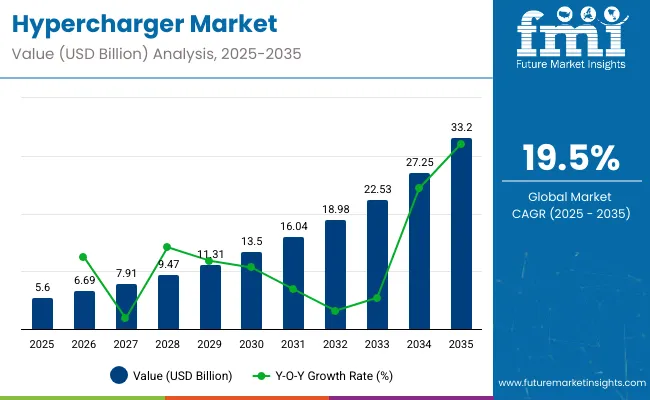

In 2025, the hypercharger market is valued at USD 5.6 billion and is expected to reach USD 33.2 billion by 2035, representing a compound annual growth rate of 19.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.6 billion |

| Industry Value (2035F) | USD 33.2 billion |

| CAGR (2025 to 2035) | 19.5% |

This growth translates to an increase by a factor of approximately 5.93 over the decade. The expansion is driven by the growing adoption of electric vehicles alongside the demand for fast and dependable charging infrastructure worldwide. Peak-to-trough analysis reveals typical market fluctuations driven by investment cycles, regulatory support, and technological advancements. Peak phases often align with periods of accelerated infrastructure deployment, supported by government incentives and rising EV sales.

Troughs occur due to temporary supply chain issues, infrastructure bottlenecks, or shifts in funding priorities, which can slow market expansion temporarily. Despite these cyclical variations, the overall upward trend remains strong, with each growth peak higher than the previous one and trough durations becoming shorter as the market matures.

The multiplying factor of nearly six times within a decade highlights the significant revenue potential and resilience of the hypercharger market. Continued technological innovation and regulatory backing are expected to further minimize trough impacts, supporting sustained growth and expanding opportunities for manufacturers, network operators, and service providers through 2035.

The hypercharger market represents a key segment of the electric vehicle charging infrastructure industry. It holds an estimated 5-7% share of the global EV charging infrastructure market. Within the broader electric vehicle market, hyperchargers account for about 1-2%.

Their presence is notably stronger in regions with high electric vehicle adoption, including parts of Europe and North America, where their share can exceed 10%. These figures highlight the increasing importance of ultra-fast charging solutions, which play a critical role in supporting the growth and convenience of electric vehicle usage worldwide.

The industry is advancing rapidly, fueled by the rise in electric vehicle adoption and the need for faster charging solutions. Key players are focusing on expanding ultra-fast charging networks capable of supporting both passenger and commercial vehicles. Integration of renewable energy with charging stations is becoming a priority, reducing environmental impact.

Strategic collaborations aim to accelerate infrastructure deployment and improve customer access. Technological innovations include higher power output chargers and smart charging systems to optimize energy use. These developments are essential to accommodate the growing electric vehicle ecosystem and enhance user convenience and sustainability.

The market is expanding alongside the increasing global adoption of electric vehicles (EVs). Technological progress in ultra-fast charging systems enables charging speeds up to 350 kW, reducing vehicle charge time by more than 50% compared to conventional chargers. Investments in EV infrastructure have surpassed USD 15 billion globally in recent years, supporting hypercharger deployment in urban and highway locations.

Government incentives and stricter emission regulations in regions like Europe, China, and North America accelerate the shift to EVs, driving demand for efficient charging solutions. Despite infrastructure challenges, hyperchargers offer operational advantages, including better grid management and enhanced user convenience, contributing to market growth.

The rise in electric vehicle sales, with global EV stock growing over 40% annually, directly influences the hypercharger market demand. Several governments have set ambitious EV adoption targets supported by subsidies and grants, fueling infrastructure investments. Expansion of public and private charging networks addresses range anxiety among consumers, which remains a key barrier to EV adoption.

The ability of hyperchargers to deliver rapid charging in under 20 minutes attracts fleet operators and individual users alike. The trend of integrating renewable energy sources into charging stations further enhances market appeal, aligning with clean energy goals and boosting demand for hyperchargers.

The installation cost of hypercharger stations can exceed USD 200,000 per unit, presenting a significant barrier for widespread deployment, particularly in developing regions. Integrating hyperchargers requires substantial upgrades to local power grids, often involving complex permitting processes and coordination with utility providers.

Electrical grid constraints, including limited capacity and instability in some regions, restrict the ability to support multiple high-power chargers simultaneously. High maintenance and operation costs add further financial strain. These challenges slow infrastructure rollouts and require innovative solutions such as energy storage systems and smart grid integration to enable broader hypercharger adoption.

Growing incorporation of renewable energy, such as solar and wind, with hypercharger stations creates opportunities for sustainable charging solutions. Combining energy storage systems with hyperchargers reduces grid stress during peak demand and enables load balancing, improving overall efficiency.

Advances in smart grid technologies and vehicle-to-grid (V2G) capabilities offer additional growth potential by allowing bidirectional energy flows. Expanding EV fleets in emerging economies present untapped markets for hypercharger installations. Strategic partnerships between utility companies, charging infrastructure providers, and automakers foster innovation and create scalable business models, supporting market expansion.

Smart charging systems that optimize energy use based on grid conditions and user demand are becoming standard in hypercharger installations. Integration of AI and IoT enables predictive maintenance, reducing downtime and operational costs. Autonomous vehicle growth increases the need for fully automated charging stations.

Governments continue to update policies to encourage fast charger deployment, including standardized connectors and interoperability requirements. Environmental focus leads manufacturers to develop more efficient chargers with recyclable materials. Collaborative innovation between tech firms and infrastructure providers accelerates advancements, positioning the hypercharger market to meet evolving EV charging needs globally.

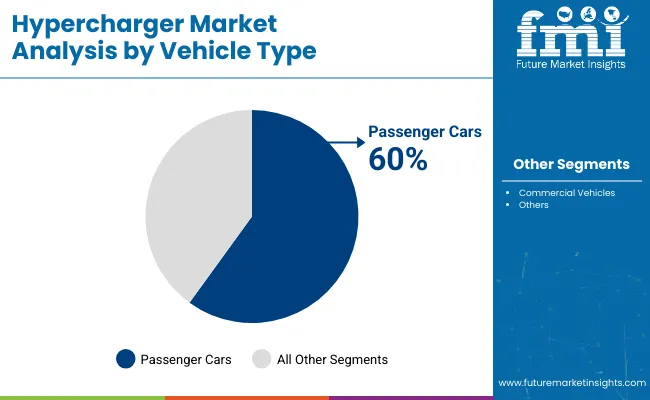

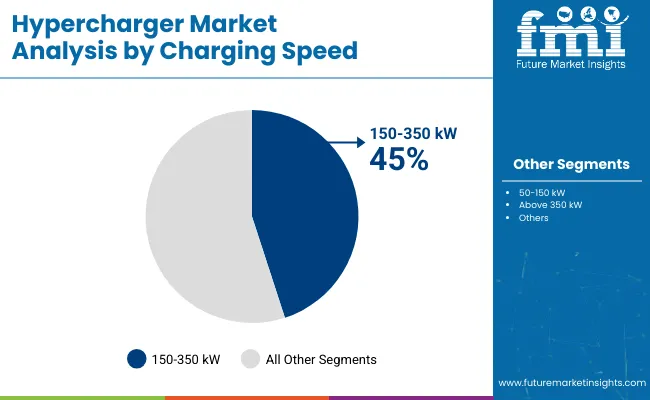

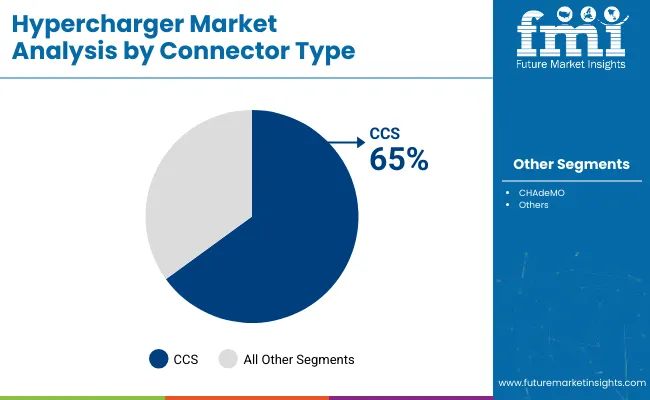

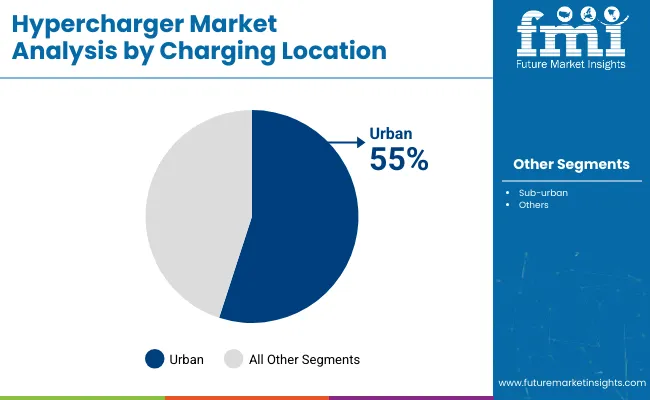

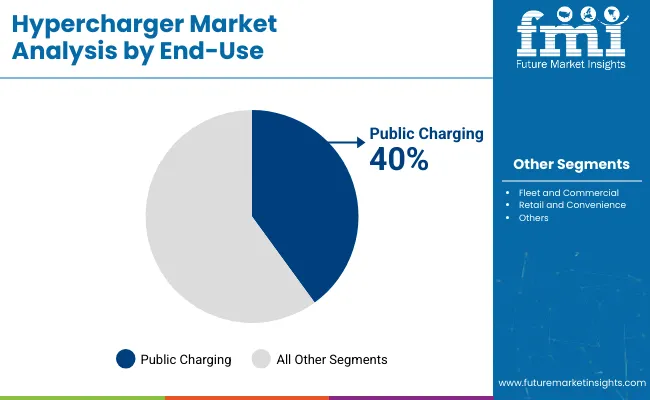

The hypercharger market in 2025 is led by passenger cars, comprising 60% of demand due to expanding electric vehicle ownership. Charging speeds between 150 and 350 kW represent 45% of the market, balancing fast recharging and manageable power draw. CCS connectors hold a 65% share, becoming the dominant standard. Urban charging locations account for 55%, reflecting dense EV populations in cities. Public charging services represent the largest end-use with 40%, driven by infrastructure expansion.

Passenger vehicles form the largest segment at 60%, fueled by rising consumer interest and a growing electric vehicle model lineup. Chargers in this category aim to deliver an 80% charge within 25-30 minutes, reducing downtime for drivers. Companies such as Tesla and Blink emphasize multi-brand compatibility, increasing accessibility for diverse users.

Advances in thermal regulation technology help lower battery wear by approximately 15%, thereby prolonging vehicle battery life. Incentives and policies supporting personal EV ownership continue to push charger installations in residential and public areas.

Chargers operating within the 150-350 kW range capture 45% of the market by providing fast charging while maintaining grid stability. This power bracket supports a broad variety of EVs, cutting charge times by up to 40% compared to slower units. Installation and maintenance costs are lower than ultra-high-speed chargers, enabling wider deployment in urban and suburban areas.

Smart energy management software optimizes peak demand, resulting in approximately 20% lower electricity costs for operators. These chargers also help reduce wait times during peak usage, enhancing overall user satisfaction.

The CCS connector holds 65% of the market due to its widespread acceptance and technical advantages. Its compatibility with fast-charging standards makes it the preferred choice for most passenger and commercial EV models. The connector supports power delivery up to 350 kW, accommodating both mid-range and ultra-fast charging requirements.

Its robust design minimizes connection failures by about 15%, decreasing maintenance needs. Infrastructure developers favor CCS to align with evolving global EV standards, ensuring easier scalability and network interoperability.

Urban hypercharger installations account for 55% of the market, reflecting the concentration of electric vehicles in city environments. High population density and frequent EV use in urban areas drive demand for convenient and accessible charging points. Chargers in urban settings often incorporate advanced queue management systems that reduce wait times by up to 25%.

Urban deployments also focus on integrating with renewable energy sources, enabling up to 30% of charging energy to come from green electricity, lowering carbon footprints. Location density improves charging availability, increasing customer satisfaction and repeat usage.

Public charging stations make up 40% of the hypercharger market, driven by expanding networks aimed at general EV users. These stations often feature multiple connectors and flexible payment systems, supporting diverse user preferences and increasing adoption. Integration with mobile apps provides real-time availability, reducing search times by nearly 20%.

Public chargers serve as essential infrastructure for long-distance travel, with many offering amenities like restrooms and retail access, improving the overall customer experience. Operators continuously invest in upgrading software for seamless interoperability across different charging networks.

Commercial vehicles represent 40% of the hypercharger market, growing due to increasing electrification in logistics and public transport fleets. These chargers often support higher power outputs, enabling fast turnaround times essential for fleet operations. Companies focus on durability and uptime, achieving over 95% availability rates to meet operational demands.

Fleet chargers also integrate with fleet management software for route planning and energy optimization, reducing charging-related delays by approximately 18%. Investment in heavy-duty thermal management ensures battery longevity under frequent fast charging cycles.

Sub-urban hypercharging accounts for 45% of installations, catering to EV users commuting between urban centers and outlying areas. Chargers in these zones balance power output and cost-efficiency, with many stations offering mid-range speeds around 150 kW. Sub-urban sites often leverage local grid capacity, reducing infrastructure strain and improving reliability.

These locations focus on ease of access, often situated near shopping centers or highways, increasing convenience. Demand is supported by expanding residential EV ownership and commercial fleets operating beyond city limits.

Fleet and commercial operations represent 35% of hypercharger utilization, driven by electrification of buses, trucks, and delivery vehicles. Chargers serving fleets prioritize high uptime and fast turnaround, with average charge sessions under 45 minutes. Integration with fleet software allows real-time monitoring, optimizing charging schedules and energy costs.

Charging infrastructure for commercial vehicles often includes heavy-duty connectors supporting higher currents, reducing battery recharge times by 25%. Growing regulatory mandates for cleaner transport propel investment in this segment.

Retail and convenience locations comprise 25% of the market, providing charging services where consumers shop or take breaks. These sites focus on customer experience by offering chargers integrated with loyalty programs and contactless payments. Charging speed typically ranges between 150-350 kW, balancing user wait times with infrastructure costs.

Retail chargers also often feature energy storage systems to manage peak loads, reducing grid impact by approximately 15%. Such locations encourage EV adoption by enhancing convenience and combining charging with everyday errands.

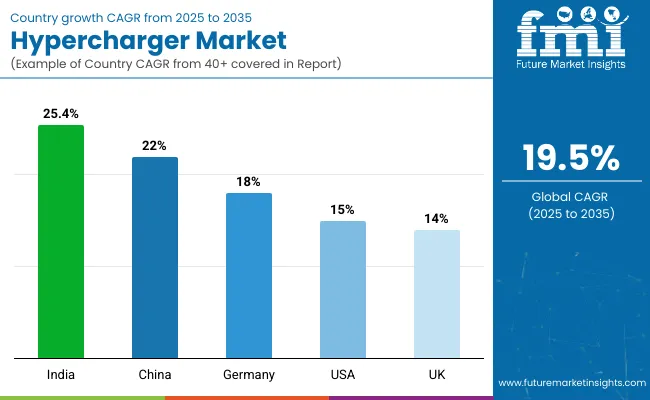

The global hypercharger market is forecasted to expand at a CAGR of 19.5% between 2025 and 2035. India leads with a CAGR of 25.4%, exceeding the global average by 30%. China follows at 22.0%, maintaining a 13% premium over the global rate. Germany registers 18.0%, slightly below the global benchmark by 8%. The United States and United Kingdom record growth rates of 15.0% and 14.0%, respectively, trailing the global CAGR by 23% and 28%.

Growth in India and China is driven by rapid electric vehicle adoption and government policies promoting charging infrastructure. Germany and other OECD members focus on enhancing existing networks and incorporating advanced technology. ASEAN regions, while not leading, are expected to gradually increase market participation through regional electrification initiatives. Distinct growth patterns highlight the evolving hypercharger market across BRICS, OECD, and ASEAN economies, reflecting differences in infrastructure development, regulatory support, and market maturity.

The hypercharger market in India is expected to grow at a CAGR of 25.4%, driven by a fast-growing electric vehicle fleet and supportive government policies. The development of fast-charging infrastructure along highways and in metropolitan areas aims to reduce charging times and alleviate range anxiety. Private investments and collaborations between energy firms and EV manufacturers accelerate network expansion.

Integration of renewable energy sources such as solar power in hypercharger stations helps reduce operational costs and carbon impact. Growing consumer awareness and incentives for EV adoption further encourage infrastructure build-out. The focus on making chargers affordable and accessible in tier 2 and tier 3 cities is gaining momentum.

The hypercharger market in China is projected to grow at a CAGR of 22.0%, driven by the country’s position as the largest EV market globally. Extensive government support enables rapid deployment of fast-charging stations, especially in urban areas and along major transport corridors. State-owned enterprises and private companies invest heavily in high-capacity chargers to accommodate increasing EV traffic.

Improvements in battery technology allow higher charging speeds, reducing wait times significantly. Integration with smart grid systems optimizes power consumption, balancing demand and supply. Additionally, subsidies and incentives reduce installation and operational costs, encouraging rapid network expansion.

The Demand of hypercharger in Germany is forecast to expand at a CAGR of 18.0%, supported by ambitious EV adoption goals and environmental policies. Deployment of ultra-fast chargers in urban centres and along autobahns facilitates longer EV trips and daily commuting. The market sees strong collaboration between energy companies and automakers to enhance technology and coverage.

Integration of renewable energy sources and battery storage systems stabilizes grid load and improves sustainability. Digital features such as app-based reservation systems enhance user convenience and charger availability. The focus on clean energy ensures the charging infrastructure aligns with national emission reduction targets.

The United States hypercharger market is anticipated to grow at a CAGR of 15.0%, backed by federal and state incentives promoting EV adoption and infrastructure development. Priority focuses include expanding fast-charging networks along intercity corridors and urban hubs to reduce range anxiety. Significant investments in grid modernization enable higher power delivery and enhance reliability.

Collaboration between major automakers, utilities, and private providers accelerates deployment. Interoperability standards ensure chargers work seamlessly across different EV brands, improving user experience. Consumer demand for convenient, fast charging is pushing network density higher, supporting wider EV adoption.

The United Kingdom’s hypercharger market is forecast to grow at a CAGR of 14.0%, driven by government policies promoting zero-emission vehicles and expanding charging infrastructure. Focus is on installing ultra-fast chargers along motorways and in urban centers to support commuter and long-distance EV use.

Investments in battery storage at charging hubs enhance grid stability and allow for renewable energy integration. Increasing customer expectations have led to widespread adoption of contactless payments and mobile app-based access. Market growth is supported by collaboration among government agencies, energy providers, and private investors to meet national climate goals.

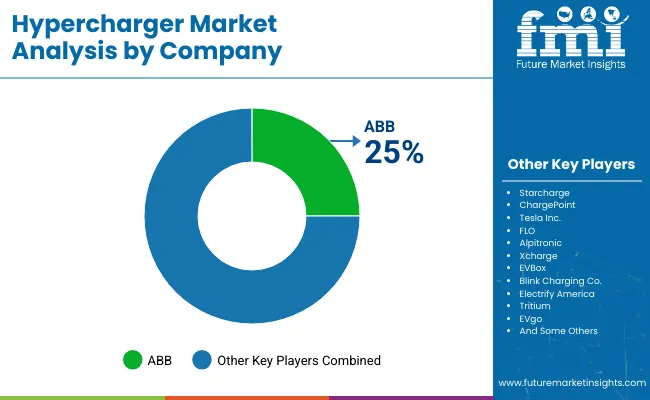

Leading hypercharger manufacturers, suppliers, and distributors adopt distinct strategies to expand their market presence and address evolving charging needs. ABB introduces high-power chargers designed for reliability and seamless integration, while Starcharge emphasizes modular, scalable solutions for commercial and public applications.

ChargePoint expands its network through strategic partnerships and launches faster chargers to reduce charging times. Tesla Inc. operates an extensive Supercharger network, increasing station numbers and enhancing charger performance for its vehicle lineup. FLO improves customer experience and broadens coverage across North America. Alpitronic targets highway corridors with ultra-high-power chargers that minimize charging duration.

Xcharge grows internationally by collaborating with local operators and adapting chargers to regional power grids. EVBox offers versatile charging units suitable for residential, commercial, and fleet users. Blink Charging Co. strengthens user engagement through app-based controls and subscription models. Electrify America rapidly deploys high-capacity chargers in key locations.

Tritium focuses on compact, fast chargers optimized for easy installation and maintenance. EVgo emphasizes network expansion and loyalty programs to build its customer base. Emerging companies leverage flexible models and cost-effective technology to enter competitive markets. These approaches reflect how industry players position themselves to meet varying demands and enhance charging infrastructure.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.6 billion |

| Projected Market Size (2035) | USD 33.2 billion |

| CAGR (2025 to 2035) | 19.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Vehicle Types Analyzed (Segment 1) | Passenger Cars, Commercial Vehicles |

| Charging Speeds Analyzed (Segment 2) | 50-150 kW, 150-350 kW, Above 350 kW |

| Connector Types Analyzed (Segment 3) | CCS, CHAdeMO, Others |

| Charging Locations Analyzed (Segment 4) | Urban, Sub-urban |

| End-Use Segments Analyzed (Segment 5) | Retail and Convenience, Public Charging, Fleet and Commercial |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, China, Japan, South Korea, India, Brazil, South Africa, UAE |

| Key Players Influencing the Market | ABB, Starcharge, ChargePoint, Tesla Inc., FLO, Alpitronic, Xcharge, EVBox, Blink Charging Co., Electrify America, Tritium, EVgo |

| Additional Attributes | Dollar sales by charger type and vehicle category, demand trends across passenger cars, commercial vehicles, and buses, regional adoption in North America, Europe, and Asia-Pacific, innovation in ultra-fast charging, smart grid integration, and wireless charging, environmental impact of energy sourcing and infrastructure, and emerging uses in fleet electrification and highway charging networks. |

The hypercharger market is expected to reach USD 33.2 billion by 2035.

The market is growing at a CAGR of 19.5% during this period.

Passenger cars hold the leading segment with 60% market share in 2025.

The 150-350 kW chargers segment leads with 45% share.

ABB holds the largest share with 25% of the industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA