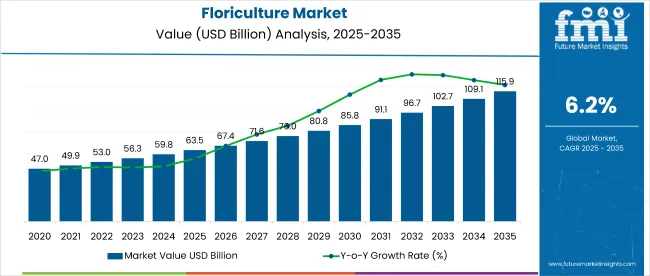

The global floriculture market is poised for significant growth, with its value estimated at USD 63.49 billion in 2025 and projected to reach USD 115.86 billion by 2035. This robust expansion reflects a CAGR of 6.2% over the study period.

Growth in the sector is driven by increasing consumer demand for ornamental plants and flowers, fueled by rising disposable incomes, rapid urbanization, and a growing interest in home décor and landscaping. Consumers are increasingly inclined to enhance their living spaces with vibrant and diverse floral arrangements, thereby boosting demand.

Additionally, technological advancements in cultivation and distribution have improved the availability, variety, and quality of products worldwide, making them more accessible. Innovations such as controlled environment agriculture and improved supply chain logistics have reduced waste and enhanced freshness, thereby strengthening the industry's appeal.

Looking ahead, the sector is likely to continue its strong upward trajectory as consumer preferences evolve and sustainability becomes central to industry practices. Innovations in automated cultivation, such as precision farming and AI-driven crop management systems, are expected to enhance production efficiency and product quality, reducing resource consumption and operational costs.

Moreover, the adoption of biodegradable packaging materials and water-efficient growing techniques is likely to gain momentum, addressing mounting environmental concerns and regulatory pressures. The expansion of e-commerce platforms and digital marketplaces is also poised to reshape distribution channels, making products more accessible to a wider global audience. Overall, the sector stands to benefit from these technological and environmental advancements, sustaining healthy growth through 2035 while catering to evolving consumer needs.

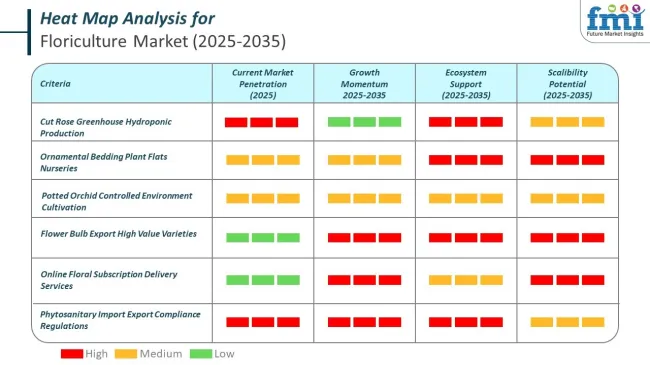

Government regulations play a crucial role in shaping industry dynamics, particularly in terms of quality standards, environmental sustainability, and international trade. Many countries have implemented strict phytosanitary measures to prevent the spread of pests and diseases, ensuring that exported flowers and plants meet health and safety criteria.

Environmental regulations are increasingly influencing cultivation practices, encouraging reduced pesticide use, water conservation, and the adoption of organic farming methods. Policies promoting sustainable packaging and waste management aim to minimize the ecological footprint of these products.

Trade regulations, including tariffs and quarantine protocols, continue to impact access, prompting stakeholders to maintain compliance while optimizing global supply chains. These frameworks aim to strike a balance between industry growth and environmental protection, as well as consumer safety.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 63.49 billion |

| Industry Value (2035F) | USD 115.86 billion |

| CAGR (2025 to 2035) | 6.2% |

Trade and import/export landscape is a critical operational factor in the Floriculture Market, with strict phytosanitary regulations shaping cross-border movement of flowers and ornamental plants in both the EU and US markets.

Per capita floriculture spending varies considerably across regions, shaped by cultural traditions, income levels, and retail sophistication. Western economies dominate in ornamental plant and flower consumption, while Asian markets remain underpenetrated but present strong growth opportunities. These contrasts highlight the importance of consumer behavior, festive culture, and technological integration in driving market dynamics globally.

Floriculture spending in North America is the highest globally, supported by a strong gifting culture and advanced retail infrastructure. Supermarkets, online stores, and subscription-based floral delivery services have made flowers more accessible, encouraging impulse purchases and recurring orders. Seasonal peaks during Mother’s Day and weddings reinforce consistent demand. Digital platforms, combined with same-day delivery services, enhance convenience and strengthen consumer engagement, making the region a key market for premium and decorative floral products.

Europe represents a mature floriculture landscape with high ornamental plant penetration and strong cultural traditions. Countries such as Germany and the Netherlands dominate both production and consumption, benefiting from robust retail channels and DIY gardening activities. A rising preference for home décor and decorative trends continues to drive floral adoption beyond festive occasions. Local sourcing and aesthetic-driven demand ensure a stable market outlook while reinforcing the region’s leadership in global floriculture practices.

The Asian floriculture market displays contrasting dynamics, blending Japan’s cultural traditions with China’s rapid modernization. Japan sustains demand through ikebana and ceremonial gifting practices, though younger consumers lean toward digital alternatives, slowing growth. In contrast, China’s market is expanding quickly, powered by rising urban incomes, lifestyle-driven aspirations, and influencer-led campaigns. Online flower delivery platforms and subscription services are revolutionizing access, positioning Asia as a key growth frontier for premium and mass floral segments.

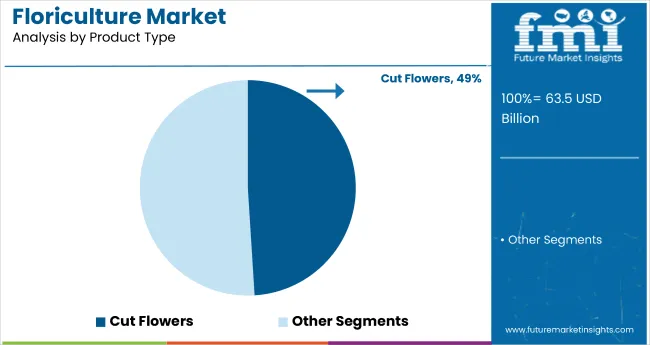

The industry is segmented by product type into cut flowers, cut foliage, plants, and propagation material; by flower type into rose, chrysanthemum, tulip, lily, gerbera, carnations, Texas bluebell, freesia, hydrangea, and others (orchids, gladiolus, alstroemeria, snapdragons); by end use into personal use, institutions/events, hotels, resorts & spas, and industrial; by sales channel into direct sales, specialty stores, franchises, florists & kiosks, supermarkets/hypermarkets, independent small stores, online retailers, and other sales channels (corporate gifting services, subscription-based delivery, event planners, wholesale distributors); and by region into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Cut flowers are projected to dominate the sector in terms of value over the forecast period. Estimated to account for USD 18.5 billion in 2025, the cut flowers segment is forecasted to reach USD 32 billion by 2035, growing at a CAGR of 6.8%.

This segment's strong growth is supported by sustained demand across personal, institutional, and hospitality applications, driven by increasing disposable incomes and the expansion of the events and gifting industries globally. Cut foliage is expected to grow moderately, demand is mainly fueled by its use as complementary greenery in floral arrangements and landscaping.

The plants segment, comprising potted and ornamental plants, is expected to grow significantly during the forecast period. Growth in this segment is driven by rising urbanization, increasing interest in home gardening, and the growing adoption of sustainable living practices.

Propagation material, the smallest segment by revenue, is projected to expand. Although this segment grows at a slower pace, it remains vital to the industry by supplying high-quality planting stock and supporting technological improvements in breeding.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Cut Flowers | 6.8% |

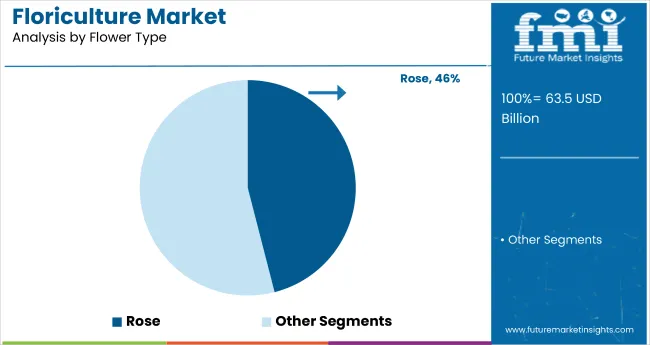

Roses are projected to retain dominance in the sector by value over the forecast period. Estimated to account for USD 12.9 billion in 2025, the rose segment is forecasted to reach USD 22 billion by 2035, growing at a CAGR of 7.1%.

This segment’s sustained expansion is supported by high global demand for roses in gifting, events, and decorative applications, reflecting their cultural significance and versatility. Chrysanthemums, the second-largest segment, are expected to grow significantly during the forecast period. This growth is driven by their popularity in seasonal décor, especially across Asia and Europe.

Segments like tulip, lily, gerbera, carnations, Texas bluebell, freesia, and hydrangea are experiencing growing demand in the floriculture market due to their diverse ornamental value, long vase life, and increasing use in events, decor, and gifting. Tulips and lilies are widely preferred for their vibrant hues and symbolic significance in weddings and cultural ceremonies.

Gerberas and carnations are gaining traction for corporate gifting and floral arrangements because of their availability in a range of colors and affordability. Native varieties like Texas bluebell are becoming popular in eco-conscious landscaping due to their adaptability and low maintenance needs.

Freesia and hydrangea are increasingly used in premium bouquets and seasonal displays, driven by rising disposable incomes and consumer preference for exotic floral designs. The “others” category-comprising orchids, gladiolus, alstroemeria, and snapdragons-continues to grow due to their role in luxury floristry, export-oriented cultivation, and rising adoption in urban home gardening. Together, these trends reflect expanding floriculture demand across retail, hospitality, and ceremonial channels globally.

| Flower Type Segments | CAGR (2025 to 2035) |

|---|---|

| Roses | 7.1% |

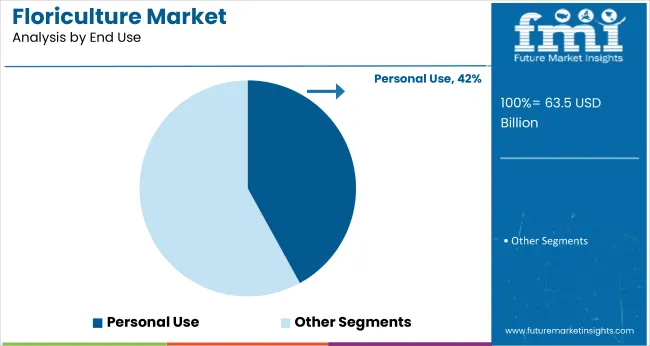

The personal use segment is projected to retain dominance in the sector, contributing the largest share by value over the forecast period. Estimated to account for USD 20.5 billion in 2025, personal use is forecasted to reach USD 38 billion by 2035, growing at a CAGR of 7%. This sustained expansion is supported by rising consumer spending on home décor, gifting, and wellness-related plant purchases, driven by increasing disposable incomes and urbanization.

The segments including institutions and events, hotels, resorts, and spas, and industrial users are witnessing notable growth in the floriculture market due to their increasing emphasis on aesthetics, ambiance, and customer experience. Institutions and event organizers rely heavily on floral arrangements for ceremonies, corporate gatherings, and public functions, where flowers enhance décor and symbolize celebration.

Hotels, resorts, and spas are investing in fresh and exotic floral decorations to elevate guest satisfaction, align with wellness branding, and promote a serene atmosphere. Daily floral displays in lobbies, rooms, and spa treatment areas have become standard, especially in luxury segments.

Meanwhile, the industrial sector is adopting floriculture for eco-landscaping around office campuses and production facilities, driven by sustainability goals and the need to create greener, more employee-friendly environments. These segments benefit from the rising availability of customized floral solutions and the integration of floriculture into brand identity and environmental responsibility strategies.

| End Use Segments | CAGR (2025 to 2035) |

|---|---|

| Personal Use | 7% |

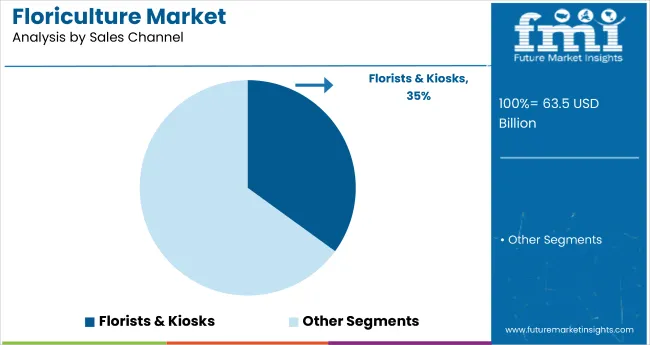

Online retailers are projected to lead the sector by value over the forecast period. Estimated to account for USD 7.5 billion in 2025, online retail is forecasted to reach USD 18 billion by 2035, growing at a CAGR of 9.2%. This segment’s rapid expansion is supported by increasing consumer preference for convenient and contactless shopping, enhanced digital platforms, and broad geographic reach across mature and emerging industries.

Sales channels such as direct sales, specialty stores, franchises, florists and kiosks, supermarkets/hypermarkets, and independent small stores are all experiencing growth in the floriculture market due to rising consumer access, personalization, and convenience.

Direct sales and specialty stores thrive by offering curated arrangements and exotic varieties tailored for weddings, anniversaries, and premium gifting. Franchises benefit from brand recognition and standardized service quality, attracting loyal customers across urban and suburban areas. Florists and kiosks remain integral for last-minute purchases and localized customization, especially in high-footfall areas like malls and transit points.

Supermarkets and hypermarkets are expanding floral sections to drive impulse buying, leveraging their established supply chains and broad customer base. Independent small stores, often family-owned, offer localized service and strong community relationships.

| Sales Channel Segments | CAGR (2025 to 2035) |

|---|---|

| Online Retailers | 9.2% |

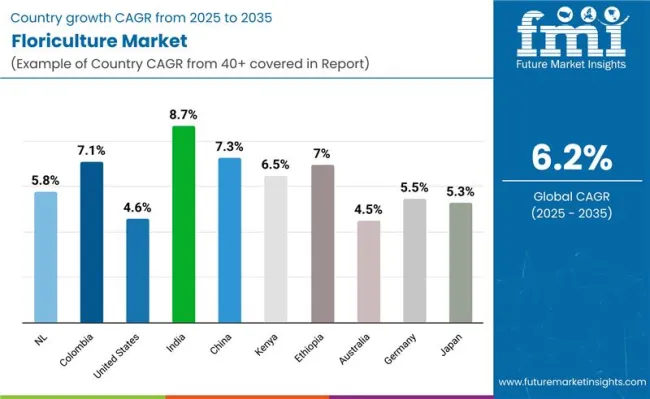

The Netherlands is projected to grow from USD 10.8 billion in 2025 to USD 19.7 billion by 2035, registering a CAGR of 5.8%. This country holds a dominant position in the global floriculture market due to its advanced greenhouse technology, sophisticated breeding programs, and highly efficient logistics infrastructure.

The regulatory environment is stringent, enforcing sustainable farming practices, strict pesticide regulations, and environmental protection laws that guarantee high product quality and safety. The Dutch Flower Auctions serve as a premier global trading platform, facilitating large volumes of exports primarily to Europe and North America.

Government initiatives strongly support innovation in automation, biotechnology, and supply chain digitization, which improve productivity and reduce waste. The extensive cold chain network maintained by the industry minimizes product loss and extends the freshness of products during transit.

Rising global demand for premium, eco-friendly flowers underpins steady industry expansion. Investments in sustainable cultivation methods and digital supply chain tools are expected to maintain the Netherlands' leadership in the international sector, solidifying its strategic role for years to come.

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 5.8% |

Colombia is projected to grow from USD 6.2 billion in 2025 to USD 12.1 billion by 2035, registering a CAGR of 7.1%. The country benefits from a unique combination of high-altitude climates and favorable growing conditions, which enable year-round production, particularly of roses.

Colombia's industry is highly export-oriented, with the United States and Europe as key regions. Regulatory focus includes labor rights, pesticide use, and environmental sustainability, aligning increasingly with international certification standards. Investments in cold chain logistics and improved infrastructure have enhanced product quality and access.

The government supports sustainable agriculture through policies and subsidies aimed at reducing water consumption and chemical inputs. Despite infrastructure challenges in rural areas, public-private partnerships have begun addressing these gaps. The skilled workforce and strong trade agreements bolster Colombia's competitive advantage globally.

The growing demand for sustainably produced flowers, combined with adherence to strict quality controls, underpins robust growth. Continued improvements in compliance, infrastructure, and sustainable practices position Colombia as a critical player in industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Colombia | 7.1% |

The United States is projected to grow from USD 8.3 billion in 2025 to USD 13.5 billion by 2035, registering a CAGR of 4.6%. The USA floriculture market benefits from a large and mature consumer base with consistent demand for ornamental plants and floral gifts.

Regulatory frameworks enforce pesticide regulations, labor standards, and environmental sustainability, overseen by agencies like the EPA and USDA. Rising consumer preference for locally grown and sustainably produced flowers supports niche organic and greenhouse-grown segments. Diverse climate zones enable varied production, but the country remains reliant on imports for many flower varieties.

Distribution channels are well developed, combining brick-and-mortar stores with rapidly growing e-commerce platforms. Challenges include rising labor costs and regulatory complexity, which pressure domestic growers. Continuous innovation in breeding, packaging, and supply chain efficiency strengthens competitiveness. The USA sector’s size, combined with evolving consumer preferences toward sustainability and digital shopping, supports steady growth through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

India’s floriculture market is projected to expand from USD 3.8 billion in 2025 to USD 9.4 billion by 2035, registering a CAGR of 8.7%. The country’s diverse climatic zones enable year-round cultivation of a broad range of flowers, including roses, marigolds, jasmine, and orchids.

Rapid urbanization and a growing middle class are driving strong domestic demand for ornamental plants and cut flowers, especially in metropolitan areas. Government initiatives offer financial subsidies and technical support for infrastructure development, including cold storage, transportation, and processing facilities, thereby significantly enhancing supply chain efficiency and reducing post-harvest losses.

Regulatory frameworks are evolving steadily to improve quality standards, pesticide control, and export certifications, aligning India's products with global industry requirements. India's export destinations primarily include the Middle East and Europe, supported by favorable trade agreements that facilitate smoother cross-border trade.

Although infrastructure challenges persist, they are being gradually addressed through coordinated public and private investments. Rising consumer awareness about floral aesthetics, wellness benefits, and gifting traditions further fuel sector growth. The combination of robust domestic consumption and expanding export potential positions India as one of the fastest-growing industries worldwide.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.7% |

Sales in Chinaare expected to grow from USD 5.5 billion in 2025 to USD 11.3 billion by 2035, registering a CAGR of 7.3%. Rapid urbanization and rising disposable incomes continue to fuel demand for ornamental plants and flowers used in gifting, home décor, and public spaces.

The government enforces strict regulations on pesticide residues, environmental protection, and food safety, aligning closely with international quality standards to ensure product safety and industry access. Large-scale investments in greenhouse infrastructure and cold chain logistics significantly improve production efficiency and extend product freshness, addressing previous supply chain challenges.

While fragmented smallholder farming limits uniformity and scale, ongoing consolidation efforts and modernization programs are making progress. E-commerce platforms are expanding access, particularly among younger consumers who seek convenience, variety, and quality assurance.

Sustainable farming practices are gaining increasing importance under regulatory pressure and rising consumer environmental awareness. China’s massive domestic sector, supported by ongoing infrastructure upgrades and favorable policy incentives, ensures strong growth potential and solidifies its position as a key player globally over the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.3% |

Kenya's floriculture market is projected to grow from USD 2.7 billion in 2025 to USD 5.1 billion by 2035, representing a CAGR of 6.5%. The country's equatorial climate provides ideal conditions for year-round flower cultivation, positioning Kenya as a vital supplier to major European regions. Preferential trade agreements with the European Union facilitate smoother export processes and enhance industry access to the European market.

Kenya's regulatory frameworks emphasize strict compliance with phytosanitary standards, labor laws, and environmental sustainability practices, with increasing focus on water conservation and responsible pesticide management. Significant investments in logistics infrastructure, including cold chain facilities and transportation networks, have improved product quality and delivery reliability, reducing post-harvest losses.

Competitive labor costs combined with adherence to global sustainability certifications bolster Kenya's competitiveness in international trade. Although infrastructure challenges remain, coordinated efforts by government and private sector stakeholders are addressing these issues to improve operational efficiency. Kenya's sector is well positioned for sustained growth, driven by favorable climatic conditions, strong international demand, and regulatory alignment with global industry requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Kenya | 6.5% |

Ethiopia's floriculture market is projected to grow from USD 1.8 billion in 2025 to USD 3.6 billion by 2035 at a CAGR of 7%. The country benefits from favorable climatic conditions and high-altitude growing regions that enable year-round flower production, attracting significant foreign investment and driving sector growth.

The government actively promotes this sector as a key export industry, offering financial incentives and investing in infrastructure improvements such as road networks, cold storage facilities, and logistics systems. Regulatory frameworks focus on phytosanitary standards and environmental sustainability, though enforcement remains less stringent compared to some regional competitors.

Improvements in water management and pesticide use are ongoing, with sustainability gaining increasing emphasis across the industry. Low labor costs, expanding production capacity, and strategic location near major export regions position the country as an emerging player in the global sector. The combination of favorable climate, government support, and continued infrastructure development provides a solid foundation for steady and sustained growth throughout the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Ethiopia | 7% |

Sales in Australiaare projected to grow from USD 1.9 billion in 2025 to USD 3.1 billion by 2035, registering a CAGR of 4.5%. The market is characterized by a strong consumer preference for high-quality ornamental plants and premium flowers, driven by urban lifestyles, gardening trends, and increasing interest in wellness and sustainability.

Regulatory frameworks place significant emphasis on biosecurity measures, pesticide management, and environmental protection to safeguard native flora and promote sustainable cultivation practices. Advanced greenhouse technologies and certification programs enable the development of niche, premium product segments that cater to discerning consumers.

Australia’s relatively high production and labor costs limit large-scale industry expansion; however, innovations in controlled environment agriculture and automation partially offset these challenges by improving efficiency. Domestic consumption remains robust, fueled by lifestyle trends and growing demand for locally produced flowers.

Export activities primarily focus on high-value specialty products targeting niche segments. Overall, Australia’s sales are expected to maintain steady growth supported by stringent regulations, high-quality standards, and evolving consumer demand for sustainable, premium floral products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 4.5% |

Germany's floriculture market is projected to grow from USD 4.4 billion in 2025 to USD 7.8 billion by 2035 at a CAGR of 5.5%. The market benefits from strong consumer interest in ornamental gardening and growing demand for eco-friendly and sustainably produced floral products.

Stringent environmental and agricultural regulations enforce strict control over pesticide use, promoting organic certification and significantly influencing both domestic production and import standards. Germany’s advanced distribution networks, including specialty retailers, garden centers, and a rapidly expanding online segment, enhance industry accessibility and convenience.

Rising demand for locally sourced and sustainably produced flowers aligns closely with government initiatives that support urban greening, biodiversity, and sustainable agriculture. Investments in digital supply chains and modern sustainable cultivation methods improve operational efficiency and ensure regulatory compliance.

Germany’s sector demonstrates steady expansion, driven by increased regulatory oversight, heightened consumer environmental awareness, and continuous innovation in retail formats and marketing. These factors combine to solidify Germany’s role as a key player in Europe’s sales growth trajectory through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.5% |

Sales in Japan are projected to grow from USD 3.7 billion in 2025 to USD 6.3 billion by 2035, registering a CAGR of 5.3%. The industry is deeply influenced by cultural traditions that emphasize flower appreciation, sustaining strong and consistent domestic demand. Regulatory frameworks place a strong emphasis on quality control, pesticide regulations, and environmental conservation to ensure product safety and long-term sustainability.

Japan faces limited production capacity due to land constraints and seasonal limitations, resulting in heavy reliance on imports to meet consumer needs. Demographic shifts, particularly an aging population, are creating increased demand for low-maintenance and indoor plants that suit smaller living spaces.

High consumer expectations for aesthetics and quality drive continuous innovation in packaging, presentation, and retail formats. The rapid growth of e-commerce platforms and specialty stores further expands access to a diverse array of floral products, enhancing convenience for consumers. Despite production scale constraints, Japan maintains significance by combining its cultural importance, stringent regulatory rigor, and ongoing consumer-driven innovation, positioning it well for steady growth through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

| Key Players | Estimated Market Share |

|---|---|

| Forest Produce Ltd. | 12% |

| Selecta Cut Flowers SAU | 10% |

| Native Floral Group | 8% |

| Tropical Foliage Plants, Inc. | 7% |

| Oserian Group | 6% |

The top five players in the floriculture market collectively account for 43% of global revenues, indicating a moderately consolidated competitive landscape. Forest Produce Ltd. leads this group with an estimated 12% share of the industry, leveraging its extensive cultivation facilities and a robust global distribution network. Selecta Cut Flowers SAU holds about 10%, benefiting from advanced breeding technologies and a diverse product portfolio that caters to various consumer preferences.

The Native Floral Group captures around 8% of the landscape, focusing on quality and innovation in its floral varieties. Tropical Foliage Plants, Inc. accounts for 7%, specializing in tropical and exotic plants, while Oserian Group holds 6%, known for its sustainable practices and large-scale flower production based in East Africa.

Leading companies employ strategies centered on vertical integration, technology adoption, and geographic expansion to strengthen their positions within the sector. Forest Produce Ltd. invests significantly in automation and greenhouse technologies to increase yields and reduce operational costs. Selecta Cut Flowers continues to expand its breeding capabilities and enhance supply chain transparency to improve product quality and foster customer trust.

Native Floral Group targets premium and niche floral varieties to capture higher profit margins. Tropical Foliage Plants invests in sustainable cultivation methods to comply with evolving environmental standards. Meanwhile, Oserian Group focuses on strengthening export logistics and regulatory compliance to maintain competitiveness in global trade.

In contrast, smaller-scale players differentiate themselves through regional specialization and greater agility in responding to shifts in the industry landscape. Many of these firms concentrate on organic and sustainable production methods or cultivate unique flower varieties tailored to local demand.

These players emphasize personalized customer relationships and niche product offerings to compete effectively with larger multinational corporations. Although smaller in scale, they benefit from flexibility and the ability to swiftly adapt to emerging trends and regional consumer preferences, which helps them maintain relevance in a dynamic industry.

Overall, the sector strikes a balance between innovation and sustainability, led by dominant companies and characterized by nimble responsiveness from smaller players. This competitive mix drives ongoing growth and diversification within the industry. Together, these firms shape industry dynamics, influence pricing, and steer the development of new products, thereby contributing to the sector's resilience and global expansion.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 63.49 billion |

| Projected Market Size (2035) | USD 115.86 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in units |

| By Product Type | Cut Flowers, Cut Foliage, Plants, and Propagation Material |

| By Company Size | Rose, Chrysanthemum, Tulip, Lily, Gerbera, Carnations, Texas Blueball , Freesia, Hydrangea, and Others ( Orchids, Gladiolus, Alstroemeria , Snapdragons) |

| By End Use | Personal Use, Institutions/Events, Hotels, Resorts & Spas, and Industrial |

| By Sales Channel | Direct Sales, Specialty Stores, Franchises, Florists & Kiosks, Supermarkets/Hypermarkets, Independent Small Stores, Online Retailers, and Other Sales Channel (Corporate gifting services, Subscription-based delivery, Event planners, Wholesale distributors) |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa |

| Countries Covered | Netherlands, Colombia, United States, India, China, Kenya, Ethiopia, Australia, Germany, Japan |

| Key Players | Forest Produce Ltd., Selecta Cut Flowers SAU, Native Floral Group, Tropical Foliage Plants, Inc., Oserian Group, Esmeralda Farms, Marginpar BV, DOS GRINGOS, LLC, Flamingo Horticulture Ltd., Danziger Group, Florensis Flower Seeds UK Ltd., Verbeek Export B.V., Florance Flora |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry is expected to reach USD 115.86 billion by 2035.

The industry is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2035.

Cut flowers and plants are the leading product types, capturing the largest shares globally.

Europe, North America, and Asia Pacific are the major regions driving industry growth.

Rising disposable incomes, urbanization, increasing consumer preference for home décor, and growth in the events and hospitality sectors are primary drivers of growth.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Floriculture Market Analysis - Size, Share & Trends 2025 to 2035

Korea Floriculture Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Floriculture Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA