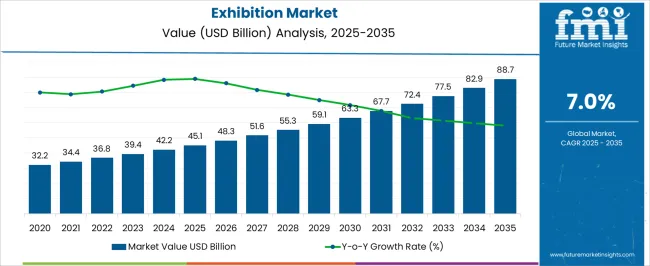

The exhibition market, estimated at USD 45.1 billion in 2025 and forecasted to reach USD 88.7 billion by 2035 at a CAGR of 7.0%, follows a growth trajectory that reflects a gradual shift along the market maturity curve. The consistent upward progression from USD 45.1 billion to USD 88.7 billion suggests a stable compound expansion without sharp volatility, indicative of an industry transitioning from a growth phase into early stages of maturity.

Between 2025 and 2029, the industry remains in an accelerated adoption phase, supported by steady annual increments from USD 45.1 billion to USD 59.1 billion. During this period, expansion is driven by greater corporate participation, demand for brand visibility, and hybrid event models integrating physical and digital exhibitions. This indicates an early majority adoption where market acceptance grows significantly across regions and sectors.

From 2030 to 2035, values rise from USD 63.3 billion to USD 88.7 billion, showing that while growth remains strong, the pace stabilizes, reflecting entry into the late majority phase of the adoption lifecycle. Market players emphasize innovation in visitor engagement and sustainability standards to maintain competitiveness. The exhibition sector demonstrates a sustained but controlled climb along the maturity curve, highlighting resilience and adaptability while progressing toward broader mainstream adoption.

| Metric | Value |

|---|---|

| Exhibition Market Estimated Value in (2025 E) | USD 45.1 billion |

| Exhibition Market Forecast Value in (2035 F) | USD 88.7 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The exhibition market is considered an essential platform within the global events ecosystem, enabling trade facilitation and business networking across industries. It contributes about 7.8% to the events industry, while its share within business services is estimated at 3.2% due to its role in driving client acquisition and lead generation. In trade promotion and marketing, exhibitions hold a significant 9.5% share, reflecting their importance in product showcasing and brand positioning.

Within tourism and hospitality, a 2.4% contribution is observed, supported by travel and accommodation spending. Venue management and infrastructure account for 6.1% of exhibition-driven activities. Recent industry trends highlight the accelerated shift toward hybrid exhibition formats, where physical and virtual participation are integrated to expand global reach. Groundbreaking strategies have included investments in digital platforms for virtual booths, AI-driven matchmaking tools, and immersive technologies such as AR and VR for product demonstrations.

Key players have focused on sustainability by introducing energy-efficient exhibition spaces and reducing material waste through reusable booth structures. Strategic collaborations with technology providers have further enhanced the value proposition by enabling data analytics to measure visitor engagement.

The exhibition market is experiencing consistent growth, supported by increasing corporate emphasis on brand visibility, networking, and direct customer engagement. Rising globalization of business, expanding cross-border trade, and the need for face-to-face marketing in high-value sectors are driving event participation.

Technological integration, including virtual and hybrid formats, is enhancing attendee reach and operational flexibility while complementing physical events. Investment in large-scale venues, advanced logistics, and attendee experience optimization is further boosting market appeal.

Regional growth is being propelled by government initiatives to promote trade, tourism, and investment through business events. Over the forecast period, the market is expected to benefit from sustained demand across industries such as technology, manufacturing, healthcare, and consumer goods, with exhibitors focusing on measurable ROI, enhanced digital engagement, and strategic collaborations to maximize impact.

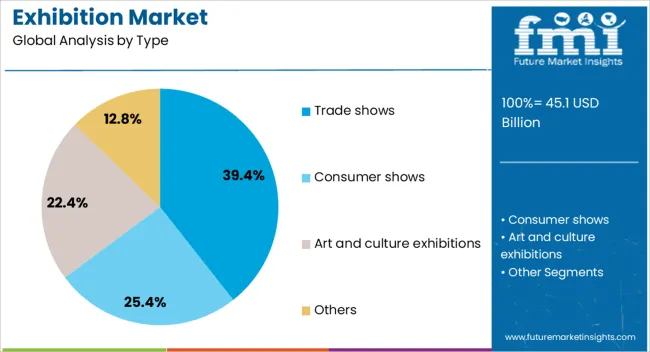

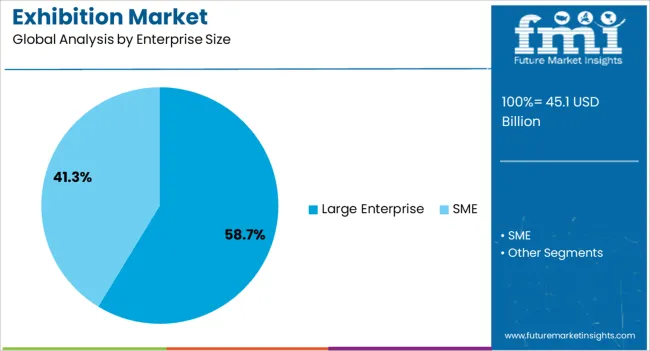

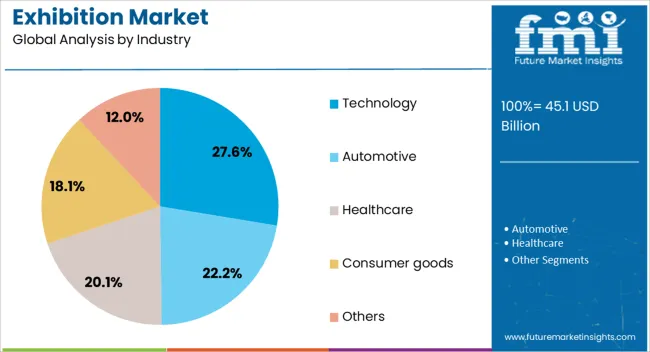

The exhibition market is segmented by type, enterprise size, industry, and geographic regions. By type, exhibition market is divided into Trade shows, Consumer shows, Art and culture exhibitions, and Others. In terms of enterprise size, exhibition market is classified into Large Enterprise and SME. Based on industry, exhibition market is segmented into Technology, Automotive, Healthcare, Consumer goods, and Others.

Regionally, the exhibition industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trade shows segment, holding 39.40% of the type category, leads the market due to its proven ability to generate significant business opportunities, attract targeted audiences, and foster industry-specific knowledge exchange. Trade shows offer exhibitors a platform to launch products, strengthen partnerships, and gather market intelligence in a concentrated timeframe.

Their popularity is reinforced by their role in driving supply chain connections and enabling real-time demonstrations of products and services. Continuous investment in thematic, sector-focused events and integration of digital tools for pre- and post-event engagement are enhancing participant value.

As industries prioritize brand positioning and market penetration, trade shows remain the preferred exhibition format for generating high-quality leads and strategic partnerships.

The large enterprise segment, accounting for 58.70% of the enterprise size category, dominates due to its higher marketing budgets, global operational presence, and need for large-scale event participation to sustain brand leadership. These companies leverage exhibitions to reinforce market positioning, introduce innovation pipelines, and access international markets.

Large enterprises also tend to secure premium exhibition spaces, advanced booth designs, and comprehensive marketing campaigns to maximize visibility. Their dominance is further supported by established networks and the capacity to participate in multiple events globally.

Investment in data-driven event strategies and customer relationship management tools is helping these enterprises optimize engagement outcomes.

The technology segment, representing 27.60% of the industry category, leads due to rapid innovation cycles, competitive market dynamics, and the sector’s reliance on exhibitions to showcase product advancements. Technology companies utilize exhibitions to engage with decision-makers, demonstrate solutions, and position themselves at the forefront of emerging trends such as AI, IoT, and 5G.

The segment benefits from strong attendee interest, driven by the need for hands-on experience with cutting-edge products and services. Global demand for tech-focused exhibitions is being reinforced by accelerated digital transformation across industries and the increasing role of technology in everyday business operations, ensuring sustained leadership in the market.

The sector is shaped by evolving business models, digital integration, regional trade expansion, and shifting preferences for hybrid events. While face-to-face interactions remain critical, technology has introduced new participation modes, increasing accessibility and global reach. Economic cycles, industry-specific developments, and corporate budgets play a significant role in determining market activity levels. Despite external disruptions, exhibitions remain an essential medium for brand positioning and cross border trade opportunities.

The expansion of international trade has reinforced the relevance of exhibitions as critical platforms for showcasing products and services to global audiences. Businesses are leveraging exhibitions to reach potential clients across new geographies, leading to higher participation in international trade fairs. Developing markets in the Asia Pacific, the Middle East, and Latin America are witnessing rapid growth in exhibition hosting due to rising investments and infrastructure development. Established exhibition hubs in Europe and North America continue to attract strong global participation. The role of exhibitions as catalysts for cross border partnerships has been reinforced, driving their significance in global commerce.

The exhibition market has been influenced by the integration of digital platforms, enabling hybrid participation models. Virtual and augmented reality solutions, live streaming, and digital networking tools have expanded audience reach beyond physical event boundaries. Companies are adopting these solutions to maximize engagement while reducing travel and operational expenses. The hybrid format has proven valuable in attracting both international and local participants simultaneously. While in-person experiences remain irreplaceable for product demonstrations and relationship building, digital components are enhancing the accessibility of exhibitions. This shift has transformed the competitive dynamics, making technological integration a key factor in event success.

Exhibitions focused on specific industries such as automotive, electronics, pharmaceuticals, energy, and construction are gaining prominence. These sector focused platforms enable businesses to directly engage with targeted audiences, resulting in more effective networking and business development. The expansion of specialized exhibitions has been driven by demand for knowledge sharing, showcasing advanced technologies, and forming collaborative ventures.

Exhibitors value these industry-specific platforms as they provide concentrated exposure to potential buyers and decision makers. The continuous diversification of exhibition themes across emerging industries such as renewable energy, biotechnology, and digital technologies has further supported growth and relevance.

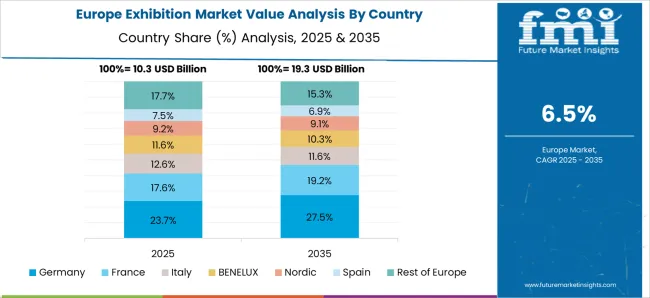

The ability of regions to host large-scale exhibitions depends heavily on infrastructure, including convention centers, transportation facilities, and accommodation capacity. Significant investments in exhibition infrastructure have been made in the Asia Pacific and the Middle East, strengthening their competitiveness in attracting international events.

Europe has retained its leadership with established exhibition hubs, while North America remains strong due to corporate demand. The growing competition between regions to host globally recognized exhibitions has increased investments in modern venues and smart technologies. This infrastructure expansion ensures long-term opportunities for the exhibition market, while also fostering regional economic growth.

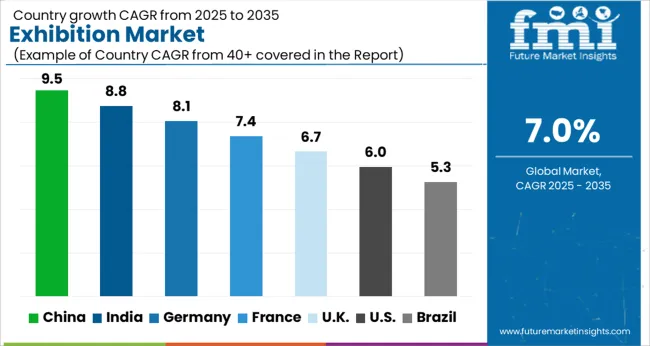

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

China led the market with a forecast CAGR of 9.5%, supported by rapid expansion of trade fairs, cultural events, and international business exhibitions that strengthened its global position. India followed with 8.8%, where consistent growth was driven by increased corporate participation, rising tourism-linked events, and government-backed industry showcases. Germany registered 8.1%, benefiting from its established infrastructure for international trade shows and exhibitions across automotive, machinery, and technology sectors. The United Kingdom recorded 6.7%, reflecting stable demand for exhibitions in finance, technology, and cultural platforms. The United States posted 6.0%, supported by strong activity in entertainment expos, business conventions, and academic conferences. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to record a CAGR of 9.5% in the market, driven by expanding trade activities and the growing importance of international expos. Rising investments in infrastructure for large convention centers and exhibition halls are strengthening the industry’s capacity to host large-scale events. The participation of global enterprises seeking to access Chinese consumers is further boosting demand. Digital integration is being widely adopted, with hybrid event models offering both physical and virtual participation. Government support for trade fairs and cultural exhibitions is also enhancing market visibility. As China continues to emerge as a global business hub, the exhibition industry is expected to remain a key driver of commercial engagement.

India is anticipated to grow at a CAGR of 8.8% in the market, supported by rising trade volumes and increasing corporate investments in promotional activities. The development of modern convention centers in major cities has expanded the country’s ability to host domestic and international exhibitions. Industries such as textiles, pharmaceuticals, and technology are leading participants, showcasing significant demand for organized exhibition spaces. Digital adoption is improving audience engagement, with hybrid formats allowing broader access to events. Strong government support through trade promotion councils and industry associations is expected to provide further growth momentum. India’s expanding economy and evolving business environment are set to maintain a positive outlook for the exhibition market.

Germany is forecasted to witness a CAGR of 8.1% in the market, supported by its strong position as a hub for international trade fairs. The country’s advanced infrastructure and long-established exhibition culture have made it a leading destination for global industry events. Key sectors such as automotive, engineering, and technology consistently utilize exhibitions for product showcasing and networking. Integration of advanced technologies like virtual platforms and digital ticketing systems is enriching visitor experiences. Sustainability is becoming a defining factor, with eco-friendly practices being introduced in exhibition management. Germany’s global connectivity and innovation-driven industries are expected to maintain its prominence in the European exhibition landscape.

The United Kingdom is expected to expand at a CAGR of 6.7% in the exhibition market, backed by its strong services economy and the presence of international business hubs like London and Birmingham. Exhibitions in sectors such as finance, healthcare, and creative industries are witnessing consistent participation. Digital platforms are being increasingly integrated, providing exhibitors with hybrid engagement opportunities. The country’s strategic location enhances its role as a bridge between Europe and global markets, attracting diverse international exhibitors. While regulatory challenges and economic uncertainties may influence market trends, the adaptability of organizers and growing reliance on digital tools provide resilience. The UK exhibition sector is poised to remain competitive in a globalized environment.

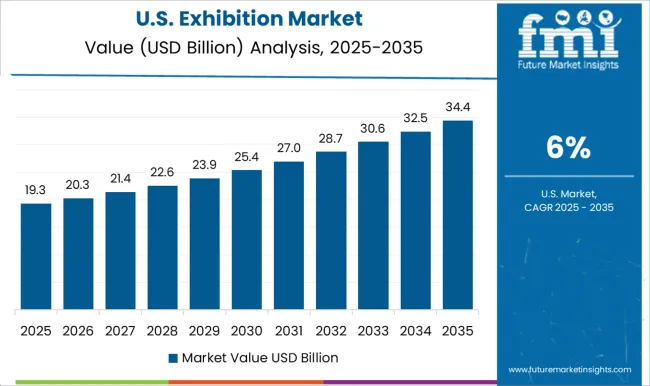

The United States is projected to achieve a CAGR of 6.0% in the market, driven by strong participation from industries such as technology, healthcare, and consumer goods. Large-scale convention centers across major cities provide robust infrastructure for hosting global events. Exhibitions are increasingly integrating digital technologies for live streaming, virtual tours, and audience analytics, which enhance engagement. The country’s strong marketing culture supports consistent investment in trade shows and promotional events. While competition is high due to the presence of multiple regional and international exhibitions, innovation and audience-focused strategies continue to create growth opportunities. The US exhibition market is expected to remain dynamic and adaptive to changing industry needs.

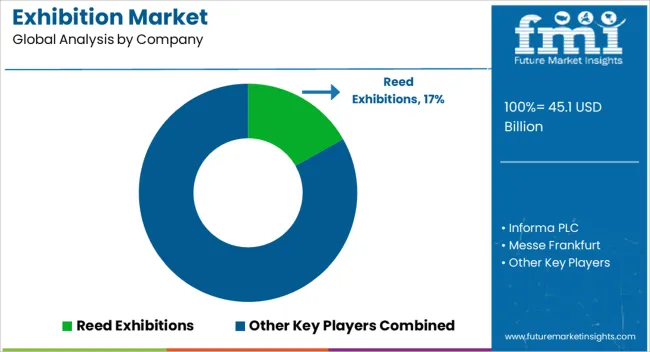

The market is shaped by a network of global organizers that provide platforms for trade, business networking, and brand visibility across industries. Reed Exhibitions has built a dominant position with its large portfolio of international trade fairs and business events, serving sectors such as technology, healthcare, and consumer goods. Informa PLC is recognized for its diverse exhibitions, conferences, and knowledge-driven events, with an emphasis on business intelligence and global reach. Messe Frankfurt has become a cornerstone in the European exhibition ecosystem, operating world-class venues and trade fairs with a strong focus on automotive, textiles, and consumer goods. Messe Düsseldorf complements this by hosting specialized exhibitions in areas like plastics, printing, and medical technologies, attracting worldwide exhibitors and attendees.

Fiera Milano plays a central role in Italy, organizing large-scale exhibitions that connect European industries with global participants, particularly in fashion, design, and technology. Emerald Expositions Events, Inc. is among the leading USA organizers, specializing in business-to-business exhibitions across sectors including design, construction, and consumer lifestyle. Koelnmesse GmbH has built its reputation by hosting iconic trade fairs such as Anuga and imm Cologne, which serve as influential hubs for the food, furniture, and lifestyle industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.1 Billion |

| Type | Trade shows, Consumer shows, Art and culture exhibitions, and Others |

| Enterprise Size | Large Enterprise and SME |

| Industry | Technology, Automotive, Healthcare, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Reed Exhibitions, Informa PLC, Messe Frankfurt, Messe Düsseldorf, Fiera Milano, Emerald Expositions Events, Inc., and Koelnmesse GmbH |

| Additional Attributes | Dollar sales by exhibition type and industry vertical, demand dynamics across trade shows, conferences, and consumer events, regional trends in business networking and event adoption, innovation in digital platforms, hybrid formats, and experiential design, environmental impact of event logistics and material usage, and emerging use cases in virtual exhibitions and sustainable event management. |

The global exhibition market is estimated to be valued at USD 45.1 billion in 2025.

The market size for the exhibition market is projected to reach USD 88.7 billion by 2035.

The exhibition market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in exhibition market are trade shows, consumer shows, art and culture exhibitions and others.

In terms of enterprise size, large enterprise segment to command 58.7% share in the exhibition market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA