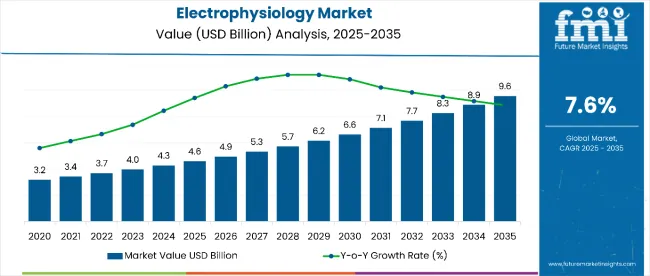

The electrophysiology market is estimated to be valued at USD 4.6 billion in 2025. It is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

The market is projected to add an absolute dollar opportunity of USD 5.0 billion over the forecast period. This reflects a 2.09 times growth at a compound annual growth rate of 7.6%. The market's evolution is expected to be shaped by the rising prevalence of atrial fibrillation, breakthrough pulsed field ablation (PFA) technologies, advanced 3D mapping systems, and growing demand for minimally invasive cardiac procedures, particularly where precision treatment and improved patient outcomes are required.

By 2030, the market is likely to reach USD 6.6 billion, accounting for USD 2.0 billion in incremental value over the first half of the decade. The remaining USD 3.1 billion is expected to be realized during the second half, suggesting a moderately accelerated growth pattern. Product innovation in PFA systems, radiofrequency ablation catheters, and AI-powered mapping technologies is gaining traction.

Companies such as Johnson & Johnson (Biosense Webster) and Abbott Laboratories are advancing their competitive positions through investment in electrophysiology device development, clinical trial programs, and specialty cardiac catheterization laboratories. Rising healthcare awareness, expanding access to cardiac electrophysiology specialists, and improved insurance coverage are supporting expansion into hospitals, cardiac centers, and ambulatory surgery applications. Market performance will remain anchored in clinical efficacy standards, safety profiles, and procedural outcome optimization benchmarks.

The market holds a notable and rapidly expanding position within its parent markets. Within the global cardiac devices market, it accounts for 12.3% due to its specialized procedural requirements. In the minimally invasive surgery segment, it commands a 15.7% share, supported by breakthrough ablation technologies. It contributes nearly 18.9% to the arrhythmia treatment market and 8.2% to the catheter-based intervention segment. In interventional cardiology procedures, electrophysiology treatments hold around 11.4% share, driven by increasing AF ablation volumes. Across the cardiac rhythm management market, its share is close to 24.6%, owing to its position as a leading curative approach for cardiac arrhythmias requiring specialized intervention.

The market is undergoing a strategic transformation driven by rising demand for curative cardiac arrhythmia treatments, personalized electrophysiology approaches, and comprehensive cardiac rhythm management solutions. Advanced therapeutic technologies using pulsed field ablation, 3D electro anatomical mapping, and AI-guided navigation systems have enhanced procedural efficacy, safety profiles, and patient outcomes, making electrophysiology procedures viable alternatives to long-term antiarrhythmic drug therapy. Manufacturers are introducing specialized catheter designs, including contact force sensing and irrigated tip technologies tailored for different arrhythmia types, expanding their role beyond symptom management to permanent arrhythmia elimination. Strategic collaborations between device manufacturers and cardiac electrophysiology centers have accelerated innovation in procedure development and market penetration.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 4.6 billion |

| Projected Value (2035F) | USD 9.6 billion |

| CAGR (2025 to 2035) | 7.6% |

The electrophysiology market's exceptional growth is driven by increasing atrial fibrillation prevalence, breakthrough ablation technologies, and expanding cardiac electrophysiology expertise, making it an attractive therapeutic area for medical device companies and healthcare providers seeking innovative cardiac treatment solutions. The rising incidence of cardiac arrhythmias, improved procedural capabilities, and growing awareness of curative treatment options appeal to patients and healthcare providers prioritizing long-term rhythm control and quality of life improvements.

A growing understanding of arrhythmia mechanisms, personalized ablation approaches, and patient-centric care models is further propelling adoption, particularly in specialized electrophysiology laboratories, cardiac centers, and integrated cardiovascular services. Rising healthcare expenditure, expanding insurance coverage for complex cardiac procedures, and regulatory approvals for innovative ablation technologies are also enhancing treatment accessibility and market penetration.

As precision medicine and targeted therapies accelerate across cardiovascular systems and specialty cardiac care becomes increasingly important, the market outlook remains highly favorable. With patients and providers prioritizing procedural success rates, safety profiles, and long-term arrhythmia freedom, electrophysiology treatments are well-positioned to expand across various cardiac, hospital, and ambulatory surgery applications.

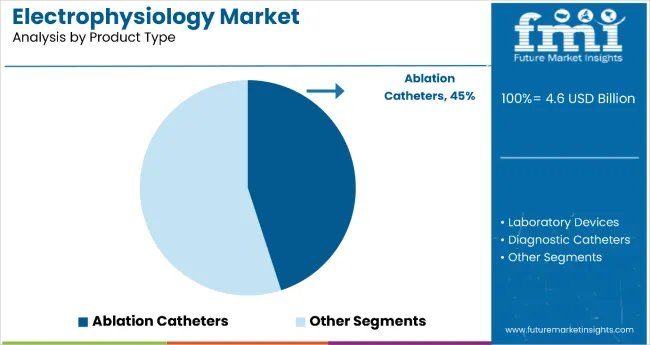

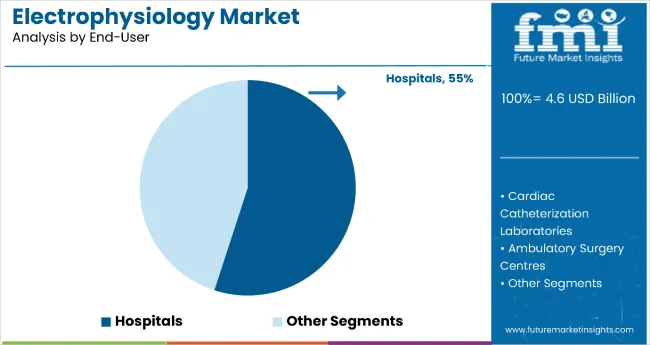

The market is segmented by product type, indication, end user, and region. By product type, the market is categorized into laboratory devices (3D mapping systems, recording systems, radiofrequency (RF) ablation systems, intracardiac echocardiography (ICE), ultrasound imaging systems, cardiac stimulators and others), ablation catheters (cryoablation catheters, radiofrequency (RF) ablation catheters, irrigated tip RF ablation catheters and laser ablation catheters), diagnostic catheters (conventional diagnostic catheters, advanced diagnostic catheters and ultrasound diagnostic catheters), and access devices. Based on indication, the market is divided into atrial fibrillation, atrial flutter, ventricular tachycardia, and others. In terms of end-user, the market is divided into hospitals, cardiac catheterization laboratories, and ambulatory surgery centers. Regionally, the market is classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The ablation catheters segment holds a dominant position with 45% of the market share in the product category, owing to their direct therapeutic application in arrhythmia elimination, advanced catheter technologies, and ability to achieve permanent rhythm restoration in previously medication-resistant patients. Ablation catheters, including radiofrequency, cryoablation, and emerging pulsed field ablation systems, are widely used across electrophysiology laboratories due to their curative properties, improved safety profiles, and ability to reduce long-term healthcare costs through arrhythmia elimination significantly.

It enables healthcare providers and patients to achieve permanent rhythm control while maintaining excellent procedural safety standards and treatment durability in chronic arrhythmia management scenarios. As demand for curative treatments, minimally invasive procedures, and personalized ablation approaches grows, the ablation catheters segment continues to gain preference in both complex and routine electrophysiology procedures.

Manufacturers are investing in advanced catheter development, contact force sensing technology, and enhanced cooling systems to improve efficacy, reduce procedural times, and enhance safety outcomes. The segment is poised to grow further as global treatment guidelines favor ablation interventions and reimbursement coverage improves for electrophysiology procedures.

Hospitals remain a core end-user segment with 55% of the market share in 2025, as they provide specialized electrophysiology laboratories, comprehensive cardiac care teams, and advanced procedural infrastructure for complex ablation procedures and critical arrhythmia cases. Their functional expertise supports procedural planning, real-time monitoring, and post-procedural care in patients requiring intensive cardiac electrophysiology services and multidisciplinary management.

Hospitals also ensure proper equipment maintenance, specialist availability, and emergency response capabilities for electrophysiology procedures, while offering integrated care coordination with cardiac specialists. This makes them indispensable in modern cardiac care and tertiary treatment environments.

Ongoing demand for complex ablation procedures and the specialization required for advanced electrophysiology interventions are key trends driving the sustained relevance of hospitals in this therapeutic area.

In 2024, global electrophysiology adoption grew by 12% year-on-year, with North America taking a 35% share. Applications include ablation procedures, diagnostic mapping, and rhythm management. Manufacturers are introducing specialized catheter systems and AI-powered mapping platforms that deliver superior procedural outcomes and patient-centered results. Pulsed field ablation formulations now support precision treatment positioning. Evidence-based procedural guidelines and professional society recommendations support physician confidence. Technology providers increasingly supply integrated ablation systems with real-time monitoring capabilities to reduce procedural complexity.

Technological Innovation Accelerates Electrophysiology Market Demand

Medical device companies and healthcare systems are choosing advanced electrophysiology technologies to achieve superior procedural outcomes, enhance patient safety, and meet growing demands for curative, effective arrhythmia treatments. In clinical studies, pulsed field ablation and contact force catheters deliver up to 85% procedural success rates compared to conventional ablation at 65-75%. Technologies formulated with advanced mapping maintain efficacy throughout complex procedures and extended ablation sessions. In specialized electrophysiology centers, integrated ablation programs help reduce procedure times while maintaining safety standards by up to 40%. Advanced applications are now being deployed for pediatric indications, thereby increasing adoption in sectors requiring comprehensive age-appropriate cardiac care. These advantages help explain why adoption rates of electrophysiology technologies rose by 28% in 2024 across North America and Europe.

Cost Pressures, Training Requirements and Infrastructure Limitations Limit Growth

Market expansion faces constraints due to high procedure costs, specialized training requirements, and advanced laboratory infrastructure needs. Electrophysiology procedures can range from $25,000 to $75,000 per case, depending on complexity and technology selection, impacting patient access and leading to treatment delays in some healthcare systems. Specialized physician training and certification processes require 1-2 years of additional fellowship training. Advanced mapping systems and ablation infrastructure extend healthcare facility costs by 200-300% compared to conventional cardiac catheterization laboratories. Limited availability of trained electrophysiologists restricts scalable treatment access, especially for complex procedures and rural populations. These constraints make electrophysiology adoption challenging in resource-limited healthcare systems despite growing clinical evidence and treatment demand.

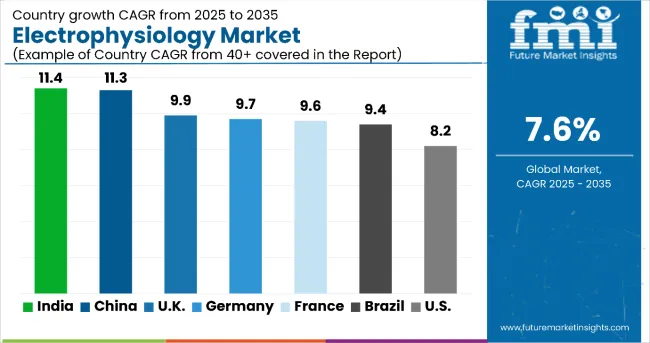

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 11.4% |

| China | 11.3% |

| UK | 9.9% |

| Germany | 9.7% |

| France | 9.6% |

| Brazil | 9.4% |

| USA | 8.2% |

In the electrophysiology market, India leads with the highest projected CAGR of 11.4% from 2025 to 2035, driven by rapid healthcare infrastructure development, increasing cardiovascular disease burden, and expanding access to cardiac electrophysiology services. China follows with a CAGR of 11.3%, supported by growing cardiac care specialization and rising healthcare investments. The UK shows strong growth at 9.9%, benefiting from NHS support for cardiac interventions and established electrophysiology programs. Germany and France demonstrate consistent growth at 9.7% and 9.6% respectively, supported by advanced healthcare systems and comprehensive cardiac care networks. Brazil and the USA show steady expansion at 9.4% and 8.2% respectively, supported by established electrophysiology centers and specialty care infrastructure.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from electrophysiology treatments in India is projected to grow at a CAGR of 11.4% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by rising cardiovascular disease prevalence, expanding cardiac care infrastructure, and increasing access to electrophysiology procedures across major urban centers, including Mumbai, Delhi, and Bangalore. Indian healthcare systems are increasingly adopting advanced ablation technologies as medical insurance coverage improves and cardiac electrophysiology services expand.

Key Statistics

The electrophysiology market in the USA is anticipated to expand at a CAGR of 8.2% from 2025 to 2035, reflecting mature market dynamics with a focus on procedural optimization. Growth is centered on advanced ablation adoption and electrophysiology center expansion in California, Texas, and New York regions. Advanced procedural protocols and insurance coverage improvements are being deployed for complex arrhythmias, AF ablation, and comprehensive rhythm management. FDA regulatory frameworks and clinical guidelines support practical procedure application development across diverse healthcare settings.

Key Statistics

Sales of electrophysiology devices in China are slated to flourish at a CAGR of 11.3% from 2025 to 2035, approaching global leadership levels. Growth has been concentrated in urban healthcare expansion and the development of cardiac specialties in the Beijing, Shanghai, and Guangzhou regions. Treatment adoption is shifting from basic arrhythmia management toward comprehensive ablation and advanced electrophysiology approaches. Local healthcare infrastructure improvements and international medical device partnerships are leading commercial deployment strategies.

Key Statistics

The electrophysiology market in the UK is expected to grow at a CAGR of 9.9% from 2025 to 2035, reflecting strong mature market expansion. Growth is driven by NHS coverage improvements and cardiac specialty optimization in the London, Manchester, and Edinburgh regions. Integrated electrophysiology pathways and cardiac specialist networks are expanding treatment accessibility, while healthcare providers incorporate evidence-based protocols into comprehensive arrhythmia management programs.

Key Statistics

Demand for electrophysiology treatments in Germany is expected to increase at a CAGR of 9.7% from 2025 to 2035, exceeding the mature market average. Demand is driven by advanced cardiac healthcare systems, robust medical device research infrastructure, and comprehensive insurance coverage in Berlin, Munich, and Hamburg markets. Evidence-based ablation protocols and specialized electrophysiology centers are increasingly adopting innovative PFA technologies for optimal patient outcomes.

Key Statistics

Revenue from electrophysiology treatments in France is projected to rise at a CAGR of 9.6% from 2025 to 2035, supported by strong demand for advanced ablation technologies and integrated cardiac care management. Healthcare systems in Paris, Lyon, and Marseille are experiencing expansion in cardiac electrophysiology services, evidence-based procedural protocols, and patient-centered arrhythmia care approaches. French cardiac institutions are leveraging advanced ablation options to meet quality expectations for comprehensive electrophysiology management.

Key Statistics

The demand for electrophysiology treatments in Brazil is projected to expand at a CAGR of 9.4% from 2025 to 2035, driven by healthcare system improvements and expanding access to cardiac specialty care. Growth is concentrated in urban healthcare markets, including São Paulo, Rio de Janeiro, and Brasília, where cardiac electrophysiology services and procedural accessibility are expanding. Healthcare infrastructure investments and international medical device partnerships are gradually building comprehensive electrophysiology treatment capabilities.

Key Statistics

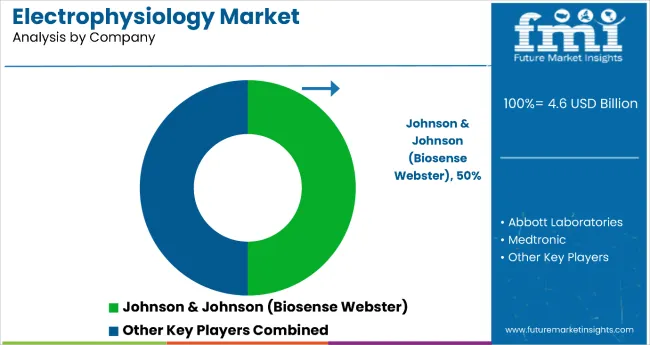

The global electrophysiology and cardiac ablation devices market is moderately concentrated, dominated by major medical technology companies alongside specialized cardiac innovators. Johnson & Johnson (Biosense Webster, Inc.) leads the industry with an estimated 50% market share, supported by its extensive electrophysiology portfolio that includes advanced 3D cardiac mapping systems and radiofrequency ablation catheters widely adopted in arrhythmia treatment. Abbott Laboratories follows as a strong competitor, leveraging its EnSite™ mapping system and comprehensive diagnostic solutions. Abbott’s success is reinforced by strong clinical research capabilities and deep collaborations with electrophysiology centers and hospital networks.

Medtronic plc, Boston Scientific Corporation, and Biotronik SE & Co. KG further strengthen the market through diversified electrophysiology and ablation technology portfolios, focusing on cryothermal, laser, and radiofrequency modalities. Their strategies emphasize workflow integration, data-driven procedural support, and physician training programs to enhance treatment outcomes. Regional and emerging players such as MicroPort Scientific Corporation, Japan Lifeline Co., Ltd., Merit Medical Systems, and APN Health LLC contribute to innovation in ablation catheter design and localized clinical development. High regulatory barriers, stringent clinical validation requirements, and the need for technological differentiation continue to define market entry challenges, with long-term competitiveness hinging on clinical trial success and hospital access capabilities across cardiac care ecosystems.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 4.6 Billion |

| Product Type | Laboratory Devices (3D Mapping Systems, Recording Systems, Radiofrequency (RF) Ablation Systems, Intracardiac Echocardiography (ICE), Ultrasound Imaging Systems, Cardiac Stimulators a nd Others), Ablation Catheters (Cryoablation Catheters, Radiofrequency (RF) Ablation Catheters, Irrigated Tip Rf Ablation Catheters a nd Laser Ablation Catheters), Diagnostic Catheters (Conventional Diagnostic Catheters, Advanced Diagnostic Catheters a nd Ultrasound Diagnostic Catheters), Access Devices |

| Indication | Atrial Fibrillation, Atrial Flutter, Wolff-Parkinson-White Syndrome (WPW), Atrioventricular Nodal Reentry Tachycardia (AVNRT), Ventricular Tachycardia (VT), Others |

| End User | Hospitals, Cardiac Catheterization Laboratories, Ambulatory Surgery Centers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, France, India, Canada, China, Japan, Brazil, United Kingdom and 40+ Countries |

| Key Companies Profiled |

Abbott Laboratories, Johnson & Johnson (Biosense Webster, Inc.), Medtronic plc, Boston Scientific Corporation, Koninklijke Philips N.V. Biotronik SE & Co. KG, MicroPort Scientific Corporation, Japan Lifeline Co., Ltd., Merit Medical Systems, APN Health LLC. |

| Additional Attributes | Dollar sales by indication and product type, regional demand trends, competitive landscape, preferences for invasive versus non-invasive procedures, integration with cardiac care systems, and innovations in mapping, ablation, and clinical standardization |

The global electrophysiology market is estimated to be valued at USD 4.6 billion in 2025.

The market size for electrophysiology is projected to reach USD 9.6 billion by 2035.

The electrophysiology market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The ablation catheters segment is projected to lead in the electrophysiology market with 45% market share in 2025.

In terms of end user, hospitals are projected to command 55% share in the electrophysiology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrophysiology Equipment and Recording Systems Market Size and Share Forecast Outlook 2025 to 2035

Visual Electrophysiology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA