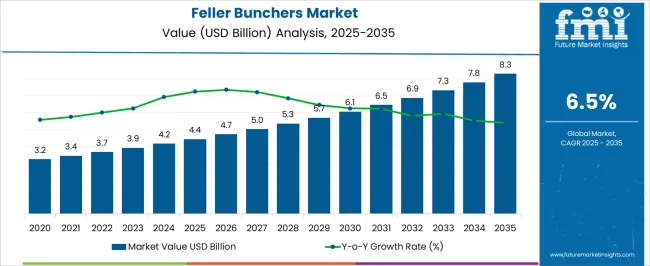

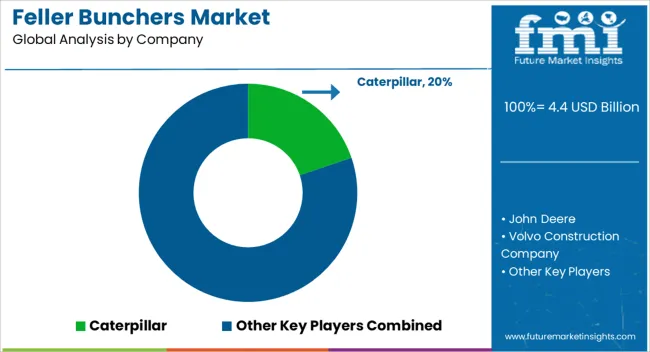

The feller bunchers market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The feller bunchers market is valued at USD 4.4 billion in 2025 and is projected to reach USD 8.3 billion by 2035, with a CAGR of 6.5%. The saturation point analysis reveals key growth phases and highlights how market expansion continues despite eventual deceleration in certain regions and segments. From 2021 to 2025, the market experiences steady growth, moving from USD 3.2 billion to 4.4 billion, passing through intermediate values of USD 3.4 billion, 3.7 billion, and 3.9 billion. This early phase reflects moderate growth, fueled by expanding forestry operations and the need for efficient logging equipment. Increasing mechanization in forest management, especially in North America and Europe, contributes to this rise.

Between 2026 and 2030, the market shows stronger momentum, growing from USD 4.4 billion to 6.5 billion, with values reaching USD 4.7 billion, 5.0 billion, 5.3 billion, and 5.7 billion. The rapid adoption of feller bunchers in emerging markets, as well as technological innovations such as automated systems and eco-friendly features, contributes to accelerated growth during this period.

From 2031 to 2035, the market continues to rise from USD 6.1 billion to 8.3 billion, with a saturation point approaching as markets mature. Although growth continues, it becomes more gradual due to high market penetration in developed regions, highlighting a stabilization in growth as newer, more advanced solutions become widely adopted.

| Metric | Value |

|---|---|

| Feller Bunchers Market Estimated Value in (2025 E) | USD 4.4 billion |

| Feller Bunchers Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The feller bunchers market is shaped by five key parent markets that drive its growth, demand, and technological advancements across the forestry and construction sectors. The forestry and logging equipment market contributes the largest share, about 30-35%, as feller bunchers are essential for cutting and collecting trees in large-scale logging operations, improving efficiency and productivity in timber harvesting. The construction and earthmoving equipment market adds approximately 20-24%, as feller bunchers are increasingly used in construction projects to clear land, prepare sites for development, and manage vegetation.

The agriculture and land management market contributes around 15-18%, with feller bunchers being employed in forest management and land reclamation projects to control vegetation growth and maintain the health of ecosystems. The heavy equipment rental market accounts for roughly 12-15%, as feller bunchers are often rented for short-term projects, enabling businesses to access specialized equipment without the cost of ownership. Finally, the sustainable forestry and environmental management market represents about 8-10%, as the push for sustainable forestry practices has led to the adoption of advanced feller bunchers equipped with environmentally friendly features such as low emissions, fuel efficiency, and precision cutting.

The feller bunchers market is growing steadily, driven by rising mechanization in forestry operations and the need for efficient timber harvesting solutions. Industry reports and forestry equipment manufacturer updates have noted that increasing demand for high-output logging equipment, particularly in commercial forestry, is pushing operators toward advanced feller buncher models.

Expansion of logging activities in both developed and emerging markets, coupled with stricter safety regulations, has encouraged the adoption of machines that reduce manual labor risks while improving productivity. Technological improvements in hydraulic systems, operator cabins, and attachment versatility have enhanced machine performance and operational comfort.

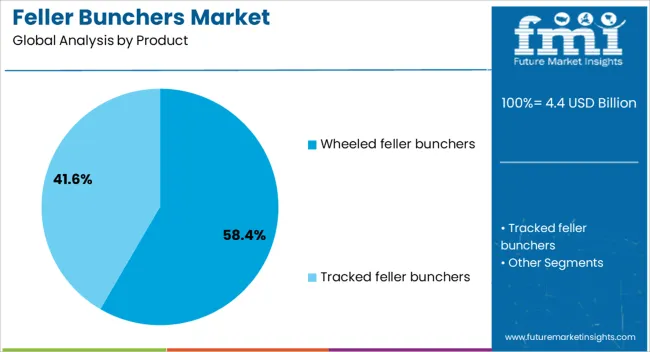

Moreover, sustainable forest management practices are prompting investment in equipment that can harvest trees with minimal soil disruption and improved precision. The market is expected to maintain upward momentum as forestry companies modernize fleets, with wheeled models, manual operation systems, and diesel-powered configurations dominating due to their established performance and operational familiarity.

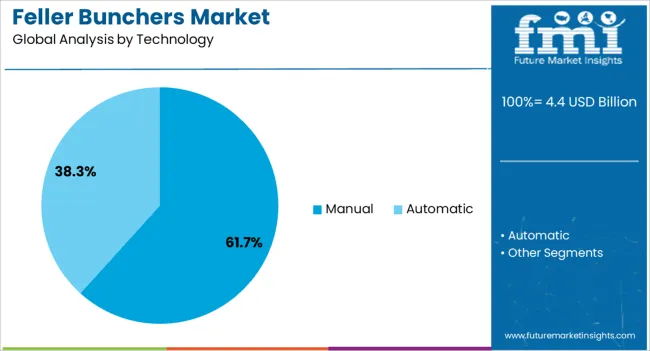

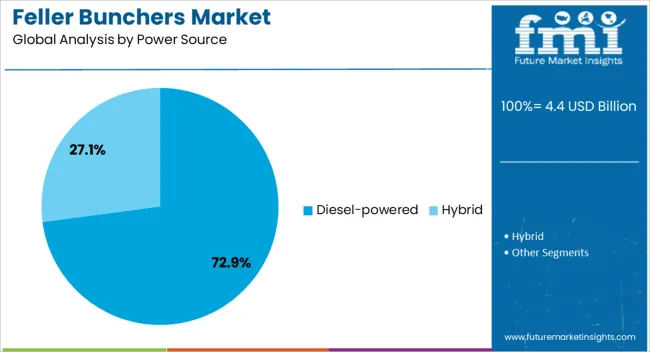

The feller bunchers market is segmented by product, technology, power source, application, end user, and geographic regions. By product, feller bunchers market is divided into wheeled feller bunchers and tracked feller bunchers. In terms of technology, feller bunchers market is classified into manual and automatic. Based on power source, feller bunchers market is segmented into diesel-powered and hybrid. By application, feller bunchers market is segmented into logging, land clearing, and construction. By end user, feller bunchers market is segmented into forestry companies, construction companies, government agencies, and individuals. Regionally, the feller bunchers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wheeled feller bunchers segment is projected to account for 58.4% of the market revenue in 2025, holding its lead due to its superior mobility and versatility in varied terrain conditions. Forestry operators have favored wheeled configurations for their ability to travel quickly between cutting sites, reducing downtime during operations.

Manufacturers have designed wheeled feller bunchers with improved stability and traction systems, allowing efficient performance on both firm and moderately soft ground. Additionally, their lower ground disturbance compared to tracked alternatives aligns with sustainable forestry practices.

Reduced transport and maintenance costs have further cemented their preference among logging contractors. These advantages, combined with adaptability in mixed harvesting environments, are expected to sustain the wheeled segment’s market leadership.

The manual technology segment is expected to capture 61.7% of the market revenue in 2025, maintaining its dominant position due to its reliability and cost-effectiveness in forestry operations. Manual control systems in feller bunchers have remained popular among operators who prefer direct machine handling for precise cutting and tree placement.

This approach reduces dependence on complex automation systems, which can be costlier to maintain and require specialized training. In remote forestry locations, the simplicity of manual systems ensures higher operational uptime and easier repairs.

Equipment makers have also enhanced manual systems with ergonomic controls and hydraulic assistance, improving operator efficiency without sacrificing the control precision valued in manual operation. These factors continue to support strong adoption of manual technology in diverse forestry applications.

The diesel-powered segment is projected to hold 72.9% of the market revenue in 2025, leading the power source category due to its proven performance and high torque output necessary for heavy-duty logging operations. Diesel engines have been the preferred choice for forestry equipment owing to their durability, fuel efficiency under load, and ability to operate in remote areas without reliance on electrical infrastructure.

Advances in diesel engine design have improved emission profiles, meeting stricter environmental regulations while retaining high operational capacity. Furthermore, the global availability of diesel fuel ensures uninterrupted operations in diverse geographies.

Manufacturers have continued to integrate fuel management systems and engine optimization technologies to reduce operational costs. This combination of accessibility, reliability, and power delivery ensures that diesel-powered feller bunchers will remain the dominant choice in the market.

The feller bunchers market is growing due to rising demand for efficient logging equipment in forestry operations. Technological advancements, automation, and real-time monitoring are driving productivity improvements, while environmental regulations and sustainability concerns create challenges for the industry. Opportunities lie in emerging markets and the adoption of eco-friendly solutions, such as electric and hybrid feller bunchers. As governments push for sustainable forest management practices, the demand for precision logging equipment will continue to rise. Manufacturers focused on fuel efficiency, low-emission technologies, and compliance with environmental regulations are well-positioned to capitalize on these trends.

The feller bunchers market is experiencing growth due to the increasing demand for efficient logging and forestry equipment. Feller bunchers, used to cut down trees and group them into bundles for easy transport, are essential for modern forestry operations. As the global demand for timber and wood products rises, along with stricter environmental regulations, the need for high-performance, eco-friendly logging equipment has grown. These machines are preferred for their ability to quickly and effectively fell multiple trees in a single pass, reducing labor costs and improving productivity. Key players like Caterpillar, John Deere, and Komatsu are leading the market by offering technologically advanced feller bunchers that meet the evolving demands of the forestry industry.

The feller bunchers market is being driven by advancements in technology and automation. Modern feller bunchers are equipped with advanced GPS systems, telematics, and automated controls that improve their precision, efficiency, and safety. These technological improvements enable operators to track equipment performance in real-time, optimize fuel consumption, and enhance productivity. Additionally, automation features are helping reduce the labor required for logging tasks, allowing forestry companies to lower operational costs. As the industry continues to embrace Industry 4.0, the demand for highly automated and smart logging machinery like feller bunchers is expected to increase, further driving market growth.

Despite the growth of the feller bunchers market, the industry faces challenges related to environmental regulations and sustainability concerns. Logging operations are often subject to stringent environmental rules, including restrictions on land clearing, carbon emissions, and habitat destruction. Manufacturers of feller bunchers must comply with these regulations while maintaining high levels of efficiency. Furthermore, concerns about deforestation and the environmental impact of large-scale logging are prompting companies to develop more eco-friendly machinery that reduces soil compaction and minimizes damage to surrounding ecosystems. These factors create challenges in balancing efficiency, performance, and environmental responsibility.

The feller bunchers market is witnessing trends toward improved fuel efficiency and the development of eco-friendly solutions. With rising fuel costs and increasing environmental concerns, manufacturers are focusing on creating more fuel-efficient feller bunchers. These innovations help reduce operating costs while also lowering the carbon footprint of logging operations. Additionally, there is a growing interest in electric-powered and hybrid feller bunchers, which offer lower emissions and quieter operations. These eco-friendly alternatives are gaining popularity in regions with stringent environmental regulations. As sustainability becomes a larger focus in the forestry industry, the demand for fuel-efficient, low-emission feller bunchers is expected to rise.

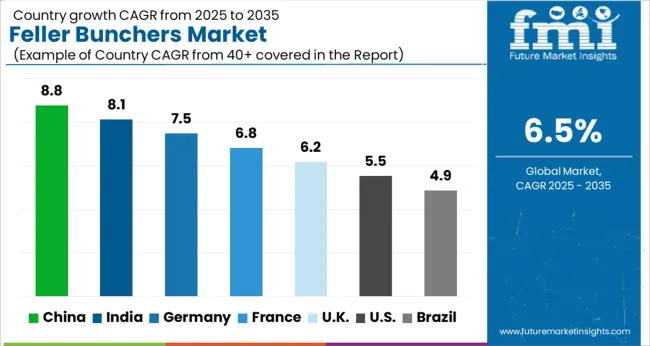

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

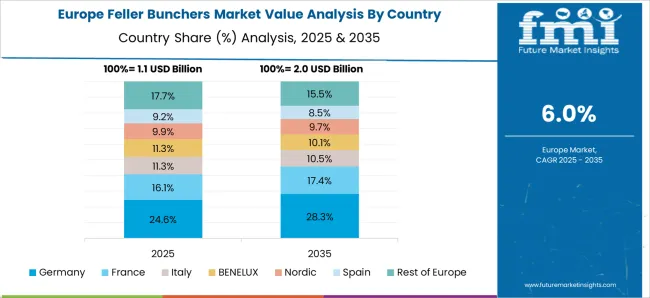

The global feller bunchers market is expected to grow at a CAGR of 6.5% from 2025 to 2035, with China leading the market at 8.8%, followed by India at 8.1%. Germany, France, the UK, and the USA also show steady growth, with CAGRs ranging from 6.2% to 5.5%. China and India are driving market growth through increased mechanization in forestry and timber harvesting, spurred by rising demand for timber in construction and manufacturing. The UK and USA markets are expanding due to government support for modernization and the growing need for efficient equipment. In contrast, Germany’s growth is driven by its established timber sector and innovations in industrial forestry solutions. The analysis includes over 40 countries, with the leading markets shown below.

The feller bunchers market in China is expected to grow at a CAGR of 8.8% from 2025 to 2035. The demand is primarily driven by the expansion of the country’s forestry and timber industries, with a focus on mechanizing operations for greater efficiency. China, one of the largest timber producers globally, is increasingly adopting advanced machinery to improve productivity and reduce labor costs in logging operations. The government’s initiatives to modernize the agricultural and forestry sectors further promote the use of feller bunchers. The growing demand for timber in construction and manufacturing industries fuels the need for efficient harvesting equipment. With China’s vast forest cover and expanding industrial base, the market for feller bunchers is poised for continued growth in the coming decade.

The feller bunchers market in India is projected to grow at a CAGR of 8.1% from 2025 to 2035. The country’s growing forestry and timber industries, combined with increased demand for mechanized logging solutions, are key drivers of this market’s growth. As the timber industry expands to meet the growing needs of the construction and paper sectors, the adoption of feller bunchers is rising.India’s increasing population and expanding urbanization require more efficient timber harvesting to meet demand. The Indian government’s support for agricultural modernization and mechanization in rural areas is further contributing to the rise in feller buncher usage. This shift toward mechanized solutions helps improve operational efficiency and reduce the physical toll on workers.

The feller bunchers market in France is expected to grow at a CAGR of 6.8% from 2025 to 2035. The country’s established forestry industry, coupled with rising demand for efficient timber harvesting solutions, creates a favorable environment for feller buncher adoption. France’s timber sector is an essential part of its economy, and there is increasing demand for mechanized equipment to improve productivity and reduce operational costs. The country’s emphasis on enhancing industrial equipment for timber processing further supports the growth of the feller bunchers market. France’s strong presence in the European timber market and its modern infrastructure for forestry operations are expected to drive the demand for advanced harvesting machines in the years ahead.

The UK feller bunchers market is projected to grow at a CAGR of 6.2% from 2025 to 2035. The growing demand for efficient and mechanized timber harvesting equipment in the UK is a key factor contributing to this market’s growth. As the forestry industry continues to modernize, the need for advanced machinery like feller bunchers to increase productivity and efficiency is rising. The UK has a growing construction industry, which directly influences the demand for timber and, in turn, drives the need for feller bunchers. The UK government’s efforts to improve forestry operations and reduce labor-intensive practices further promote the adoption of mechanized harvesting solutions.

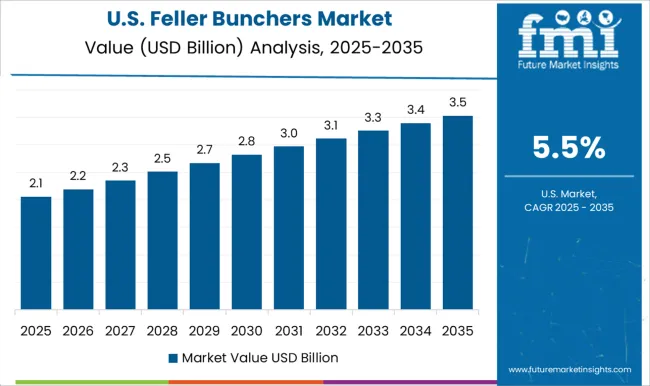

The USA feller bunchers market is projected to grow at a CAGR of 5.5% from 2025 to 2035. The demand for feller bunchers in the USA is driven by the country’s large and diverse forestry industry, which requires efficient and high-performance machinery to meet the growing need for timber. The USA timber industry, vital for construction, pulp, and paper sectors, is focusing on mechanizing its operations to improve efficiency and reduce labor costs. The government’s policies encouraging the adoption of modern forestry equipment are driving the market. The continuous advancements in feller buncher technology are expected to further increase market growth by providing more efficient and cost-effective solutions.

Competition in the feller bunchers market is shaped by product durability, cutting-edge technology, and the ability to meet the demanding needs of the forestry and logging industries. Caterpillar leads with its high-performance feller bunchers, offering a range of machines designed for maximum productivity and efficiency. Their product brochures emphasize robust construction, fuel efficiency, and advanced hydraulic systems, making them ideal for heavy-duty logging applications in diverse environments. Caterpillar differentiates through innovation, including machine control systems that optimize fuel consumption and enhance operational control.

John Deere competes by offering versatile and technologically advanced feller bunchers equipped with telematics and user-friendly controls. Their brochures highlight the ease of operation, low maintenance costs, and powerful engines that allow operators to tackle a variety of forestry tasks, from thinning to clear-cutting. John Deere emphasizes its global service network and reliable support, making it a trusted brand for large-scale forestry operations. Volvo Construction Company offers feller bunchers that focus on fuel efficiency and operator comfort.

Their product brochures emphasize ergonomic design, advanced control systems, and durable undercarriages that enhance machine longevity in tough forest environments. Volvo’s commitment to sustainability is highlighted in their marketing materials, promoting environmentally friendly technologies that reduce emissions and optimize fuel use. Ponsse Oyj stands out with its innovative and specialized feller bunchers designed for various types of forestry work, including thinning and clear-cutting. The company’s brochures showcase features like advanced cutting and handling technology, as well as operator-centric design for comfort and productivity in remote and challenging locations. Tigercat International Inc. competes with heavy-duty, high-performance feller bunchers engineered for optimal cutting precision and reliability.

Their brochures emphasize the durability of their machines in demanding environments, alongside advanced machine control systems that ensure maximum efficiency and reduced downtime. Kesla offers compact and cost-effective feller bunchers ideal for smaller operations or specific applications, with brochures highlighting ease of use, maintenance efficiency, and affordability. Their products are targeted at niche markets, emphasizing practicality and versatility for contractors requiring smaller-scale forestry equipment.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 billion |

| Product | Wheeled feller bunchers and Tracked feller bunchers |

| Technology | Manual and Automatic |

| Power Source | Diesel-powered and Hybrid |

| Application | Logging, Land clearing, and Construction |

| End User | Forestry companies, Construction companies, Government agencies, and Individuals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, John Deere, Volvo Construction Company, Ponsse Oyj, Tigercat International Inc., and Kesla |

| Additional Attributes | Dollar sales by product type, application, and engine power are rising, driven by forestry mechanization, tech advancements, and efficient logging needs. Strong growth is seen in North America, Europe, and Asia-Pacific. |

The global feller bunchers market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the feller bunchers market is projected to reach USD 8.3 billion by 2035.

The feller bunchers market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in feller bunchers market are wheeled feller bunchers and tracked feller bunchers.

In terms of technology, manual segment to command 61.7% share in the feller bunchers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA