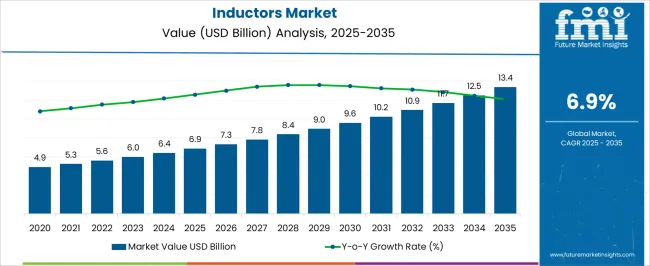

The Inductors Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. This early-phase growth is driven by increased demand for inductors in consumer electronics, automotive electronics, and renewable energy applications.

The market is expected to benefit from the ongoing shift toward miniaturized devices, with higher integration of inductors in next-gen technologies such as electric vehicles, industrial automation, and 5G communication infrastructure. The second half (2030 to 2035) will contribute USD 4.1 billion, representing 61.8% of the total growth, as demand accelerates in high-performance computing, power electronics, and wireless communications.

Annual increments during the first phase average USD 0.5 billion per year, while later years are expected to see stronger growth as inductors play a crucial role in enabling energy efficiency and signal integrity in advanced systems. Manufacturers focusing on high-frequency inductors, automotive-grade components, and energy-efficient designs will capture significant value in this USD 6.5 billion growth opportunity.

| Metric | Value |

|---|---|

| Inductors Market Estimated Value in (2025 E) | USD 6.9 billion |

| Inductors Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The inductors market is expanding steadily due to increasing demand for efficient power management across automotive, industrial automation, and consumer electronics sectors. The proliferation of advanced driver-assistance systems (ADAS), 5G infrastructure, and compact consumer devices has elevated the need for high-frequency, thermally stable inductive components.

Key players are investing in miniaturized, high-Q inductors capable of operating at higher frequencies while maintaining low core losses. Material science advancements and integration of automated surface-mount production technologies are helping manufacturers reduce form factors and improve performance under thermal and electrical stress.

As electrification continues across mobility and IoT ecosystems, inductors remain essential for EMI filtering, voltage regulation, and energy storage applications. Long-term growth is expected to be shaped by increased semiconductor content per device and the widespread adoption of electric vehicles and power-dense industrial equipment.

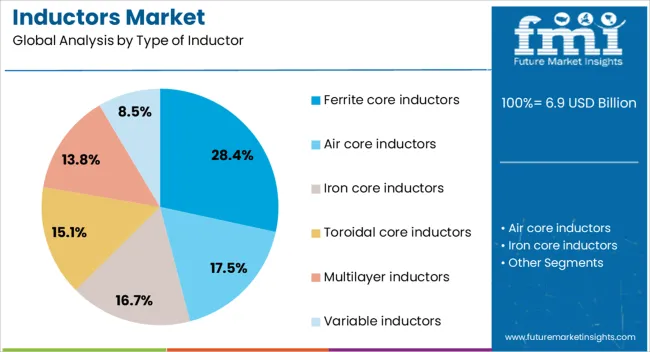

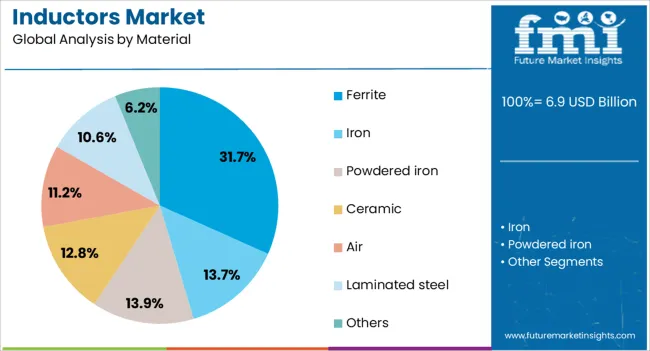

The inductors market is segmented by type of inductor, material, mounting type, application, end-use industry, and geographic regions. By type of inductor, the inductors market is divided into Ferrite core inductors, Air core inductors, Iron core inductors, Toroidal core inductors, Multilayer inductors, and Variable inductors. In terms of material, the inductors market is classified into Ferrite, Iron, Powdered iron, Ceramic, Air, Laminated steel, and Others.

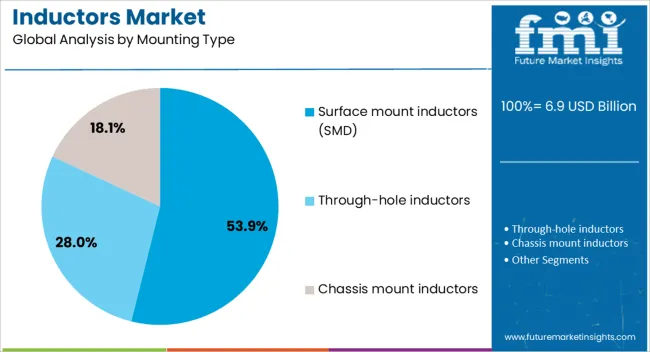

Based on mounting type, the inductors market is segmented into Surface mount inductors (SMD), Through-hole inductors, and Chassis mount inductors. By application of the inductors market is segmented into Power inductors, RF inductors, Coupled inductors, Multilayer inductors, and Other specialized inductors.

The inductors market is segmented by end-use industry into Consumer electronics, Automotive, Industrial, Telecommunications, Aerospace and defense, Healthcare, Energy and power, and Others. Regionally, the inductors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ferrite core inductors are projected to hold 28.40% of the total market share in 2025, establishing themselves as the leading inductor type. Their dominance is supported by excellent frequency stability, high magnetic permeability, and low eddy current losses, which make them well-suited for a wide range of switching power supplies and RF circuits.

These inductors offer efficient energy transfer at high frequencies while minimizing heat generation, enabling their use in compact and high-performance applications. The cost-effectiveness and availability of ferrite materials, combined with their adaptability in both consumer and industrial circuits, have contributed to sustained demand.

As power electronics shift toward higher switching speeds, ferrite core inductors are increasingly preferred for their noise suppression capabilities and consistent performance.

Ferrite materials are expected to account for 31.70% of the inductors market revenue in 2025, making them the most widely used material segment. Their selection is driven by superior magnetic properties, including high resistivity and controlled saturation, which enhance operational efficiency and reduce core losses.

Ferrite compositions are especially beneficial in high-frequency applications, where stability and EMI suppression are critical. The material’s compatibility with automated manufacturing processes has improved yield consistency and reduced production cost.

Ferrite’s versatility across both molded and wire-wound formats has enabled deployment in high-density PCB layouts. With the rise in power-dense electronics and the continued evolution of wireless communication systems, ferrite remains a go-to material for balancing performance, thermal resilience, and affordability.

Surface mount inductors (SMD) are forecast to lead the mounting type category with a 53.90% share in 2025. This leadership is being reinforced by the increasing miniaturization of electronic devices and the demand for high-speed automated assembly lines.

SMD inductors provide excellent board-level integration, reduce space constraints, and support higher component density without compromising electrical performance. The compatibility of SMD technology with high-frequency circuits and power regulation functions has enabled its extensive use in smartphones, laptops, wearables, and automotive ECUs.

Their robust mechanical stability and low-profile packaging also improve vibration resistance and thermal performance. As industries shift toward compact, energy-efficient systems, the preference for surface mount designs is expected to solidify their market position across next-generation electronics further.

The inductors market is growing due to the increasing demand for electronic devices in automotive, telecommunications, and consumer electronics sectors. Growth in 2024 and 2025 was driven by the proliferation of smart devices and electric vehicles (EVs). Opportunities lie in the development of high-performance inductors for power supply systems. Emerging trends include the shift toward smaller, more efficient components for miniaturized devices. However, high manufacturing costs and supply chain disruptions pose challenges for the market's expansion.

The major growth driver for the inductors market is the increasing demand for electronic devices in the automotive and telecommunications sectors. In 2024, the automotive industry’s shift towards electric vehicles (EVs) created a significant demand for power electronic components, including inductors, to manage power supplies. Likewise, the growth in 5G infrastructure and wireless communication networks has driven the need for inductors in telecom equipment, boosting market growth in these industries.

Opportunities in the inductors market arise from the development of high-performance inductors for power supply systems. In 2025, there was a growing demand for inductors capable of handling higher power levels while maintaining efficiency in power systems. These components are essential for applications in renewable energy grids, industrial automation, and data centers. As industries continue to move toward advanced, high-efficiency power solutions, the demand for high-performance inductors is expected to increase, opening new growth avenues.

Emerging trends in the inductors market are largely driven by the miniaturization of electronic devices. In 2024, there was a noticeable shift toward smaller and more efficient inductors in consumer electronics and wearable devices. As devices become more compact, inductors need to offer higher performance in smaller form factors without compromising their energy efficiency. This trend toward miniaturization aligns with the increasing demand for portable and smart devices, pushing the market for inductors to develop more space-saving solutions.

The major restraints in the inductors market include high manufacturing costs and ongoing supply chain disruptions. In 2024 and 2025, the rising costs of raw materials, such as copper and iron, significantly impacted the production costs of inductors. Additionally, global supply chain issues, such as delays in component deliveries and fluctuations in pricing, hindered the ability of manufacturers to meet demand in a timely manner. These factors have slowed market growth, especially in cost-sensitive regions and industries.

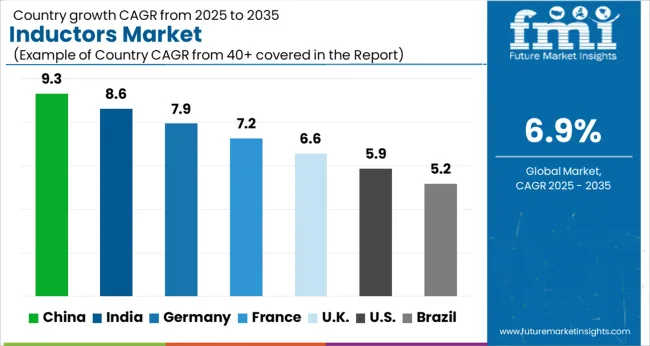

The global inductors market is projected to grow at 6.9% CAGR from 2025 to 2035. China leads with 9.3% CAGR, driven by the rapid industrialization and technological advancements in sectors such as electronics, automotive, and renewable energy. India follows at 8.6%, supported by the expanding electronics manufacturing sector, automotive industry, and demand for energy-efficient solutions.

Germany records 7.9% CAGR, with strong demand for high-performance inductors in the automotive, electronics, and telecommunications industries. The United Kingdom grows at 6.6%, while the United States posts 5.9%, reflecting steady demand in mature markets with a focus on technological innovation and high-performance solutions. Asia-Pacific leads market growth, while Europe and North America focus on product advancements and energy-efficient solutions.

The inductors market in China is forecasted to grow at 9.3% CAGR, driven by the rapid growth of electronics, automotive, and renewable energy sectors. China’s dominance in electronics manufacturing, combined with its increasing demand for electric vehicles and smart grids, accelerates the need for high-performance inductors. Furthermore, the country’s push for energy efficiency and environmental sustainability fuels the adoption of advanced inductors in power electronics, industrial automation, and renewable energy applications.

The inductors market in India is projected to grow at 8.6% CAGR, supported by the expanding electronics manufacturing sector, the rise of electric vehicle adoption, and growing demand for energy-efficient solutions. India’s booming industrial sector, combined with increasing investments in infrastructure, contributes to the rising demand for inductors in various applications, including power systems, telecommunications, and consumer electronics. Additionally, government policies promoting clean energy solutions and the smart grid further boost the market.

The inductors market in Germany is expected to grow at 7.9% CAGR, driven by the demand for advanced inductors in the automotive, telecommunications, and electronics industries. Germany’s robust manufacturing and industrial base, combined with its strong focus on Industry 4.0 and digitalization, strengthens market growth. The increasing shift toward electric vehicles and renewable energy sources also accelerates the adoption of energy-efficient inductors in various applications.

The inductors market in the United Kingdom is projected to grow at 6.6% CAGR, driven by the country’s push for energy-efficient solutions in electronics, telecommunications, and automotive industries. The demand for inductors in power systems, renewable energy technologies, and electric vehicle applications continues to grow as the UK focuses on sustainability and green technologies. Additionally, advancements in power electronics, combined with government incentives, further contribute to market growth.

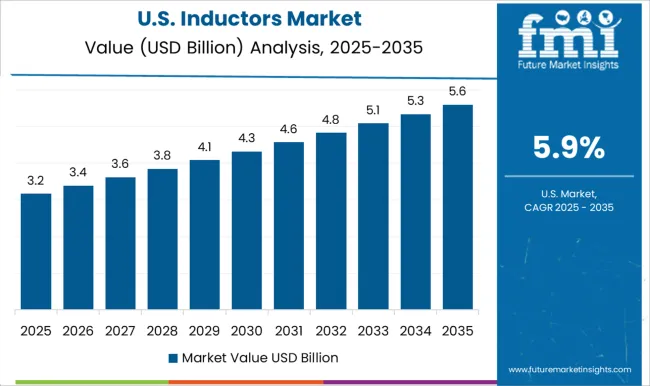

The inductors market in the United States is projected to grow at 5.9% CAGR, reflecting steady demand in a mature market with a focus on technological advancements. As the USA continues to focus on developing energy-efficient solutions for power systems, electronics, and telecommunications, the need for high-performance inductors increases. The growing use of inductors in electric vehicles, smart grids, and renewable energy projects further boosts market demand, along with increased investments in digital technologies.

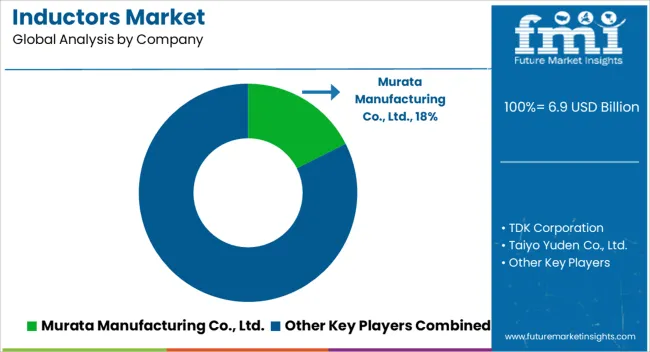

The inductors market is dominated by Murata Manufacturing Co., Ltd., a global leader in the design and production of electronic components. Murata holds a strong market position due to its wide range of high-performance inductors used in telecommunications, automotive, and consumer electronics. Known for its advanced technologies and innovative solutions, Murata has a broad customer base and a reputation for delivering high-quality, reliable inductors that meet the growing demand for efficient power management and signal filtering.

Its global presence, coupled with continuous R&D investment, has allowed the company to maintain leadership in the inductors market. Murata’s market share typically ranges between 20% and 30%, making it one of the key players in this competitive market. In addition to Murata, other significant players in the inductors market include TDK Corporation, Taiyo Yuden Co., Ltd., and Vishay Intertechnology, Inc.

These companies hold substantial market shares due to their diverse product portfolios and strong market presence across industries. TDK Corporation, for example, is known for its high-quality inductors for automotive and industrial applications.

Taiyo Yuden and Vishay Intertechnology focus on providing advanced inductors for power supplies, automotive electronics, and telecommunications. Collectively, these companies contribute to the steady growth of the inductors market, driven by increasing demand for efficient energy solutions, compact electronics, and advanced automotive systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Type of Inductor | Ferrite core inductors, Air core inductors, Iron core inductors, Toroidal core inductors, Multilayer inductors, and Variable inductors |

| Material | Ferrite, Iron, Powdered iron, Ceramic, Air, Laminated steel, and Others |

| Mounting Type | Surface mount inductors (SMD), Through-hole inductors, and Chassis mount inductors |

| Application | Power inductors, RF inductors, Coupled inductors, Multilayer inductors, and Other specialized inductors |

| End-Use Industry | Consumer electronics, Automotive, Industrial, Telecommunications, Aerospace and defense, Healthcare, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Vishay Intertechnology, Inc., Coilcraft, Inc., Laird Performance Materials, Sumida Corporation, KYOCERA AVX Components Corporation., KEMET Corporation, Bourns, Inc., Chilisin Electronics Corp., Delta Electronics, Inc., Samsung Electro-Mechanics, Würth Elektronik GmbH & Co. KG, and Panasonic Corporation |

| Additional Attributes | Dollar sales by inductor type and application, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in inductor adoption, innovation in high-efficiency and miniaturized designs, impact of regulatory standards on electromagnetic interference, and emerging use cases in IoT devices and electric vehicles. |

The global inductors market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the inductors market is projected to reach USD 13.4 billion by 2035.

The inductors market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in inductors market are ferrite core inductors, air core inductors, iron core inductors, toroidal core inductors, multilayer inductors and variable inductors.

In terms of material, ferrite segment to command 31.7% share in the inductors market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA