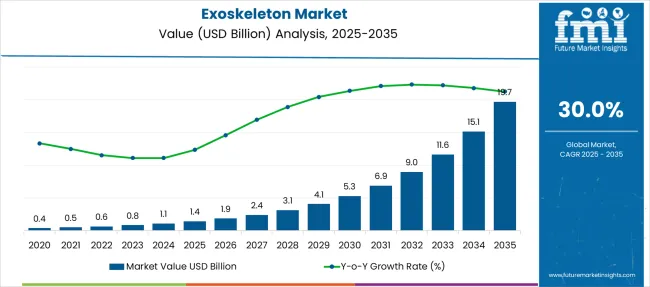

The Exoskeleton Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 19.7 billion by 2035, registering a compound annual growth rate (CAGR) of 30.0% over the forecast period. The growth shows a 16x expansion in 11 years, highlighting rapid scalability potential. A notable acceleration occurs post-2028 when market value doubles approximately every three years, moving from USD 3.1 billion in 2028 to USD 6.9 billion in 2031, and then hitting USD 15.1 billion by 2034. This growth curve suggests an inflection point post-2026, attributed to the increased adoption of powered exoskeletons in defense and rehabilitation.

The absolute dollar opportunity between 2025 and 2030 is estimated at USD 4.2 billion, while the following five years add USD 11.6 billion, showing that 2029–2035 contributes nearly 70% of future gains. Strategic prioritization of R&D and cost optimization becomes crucial as YoY growth rates flatten after 2033, signaling early maturity. Companies entering before 2028 capture compounding benefits as competitive saturation remains minimal during high acceleration phases.

Industries with high physical strain, such as logistics, construction, and automotive, are facing escalating costs from workplace injuries and chronic labor shortages. Exoskeleton technology, projected to reach nearly USD 19.7 billion by 2035, is evolving into a structural solution that addresses these systemic challenges rather than functioning as a discretionary tool.

In North America alone, musculoskeletal injuries account for more than USD 16 billion annually in employer costs, making prevention strategies financially compelling. Exoskeletons deliver measurable returns through reduced injury claims, productivity improvement, and enhanced compliance with safety regulations. Yet barriers persist. Capital cost amortization, user acceptance, and ethical questions about augmentation blur traditional workforce models, creating an environment where regulation and policy must evolve alongside innovation.

For stakeholders, competitive advantage will belong to companies that move beyond hardware manufacturing to integrated solutions combining predictive analytics, biometric data, and AI-driven motion optimization. Collaborations with insurers and regulators will shape adoption speed, while cost compression via modular architecture and additive manufacturing will determine scalability.

| Metric | Value |

|---|---|

| Exoskeleton Market Estimated Value in (2025 E) | USD 1.4 billion |

| Exoskeleton Market Forecast Value in (2035 F) | USD 19.7 billion |

| Forecast CAGR (2025 to 2035) | 30.0% |

The exoskeleton market is undergoing accelerated advancement, supported by technological innovation, demographic shifts, and growing emphasis on rehabilitation and human augmentation. The adoption of exoskeletons has gained traction across sectors such as healthcare, defense, and industrial safety, where physical support and endurance enhancement are critical.

Strategic investments by medical device manufacturers, rising demand for post-injury mobility solutions, and increasing military funding for soldier-wearable robotics are reshaping the industry landscape. Integration of AI, real-time feedback systems, and sensor-based motion control has improved both usability and patient outcomes.

The regulatory landscape is gradually evolving, with pilot reimbursement programs and safety certifications enhancing commercial viability. As the market matures, collaboration among robotics firms, clinical institutions, and public health systems is expected to unlock new deployment models and long-term adoption pathways..

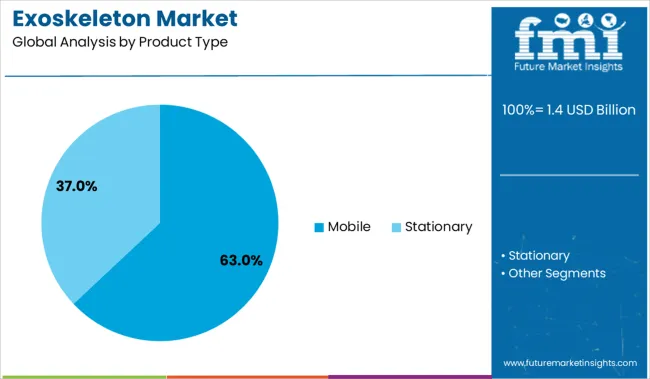

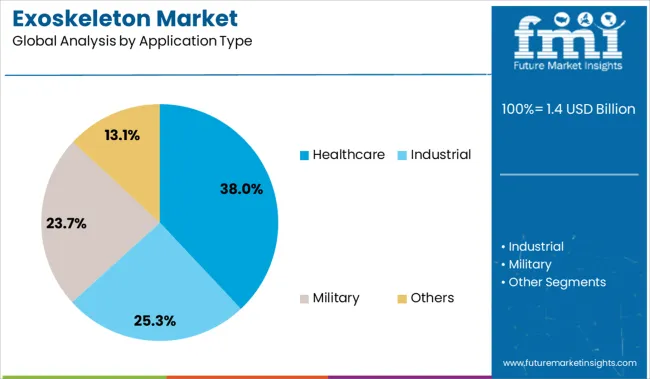

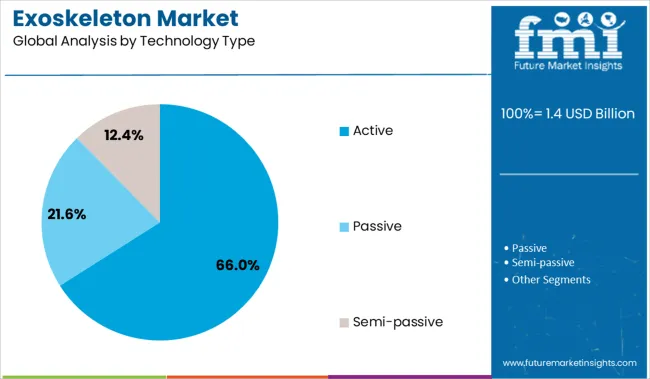

The exoskeleton market is segmented by product type, application type, technology type, and region. By product type, it includes mobile and stationary exoskeletons, designed for varying mobility and operational requirements. In terms of application type, the segmentation comprises healthcare, industrial, military, and other specialized uses, reflecting diverse demand across sectors. Based on technology type, the market is categorized into active, passive, and semi-passive systems, each offering different levels of power assistance and control. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Mobile exoskeletons are projected to hold 63.0% of the total revenue share in 2025, making them the dominant product category. Their leadership has been driven by the growing need for dynamic, user-controlled support in rehabilitation centers, personal mobility use cases, and workplace injury prevention.

Unlike stationary systems, mobile exoskeletons allow for greater freedom of movement and adaptability across varied environments, which is critical for both therapeutic and performance-enhancing applications. Improvements in battery life, material strength-to-weight ratio, and real-time kinematic calibration have contributed to their commercial scalability.

As institutions prioritize outpatient recovery, patient independence, and ergonomic safety in labor-intensive tasks, mobile units are being adopted over static alternatives due to their versatility and user-centric functionality.

Healthcare applications are expected to contribute 38.0% of the overall market revenue in 2025, securing their position as the leading use-case segment. This growth has been supported by the rising prevalence of mobility impairments, neurological disorders, and age-related degenerative conditions.

Exoskeletons are increasingly integrated into rehabilitation therapy programs for stroke recovery, spinal cord injuries, and musculoskeletal disorders, owing to their ability to deliver consistent, repetitive motion that supports neural recovery. The adoption of robotic rehabilitation tools is being reinforced by positive clinical trial outcomes, increasing insurance coverage experimentation, and institutional investment in assistive technologies.

Healthcare providers are also recognizing the role of exoskeletons in enhancing caregiver efficiency and reducing long-term dependency costs, making this application segment essential to the market’s structural growth.

Active exoskeletons are anticipated to dominate the technology landscape, accounting for 66.0% of the market revenue share in 2025. This segment’s lead has been fueled by demand for powered systems that provide real-time mechanical assistance, reducing muscle fatigue and improving gait restoration outcomes.

Active systems leverage integrated sensors, actuators, and control algorithms to mimic and support natural body movements, enhancing both patient engagement and task performance. Rapid progress in actuator miniaturization, AI-based motion prediction, and wearable battery solutions has made active exoskeletons more practical and ergonomic for long-term use.

Their capability to adapt to individual biomechanics in real time has broadened adoption across medical rehabilitation, industrial lifting, and military endurance applications. As performance expectations rise and use cases diversify, active technology is positioned as the preferred architecture for functional, scalable, and intelligent exoskeleton systems.

Demand for exoskeletons continues to rise across rehabilitation, industrial, and defense sectors as organizations prioritize injury prevention and performance enhancement. Sales of powered wearable suits increased sharply in 2025, driven by measurable gains in worker safety and mobility outcomes. Expanded FDA approvals and favorable economics are accelerating transition from pilot studies to scaled implementation across logistics, healthcare, and military domains.

Deployments of industrial exoskeletons in logistics and warehouse operations grew 22% year over year in 2025, reflecting their impact on worker safety. Amazon reported a 19% decrease in lower-back strain incidents after introducing passive back-support exosuits in trial sites.

Automotive manufacturers in Germany and Japan recorded 15 to 18% fewer errors linked to fatigue in repetitive assembly-line functions. The installed base surpassed 63,000 units globally by end-2025, up from 47,000 in 2024. Return on investment was achieved within 16 months in many logistics settings, particularly for shoulder-assist systems in vertical handling tasks. These performance benchmarks are prompting firms to shift from experimental use to mainstream deployment.

Global sales of powered medical exoskeletons rose 28% in 2025, with strong uptake among rehabilitation centers treating stroke and spinal cord injury patients. Clinics in the United States reported a 23% improvement in motor-function recovery using gait-assist exosuits during early neurorehabilitation.

Patient session times increased by 12 minutes on average, supporting better engagement and clinician efficiency. Across the Asia Pacific, hospital adoption rose 31%, led by large-scale programs in China and South Korea. More than 400 hospitals added robotic-assisted therapy in 2025. Device leasing models lowered upfront costs by 35%, enabling adoption among mid-tier facilities and outpatient care providers in Europe.

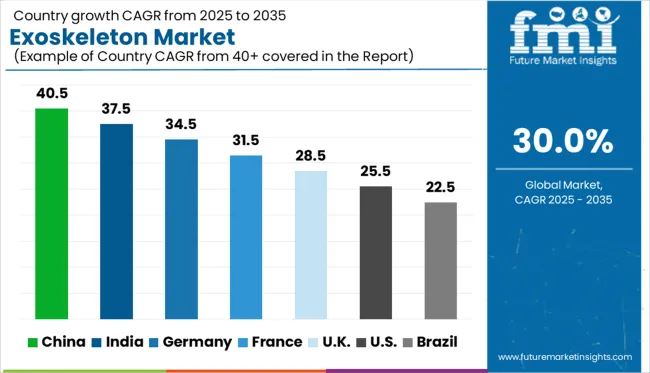

| Countries | CAGR |

|---|---|

| China | 40.5% |

| India | 37.5% |

| Germany | 34.5% |

| France | 31.5% |

| UK | 28.5% |

| USA | 25.5% |

| Brazil | 22.5% |

The global market is projected to expand at a compound annual growth rate of 30.0% from 2025 to 2035. China leads with a 40.5% CAGR, driven by investment in aging care robotics and scalable rehabilitation infrastructure. India follows at 37.5%, supported by assistive mobility programs and government-funded innovation in defense.

Germany is forecast to grow at 34.5%, with strong support from industrial safety protocols and state-backed R&D. The United Kingdom is expected to post 28.5% growth, slightly below the global average due to a focus on niche applications. The United States will see 25.5% CAGR, reflecting regulatory maturity and slower reimbursement evolution despite a robust innovation pipeline. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to achieve a CAGR of 40.5% from 2025 to 2035, extending growth driven by industrial and military use during 2020 to 2024. Clinical applications are now expanding, with a shift toward eldercare and post-stroke rehabilitation. Government health initiatives and state funding are encouraging hospitals to deploy gait-assist devices. Meanwhile, domestic manufacturers are increasing production volumes, which is improving affordability and accelerating deployment in high-risk sectors like construction and logistics.

India is expected to post a CAGR of 37.5% from 2025 to 2035, building on pilot deployments and growing market familiarity established during 2020 to 2024. Healthcare applications are widening, particularly in neurorehabilitation and spinal injury therapy. Industrial users are beginning to adopt passive suits to address ergonomic stress among workers. Local startups are gaining traction by offering low-cost and context-specific solutions for the Indian market.

Germany is forecast to grow at a CAGR of 34.5% through 2035, building on industrial trials and academic research conducted between 2020 and 2024. The focus is now shifting toward integration in factory safety systems and robotic rehabilitation centers. Automotive firms are leading demand, supported by public R&D subsidies and aging workforce considerations. Healthcare networks are integrating gait training exosuits into neurorehabilitation therapy under insurance reimbursement schemes.

The United Kingdom is set to expand at a CAGR of 28.5% from 2025 to 2035, with early use seen in research settings and pilot deployments during 2020 to 2024. In the next phase, adoption is increasing across public health and commercial logistics environments. National Health Service institutions are validating robotic gait systems for neurological recovery. Private-sector firms are experimenting with ergonomic aids in high-lift operations. Medtech startups are receiving funding through innovation grants to accelerate commercialization.

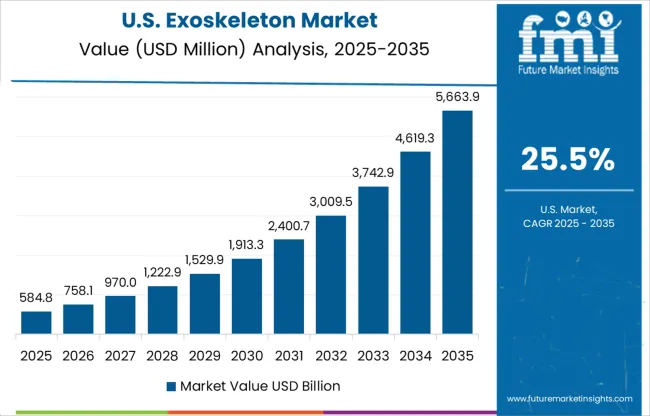

The United States is projected to grow at a CAGR of 25.5% through 2035, following a research-heavy phase between 2020 and 2024. Broader commercial and clinical deployment is now taking shape. Military programs are investing in powered exosuits for mobility and endurance. Hospitals are scaling up stroke and spinal injury programs that use gait-assist devices. Insurance firms are slowly approving reimbursement for outpatient applications, which is expected to support future growth.

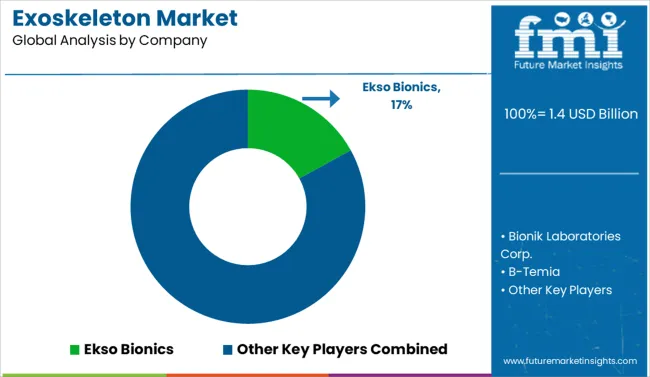

Ekso Bionics leads the global market with a 17% share, supported by a broad portfolio of FDA-cleared devices for mobility rehabilitation and industrial safety. ReWalk Robotics and Bionik Laboratories are expanding their footprint in neurorehabilitation, especially for spinal and stroke recovery.

Cyberdyne Inc. and REX Bionics are developing AI-driven systems with real-time movement adaptation and predictive gait support. Ottobock and Parker Hannifin are pushing lightweight passive exosuits into industrial applications for load reduction and ergonomic support.

Hyundai and Lockheed Martin are actively developing powered exoskeletons for logistics and military operations. Industry competition is intensifying around battery efficiency, real-time motion sensing, and device weight reduction.

In June 2024, Ekso Bionics launched a collaboration with Shepherd Center to assess the use of EksoNR and Ekso Indego in both inpatient rehabilitation and home-based care. The research initiative aims to enhance training protocols and improve recovery for patients with spinal cord and brain injuries.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product Type | Mobile and Stationary |

| Application Type | Healthcare, Industrial, Military, and Others |

| Technology Type | Active, Passive, and Semi-passive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ekso Bionics, Bionik Laboratories Corp., B-Temia, Cyberdyne Inc., Gogoa, Hocoma, Hyundai Motor Company, Levitate Technologies, Inc., Lockheed Martin Corporation, Noonee, Ottobock SE & Co. KGaA, Parker Hannifin, ReWalk Robotics, REX Bionics, and Sarcos |

| Additional Attributes | Dollar sales by exoskeleton type (powered, passive, hybrid) and application (industrial, healthcare, defense), demand dynamics across rehabilitation, worker ergonomics, and military use, regional adoption leadership in North America and fast‑grower Asia‑Pacific, innovation in AI‑enabled actuation and materials, environmental impact of battery use and device lifecycle. |

The global exoskeleton market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the exoskeleton market is projected to reach USD 19.7 billion by 2035.

The exoskeleton market is expected to grow at a 30.0% CAGR between 2025 and 2035.

The key product types in exoskeleton market are mobile and stationary.

In terms of application type, healthcare segment to command 38.0% share in the exoskeleton market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

The Medical Bionic Implant and Exoskeleton Market is segmented by Bionic Forelimbs/Hand Bionics, and Bionic Legs/Lower Limbs from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA