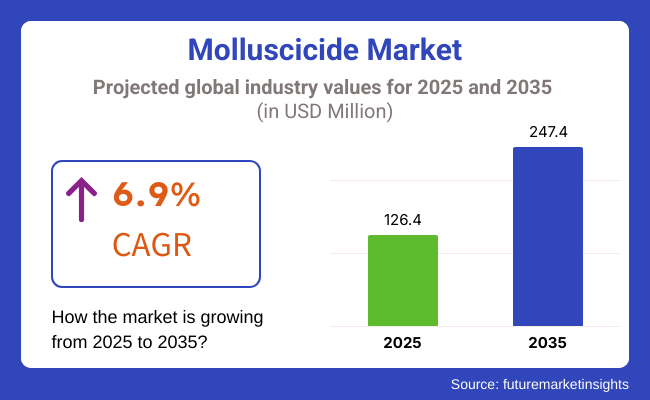

The global molluscicide market is projected to grow from USD 126.4 million in 2025 to USD 247.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.9% during the forecast period. Market expansion is being influenced by increasing incidences of mollusk infestations in agricultural fields and the rising adoption of integrated pest management (IPM) systems that emphasize the use of targeted, residue-minimizing products.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 126.4 million |

| Industry Value (2035F) | USD 247.4 million |

| CAGR (2025 to 2035) | 6.9% |

Molluscicides are used primarily to control slugs and snails that damage a wide variety of crops including cereals, oilseeds, vegetables, and fruits. Their application is being observed with increasing frequency in both open-field and greenhouse settings, particularly in areas prone to wet climates where mollusks thrive. The need to protect high-value crops, combined with growing awareness regarding food safety and crop quality, is reinforcing the demand for effective molluscicidal treatments.

In response to regulatory restrictions on synthetic chemical pesticides, especially those containing metaldehyde, several governments and agricultural advisory bodies have begun encouraging the use of safer alternatives. In 2020, the UK's Department for Environment, Food & Rural Affairs (DEFRA) banned the outdoor use of metaldehyde, citing risks to wildlife and water bodies. This decision has accelerated the shift toward ferric phosphate-based formulations, which have been approved under the European Union's Biocidal Products Regulation (BPR) and are considered less harmful to non-target organisms.

Several companies are investing in the development of biological molluscicides derived from natural substances or microorganisms. Marrone Bio Innovations, for example, has initiated research into bio-based snail control agents as part of its broader biological pest management portfolio. Industry players are also prioritizing product performance under varying environmental conditions, focusing on rainfastness, longevity, and compatibility with organic farming practices.

Farmers are increasingly seeking molluscicides that not only provide reliable control but also support compliance with organic certification standards and retailer residue policies. According to the International Federation of Organic Agriculture Movements (IFOAM), global organic farmland has surpassed 76 million hectares, creating a sizable market for certified molluscicidal inputs.

Chemical molluscicides are projected to hold approximately 72% of the global molluscicide market share in 2025 and are expected to grow at a CAGR of 6.7% through 2035. These products, primarily based on metaldehyde and ferric phosphate, are widely used in agricultural fields, nurseries, and horticultural operations to control slugs and snails that damage crops such as lettuce, strawberries, cereals, and ornamentals.

Their quick knockdown effect and cost-efficiency make them suitable for large-scale use. However, manufacturers are focusing on improving environmental safety by developing reduced-toxicity formulations that comply with regional regulations and pollinator safety standards.

Pellet-based molluscicides are estimated to account for approximately 64% of the global market share in 2025 and are projected to grow at a CAGR of 7.0% through 2035. Pellets are commonly used in row crops, greenhouses, and garden settings, offering controlled release and resistance to weather conditions.

Their solid form allows for precision placement and minimized drift, making them suitable for integrated pest management systems. Innovations in bait formulations that combine attractants with active ingredients are enhancing efficiency and reducing the required application volume. As sustainable agriculture gains momentum, pellet-based delivery systems remain central to molluscicide application strategies in both commercial and small-scale farming environments.

The sector observed a notable growth between 2020 and 2024 due to rising adoption of chemical-based solutions including metaldehyde and methiocarb. Accordingly, farmers applied these products because their rapid action against mollusk infestations is crucial for high-value crops, and for food security overall. However, with environmental impact and non-target species’ safety concerns, the conversations shifted toward more sustainable practices.

From 2023 to 2035, greenized, biological molluscicides will change the face of the market. To respond to this, technological advancement in biotechnology is assisting in developing naturally derived products for targeted pest management with little disturbance to the ecosystem. Increased focus on Sustainable Solutions: Stringent regulations on chemical molluscicide are expected to be imposed by regulatory bodies, which eventually will fuel sustainable solutions. This adaptation is part of a wider evolution in agricultural practices in which environmental stewardship and ecosystem health are prioritized.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for higher crop yields and food security | Strict regulations on chemical-based molluscicides |

| Increasing awareness of eco-friendly and biological molluscicides | High costs of organic and biological alternatives |

| Rising agricultural activities and expansion of farmlands | Limited effectiveness of some biological molluscicides |

| Government support for sustainable farming practices | Resistance development in mollusks against certain chemical treatments |

| Climate change leading to higher mollusk infestations | Lack of awareness and adoption in developing regions |

Drivers Impact Assessment

| Key Drivers | Impact Level |

|---|---|

| Growing demand for higher crop yields and food security | High |

| Increasing awareness of eco-friendly and biological molluscicides | High |

| Rising agricultural activities and expansion of farmlands | Medium |

| Government support for sustainable farming practices | High |

| Climate change leading to higher mollusk infestations | Medium |

Restraints Impact Assessment

| Key Restraints | Impact Level |

|---|---|

| Strict regulations on chemical-based molluscicides | High |

| High costs of organic and biological alternatives | Medium |

| Limited effectiveness of some biological molluscicides | Medium |

| Resistance development in mollusks against certain chemical treatments | High |

| Lack of awareness and adoption in developing regions | Medium |

By the same token, the market for molluscicides in the United States will show a steady growth trend in the forthcoming decade, as an upsurge in pest control demand for agriculture and horticulture will be the factor bolstering demand. Regulatory bodies will still be enforcing strict guidelines on chemical usage resulting in greater adoption of bio-based alternatives. Technology advances and research investments will improve product performance.

The presence of major participants in the market and a strong supply chain will aid in market growth. Increasing apprehension regarding the presence of invasive pests as well as crop protection will continue making significant contribution towards enhancing molluscicide demand across farming and landscaping end use sectors. Growing consumer demand for environmentally friendly solutions will further facilitate the transition to sustainable molluscicide alternatives.

The growing trend towards sustainable farming practices, will enhance the molluscicide market in Canada. Demand for bio-based alternatives will be driven by government incentives promoting eco-friendly approaches. Since climate should always allow for pest growth, the cold climate of the country says a great deal about the close nature of pests, but increasing in temperature because of climate change is making agricultural losses associated for pests, and molluscicides need is increasing.

The market will be molded by the rise of organic farming and public awareness about the production of chemical-free foods. Regulatory backing for sustainable pest-controlling solutions will further motivate new molluscicide development. Let us build on this together, so we have a stronger future when research and development will spawn even better products built for Canada's diverse agriculture.

Stringent environmental policies and growing restrictions on chemical pesticides will support the United Kingdom's molluscicide market. Farmers will lean into bio-based solutions to help them meet sustainability targets and regulatory requirements. Increasing demand for organic food and sustainable agricultural practices will always driving innovation in the formulations. The government’s commitment to phasing out synthetic chemicals from citizens’ food will spur investment in research and development of alternative pest control methods.

The growing consumer awareness regarding food safety will increase the adoption of eco-friendly molluscicides. Market growth will be driven by partnerships between agricultural companies and academic institutions engaged in the development of next-generation pest control technologies.

France is projected to be another prominent country with strong growth due to government support for sustainable agriculture leading to robust development in France's molluscicide market. The need for strict pesticide regulations and demand for chemical-free crops from consumers will drive farmers towards using bio-based molluscicides. The nation’s focus on organic farming will drive innovation in natural pest control solutions. Farmers will benefit from biotech and microbial-based molluscicides.

Similar to its restriction of synthetic pesticides, France's desire to preserve biodiversity and reduce environmental damage will further quicken the transition from synthetic to bio-based molluscicides. Invest on agricultural R&D will result in new, very effective molluscicides adapted to local farming conditions.

Germany's molluscicide market is significantly influenced by its dedication to environmental sustainability and advancements in agricultural technology. This advancement will depend on the country’s strong research infrastructure, which will drive the development of advanced, bio-based molluscicides. Data up to 10/2023 [Pesticide statistics appear to show that as pesticide regulations become even stricter, the use of chemical molluscicide decreases and so eco-friendly alternatives are encouraged.

Increasing demand for organic food and sustainable agriculture practices will continue to raise adoption rates. The Government will continue to support initiatives to reduce chemical inputs in agriculture, stimulating both research in and investment in bio-based pest control solutions. Partnerships between agricultural companies and research institutes will result in commercialization of new and effective molluscicide products.

The country’s increased focus on food safety and sustainability will also drive growth in South Korea’s molluscicide market. Increasing pest infestation owing to the climatic changes is expected to propel the growth of effective molluscicide solutions. Thus, favorable government policies on sustainable agriculture will broaden the scope of adopting bio-based molluscicides. Technologies in pest control will make product more efficient, as well as better market penetration.

To meet strict chemical pesticide regulations, farmers will increasingly use eco-friendly molluscicides. Domestic and global players will find key opportunities in the microbial and plant-based molluscicides market marked by the research and innovation observed in the industry.

As agriculture modernization and sustainability initiatives gain the limelight, Japan’s molluscicide market would continue to witness moderate growth. Its highly developed agriculture will invest in high tech pest control, such as bio-based molluscicides. Environment-friendly farming will be promoted through government policies that will decrease reliance on chemical pesticides. The increasing concern regarding food safety and growing consumer preference toward organic food products will further accelerate market growth.

By focusing research in biotechnology, Quasophote will create innovative molluscicide solutions appropriate for Japan’s diverse farming landscape. This will further lead domestic agricultural companies to work more closely with international investments in sustainable pest control.

Different nations are also developing strategies to reduce freshwater pollution, so the market for molluscicides for the treatment and prevention of invasive aquatic species in China is expected to grow rapidly due to environmental, economic, and public health needs, particularly as the country focuses on food security and environmental sustainability (Liu etal. 2022). The higher threat of pests due to the rapid industrialization and climate change will boost the demand for effective molluscicides.

The government will restrict chemical pesticides and promote bio-based alternatives. The increasing demand from consumers for organic food will drive the transition to environmentally friendly pest control methods. Agricultural research and biotechnology investments will result in the production of high-performance molluscicides. The agriculture sector is expanding rapidly, thus, the market players during the forecasted period will be focusing on increasing the production capacities and improving the product formulation.

The India molluscicide market is expected to witness robust growth on account of the country's proliferating agricultural sector coupled with the rising crop loss caused by pests. The demand of bio-based molluscicides is going to be fuelled due to government plan for sustainable farming and organic agriculture. Increasing farmer awareness regarding environmentally safe pest control methods will, in turn, drive market adoption.

This project will host collaborative efforts between research institutions and agribusinesses to develop affordable, effective molluscicides for use in varied Indian climatic conditions. Innovative pest control solutions will thrive under regulatory policies that promote and reward innovation and commercialization. Key factors shaping India molluscicide market will be increase in farm productivity and concern regarding food security.

The molluscicide market is shifting towards innovative, environmentally safe solutions for controlling pests like the golden apple snail in rice fields. Niclosamide-based formulations are gaining popularity for their efficiency, low toxicity, and compatibility with integrated pest management (IPM). Manufacturers are focusing on enhancing bioavailability, fast action, and minimal impact on beneficial species. These products are gaining traction in major rice-producing regions, supporting food security and aligning with national green agricultural standards.

Increasing demand for sustainable pest control solutions and strict regulations by environmental protection authorities are the key factors fueling market growth.

USA and Western European countries are among the countries that are likely to create highest opportunities.

High costs, low awareness and regulatory challenges can inhibit the adoption of new technologies in certain areas.

In addition to bio-based solutions and advanced formulations companies are exploring collaboration to enhance product efficacy.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA