainable and high-performance chemicals are also fuelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The cyclohexylbenzene market is developing on account of its expanding requests in compound blend, polymer creation, hardware, and modern applications. It is used as an important intermediate in organic modification, heat transfer fluids, and specialty coatings.

The emphasis of organizations is mainly on leveraging artificial intelligence technologies to improve production optimization (AI OP), manufacturing with high purity cyclohexylbenzene formulations, and advancing sustainable chemical processing to provide optimized performance, reduced production costs, and effective regulatory compliance.

Chemical manufacturers, specialty material suppliers, and industrial solvent providers form part of a market that has led to technological innovations like cyclohexylbenzene generation, AI-based quality approvals, and eco innovations in synthesis routes.

Market Share Analysis by Key Players & Cyclohexylbenzene Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Kumho Petrochemical Co., Ltd. | 18-22% |

| Lanxess AG | 12-16% |

| Eastman Chemical Company | 10-14% |

| Ascend Performance Materials | 8-12% |

| Tokyo Chemical Industry Co., Ltd. (TCI) | 5-9% |

| Other Specialty Chemical Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kumho Petrochemical Co., Ltd. | Develops high-purity cyclohexylbenzene for polymer synthesis, AI-optimized chemical refinement, and sustainable chemical production. |

| Lanxess AG | Specializes in cyclohexylbenzene-based specialty chemicals, AI-powered reaction process control, and industrial solvent solutions. |

| Eastman Chemical Company | Provides customized cyclohexylbenzene formulations, AI-assisted material performance enhancements, and high-temperature-resistant derivatives. |

| Ascend Performance Materials | Focuses on cyclohexylbenzene applications in polymer chemistry, AI-driven purity control, and specialty monomer synthesis. |

| Tokyo Chemical Industry Co., Ltd. (TCI) | Offers high-purity cyclohexylbenzene for research applications, AI-powered process efficiency, and lab-scale organic synthesis. |

Key Market Insights

Kumho Petrochemical Co., Ltd. (18-22%)

Kumho industries lead the cyclohexylbenzene market through its high performance chemical formulations, AI powered process efficiency, and industrial-grade purity solutions.

Lanxess AG (12-16%)

The production of cyclohexylbenzene-based specialty chemicals at Lanxess guarantees AI-powered reaction optimization, heat stability enhancements, and compliance with industrial standards.

Eastman Chemical Company (10-14%)

Eastman supplies cyclohexylbenzene derivatives for coatings, heat transfer fluids, and polymer applications while streamlining AI-driven molecular structure analysis and efficient production methods.

Ascend Performance Materials (8-12%)

Ascend revolves around cyclohexylbenzene encompasses polymerization of cyclohexylbenzene brought together and refined whilst using AI to purge monocyclic benzene, allowing for high performing applications.

Tokyo Chemical Industry Co., Ltd. (5-9%)

TCI is win now producing HPLC-grade cyclohexylbenzene featuring AI-rich reaction monitoring, making TCI cyclohexylbenzene batch-to-batch consistency testing and quality testing guaranteed.

Other Key Players (30-40% Combined)

Several specialty chemical manufacturers, polymer material developers, and industrial solvent producers contribute to next-generation cyclohexylbenzene innovations, AI-powered production advancements, and high-performance chemical processing. These include:

The overall market size for cyclohexylbenzene market was USD 484.9 Million in 2025.

Cyclohexylbenzene market is expected to reach USD 753.1 Million in 2035.

The demand for cyclohexylbenzene is expected to rise due to its increasing use as an intermediate in chemical synthesis, growing demand in electronics and semiconductor applications, and expanding usage in specialty chemicals and lubricants.

The top 5 countries which drives the development of cyclohexylbenzene market are USA, UK, Europe Union, Japan and South Korea.

High purity cyclohexylbenzene and plastics application to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

1,4-Dicyclohexylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA