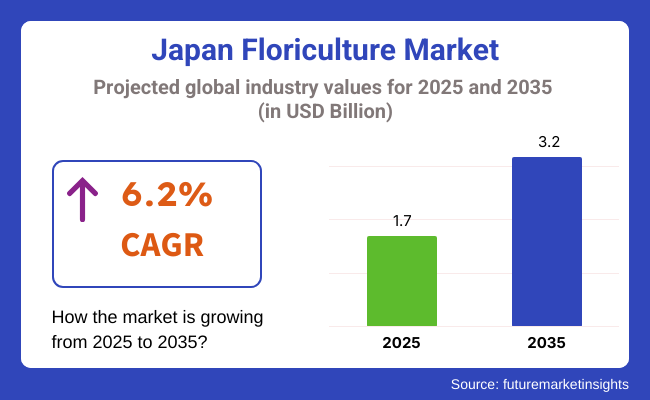

The Japan floriculture market is poised to register a valuation of USD 1.7 billion in 2025. The industry is slated to grow at 6.2% CAGR from 2025 to 2035, witnessing USD 3.2 billion by 2035. The market is witnessing rapid growth as a result of various major factors that are strongly related to the culture of the country, urban development, and shifting customer needs.

Japan has a longstanding tradition of respecting flowers as part of its own cultural heritage. Giving flowers on special festivals, holidays, and ceremonies like wedding and funeral is an age-old custom. With this cultural belief, the market for good-quality and good-looking flowers is always on the rise.

In addition, flowers are a critical part of Japanese tradition, where there is the use of decorative plants in temples, gardens, and public places. This cultural predisposition towards flowers, coupled with a changing consumer preference, is driving the growth of the floriculture market.

The trend of urbanization in Japan is another significant driver of the market. With more individuals migrating to urban areas, the market for indoor flowers and plants has grown. Urban residents, who mostly reside in apartments with little or no outdoor space, are increasingly using plants and flowers as a way of decorating their living spaces.

There is also a trend towards the use of flowers in home and office decor, which is further enhancing the market. The growing popularity of flower arrangements as interior design, both at home and in the corporate world, also adds to this growth.

The growth of e-commerce and the convenience it provides has further fueled the market's growth. Customers can now conveniently buy flowers and plants online, enabling florists and growers to access a larger customer base. Online sites also serve specialist tastes, including out-of-season or unusual flowers, which appeal to collectors and enthusiasts.

With these factors all coming together-cultural importance, urbanization, changing consumer habits, and the growth in online sales-the Japan floriculture market is set for continued growth in the next few years.

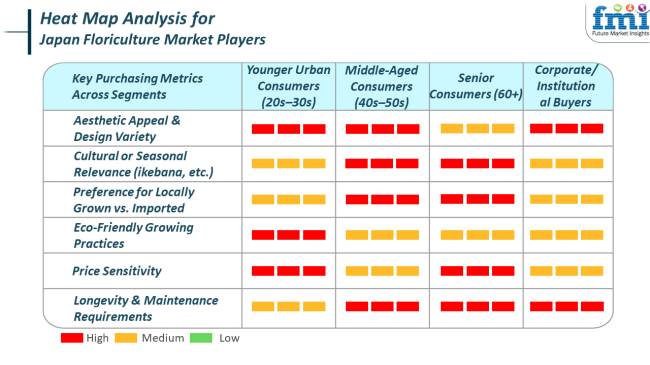

Japan's floriculture industry is influenced by wide-ranging trends and buying behaviors of the key end-use applications in the home, commercial facilities, and ceremonial activities. For the home, buying demand for flowers and ornamented plants stems from increased curiosity regarding wellness, indoor decor, and living inspired by nature.

Customers in this group value convenience, price, and low-maintenance products, tending to prefer seasonal flowers and pot plants. There is also a discernible trend towards locally grown and sustainable flowers, which mirror growing environmental consciousness.

Commercial purchasers-offices, hotels, and restaurants-on the other hand, emphasize visual appeal, brand consistency, and long-term arrangements. Simple, sophisticated flower arrangements are popular, and buying decisions are guided by quality, consistency, and availability of maintenance services.

In the event and ceremonial segment, tradition and symbolism are most important. Flowers feature in weddings, funerals, graduation ceremonies, and holidays, where certain flowers have profound cultural significance-like chrysanthemums in mourning or cherry blossoms in celebration. Here, customers prioritize freshness, timely arrival, and culturally sensitive designs. Throughout all segments, digital disruption is increasingly becoming a powerful force, and through online channels.

Between 2020 to 2024, Japan's floriculture sector experienced significant changes influenced by consumer behavior changes, technology uptake, and lifestyle changes due to the COVID-19 pandemic. The pandemic first hampered the supply chain as well as event-based demand, affecting big floral wholesalers and event floral designers.

It also caused renewed consumer interest in home gardening and indoor plants as people stayed home more. This resulted in an increase in online flower purchases, do-it-yourself floral kits, and a boost in the sale of low-maintenance ornamental plants.

The sector also experienced a slow digital shift, with conventional flower shops opening up e-commerce websites, and customers adopting contactless delivery methods. Additionally, there was a significant rise in awareness of sustainability, which led to a move towards locally grown, seasonal, and environmentally friendly flower varieties.

Forward-looking to 2025 to 2035, the sector will develop on several trends. The integration of technology is one major direction, with AI-based recommendations for online flower shopping, intelligent greenhouses, and robotic flower farming practices that increase productivity while eliminating loss.

Urbanization and high-density living will further drive demand for small-space flower solutions such as vertical gardens, miniature bonsai, and indoor hydroponic flower systems. In addition, customization and personalization will become more prominent, with consumers looking for tailored arrangements for everyday enjoyment and for special occasions.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers increasingly bought flowers and plants to improve their home environment during lockdowns. Aesthetic appearance and simplicity were major drivers. | Consumers will place greater emphasis on personalized, lifestyle-driven floral choices. Wellness, mood boost, and design compatibility will influence demand. |

| The pandemic pushed e-commerce and aided contactless delivery. | Online channels will reign supreme, with AI-driven browsing, virtual try-on for arrangements, and subscription flower delivery plans. |

| Preference was for low-maintenance, seasonal blooms and small, apartment- and small-space-friendly arrangements. | Demand will move to personalized, thematic arrangements and space-saving solutions that are specifically designed for contemporary, urban lifestyles and individual tastes. |

| Technology adoption was confined to online ordering systems and minimal logistics. Greenhouse automation was niche. | Smart greenhouses, automated cultivation, AI-driven supply chain management, and predictive analytics will be the industry standard. |

The Japanese floriculture market, although maintaining consistent growth, is exposed to some significant risks that may affect its future course. One of the greatest risks is the exposure of the supply chain, particularly due to excessive reliance on imported flowers and raw materials.

Disruptions on a global level-such as geopolitical pressures, shipping delays, or climate events-may result in price volatility and unavailability. Japan's aging agricultural population also represents a structural risk over the long term. Most flower growers are aged, and there are few young entrants into the industry, which may result in shortages of labor and lower domestic production capacity in the future.

Another major risk is the effect of climate change on floriculture. Weather patterns, temperature fluctuations, and natural disasters like typhoons and rainfall can adversely influence both the quality and quantity of floral crops. This is especially true for fragile flowers with specific growing conditions. Additionally, changing consumerism could prove to be a challenge.

Cut flowers are the most ubiquitous and culturally most meaningful in Japan. Such popularity has primarily its foundations in deeply established customs and symbolism that flowers enjoy in Japan. Particular flowers such as chrysanthemums, lilies, and orchids hold deeply established links to tradition, religious ritual, and festive occasion.

Similarly, the Japanese appreciation for simplicity, elegance, and seasonality are also found in ikebana (the flower arrangement art), which significantly depends on cut flowers to portray harmony and beauty in terms of form.

Cut flowers are also popular because of their versatility and visual appeal. They are utilized in both personal and commercial environments-seen in residences, hotel lobbies, restaurants, and offices as interior design elements. Their instant attraction and potential for rejuvenating living or working areas render them a popular choice.

Specialty stores, in the form of stand-alone flower shops and florists, are Japan's floriculture market's most popular and accepted sales channel. Such stores are firmly rooted within local culture and society, providing not just fresh cut flowers but expert guidance, made-to-order arrangements, and personalized service specifically tailored to conform to traditional Japanese floral practices.

Whether for ritual events such as weddings and funerals or holiday gift-giving, consumers frequently go to their local florists for consistent quality. Such shops also complement practices such as ikebana (arranging flowers), in which certain flowers and attention to detail in choosing them are important, so expert advice is useful.

The Japanese floriculture market is a dynamic industry marked by both multinational corporations and niche participants. It is fueled by the rich floral culture of the nation as well as the increasing need for high-quality, environmentally friendly floral products.

From the global behemoths operating with large networks to specialized growers catering to local niches, the entities drive the sector's uniquely diverse character to address the specific demands of the Japanese consumer whose tastes range from high-end flower arrangements to locally cultivated, environmentally friendly flowers.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| FS-Bloom | 6-9% |

| MIYOSHI & CO., LTD | 5-7% |

| Forest Produce Ltd. | 3-5% |

| Selecta Cut Flowers SAU | 4-6% |

| Native Floral Group | 3-5% |

| Tropical Foliage Plants, Inc. | 2-4% |

| Oserian Group | 4-6% |

| Esmeralda Farms | 3-5% |

| Marginpar BV | 2-3% |

| DOS GRINGOS, LLC | 1-2% |

| Company Name | Key Offerings/Activities |

|---|---|

| FS-Bloom | A top-tier cut flower supplier of premium roses and orchids, with emphasis on sustainability and local production in Japan. |

| MIYOSHI & CO., LTD | Famous for its extensive variety of ornamental flowers, MIYOSHI is a specialist in growing and distributing high-quality flowers, mainly in the wedding and event categories. |

| Forest Produce Ltd. | Emphasizes supplying diverse exotic and season flowers with focus on local as well as foreign floral varieties suitable for niche Japanese markets. |

| Selecta Cut Flowers SAU | A cut flower industry global market leader, Selecta Cut Flowers exports roses, chrysanthemums, and other season flowers, focusing increasingly on sustainability. |

| Native Floral Group | Deals in the production and sale of native Japanese flowers, providing unique species for retail and ceremonial purposes with an emphasis on indigenous biodiversity. |

| Tropical Foliage Plants, Inc. | Provides tropical plants and leaves to the floriculture industry, supplying greenery for decorative and interior design, with an emphasis on exotic, low-maintenance species. |

| Oserian Group | It is a leading global cut flower player that produces sustainable, quality roses and other cut flowers which are supplied to Japan's high-end floriculture market. |

| Esmeralda Farms | With a wide variety of premium flowers, especially roses and lilies, Esmeralda Farms is dedicated to sustainable agriculture and provides a stable chain supply to the Japanese market. |

| Marginpar BV | A pioneer in the supply of exotic flowers and foliage, Marginpar is dedicated to providing superior-quality, trend-setting floral compositions that appeal to the Japanese luxury market. |

| DOS GRINGOS, LLC | Engaged in bringing in and distributing cut flowers, with a particular emphasis on roses and seasonal cuts, and focused on efficient logistics to guarantee fresh deliveries throughout Japan. |

The floriculture market in Japan continues to be strong, with veteran global players such as Esmeralda Farms and Oserian Group still leading the market with their high-quality, sustainable products. Small specialist growers like Forest Produce Ltd. and Native Floral Group are establishing niche markets by highlighting locally produced flowers and unusual varieties.

With growing consumer demand in Japan for sustainability and environmentally friendly buying, those businesses that value green processes and local manufacturing, like FS-Bloom and MIYOSHI & CO., LTD, are poised for success.

With respect to type, the market is classified into cut flowers, cut foliage, plants, and propagation material.

In terms of flower type, the industry is divided into rose, chrysanthemum, tulip, lily, gerbera, carnations, Texas bluebell, freesia, hydrangea, andothers.

Based on end use, the industry is divided into personal use, institutions/events, and industrial.

In terms of sales channel, the market is classified into direct sales, specialty stores, supermarkets, online retailers, andothers.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 1.7 billion in 2025.

The industry is projected to witness USD 3.2 billion by 2035.

The industry is projected to witness 6.2% CAGR during the study period.

Specialty stores are major sales channels.

Leading companies include FS-Bloom, MIYOSHI & CO., LTD, Forest Produce Ltd., Selecta Cut Flowers SAU, Native Floral Group, Tropical Foliage Plants, Inc., Oserian Group, Esmeralda Farms, Marginpar BV, and DOS GRINGOS, LLC.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 6: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 8: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 9: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 10: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 12: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 14: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 16: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 17: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 18: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 20: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 22: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 24: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 25: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 26: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 29: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 25: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 26: Kanto Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 27: Kanto Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 28: Kanto Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 29: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 30: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 31: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 32: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 34: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 35: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 36: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 40: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 41: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 43: Kanto Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 44: Kanto Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 45: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 46: Chubu Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 47: Chubu Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 48: Chubu Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 49: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 50: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 51: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 52: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 53: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 54: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 55: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 57: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 58: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 60: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 61: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 62: Chubu Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 63: Chubu Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 64: Chubu Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 65: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 66: Kinki Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 67: Kinki Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 68: Kinki Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 69: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 70: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 72: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 73: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 74: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 75: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 76: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 77: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 78: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 80: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 81: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 82: Kinki Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 83: Kinki Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 84: Kinki Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 85: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 86: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 87: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 88: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 89: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 90: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 91: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 92: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 93: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 94: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 95: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 96: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 97: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 98: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 99: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 100: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 101: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 102: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 106: Tohoku Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 107: Tohoku Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 108: Tohoku Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 109: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 110: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 111: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 114: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 115: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 116: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 117: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 118: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 119: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 120: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 121: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 122: Tohoku Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 123: Tohoku Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 124: Tohoku Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 125: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 126: Rest of Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 134: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 135: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 136: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 140: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 141: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 142: Rest of Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 143: Rest of Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 144: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 145: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA