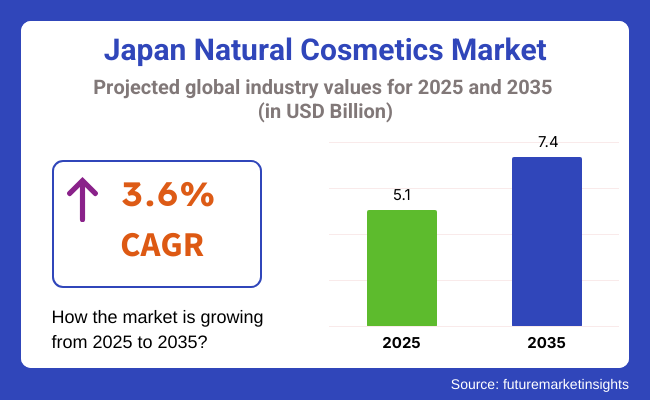

The Japan natural cosmetics market is poised to register a valuation of USD 5.1 billion in 2025. The industry is slated to grow at 3.6% CAGR from 2025 to 2035, witnessing USD 7.4 billion by 2035. The expansion of the market is being fueled by a mix of cultural affinity, demographic change, and growing concern about the environment.

Japanese consumers have traditionally prized purity, simplicity, and concordance with nature-attributes that are inherent in the concepts of natural and organic beauty products. This cultural predisposition towards simplicity and tradition renders natural cosmetics highly desirable, since they are perceived as being gentler on the skin and closer to traditional Japanese beauty practices, such as the application of plant ingredients such as green tea, rice bran, camellia oil, and seaweed.

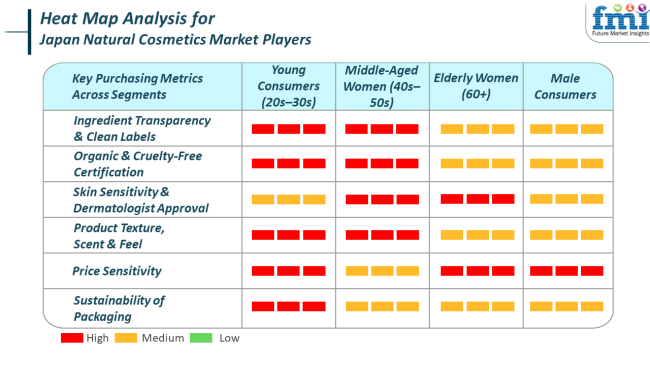

Demographics also have a great impact. Japan boasts one of the world's oldest populations, and with age comes increased interest in skincare and wellness. Older consumers are more health-oriented and care about what they apply to their skin, which creates demand for cleaner, chemical-free products.

Meanwhile, younger generations, led by global sustainability trends and social media, are increasingly focused on ethical consumption. They want transparency in ingredient sourcing, cruelty-free ingredients, and eco-friendly packaging-all of which are trademarks of the natural cosmetics category. Environmental issues are further driving the move. Consumers in Japan are increasingly becoming aware of the green factor of traditional cosmetics.

This leads to encouraging brand innovation with the use of earth-friendly options, like biodegradable packaging and refillable dispensers, further drawing in shoppers. Government initiatives at fostering sustainability as well as preventing harmful chemicals being used in products by consumers indirectly help drive demand for the natural segment.

Consumer trends and buying habits differ across end-use segments like skincare, haircare, body care, and makeup in Japan's natural cosmetics industry. Skincare is the leading category, fueled by a cultural focus on youthful, healthy skin and liking for delicate, plant-derived ingredients such as rice extract, yuzu, and camellia oil.

Simple routines and multi-functional products are particularly favored by middle-aged and elderly consumers for anti-aging and moisturizing effects. Hair care is also increasing steadily, driven by heightened awareness of scalp health and sensitivity to harsh chemicals. Consumers seek sulfate- and silicone-free products with holistic, herbal formulations and are highly driven by ingredient transparency and brand ethics.

Body care and makeup are also gaining ground, albeit with slightly different criteria. In body care, naturally scented and allergen-free products are popular, particularly those with refillable and eco-friendly packaging. Seasonal requirements also influence preferences, with richer textures in winter and lighter textures in summer.

Natural makeup, although slower to gain traction, is gaining popularity among younger consumers who seek breathable, skin-friendly formulas that provide consistent performance. Cross-segmentally, the most important drivers of purchasing involve ingredient safety, visible efficacy, sustainable packaging, and ethics alignment, mirroring a more global consumer move toward health-oriented and eco-friendly beauty selection.

Between 2020 and 2024, the natural cosmetics market in Japan experienced significant changes influenced by global health trends, shifting consumer values, and cutting-edge technology. The COVID-19 pandemic contributed significantly to the fast-tracking of wellness awareness and skin wellness, which led most consumers to review their daily habits and pivot towards safer, gentler, and natural products.

There was a shift away from strongly scented or chemically engineered cosmetics towards clean-label products with open ingredient panels. Throughout this time, Japanese consumers also became increasingly aware of sustainability, pushing demand for environmental packaging, reusable containers, and companies that proved ethical sourcing methods.

The sector saw an increase in online beauty consultations, e-commerce expansion, and social media impact on buying behavior, particularly among younger consumers. In the future, Japan's natural cosmetics market will continue to develop with trends revolving around personalization, biotechnology, and greater sustainability.

With growing AI and data integration in the beauty sector, the consumer is increasingly likely to desire highly personalized products according to individual skin profiles, lifestyles, and environmental conditions. Natural formulations will continue to dominate, but they will increasingly find their parallel development in biotech innovation like fermentation-based actives and lab-grown botanicals, promising both effectiveness and environmental friendliness.

Sustainability will become even more entrenched deeper than packaging, with greater emphasis on circular beauty models, zero-waste manufacturing, and carbon-neutral supply chains. The aging population will also continue to boost product innovation, with emphasis on anti-aging and wellness-focused beauty.

On the other hand, younger consumers will drive even more comprehensive, cruelty-free, and gender-neutral products so that natural cosmetics in Japan stay vibrant and adaptable to changing societal values throughout the decade ahead.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Forecasted) |

|---|---|

| After the global pandemic, Japanese consumers were extremely sensitive to skin health and product safety. This time experienced a boom in the demand for clean, natural cosmetics with non-toxic formulations. Consumers actively shunned synthetic additives and looked for ingredients that promoted skin immunity and overall well-being. | The coming decade will bring a fresh wave of customized skincare, backed by AI diagnostics, DNA testing, and digital skin profiling. Shoppers will head towards personalized products that target individual issues like pollution exposure, stress, hormonal fluctuations, and aging. |

| This period was a firm turn toward transparency in ingredient sourcing and labeling . Natural cosmetics that focused on traditional Japanese botanicals such as green tea, yuzu, rice ferment, and seaweed became popular. | Innovation will be the core, merging nature and cutting-edge science. The future will witness greater application of lab-grown plant cells, bio-fermented actives, and biomimetic ingredients that mimic the advantages of conventional botanicals with enhanced efficacy and environmental sustainability. |

| There was a visible increase in awareness about sustainability, with brands providing recyclable materials, refill pouches, and minimalist packaging. Though this was the start of eco-consumerism, the efforts were superficially focused on packaging rather than the entire life cycle of products. | From eco-packaging, companies will pursue circular production principles, employ upcycled ingredients, embrace carbon-neutral production, and adopt supply chain transparency. |

| Through this time, e-commerce emerged as a leading platform for beauty buys, further driven by pandemic-imposed restrictions. Brands made investments in virtual storefronts, virtual try- ons, and influencer marketing. | The future retail environment will be seamlessly integrated, with customers switching between brick-and-mortar stores, mobile apps, and intelligent devices without interruption. Augmented reality, artificial intelligence, and Internet of Things technologies will provide immersive experiences such as virtual skin scans, personalized product dispensers, and AI-driven skincare routines, driving both convenience and engagement. |

Although the Japanese natural cosmetics market is promising, it is not risk-free. Regulatory uncertainty is one of the major challenges. Japan lacks a uniform definition or certification process for "natural" or "organic" cosmetics, in contrast to markets like the EU.

In the long term, this can undermine consumer confidence and make it hard for truly natural brands to stand out. Moreover, tighter government controls or new labeling requirements-if imposed abruptly-may upset market balances and necessitate expensive reformulations or rebranding.

Another critical risk is supply chain exposure, especially in the area of natural and organic raw material sourcing. Several Japanese brands depend on particular plant-based ingredients that are either locally cultivated in small quantities or sourced from other regions.

Climatic disruptions, geopolitical stress, or worldwide disturbances (such as pandemics or trade wars) may influence ingredient supply and prices. This not only threatens production continuity but also sustainable product quality and ethical sourcing assertions, which are at the heart of consumer trust in this niche.

Natural skincare for dry and sensitive skin is the most popular and in-demand kind of natural cosmetic in Japan. This emphasis has strong links to environmental conditions as well as cultural beauty standards. Japan has distinct seasonal changes, with cold and dry winters and humid summers, that may result in variable skin conditions.

Most consumers, particularly women over the age of 30, undergo dryness, irritation, and increased sensitivity during these phases, which boost demand for products that calm, hydrate, and shield the skin without using aggressive chemicals.

Natural skincare products addressing dry and sensitive skin are usually made with long-standing Japanese ingredients such as rice ferment filtrate (sake lees), camellia oil, and yuzu extract, which are recognized for their moisturizing, nourishing, and antioxidant capabilities.

These ingredients are not only perceived as being effective but also as belonging to a culturally recognized and trusted heritage. Japanese consumers like light but intensely hydrating formulas that are easily absorbed and feel soft on the skin-particularly those without parabens, artificial fragrance, and alcohol, which are known to cause dryness and irritation.

Bottles and jars are the most common and accepted form of packaging for natural cosmetics, particularly in the skincare category, in Japan. This type of packaging suits the cultural value placed on product purity, presentation, and the heritage beauty ritual experience.

Japanese consumers appreciate the sensory and visual qualities of cosmetics and bottles and simple glass jars tend to represent purity, luxury, and credibility. For natural cosmetics, these containers also support the impression of product safety, cleanliness, and ingredient purity, particularly relevant to sensitive skin or luxury organic products.

Jars and bottles are especially favored for cleansing oils, creams, lotions, and balms, which need airtight or UV-resistant packaging in order to keep the natural ingredients fresh. Glass and premium recyclable plastics are widely used by many Japanese brands, as the growing consumer trend for eco-friendly packaging is also seen. Refillable jars are increasingly popular as well, with a sustainable option that aligns with Japan's overall efforts at waste reduction and the zero-waste beauty trend.

The Japanese natural cosmetics market is influenced by customer demand for transparency of ingredients, skin-friendly composition, and eco-friendliness, which corresponds to cultural principles of purity, health, and harmony with nature.

Local brands such as Fancl Corporation and Shiseido dominate with cutting-edge, preservative-free formulations and extensively studied botanicals that resonate with skin-sensitive and aging consumers. Global players such as LVMH and MAC Cosmetics capitalize on high-end branding and clean-beauty innovation to reach urban, trend-driven consumers, with German producer Laverana GmbH & Co. KG establishing a niche for organic-certified products through rigorous EU-grade formulations.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Fancl Corporation | 12-14% |

| Shiseido | 10-12% |

| Kanebo | 8-10% |

| Kose Corporation | 7-9% |

| Kao Corporation | 6-8% |

| LVMH | 4-6% |

| MAC Cosmetics | 3-5% |

| Mary Kay Cosmetics | 2-4% |

| Johnson & Johnson | 2-3% |

| Laverana GmbH & Co. KG | 1-2% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fancl Corporation | A first mover in preservative-free cosmetics in Japan, Fancl is dedicated to natural skincare for sensitive and mature skin. It champions clean beauty with scientific support, fragrance-free, and eco-friendly refill packaging. |

| Shiseido | A technological innovator at the forefront that merges tradition and state-of-the-art R&D. Its natural beauty ranges utilize Japanese botanicals such as ume and shiso leaf. Shiseido has introduced clean, sustainable lines aimed at young consumers under its "WASO" and "BAUM" sub-brands. |

| Kanebo | Provides simple and refined skincare based on Japanese nature, with a focus on hydration and texture improvement. Its "free-from" brands serve the clean-beauty trend, especially targeting older female consumers. |

| Kose Corporation | With its extensive use of rice-based actives and herbal extracts, Kose's "Nature & Co." and " Predia " brands resonate with natural skincare consumers. The firm is also moving forward in refill systems and environmentally friendly packaging. |

| Kao Corporation | Blends dermatological know-how with botanical formulations. Kao's brands are centered around hypoallergenic, pH-balanced family-friendly skincare, with best-sellers like " Curél " centered on repairing sensitive skin barriers. |

| LVMH | Through its Fresh and Guerlain brands, LVMH exploits high-end honey and botanical-based skincare with green sourcing and luxury positioning. Firm retail presence in Japan's city centers underpins its premium approach. |

| MAC Cosmetics | Though best recognized for cosmetics, MAC is more and more using natural ingredients and cruelty-free promises in its skincare primers and foundation products to address Japan's increasing need for clean color cosmetics. |

| Mary Kay Cosmetics | Sells nature-based skincare and makeup with an emphasis on the use of gentle ingredients. The firm establishes itself on a person-to-person basis through individualized selling and offering clean, plant-dense choices for sensitive and acne skin. |

| Johnson & Johnson | Sells dermatologist-prescribed natural skin care under sub-brands such as Aveeno, which feature oat, chamomile, and no-fragrance ranges, favored by Japanese consumers suffering from eczema or sensitive skin. |

| Laverana GmbH & Co. KG | German manufacturer of Lavera brand, famous for certified organic products and rigorous EU compliance. It targets environmentally conscious Japanese consumers looking for certified vegan and cruelty-free skin care with no synthetic ingredients. |

The future of Japan's natural cosmetics market is fueled by increasing health awareness, an aging population, and increasing demand for transparency and sustainability. Local players such as Fancl and Shiseido are likely to continue to lead through innovation in clean science and strong ties to Japanese heritage ingredients. Global entrants such as LVMH, Laverana, and Johnson & Johnson will build further on their presence by launching products coupling effectiveness with eco-responsibility.

Social media channels and sustainable branding-especially in the case of the younger, urban consumer-will surge competitive initiatives, with refill programs and zero-waste formats potentially becoming market standards. Firms that adopt holistic sustainability, provide evidence-supported clean formulas, and connect consumers through digital narrative will have the best competitive edge in the next decade.

In terms of product type, the market is classified into skin and sun care, hair care, bath & shower, men’s grooming (only shaving), color cosmetic, fragrances & deodorants, and oral care.

With respect to consumer orientation, the industry is divided into male, female, unisex, and baby & kids.

Based on packaging, the industry is classified into bottles & jars, tubes, pouches & sachets, and pencils & sticks.

With respect to sales channel, the industry is divided into supermarkets/hypermarkets, department stores, specialty stores, online sales channels, mono brand stores, and other sales channels.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 14: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 16: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 22: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 24: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 30: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 32: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 46: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 48: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 54: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 56: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 58: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 40: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 44: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 64: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 68: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 88: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 92: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 136: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 140: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 156: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 160: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 164: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 168: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

The industry is expected to reach USD 5.1 billion in 2025.

The industry is projected to witness USD 7.4 billion by 2035.

The industry is projected to witness 3.6% CAGR during the study period.

Natural skincare products are widely sold.

Leading companies include Fancl Corporation, Shiseido, Kanebo, Kose Corporation, LVMH, MAC Cosmetics, Mary Kay Cosmetics, Johnson & Johnson, Kao Corporation, and Laverana GmbH & Co. KG.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA