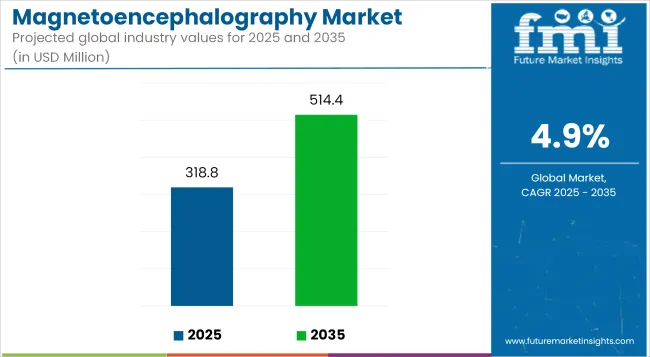

The market is projected to reach USD 318.8 Million in 2025 and is expected to grow to USD 514.4 Million by 2035, registering a CAGR of 4.9% over the forecast period. The expansion of neurotechnology research, increasing adoption in epilepsy and Alzheimer's disease diagnostics, and advancements in optically pumped magnetometers (OPMs) for portable MEG systems are shaping the industry’s future. Additionally, government funding for brain research projects and growing investment in personalized medicine are fueling market expansion.

From 2025 to 2035, the magnetoencephalography (MEG) market is set to proliferate extensively. This rise is due to the necessity for secure brain scans, increased brain disorders, and improved brain mapping tools.MEG is a very sharp way to see brain activity by tracking magnetic fields made by nerve cells. MEG is key for health checks, learning about the brain, and brain-computer work.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 318.8 Million |

| Market Value (2035F) | USD 514.4 Million |

| CAGR (2025 to 2035) | 4.9% |

North America will lead the magnetoencephalography (MEG) market. Strong research money, more brain illness cases, and great health care help drive this. The US and Canada are on top due to high use of MEG for epilepsy, tumors, and brain disease studies.

AI-powered brain imaging growth, more use of MEG for mental health, and wider use in brain function tests push market need. Plus, government-backed neuroscience projects, like the USA BRAIN Initiative and Canada’s brain studies, speed up growth for the industry.

Europe has a big part of the magnetoencephalography (MEG) market. Countries like Germany, the UK, France, and the Netherlands are top in brain research and new MEG systems. The EU spends money on brain health projects, research groups work with hospitals, and more portable MEG tech is used.

More uses for MEG in brain tools, use in planning for epilepsy and brain tumors, and AI brain checks are big trends. Europe also helps with rules for safe brain scanning tools. This boosts new products.

The Asia-Pacific area will likely see the highest growth in the magnetoencephalography (MEG) market. This is due to more need for better brain scans, more government money for brain research, and more brain problems. China, Japan, South Korea, and India lead in brain imaging, AI in health checks, and more places for brain health care.

China’s growing brain studies, more use of MEG for mental health checks, and many makers of medical tools help the market grow. Japan’s strong role in brain tech, more use of MEG for mind studies, and more small MEG systems for clinics also help growth. South Korea and India’s growing money for mental health research and use of MEG for brain health checks push the market even more.

Challenges

High Cost of MEG Systems and Limited Availability of Specialized Facilities

A big problem in the magnetoencephalography (MEG) market is the high price of traditional superconducting systems. This makes them hard to get for small hospitals and research centers. Plus, they need special rooms and trained people, which stops them from being used more widely in clinics.

Joining MEG with other brain imaging tools, like MRI and PET scans, is also hard. This leads to both technical and practical issues.

Opportunities

Portable MEG Systems, AI-Driven Brain Mapping, and Brain-Computer Interface (BCI) Applications

While facing obstacles, the magnetoencephalography (MEG) market shows big growth chances. Portable and wearable MEG systems are growing. They use OPMs, making brain imaging cheaper and easier to use. This helps more people and places adopt them.

AI-powered brain mapping tools are rising too. They let us watch brain activity in real-time and spot neurological issues fast. This opens new doors in brain science and mental health care.

More MEG-based BCIs are being made too. These help manage prosthetics and tech aids with brain signals, boosting future market growth. MEG is used more in personalized medicine as well. It helps create tailored treatment plans for brain issues. This is set to speed up market growth.

From 2020 to 2024, the magnetoencephalography (MEG) market grew steadily. This was due to more demand for brain scans without surgery in science, medical care, and mind studies. Better brain scan methods, knowing more about brain problems, and more money for brain research helped the market grow, too. But there were problems. The tools are pricey, not many MEG machines are around, and you need special places and skills to use them. This made it hard for many places to start using MEG.

From 2025 to 2035, the MEG market will change a lot. New tech, AI data help, and wearable MEG devices will drive this change. Small, cheaper, and easy-to-use MEG sensors will make it more accessible. This will help more with clinical and research uses. AI and cloud data will speed up and make better brain issue diagnoses. As brain studies grow and tailor-made treatments rise, MEG tools will aid in grasping brain work and spotting brain problems early on.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with medical imaging and patient safety standards. |

| Technological Advancements | Use of traditional superconducting MEG systems with cryogenic cooling. |

| Industry Applications | Primarily used in epilepsy diagnosis, brain research, and cognitive studies. |

| Adoption of Smart Equipment | Limited automation in MEG data analysis and interpretation. |

| Sustainability & Cost Efficiency | High costs due to cryogenic cooling and specialized lab requirements. |

| Data Analytics & Predictive Modeling | Manual interpretation of MEG scans with limited AI integration. |

| Production & Supply Chain Dynamics | Dependence on specialized manufacturing for superconducting sensors. |

| Market Growth Drivers | Demand driven by increasing neurological disorder cases and research funding. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations for AI-assisted diagnostics and data security in neuroimaging. |

| Technological Advancements | Development of room-temperature quantum sensors and portable MEG systems. |

| Industry Applications | Expansion into mental health assessments, neurodegenerative disease monitoring, and brain-computer interfaces (BCI). |

| Adoption of Smart Equipment | AI-powered MEG data processing, real-time analytics, and cloud-based diagnostics. |

| Sustainability & Cost Efficiency | Cost-effective, miniaturized MEG devices with energy-efficient designs. |

| Data Analytics & Predictive Modeling | AI-driven predictive modeling for early detection of neurological disorders. |

| Production & Supply Chain Dynamics | Shift towards scalable production of compact, wearable MEG devices with global accessibility. |

| Market Growth Drivers | Growth fueled by AI-driven diagnostics, advancements in wearable neurotechnology , and personalized brain health solutions. |

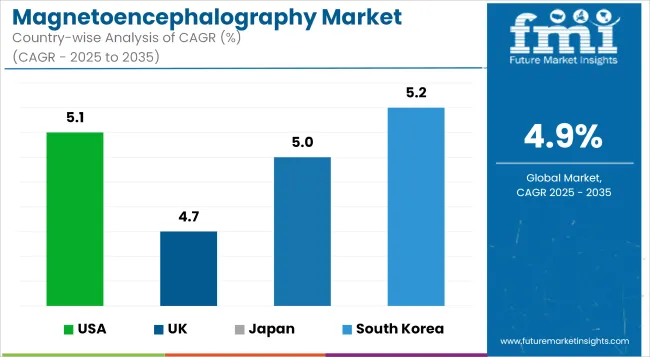

The magnetoencephalography (MEG) market in the USA is growing, pushed by more MEG use in brain research, more brain disorders, and strong funds from the government for high-tech imaging. The USA FDA and NIH approve MEG devices for study and funding.

More use of MEG in finding epilepsy and brain diseases, more schools and research places using MEG, and better portable MEG systems help the market grow. Also, more money in AI MEG data for early disease spotting is driving new ideas.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

The magnetoencephalography (MEG) market in the UK is growing. This is due to strong help from the government for brain research. More people are using MEG for mind and mental health studies. There is also a need for exact tests for brain issues. The UK Medicines and Healthcare Products Regulatory Agency and National Institute for Health and Care Excellence keep an eye on MEG device safety and how they are used in clinics.

MEG is being used more in brain studies. Schools and hospitals are working together more for research. There's also more money going into AI brain scan tech. Advances in MEG sensors that do not use cold liquids are also changing the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The magnetoencephalography (MEG) market in the EU is growing steadily. This is because more people have brain issues, there's more money for brain studies, and strict EU rules for medical scan devices exist. The EMA and Horizon Europe Program by the European Commission handle medical device approvals and funding for brain scan research.

Germany, France, and Italy are leaders in using MEG for epilepsy and autism research. They are expanding brain research centers and investing more in new quantum MEG systems. Also, combining MEG with MRI and PET for better diagnoses is helping the market grow.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The magnetoencephalography (MEG) market in Japan is growing. It is due to more old people needing help for diseases of the mind, more money from the government for brain research, and many top makers of imaging tech. The Japanese Ministry of Health, Labour, and Welfare (MHLW) and the Japan Neuroscience Society (JNS) manage MEG tech growth and use.

Japanese firms put money into small MEG sensors, growth of brain-computer links with MEG, and new portable MEG tools for real-world brain studies. Also, the use of quantum sensors for very high sensitivity MEG readings is shaping trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The magnetoencephalography (MEG) market in South Korea is growing fast. This growth is helped by more money from the government for brain research and more use of MEG in mental health and child brain studies. Investments in AI-powered brain scan tech are also on the rise. The South Korean Ministry of Food and Drug Safety (MFDS) and the Korea Brain Research Institute (KBRI) manage MEG device rules and brain scan projects.

AI helps in early finding of brain disorders, with more teamwork between research centers and hospitals. There's also a rise in cheap, room-temperature MEG sensor tech. New hybrid MEG-fMRI imaging for full brain activity maps is also boosting market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The magnetoencephalography (MEG) market is growing fast. The cause of this is the rising popularity of non-invasive means for mapping brain activity. There are also more cases of brain disorders, and there have been big steps forward in scanning the brain in real-time. Clinical and research uses are the most common, making MEG popular in health checks and brain studies.

MEG is used in early detection of brain disorders, brain mapping for surgery, and checking brain activity without operation. It offers high time resolution, real-time brain check, and little patient discomfort. These uses give key insights into brain function, and help in finding and treating diseases.

More people are using MEG due to more cases of brain diseases, need for planning epilepsy surgery, and precision medicine in brain study. Also, AI helps understand signals better, combining MEG and MRI imaging, and making MEG systems portable. These make diagnosis more accurate and easy.

However, there are issues like high setup costs, few MEG centers, and complex data. Yet, new wearable MEG tech, AI for brain disorder sorting, and cheaper sensors may increase its use and benefits.

MEG is used a lot in brain studies and for looking at brain function and mental health problems. It helps map brain activity in detail and gives us real-time information. Researchers use it to learn about how the brain connects, grows, and works with mental health.

MEG is getting more popular because more money is invested in studying how the brain and computers link. There's also more focus on mapping how different parts of the brain talk to each other and using smart tech to look at brain scans. Better sensors, combining different brain scan methods, and smart tech to read brainwaves make it more reliable and useful.

But, there are still problems. Analyzing MEG data is hard, it needs a lot of computer power to work in real-time, and in some places, and there isn't enough money for research. New tech, like using AI to understand MEG data better, cloud systems for brain scans, and sensors that don't need very low temps, will help make it more widely used and useful for research.

The need for MEG tech is mainly because of its use. Hospitals and imaging centers are big users. They care about early diagnosis, planning before surgery, and checking brain disorders.

Hospitals use MEG a lot to check for epilepsy, look at brain tumors, and test thinking skills. It gives detailed brain images, helps with surgeries, and provides personalized brain care. These systems help doctors see brain activity very accurately, which makes caring for patients better.

The use of MEG in hospitals is growing because there is more demand for better brain test tools. More hospitals are using AI to map brain activity, and there are more centers for epilepsy and dementia. Also, new combined MEG-MRI systems, real-time brain map software, and AI tools for predicting brain problems are helping improve patient care and diagnosis.

Even with all the benefits of MEG, there are still problems like high equipment costs, low insurance coverage, and the need for trained medical staff. But new portable MEG scanners, AI for real-time brain problem detection, and cheaper MEG equipment are expected to make MEG more accessible and widely used.

MEG in imaging centers is widely used to check brain function, plan surgeries, and find mental health issues. It offers special services for patients sent by hospitals and research groups. These places focus on MEG-based scans, cutting down wait times and giving more people access.

The need for MEG in imaging centers is growing. More people know the benefits of brain scans. MEG is used more for autism and stroke checks. More centers now offer these special services. Developments in AI help read MEG scans better. Storing data in the cloud and using centers that mix MEG with EEG and MRI make services better and faster.

But, there are challenges. Running these centers costs a lot. There are not many trained MEG experts. Constant upgrades in tech are needed. New ideas in automatic MEG data processing, AI-driven service management, and online MEG consultations should help. They will make services available to more people.

The magnetoencephalography (MEG) market is growing due to more interest in non-invasive ways to look at the brain. This is important for studying the brain, diagnosing conditions, and using brain-computer interfaces. This growth is because MEG technology is getting better, more people have brain issues, and there is more money going into brain studies. Companies work on clear and quick brain scans, portable MEG devices, and using AI to make better sense of data.

This helps in making diagnoses more accurate, makes the tools easier to use, and improves research. The market has big medical imaging companies, neuroscience tech firms, and research colleges. They are all working on cool new tech like superconducting quantum interference devices (SQUIDs), optically pumped magnetometers (OPMs), and mixed methods for looking at the brain.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ricoh Company, Ltd. (Ricoh MEG) | 18-22% |

| CTF MEG International Services LP | 14-18% |

| Compumedics Limited (Neuroscan) | 12-16% |

| MEGIN (A York Instruments Company) | 10-14% |

| FieldLine Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ricoh Company, Ltd. (Ricoh MEG) | Develops high-performance SQUID-based MEG systems for clinical and research applications. |

| CTF MEG International Services LP | Specializes in customizable MEG solutions with advanced noise reduction for epilepsy and cognitive research. |

| Compumedics Limited (Neuroscan) | Manufactures integrated EEG-MEG systems for neurodiagnostics and brain function analysis. |

| MEGIN (A York Instruments Company) | Provides next-generation OPM-based MEG technology with enhanced portability and spatial resolution. |

| FieldLine Inc. | Focuses on miniaturized, wearable MEG sensors for real-time brain activity monitoring. |

Key Company Insights

Ricoh Company, Ltd. (18-22%)

Ricoh leads the MEG market, offering high-resolution neuroimaging solutions for hospitals and research institutions worldwide.

CTF MEG International Services LP (14-18%)

CTF MEG specializes in high-sensitivity SQUID-based MEG systems, ensuring precise detection of brain activity for epilepsy and psychiatric research.

Compumedics Limited (Neuroscan) (12-16%)

Compumedics provides hybrid EEG-MEG technology, optimizing multi-modal brain imaging for clinical and cognitive neuroscience applications.

MEGIN (A York Instruments Company) (10-14%)

MEGIN focuses on lightweight, high-sensitivity OPM-based MEG systems, enhancing usability in non-traditional clinical environments.

FieldLine Inc. (6-10%)

FieldLine develops wearable, ultra-sensitive MEG sensors, expanding brain activity monitoring into mobile and real-world applications.

Other Key Players (30-40% Combined)

Several medical imaging firms, neuroscience startups, and research-driven technology companies contribute to advancements in MEG system sensitivity, cost reduction, and clinical accessibility. These include:

The overall market size for the magnetoencephalography (MEG) market was USD 318.8 Million in 2025.

The magnetoencephalography (MEG) market is expected to reach USD 514.4 Million in 2035.

Increasing prevalence of neurological disorders, growing demand for non-invasive brain imaging techniques, and advancements in sensor technology will drive market growth.

The USA, Germany, Japan, China, and the UK are key contributors.

Superconducting quantum interference device (SQUID)-based MEG systems are expected to dominate due to their high sensitivity and precision in detecting brain activity.

Table 1: Global Market Value (US$ Million), By Application, 2018 to 2022

Table 2: Global Market Value (US$ Million), By Application, 2023 to 2033

Table 3: Global Market Value (US$ Million), By End-use, 2018 to 2022

Table 4: Global Market Value (US$ Million), By End-use, 2023 to 2033

Table 5: Global Market, By Region, 2018 to 2022

Table 6: Global Market, By Region, 2023 to 2033

Table 7: North America Market Value (US$ Million), By Application, 2018 to 2022

Table 8: North America Market Value (US$ Million), By Application, 2023 to 2033

Table 9: North America Market Value (US$ Million), By End-use, 2018 to 2022

Table 10: North America Market Value (US$ Million), By End-use, 2023 to 2033

Table 11: North America Market, By Country, 2018 to 2022

Table 12: North America Market, By Country, 2023 to 2033

Table 13: Latin America Market Value (US$ Million), By Application, 2018 to 2022

Table 14: Latin America Market Value (US$ Million), By Application, 2023 to 2033

Table 15: Latin America Market Value (US$ Million), By End-use, 2018 to 2022

Table 16: Latin America Market Value (US$ Million), By End-use, 2023 to 2033

Table 17: Latin America Market, By Country, 2018 to 2022

Table 18: Latin America Market, By Country, 2023 to 2033

Table 19: Europe Market Value (US$ Million), By Application, 2018 to 2022

Table 20: Europe Market Value (US$ Million), By Application, 2023 to 2033

Table 21: Europe Market Value (US$ Million), By End-use, 2018 to 2022

Table 22: Europe Market Value (US$ Million), By End-use, 2023 to 2033

Table 23: Europe Market, By Country, 2018 to 2022

Table 24: Europe Market, By Country, 2023 to 2033

Table 25: Asia Pacific Market Value (US$ Million), By Application, 2018 to 2022

Table 26: Asia Pacific Market Value (US$ Million), By Application, 2023 to 2033

Table 27: Asia Pacific Market Value (US$ Million), By End-use, 2018 to 2022

Table 28: Asia Pacific Market Value (US$ Million), By End-use, 2023 to 2033

Table 29: Asia Pacific Market, By Country, 2018 to 2022

Table 30: Asia Pacific Market, By Country, 2023 to 2033

Table 31: MEA Market Value (US$ Million), By Application, 2018 to 2022

Table 32: MEA Market Value (US$ Million), By Application, 2023 to 2033

Table 33: MEA Market Value (US$ Million), By End-use, 2018 to 2022

Table 34: MEA Market Value (US$ Million), By End-use, 2023 to 2033

Table 35: MEA Market, By Country, 2018 to 2022

Table 36: MEA Market, By Country, 2023 to 2033

Table 37: Global Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 38: Global Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 39: Global Market Incremental $ Opportunity, By Region, 2023 to 2033

Table 40: North America Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 41: North America Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 42: North America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 43: Latin America Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 44: Latin America Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 45: Latin America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 46: Europe Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 47: Europe Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 48: Europe Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 49: Asia Pacific Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 50: Asia Pacific Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 51: Asia Pacific Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 52: MEA Market Incremental $ Opportunity, By Application, 2018 to 2022

Table 53: MEA Market Incremental $ Opportunity, By End-use, 2023 to 2033

Table 54: MEA Market Incremental $ Opportunity, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ Million

Figure 3: Global Market Share, By Application, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Application – 2023 to 2033

Figure 6: Global Market Share, By End-use, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 8: Global Market Attractiveness Index, By End-use – 2023 to 2033

Figure 9: Global Market Share, By Region, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Region – 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Region – 2023 to 2033

Figure 12: North America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 13: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 14: North America Market Share, By Application, 2023 & 2033

Figure 15: North America Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 16: North America Market Attractiveness Index, By Application – 2023 to 2033

Figure 17: North America Market Share, By End-use, 2023 & 2033

Figure 18: North America Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 19: North America Market Attractiveness Index, By End-use – 2023 to 2033

Figure 20: North America Market Share, By Country, 2023 & 2033

Figure 21: North America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 22: North America Market Attractiveness Index, By Country – 2023 to 2033

Figure 23: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 24: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 25: Latin America Market Share, By Application, 2023 & 2033

Figure 26: Latin America Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 27: Latin America Market Attractiveness Index, By Application – 2023 to 2033

Figure 28: Latin America Market Share, By End-use, 2023 & 2033

Figure 29: Latin America Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 30: Latin America Market Attractiveness Index, By End-use – 2023 to 2033

Figure 31: Latin America Market Share, By Country, 2023 & 2033

Figure 32: Latin America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 33: Latin America Market Attractiveness Index, By Country – 2023 to 2033

Figure 34: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 35: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 36: Europe Market Share, By Application, 2023 & 2033

Figure 37: Europe Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 38: Europe Market Attractiveness Index, By Application – 2023 to 2033

Figure 39: Europe Market Share, By End-use, 2023 & 2033

Figure 40: Europe Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 41: Europe Market Attractiveness Index, By End-use – 2023 to 2033

Figure 42: Europe Market Share, By Country, 2023 & 2033

Figure 43: Europe Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 44: Europe Market Attractiveness Index, By Country – 2023 to 2033

Figure 45: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 46: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 47: MEA Market Share, By Application, 2023 & 2033

Figure 48: MEA Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 49: MEA Market Attractiveness Index, By Application – 2023 to 2033

Figure 50: MEA Market Share, By End-use, 2023 & 2033

Figure 51: MEA Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 52: MEA Market Attractiveness Index, By End-use – 2023 to 2033

Figure 53: MEA Market Share, By Country, 2023 & 2033

Figure 54: MEA Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 55: MEA Market Attractiveness Index, By Country – 2023 to 2033

Figure 56: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 57: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 58: Asia Pacific Market Share, By Application, 2023 & 2033

Figure 59: Asia Pacific Market Y-o-Y Growth Projections, By Application – 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness Index, By Application – 2023 to 2033

Figure 61: Asia Pacific Market Share, By End-use, 2023 & 2033

Figure 62: Asia Pacific Market Y-o-Y Growth Projections, By End-use – 2023 to 2033

Figure 63: Asia Pacific Market Attractiveness Index, By End-use – 2023 to 2033

Figure 64: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 65: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 66: Asia Pacific Market Attractiveness Index, By Country – 2023 to 2033

Figure 67: US Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 68: US Market Share, By Application, 2022

Figure 69: US Market Share, By End-use, 2022

Figure 70: Canada Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 71: Canada Market Share, By Application, 2022

Figure 72: Canada Market Share, By End-use, 2022

Figure 73: Brazil Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 74: Brazil Market Share, By Application, 2022

Figure 75: Brazil Market Share, By End-use, 2022

Figure 76: Mexico Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 77: Mexico Market Share, By Application, 2022

Figure 78: Mexico Market Share, By End-use, 2022

Figure 79: Germany Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 80: Germany Market Share, By Application, 2022

Figure 81: Germany Market Share, By End-use, 2022

Figure 82: United Kingdom Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 83: United Kingdom Market Share, By Application, 2022

Figure 84: United Kingdom Market Share, By End-use, 2022

Figure 85: France Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 86: France Market Share, By Application, 2022

Figure 87: France Market Share, By End-use, 2022

Figure 88: Italy Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 89: Italy Market Share, By Application, 2022

Figure 90: Italy Market Share, By End-use, 2022

Figure 91: BENELUX Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 92: BENELUX Market Share, By Application, 2022

Figure 93: BENELUX Market Share, By End-use, 2022

Figure 94: Nordic Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 95: Nordic Countries Market Share, By Application, 2022

Figure 96: Nordic Countries Market Share, By End-use, 2022

Figure 97: China Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 98: China Market Share, By Application, 2022

Figure 99: China Market Share, By End-use, 2022

Figure 100: Japan Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 101: Japan Market Share, By Application, 2022

Figure 102: Japan Market Share, By End-use, 2022

Figure 103: South Korea Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 104: South Korea Market Share, By Application, 2022

Figure 105: South Korea Market Share, By End-use, 2022

Figure 106: GCC Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 107: GCC Countries Market Share, By Application, 2022

Figure 108: GCC Countries Market Share, By End-use, 2022

Figure 109: South Africa Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 110: South Africa Market Share, By Application, 2022

Figure 111: South Africa Market Share, By End-use, 2022

Figure 112: Turkey Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 113: Turkey Market Share, By Application, 2022

Figure 114: Turkey Market Share, By End-use, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA