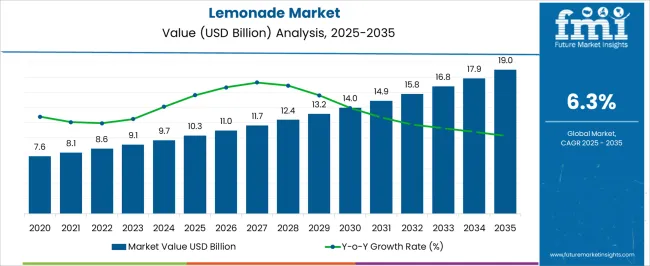

The lemonade market is valued at USD 10.3 billion in 2025 and is expected to reach USD 19.0 billion by 2035, registering a CAGR of 6.3%. Between 2021 and 2025, the market grows steadily from USD 7.6 billion to USD 10.3 billion, with annual increments moving from USD 8.1 billion in 2022 to USD 9.7 billion by 2025. This phase reflects a steady increase in demand for refreshing beverages, driven by changing consumer preferences towards healthier and more natural drinks.

From 2026 to 2030, the market strengthens further, advancing from USD 10.3 billion to USD 14.9 billion. The growth from USD 11.0 billion to USD 13.2 billion is fueled by the increasing shift toward organic, low-sugar, and functional lemonade variants, along with the growing popularity of ready-to-drink (RTD) beverages. This segment experiences heightened demand due to the convenience and health-conscious appeal of such options. From 2031 to 2035, the market continues its upward trajectory, reaching USD 19.0 billion by 2035. The incremental values from USD 14.0 billion to USD 17.9 billion reflect a greater adoption of lemonade in global markets, especially in emerging regions. Consumer trends, including the preference for low-sugar and health-enhancing drinks, further support this expansion. The market also benefits from ongoing product innovations and enhanced distribution channels.

| Metric | Value |

|---|---|

| Lemonade Market Estimated Value in (2025 E) | USD 10.3 billion |

| Lemonade Market Forecast Value in (2035 F) | USD 19.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The beverage industry market is the largest parent market, contributing approximately 20-25%. Lemonade, as a refreshing drink, falls under the broader beverage category, which includes soft drinks, bottled waters, and other non-alcoholic beverages. The non-alcoholic beverages market also plays a major role, accounting for around 15-18%, as lemonade is a prominent non-alcoholic drink that competes with other beverages like fruit juices, iced teas, and flavored waters. This market drives the growth of lemonade in both retail and foodservice segments. Additionally, the fruit juice market contributes about 12-15%, as lemonade is primarily made from lemon juice, which places it in direct competition with other fruit-based drinks.

The convenience food and beverages market, which contributes around 10-12%, has seen an increase in consumer demand for ready-to-consume products, further driving the growth of bottled and canned lemonade. The health and wellness beverage market, accounting for 8-10%, is seeing a rise in demand for healthier, low-sugar, and organic alternatives. This trend has led to the introduction of sugar-free, organic, and fortified lemonade products aimed at health-conscious consumers.

The lemonade market is experiencing consistent growth driven by rising consumer demand for refreshing, naturally positioned beverages and increasing awareness around healthier drink alternatives. A shift toward low sugar, organic, and clean label formulations is encouraging manufacturers to innovate with functional ingredients while retaining the appeal of traditional lemonade.

Expansion of distribution channels, including e commerce and ready to drink offerings in convenience retail, has strengthened accessibility. Advances in flavor stabilization, shelf life extension, and sustainable packaging have further supported product adoption across diverse markets.

Regulatory encouragement for reduced sugar consumption and the premiumization trend in non alcoholic beverages are also contributing to the category’s positive outlook. With a growing preference for functional hydration and versatile consumption occasions, the market is positioned for steady expansion in both developed and emerging economies.

The lemonade market is segmented by product type, product format, packaging type, distribution channel, and geographic regions. By product type, lemonade market is divided into Unflavoured and Flavoured. In terms of product format, lemonade market is classified into Ready-to-drink (RTD) lemonade, Concentrate lemonade, and Powdered lemonade. Based on packaging type, lemonade market is segmented into Bottles, Cans, Cartons, Pouches, and Others. By distribution channel, lemonade market is segmented into B2B and B2C. Regionally, the lemonade industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

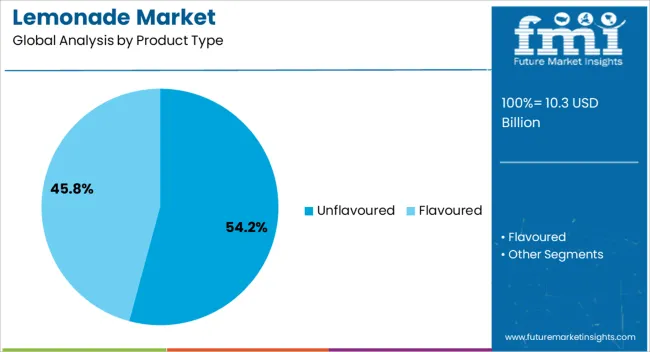

The unflavoured product type segment is expected to hold 54.20% of total revenue by 2025, making it the leading segment within the product type category. This dominance is supported by consumer preference for classic lemonade taste profiles without added flavoring, which is perceived as more natural and less processed.

Health conscious buyers often associate unflavoured options with fewer additives and greater authenticity. Additionally, its versatility as both a standalone beverage and a mixer in foodservice settings contributes to higher consumption volumes.

Minimal processing requirements and wider consumer acceptance have reinforced its strong position in the market.

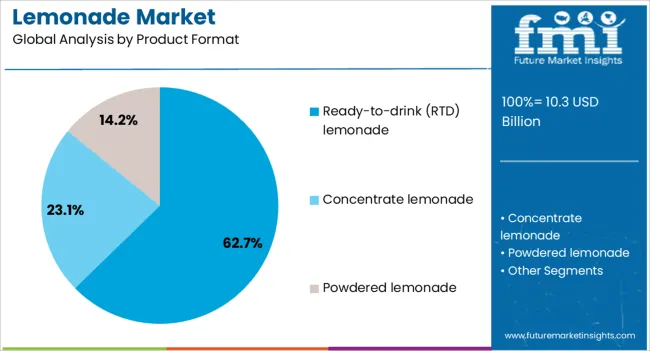

The ready to drink lemonade segment is projected to capture 62.70% of market revenue by 2025, positioning it as the most prominent format. This is driven by the convenience offered to consumers seeking immediate consumption options without preparation.

The format’s portability and availability across supermarkets, cafés, and vending channels enhance its appeal. Increasing urbanization and on the go lifestyles have amplified demand for RTD products, while packaging innovations and portion controlled serving sizes have further boosted sales.

The segment’s alignment with modern consumption habits ensures its sustained leadership in the market.

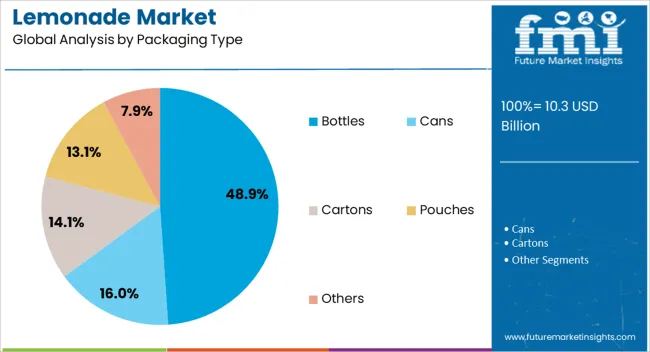

The bottles packaging type segment is anticipated to account for 48.90% of the total market by 2025, making it the leading packaging choice. Bottles offer durability, resealability, and ease of transport, making them a preferred choice for both retail and foodservice sectors.

Their compatibility with various materials, such as glass and PET, allows manufacturers to target both premium and mass market consumers. The format also supports extended shelf life and branding opportunities through label customization.

As sustainability initiatives grow, lightweight and recyclable bottle designs are expected to strengthen this segment’s dominance further.

The lemonade market is growing as consumers demand refreshing, natural, and healthy beverage alternatives. Demand is driven by the rising popularity of fruit-based drinks, health-conscious consumers, and increased availability of premium, organic, and flavored lemonade options.

Challenges include high production costs, raw material price fluctuations, and competition from other fruit juices and ready-to-drink beverages. Opportunities exist in low-sugar, all-natural, and functional beverages, as well as in sustainable packaging and innovative flavors. Trends highlight expanding product lines in sparkling and probiotic lemonade, as well as plant-based ingredients. Suppliers offering consistent quality, natural formulations, and innovative flavors are well-positioned to capture market growth across retail and e-commerce channels.

Health-conscious consumers are increasingly opting for lemonade as a natural and refreshing beverage alternative to sugary sodas. Lemonade, with its inherent citrus flavor, is viewed as a hydrating option that offers potential digestive benefits. The shift towards clean-label products, which emphasize transparency in ingredients, and the growing demand for organic and non-GMO options are further fueling this trend. Moreover, the rise of functional beverages has positioned lemonade as a versatile option for consumers seeking more than just refreshment. Many lemonade varieties now feature added benefits such as improved immunity, gut health support, and detoxification. As wellness and hydration become increasingly prioritized by a broader range of consumers, lemonade is gaining ground in markets worldwide, appealing to both younger and older demographics.

The lemonade market faces a number of constraints, primarily driven by fluctuating citrus fruit prices, particularly lemons, which can significantly impact production costs. The market is subject to the uncertainties of regional crop availability and climate change, which affect fruit yields and lead to price volatility. Stringent regulations around labeling, health claims, and ingredient sourcing also require careful attention to compliance, increasing operational complexity. Moreover, ensuring consistency in flavor, quality, and product characteristics across batches can be challenging due to natural variations in ingredients. On top of these, there is a growing consumer preference for eco-friendly, clean packaging, which adds additional cost and production complexity. In light of these factors, beverage manufacturers must focus on efficient sourcing, maintaining high product quality, and ensuring regulatory compliance while navigating these ongoing challenges in the marketplace.

Opportunities in the lemonade market are particularly strong in the development of low-sugar, all-natural, and organic products that cater to health-conscious consumers. With the growing demand for healthier alternatives, there is an opportunity for lemonade brands to capitalize on the increasing preference for beverages that are free from artificial sweeteners and additives. Functional lemonade options, such as those enriched with probiotics, antioxidants, and vitamins, are gaining traction as part of the wellness trend. Additionally, flavored lemonade varieties, including hibiscus, ginger, and berry infusions, are appealing to more adventurous consumers seeking novel and exotic flavors. Regional growth in North America, Europe, and Asia-Pacific, driven by greater awareness of health benefits, is opening up lucrative prospects for these functional and clean-label products. Companies that integrate sustainable packaging solutions into their offerings, while maintaining a high standard of quality, are poised to thrive in this growing market segment.

Probiotic lemonade, in particular, is gaining popularity as a natural option for gut health, aligning with the growing interest in digestive wellness. The demand for plant-based beverages is also influencing the development of non-dairy lemonades, with coconut water and other plant-based liquids being used as alternatives to traditional ingredients. Furthermore, the rising trend of sparkling lemonade is providing consumers with a refreshing, carbonated alternative to sodas. These innovations allow lemonade brands to cater to a broader audience seeking both healthier and more exciting beverage options. As consumer preferences evolve toward functional, plant-based, and low-sugar products, lemonade companies are diversifying their offerings to align with these emerging trends, helping them capture new segments of the market.

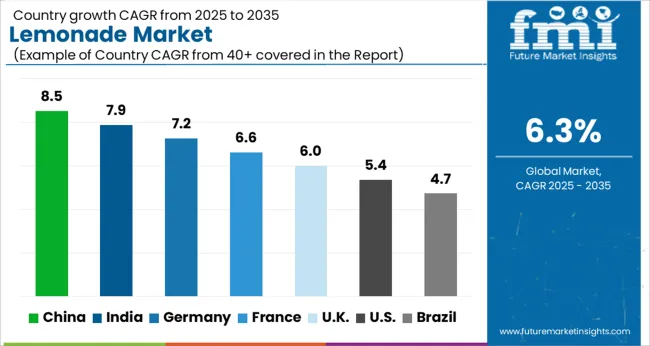

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

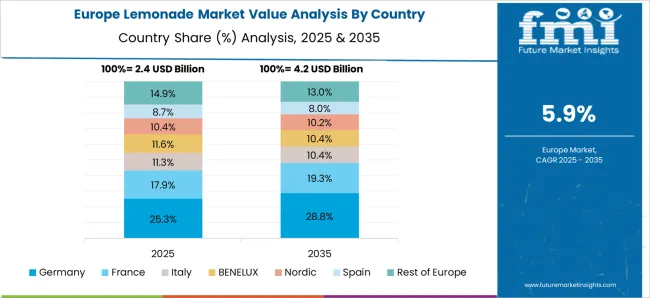

The global lemonade market is projected to grow at a CAGR of 6.3% from 2025 to 2035. China leads with 8.5%, followed by India at 7.9%, and Germany at 7.2%. The UK and the USA show moderate growth at 6.0% and 5.4% respectively. The rise in health-conscious consumers, the increasing demand for organic and functional beverages, and the shift towards non-carbonated, natural drinks are driving market expansion. E-commerce and product innovation in packaging and flavor offerings are further enhancing accessibility and variety. This growth is also driven by seasonal demand, particularly in summer months, as lemonade becomes a preferred hydrating beverage. The analysis includes over 40+ countries, with the leading markets detailed below.

The lemonade market in China is projected to grow at a CAGR of 8.5% from 2025 to 2035. The increasing demand for refreshing and healthy beverages, especially among younger consumers, is fueling market growth. Health-conscious individuals are increasingly shifting away from sugary sodas and opting for lemonade as a natural alternative, benefiting from its hydrating properties and potential digestive benefits. The rise of e-commerce platforms and the availability of premium lemonade products in supermarkets and online channels are also driving growth. The growing preference for organic ingredients and clean-label products is also shaping the market. Rising disposable income in tier-1 and tier-2 cities is encouraging the consumption of higher-end lemonade variants.

The lemonade market in India is set to grow at a CAGR of 7.9% from 2025 to 2035, driven by the increasing popularity of functional beverages and a shift towards healthier drink options. The rising middle-class population, coupled with growing urbanization, is contributing to the demand for ready-to-drink beverages like lemonade. Seasonal consumption spikes, particularly in the summer months, as consumers look for hydrating and refreshing drinks. The availability of fresh and locally sourced ingredients in urban centers is also influencing market growth. The growing trend of organic and natural products is accelerating the demand for premium lemonade products.

The lemonade market in Germany is projected to expand at a CAGR of 7.2% from 2025 to 2035. The increasing preference for non-carbonated, refreshing beverages is driving the demand for lemonade. The health and wellness trend in Germany, with consumers opting for beverages with lower sugar content and natural ingredients, is boosting market growth. Additionally, the demand for organic lemonade is increasing, with consumers looking for products that are free from artificial preservatives and additives. The convenience of ready-to-drink lemonade in retail outlets and the increasing number of new product launches are expected to continue supporting market growth.

The lemonade market in the United Kingdom is expected to grow at a CAGR of 6.0% from 2025 to 2035. The demand for lemonade is being driven by growing consumer interest in healthier beverage options, with a significant shift from sugary sodas to fruit-based drinks. The availability of lemonade with natural ingredients, such as lemon juice and organic sweeteners, is attracting health-conscious consumers. The growing trend of functional beverages, including those with added vitamins or probiotics, is spurring new product development. Increased availability through retail chains, online stores, and foodservice channels is further enhancing market penetration.

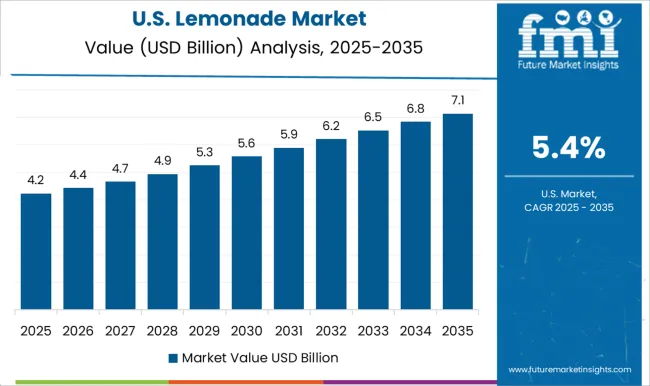

The USA lemonade market is expected to grow at a CAGR of 5.4% from 2025 to 2035. The shift towards healthier beverages continues to drive demand, with consumers seeking refreshing drinks with fewer calories and natural ingredients. The rise in popularity of artisanal and craft lemonade, which offers unique flavors and premium ingredients, is influencing consumption patterns. The rise of plant-based and organic beverages has contributed to the growing availability of organic lemonades in supermarkets. The availability of both traditional and innovative lemonade options in a variety of packaging formats, including single-serve bottles, is expected to continue supporting market growth.

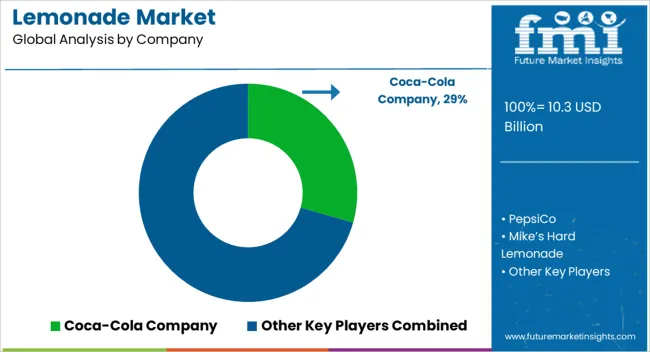

The global lemonade market is shaped by a mix of beverage giants, regional producers, and emerging natural and functional drink brands. Leading players such as PepsiCo (Tropicana), The Coca-Cola Company (Minute Maid), Cott Beverages, and Nestlé maintain strong positions by offering diversified portfolios of ready-to-drink lemonades, sparkling lemon beverages, and flavored variants. Competitive differentiation is driven by taste profile, natural ingredients, sugar content, packaging innovation, and distribution reach.

Regional manufacturers, particularly in North America, Europe, and Asia-Pacific, compete by offering artisanal, organic, and locally sourced lemonade products to cater to niche consumer preferences. Strategic partnerships with retail chains, e-commerce platforms, and foodservice providers help expand market penetration and enhance brand visibility. Innovation in low-calorie formulations, functional ingredients (such as vitamin C or probiotics), and eco-friendly packaging further strengthens market positioning. Companies focusing on quality assurance, regulatory compliance, and responsive supply chains are poised to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Product Type | Unflavoured and Flavoured |

| Product Format | Ready-to-drink (RTD) lemonade, Concentrate lemonade, and Powdered lemonade |

| Packaging Type | Bottles, Cans, Cartons, Pouches, and Others |

| Distribution Channel | B2B and B2C |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Coca-Cola Company, PepsiCo, Mike’s Hard Lemonade, Arizona Beverages, The Kraft Heinz Company, Santa Cruz Organic, Simply Beverages, and Snapple Beverages |

| Additional Attributes | Dollar sales by product type (regular, premium, organic, flavored), packaging (bottles, cans, tetra packs), and distribution channel (supermarkets, convenience stores, e-commerce). The market dynamics are influenced by trends toward healthier options, the rise of functional drinks, and shifting preferences for low-sugar, organic beverages. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, driven by the growing demand for ready-to-drink beverages and innovations in packaging and flavor combinations. |

The global lemonade market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the lemonade market is projected to reach USD 19.0 billion by 2035.

The lemonade market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in lemonade market are unflavoured and flavoured.

In terms of product format, ready-to-drink (rtd) lemonade segment to command 62.7% share in the lemonade market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA