The global long-acting rhG-CSF market is valued at USD 4.5 billion in 2025. It is slated to reach USD 8.1 billion by 2035, recording an absolute increase of USD 3.7 billion over the forecast period. Demand is expected to grow by 82.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.83X during the same period, supported by increasing cancer incidence rates, growing adoption of biosimilars in chemotherapy-induced neutropenia management, and rising emphasis on patient-centered treatment protocols that reduce hospitalization and improve quality of life across diverse oncology, hematology, and immunotherapy applications.

Between 2025 and 2030, the long-acting rhG-CSF market is projected to expand from USD 4.5 billion to USD 6.0 billion, resulting in a value increase of USD 1.6 billion, which represents 42.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing cancer treatment volumes and expanding chemotherapy protocols, rising biosimilar penetration in developed markets with patent expirations, and growing demand for convenient once-per-cycle administration regimens in both hospital and outpatient settings. Pharmaceutical companies and healthcare providers are expanding their long-acting rhG-CSF capabilities to address the growing demand for effective neutropenia management solutions that ensure patient safety and treatment continuity.

From 2030 to 2035, the market is forecast to grow from USD 6.0 billion to USD 8.1 billion, adding another USD 2.1 billion, which constitutes 57.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of novel oncology combination therapies requiring enhanced hematopoietic support, the development of next-generation pegylated formulations with improved pharmacokinetic profiles, and the growth of emerging market access programs facilitating affordable neutropenia management in resource-limited settings. The growing adoption of personalized medicine approaches and value-based care models will drive demand for long-acting rhG-CSF products with enhanced efficacy and optimized dosing convenience features.

Between 2020 and 2025, the long-acting rhG-CSF market experienced steady growth, driven by increasing recognition of chemotherapy-induced neutropenia as a critical dose-limiting toxicity and growing acceptance of pegylated granulocyte colony-stimulating factors as standard supportive care in cancer treatment protocols. The market developed as oncologists and hematologists recognized the potential for long-acting rhG-CSF technology to reduce febrile neutropenia incidence, minimize treatment delays, and support optimal chemotherapy dose intensity while improving patient convenience. Technological advancement in protein pegylation and sustained-release formulations began emphasizing the critical importance of maintaining consistent neutrophil recovery and reducing infection complications in immunocompromised patient populations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.5 billion |

| Forecast Value in (2035F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

Market expansion is being supported by the increasing global cancer burden driven by aging populations and improved diagnostic capabilities, alongside the corresponding need for effective supportive care therapies that can prevent chemotherapy-induced neutropenia complications, enable optimal dose-dense treatment regimens, and maintain patient safety across various solid tumor, lymphoma, leukemia, and immunotherapy applications. Modern oncologists and hematology specialists are increasingly focused on implementing long-acting rhG-CSF solutions that can reduce febrile neutropenia risk, minimize treatment interruptions, and provide consistent neutrophil support throughout intensive chemotherapy cycles.

The growing emphasis on biosimilar adoption and healthcare cost containment is driving demand for affordable long-acting rhG-CSF products that can deliver equivalent clinical outcomes while reducing treatment costs for healthcare systems and patients. Healthcare providers' preference for convenient once-per-cycle administration that combines clinical efficacy with improved patient compliance and reduced nursing workload is creating opportunities for innovative long-acting rhG-CSF implementations. The rising influence of precision oncology and personalized treatment protocols is also contributing to increased adoption of long-acting rhG-CSF products that can provide reliable hematopoietic support without compromising treatment intensity or patient quality of life.

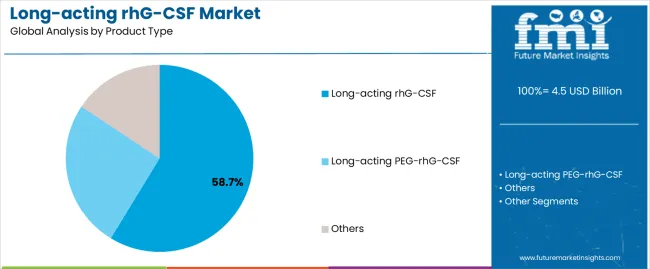

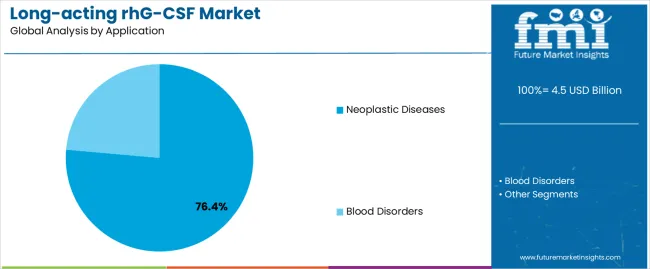

The market is segmented by product type, application, and region. By product type, the market is divided into long-acting rhG-CSF, long-acting PEG-rhG-CSF, and others. Based on application, the market is categorized into neoplastic diseases and blood disorders. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The long-acting PEG-rhG-CSF segment is projected to maintain its leading position in the long-acting rhG-CSF market in 2025 with a 58.7% market share, reaffirming its role as the preferred product category for chemotherapy-induced neutropenia prophylaxis and hematopoietic support applications. Oncologists and hematology specialists increasingly utilize pegylated granulocyte colony-stimulating factors for their superior pharmacokinetic profiles, extended half-life characteristics, and proven effectiveness in maintaining neutrophil counts with once-per-cycle administration. PEG-rhG-CSF technology's proven effectiveness and clinical versatility directly address the healthcare requirements for convenient neutropenia management and optimal chemotherapy dose intensity across diverse cancer types and treatment protocols.

This product segment forms the foundation of modern supportive cancer care, as it represents the formulation with the greatest contribution to patient convenience improvements and established safety record across multiple oncology indications and chemotherapy regimens. Pharmaceutical industry investments in biosimilar development and patent expiration transitions continue to strengthen adoption among oncology centers and outpatient clinics. With clinical guidelines recommending prophylactic use in high-risk chemotherapy regimens, long-acting PEG-rhG-CSF aligns with both evidence-based practice standards and patient-centered care objectives, making it the central component of comprehensive neutropenia management strategies.

The neoplastic diseases application segment is projected to represent the largest share of long-acting rhG-CSF demand in 2025 with a 76.4% market share, underscoring its critical role as the primary driver for long-acting rhG-CSF adoption across breast cancer, lung cancer, lymphoma, colorectal cancer, and other solid tumor malignancies requiring myelosuppressive chemotherapy. Oncologists prefer long-acting rhG-CSF for cancer treatment support due to its exceptional efficacy in preventing febrile neutropenia, documented ability to maintain chemotherapy dose intensity, and capacity to reduce infection-related hospitalizations while supporting optimal treatment outcomes and patient quality of life. Positioned as essential supportive medications for modern cancer care, long-acting rhG-CSF products offer both clinical protection and treatment convenience benefits.

The segment is supported by continuous expansion in cancer treatment volumes and the growing availability of biosimilar alternatives that enable broader patient access with reduced treatment costs. Additionally, oncology centers are investing in comprehensive supportive care programs to address increasingly complex chemotherapy regimens and immunotherapy combinations requiring enhanced hematopoietic support. As cancer survival rates improve and treatment protocols intensify, the neoplastic diseases application will continue to dominate the market while supporting advanced neutropenia prophylaxis and treatment optimization strategies.

The long-acting rhG-CSF market is advancing steadily due to increasing cancer incidence driven by demographic aging and lifestyle factors requiring intensive chemotherapy protocols with significant neutropenia risk, and growing adoption of biosimilar products that provide cost-effective treatment alternatives while maintaining clinical efficacy across diverse oncology, hematology, and transplantation applications. However, the market faces challenges, including high treatment costs limiting access in resource-constrained settings, competition from short-acting granulocyte colony-stimulating factors with established clinical experience, and reimbursement constraints related to healthcare budget pressures and biosimilar substitution policies. Innovation in novel pegylation technologies and patient assistance programs continues to influence product development and market expansion patterns.

The growing availability of biosimilar pegfilgrastim products following patent expirations of originator brands is driving market transformation through increased price competition, expanded patient access, and healthcare system cost savings. Biosimilar manufacturers are successfully demonstrating comparable efficacy and safety profiles to reference products while offering substantial price reductions that enable broader utilization in both developed and emerging markets. Oncology practices are increasingly recognizing the clinical equivalence and economic advantages of biosimilar adoption for routine neutropenia prophylaxis, creating opportunities for market expansion through improved affordability and reduced treatment barriers. Regulatory agencies' establishment of streamlined biosimilar approval pathways continues to facilitate competitive market entry and accelerate patient access to cost-effective long-acting rhG-CSF therapies.

Modern oncology practice is incorporating precision medicine approaches and individualized risk assessment strategies to optimize supportive care interventions, including targeted use of long-acting rhG-CSF based on patient-specific neutropenia risk factors, chemotherapy regimen intensity, and treatment intent. Leading cancer centers are developing predictive models utilizing patient characteristics, tumor biology, and treatment parameters to identify populations most likely to benefit from prophylactic granulocyte colony-stimulating factor support. These personalized approaches improve clinical outcomes while optimizing healthcare resource utilization, enabling appropriate treatment selection based on established risk stratification tools and evidence-based guidelines. Advanced clinical decision support integration also allows healthcare providers to balance neutropenia prevention benefits against treatment costs and patient preferences in comprehensive care planning.

The advancement of novel pegylation technologies, alternative polyethylene glycol conjugation strategies, and innovative sustained-release formulations is driving demand for next-generation long-acting rhG-CSF products with enhanced pharmacokinetic properties and optimized clinical performance. Pharmaceutical companies are investing in research programs exploring improved protein engineering techniques, alternative administration routes, and combination supportive care strategies that address current product limitations and emerging clinical needs. These technological innovations create opportunities for differentiated product offerings with enhanced efficacy profiles, reduced side effect burdens, and improved patient convenience features that support competitive positioning in mature markets while enabling expansion into underserved patient populations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The long-acting rhG-CSF market is experiencing solid growth globally, with China leading at an 8.4% CAGR through 2035, driven by rapidly expanding cancer treatment infrastructure, increasing healthcare insurance coverage for supportive care medications, and aggressive biosimilar market penetration strategies from domestic manufacturers. India follows at 7.8%, supported by rising cancer incidence, growing middle-class access to modern oncology care, and expanding local biosimilar production capabilities serving domestic and export markets. Germany shows growth at 7.1%, emphasizing comprehensive cancer care standards, robust biosimilar adoption frameworks, and strong healthcare reimbursement supporting guideline-concordant prophylaxis.

Brazil demonstrates 6.5% growth, supported by expanding public health system coverage, growing private oncology sector, and increasing biosimilar availability improving treatment affordability. The USA records 5.9%, focusing on established oncology infrastructure, competitive biosimilar market dynamics, and value-based care initiatives promoting cost-effective supportive care. The UK exhibits 5.3% growth, emphasizing NHS cancer treatment priorities and biosimilar procurement strategies. Japan shows 4.7% growth, supported by aging population demographics and comprehensive national health insurance coverage for cancer supportive care.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from long-acting rhG-CSF in China is projected to exhibit exceptional growth with a CAGR of 8.4% through 2035, driven by rapidly expanding cancer treatment capacity and growing healthcare insurance coverage for oncology supportive care medications supported by government Healthy China 2030 initiatives and healthcare modernization programs. The country's massive cancer patient population and increasing investment in biosimilar manufacturing technologies are creating substantial demand for affordable long-acting rhG-CSF solutions. Major pharmaceutical companies and domestic biosimilar manufacturers are establishing comprehensive production capabilities to serve both domestic markets and international export opportunities.

Revenue from long-acting rhG-CSF in India is expanding at a CAGR of 7.8%, supported by the country's position as a leading biosimilar manufacturing hub, expanding cancer treatment infrastructure, and increasing middle-class access to modern oncology care through growing health insurance penetration and government healthcare initiatives. The country's comprehensive pharmaceutical manufacturing expertise and cost-competitive production capabilities are driving sophisticated biosimilar development throughout domestic and export markets. Leading pharmaceutical companies and biosimilar specialists are establishing extensive production and innovation facilities to address growing domestic demand and international market opportunities.

Revenue from long-acting rhG-CSF in Germany is expanding at a CAGR of 7.1%, supported by the country's comprehensive cancer care infrastructure, strong biosimilar acceptance frameworks, and robust healthcare reimbursement systems supporting evidence-based supportive care interventions. The nation's advanced oncology expertise and emphasis on guideline-concordant treatment are driving sophisticated long-acting rhG-CSF utilization throughout comprehensive cancer centers. Leading pharmaceutical companies and biosimilar manufacturers are investing extensively in market access programs and clinical evidence generation supporting optimal product utilization.

Revenue from long-acting rhG-CSF in Brazil is expanding at a CAGR of 6.5%, supported by the country's expanding public health system coverage for cancer treatments, growing private oncology sector, and increasing biosimilar availability improving treatment affordability for diverse patient populations. The nation's comprehensive Sistema Único de Saúde and expanding private healthcare infrastructure are driving demand for accessible long-acting rhG-CSF solutions. Pharmaceutical companies and healthcare providers are investing in market access strategies and patient support programs to address cancer care needs.

Revenue from long-acting rhG-CSF in the USA is expanding at a CAGR of 5.9%, supported by the country's established oncology infrastructure, competitive biosimilar market landscape, and growing emphasis on value-based care models promoting cost-effective supportive care interventions. The nation's comprehensive cancer treatment capabilities and pharmaceutical innovation leadership are driving demand for diverse long-acting rhG-CSF product options. Pharmaceutical companies and healthcare systems are investing in biosimilar adoption strategies and clinical pathway optimization to balance clinical outcomes with treatment costs.

Revenue from long-acting rhG-CSF in the UK is expanding at a CAGR of 5.3%, supported by the country's National Health Service cancer treatment priorities, established biosimilar procurement frameworks, and comprehensive clinical guidelines supporting appropriate prophylactic granulocyte colony-stimulating factor utilization. The UK's centralized healthcare system and evidence-based medicine emphasis are driving strategic long-acting rhG-CSF adoption. NHS trusts and cancer networks are implementing standardized supportive care protocols incorporating cost-effective biosimilar products.

Revenue from long-acting rhG-CSF in Japan is growing at a CAGR of 4.7%, driven by the country's rapidly aging population demographics, comprehensive national health insurance coverage for cancer supportive care, and established oncology treatment infrastructure supporting guideline-based neutropenia management. Japan's healthcare sophistication and regulatory rigor are supporting demand for high-quality long-acting rhG-CSF products. Leading pharmaceutical companies are maintaining market presence through originator brands while preparing for biosimilar market evolution.

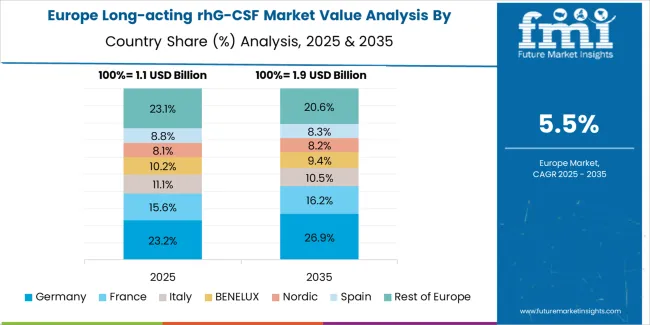

The long-acting rhG-CSF market in Europe is projected to grow from USD 1.2 billion in 2025 to USD 2.1 billion by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain leadership with a 26.5% market share in 2025, moderating to 25.8% by 2035, supported by comprehensive cancer care infrastructure, strong biosimilar adoption, and robust healthcare reimbursement systems.

France follows with 19.3% in 2025, projected at 19.6% by 2035, driven by centralized oncology networks, established supportive care protocols, and growing biosimilar utilization in public hospital systems. The UK holds 16.8% in 2025, expected to reach 17.1% by 2035 supported by NHS cancer treatment priorities and biosimilar procurement strategies. Italy commands 13.4% in 2025, rising slightly to 13.6% by 2035, while Spain accounts for 10.2% in 2025, reaching 10.4% by 2035 aided by expanding regional oncology services and increasing biosimilar penetration.

The Netherlands maintains 4.9% in 2025, up to 5.1% by 2035 due to advanced cancer care standards and comprehensive health insurance coverage. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 8.9% in 2025 and 8.4% by 2035, reflecting varied healthcare system maturity and biosimilar adoption trajectories across diverse national markets.

The long-acting rhG-CSF market is characterized by competition among established biopharmaceutical innovators, biosimilar manufacturers, and regional pharmaceutical companies. Companies are investing in biosimilar development, manufacturing capacity expansion, market access strategies, and clinical evidence generation to deliver clinically effective, affordable, and accessible long-acting rhG-CSF solutions. Innovation in pegylation technologies, sustained-release formulations, and patient support programs is central to strengthening market position and competitive advantage.

Amgen Inc. leads the market as the originator of pegfilgrastim with significant market presence, offering the reference product Neulasta with established clinical evidence, comprehensive safety data, and strong brand recognition across global oncology markets. Pfizer provides biosimilar pegfilgrastim products with emphasis on manufacturing excellence, competitive pricing strategies, and comprehensive market access programs supporting adoption in developed and emerging markets. Mylan offers biosimilar alternatives focusing on affordability and broad geographic distribution through established pharmaceutical networks. Sandoz (Novartis) delivers biosimilar pegfilgrastim with emphasis on quality manufacturing, regulatory compliance, and strategic partnerships with healthcare systems and pharmacy benefit managers.

Biocon Biologics Inc. specializes in biosimilar development with focus on emerging markets and cost-competitive product offerings. Coherus BioSciences Inc. provides biosimilar pegfilgrastim emphasizing differentiated formulations and patient-focused delivery innovations. Fresenius Kabi offers supportive care products including granulocyte colony-stimulating factors for hospital and clinic settings. Spectrum Pharmaceuticals focuses on oncology supportive care with specialized product portfolio. Yifan Pharmaceutical provides long-acting rhG-CSF products for Chinese and Asian markets. CSPC emphasizes domestic Chinese market leadership with biosimilar manufacturing capabilities. Jiangsu Hengrui Medicine offers comprehensive oncology product portfolio including neutropenia management solutions. Qilu Pharmaceutical specializes in biosimilar development serving domestic and international markets.

Long-acting rhG-CSF represents a critical supportive care segment within oncology and hematology applications, projected to grow from USD 4.5 billion in 2025 to USD 8.1 billion by 2035 at a 6.2% CAGR. These hematopoietic growth factor products, primarily pegylated granulocyte colony-stimulating factor formulations for chemotherapy-induced neutropenia prevention, serve as essential supportive medications in cancer treatment, bone marrow transplantation, and blood disorder management where prevention of severe neutropenia complications and maintenance of treatment intensity are critical. Market expansion is driven by increasing global cancer burden, growing biosimilar penetration following patent expirations, expanding treatment access in emerging markets, and rising emphasis on patient-centered care models prioritizing convenience and quality of life.

How Healthcare Regulators Could Strengthen Product Standards and Patient Safety?

How Clinical Guidelines Organizations Could Advance Evidence-Based Practice?

How Pharmaceutical Manufacturers Could Drive Innovation and Market Access?

How Healthcare Providers Could Optimize Treatment Delivery and Patient Outcomes?

How Research Institutions Could Enable Scientific Advancement?

How Payers and Health Systems Could Support Access and Value Optimization?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.5 billion |

| Product Type | Long-acting rhG-CSF, Long-acting PEG-rhG-CSF, Others |

| Application | Neoplastic Diseases, Blood Disorders |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Amgen Inc., Pfizer, Mylan, Sandoz (Novartis), Biocon Biologics Inc., Coherus BioSciences Inc. |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, biosimilar market dynamics, clinical evidence development, patient access programs, and healthcare value optimization |

The global long-acting rhG-CSF market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the long-acting rhG-CSF market is projected to reach USD 8.2 billion by 2035.

The long-acting rhG-CSF market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in long-acting rhG-CSF market are long-acting rhg-csf, long-acting peg-rhg-csf and others.

In terms of application, neoplastic diseases segment to command 76.4% share in the long-acting rhG-CSF market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA