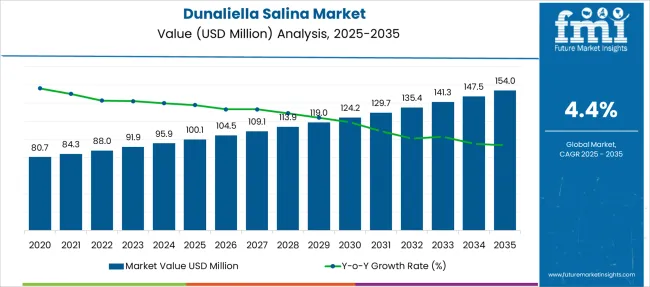

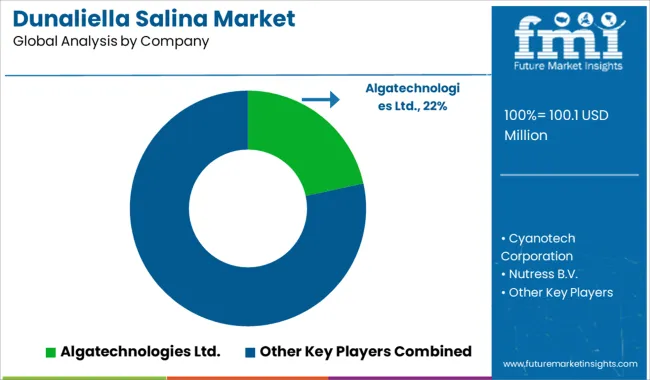

The Dunaliella Salina Market is estimated to be valued at USD 100.1 million in 2025 and is projected to reach USD 154.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Dunaliella Salina Market Estimated Value in (2025 E) | USD 100.1 million |

| Dunaliella Salina Market Forecast Value in (2035 F) | USD 154.0 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The dunaliella salina market is gaining traction globally due to its natural antioxidant properties, high beta-carotene content, and increasing demand across health-focused industries. As consumers become more conscious of clean-label and nutrient-rich ingredients, Dunaliella salina is emerging as a preferred algae source for natural coloring, dietary supplements, and skin-care formulations.

The ingredient’s adaptability in both food-grade and cosmetic applications, coupled with the growing shift toward plant-based products, is reinforcing market interest. Its cultivation in extreme saline environments allows for sustainable production, aligning with the industry’s push toward environmentally friendly sourcing.

Market growth is expected to be supported by advancements in algae harvesting technologies, increased research on bioactive compounds, and the expansion of product lines in nutraceuticals and fortified foods. Regulatory support for natural additives and continued innovation in algae-based ingredients are likely to play a pivotal role in driving long-term demand.

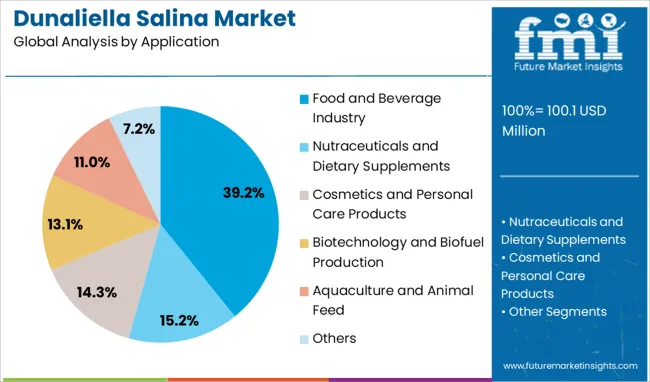

The dunaliella salina market is segmented by application and geographic regions. By application of the dunaliella salina market is divided into Food and Beverage Industry, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care Products, Biotechnology and Biofuel Production, Aquaculture and Animal Feed, and Others. Regionally, the dunaliella salina industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food and beverage industry holds a dominant 39.2% share of the Dunaliella salina market, driven by the rising demand for natural and nutrient-dense additives that support health-conscious lifestyles. The segment’s growth is underpinned by the ingredient’s high beta-carotene content, which serves as a powerful antioxidant and natural colorant in various food and drink formulations.

Food manufacturers are increasingly adopting Dunaliella salina to replace synthetic additives, particularly in organic and clean-label products targeting wellness-oriented consumers. Functional beverages, dietary supplements, and fortified snacks are among the key product categories incorporating this algae, reflecting broader trends toward preventive health and plant-based nutrition.

Additionally, the versatility of Dunaliella salina in powder, capsule, and extract forms allows for seamless integration into different formats. This segment is expected to expand further as the industry responds to growing consumer preference for sustainable, bioavailable, and natural functional ingredients.

Demand for dunaliella salina is gaining traction through applications in nutraceuticals, premium cosmetics, and natural food colorants, supported by controlled cultivation. Its beta-carotene richness positions it as a critical ingredient for health, beauty, and clean-label food solutions.

The dunaliella salina segment is gaining momentum due to its concentration of natural beta-carotene, widely utilized in nutraceuticals for eye health, immune function, and antioxidant benefits. Consumers increasingly prefer natural carotenoid sources over synthetic alternatives, creating consistent demand for algae-derived ingredients. Functional food and beverage manufacturers have incorporated this ingredient to strengthen their natural fortification claims. Its ability to provide high nutritional density in minimal dosage formats enhances its relevance for capsule-based supplements and powdered blends. This growing application in preventive healthcare and wellness nutrition has positioned Dunaliella salina as a critical raw material in the nutraceutical supply chain, influencing strategic sourcing and long-term formulation planning across global health-focused markets.

Cosmetic and personal care brands are leveraging Dunaliella salina extract for its anti-aging, skin-brightening, and UV-protective properties. It's rich beta-carotene and antioxidant profile appeals to consumers seeking natural bioactive ingredients in high-performance skincare solutions. Manufacturers highlight its efficacy in combating oxidative stress, improving skin hydration, and enhancing elasticity in topical formulations. Premium brands are introducing serums, creams, and sun-care products enriched with algae extracts to differentiate in a crowded clean-beauty market. This integration into luxury and professional skincare portfolios underlines its versatility and perceived value, driving significant adoption among manufacturers targeting both dermatological and cosmeceutical segments.

Controlled cultivation methods for dunaliella salina have become a central focus for improving yield, quality consistency, and cost efficiency. High-salinity ponds and photobioreactor systems are preferred to minimize contamination risk and optimize carotenoid content. Producers are adopting hybrid setups to achieve scalability and maintain pigment integrity throughout the extraction process. These advancements enable stable year-round production, addressing one of the key supply challenges associated with traditional open-pond systems. Market observers consider this dynamic crucial for future price stability and competitive positioning, as consistent raw material availability ensures smoother integration into large-scale nutraceutical and cosmetic manufacturing pipelines across global markets.

The food industry’s shift toward natural pigments has intensified demand for Dunaliella salina as a beta-carotene-rich alternative to synthetic colorants. Food processors incorporate their extract to enhance color stability and nutritional value in bakery items, dairy-based products, and beverages. This trend has been supported by consumer preference for additive-free formulations and regulatory guidelines favoring natural ingredients. The adoption of microalgae-derived colorants in high-visibility product categories offers a strategic advantage for brands seeking cleaner labels and differentiated value propositions.

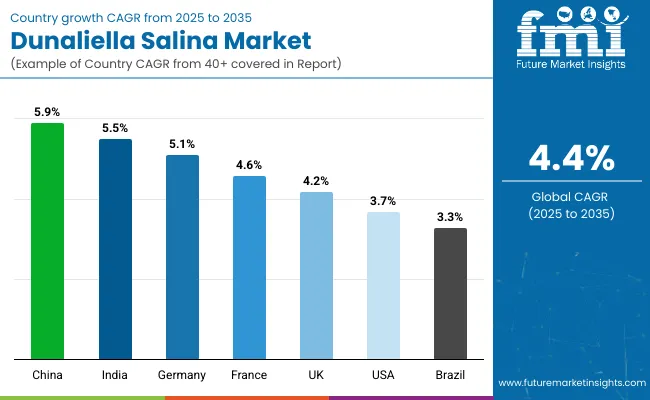

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

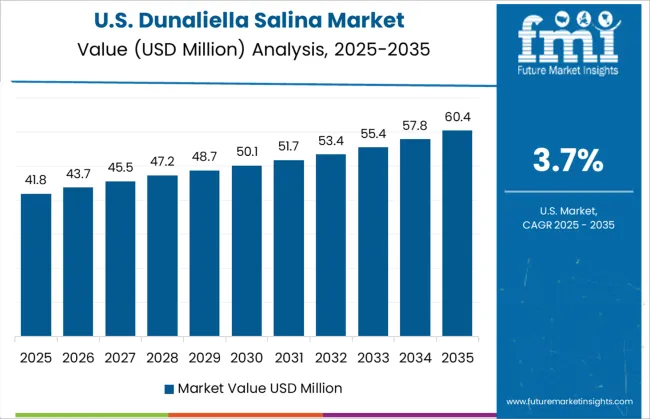

| USA | 3.7% |

| Brazil | 3.3% |

The dunaliella salina market, expected to grow at a global CAGR of 4.4%, is experiencing varying growth across key countries. China leads with a 5.9% CAGR, driven by its large-scale production capabilities and significant demand in the nutraceutical and cosmetics industries. India follows with a 5.5% CAGR, supported by increasing adoption of natural ingredients in health supplements and the growing awareness of its antioxidant properties. Germany also exhibits strong performance with a 5.1% CAGR, primarily due to high demand for natural products in the food and personal care sectors.

Slower growth rates are seen in the UK and the USA, with CAGRs of 4.2% and 3.7%, respectively, reflecting a stable but mature market. The UK's demand is driven by premium health products, while the USA shows moderate growth despite a large consumer base, impacted by shifts toward synthetic alternatives. This diverse growth reflects both market maturity and emerging opportunities in natural-based wellness products, particularly in developing countries like India and China. The report covers a detailed analysis of 40+ countries, with the top five countries highlighted above as a reference.

The CAGR in the United Kingdom shifted from nearly 3.8% during 2020–2024 to about 4.2% for the 2025–2035 horizon. This rise is attributed to increased acceptance of algae-derived beta-carotene in functional foods and cosmetics, alongside consistent demand in dietary supplements. Domestic manufacturers focused on high-purity extraction techniques to meet EU clean-label standards, while importers expanded sourcing networks for premium algae biomass. E-commerce channels widened product visibility, helping small and mid-sized nutraceutical firms market beta-carotene-based capsules and powders directly to health-conscious consumers. Regulatory approvals streamlined entry for innovative formulations, boosting confidence among retail distributors.

The CAGR in China improved from about 5.4% during 2020–2024 to approximately 5.9% for 2025–2035. This increase is supported by scaled industrial cultivation and inclusion of algae-based antioxidants in preventive healthcare strategies. Government-driven food safety certifications simplified adoption of natural carotenoids in packaged foods and beverages. Nutraceutical brands partnered with large e-commerce ecosystems for wide-reaching distribution. Cosmetic players used Dunaliella salina extracts in skin-enhancing serums targeting oxidative stress reduction. Provincial health initiatives enhanced beta-carotene’s role in dietary plans, creating predictable demand across wellness channels.

India’s CAGR progressed from nearly 4.8% in 2020–2024 to 5.5% for 2025–2035 due to significant adoption in nutraceuticals, functional beverages, and cosmetic formulations. Ayurveda-compatible algae blends gained traction across herbal supplement categories. Domestic companies advanced cultivation technology using closed-pond systems, reducing contamination risks and ensuring consistent beta-carotene yields. Nutraceutical giants collaborated with retail chains to penetrate semi-urban segments, making algae-based supplements more accessible. Export opportunities also surged as Indian suppliers achieved compliance with European and Middle Eastern quality standards.

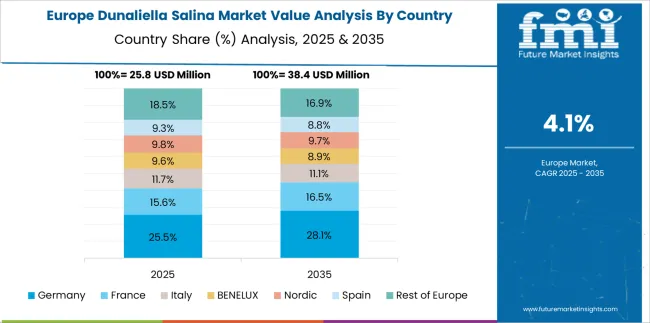

Germany’s CAGR improved from 4.6% in 2020–2024 to 5.1% in the 2025–2035 timeframe. The increase stems from strong regulatory approval for algae-based colorants and antioxidants in dietary and functional food products. High adoption in vegan cosmetics and fortified beverages further accelerated demand. German retailers prioritized traceable sourcing and clean-label carotenoids for premium health products. Strategic collaborations between algae producers and cosmetic brands resulted in innovative anti-aging creams and antioxidant serums. Growth in e-commerce platforms amplified access for personalized wellness products containing algae-derived beta-carotene.

The CAGR in the USA rose from nearly 3.3% during 2020–2024 to 3.7% in 2025–2035. Increased preference for natural beta-carotene in plant-based supplements and functional beverages supported this growth. Regulatory clarity from FDA on algae-based nutraceutical ingredients eased adoption by wellness brands. Direct-to-consumer channels expanded, with supplement subscription models gaining traction among health-conscious demographics. Premium skincare manufacturers began using Dunaliella extracts in antioxidant formulations targeting oxidative stress reduction. Local algae cultivation received investment to reduce dependence on imported raw material, ensuring stable supply for domestic nutraceutical brands.

In the dunaliella salina market, key players are actively developing high-quality beta-carotene extracts and nutrient-rich algae derivatives to cater to nutraceutical, cosmetic, and functional food applications. Algatechnologies Ltd. is recognized for its premium algae-based carotenoids, serving dietary supplement brands seeking natural antioxidant solutions. Cyanotech Corporation emphasizes sustainable cultivation and robust processing techniques for microalgae ingredients, ensuring high purity for wellness formulations. Nutress B.V. focuses on European supply chains for algae-based functional food ingredients, delivering clean-label formulations to meet rising consumer preferences for natural sources of beta-carotene.

Plankton Australia Pty Ltd. has carved its niche in high-value marine bioactives, ensuring traceable sourcing for algae-derived ingredients. Shanghai Haoyue Group Co., Ltd. specializes in scalable production for Asian markets, supporting demand from food, feed, and cosmetic manufacturers. EID Parry (India) Ltd. and its subsidiary Parry Nutraceuticals have established a strong presence by offering algae-based bioactives integrated into functional nutrition and wellness solutions.

New Shores Holdings Limited is diversifying its algae portfolio through strategic investments in carotenoid-rich products for global nutraceutical clients. Aquapharm Biodiscovery focuses on extracting bioactives for pharmaceutical-grade applications, capitalizing on Dunaliella’s antioxidant and anti-inflammatory properties.

Borregaard LignoTech adds value through research-driven approaches targeting algae-based biomaterials, enhancing formulation flexibility across health and cosmetic sectors. Collectively, these companies emphasize scalable cultivation, advanced extraction techniques, and regulatory-compliant processing to address the rising demand for natural beta-carotene and related bioactive compounds worldwide.

Key strategies and drivers for 2024 and 2025 in the Dunaliella Salina market include expansion of algae cultivation capacity using photobioreactors, partnerships with nutraceutical and cosmetic brands for beta-carotene-based formulations, and diversification into functional beverages and fortified foods. Regulatory clarity in major markets accelerated clean-label carotenoid adoption. Manufacturers emphasized advanced drying and extraction technologies for higher purity and shelf stability. Rising e-commerce penetration and subscription-based supplement models boosted direct-to-consumer sales. Investments in R&D for antioxidant-rich algae strains and strategic global distribution agreements positioned players for sustained growth across nutraceutical, skincare, and functional wellness segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 100.1 Million |

| Application | Food and Beverage Industry, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care Products, Biotechnology and Biofuel Production, Aquaculture and Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Algatechnologies Ltd., Cyanotech Corporation, Nutress B.V., Plankton Australia Pty Ltd., Shanghai Haoyue Group Co., Ltd., EID Parry (India) Ltd., New Shores Holdings Limited, Aquapharm Biodiscovery, Parry Nutraceuticals, and Borregaard LignoTech |

| Additional Attributes | Dollar sales, share, growth rate by region, competitive landscape, pricing trends, demand drivers in nutraceuticals and cosmetics, production cost analysis, regulatory compliance, supply chain insights, and future opportunity mapping. |

The global dunaliella salina market is estimated to be valued at USD 100.1 million in 2025.

The market size for the dunaliella salina market is projected to reach USD 154.0 million by 2035.

The dunaliella salina market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in dunaliella salina market are food and beverage industry, nutraceuticals and dietary supplements, cosmetics and personal care products, biotechnology and biofuel production, aquaculture and animal feed and others.

In terms of , segment to command 0.0% share in the dunaliella salina market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA