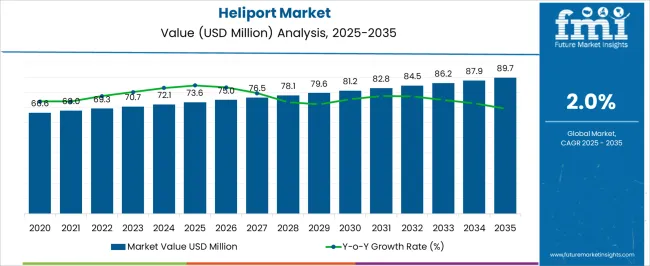

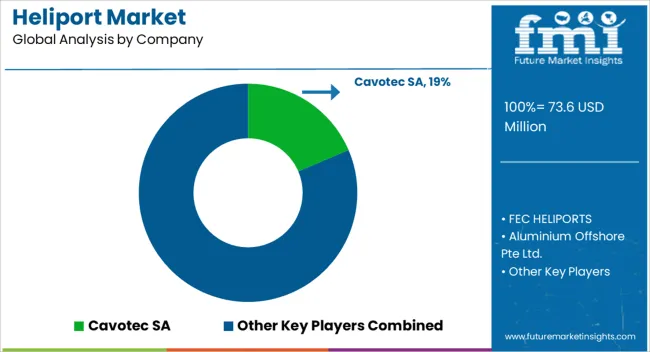

The heliport market, estimated at USD 73.6 million in 2025 and projected to reach USD 89.7 million by 2035 at a modest CAGR of 2.0%, exhibits a comparatively slow but steady growth trajectory across regions. Asia-Pacific is likely to emerge as a leading growth region due to the rapid expansion of urban transport infrastructure, increasing private and commercial helicopter operations, and the rise of heliport networks in major metropolitan hubs.

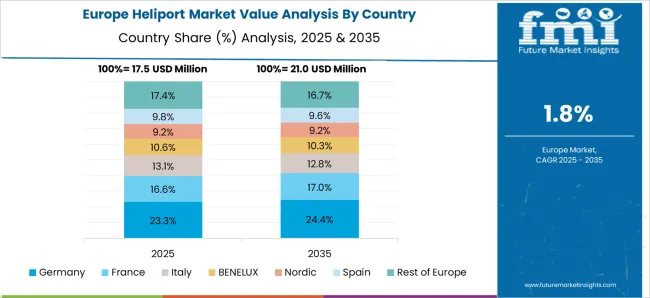

The region’s adoption is supported by government initiatives to improve air mobility, alongside investments in emergency medical services and tourism-oriented heliport facilities. Incremental growth in the Asia-Pacific region contributes significantly to the overall market, reflecting both infrastructure development and a gradual shift toward organized aerial transport solutions. Europe, with its established aviation ecosystem and stringent regulatory frameworks, is expected to maintain a stable yet moderate expansion in the heliport market. Growth is driven by the modernization of existing facilities, integration with urban air mobility initiatives, and compliance with safety and environmental regulations.

The focus on operational efficiency and high-quality standards restricts rapid expansion, resulting in a controlled market increase that aligns with the region’s conservative infrastructure investment approach. North America shows a relatively steady but slower expansion compared with Asia-Pacific, with market value increases primarily tied to private heliport installations, corporate travel, and medical emergency networks. Regulatory oversight, land use limitations, and saturated metropolitan heliport networks limit growth potential, producing a more incremental increase in market share. The regional growth imbalance highlights Asia-Pacific as the fastest-growing region, followed by Europe and North America, with the latter demonstrating the slowest pace despite high operational sophistication.

| Metric | Value |

|---|---|

| Heliport Market Estimated Value in (2025 E) | USD 73.6 million |

| Heliport Market Forecast Value in (2035 F) | USD 89.7 million |

| Forecast CAGR (2025 to 2035) | 2.0% |

The heliport market represents a specialized segment within the aviation infrastructure and transportation industry, emphasizing vertical takeoff and landing operations for commercial, private, and emergency services. Within the broader airport and airfield infrastructure market, it accounts for about 3.8%, reflecting growing demand in urban mobility, offshore operations, and medical evacuation services. In the rotary-wing aircraft support segment, it holds nearly 4.2%, driven by increasing helicopter traffic for corporate, tourism, and logistics purposes.

Across the urban air mobility and vertiport development sector, the segment captures 3.1%, supporting integration with smart city transport planning. Within the emergency medical services and disaster response category, it represents 3.5%, highlighting its critical role in patient transport and rapid deployment. In the defense and offshore oil and gas infrastructure sector, it secures 3.0%, emphasizing operational reliability and safety compliance. Recent developments in this market have focused on advanced design standards, modular construction, and digital integration. Innovations include prefabricated heliport pads, lightweight composite materials, and smart navigation lighting systems to improve safety and reduce construction time.

Key players are collaborating with urban planners, aviation authorities, and helicopter operators to expand networks in metropolitan and offshore locations. Integration with real-time monitoring, automated landing guidance, and UAV traffic management is gaining momentum to enhance operational efficiency. Additionally, heliports are being developed with multi-use capabilities, including emergency response, cargo, and passenger services. These trends demonstrate how infrastructure innovation, digitalization, and operational efficiency are shaping the heliport market.

The heliport market is experiencing consistent growth, supported by rising demand for rapid air transport solutions in emergency services, tourism, offshore operations, and corporate travel. Industry updates and aviation authority data have pointed to a steady increase in helicopter usage for both passenger and cargo purposes, prompting infrastructure expansion.

Government and private sector investments in aviation facilities, coupled with evolving regulatory frameworks for air mobility, have accelerated the construction and modernization of heliports. Technological improvements in navigation, lighting, and safety systems have enhanced operational efficiency and compliance, encouraging broader adoption.

Additionally, growth in medical evacuation requirements, offshore oil and gas activity, and urban air mobility concepts has widened the application base. Market expansion is further driven by the need for heliports in strategic locations to support regional connectivity and emergency preparedness. In the near term, surface level designs, small-capacity facilities, and medical end-use applications are expected to dominate due to their cost efficiency, operational flexibility, and high demand from critical services.

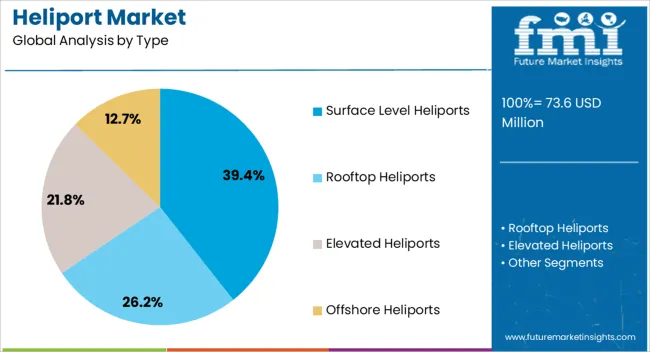

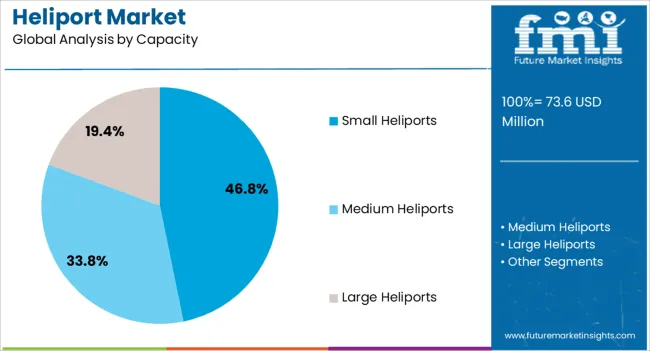

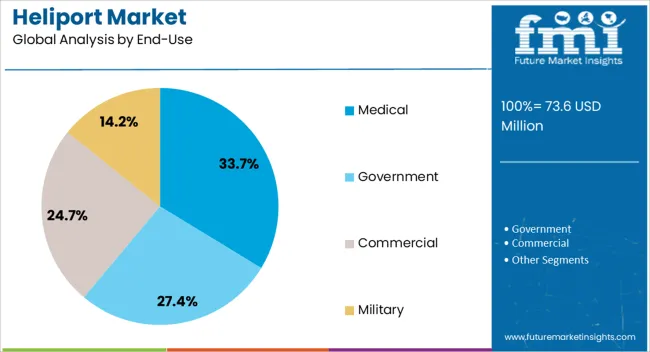

The heliport market is segmented by type, capacity, end-use, and geographic regions. By type, heliport market is divided into Surface Level Heliports, Rooftop Heliports, Elevated Heliports, and Offshore Heliports. In terms of capacity, heliport market is classified into Small Heliports, Medium Heliports, and Large Heliports. Based on end-use, heliport market is segmented into Medical, Government, Commercial, and Military. Regionally, the heliport industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface level heliports segment is projected to contribute 39.4% of the heliport market revenue in 2025, maintaining its leadership among heliport types. This segment’s dominance is driven by its lower construction and maintenance costs compared to elevated or rooftop alternatives, making it suitable for both urban and rural deployments.

Surface-level designs allow for easier access, quicker turnaround times, and flexibility in site selection, which is essential for emergency services and regional transport. Civil aviation regulations and safety guidelines have supported their adoption, particularly in areas with sufficient land availability.

Furthermore, the ability to accommodate a variety of helicopter models without extensive structural modifications has reinforced their appeal. With increasing investment in aviation infrastructure and growing demand for cost-effective heliport solutions, the surface level heliports segment is expected to retain its strong market position.

The small heliports segment is expected to account for 46.8% of the market revenue in 2025, securing its position as the leading capacity category. This segment’s growth is linked to its suitability for single- or limited-bay operations, which align with the operational requirements of most emergency, tourism, and corporate services.

Small heliports require less space, reduced capital expenditure, and simplified regulatory approvals compared to medium or large facilities, enabling faster deployment in diverse locations. Their adaptability to temporary or semi-permanent setups has also supported their use in remote and underserved areas.

In addition, their lower operational complexity makes them ideal for integration into hospitals, industrial sites, and regional transport hubs. As demand for point-to-point helicopter services grows, small heliports are likely to remain the preferred choice for operators seeking efficiency and accessibility.

The medical segment is projected to hold 33.7% of the heliport market revenue in 2025, reflecting its critical role in emergency healthcare logistics. This segment’s prominence is driven by the increasing reliance on helicopter services for rapid patient transport, organ transfers, and disaster response.

Hospital-based heliports and dedicated medical landing sites have expanded globally in response to rising demand for faster emergency care access, especially in remote or congested regions. Investments in specialized medical heliport infrastructure, including integrated lighting systems and direct access to emergency departments, have improved operational readiness.

Health sector reports and emergency service data have highlighted the effectiveness of helicopter-based evacuation in reducing treatment times, directly impacting patient survival rates. With continued emphasis on healthcare accessibility, especially in rural areas and during crisis events, the medical end-use segment is expected to sustain strong demand within the heliport market.

The market has witnessed steady growth as urban air mobility, emergency medical services, and private aviation demand specialized landing infrastructure. Heliports are being constructed in urban centers, hospitals, airports, and remote locations to provide efficient rotorcraft operations. Rising adoption of helicopters for passenger transport, cargo delivery, surveillance, and medical evacuation has increased the need for strategically located, safe, and certified heliports. Regulatory requirements for safety, lighting, and air traffic coordination influence planning and design. The growth of air taxi services, VIP transportation, and tourism-driven helicopter operations further contributes to market expansion.

Urban air mobility initiatives have been a primary driver for the heliport market, particularly in densely populated cities with traffic congestion issues. Helicopter and eVTOL (electric vertical take-off and landing) operations rely on strategically located landing sites for efficient passenger transport. Municipal authorities and private developers are investing in rooftop and ground-level heliports to support emergency services, air taxis, and business travel. Integration with city transport infrastructure, including metro and bus networks, enhances passenger convenience and operational efficiency. Safety regulations, noise management, and urban zoning policies play a significant role in planning. As cities adopt smart mobility solutions and explore airborne commuting options, demand for certified and technologically equipped heliports continues to rise, creating opportunities for infrastructure expansion and service innovation.

Hospitals and emergency medical service providers have increased the deployment of dedicated heliports to facilitate rapid patient transfer and critical care access. Air ambulance services utilize heliports for 24/7 operations, reducing response time in accident or disaster scenarios. Strategic placement near trauma centers and rural health facilities ensures efficient coverage across regions. Regulatory requirements dictate helipad size, lighting, and safety features to comply with aviation standards. Integration of communication systems, navigation aids, and weather monitoring enhances operational reliability. The expansion of medical evacuation networks and disaster response initiatives has amplified the need for robust heliport infrastructure. This segment supports broader public health objectives while contributing significantly to heliport market demand and investment.

Technological advancements have improved the safety, functionality, and operational efficiency of heliports. Automated lighting systems, digital navigation aids, and advanced communication networks assist pilots during take-off and landing. Fire suppression systems, weather monitoring equipment, and obstacle detection technologies enhance safety compliance. Software platforms for heliport scheduling, maintenance tracking, and traffic coordination support efficient operations. Integration with air traffic management systems enables seamless coordination with surrounding airports and drone corridors. These innovations reduce operational risk, improve throughput, and ensure regulatory compliance, which is critical for emergency, commercial, and urban mobility applications. As new rotorcraft technologies, including eVTOLs, enter service, technologically advanced heliports will remain a strategic enabler of market growth.

Despite rising demand, the heliport market faces challenges due to regulatory constraints and limited site availability. Urban development policies, noise regulations, and zoning restrictions can delay construction or limit capacity.

Obtaining permits and certifications involves strict adherence to aviation safety standards, including helipad design, obstacle clearance, and operational procedures. Land scarcity in city centers drives the need for creative rooftop or multi-use structures, which may increase costs and complexity. Maintenance, operational safety, and insurance requirements add further financial and administrative burdens. These challenges necessitate careful planning, investment in compliance, and coordination with aviation authorities.

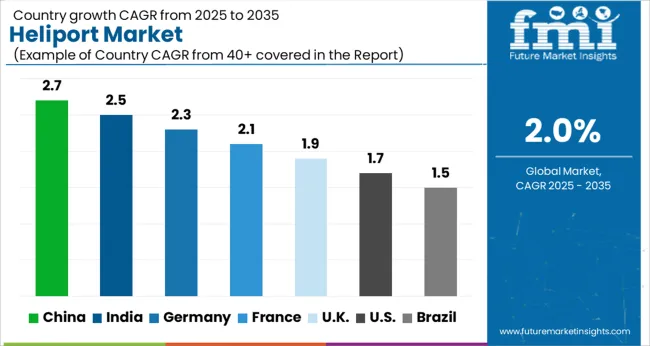

| Country | CAGR |

|---|---|

| China | 2.7% |

| India | 2.5% |

| Germany | 2.3% |

| France | 2.1% |

| UK | 1.9% |

| USA | 1.7% |

| Brazil | 1.5% |

China maintained the leading position in the market with a forecast growth of 2.7%, supported by increased investments in urban air mobility infrastructure. India followed at 2.5%, driven by expansion of regional and private heliport facilities. Germany recorded 2.3% growth, supported by modernization of heliport networks and integration with emergency services. The United Kingdom achieved 1.9%, reflecting focused development of private and commercial heliport facilities. The United States posted 1.7%, where gradual expansion of urban and offshore heliports contributed to steady market activity. These countries collectively illustrate the varied adoption and development shaping the global heliport landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 2.7%, fueled by rapid urbanization, increasing commercial aviation activity, and growing demand for emergency medical transport. Investments in infrastructure development, including heliports for corporate, logistics, and tourism purposes, are supporting market growth. The aviation sector is witnessing an increase in air mobility services for last-mile connectivity in congested cities. Private and government initiatives are focused on expanding heliport networks near metropolitan and industrial hubs. The technological advancements in helicopter design and safety systems are enabling higher traffic throughput at heliport facilities.

India is expected to grow at a CAGR of 2.5%, supported by increased utilization for emergency medical services, corporate transport, and tourism applications. Expansion of urban air mobility initiatives and regional connectivity programs is driving the development of new heliport facilities. Public-private partnerships are contributing to improved heliport infrastructure, particularly near major cities and industrial zones. The government is also encouraging integration of heliports within smart city projects and logistics hubs. Rising helicopter fleet deployment and the growing adoption of air mobility solutions for time-sensitive travel are further strengthening the market outlook.

Germany is anticipated to grow at a CAGR of 2.3%, driven by demand from emergency medical services, corporate aviation, and high-value logistics operations. Heliports are increasingly being developed near hospitals, airports, and urban centers to enhance operational efficiency. Stringent safety and regulatory standards are guiding infrastructure development, ensuring secure operations for helicopters. The growing focus on integrating heliports with multimodal transport systems is enabling seamless connectivity. Investments in automation, navigation, and communication systems at heliports are contributing to higher throughput and service reliability.

The United Kingdom’s market is projected to grow at a CAGR of 1.9%, with expansion driven by offshore operations, medical transport, and urban air mobility solutions. Heliports supporting offshore energy, oil, and gas sectors are witnessing significant traffic. Urban heliport development is also increasing to facilitate corporate travel and rapid response services. Compliance with aviation safety regulations is central to infrastructure planning, ensuring secure and efficient operations. The adoption of advanced traffic management and navigational technologies is improving operational efficiency and reducing turnaround times for helicopters at busy urban and regional hubs.

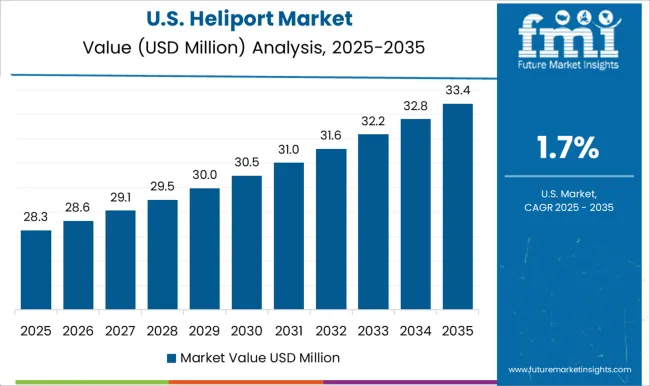

The market in the United States is expected to expand at a CAGR of 1.7%, driven by corporate aviation, emergency services, and medical transport demand. Heliport infrastructure development near urban centers, hospitals, and industrial facilities is enhancing accessibility and operational efficiency. The growing popularity of air mobility solutions for last-mile connectivity and executive transport is contributing to the market. Investments in advanced helicopter traffic management, navigation, and safety technologies are improving service reliability. The government and private sectors are collaborating on initiatives to develop heliport networks to support commercial and emergency aviation services across metropolitan and regional areas.

The market is led by specialized infrastructure developers, engineering firms, and integrated systems providers focused on creating safe, efficient, and technologically advanced heliport facilities. Cavotec SA offers innovative automated mooring and refueling solutions, ensuring operational safety and efficiency at heliports globally. FEC HELIPORTS provides turnkey heliport construction and maintenance services, catering to both urban and offshore applications with compliance to aviation standards. Aluminium Offshore Pte Ltd. and Calzoni contribute through high-quality structural components, including modular landing platforms and mechanical systems designed for durability under extreme conditions.

Eaton Corporation Plc. enhances heliport operations with power management and electrical distribution solutions, optimizing safety and reliability. Heliport Systems Inc. delivers comprehensive heliport equipment and support solutions, including lighting, safety barriers, and ground handling systems. Technokontrol Global Ltd. specializes in monitoring and control systems, integrating advanced technologies for automated operations and safety compliance. These players are driving innovation in heliport infrastructure, blending engineering excellence, automation, and safety management to meet the rising demand for efficient rotorcraft operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 73.6 Million |

| Type | Surface Level Heliports, Rooftop Heliports, Elevated Heliports, and Offshore Heliports |

| Capacity | Small Heliports, Medium Heliports, and Large Heliports |

| End-Use | Medical, Government, Commercial, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cavotec SA, FEC HELIPORTS, Aluminium Offshore Pte Ltd., Calzoni, Eaton Corporation Plc., Heliport Systems Inc., and Technokontrol Global Ltd |

| Additional Attributes | Dollar sales by heliport type and application, demand dynamics across commercial, emergency, and private aviation sectors, regional trends in urban air mobility and heliport infrastructure adoption, innovation in safety systems, lighting, and modular construction, environmental impact of land use and energy consumption, and emerging use cases in medical transport, offshore operations, and urban air taxi services. |

The global heliport market is estimated to be valued at USD 73.6 million in 2025.

The market size for the heliport market is projected to reach USD 89.7 million by 2035.

The heliport market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in heliport market are surface level heliports, rooftop heliports, elevated heliports and offshore heliports.

In terms of capacity, small heliports segment to command 46.8% share in the heliport market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA