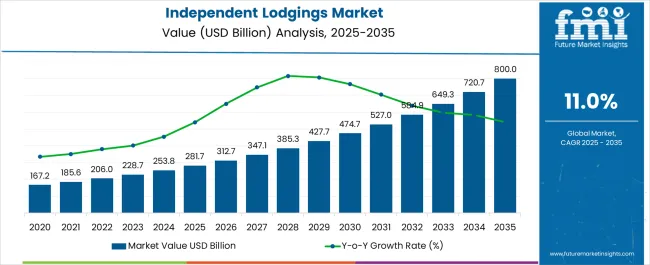

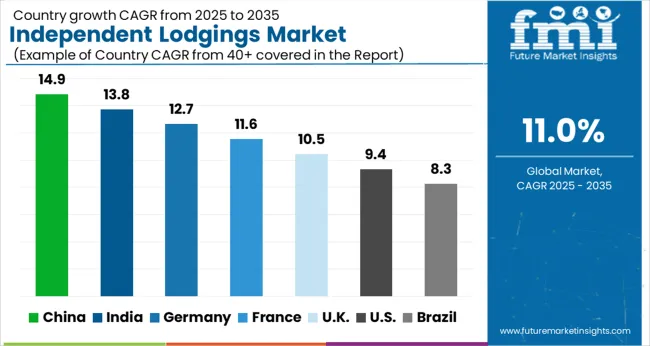

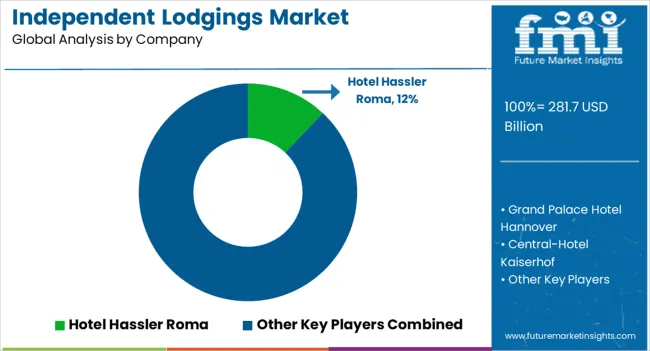

The Independent Lodgings Market is estimated to be valued at USD 281.7 billion in 2025 and is projected to reach USD 800.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

| Metric | Value |

|---|---|

| Independent Lodgings Market Estimated Value in (2025 E) | USD 281.7 billion |

| Independent Lodgings Market Forecast Value in (2035 F) | USD 800.0 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The independent lodgings market is experiencing steady growth, supported by changing traveler expectations, digital accessibility, and increased demand for localized and personalized accommodations. Unlike branded chains, independent lodgings are being favored for their unique character, regional connection, and tailored guest experiences. The rise of digital travel aggregators and direct booking platforms has enabled independent operators to compete more effectively by improving visibility and dynamic pricing.

Travelers seeking authenticity and immersive experiences are increasingly selecting small, owner-managed hotels over standardized offerings. Additionally, post-pandemic travel behavior has emphasized hygiene, flexibility, and social distancing, all of which have benefited smaller, non-chain establishments.

Future growth is expected to be supported by technological integration, digital marketing adoption, and a shift toward sustainable and community-driven tourism models. Independent hotels that can offer personalized service and leverage online visibility will continue to shape this evolving market landscape.

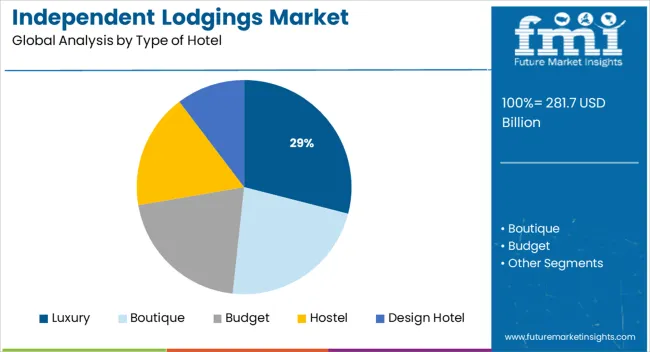

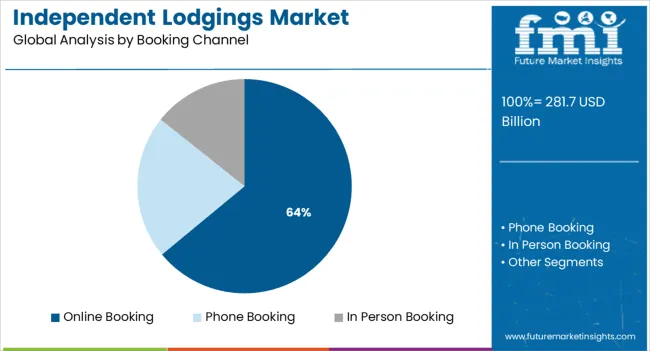

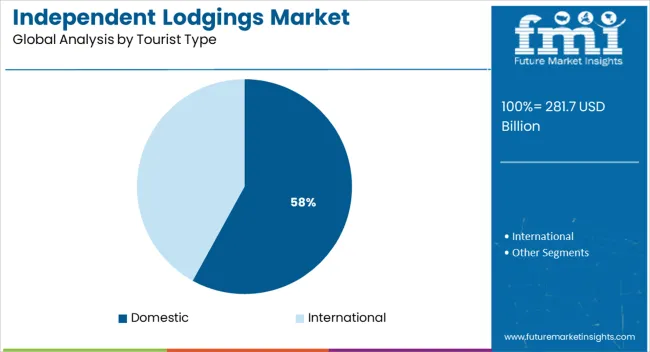

The market is segmented by Type of Hotel, Booking Channel, Tourist Type, Tour Type, and Consumer Orientation and region. By Type of Hotel, the market is divided into Luxury, Boutique, Budget, Hostel, and Design Hotel. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourist Type, the market is segmented into Domestic and International. By Tour Type, the market is divided into Independent Traveller, Package Traveller, and Tour Group. By Consumer Orientation, the market is segmented into Women and Men. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Luxury hotels are projected to account for 29.0% of the overall revenue in the independent lodgings market by 2025, making it the leading segment by type. This leadership is being attributed to a rise in demand for premium yet distinctive hospitality experiences that reflect local heritage, design, and service ethos.

Independent luxury hotels offer an alternative to corporate chains by focusing on bespoke services, curated interiors, and exclusive amenities, which resonate strongly with affluent travelers. The growing influence of travel influencers and lifestyle branding has also contributed to this trend, positioning boutique luxury accommodations as aspirational yet intimate.

High net-worth individuals and experiential travelers are increasingly prioritizing privacy, customization, and ambiance—needs that are being well met by upscale independent establishments. As consumer loyalty becomes experience-driven rather than brand-driven, luxury independents are gaining market prominence.

Online booking is expected to command 64.0% of the total market share in 2025, establishing it as the dominant channel in the independent lodgings market. The growth of this segment is being fueled by the digital transformation of the travel and hospitality industry, where mobile-first consumers prioritize convenience, real-time availability, and price comparison.

Independent hotel operators are increasingly leveraging online travel agencies (OTAs), metasearch platforms, and their own direct booking websites to expand visibility and streamline operations. Enhancements in user experience, integrated payment solutions, and personalized deal offerings have made online booking the preferred method for both spontaneous and planned travelers.

Additionally, the integration of customer review systems and influencer content has improved trust and decision-making, further reinforcing the shift away from traditional offline bookings.

Domestic tourists are projected to contribute 58.0% of the total revenue in the independent lodgings market by 2025, making them the leading customer base. This segment's strength is being driven by the resurgence of local travel, affordability concerns, and cultural familiarity.

Government campaigns promoting regional tourism and the rise of weekend getaways and staycations have further strengthened domestic travel intent. Independent hotels located in heritage towns, nature reserves, and secondary cities are capitalizing on this momentum by offering curated experiences tailored to local preferences.

The flexibility to travel without international documentation, coupled with better knowledge of local conditions, has made domestic travel a more accessible and dependable option for many consumers. As travel preferences shift toward proximity and personalization, domestic tourists are expected to remain the cornerstone of independent lodging growth.

The independent lodging tourism market is forecasted to grow at a steady rate during the forecast period. The growth can be attributed to several reasons both international and domestic. These hotels can directly target a greater flow of guests at a much high market share than other franchise hotels. In addition, a franchise has to face the task of running hundreds of hotels. Independent lodgings can simply be mindful of standardizing the procedures for enhancing their performance.

They may not have a central hierarchy system. In the case of chain hotels, they all run under the same brand and have to maintain the same quality in every hotel. So there is not much scope for innovation in chain hotels, since they all maintain the same quality.

This means that there are no changes that a chain hotel can offer for people who stay there regularly. Independent lodgings can adapt to local dwelling environments. They have a unique identity that makes them stand apart from chain hotels. They have the freedom to be creative and innovative.

Franchise Hotels have their hotels in different cities and different countries. These hotels have their control in the hand of the central system. They have a general manager to operate each hotel. These managers do not have enough rights to make policies for the hotel. They have to follow the guidelines of the central system. While in the case of independent lodgings, management spends their time on it.

They are more devoted to planning for a hotel/ They can utilize resources more optimally and management can focus on improving the performance of the hotel more effectively than a franchise. They are free to adopt any type of innovation in their hotels.

Amenitiz is an all-in-one solution centralizing all the tools an independent hotelier needs to run his hotel and boost direct bookings.

Hotels need social media to attract new guests. You need to provide your hotel with what it wants and use social media to provide content that tells a story and can inspire guests to make your hotel their destination. You should post that will allow your new guests to find out if what you offer is really what you advertise.

You can communicate with them with interesting information, beautiful imagery, and informative videos. Even if you can hire influencers it’s not necessary to be celebrities who have significant community or followers and friends who can influence your customers via social media like Facebook, Instagram, and Twitter.

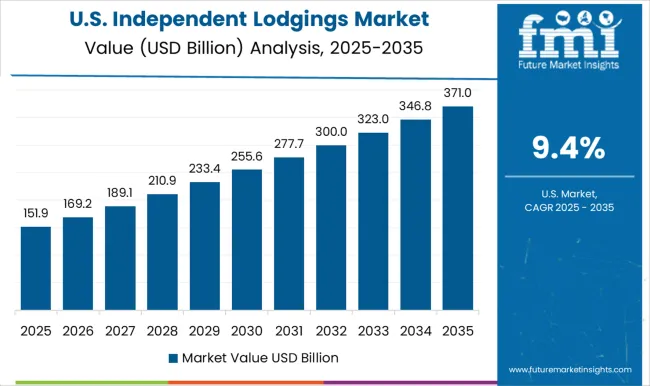

A variety of hotels and motels in the USA and the hotel industry collect great revenue from the hotel industry

Independent hotel has become more important to the hotel and tourism industry, and they will continue to grow, according to the Lodging Automation Industry Research. Independent collections have become the growing sector, whereas chains, which have been outperforming independently.

There are over 91,000 hotels and motels in the USA. The main industry players must stay alert for what else may impact the industry after the pandemic. After the pandemic, the market size of the hotels and motel industry in the USA increased faster by the economy overall. The average market growth from 2025 to 2025 is 11% CAGR.

Film festivals are the major driving factor in the France Film Tourism market

It is important for an independent hotel to ensure that its guests leave with a warm and inviting environment. This could be done by using technology that lets the guests feel as if they are in their homes. For independent hoteliers, this could include things like allowing guests to use all of the rooms with minimal fees. Not charging dues ensures that at least some of the guests could afford the stay. Hoteliers, could maintain the personal touch, stand out from the crowd, memorable yet affordable experiences, attracting the best talent, digital discount wars, guest satisfaction is of utmost importance.

These numbers show the taking off the ubiquity of autonomous lodgings among explorers - however not just that. The rising progress of the present free convenience and housing suppliers additionally lets us know that the hoteliers behind these properties are adjusting to changes in voyager conduct and inn-promoting channels. They're getting on the web, and they're embracing innovation.

Also, that is the way these well-informed free thinkers benefit from explorers' proceeded with energy and interest for the special inn encounters they offer. Innovation has made everything fair by permitting more modest lodgings to play large through admittance to top-notch advertising, income the board, internet business, and cutthroat bits of knowledge apparatuses and advancements.

Hotels are the most preferred type of stay in the Independent Lodgings sector

Typically, hotels are the most popular type of accommodation for tourists. As a hotelier, you can run your hotel independently, or join a corporation, making your hotel a part of a global chain. Whichever form your hotel takes, you need to understand its rankings to attract tourists. The size, type of amenities, location, and price of your hotel determine its rating, which ranges on a scale between 1-5 stars. The higher the number, the better the hotel performs. Those that open their doors for lodging are welcoming visitors. Hoteliers need to provide them with accommodation and entertainment activities.

Online booking channels lead the booking channel segmentation

The growth of the online booking channel has originated due to the ease of use online and the online presence of advertised firms. Today, it is the most preferred channel for booking a tour. People appreciate the hassle-free experience as well as the decent number of tour options found in the online channel. These factors are expected to increase the adoption of this channel for online booking in the future.

Packaged Traveler is the most prominent category

Commonly, packaged travelers are made up of people who buy travel tours with certain locations planned within the tour package. They are less likely to book tours separately, buy tour packages separately or customize tours. Having packages built by travel agencies help these customers save money, effort, and time by buying them in bulk and they also find the tour package attractive. They are now the majority segment in the hotel tour type sector.

The market leaders are continuously diversifying to stay ahead of their competitors, with some offering all-inclusive tour packages to keep tourists from cluttering around, and others, by way of initiatives by the government and promotions, improving their service offerings

For Instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East; and Africa(MEA). |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Benelux, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | Type of hotels, Booking Channel, Tourist Type, Tour Type, Consumer Orientation, Age Group, and Region |

| Key Companies Profiled | Karaman Group Hotel; Grand Palace Hotel Hannover; Central-Hotel Kaiserhof; Palace Hotel Tokyo; Sandy Lane Hotel; Hotel Hassler Roma, |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global independent lodgings market is estimated to be valued at USD 281.7 billion in 2025.

The market size for the independent lodgings market is projected to reach USD 800.0 billion by 2035.

The independent lodgings market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in independent lodgings market are luxury, boutique, budget, hostel and design hotel.

In terms of booking channel, online booking segment to command 64.0% share in the independent lodgings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA