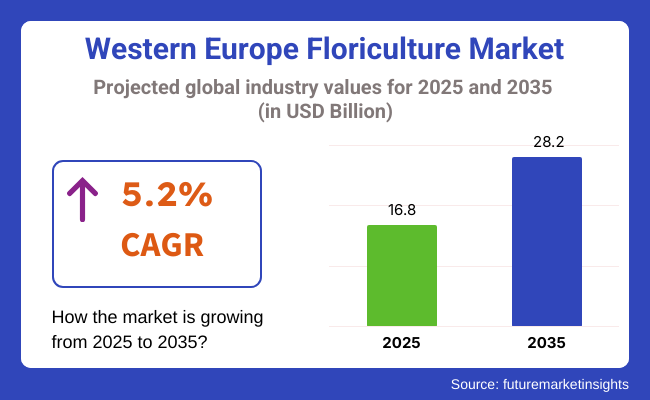

The Western Europe floriculture market is poised to register a valuation of USD 16.8 billion in 2025. The industry is slated to grow at 5.2% CAGR from 2025 to 2035, witnessing USD 28.2 billion by 2035. The industry is witnessing steady growth, driven primarily by shifting consumer trends, rising urbanization, and the growing significance of flowers in daily life and in cultural practices.

Increasing demand for floral and ornamental plants, both indoors and outdoors, due to growing consumers' desire to beautify their homes with greenery and floral elements is among the drivers. This has been fueled by the post-pandemic wellness and home enhancement trend, with plants and flowers being viewed as harbingers of serenity, nature's beauty, and emotional revitalization. Consequently, consumers are increasingly spending on flowers for enjoyment, outside the customary settings of weddings and holidays.

Another driver is the increased focus on sustainability. Consumers in nations such as the Netherlands, Germany, and France are now more aware of issues related to the environment, opting for seasonally and locally grown flowers with a low carbon footprint.

This has encouraged local floriculture practices, as well as the demand for organically produced and pesticide-free flowers. At the same time, regional governments and agricultural policies favor floriculture with grants and innovation programs to enhance yield, lower water consumption, and incorporate tech-based greenhouse management.

Flowers are also culturally a part of Western European heritage-utilized in rituals, gift-giving, and even corporate environments. The symbolic significance of flowers continues to drive steady demand across various segments. Furthermore, the development of flower delivery websites and flower-of-the-month subscriptions has made fresh flowers more readily available and convenient for consumers to incorporate into their daily lives instead of periodic indulgences. Packaging, logistics, and preservation innovations have also contributed to guaranteeing freshness and availability throughout the year.

The industry is experiencing significant changes within various end-use segments due to changing consumer preferences and new trends. Consumers in the retail sector value high-quality, visually appealing flowers, with a rising popularity for sustainability through locally grown flowers and environmentally friendly packaging. Online retailers have taken advantage of the convenience trend, providing quick delivery, ordering customization, and subscription services, with sustainability being an important purchasing influence.

Under the wholesale segment, companies prioritize cost-effectiveness and reliable supply in line with sustainability objectives and technological application for efficient logistics. For the corporate and event segment, premium, high-quality floral arrangements are prioritized, with the demand for more eco-friendly supplies.

The industry is experiencing increased demand for low-maintenance plants, particularly those that promote urban living and biodiversity, including wildflowers and pollinator plants. Consumers in this industry also look for plants that are disease- and pest-resistant, as sustainability is now the main concern.

Across every segment, the overarching trends of convenience, personalization, and sustainability are redefining buying decisions as both individual shoppers and companies put quality, the environment, and customized offerings at the top of their lists. As these trends progress, the floriculture sector will have to adapt and innovate to keep pace with the shifting needs of the industry.

From 2020 to 2024, the Western European floriculture industry underwent profound changes due to international events, altered consumer attitudes, and technological changes. The COVID-19 pandemic first caused disturbances in supply chains and resulted in short-term flower market closure and dwindling demand due to events and hospitality industries.

This was subsequently followed by a remarkable bounce back due to lockdowns with increased home gardening and online buying of flowers. E-commerce became an essential distribution channel, with retailers and growers investing in digital platforms and contactless delivery systems.

In the future, the industry will continue to evolve along three key directions: sustainability, technology, and personalization. There will be a growing demand for higher transparency in floral product sourcing and lifecycle by consumers, compelling growers towards carbon-neutral production and regenerative farming. Urban floriculture and vertical floriculture may become attractive models, especially in high-density cities looking to minimize transport emissions.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry was influenced by a mix of pandemic-induced disruptions and a consequent change in consumer lifestyle. Lockdowns and social distancing lowered demand from weddings, corporate events, and hospitality, but home gardening and DIY flower arrangements increased. | During the next ten years, the industry will be shaped by large-scale socio-environmental forces such as climate change policy, urbanization, and others. Governments and consumers will value sustainability, while urban infrastructure will increasingly include green space and vertical horticulture. |

| Consumers became more active in floriculture as a home improvemen t and mental wellness activity. This created more demand for houseplants, flower-of-the-month subscriptions, and symb olic meaning of gifting flowers. | Next-generation consumers, particularly Millennials and Gen Z, will demand greater connection with brands. They will seek transparency of sourcing, sustainability certifications, and customized experiences. |

| Environmental issues came to the forefront, particularly regarding plastic use and flower imports with high carbon values. Retailers and growers started to move to recyclable packaging, organic culture, and local materials to fit with consumer values. | Sustainability will be a standard requirement by 2035 instead of a differentiator. Priorities will include carbon neutrality, the principles of circular economy, and regenerative floriculture. The consumers will demand end-to-end supply chain transparency using blockchain or QR-code-enabled tracking. |

| Technology acted as a savior , allowing conventional growers to shift to digital sales through web-based marketplaces and contactless delivery networks. A few started to incorporate simple greenhouse automation and energy-efficient devices such as LED lights to tackle high energy expenses. Floriculture will become a technology-integrated industry in the next decade. | Logistics and cold chain management will be streamlined with real-time monitoring and predictive analysis. Shopping will be immersive at the consumer end-customers will be able to virtually stage flowers or see bouquets in their homes through augmented reality apps. |

The Western European industry continues to be strongly dependent on sophisticated international supply chains, especially for African and Latin American imports. This makes the industry vulnerable to geopolitical tensions, trade barriers, and logistical blockages. The industry witnessed the vulnerability of such systems, particularly with air freight reliance. Emerging risks in the future may be due to increased fuel prices, tighter import controls, and climate-related disruptions to producing areas.

Floriculture, particularly production under glass widespread in nations such as the Netherlands, is very energy-intensive. With increasing pressure to cut the use of fossil fuels and variations in energy prices, growers have considerable cost pressures. The transition to renewable power, although unavoidable, involves enormous capital outlays. Moreover, fertilizers, water, and pest control inputs cost and availability will vary with international supply trends and environmental regulations, jeopardizing margins.

In Western Europe, cut flowers are the most common type of floriculture because of their cultural and commercial significance. Western Europe has a tradition of using flowers in celebrations, festivities, weddings, holidays, and funerals, which provides huge demand for fresh, cut flowers.

This cultural demand is strongly ingrained, with flowers as a central part of both public and private festivities. The industry for cut flowers is also driven by the strong floral gift-giving culture of the region, where individuals tend to give flowers to celebrate special occasions or in appreciation.

One of the major drivers of the use of cut flowers throughout Western Europe is the sophisticated cultivation and transport systems that make year-round availability possible. The Netherlands, as a country, is a principal center for cut flower production, with state-of-the-art farming methods that provide quality blooms all year round. The nation's strong flower auction network, e.g., Aalsmeer Flower Auction, ranks among the largest in the globe, ensuring seamless distribution of flowers throughout Europe and the world at large.

In Western Europe, supermarkets now constitute the big sales channel of floriculture. Supermarkets alone make up the largest percentage of flower sales, as they offer convenience and expansive coverage. The majority of supermarkets carry a whole section for florals where people can easily get fresh flowers. Consumers are attracted by the convenience to visit one source to obtain new flowers as they pick up fresh food staples every day. In addition, supermarkets provide competitive prices that make flowers available to a wider population.

The Western European supermarket industry enjoys a well-organized supply chain for fresh and consistent delivery of flowers. Supermarkets closely collaborate with large-scale floriculture producers and distributors and order flowers from reputed flower centers such as the Netherlands frequently.

This robust supply chain, augmented by the capacity to buy in bulk, enables supermarkets to present a variety of flowers, from everyday to seasonal flowers, at competitive prices. In addition, supermarkets' capacity to maximize in-store promotions and discounts enhances their attractiveness to price-sensitive consumers, further solidifying supermarkets' position as the leading sales channel for flowers.

The Western European floriculture industry is extremely dynamic and competitive, fueled by a combination of established global industry players and niche specialist firms. The industry leaders are emphasizing innovation, sustainability, and enhanced quality and variety of floral offerings to accommodate changing consumer tastes.

Major players like Driscoll's of Europe B.V., Royal FloraHolland, and Flamingo Flowers Ltd. dominate the industry in terms of share, whereas specialized players like Eden Horticulture and Selecta Cut Flowers SAU. are finding space in niche organic and sustainable flower segments. With the increasing demand for environmentally friendly practices, corporations are investing more in sustainability programs, technology embedding, and premium floral products to serve commercial buyers as well as individual consumers.

Company Name Estimated Industry Share (%)

| Company Name | Estimated Industry Share (%) |

|---|---|

| Driscoll's of Europe B.V. | 10-12% |

| Royal FloraHolland | 12-15% |

| Forest Produce Ltd. | 8-10% |

| Royal Brinkman UK | 6-8% |

| Flamingo Flowers Ltd | 9-11% |

| Eden Horticulture | 4-6% |

| Selecta Cut Flowers SAU. | 5-7% |

| Native Floral Group | 3-5% |

| Tropical Foliage Plants, Inc. | 2-4% |

| Verbeek Export B.V. | 4-6% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Driscoll's of Europe B.V. | Provider of premium berries and flowers, specializing in the cultivation of high-quality, sustainable flowers. Stresses innovation through breeding and environmentally friendly practices. |

| Royal FloraHolland | Prominent global marketplace for plants and flowers, providing a wide assortment of floral items. Reputed for sustainable and efficient auctioning procedures for commercial and retail consumers. |

| Forest Produce Ltd. | Deals in the importation and distribution of fresh cut flowers. Emphasizes sustainable sourcing and provides a large range of flowers for wholesale and retail markets. |

| Royal Brinkman UK | Offers horticultural equipment and solutions, as well as flower and plant production services. Dedicated to pioneering and sustainable solutions for professional growers. |

| Flamingo Flowers Ltd. | An international flower exporter specializing in high-quality cut flowers. Renowned for sustainability programs in flower cultivation and distribution. |

| Eden Horticulture | Provides a broad variety of plants and flowers, with a focus on sustainable horticultural methods and eco-friendly product lines. |

| Selecta Cut Flowers SAU. | Specializes in the cultivation of high-quality cut flowers with a focus on sustainability and rare flower varieties. Renowned for a strong presence in the European industry. |

| Native Floral Group | Expert in native and seasonal blooms, with a distinct range of flower products. Reputable for local sourcing and eco-friendly operations. |

| Tropical Foliage Plants, Inc. | A prime supplier of tropical plants and foliage, specializing in exotic plants and blooms for the European industry. Sourcing and cultivation sustainability is a prime concern. |

| Verbeek Export B.V. | Renowned for an extensive range of flowers, Verbeek Export engages in the exportation of quality, eco-friendly flowers to global markets. |

The Western European floriculture industry is characterized by intense competition with an equilibrium of large players and small niche players specializing in high-end products. Industry giants such as Royal FloraHolland, Driscoll's of Europe B.V., and Flamingo Flowers Ltd. have a dominating presence in the industry with their use of innovation and scalability to service large-scale retail as well as direct-to-consumer needs

Sustainability is still a major trend in the industry, with businesses emphasizing minimizing environmental footprint through green packaging, sustainable sourcing, and innovative production methods. Furthermore, as consumer tastes continue to shift, there is increasing demand for niche, specialty floral products, especially in the realms of local sourcing and seasonal flowers. These trends are likely to continue influencing the industry, fueling increased innovation and competition in the coming years.

In terms of type, the industry is classified into cut flowers, cut foliage, plants, and propagation material.

Based on flower type, the industry is divided into roses, chrysanthemums, tulips, lilies, gerberas, carnations, Texas blueball, freesia, hydrangeas, and other flowers.

Based on end use, the industry is segregated into personal use, institutions/events, and industrial.

In terms of sales channel, the industry is divided into direct sales, specialty stores, supermarkets, online retailers, and others.

By country, the industry is segregated into the U.K., Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 16.8 billion in 2025.

The market is projected to witness USD 28.2 billion by 2035.

The industry is slated to capture 5.2% CAGR during the study period.

Supermarkets are major sales channels.

Leading companies include Driscoll's of Europe B.V., Royal FloraHolland, Forest Produce Ltd., Royal Brinkman UK, Flamingo Flowers Ltd., Eden Horticulture, Selecta Cut Flowers SAU., Native Floral Group, Tropical Foliage Plants, Inc., and Verbeek Export B.V.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 6: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 11: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 12: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 14: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 16: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 17: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 21: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 22: France Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: France Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 24: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 25: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 26: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 27: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 29: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 31: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Flower Type, 2018 to 2033

Table 33: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 34: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 25: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 27: UK Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 28: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 35: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 44: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 45: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 49: UK Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 50: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 54: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 55: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 56: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 57: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 58: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 59: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 60: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 63: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 67: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 68: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 69: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 71: Germany Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 72: Germany Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 75: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 76: Italy Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 77: Italy Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 78: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 79: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 80: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 81: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 82: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 83: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 84: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 86: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 87: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 88: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 89: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 90: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 91: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 94: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 97: Italy Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 98: Italy Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 99: Italy Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 100: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 101: France Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 102: France Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 103: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 104: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 105: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 106: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 107: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 108: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 109: France Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: France Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 113: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 114: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 115: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 119: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 120: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 121: France Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 122: France Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 123: France Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 124: France Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 125: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 126: Spain Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 127: Spain Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 128: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 130: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 131: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 132: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 133: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 134: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 138: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 139: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 140: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 141: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 142: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 143: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 144: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 145: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 146: Spain Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 147: Spain Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 148: Spain Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 149: Spain Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 150: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Type, 2023 to 2033

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Flower Type, 2023 to 2033

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 156: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 157: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 158: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Flower Type, 2018 to 2033

Figure 159: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Flower Type, 2023 to 2033

Figure 160: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Flower Type, 2023 to 2033

Figure 161: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 163: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 164: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 167: Rest of Industry Analysis and Outlook Attractiveness by Type, 2023 to 2033

Figure 168: Rest of Industry Analysis and Outlook Attractiveness by Flower Type, 2023 to 2033

Figure 169: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 170: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA