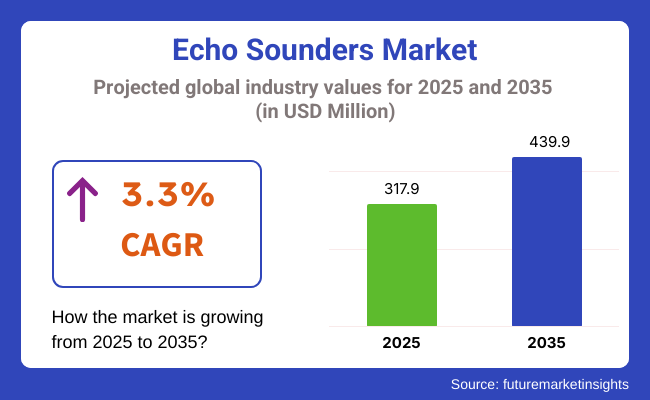

The echo sounders market is expected to expand steadily, with a size of USD 317.9 million in 2025, anticipated to reach around USD 439.9 million by 2035, growing at a CAGR of around 3.3%. This expansion is spurred by increasing demand in marine research, navigation, and underwater surveying.

One of the key drivers of the industry is the increased demand for oceanographic and hydrographic data to underpin global maritime industries. With nations investing in port development, offshore wind farms, submarine pipelines, and dredging schemes, the demand for reliable seabed characterization and depth measurement has never been higher.

The growth in aquaculture and fisheries also underpins the industry. Industrial fishing boats utilize this system to locate fish schools, estimate biomass, and optimize harvesting efficiency. The devices increase yield and sustainable fishing by enabling them to make better data-informed decisions.

Innovations in technology are improving system performance and function. Multi-beam, dual-frequency systems and integration with GPS and GIS platforms are enabling higher resolution and accuracy in mapping and data collection. Such technology is expanding the use of echo sounders from traditional depth sounding to 3D seabed imagery and habitat assessment.

Unmanned surface and underwater vehicles (USVs and AUVs) are also a driving force. Autonomous units, more frequently used in defense and marine science operations, rely heavily on high-accuracy, lightweight echo sounders to provide real-time bathymetry in remote or hazardous locations.

Regionally, North America and Europe dominate the industry due to their established marine infrastructure, research organizations, and defense purposes. Asia-Pacific will grow at a very high rate, driven by port modernization, fishery expansion, and marine exploration activities in China, Japan, and Southeast Asia.

Core equipment in aquatic and marine exploration. With the development of maritime industries and the increasing demand for ocean data, these instruments will remain essential in navigating, mapping, and safeguarding underwater ecosystems.

The industry is developing extremely rapidly, driven by the increasing demand for efficient maritime operations and the necessity of precise depth measurement and seafloor mapping. These devices play a crucial role in navigation and ensuring the safety of ships.

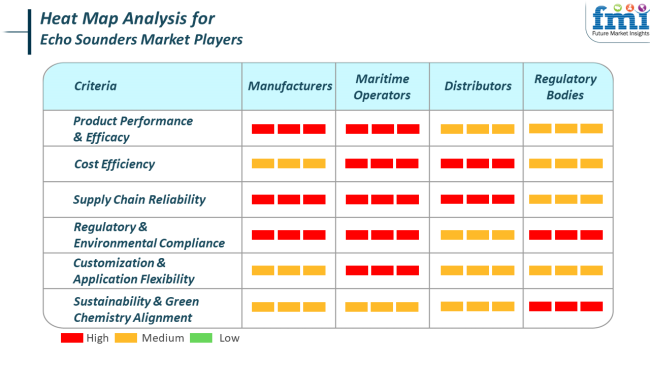

The industry relies heavily on technologies that enhance operational efficiency. Manufacturers concentrate on producing high-performing echo sounders that provide the high standard required by the seafaring business. They allocate resources to making eco-friendly methods of production while striving to build a stable chain of supply for meeting the developing world demand.

Distributors emphasize the importance of having a reliable supply chain to cater to the requirements of maritime operators. They thrive on delivering a broad portfolio of products suitable for various applications, while offering effective delivery and value for money.

Regulatory authorities ensure compliance with safety and environmental standards, promoting the use of sustainable and green echo sounder solutions. They have a critical role in influencing the industry by enacting regulations that promote the utilization of green technologies and minimize the environmental impact of maritime activities.

The industry is characterized by the cooperative nature among stakeholders, who work together to create and implement products that meet performance requirements, environmental standards, and adapt to industry changes.

From 2020 to 2024, the industry experienced gradual growth, with demand largely driven by the increasing need for accurate and real-time underwater data in applications such as marine research, fishing, and oil and gas exploration. The worldwide requirement for accuracy in navigation, seabed mapping, and fishery management resulted in the extensive use of sophisticated echo sounder systems.

Additionally, the expansion of offshore oil exploration and fishing into emerging industries contributed to the growing demand. At this time, there was also an observed trend towards more efficient and portable fishing vessels for smaller vessels and for recreational use. Yet, limitations such as the expense of sophisticated systems and competition from other sonar technologies held back the growth of the industry.

The industry stands on the threshold of seismic transformation with the emergence of digital technologies and artificial intelligence (AI). This system will become more advanced, featuring enhanced analytics and higher-resolution images for improved readings.

Technologies such as real-time monitoring, automated data processing, and increased data-sharing capabilities will drive growth in commercial, scientific, and recreational industries. In addition, green designs and the implementation of green technologies in marine equipment will become more prevalent, with regulations requiring energy-efficient and green-based solutions in the maritime sectors. Increased marine research, renewable energy investigation, and commercial fishing in newly opened areas will bring new industry opportunities.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for accurate navigation, sea mapping, and fishery management. Increased activity in offshore explorations. | Increased integration with artificial intelligence, real-time monitoring, and automatic data processing. Growth in the exploration of renewable energy and ocean studies. |

| Greater use of smaller, handheld echo sounders with more user friendliness. Use of high-resolution imagery and advanced sonar technology. | Greater integration with machine learning and artificial intelligence to analyze data, smarter sensors with improved results, and more energy-efficient solutions. |

| Greater initial cost of advanced equipment, alternative sonar technology competition. | Need for large-scale adoption of new-generation technologies, regulation mandating eco-friendly innovations, and fragmentation of industries. |

| Heavy expansion of commercial fishing, offshore exploration, and ocean research in developing economies. | Increasing adoption among developing countries, expansion of renewable energy sectors, and development of green maritime regulations. |

| Regulations mandating the implementation of advanced sonar systems for improved environmental and safety monitoring. | Stringent environmental regulation is needed to reduce carbon footprints in maritime activities and achieve higher sustainability. |

| Portable, lightweight systems with better accuracy and user-friendliness. Higher demand for multi-function systems. | Real-time monitoring, more data analysis, and prediction modeling integrated with AI for marine exploration and research. |

The industry, which enables use in hydrographic surveying, fishing, underwater exploration, and defense, is increasing steadily, but not without significant risks. Perhaps the most immediate challenge for 2024 is the high initial investment required for advanced systems, most notably multibeam and dual-frequency systems.

These systems, although very accurate, are capital beyond the reach of small marine operators and research centers with modest capital. Complexity in operation further creates this obstacle. This system requires experienced personnel for calibration, data collection, and interpretation, yet the pool of talent is limited.

Technological obsolescence looms as a waiting threat. With further advances in sonar and acoustic sensing technology, older platforms may become unserviced by new mapping, positioning, or data integration software. Companies that fail to invest in innovation or modular enhancement are at risk of declining competitiveness.

The coupling of echo sounders with digital networks, such as GNSS, GIS, and real-time navigation, also introduces associated risks of software faults and cyber threats, particularly in commercial and defense marine applications. Moreover, the industry cannot escape macroeconomic risks. Worldwide supply chain disruptions, triggered by geopolitical tensions or raw material shortages, could slow the supply of transducers, processors, and other essential components.

Although this system is an essential part of modern marine operations, the industry must contend with high procurement costs, regulatory pressures, scarcity of skilled staff, technological changes, and fluctuation of the supply chain all over the world. Active countermeasures will be the determinant of maintaining reliability and relevance in this ever-changing landscape.

In 2025, multi-beam echo sounders are expected to dominate the industry with a 60% industry share, followed by single-beam echo sounders with a share of 40%

Multi-beam technology conquered the industry by enabling the capture of wider swaths of the seafloor, which facilitated extremely accurate mapping with high resolution in aquatic surveys. Large-area mapping of seabeds, environmental monitoring, and fisheries management benefit greatly from multi-beam systems.

These systems provide high-resolution data over large stretches of water that could otherwise be surveyed in shorter times. So important for the industries that depend on marine research, offshore oil and gas exploration, and sea freight.

Leading names in the industry, such as Kongsberg Gruppen and Teledyne Marine, offer cutting-edge multi-beam systems, including the Kongsberg EM series, which are widely used in hydrographic surveys and underwater mapping applications due to their accuracy and versatility.

In fact, single-beam systems are a big part of the industry, and for very good reasons: they are cheaper and simpler in their design, and they are easy to operate. They are designed for the basic applications of depth measurement or very simple and often less frequent bathymetric surveys.

In fact, although single-beam systems provide less detailed data recording compared to multi-beam systems, they are widely used for 4%-5% of commercial fishing, recreational boating, and environmental monitoring, where high resolution is not a significant need. Companies such as Furuno and Raymarine continue to lead in the single-beam segment by offering bundle packages of low-cost yet reliable models for smaller-scale applications.

The future of both technologies glimmers with the promise of being advanced and user-friendly. Demand is expected to rise with technological innovations and the improved accuracy and diversity of applications in the marine and underwater industries.

In 2025, the industry is expected to be dominated by fishing applications, which are projected to capture approximately 50% of the overall industry share. The marine survey application is next, estimated to account for 40% of the industry.

Advanced echo sounders are used to identify fish schools, measure water depth, and map the seafloor, which drives the fishing application. These systems are heavily relied upon by fishermen to minimize fuel consumption and bureaucracy by targeting areas with the maximum concentration of fish.

Major companies such as Garmin and Lowrance manufacture this technology, with the most user-friendly and portable fish finders in the industry. Their systems, such as the Garmin EchoMap series and Lowrance HDS Live, utilize sonar technology that enables fishermen to make real-time, informed decisions, thereby improving operational efficiency.

On the other hand, the Marine Survey segment accounts for approximately 40% of the industry and encompasses hydrographic surveys, underwater construction projects, and environmental monitoring. Through multi-beam and single-beam surveys, the marine survey provides detailed mapping of the seafloor, which is vital for infrastructure works, namely underwater pipelines, offshore drilling, and port construction.

Some of the key operators in this field, such as Teledyne Marine and Kongsberg Gruppen, provide high-end equipment used in large-scale marine surveys. In particular, the Reson series from Teledyne and the EM series from Kongsberg are widely used by professionals to collect high-resolution and accurate data for marine mapping and research.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 5.1% |

| France | 4.8% |

| Germany | 5.4% |

| Italy | 4.6% |

| South Korea | 6.2% |

| Japan | 5 % |

| China | 6.7% |

| Australia-NZ | 5.3% |

The US industry is expected to grow at a rate of 5.9% CAGR during the study period. The expansion of marine research, defense surveillance, and commercial fisheries is pushing the demand for these systems. Greater reliance on oceanographic information implies that accurate depth measurement and seafloor mapping are becoming top priorities in the USA Navy operations, the National Oceanic agencies, and offshore industries.

Commercial fishing fleets, especially in Alaska and the Pacific Northwest, are ordering high-frequency multi-beam to enhance catch efficiency and sustainability. Domestic production capabilities, including the integration of GPS and sonar technologies, and increasing federal investments in shipping infrastructure, are also driving demand.

Additionally, recreational boat and sport fish utilization in coastal and inland waters continues to provide consistent demand. Technological advancements, such as AI-based detection and wireless data integration, are poised to drive product adoption in both research and industrial applications.

The UK industry will expand at a 5.1% CAGR during the study period. Strategic naval investment, in the form of maritime modernization and fisheries management, is driving demand. Ports and harbors across the UK are increasingly utilizing hydrographic surveys, augmented by advanced sonar systems, to inform maintenance and development planning.

Scottish and Northern English commercial fishing operators employ this system to meet sustainability quotas and optimize yield. In addition, the UK's strong marine research culture is adopting multi-frequency for accurate seabed categorization and marine ecosystem surveys. Establishing good sonar vendors and compatibility with geospatial analytics platforms is fueling product adoption.

Growth in the usage of autonomous underwater vehicles (AUVs) and uncrewed surface vessels (USVs) by the defense and survey sectors similarly drives industry growth over the forecast period.

The French industry is expected to have a 4.8% compound annual growth rate (CAGR) throughout the study period. With a vast maritime space and strategically placed Atlantic and Mediterranean seaports, France is investing in underwater vigilance capabilities. Naval research expenditures and fishing governance expenditures are consistently increasing to serve the demand for precise echo sounders.

Institutions conducting oceanographic research and marine biodiversity conservation are equipping their research vessels with advanced sonar mapping systems. Sales are also increasing from pleasure boating in regions such as Brittany and the French Riviera.

Luxury yacht and sailboat installation of this system is creating an upscale demand niche. Low-noise, power-efficient equipment and domestic technological innovation in acoustic sensors will continue to drive industry growth.

The German industry is projected to grow at a 5.4% CAGR during the study period. As a world leader in precision engineering and maritime technology, Germany is aggressively integrating echo sounders into oceanography, harbor infrastructure, and inland waterway applications. These systems are widely applied in monitoring the Rhine, Elbe, and Danube rivers for sediment studies and ensuring safe navigation.

Germany's defense and surveillance sectors are also contributing to stable growth, especially with increased investment in unmanned ocean systems. Effective collaboration between research institutes and academic institutions is yielding technologically sophisticated and customizable sonar systems. High-resolution bathymetric surveys, used for environmental regulatory purposes and renewable energy applications such as offshore wind farms, are also contributing to product demand.

The Italian industry will increase by 4.6% CAGR during the research period. Italy is bordered geographically by the Mediterranean Sea on three sides, with significant seaborne strategic interests in coastal defense, ports, and environmental monitoring. Echo sounding is being utilized in national maritime parks and underwater site archaeological prospection.

The Italian Coast Guard and fisheries agencies are utilizing echo sounders to enforce sustainable fishing practices and monitor marine traffic. Demand also remains strong from commercial vessels and yacht operators for high-resolution depth sensors.

Integration with GIS platforms for coastal development planning and erosion monitoring is taking flight. Miniaturized platforms are the focus of Italian manufacturers, and they are easily installable in mid-size yachts and ships.

The South Korean industry is expected to grow at a 6.2% compound annual growth rate (CAGR) during the research period. Increasing expenditure on marine observation, fisheries, and shipbuilding has fueled growth in demand. Its strategic positioning in the maritime trade, together with advanced manufacturing capabilities, is making South Korea a regional powerhouse for acoustic measuring systems.

Fleet updating and intelligent port development are inducing high-volume utilization for live seafloor mapping and navigation support. Studies in oceanography and climate studies are also facilitating the installation of multi-beam systems on research vessels. Automation, artificial intelligence, and integration with national maritime databases are becoming the focus to drive further growth in the industry.

The Japanese industry is expected to grow at a 5.0% CAGR during the forecast period. The country's rich seafaring tradition and heavy dependence on marine industries are driving the widespread use. Fisheries, hydrography, and marine research institutions are frequent users of sonar technology to ensure the optimal usage of resources and ecological preservation.

Japan's leadership in world consumer and industrial electronics helps promote small and precision devices. There is a demand for multifunctional systems that are used for mapping, positioning, and detecting biological information. Additionally, Japan has a stable population of serious amateur fishers in coastal prefectures. Intelligent fishing equipment and wireless sonar through phone applications are creating new business opportunities.

The Chinese industry is expected to grow at a 6.7% compound annual growth rate (CAGR) during the period of this research. China, being one of the largest maritime economies, is aggressively driving its use in deep-sea exploration, the fishing business, and naval operations. The government plan for ocean development focuses on maritime surveillance, port expansion, and marine ecosystem preservation, which is driving demand across industries.

Domestic production of mid- and high-level echo sounders by local businesses is shifting towards domestic consumption and exports.

Local fishermen along the country's east coast are adopting low-cost GPS-based systems to achieve better navigation and yield monitoring. China is also leading the development of AI-supported sonar platforms for ocean studies and tracking. The nation's large shipbuilding industry is incorporating sonar systems as a standard feature in both commercial and research-grade ships.

The Australia-New Zealand industry will develop at 5.3% CAGR through the study period. Both countries possess extensive coastlines and dynamic marine-based economies, with port facilities, commercial fishing, and ocean conservation activities creating demand. Australia's northern coast and New Zealand's deep fjords require extensive seafloor mapping for navigation and environmental protection.

National oceanographic research institutions and universities participating in fisheries management are integrating sonar systems into coastal monitoring programs. Recreational boating and offshore travel also fuel demand for small echo sounders.

Increased focus on coral reef health, sediment monitoring, and underwater development will be anticipated to fuel demand for precise sonar equipment. Suppliers are highlighting easy-to-fit, multifunctional units that suit smaller and mid-size boats operating in fluctuating environments in the ocean.

The industry is engendered by rivalry among established manufacturers of marine electronics, hydrographic survey specialists, and emergent ones focused on advanced sonar technology. Precision, depth range, and integration with navigation systems by analog devices have all increased lines of competition, while innovation serves as the denominator for differentiation. Opting for multi-beam and single-beam solutions, valiant players tailor their trends to meet the needs of the commercial shipping, defense, and scientific exploration sectors.

Competition sharpens with real-time seabed mapping technology, on-the-go AI-enabled sonar interpretation, and autonomous underwater vehicles (AUVs) through integration. Hence, companies invest in partnerships with navies, offshore energies, and research institutes to grow within the spectrum of their industry existence. Precision in shallow and deep-water applications, combined with that of global positioning and digital charting systems, remains critical in any competitive field.

Merger and acquisition activities are dominating the industry, where leading companies acquire an additive niche hydrographic technology provider to enhance their portfolio. Such firms adopt international hydrographic standards, ensuring global marine sector adoption. With miniaturized portable companies, tripping into the trendy industry demand, wherein use ranges from fishing to recreational boating and coastal mapping.

Pricing strategies vary, as expected by end-users. Premium solutions with higher margin requirements tend to be found in defense and offshore exploration applications, while economically attractive examples can be seen in commercial fishing and survey applications. Capitalizing on global distribution, after-sales support, and cloud-on-sonar data storage will be the way that industry leaders will guarantee the long-term retention of customers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kongsberg Maritime AS | 22-27% |

| Navico | 18-23% |

| Knudsen Engineering Ltd. | 12-16% |

| Teledyne Odom Hydrographic, Inc. | 8-12% |

| FURUNO ELECTRIC CO., LTD. | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kongsberg Maritime AS | Develops high-precision multi-beam sonar for commercial, defense, and deep-sea exploration. |

| Navico | Specializes in GPS-integrated echo sounders for fishing and recreational boating. |

| Knudsen Engineering Ltd. | Provides hydrographic survey-grade sonar with depth measurement accuracy. |

| Teledyne Odom Hydrographic, Inc. | Focuses on AUV-compatible echo sounders for scientific and military applications. |

| FURUNO ELECTRIC CO., LTD. | Manufactures compact and cost-effective sonar systems for commercial and navigation use. |

Key Company Insights

Kongsberg Maritime AS (22-27%)

A leader in high-performance hydroacoustic solutions, Kongsberg Maritime integrates AI-driven sonar interpretation with multi-beam echo sounders for both defense and commercial applications.

Navico (18-23%)

Navico strengthens its industry presence with GPS-enabled echo sounders tailored for professional anglers and commercial fishing operations.

Knudsen Engineering Ltd. (12-16%)

Knudsen Engineering specializes in high-frequency hydrographic sonar, with a focus on precision mapping for maritime research and the offshore industry.

Teledyne Odom Hydrographic, Inc. (8-12%)

Teledyne Odom Hydrographic leverages AUV-mounted sonar solutions, providing seamless integration for underwater autonomous surveys.

FURUNO ELECTRIC CO., LTD. (6-10%)

FURUNO ELECTRIC CO., LTD. enhances its portfolio with cost-efficient sonar technology, targeting commercial vessel operators and small-scale marine applications.

Other Key Players (25-35% Combined)

By product type, the industry is segmented into single beam and multi-beam.

By application, the industry finds applications in fishing, marine survey, and other related activities.

By usage, the industry is categorized into fixed and portable.

By frequency range, the segmentation includes below 30 kHz, 30 to 100 kHz, and above 100 kHz.

By region, the industry is geographically divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is estimated to reach USD 317.9 million by 2025.

The industry is projected to grow to USD 439.9 million by 2035.

China is expected to experience a 6.7% growth rate.

The multi-beam segment is leading the industry, driven by the increasing need for high-precision marine data collection.

Key players include Kongsberg Maritime AS, Navico, Knudsen Engineering Ltd., Teledyne Odom Hydrographic, Inc., FURUNO ELECTRIC CO., LTD., CEE HydroSystems, KAIZEN IMPERIAL, Fugro, Sonar Products Limited, and Neptune Sonar Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Frequency Range, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Frequency Range, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Usage, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Usage, 2023 to 2033

Figure 29: Global Market Attractiveness by Frequency Range, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Usage, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Usage, 2023 to 2033

Figure 59: North America Market Attractiveness by Frequency Range, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Usage, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Usage, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Frequency Range, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Usage, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Usage, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Frequency Range, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Usage, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Usage, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Frequency Range, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Usage, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Usage, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Frequency Range, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Usage, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Usage, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Frequency Range, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Usage, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Frequency Range, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Frequency Range, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Frequency Range, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Frequency Range, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Frequency Range, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Usage, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Frequency Range, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Echogenic Catheters Market

Anechoic Chamber Market Growth - Trends & Forecast 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Global Catecholamine Market Analysis – Size, Share & Forecast 2024-2034

Intracardiac Echocardiography Market Insights - Growth & Forecast 2025 to 2035

Transesophageal Echocardiography (TEE) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA