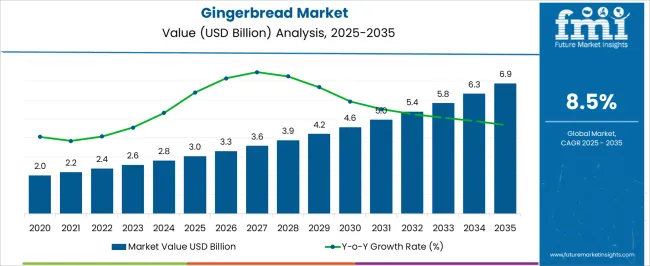

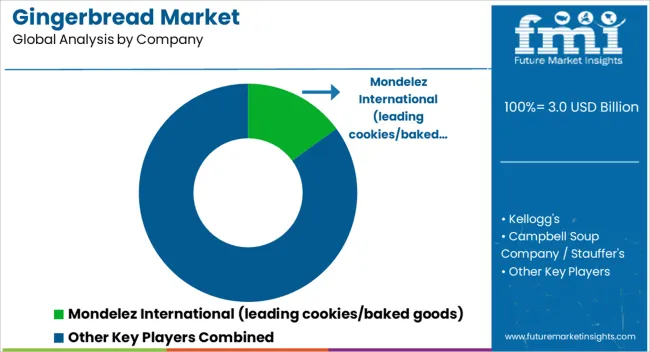

The gingerbread market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

Beginning at a baseline of USD 2.0 billion in 2024, the market demonstrates consistent upward movement, with the trough representing the lower-end growth in the early forecast years and the peak reflecting accelerated adoption in the later period. By 2027, the market climbs to USD 2.6 billion, showing early traction driven by rising consumer preference for seasonal indulgences and premium bakery innovations. Midway through the forecast, around 2030, gingerbread sales surpass USD 4.2 billion, marking the transition from a niche festive item to a mainstream bakery category, supported by healthier formulations, gluten-free options, and artisanal bakery trends.

The peak phase from 2031 to 2035 indicates sharp compounded growth, with the market crossing USD 5.8 billion in 2033 and eventually peaking at USD 6.9 billion in 2035. This trajectory highlights not only stable consumer demand but also the growing influence of e-commerce channels, festive gifting traditions, and innovative product positioning in both developed and emerging markets. The Peak-to-Trough Analysis underscores minimal volatility, signaling steady confidence in gingerbread as a market that successfully blends cultural tradition with modern consumer trends.

| Metric | Value |

|---|---|

| Gingerbread Market Estimated Value in (2025 E) | USD 3.0 billion |

| Gingerbread Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The gingerbread market holds a notable share within the broader bakery and confectionery sector, accounting for approximately 12–14% of global spiced and seasonal baked goods sales. Within the sweet baked goods category, gingerbread contributes around 8–10%, driven by consumer preference for holiday-themed, flavored, and artisanal bakery products. In seasonal confectionery and festive food segments, gingerbread captures close to 4–6% of share, supported by high demand during Christmas, winter festivals, and specialty gift-pack promotions. Growth is fueled by innovations in recipe variations, natural spice blends, and premium ingredient incorporation, enhancing flavor, shelf life, and presentation appeal.

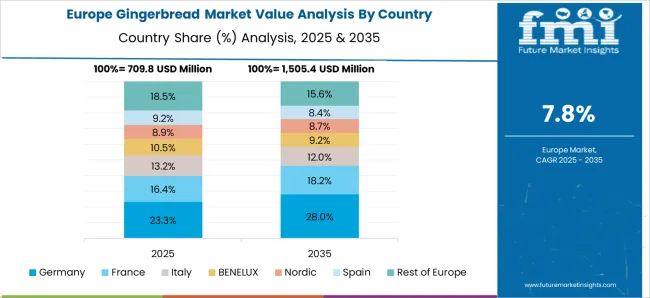

Artisan and craft bakeries are expanding production of gingerbread cookies, houses, and themed kits, while large-scale commercial bakeries are leveraging automated lines to meet holiday peak demand. Regional adoption is strongest in Europe and North America due to traditional cultural festivities, baking traditions, and gift-oriented consumer behavior, whereas Asia-Pacific is witnessing gradual penetration through Western-style holiday promotions and retail partnerships. Despite seasonal demand fluctuations and raw material price volatility, the gingerbread market maintains relevance through product diversification, festive marketing, and collaborations between confectioners, retailers, and gift-pack manufacturers, ensuring steady share growth within the global bakery ecosystem.

The gingerbread market is experiencing notable growth, supported by rising consumer interest in seasonal confectionery and traditional bakery products. Increasing demand during festive seasons, coupled with expanding year-round consumption in both developed and emerging markets, has reinforced the product’s commercial viability. Growth is being propelled by innovations in flavor profiles, packaging, and the introduction of healthier ingredient options without compromising taste.

Supply chain improvements and the availability of premium and artisanal varieties in supermarkets and specialty stores have enhanced accessibility. In addition, online retail platforms are contributing to broader distribution and consumer reach. The market is also benefitting from the integration of gingerbread products into hospitality, gifting, and event catering services.

Strategic investments in marketing, coupled with rising consumer nostalgia and cultural significance associated with gingerbread, are expected to sustain demand With increasing product diversification and expansion into new demographics, the gingerbread market is positioned for continued growth in both traditional and modern retail channels.

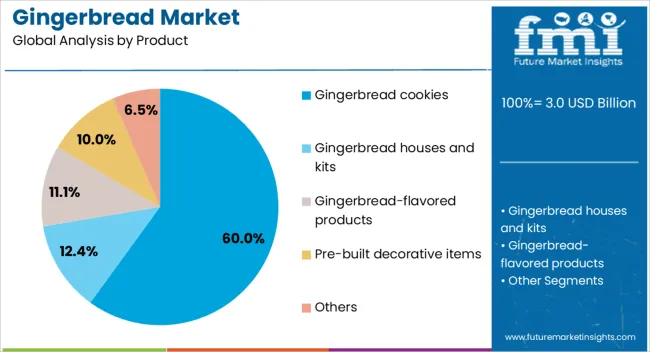

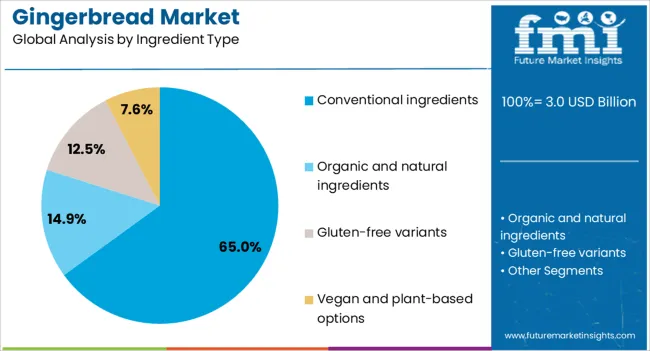

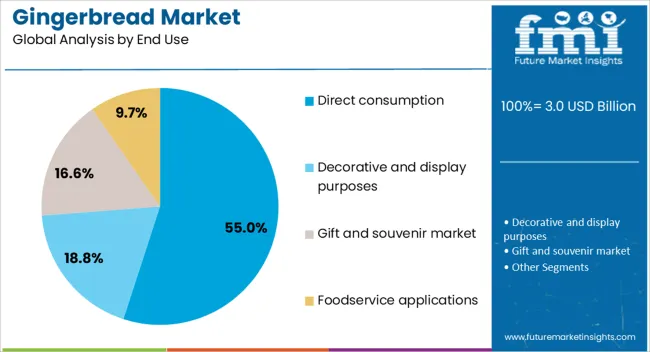

The gingerbread market is segmented by product, ingredient type, end use, distribution channel, packaging type, and geographic regions. By product, gingerbread market is divided into gingerbread cookies, gingerbread houses and kits, gingerbread-flavored products, pre-built decorative items, and others. In terms of ingredient type, gingerbread market is classified into conventional ingredients, organic and natural ingredients, gluten-free variants, and vegan and plant-based options. Based on end use, gingerbread market is segmented into direct consumption, decorative and display purposes, gift and souvenir market, and foodservice applications. By distribution channel, gingerbread market is segmented into supermarkets and hypermarkets, specialty stores and bakeries, online retail and e-commerce, convenience stores, and others. By packaging type, gingerbread market is segmented into Boxes and cartons, Pouches and bags, Clamshells and trays, Gift packaging, and Others. Regionally, the gingerbread industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gingerbread cookies product segment is estimated to hold 60% of the gingerbread market revenue share in 2025, making it the leading product category. This dominance has been driven by strong consumer preference for ready-to-eat formats that offer both convenience and traditional flavor appeal. gingerbread cookies have been favored for their versatility in shapes, decorations, and packaging, which enhances their appeal during festive occasions and gifting seasons. The segment’s growth has also been supported by mass production capabilities, enabling consistent quality and availability across retail channels. Manufacturers have increasingly focused on introducing seasonal varieties, premium ingredients, and visually appealing designs to capture consumer interest. Retail promotions and the presence of gingerbread cookies in both artisanal bakeries and large supermarkets have strengthened their market position The ability to balance tradition with innovative presentation has ensured sustained demand, enabling this category to maintain its leadership in the overall gingerbread market.

The conventional ingredients segment is projected to account for 65% of the market revenue share in 2025, making it the dominant ingredient type. This leadership has been maintained due to widespread consumer acceptance of traditional recipes that rely on familiar and time-tested components such as refined flour, butter, and classic spices. Conventional ingredient-based products are generally more affordable and accessible, enabling large-scale production and distribution. The flavor authenticity associated with conventional ingredients has contributed significantly to consumer loyalty and repeat purchases. Additionally, bakeries and manufacturers benefit from well-established supply chains for these ingredients, ensuring consistent quality and cost efficiency. While emerging demand for alternative or health-focused formulations is growing, conventional ingredient formulations continue to capture the majority share due to their alignment with consumer expectations of taste, texture, and aroma in gingerbread products The combination of tradition, availability, and affordability has cemented this segment’s leading position in the market.

The direct consumption segment is expected to hold 55% of the market revenue share in 2025, establishing it as the leading end-use category. This position has been supported by the widespread appeal of gingerbread as an immediate snack or dessert option without the need for further preparation. The segment benefits from strong seasonal demand, particularly during holidays, as well as steady off-season consumption driven by retail availability and impulse purchases. Convenient packaging formats, portion-controlled servings, and attractive product displays in supermarkets and convenience stores have contributed to increasing consumer uptake. Furthermore, the integration of gingerbread into café menus, dessert counters, and ready-to-eat bakery assortments has reinforced its visibility and accessibility. Marketing campaigns that emphasize the nostalgic and festive associations of gingerbread have further strengthened direct consumption trends The ease of purchase and immediate enjoyment offered by this segment ensures its continued dominance in the end-use landscape of the gingerbread market.

Gingerbread demand is driven by flavor innovation, festive-season trends, and expanding retail channels, while producers manage costs and ingredient sourcing to maintain competitive positioning. Seasonal peaks and consumer preferences shape market growth and product strategies.

Gingerbread product lines are witnessing growth due to rising consumer interest in novel flavors, spice combinations, and premium ingredients. Traditional recipes are being reinterpreted with inclusions like chocolate, nuts, and natural sweeteners to attract both younger and adult demographics. Seasonal offerings, such as festive houses and themed cookies, are increasingly popular in retail and e-commerce channels. Artisanal bakeries are experimenting with decorative designs, edible prints, and multi-texture compositions, enhancing visual appeal alongside taste. Consumer preference for high-quality ingredients has encouraged suppliers to adopt organic spices and specialty flours, further differentiating products in competitive markets. Retailers are leveraging these trends to drive higher seasonal revenue and customer engagement through promotions and gift packaging.

Demand for gingerbread products is heavily influenced by seasonal events, particularly winter holidays and festivals. Retail sales peak during Christmas, Thanksgiving, and related winter celebrations, with themed packaging and gift sets playing a key role. Large-scale retailers, supermarkets, and specialty stores coordinate marketing campaigns, timed promotions, and festive in-store displays to maximize sales. E-commerce channels also contribute significantly, with pre-orders and limited-edition products driving early engagement. Cultural celebrations in Europe and North America remain primary growth drivers, while Asia-Pacific markets are gradually embracing holiday-inspired baked goods. These seasonal surges require precise production planning, inventory management, and logistics coordination to avoid stockouts and ensure timely delivery.

Retailers and manufacturers are expanding distribution channels to reach a broader consumer base, including supermarkets, convenience stores, specialty food shops, and online platforms. Partnerships with large retail chains allow for mass production and wide availability, while niche bakeries focus on premium and limited-edition offerings. Online marketplaces provide visibility to younger demographics and urban populations, enabling direct-to-consumer sales and subscription models for seasonal products. Packaging innovations, including eco-friendly wraps and attractive gift boxes, support market penetration. Promotional campaigns, loyalty programs, and collaborations with influencers or celebrity chefs increase product awareness and purchase intent, creating a competitive advantage. Distribution channel diversification also mitigates regional sales variability and enhances overall revenue.

Gingerbread production faces challenges related to ingredient costs, supply chain consistency, and quality control. Spices such as ginger, cinnamon, and cloves are subject to global price fluctuations, affecting manufacturing budgets. Seasonal demand peaks require advanced planning to secure raw materials and prevent production delays. Maintaining consistent taste, texture, and quality across large-scale production requires investment in process optimization and skilled workforce. Ingredient sourcing from international suppliers can introduce logistical delays and currency-related costs. Manufacturers must balance affordability with premium product positioning to satisfy both mass-market and artisanal segments. Strategic supplier relationships and inventory management are crucial to ensure timely production and sustained profit margins throughout the year.

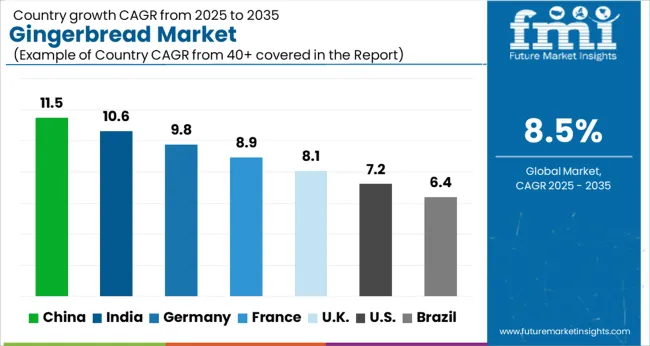

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The gingerbread market is projected to grow globally at a CAGR of 8.5% between 2025 and 2035, fueled by rising consumer interest in festive baked goods, premium flavors, and seasonal gifting trends. China leads with a CAGR of 11.5%, driven by expanding retail chains, growing holiday celebrations, and increasing demand for flavored and artisanal gingerbread products. India follows at 10.6%, supported by festive adoption, rising disposable income, and proliferation of e-commerce platforms offering specialty baked goods. France posts 8.9%, with growth driven by holiday traditions, seasonal promotions, and collaborations between artisanal bakeries and retail chains. The United Kingdom grows at 8.1%, shaped by Christmas-themed product demand, gift packaging innovations, and rising online sales, while the United States records 7.2%, reflecting steady retail sales, established festive traditions, and seasonal marketing campaigns. The analysis spans over 40 countries, with these five serving as benchmarks for production planning, marketing strategies, and seasonal distribution optimization in the global gingerbread industry.

China is projected to post a CAGR of 11.5% for 2025–2035, substantially above the global baseline of 8.5%. During 2020–2024, the market grew at 9.8%, driven by expanding holiday celebrations, e-commerce penetration, and rising adoption of flavored and artisanal gingerbread products. Early growth was supported by retail promotions, bakery collaborations, and festive gifting campaigns in urban centers. The next decade will see higher expansion due to increasing seasonal consumption, premium product launches, and rising demand for packaged and decorative gingerbread varieties. Investments in production capacity, partnerships with international bakeries, and scale-up of specialty flavors will sustain accelerated growth.

India is expected to register a CAGR of 10.6% from 2025 to 2035, up from 9.1% during 2020–2024. Initial growth was fueled by increasing festive adoption, disposable income rise, and proliferation of online specialty baked goods. Strategic collaborations with international confectioners enabled new flavor introductions and decorative offerings. The next decade will see accelerated expansion as holiday-based gifting, seasonal promotions, and demand for artisanal gingerbread scale nationwide. Growing modern retail networks and e-commerce delivery infrastructure will further strengthen market penetration across tier-1 and tier-2 cities.

France is projected to post a CAGR of 8.9% for 2025–2035, above the global baseline of 8.5%. During 2020–2024, growth was 7.5%, driven by holiday traditions, artisan bakery promotions, and retail seasonal campaigns. The initial phase saw steady expansion as classic and gourmet gingerbread varieties were embraced in urban centers. The next few years will witness higher growth as festival-driven demand, product personalization, and collaborations between local bakeries and retail chains strengthen penetration. Investments in decorative packaging and specialty flavors will further enhance visibility and sales.

The UK market is projected to post a CAGR of 8.1% for 2025–2035, slightly below the global 8.5% benchmark. During 2020–2024, growth stood at 7.0%, supported by established holiday traditions, retail promotions, and festive gifting demand. Early adoption was bolstered by seasonal product launches, premium packaging, and online retail accessibility. Over the next decade, higher growth is expected due to rising seasonal consumption, increased product customization, and expansion of decorative and artisan gingerbread varieties. Partnerships between local bakeries and large retail chains will enable wider distribution.

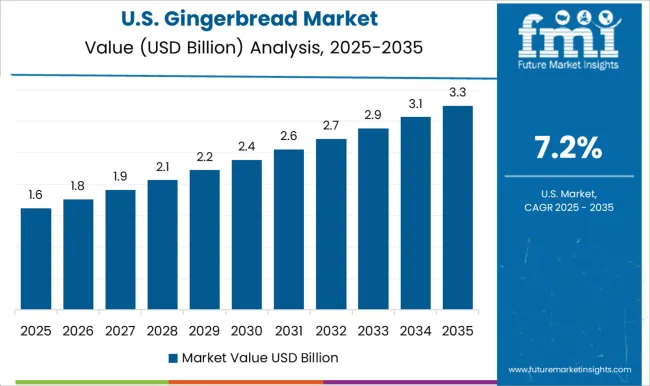

The USA market is projected to post a CAGR of 7.2% for 2025–2035, below the global 8.5% benchmark. Between 2020–2024, growth reached 6.3%, driven by long-standing holiday traditions, retail promotions, and seasonal gifting trends. Initial growth was reinforced by mainstream bakery chains introducing decorated and flavored gingerbread products. Over the next decade, moderate expansion is expected as demand for artisan, premium, and novelty holiday items rises, with seasonal campaigns and online retail boosting visibility and adoption. Investments in festive packaging and collaborative promotions between retailers and bakeries will further support market penetration.

The gingerbread market features key players such as Mondelez International, Kellanova, Campbell Soup Company/Stauffer's, Parle, Britannia, and numerous local and artisanal gingerbread makers, competing through brand recognition, flavor innovation, seasonal packaging, and distribution reach. Mondelez International leads with extensive retail penetration, emphasizing mass-produced cookies and baked goods that integrate festive flavors, premium coatings, and decorative elements suitable for gifting and holiday celebrations. Kellanova leverages its global bakery portfolio to introduce flavored gingerbread snacks, seasonal promotions, and co-branded holiday editions, targeting urban and online consumers.

Campbell Soup Company, through its Stauffer’s brand, focuses on traditional recipes and seasonal packaging to maintain heritage and appeal among long-standing customers. Parle and Britannia emphasize wide distribution, affordability, and flavored variants to capture emerging markets and festive consumption trends, balancing mass-market reach with seasonal product innovation. Local and artisanal makers differentiate through unique recipes, hand-decorated designs, and niche product offerings catering to festive gifting, premium collections, and boutique retail outlets. Competitive priorities across the market include expanding dollar sales through e-commerce and retail channels, enhancing share through flavor variety and premiumization, developing co-branding and collaboration initiatives, and scaling production during peak seasonal demand.

Companies are increasingly investing in decorative packaging, limited-edition releases, and festive marketing campaigns to strengthen consumer engagement, with the USA, UK, China, India, and France serving as focal regions for growth and strategic expansion. The market is expected to see continued innovation in flavors, seasonal designs, and cross-brand partnerships, while maintaining emphasis on quality, brand loyalty, and distribution efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 billion |

| Product | Gingerbread cookies, Gingerbread houses and kits, Gingerbread-flavored products, Pre-built decorative items, and Others |

| Ingredient Type | Conventional ingredients, Organic and natural ingredients, Gluten-free variants, and Vegan and plant-based options |

| End Use | Direct consumption, Decorative and display purposes, Gift and souvenir market, and Foodservice applications |

| Distribution channel | Supermarkets and hypermarkets, Specialty stores and bakeries, Online retail and e-commerce, Convenience Stores, and Others |

| Packaging Type | Boxes and cartons, Pouches and bags, Clamshells and trays, Gift packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mondelez International (leading cookies/baked goods), Kellanova, Campbell Soup Company / Stauffer's, Parle, Britannia, and Local & artisanal gingerbread makers |

| Additional Attributes | Dollar sales, market share, seasonal demand peaks, flavor and format preferences, distribution channels, competitor strategies, consumer demographics, pricing trends, premium vs mass segments, and emerging retail/e-commerce opportunities. |

The global gingerbread market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the gingerbread market is projected to reach USD 6.9 billion by 2035.

The gingerbread market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in gingerbread market are gingerbread cookies, gingerbread houses and kits, gingerbread-flavored products, pre-built decorative items and others.

In terms of ingredient type, conventional ingredients segment to command 65.0% share in the gingerbread market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA