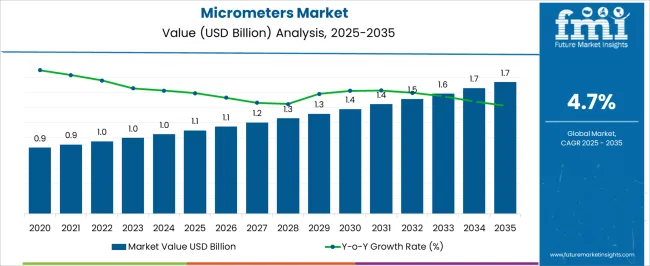

The micrometers market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Micrometers are crucial tools for precise measurement in various industries, including manufacturing, automotive, aerospace, and electronics. Their importance in ensuring product quality and precision manufacturing is undeniable, as industries continue to demand greater accuracy in production processes.

As industries increasingly focus on quality control, the demand for high-precision measurement tools like micrometers will continue to expand, supporting the growth of the market. The demand for micrometers is driven by the need for precision in high-tech manufacturing environments where small tolerances are critical. Industries such as automotive and aerospace, where components must meet strict quality standards, will likely be key contributors to market growth.

Furthermore, as industries adopt automated and digital systems, micrometers are expected to see integration with advanced measurement technologies. This trend, coupled with the expanding applications in emerging sectors like electronics and healthcare, signals strong, sustained growth for the micrometers market. While growth may be gradual, the market’s long-term outlook remains positive, as the need for precise measurements in quality control processes is unlikely to diminish.

| Metric | Value |

|---|---|

| Micrometers Market Estimated Value in (2025 E) | USD 1.1 billion |

| Micrometers Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The micrometers market is estimated to hold a notable proportion within its parent markets, representing approximately 8-10% of the measurement and testing instruments market, around 5-6% of the precision tools market, close to 12-14% of the industrial automation market, about 3-4% of the manufacturing equipment market, and roughly 2-3% of the calibration services market.

The cumulative share across these parent segments is observed in the range of 30-37%, reflecting the importance of micrometers in the broader measurement and precision instruments industry. The market has been driven by the increasing need for accurate and precise measurements in manufacturing, quality control, and calibration processes, where reliability, durability, and ease of use are highly prioritized. Adoption is guided by procurement decisions focused on measurement precision, versatility, and compatibility with a wide range of industrial applications. Market participants have focused on improving the functionality and user experience of micrometers by enhancing digital features, increasing measurement ranges, and reducing error margins.

As a result, the micrometers market has not only captured a significant share within measurement and testing instruments but has also influenced precision tools, industrial automation, and manufacturing equipment sectors, highlighting its role in ensuring product quality, operational efficiency, and consistency across various industrial processes.

The micrometers market is experiencing consistent growth, fueled by the rising demand for precision measurement tools across manufacturing, aerospace, automotive, and research sectors. Growing emphasis on dimensional accuracy and quality control in production environments is driving the adoption of micrometers, particularly in industries where tolerance levels are stringent. Technological advancements in metrology equipment, especially the integration of digital readouts and wireless data transmission, are enhancing usability and operational efficiency.

Manufacturers are increasingly focused on improving product consistency, traceability, and inspection accuracy, which is contributing to the market's expansion. As global manufacturing ecosystems shift toward automation and Industry 4.0 frameworks, the need for reliable and precise handheld instruments is becoming more pronounced. Micrometers are being favored due to their portability, ease of calibration, and ability to deliver high-resolution measurements with minimal operator error.

Investments in advanced materials and ergonomic designs are further supporting adoption in high-throughput environments. With increasing quality standards and process control requirements across various end-use industries, the micrometers market is expected to witness steady growth, led by innovations that bridge manual operation with digital integration.

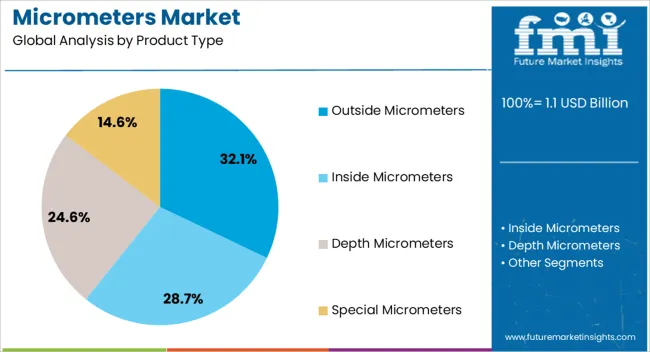

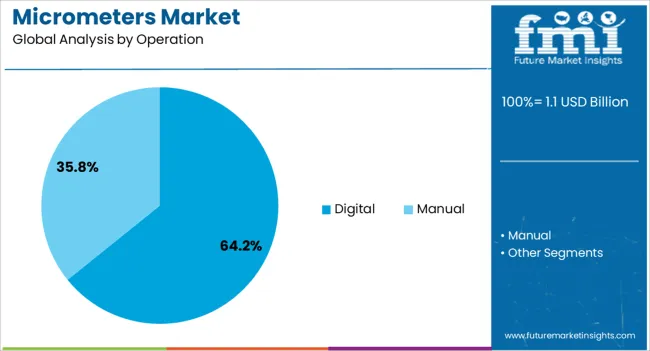

The micrometers market is segmented by product type, operation, application, pricing, distribution channel, and geographic regions. By product type, micrometers market is divided into Outside Micrometers, Inside Micrometers, Depth Micrometers, and Special Micrometers. In terms of operation, micrometers market is classified into Digital and Manual.

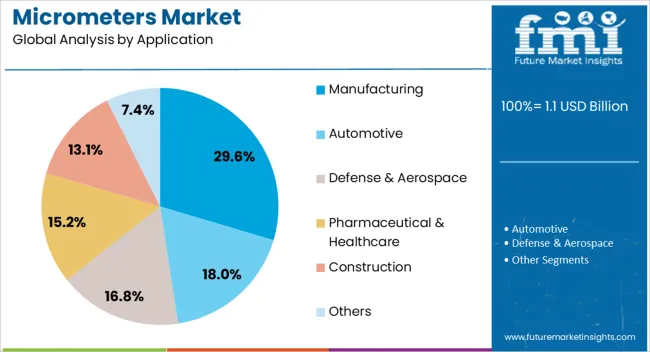

Based on application, micrometers market is segmented into Manufacturing, Automotive, Defense & Aerospace, Pharmaceutical & Healthcare, Construction, and Others. By pricing, micrometers market is segmented into Medium, Low, and High. By distribution channel, micrometers market is segmented into Offline and Online. Regionally, the micrometers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The outside micrometers segment is projected to hold 32.1% of the micrometers market revenue share in 2025, making it the leading product type. Its leadership is being driven by widespread utility in measuring external dimensions such as diameters and thicknesses with high accuracy and repeatability. Outside micrometers are being adopted extensively in manufacturing, mechanical engineering, and metalworking sectors due to their versatility and ability to perform precise measurements on a wide variety of components.

Their straightforward design and rugged construction enable consistent performance in demanding production environments. The segment is also benefiting from standardization across industries, making outside micrometers a common requirement for quality inspection and control procedures.

Ease of use, affordability, and broad availability from multiple manufacturers are reinforcing their adoption in both small-scale and large-scale production facilities. As manufacturing processes demand increasingly tight tolerances and documentation of component dimensions, outside micrometers are expected to remain a key tool for external measurement tasks, driving their continued dominance within the product type category.

The digital operation segment is expected to account for 64.2% of the micrometers market revenue share in 2025, establishing it as the leading operational mode. This segment's growth is being supported by the rising need for measurement tools that offer quick, accurate, and user-friendly readouts, especially in environments where time and accuracy are critical. Digital micrometers are being adopted for their ability to eliminate parallax errors and provide direct readings without the need for manual interpretation, significantly reducing the chance of human error.

The segment is also benefitting from features such as data storage, USB or wireless connectivity, and integration with quality control systems, all of which enhance traceability and workflow automation. In high-precision manufacturing and quality inspection settings, digital micrometers are improving efficiency by enabling fast repeat measurements and seamless data logging.

Their intuitive interfaces are simplifying operator training and reducing inspection time, contributing to cost savings. As digital technologies become more accessible and embedded into production systems, digital micrometers are expected to remain the preferred choice across a range of industries, solidifying their position as the dominant operational type.

The manufacturing segment is projected to capture 29.6% of the micrometers market revenue share in 2025, making it the leading application area. Its prominence is being driven by the critical role that precision measurement plays in ensuring quality, consistency, and adherence to tight tolerances in manufacturing processes. Micrometers are being widely used across machining, tooling, component fabrication, and assembly operations where real-time measurements are required to avoid deviations and reduce rework.

The segment is experiencing increased adoption due to the expansion of high-precision sectors such as aerospace, electronics, and automotive manufacturing, where micrometers help meet strict dimensional standards. Regulatory requirements for documented inspection and validation across many global markets are also fueling demand.

The need to enhance process reliability, minimize waste, and ensure product uniformity is reinforcing the importance of micrometers in manufacturing workflows. As digital transformation accelerates within factories, the use of digitally connected micrometers for real-time quality assurance is gaining traction, further strengthening this segment’s leadership in the overall market.

The micrometers market is expanding rapidly due to rising demand for precision measurement tools in automotive, aerospace, and manufacturing sectors. The growth of emerging markets and the shift towards digital micrometers and automation present valuable opportunities for market players. However, the market faces challenges from price-sensitive buyers and increasing competition from low-cost manufacturers. Addressing these challenges while capitalizing on emerging opportunities will be key to maintaining growth in the micrometers market.

The micrometers market has seen a notable surge in demand, primarily driven by industries requiring precise and accurate measurements, such as automotive, aerospace, and manufacturing. As businesses focus on high-quality standards, the demand for precision measurement instruments has escalated. Micrometers, known for their ability to measure small dimensions with high accuracy, are integral to ensuring that products meet stringent specifications. This growing need for precision tools across industries is expected to fuel the market's continued expansion.

Emerging markets, particularly in Asia-Pacific and Latin America, present significant opportunities for the micrometers market. As industrialization accelerates in these regions, the demand for precision measurement tools in sectors like electronics, manufacturing, and automotive is rising. The growth of these sectors in developing economies is expected to drive the demand for micrometers, which are essential for quality control and production processes. Additionally, increasing investments in infrastructure and technological upgrades in these markets contribute to further expansion opportunities.

The market for micrometers is witnessing a shift towards digital micrometers, offering enhanced functionality, data storage, and connectivity. These instruments, which provide quick and accurate readings with minimal human intervention, are becoming increasingly popular. Automation in manufacturing and testing processes is also driving the demand for digital micrometers, as they reduce the risk of human error and increase operational efficiency. The trend towards digitization and automation is expected to continue shaping the market's future, with more industries adopting these advanced tools.

Price sensitivity remains a significant challenge in the micrometers market, particularly in price-sensitive regions where low-cost alternatives are in demand. High-quality micrometers can be expensive due to their precision and advanced features, which may deter smaller businesses or those in cost-constrained industries from investing in them. Additionally, increased competition from low-cost manufacturers, especially in developing markets, may impact the pricing structure, forcing established players to adjust strategies to maintain market share.

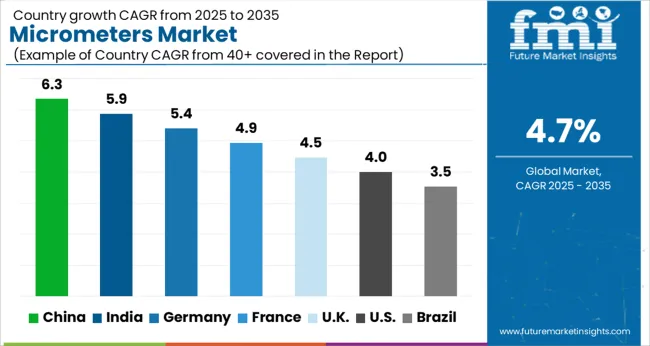

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

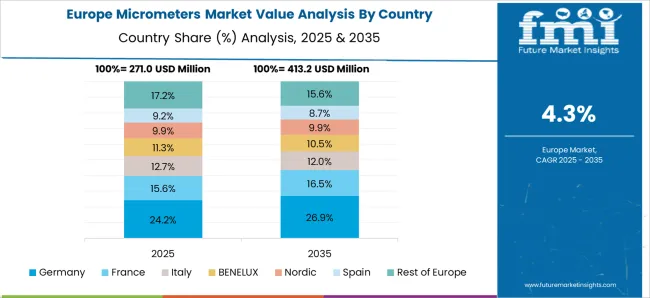

The global micrometers market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with a growth rate of 6.3%, followed by India at 5.9%, and France at 4.9%. The United Kingdom records a growth rate of 4.5%, while the United States shows the slowest growth at 4%. The demand for micrometers is driven by their extensive use in precision measurement applications across industries like automotive, aerospace, and manufacturing. As industries in emerging markets like China and India expand, the demand for precision tools like micrometers is increasing. In developed countries such as the USA and the UK technological advancements and the growing emphasis on quality control are boosting the adoption of these instruments. This report includes insights on 40+ countries; the top markets are shown here for reference.

The micrometers market in China is growing at a rate of 6.3%, driven by the country's rapid industrialization and its expanding manufacturing sector. China’s automotive, aerospace, and electronics industries are major consumers of micrometers, as precision measurement is crucial for ensuring high-quality products. As China continues to be a global manufacturing hub, the need for high-precision tools is increasing. Additionally, the rise in quality control standards and regulations is further driving the adoption of micrometers. The rapid expansion of China’s domestic markets and its increasing exports are creating a high demand for accurate measurement instruments in various industries. The trend of automation and the growth of high-tech industries are expected to further fuel the market’s growth.

The micrometers market in India is growing at a rate of 5.9%, supported by the increasing demand for precision tools across industries like automotive, aerospace, and construction. India’s manufacturing sector is expanding, with a focus on higher-quality production and meeting international standards. This has resulted in increased demand for micrometers and other precision measurement instruments. As India continues to invest in infrastructure and technology, the need for accurate measurements in sectors such as automotive and engineering is also rising. The adoption of advanced machinery in the manufacturing processes is driving the demand for precision tools, further bolstering the market growth. Additionally, India’s growing export market is fueling the demand for quality assurance tools, including micrometers.

The micrometers market in France is growing at a rate of 4.9%, with key industries such as automotive, aerospace, and heavy machinery being significant consumers of precision tools. France’s advanced manufacturing and industrial sectors require high-precision instruments to ensure the quality and efficiency of their production processes. The aerospace industry, in particular, is a major driver of demand for micrometers, as they are used for critical measurements in the production of aircraft components. Additionally, France’s commitment to technological advancements and innovation in engineering is pushing the demand for precision tools. As the manufacturing industry continues to modernize, the need for micrometers and other precision measuring instruments is expected to increase.

The micrometers market in the United Kingdom is growing at a rate of 4.5%, with significant demand from industries such as automotive, aerospace, and precision engineering. The UK has a well-established manufacturing base, and precision measurement tools like micrometers are essential to maintaining high-quality standards. The automotive sector, in particular, is increasingly adopting advanced measurement technologies to improve vehicle quality and performance. The UK’s aerospace industry is also a major contributor to the market, with micrometers being used for the precise manufacturing of aircraft components. As the UK continues to focus on innovation in its industrial sectors, the adoption of micrometers is expected to increase, especially with the growing demand for high-performance and quality products.

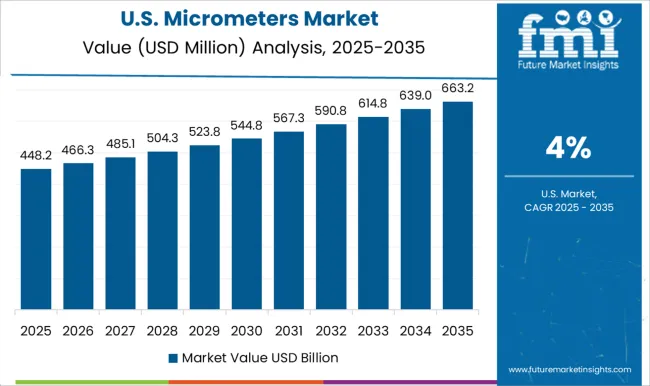

The micrometers market in the United States is growing at a rate of 4%, with key industries such as automotive, aerospace, and manufacturing driving the demand. The USA automotive sector’s emphasis on quality control and precision in vehicle production is pushing the adoption of micrometers. Additionally, the aerospace industry’s need for highly accurate measurements in the production of aircraft and defense components is a major factor in the market’s growth. The manufacturing sector in the USA is also increasingly focusing on automation and precision engineering, which further fuels the demand for micrometers. As technology and industrial processes continue to evolve, the need for high-precision measurement tools is expected to remain strong.

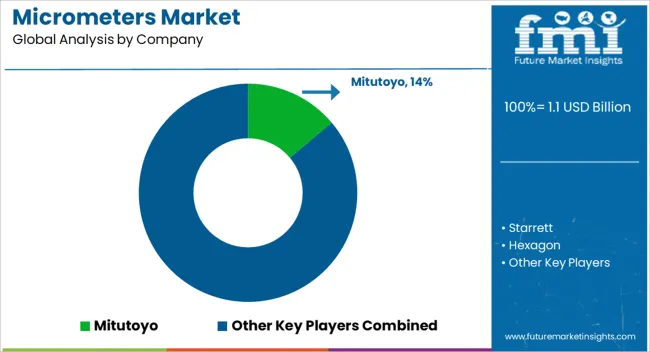

The micrometers market has witnessed robust growth due to the increasing need for precise measurement instruments across industries such as manufacturing, automotive, aerospace, and electronics. Leading companies like Mitutoyo, Starrett, and Hexagon dominate the market by offering a wide range of micrometers that provide accuracy and reliability. Mitutoyo is renowned for its advanced micrometer models, such as digital and mechanical types, which are widely used for precision measurements in manufacturing and quality control. Starrett, another key player, delivers high-quality measuring instruments known for their durability and ease of use, serving sectors that require tight tolerances. Hexagon also contributes significantly to the market with its innovative solutions, offering micrometers equipped with advanced digital technology for more accurate and faster measurements in production environments. On the other hand, TESA Technology, Snap-on, and MICROTECH are also strong contenders in the micrometer market. TESA Technology is recognized for producing high-precision tools that are widely used in calibration and quality assurance processes, especially in industrial applications.

Snap-on offers a variety of high-performance tools, including micrometers, that are engineered for use in automotive, aerospace, and repair industries, emphasizing durability and accuracy. MICROTECH, with its focus on innovation, supplies cutting-edge micrometers that cater to various measurement needs, including precision instrumentation and research applications. Thorlabs, Fowler High Precision, and other players such as INSIZE and Brown & Sharpe continue to shape the market by offering high-precision measuring tools designed for scientific and industrial applications, ensuring that companies meet stringent quality standards. With technological advancements and diverse applications, the micrometers market is expected to continue growing as industries demand more reliable and precise measurement solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | Outside Micrometers, Inside Micrometers, Depth Micrometers, and Special Micrometers |

| Operation | Digital and Manual |

| Application | Manufacturing, Automotive, Defense & Aerospace, Pharmaceutical & Healthcare, Construction, and Others |

| Pricing | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitutoyo, Starrett, Hexagon, TESA Technology, Snap-on, MICROTECH, Thorlabs, Fowler High Precision, INSIZE, Brown & Sharpe, Teclock, E.J. Cady, Central Tools, Ferree's Tools, and Brunswick Instrument |

| Additional Attributes | Dollar sales by micrometer type (outside, inside, depth, special-purpose) and application (automotive, aerospace, manufacturing, electronics) are key metrics. Trends include rising demand for precise measurement tools, growth in quality control and inspection applications, and increasing adoption of digital micrometers. Regional deployment, technological advancements, and precision manufacturing trends are driving market growth. |

The global micrometers market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the micrometers market is projected to reach USD 1.7 billion by 2035.

The micrometers market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in micrometers market are outside micrometers, inside micrometers, depth micrometers and special micrometers.

In terms of operation, digital segment to command 64.2% share in the micrometers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA