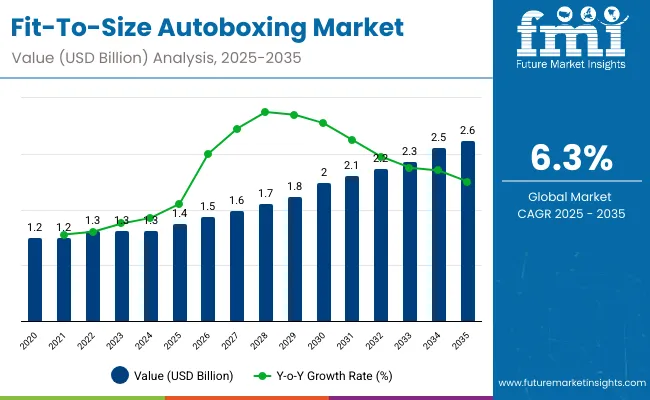

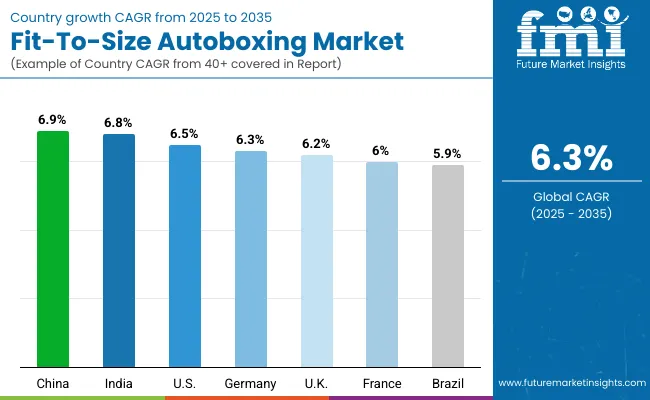

The fit-to-size autoboxing market is expected to grow from USD 1.4 billion in 2025 to USD 2.6 billion by 2035, resulting in a total increase of USD 1.2 billion over the forecast decade. This represents an 85.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 6.3%. Over ten years, the market grows by a 1.9 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 6.3% |

In the first five years (2025-2030), the market progresses from USD 1.4 billion to USD 1.9 billion, contributing USD 0.5 billion, or 41.7% of total decade growth. This phase is shaped by e-commerce and logistics players adopting right-sized packaging to reduce shipping costs and material waste. Sustainability regulations further accelerate early adoption.

In the second half (2030-2035), the market grows from USD 1.9 billion to USD 2.6 billion, adding USD 0.7 billion, or 58.3% of the total growth. This acceleration is supported by integration of AI-driven dimensioning systems, automated cartonization, and on-demand packaging materials. Growth in omnichannel retail and cross-border trade strengthens adoption, positioning fit-to-size autoboxing as a cornerstone of efficient and eco-friendly packaging operations.

From 2020 to 2024, the fit-to-size autoboxing market grew from USD 1.0 billion to USD 1.3 billion, supported by rising e-commerce volumes and sustainability regulations targeting packaging waste reduction. Nearly 70% of revenues were controlled by OEMs delivering automated, on-demand box-making solutions. Leaders such as Packsize, CMC Machinery, and WestRock emphasized right-sized packaging, corrugated material efficiency, and throughput speed. Differentiation focused on box dimension accuracy, integration with warehouse management systems, and operational cost savings, while AI-based carton optimization remained secondary. Service-driven offerings like preventive maintenance and operator training accounted for less than 20% of revenues, with capital-intensive installations dominating investments.

By 2035, the fit-to-size autoboxing market will reach USD 2.6 billion, growing at a CAGR of 6.30%, with AI-optimized packaging and subscription-driven service models contributing over 40% of total value. Competitive intensity will rise as providers introduce cloud-linked carton design, robotic handling integration, and predictive diagnostics. Established players are pivoting toward hybrid offerings that merge machine automation with SaaS-based optimization platforms. Emerging firms such as Panotec, BCS Corrugated, and Sealed Air are gaining traction by introducing recyclable corrugated materials, modular box-making systems, and energy-efficient autoboxing machines that align with global sustainability goals and growing e-commerce fulfillment needs.

The growing demand for cost-efficient, sustainable, and automated packaging is driving growth in the fit-to-size autoboxing market. These machines optimize box dimensions to product size, reducing void fill and shipping costs while enhancing protection. Rising e-commerce volumes and logistics efficiency needs are key factors accelerating adoption worldwide.

Autoboxing systems equipped with advanced sensors, AI-driven dimensioning, and high-speed automation are gaining traction for their ability to minimize material waste. Their integration with warehouse management systems improves throughput, while compact, energy-efficient designs align with sustainability initiatives. Enhanced consumer experience from reduced packaging bulk further supports widespread market growth.

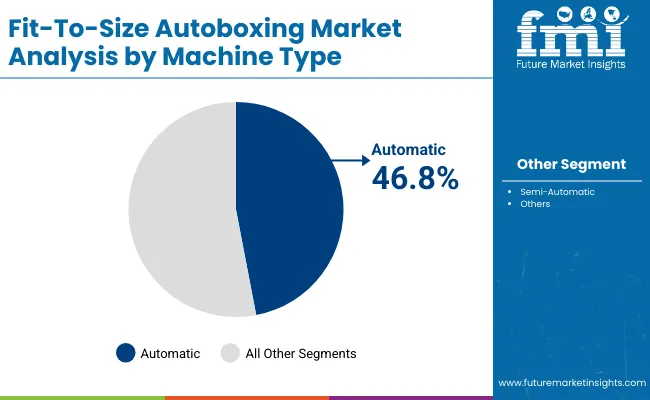

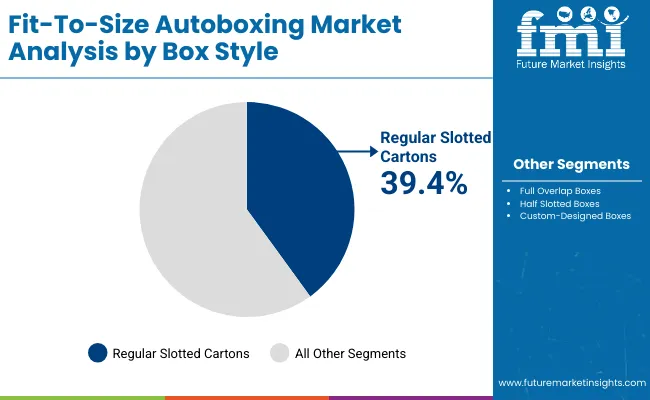

The market is segmented by machine type, box style, automation technology, application, end-use industry, and region. Machine type segmentation includes automatic fit-to-size autoboxing machines and semi-automatic fit-to-size autoboxing machines, supporting flexible packaging requirements and varying throughput levels. Box style covers regular slotted cartons (RSC), full overlap boxes, half slotted boxes, and custom-designed boxes, catering to different shipping and storage needs.

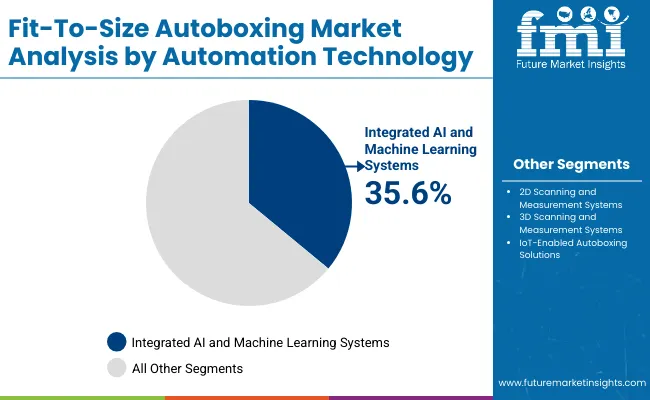

Automation technology includes 2D scanning and measurement systems, 3D scanning and measurement systems, integrated AI and machine learning systems, and IoT-enabled autoboxing solutions, enabling precision and operational efficiency. Applications span corrugated boxes, folding cartons, e-commerce shippers, and returnable packaging. End-use industries include e-commerce and retail, logistics and warehousing, electronics and consumer goods, food and beverages, and pharmaceuticals and healthcare. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Automatic fit-to-size autoboxing machines are projected to account for 46.8% of the market in 2025, driven by their ability to create custom-sized boxes at high speed with minimal manual intervention. These machines improve efficiency by reducing void fill, shipping costs, and packaging waste. Their scalability makes them ideal for large e-commerce and distribution centers.

Adoption is reinforced by the rise of automation in packaging operations, where high order volumes demand rapid, precise solutions. Integration with conveyors, printers, and labeling systems further enhances workflow continuity. With sustainability and efficiency prioritized, automatic machines remain the cornerstone of this market.

Regular slotted cartons (RSC) are forecast to hold 39.4% of the market in 2025, supported by their cost-effectiveness, structural strength, and widespread acceptance. Their standardized design makes them compatible with automatic autoboxing systems, reducing downtime during packaging. RSCs are widely used in e-commerce and retail shipments.

Their adoption is supported by versatility across product categories, from electronics to apparel. The format’s efficient use of corrugated board reduces waste while maintaining durability. As businesses aim for operational efficiency, RSC boxes remain the preferred style in automated autoboxing.

Integrated AI and machine learning systems are expected to represent 35.6% of the market in 2025, as they optimize box creation through real-time data analysis and predictive algorithms. These technologies improve accuracy in dimension measurement and minimize packaging material usage.

Their integration allows machines to self-adjust for varying product sizes and reduce errors. AI-driven systems also support sustainability initiatives by cutting carbon footprints. As packaging moves toward smarter, adaptive solutions, AI integration cements its role as a leading technology in autoboxing.

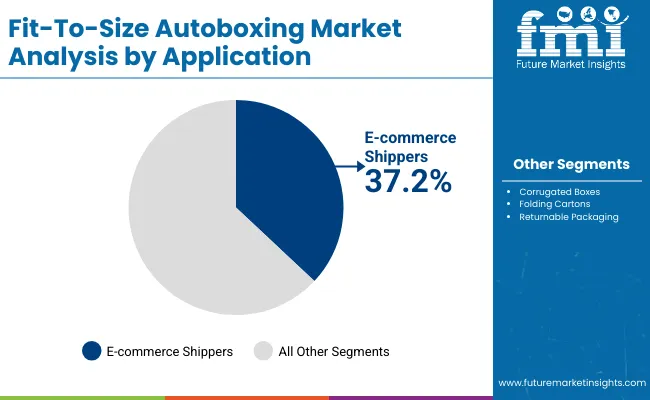

E-commerce shippers are projected to capture 37.2% of the market in 2025, reflecting the rapid expansion of online retail. Fit-to-size autoboxing ensures safe, efficient delivery by minimizing packaging waste and reducing shipping costs for high-frequency, small-parcel orders.

Retailers and logistics providers benefit from automated box customization, which enhances operational speed and sustainability. Consumer expectations for eco-friendly packaging further accelerate adoption. With e-commerce volumes rising globally, this application remains the core demand driver.

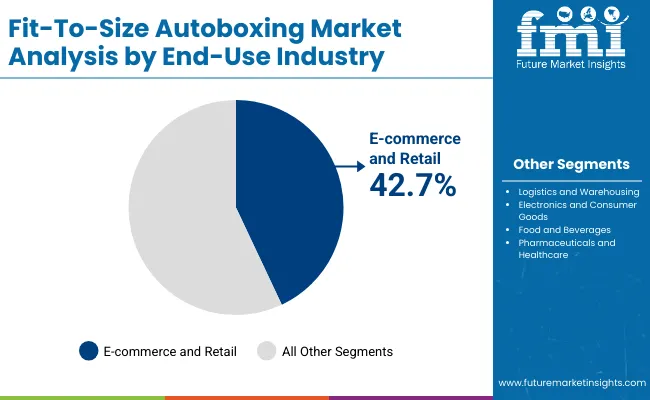

The e-commerce and retail sector is expected to account for 42.7% of the market in 2025, as businesses prioritize efficiency and customer experience. Fit-to-size packaging reduces material costs while enhancing product protection and unboxing appeal.

Major retailers adopt these systems to handle diverse SKUs and unpredictable order volumes. Automation supports real-time scalability, making it essential for peak shopping seasons. As sustainability and operational efficiency converge, e-commerce and retail remain the anchor end-use sector for this market.

The fit-to-size autoboxing market is expanding as e-commerce and logistics sectors seek automation to improve packaging efficiency, reduce void fill, and cut shipping costs. Rising demand for sustainable, right-sized packaging solutions is driving adoption. However, high capital investment and integration challenges with existing fulfillment systems restrain growth. Advances in AI-driven box optimization, on-demand packaging, and recyclable material compatibility are shaping future opportunities.

Operational Efficiency, Sustainability, and E-commerce Growth Driving Adoption

Fit-to-size autoboxing machines automatically create custom-sized boxes tailored to product dimensions, minimizing excess packaging and material waste. E-commerce and logistics providers benefit from reduced shipping volumes, lower freight costs, and improved sustainability performance. By eliminating manual packing steps, these systems increase throughput and reduce labor dependency. Enhanced product protection also reduces returns and damages, improving overall customer satisfaction. These factors position autoboxing as a key enabler of scalable, eco-friendly logistics operations.

High Equipment Costs, Integration Complexity, and Workforce Training Restraining Growth

Adoption faces challenges due to significant capital investment required for advanced autoboxing machinery and software. Integration with warehouse management systems and conveyor networks can be technically complex, often demanding infrastructure upgrades. Smaller businesses may find it difficult to justify costs without high shipping volumes. Workforce training is also necessary to manage machine operations, troubleshooting, and maintenance. These barriers slow adoption among SMEs despite growing demand in high-volume e-commerce and logistics hubs.

AI-driven Optimization, Sustainable Materials, and On-demand Packaging Trends Emerging

Key trends include the integration of AI algorithms to optimize box sizing in real time, enhancing material efficiency and lowering shipping costs. Machines are increasingly being designed to work with recyclable and biodegradable corrugated materials, supporting circular economy goals. On-demand packaging, where boxes are produced only when needed, is gaining traction to reduce storage requirements. Cloud-based analytics and IoT integration are also emerging, enabling performance monitoring and predictive maintenance. These innovations are redefining fit-to-size autoboxing as a critical tool for sustainable and intelligent packaging automation.

The global fit-to-size autoboxing market is expanding steadily, driven by rising e-commerce volumes, packaging cost reduction needs, and sustainability goals. Asia-Pacific is emerging as the fastest-growing region, with China and India adopting automated right-sized boxing to cut material waste and improve logistics efficiency. Developed economies such as the USA, Germany, and Japan are focusing on advanced systems integrated with AI, IoT, and robotics, ensuring optimized packaging operations, lower emissions, and compliance with global sustainability regulations.

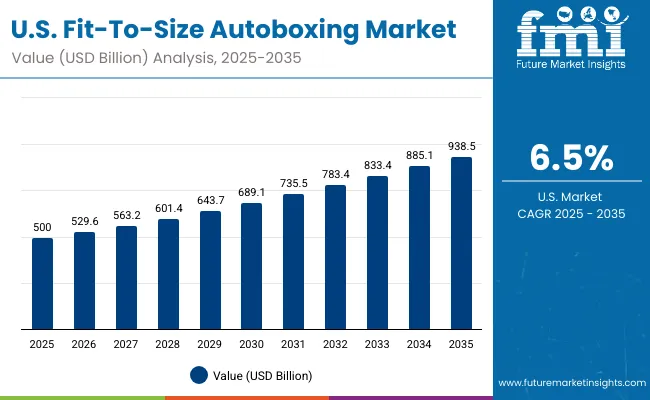

The USA market is projected to grow at a CAGR of 6.5% from 2025 to 2035, fueled by rising e-commerce, fulfillment centers, and retail logistics. Automation is central, with companies deploying AI-powered machines that create customized boxes on demand. Growth is supported by labor cost reduction, reduced shipping volumes, and increased consumer demand for eco-friendly packaging. USA firms are prioritizing advanced autoboxing technologies with real-time monitoring to improve throughput and reduce corrugate waste significantly.

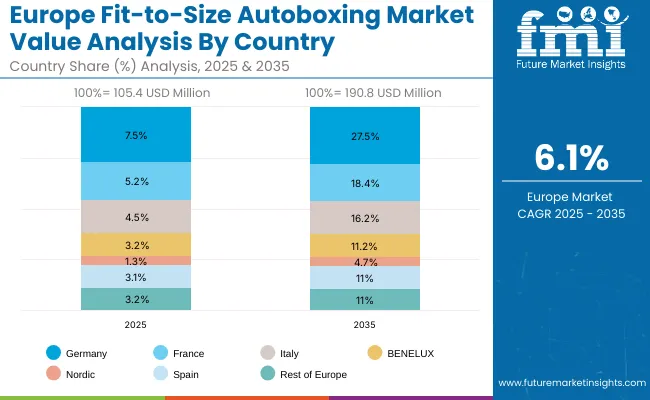

Germany’s market is expected to grow at a CAGR of 6.3%, supported by its strong logistics and manufacturing sectors. Demand is rising for automated systems that meet EU sustainability directives and reduce packaging material usage. German OEMs are innovating modular, high-speed autoboxing machines for large fulfillment centers. Adoption is also being accelerated by export industries, where right-sized packaging ensures lower freight costs and compliance with international green packaging regulations.

The UK market is forecast to grow at a CAGR of 6.2%, driven by growth in e-commerce, retail, and SMEs. Companies are adopting fit-to-size autoboxing machines to minimize void fill, reduce shipping costs, and improve sustainability. Regulatory pressures around packaging waste are reinforcing demand for smart solutions. SMEs are leveraging compact, cost-effective systems that enhance flexibility, ensuring alignment with UK sustainability and e-commerce growth initiatives.

China’s market is projected to grow at a CAGR of 6.9%, supported by large-scale e-commerce, manufacturing, and export activities. Government initiatives to reduce packaging waste and enhance logistics efficiency are accelerating adoption. Domestic OEMs are scaling affordable, AI-enabled autoboxing machines for mass deployment. Rising consumer demand for sustainable packaging and growth in cross-border e-commerce are further fueling demand, making China a global leader in packaging automation technologies.

India is forecast to grow at a CAGR of 6.8%, driven by rapid e-commerce expansion, logistics growth, and government packaging sustainability programs. SMEs and large retailers are adopting automated autoboxing to minimize packaging costs and enhance compliance with export norms. Demand for low-cost, scalable, and sustainable machines is rising. With strong government support for digitalization and “Make in India” initiatives, adoption of autoboxing systems is increasing across retail, logistics, and manufacturing ecosystems.

Japan’s market is projected to grow at a CAGR of 6.0%, led by e-commerce, electronics, and high-value retail segments. Compact, automation-ready machines are preferred due to space constraints in warehouses. Companies are focusing on precision packaging that reduces void space and enhances sustainability. Innovation is centered on AI-enabled monitoring systems and recyclable corrugated materials, aligning with Japan’s strong cultural emphasis on efficiency, quality, and environmental responsibility in packaging operations.

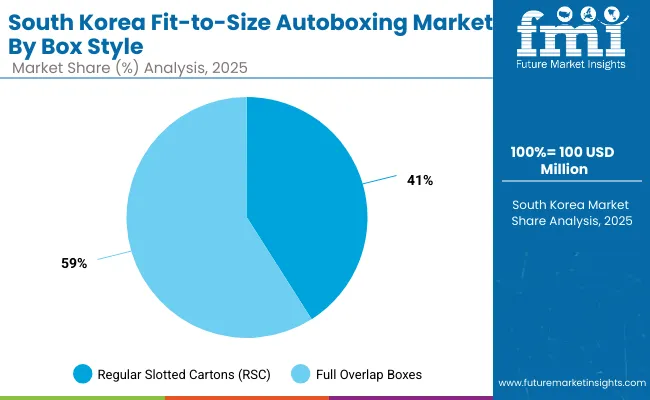

South Korea’s market is expected to grow at a CAGR of 6.2%, supported by its strong e-commerce, cosmetics, and electronics industries. Export-driven demand is pushing adoption of smart autoboxing machines capable of reducing material waste and ensuring compliance with international standards. Local OEMs are innovating automation-friendly, eco-compliant autoboxing systems. Rising consumer preference for eco-friendly packaging in K-beauty and K-food exports is reinforcing the importance of right-sized packaging solutions.

Japan’s fit-to-size autoboxing market, valued at USD 200 million in 2025, shows semi-automatic fit-to-size autoboxing machines leading with 52.5% share, reflecting strong adoption among mid-sized operations seeking cost efficiency and flexibility. Automatic machines hold 47.5%, serving high-volume industries where precision and speed are critical. The preference for semi-automatic systems highlights Japan’s balance between automation and operator control, particularly for customized packaging runs. Automatic machines, however, continue to gain traction with rising investments in digitalization and smart manufacturing. This distribution indicates Japan’s pragmatic approach, where businesses adapt automation levels to optimize production efficiency, resource utilization, and packaging versatility.

South Korea’s fit-to-size autoboxing market in 2025, valued at USD 100 million, is dominated by full overlap boxes, which capture 59.7% share due to their superior strength and protection for heavy-duty applications. Regular slotted cartons (RSC) follow with 40.3%, reflecting their cost-effectiveness and widespread use in logistics and retail packaging. Half-slotted and custom-designed boxes currently show negligible adoption. The dominance of full overlap boxes demonstrates South Korea’s focus on durability and efficiency in industrial supply chains, particularly for electronics and manufacturing exports. Meanwhile, RSC cartons remain popular for versatility and affordability, supporting South Korea’s growing e-commerce packaging demand.

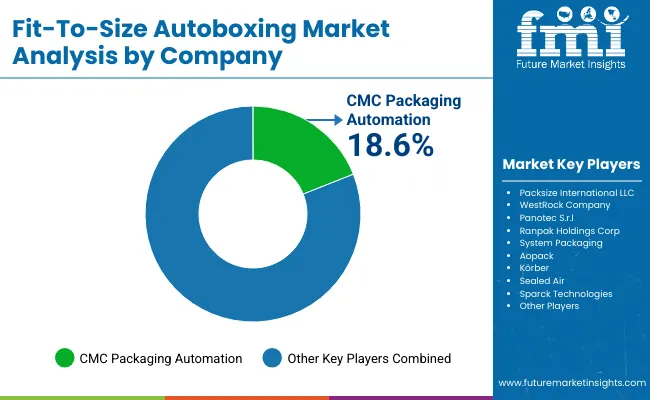

The fit-to-size autoboxing market is moderately fragmented, with global packaging automation providers, corrugated packaging leaders, and logistics solution firms competing across e-commerce, retail, and industrial supply chains. Global leaders such as CMC Packaging Automation, Packsize International LLC, and WestRock Company hold notable market share, driven by on-demand box-making technology, integration with order fulfillment systems, and compliance with sustainability standards. Their strategies increasingly emphasize waste reduction, speed, and flexible packaging formats.

Established mid-sized players including PanotecS.r.l., Ranpak Holdings Corp., and System Packaging are supporting adoption of modular autoboxing systems featuring automated dimension detection, high-speed carton production, and optimized material usage. These companies are especially active in e-commerce fulfillment centers and third-party logistics hubs, offering scalable systems that reduce void fill, lower shipping costs, and improve operational efficiency.

Specialized providers such as Aopack, Körber, Sealed Air, and Sparck Technologies focus on customized fit-to-size packaging solutions for regional markets and niche industries. Their strengths lie in compact equipment designs, integration with smart warehouse systems, and innovative carton engineering, enabling clients to enhance supply chain sustainability, reduce packaging waste, and meet evolving consumer expectations for eco-friendly deliveries.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| By Machine Type | Automatic Fit-to-Size Autoboxing Machines, Semi-Automatic Fit-to-Size Autoboxing Machines |

| By Box Style | Regular Slotted Cartons (RSC), Full Overlap Boxes, Half Slotted Boxes, Custom-Designed Boxes |

| By Automation Technology | 2D Scanning and Measurement Systems, 3D Scanning and Measurement Systems, Integrated AI and Machine Learning Systems, IoT-Enabled Autoboxing Solutions |

| By Application | Corrugated Boxes, Folding Cartons, E-commerce Shippers, Returnable Packaging |

| By End-Use Industry | E-commerce and Retail, Logistics and Warehousing, Electronics and Consumer Goods, Food and Beverages, Pharmaceuticals and Healthcare |

| Key Companies Profiled | CMC Packaging Automation, Packsize International LLC, WestRock Company, Panotec S.r.l., Ranpak Holdings Corp., System Packaging, Aopack, Körber, Sealed Air, Sparck Technologies |

| Additional Attributes | Rising demand from e-commerce and logistics sectors for on-demand, right-sized packaging solutions, growing adoption of 3D scanning and AI-enabled autoboxing systems for material efficiency, increasing use of returnable packaging in retail, and sustainability goals driving reduced corrugated waste. Food, electronics, and healthcare industries are rapidly integrating fit-to-size autoboxing to optimize supply chains and minimize costs. |

The global fit-to-size autoboxing market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the fit-to-size autoboxing market is projected to reach USD 2.6 billion by 2035.

The fit-to-size autoboxing market is expected to grow at a CAGR of 6.3% between 2025 and 2035.

The key machine types in the fit-to-size autoboxing market include automatic and semi-automatic fit-to-size autoboxing machines.

The automatic fit-to-size autoboxing machines segment is expected to account for the highest share of 45.3% in the fit-to-size autoboxing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA