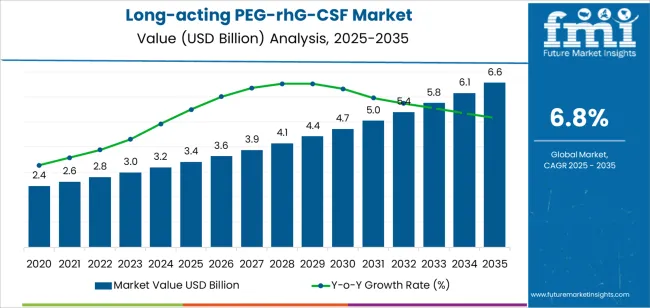

The global long-acting PEG-rhG-CSF market is expected to reach USD 6.6 billion by 2035, recording an absolute increase of USD 3.2 billion over the forecast period. The market is valued at USD 3.4 billion in 2025 and is set to rise at a CAGR of 6.8% during the assessment period. The overall market size is expected to grow by nearly 1.9 times during the same period, supported by increasing prevalence of chemotherapy-induced neutropenia in cancer treatment protocols, growing adoption of biosimilar formulations providing cost-effective treatment alternatives, and expanding access to supportive cancer care therapies in emerging healthcare markets, driving utilization of granulocyte colony-stimulating factors.

The market expansion reflects growing requirements for effective neutropenia prophylaxis in oncology settings, where long-acting PEG-rhG-CSF formulations deliver superior convenience and patient compliance compared to daily injection regimens. Healthcare facilities across oncology centers, hematology departments, and infusion therapy clinics are implementing pegylated G-CSF therapy to achieve reliable neutrophil recovery and reduce infection risk during myelosuppressive chemotherapy cycles.

The market demonstrates strong momentum across developed and emerging healthcare economies, where oncology care systems are transitioning from short-acting G-CSF formulations to long-acting pegylated variants that offer superior dosing convenience and reduced healthcare resource utilization. Long-acting PEG-rhG-CSF technology addresses critical clinical challenges including chemotherapy dose intensity maintenance through effective neutropenia prevention, reduced febrile neutropenia hospitalization rates in high-risk patient populations, and improved treatment adherence across extended cancer therapy regimens.

The oncology sector's emphasis on supportive care optimization and quality of life preservation creates sustained demand for biologic therapies capable of providing single-dose protection throughout chemotherapy cycles, minimizing patient clinic visits, and delivering consistent neutrophil recovery with predictable pharmacokinetic profiles. Medical oncologists and hematology specialists are adopting long-acting G-CSF formulations for chemotherapy support where neutropenia risk directly impacts treatment completion and survival outcomes.

Healthcare providers and cancer treatment centers are investing in long-acting PEG-rhG-CSF protocols to enhance supportive care delivery through improved patient convenience and streamlined administration schedules. The integration of biosimilar pegfilgrastim products and competitive pricing strategies enables healthcare systems to achieve treatment cost reductions of 30-50% compared to originator biologics while maintaining therapeutic efficacy standards. However, high therapy costs in certain healthcare markets and reimbursement limitations for prophylactic supportive care may pose challenges to market expansion in resource-constrained oncology practices and regions with restricted access to expensive biologic medications.

Between 2025 and 2030, the market is projected to expand from USD 3.4 billion to USD 4.7 billion, resulting in a value increase of USD 1.3 billion, which represents 41.9% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for convenient neutropenia prophylaxis in cancer chemotherapy protocols, product innovation in biosimilar pegfilgrastim development and novel pegylation technologies, as well as expanding integration with dose-dense chemotherapy regimens and value-based cancer care models. Companies are establishing competitive positions through investment in biosimilar manufacturing capabilities, competitive pricing strategies, and strategic market expansion across oncology infusion centers, hospital pharmacy networks, and specialty pharmacy distribution channels.

From 2030 to 2035, the market is forecast to grow from USD 4.7 billion to USD 6.6 billion, adding another USD 1.9 billion, which constitutes 58.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized formulations, including long-acting variants with extended duration profiles and novel delivery systems tailored for specific patient populations and treatment protocols, strategic collaborations between originator biologic manufacturers and biosimilar developers, and an enhanced focus on real-world evidence generation and health economic value demonstration. The growing emphasis on personalized cancer care and treatment optimization will drive demand for advanced, high-performance long-acting PEG-rhG-CSF solutions across diverse oncology applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.4 billion |

| Market Forecast Value (2035) | USD 6.6 billion |

| Forecast CAGR (2025-2035) | 6.8% |

The long-acting PEG-rhG-CSF market grows by enabling oncology providers to achieve effective neutropenia prevention and simplified supportive care delivery while reducing administration burden in cancer treatment operations. Cancer treatment facilities face mounting pressure to optimize chemotherapy dose intensity and minimize treatment delays, with long-acting G-CSF formulations typically requiring single administration per chemotherapy cycle compared to 7-14 daily injections with short-acting filgrastim, making these pegylated biologics essential for practical neutropenia management programs. The medical oncology specialty's need for reliable neutrophil recovery support creates demand for advanced G-CSF solutions that can provide sustained granulocyte stimulation, reduce febrile neutropenia incidence by 50-70% in high-risk populations, and enable dose-dense chemotherapy protocols across diverse cancer types and patient risk categories.

Healthcare transformation initiatives promoting value-based cancer care and patient-centered treatment models drive adoption in comprehensive cancer centers, community oncology practices, and hospital-based infusion services, where supportive care efficiency has a direct impact on treatment completion rates and healthcare cost management. The global shift toward biosimilar biologics and competitive market dynamics accelerates long-acting PEG-rhG-CSF demand as healthcare systems seek cost-effective alternatives to originator pegfilgrastim that maintain clinical efficacy while reducing pharmaceutical expenditures. However, high treatment costs in certain oncology settings and variable reimbursement coverage for prophylactic G-CSF therapy may limit adoption rates among budget-constrained cancer programs and regions with restricted access to expensive supportive care biologics and limited specialty pharmacy infrastructure.

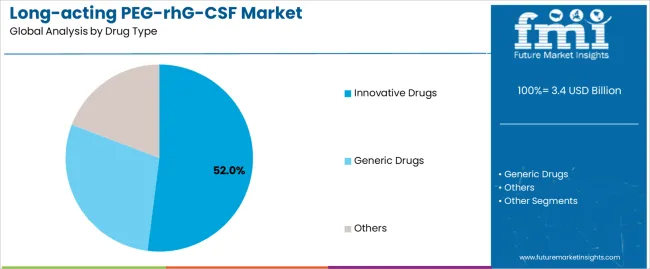

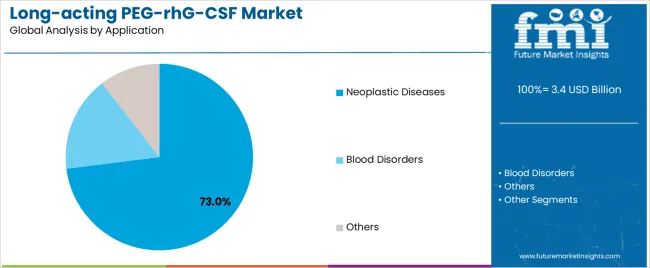

The market is segmented by drug type, application, and region. By drug type, the market is divided into innovative drugs, generic drugs, and others. Based on application, the market is categorized into neoplastic diseases, blood disorders, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The innovative drugs segment represents the dominant force in the market, capturing approximately 52.0% of total market share in 2025. This established category encompasses originator pegfilgrastim formulations, novel pegylation technologies, and advanced delivery systems optimized for enhanced pharmacokinetic profiles, delivering proven clinical efficacy and comprehensive real-world evidence supporting neutropenia prophylaxis applications. The innovative drugs segment's market leadership stems from strong brand recognition among oncology specialists, extensive clinical trial data demonstrating safety and efficacy, and established prescribing patterns across major cancer treatment centers and academic medical institutions.

The generic drugs segment maintains a substantial 39.0% market share, serving healthcare providers who require cost-effective biosimilar alternatives through pegfilgrastim biosimilars, competitive pricing structures, and interchangeable therapeutic options that enable broader treatment access. The others segment accounts for 9.0% market share, encompassing emerging long-acting G-CSF variants and novel formulation approaches.

Key advantages driving the innovative drugs segment include:

Neoplastic diseases applications dominate the market with approximately 73.0% market share in 2025, reflecting the extensive adoption of neutropenia prophylaxis across breast cancer chemotherapy regimens, lung cancer treatment protocols, and lymphoma therapy programs. The neoplastic diseases segment's market leadership is reinforced by widespread implementation in solid tumor chemotherapy support (38.0%), hematologic malignancy treatment (24.0%), and dose-dense therapy protocols (11.0%), which provide essential neutrophil recovery support and treatment completion optimization in myelosuppressive cancer therapy regimens.

The blood disorders segment represents 18.0% market share through specialized applications including bone marrow failure syndrome management (8.0%), stem cell mobilization procedures (6.0%), and congenital neutropenia treatment protocols (4.0%). Others applications account for 9.0% market share, encompassing HIV-related neutropenia management, radiation exposure treatment, and investigational therapeutic indications.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to cancer treatment patterns and supportive care standards. First, global cancer incidence expansion creates increasing requirements for neutropenia management solutions, with worldwide cancer diagnoses exceeding 19 million new cases annually across major healthcare markets, requiring reliable long-acting G-CSF therapy for chemotherapy-induced neutropenia prevention in breast cancer, lung cancer, and lymphoma treatment protocols. Second, clinical guideline adoption and evidence-based supportive care standards drive systematic G-CSF utilization, with long-acting PEG-rhG-CSF formulations enabling simplified prophylaxis protocols that improve treatment adherence and reduce febrile neutropenia hospitalization rates by 40-60% compared to no supportive intervention. Third, biosimilar market development and competitive pricing dynamics accelerate access expansion across healthcare systems, with pegfilgrastim biosimilars integrating into formulary protocols and enabling cost-effective neutropenia prophylaxis in budget-conscious oncology programs serving diverse patient populations.

Market restraints include high therapy costs affecting treatment affordability in certain healthcare markets, particularly where pegfilgrastim pricing remains elevated despite biosimilar competition and where reimbursement policies limit coverage for prophylactic supportive care medications in lower-risk chemotherapy regimens. Variable insurance coverage for G-CSF prophylaxis poses access challenges for patients in cost-sharing healthcare systems, as out-of-pocket expenses for long-acting biologics can create financial toxicity concerns that impact treatment decisions and medication adherence patterns. Limited biosimilar penetration in certain geographic markets creates additional barriers, as healthcare systems in regions with restricted biosimilar approval pathways continue to face elevated originator biologic pricing without competitive alternative options.

Key trends indicate accelerated biosimilar adoption in established healthcare markets, particularly United States and European countries, where regulatory approval of multiple pegfilgrastim biosimilars and competitive market dynamics are driving significant price erosion and expanded treatment access through formulary inclusion and pharmacy benefit management strategies. Technology advancement trends toward on-body delivery devices, extended-duration pegylation platforms, and combination supportive care approaches are driving next-generation product development. However, the market thesis could face disruption if novel neutropenia prevention strategies achieve breakthrough efficacy in protecting against chemotherapy-induced myelosuppression through alternative biological mechanisms, potentially reducing dependence on G-CSF therapy in specific oncology applications.

| Country | CAGR (2025-2035) |

|---|---|

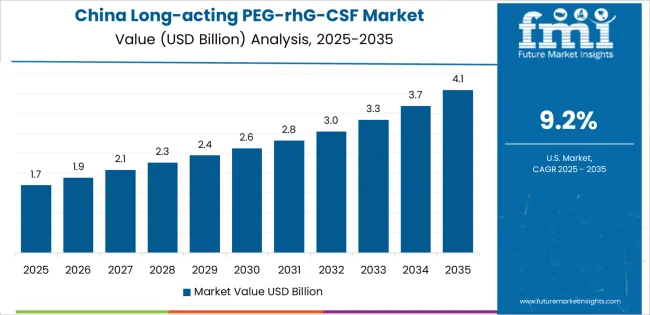

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

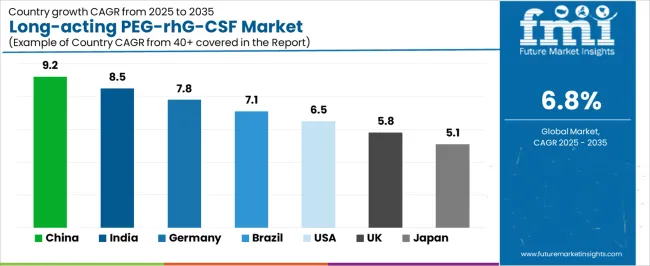

The market is gaining momentum worldwide, with China taking the lead to aggressive cancer care infrastructure expansion and biosimilar biologic development initiatives. Close behind, India benefits from growing oncology treatment capacity and domestic biosimilar manufacturing capabilities, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding private oncology networks and universal healthcare coverage programs strengthen its role in South American pharmaceutical markets.

The USA demonstrates robust growth through established biosimilar market development and comprehensive supportive care guideline implementation, signaling continued adoption in evidence-based oncology practice. Meanwhile, Japan stands out for its advanced cancer treatment infrastructure and comprehensive health insurance coverage, while UK and Germany continue to record consistent progress driven by national health service protocols and integrated cancer care pathways. Together, China and India anchor the global expansion story, while established markets build stability and biosimilar competition into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the market with a CAGR of 9.2% through 2035. The country's leadership position stems from comprehensive cancer care system expansion, intensive domestic biosimilar development programs, and aggressive pharmaceutical industry modernization targets driving adoption of supportive cancer care biologics. Growth is concentrated in major urban healthcare regions, including Beijing, Shanghai, Guangdong, and Zhejiang, where tertiary cancer hospitals, specialized oncology centers, and comprehensive medical institutions are implementing long-acting G-CSF protocols for chemotherapy support and neutropenia management programs.

Distribution channels through hospital pharmacy networks, specialty pharmaceutical distributors, and direct manufacturer relationships expand deployment across public cancer hospitals, private oncology facilities, and regional medical centers. The country's Healthy China 2030 initiative provides policy support for cancer care quality improvement, including reimbursement expansion for essential supportive care medications and domestic biologic manufacturing development.

Key market factors:

In major metropolitan healthcare zones, including Delhi, Mumbai, Bangalore, and Chennai, the adoption of long-acting PEG-rhG-CSF therapy is accelerating across corporate hospital chains, regional cancer centers, and specialty oncology practices, driven by expanding cancer treatment infrastructure and growing biosimilar availability. The market demonstrates strong growth momentum with a CAGR of 8.5% through 2035, linked to comprehensive oncology care development and increasing investment in affordable biologic therapy access.

Indian healthcare providers are implementing long-acting G-CSF protocols and evidence-based supportive care guidelines to improve chemotherapy completion rates while addressing treatment affordability through domestic biosimilar utilization serving middle-class patient populations. The country's National Cancer Control Programme creates sustained demand for cost-effective supportive care solutions, while increasing emphasis on biosimilar manufacturing drives domestic production capacity that enhances treatment accessibility.

Germany's advanced oncology sector demonstrates sophisticated implementation of long-acting PEG-rhG-CSF protocols, with documented clinical registry data showing 45-55% reduction in febrile neutropenia hospitalization rates through systematic prophylaxis programs in high-risk chemotherapy regimens.

The country's healthcare infrastructure in major medical regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Berlin, showcases integration of biosimilar pegfilgrastim formulations with existing oncology treatment protocols, leveraging expertise in evidence-based cancer care and comprehensive supportive care delivery. German oncology providers emphasize clinical guideline adherence and cost-effectiveness, creating demand for biosimilar G-CSF solutions that support quality cancer care while managing pharmaceutical expenditures. The market maintains strong growth through focus on biosimilar adoption and value-based oncology practice, with a CAGR of 7.8% through 2035.

Key development areas:

The Brazilian market leads in Latin American long-acting PEG-rhG-CSF adoption based on expanding oncology treatment infrastructure and growing biosimilar market development serving private and public healthcare sectors. The country shows solid potential with a CAGR of 7.1% through 2035, driven by universal healthcare system coverage and increasing demand for supportive cancer care therapies across urban medical centers and regional oncology facilities.

Brazilian oncology providers are adopting long-acting G-CSF therapy for compliance with Brazilian Society of Clinical Oncology guidelines, particularly in breast cancer chemotherapy requiring neutropenia prophylaxis and in lymphoma treatment protocols where dose intensity maintenance impacts cure rates. Technology deployment channels through oncology specialty distributors, hospital pharmacy procurement, and patient assistance programs expand coverage across SUS public hospitals and supplementary health system facilities.

Leading market segments:

The USA market leads in biosimilar pegfilgrastim development based on competitive market dynamics and multiple FDA-approved biosimilar products creating significant pricing pressure on originator biologics. The country shows solid potential with a CAGR of 6.5% through 2035, driven by established clinical practice guidelines and comprehensive insurance coverage for neutropenia prophylaxis in intermediate and high-risk chemotherapy regimens.

American oncology providers implement long-acting G-CSF protocols for guideline-concordant supportive care, particularly in dose-dense breast cancer regimens requiring reliable neutrophil recovery and in elderly patient populations where febrile neutropenia risk necessitates systematic prophylaxis. Technology deployment channels through specialty pharmacy networks, oncology group purchasing organizations, and integrated health system formularies expand coverage across academic cancer centers, community oncology practices, and hospital-based infusion services.

Leading market segments:

The UK market demonstrates consistent implementation focused on National Health Service oncology programs and integrated cancer care pathways, with documented biosimilar pegfilgrastim adoption achieving 70-80% market share through systematic formulary conversion and cost-effectiveness evaluation. The country maintains steady growth momentum with a CAGR of 5.8% through 2035, driven by NICE technology appraisal guidance and NHS England biosimilar incentive programs supporting cost-effective medication utilization. Major cancer treatment regions, including Greater London, Manchester, and Birmingham healthcare networks, showcase deployment of biosimilar G-CSF formulations that integrate with existing chemotherapy protocols and support national cancer treatment quality standards.

Key market characteristics:

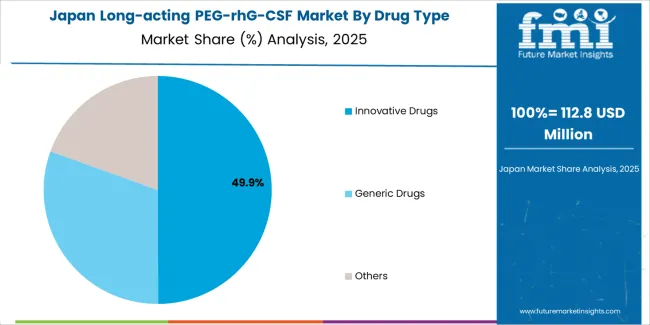

Japan's market demonstrates sophisticated implementation focused on comprehensive cancer supportive care programs and universal health insurance coverage, with documented integration of pegfilgrastim therapy achieving 50-60% prophylaxis utilization rates in high-risk chemotherapy protocols. The country maintains steady growth momentum with a CAGR of 5.1% through 2035, driven by Japanese Society of Medical Oncology guidelines and established clinical practice patterns emphasizing quality cancer care delivery. Major oncology regions, including Tokyo, Osaka, Aichi, and Fukuoka, showcase advanced deployment of long-acting G-CSF formulations that integrate with dose-dense chemotherapy protocols and comprehensive treatment planning systems.

Key market characteristics:

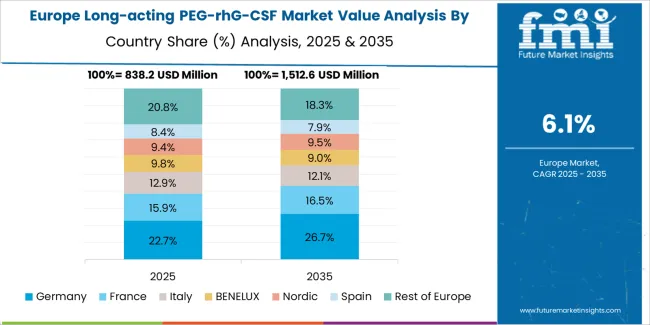

The long-acting PEG-rhG-CSF market in Europe is projected to grow from USD 1,229.7 million in 2025 to USD 2,454.9 million by 2035, registering a CAGR of 7.1% over the forecast period. Germany is expected to maintain its leadership position with a 27.3% market share in 2025, declining slightly to 26.1% by 2035, supported by its comprehensive oncology infrastructure and major cancer treatment centers, including university hospitals in Munich, Heidelberg, and Berlin.

France follows with a 19.4% share in 2025, projected to reach 20.2% by 2035, driven by comprehensive national cancer plan initiatives and integrated oncology care networks. The United Kingdom holds a 16.8% share in 2025, expected to reach 17.4% by 2035 through NHS biosimilar adoption programs and systematic supportive care implementation. Italy commands a 14.2% share in 2025, maintaining 14.5% by 2035, backed by regional oncology networks and supportive care protocols. Spain accounts for 11.9% in 2025, rising to 12.3% by 2035 on expanding cancer treatment capacity and biosimilar market development. The Rest of Europe region is anticipated to hold 10.4% in 2025, expanding to 9.5% by 2035, attributed to increasing long-acting G-CSF adoption in Nordic countries and emerging Central & Eastern European biosimilar market penetration.

The Japanese market demonstrates a mature and guideline-driven landscape, characterized by sophisticated integration of originator and biosimilar pegfilgrastim formulations with existing oncology treatment protocols across university hospitals, designated cancer care facilities, and regional medical centers. Japan's emphasis on evidence-based cancer care and systematic supportive care guidelines drives demand for long-acting G-CSF products that support chemotherapy dose intensity maintenance and clinical outcome optimization established by Japanese Society of Medical Oncology and Japan Cancer Society.

The market benefits from strong partnerships between international pharmaceutical manufacturers and domestic distributors including major pharmaceutical wholesalers, creating comprehensive supply ecosystems that prioritize product availability and pharmacovigilance programs. Oncology centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced supportive care implementations where long-acting G-CSF protocols achieve 85% prophylaxis compliance rates through systematic treatment planning and comprehensive patient education initiatives.

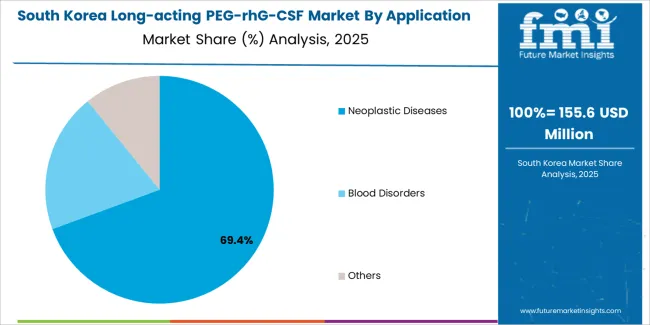

The South Korean long-acting PEG-rhG-CSF market is characterized by growing biosimilar manufacturer presence, with companies maintaining significant positions through competitive pricing strategies and comprehensive medical affairs support for oncology prescribers and hospital pharmacy departments. The market demonstrates increasing emphasis on cost-effective cancer care and biosimilar adoption, as Korean healthcare providers increasingly demand affordable long-acting G-CSF alternatives that integrate with National Health Insurance reimbursement systems and hospital formulary protocols deployed across tertiary cancer centers.

Regional pharmaceutical distributors are gaining market share through strategic partnerships with biosimilar manufacturers, offering specialized services including oncology pharmacy education programs and patient support services for chemotherapy-induced neutropenia management. The competitive landscape shows increasing collaboration between multinational biosimilar developers and Korean pharmaceutical companies, creating hybrid business models that combine international manufacturing expertise with local market access capabilities and regulatory compliance knowledge.

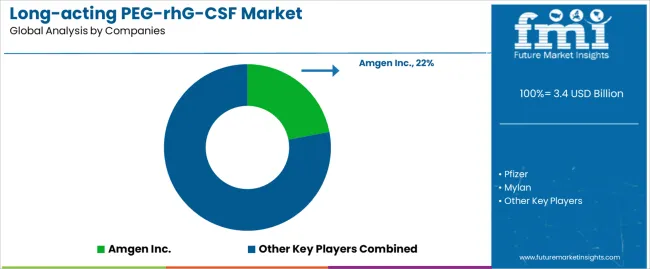

The market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 48-55% of global market share through established commercial infrastructure and comprehensive product portfolios. Competition centers on biosimilar pricing strategies, clinical equivalence demonstration, and market access capabilities rather than product differentiation alone. Amgen Inc. leads with approximately 22.0% market share through its originator Neulasta pegfilgrastim franchise and global commercial presence. Pfizer maintains strong positioning with approximately 16.0% market share through biosimilar pegfilgrastim products and established oncology market relationships. Sandoz (Novartis) holds significant market presence with approximately 14.0% market share through biosimilar portfolio and global distribution networks.

Market leaders include Amgen Inc., Pfizer, and Sandoz (Novartis), which maintain competitive advantages through global commercial infrastructure, comprehensive clinical evidence packages, and deep expertise in oncology market access across institutional oncology providers, specialty pharmacy networks, and managed care organizations, creating trust and reliability advantages with medical oncologists and hematology specialists. These companies leverage pharmacovigilance capabilities and ongoing real-world evidence generation to defend market positions while expanding into emerging oncology markets and biosimilar opportunity segments.

Challengers encompass Mylan, Biocon Biologics Inc., and Coherus BioSciences, Inc., which compete through biosimilar launches and competitive pricing strategies in key pharmaceutical markets. Product specialists, including Fresenius Kabi, CSPC, and Qilu Pharmaceutical, focus on regional markets or specific formulation approaches, offering differentiated capabilities in domestic biosimilar manufacturing, cost-effective treatment options, and localized commercial support structures.

Regional players and emerging biosimilar developers create competitive pressure through aggressive pricing strategies and local manufacturing advantages, particularly in high-growth markets including China and India, where domestic biosimilar manufacturers provide cost advantages through vertical integration and proximity to expanding oncology treatment infrastructure. Market dynamics favor companies that combine proven biosimilarity with comprehensive market access support that addresses formulary inclusion, reimbursement optimization, and patient assistance program requirements across diverse healthcare payment systems.

Long-acting PEG-rhG-CSF represents advanced supportive care biologics that enable oncology providers to achieve effective neutropenia prevention and simplified chemotherapy support delivery, providing superior convenience and patient compliance with single-dose protection throughout chemotherapy cycles and proven reduction in febrile neutropenia incidence in high-risk cancer treatment applications. With the market projected to grow from USD 3.4 billion in 2025 to USD 6.6 billion by 2035 at a 6.8% CAGR, these therapeutic biologics offer compelling advantages - treatment completion optimization, infection risk reduction, and healthcare resource efficiency - making them essential for neoplastic diseases applications (73.0% market share), blood disorder management (18.0% share), and cancer treatment programs seeking alternatives to daily G-CSF injection regimens that compromise patient convenience through frequent clinic visits and treatment burden. Scaling market adoption and biosimilar penetration requires coordinated action across healthcare policy, pharmaceutical regulation, biologic manufacturers, oncology providers, and payer organizations.

How Governments Could Spur Healthcare Access?

How Industry Bodies Could Support Market Development?

How Pharmaceutical Manufacturers Could Strengthen the Ecosystem?

How Oncology Providers Could Navigate Treatment Optimization?

How Payers Could Unlock Healthcare Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 billion |

| Drug Type | Innovative Drugs, Generic Drugs, Others |

| Application | Neoplastic Diseases, Blood Disorders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Amgen Inc., Pfizer, Mylan, Sandoz (Novartis), Biocon Biologics Inc., Coherus BioSciences, Inc., Fresenius Kabi, CSPC, Qilu Pharmaceutical, Jiangsu Hengrui Medicine |

| Additional Attributes | Dollar sales by drug type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with pharmaceutical manufacturers and biosimilar developers, healthcare facility requirements and specifications, integration with chemotherapy protocols and specialty pharmacy networks, innovations in pegylation technologies and biosimilar development platforms, and development of specialized formulations with enhanced pharmacokinetic profiles and patient convenience features. |

The global long-acting peg-rhg-csf market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the long-acting peg-rhg-csf market is projected to reach USD 6.6 billion by 2035.

The long-acting peg-rhg-csf market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in long-acting peg-rhg-csf market are innovative drugs, generic drugs and others.

In terms of application, neoplastic diseases segment to command 73.0% share in the long-acting peg-rhg-csf market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA