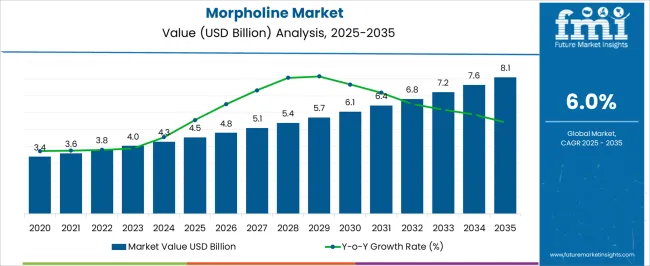

The morpholine market is estimated at 4.5 billion USD in 2025, anticipated to reach 8.1 billion USD by 2035, with a CAGR of 6.0% during the forecast period. Growth in this chemical sector has been shaped by rising demand from agrochemicals, corrosion inhibitors, and pharmaceutical intermediates, where consistent performance and functional reliability have become critical.

The YoY trajectory points to a steady climb from 3.4 billion USD in the pre-2025 phase toward 4.0 billion USD by 2027, supported by increasing consumption in industrial water treatment and polymer applications. By 2030, the market size is projected to surpass 5.4 billion USD, indicating that both regulatory adjustments and industrial usage patterns were working together to sustain expansion. Each year contributed incremental demand from multiple downstream industries, as the need for cost-efficient and versatile chemical intermediates gained momentum. The YoY growth between 2025 and 2030 averaged between 5 to 6%, while the phase from 2031 to 2035 showed stronger acceleration, averaging closer to 7 percent annually, ultimately supporting the market’s progress toward the 8.1 billion USD mark.

This growth path confirms that morpholine is moving beyond its traditional roles into a broader range of industrial applications, making it an increasingly indispensable chemical input. Companies that invest in cleaner synthesis methods, supply reliability, and regional market penetration are more likely to capture competitive advantages as the market matures.

| Metric | Value |

|---|---|

| Morpholine Market Estimated Value in (2025 E) | USD 4.5 billion |

| Morpholine Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The morpholine market is influenced by several interconnected parent markets that shape its growth prospects and application diversity across the global chemical landscape. The agrochemicals sector holds the largest share at nearly 40%, as morpholine is extensively used as an intermediate in the production of fungicides, herbicides, and plant growth regulators, supporting food security and modern farming practices.

The pharmaceutical industry contributes around a 25% share, since morpholine derivatives play a crucial role in drug formulation, synthesis of active pharmaceutical ingredients, and development of new therapeutic agents. The industrial chemicals and corrosion inhibitors market accounts for approximately 18%, with morpholine widely applied in water treatment systems, boilers, and pipelines to prevent corrosion and maintain efficiency in critical infrastructure.

The polymer and rubber processing market provides close to 10% share, where morpholine is utilized as a solvent, curing agent, and auxiliary material in producing durable elastomers and specialty plastics. The remaining 7% is attributed to coatings, textiles, and miscellaneous specialty chemical applications, where its versatility enables niche uses across industries. This layered distribution proves that morpholine has evolved from being a narrowly applied intermediate into a strategically important chemical with multi-sector significance. Its reliance on agriculture and pharmaceuticals highlights resilience against economic cycles, while emerging industrial uses ensure continuous diversification. Companies that optimize product quality, enhance supply reliability, and expand into eco-friendly production technologies are positioned to strengthen their competitive edge in this steadily growing market.

The morpholine market is witnessing consistent growth, driven by its wide applicability in various industrial sectors, including agrochemicals, pharmaceuticals, rubber processing, and corrosion inhibition. In 2025, the market outlook is being shaped by the increasing demand for intermediates in chemical synthesis, combined with robust usage in rubber and polymer formulations. The steady expansion of end-use industries, particularly in emerging markets, is contributing to higher production volumes and demand consistency.

Morpholine’s versatility and compatibility with diverse chemical processes have made it an essential compound across manufacturing chains. Strategic shifts toward process optimization, cost-effective synthesis, and adherence to environmental safety regulations are guiding investment decisions.

With rising focus on specialty chemicals and tailored formulation processes, the market is expected to benefit from technological upgrades and increasing capacity utilization rates. As industrial applications continue to scale globally, Morpholine is expected to maintain its relevance as a foundational chemical with long-term growth potential.

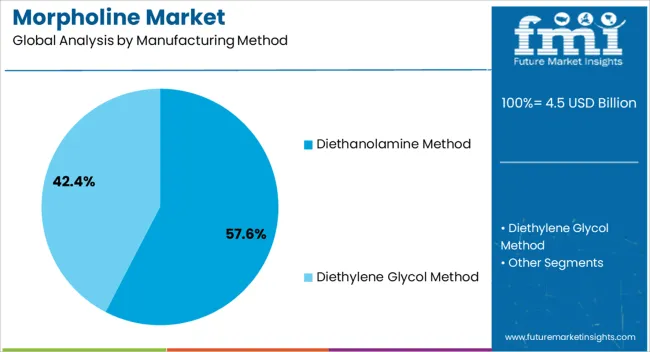

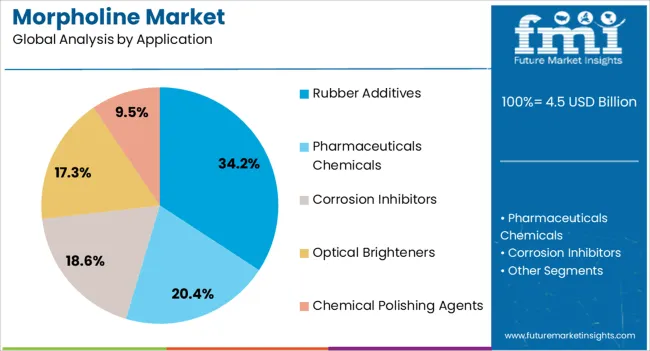

The morpholine market is segmented by manufacturing method, application, and geographic regions. By manufacturing method, morpholine market is divided into Diethanolamine Method and Diethylene Glycol Method. In terms of application, morpholine market is classified into Rubber Additives, Pharmaceuticals Chemicals, Corrosion Inhibitors, Optical Brighteners, and Chemical Polishing Agents. Regionally, the morpholine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Diethanolamine Method is projected to account for 57.6% of the overall Morpholine market revenue in 2025, making it the most widely adopted manufacturing method. This dominance is being attributed to the method’s high efficiency, cost-effectiveness, and widespread industrial acceptance. The chemical reaction involving diethanolamine with sulfuric acid enables a relatively simple synthesis route, producing high yields under controlled conditions.

Its adaptability to large-scale production facilities and compatibility with standard chemical processing infrastructure have strengthened its market position. The lower cost of raw materials, combined with the reduced complexity of this method, has led to its preference among manufacturers aiming to balance production scale with process economy.

As demand continues to rise across sectors such as rubber additives and corrosion inhibitors, this method is being relied upon for its ability to deliver consistent product quality with minimal process variation The favorable regulatory compliance and established supply chains further support its continued leadership in the manufacturing segment.

The Rubber Additives segment is expected to hold 34.2% of the Morpholine market revenue in 2025, making it the leading application area. The strong presence of Morpholine in this segment is being driven by its critical role as a vulcanization accelerator and its ability to enhance rubber performance under diverse operating conditions. Morpholine-based compounds contribute significantly to the physical properties of rubber, including flexibility, heat resistance, and aging stability, which are essential in automotive and industrial applications.

The consistent demand for high-performance rubber materials in tires, seals, hoses, and belts has fueled the growth of this segment. Additionally, the need for reliable additives in production processes that require chemical uniformity and performance consistency has supported its continued use.

The cost advantages and functional efficiency of Morpholine derivatives in rubber manufacturing processes have established it as a preferred additive As the global rubber industry expands in alignment with automotive and infrastructure development, this application is expected to remain a strong contributor to market revenues.

The morpholine market is driven by agriculture, pharmaceuticals, industrial chemicals, and polymers. Its diversified demand base ensures consistent growth across multiple industries.

The morpholine market is being significantly driven by its extensive use in agrochemicals, particularly as an intermediate for herbicides, fungicides, and plant growth regulators. Farmers across both developed and emerging economies are increasingly relying on morpholine-based solutions to improve crop yields and reduce losses caused by pests and plant diseases. The rising global food demand, coupled with pressure on agricultural productivity, has ensured that morpholine remains a preferred choice for chemical intermediates in crop protection products. This trend has been further supported by government programs aimed at strengthening agricultural output and safeguarding food supplies. The agrochemical sector provides a stable foundation for morpholine consumption, making it one of the most dependable growth drivers.

The pharmaceutical industry has emerged as another strong driver for morpholine demand, as it serves as a critical building block in active pharmaceutical ingredients (APIs). Its derivatives are widely utilized in the formulation of analgesics, anticancer agents, and anti-infective drugs, which continue to see rising global consumption. The sector benefits from increasing healthcare expenditure, aging populations, and the continuous demand for improved therapeutic solutions. Morpholine’s chemical versatility allows pharmaceutical companies to rely on it for both traditional formulations and novel drug development. The pharmaceutical segment not only broadens morpholine’s application landscape but also enhances its strategic importance by connecting the market to a sector that remains resilient to economic fluctuations.

Industrial applications of morpholine are proving essential for infrastructure maintenance, particularly in water treatment and corrosion inhibition. Power plants, refineries, and large-scale manufacturing facilities rely on morpholine in boiler treatment to prevent corrosion in steam systems and pipelines. Its ability to maintain operational efficiency while prolonging equipment lifespan has made it a valuable chemical across industrial sectors. Rising energy demands and the need to protect costly infrastructure investments have further strengthened its adoption. This segment highlights the practical value of morpholine, as it enables industries to avoid costly breakdowns and downtime, ensuring smoother operations. This industrial reliability is expected to contribute consistently to overall market growth in the coming years.

The polymer and rubber industries represent another important driver, where morpholine is used as a solvent, curing agent, and additive. Its role in producing high-performance elastomers and specialty plastics makes it essential for sectors such as automotive, construction, and packaging. Demand for durable materials that withstand extreme conditions has increased morpholine’s utility in manufacturing rubber accelerators and polymer processing aids. This trend is likely to gain momentum as industries continue to require flexible yet strong materials. The polymer and rubber segment demonstrates the adaptability of morpholine across end-use industries, making it more than just a chemical intermediate but a key enabler of product performance in industrial manufacturing.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

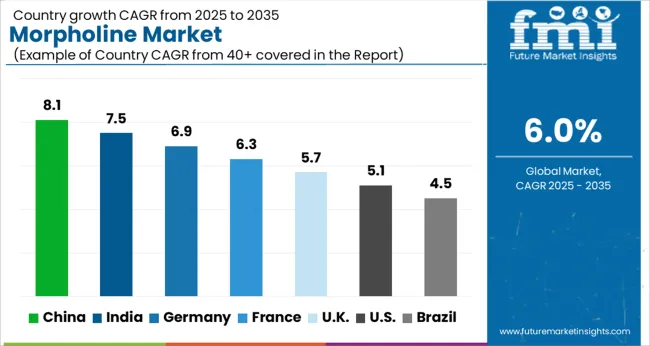

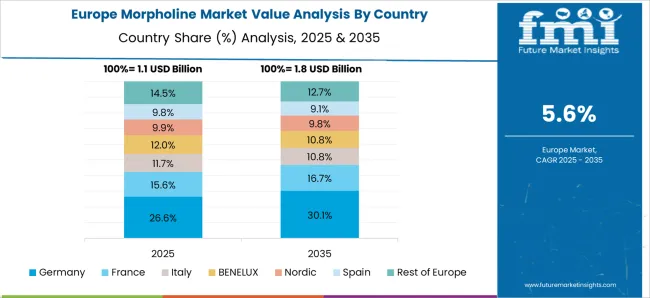

The global morpholine market is expected to expand at a CAGR of 6.0% between 2025 and 2035. China leads growth at 8.1%, followed by India at 7.5%, Germany at 6.9%, the United Kingdom at 5.7%, and the United States at 5.1%. Growth is being driven by expanding demand in agrochemicals, pharmaceuticals, industrial water treatment, and polymer processing. China and India dominate due to their large-scale chemical production bases, rising agricultural needs, and increasing investments in pharmaceutical manufacturing. Germany maintains strong growth through advanced chemical engineering, industrial applications, and regulatory-driven water treatment practices. The United Kingdom leverages innovation in pharmaceuticals and specialty chemicals, while the United States emphasizes large-scale agrochemical consumption, industrial corrosion prevention, and a steady pharmaceutical pipeline. The analysis covers more than 40+ countries, with these leading markets detailed below.

The morpholine market in China is projected to grow at a CAGR of 8.1% from 2025 to 2035, driven by the country’s expansive agrochemical sector, pharmaceutical manufacturing base, and strong industrial demand. Morpholine-based fungicides and herbicides are widely consumed to meet agricultural productivity requirements, while pharmaceutical companies depend on morpholine derivatives for drug synthesis and exports. Industrial water treatment and corrosion prevention across energy and manufacturing plants further reinforce consistent usage. Domestic producers are expanding their production capabilities while exporting to regional markets, strengthening China’s global dominance. China’s large-scale production capacity, competitive costs, and regulatory frameworks make it the most influential morpholine market worldwide.

The morpholine market in India is expected to grow at a CAGR of 7.5% from 2025 to 2035, supported by rising needs in agriculture, pharmaceuticals, and specialty chemical production. The agricultural sector, being central to India’s economy, has generated strong demand for morpholine in crop protection chemicals. Pharmaceutical applications, particularly in APIs, contribute to both domestic healthcare expansion and export growth. Industrial demand through water treatment and corrosion prevention also adds to steady adoption. Local chemical producers are scaling their output while forming partnerships with international players, reinforcing India’s global role. India’s blend of agriculture-driven demand and export-oriented pharmaceutical growth makes it a promising morpholine market.

The morpholine market in Germany is projected to grow at a CAGR of 6.9% from 2025 to 2035, shaped by advanced industrial, pharmaceutical, and regulatory-driven chemical use. Germany’s industrial infrastructure relies heavily on morpholine for corrosion prevention in boilers and steam systems, ensuring operational efficiency across energy and manufacturing plants. Pharmaceutical demand has strengthened morpholine usage in drug intermediates and high-value formulations, while the country’s chemical engineering expertise ensures strict adherence to quality and safety standards. Export-focused production has kept Germany influential within the European morpholine trade. Germany’s disciplined regulatory environment and industry sophistication make it a cornerstone of the European market.

The morpholine market in the United Kingdom is forecasted to grow at a CAGR of 5.7% from 2025 to 2035, supported by steady pharmaceutical R&D, industrial water treatment, and specialty chemical applications. Pharmaceutical companies in the UK rely on morpholine derivatives for advanced drug development, ensuring stable demand. Industrial consumption, particularly in boiler treatment systems, contributes further to the market’s strength. Specialty chemicals such as coatings and polymers also integrate morpholine for performance enhancement, expanding its role across industries. The UK market reflects steady growth with a focus on quality-driven applications and niche chemical developments.

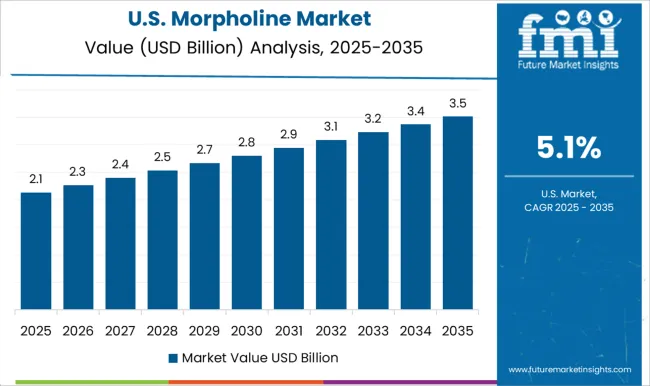

The morpholine market in the United States is anticipated to grow at a CAGR of 5.1% from 2025 to 2035, driven by demand in agrochemicals, pharmaceuticals, and industrial utilities. Large-scale agriculture remains a major consumer of morpholine-based fungicides and herbicides, while pharmaceutical companies employ morpholine derivatives in drug synthesis pipelines. Industrial water treatment applications, especially in power generation and manufacturing, provide stable baseline consumption. Domestic producers focus on maintaining regulatory compliance while catering to both local and export markets. The USA morpholine market represents resilience and diversity, with agriculture and pharmaceuticals as key pillars supporting steady growth.

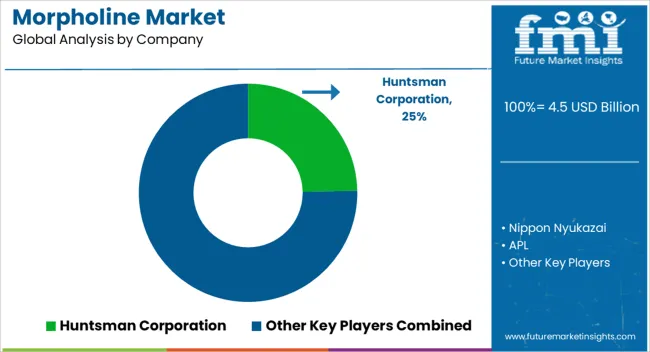

Competition in the morpholine market is shaped by regulatory compliance, feedstock integration, and the ability to cater to diverse end-use industries such as pharmaceuticals, rubber chemicals, agrochemicals, and corrosion inhibitors. Market influence is expected to be shared across global chemical multinationals, regional producers, and specialized amine manufacturers. Huntsman Corporation is positioned as a global leader, leveraging its strong amines portfolio, advanced production technologies, and international distribution networks to maintain supply reliability and high purity standards. BASF is viewed as a pace setter, bringing sustainability-driven innovation, R&D strength, and regulatory expertise that support morpholine applications in pharmaceuticals and industrial chemicals.

Nippon Nyukazai is recognized for its stronghold in Japan and broader Asia-Pacific, where close collaborations with downstream chemical formulators ensure customized morpholine derivatives. APL is emerging as a competitive producer, with growing capabilities to serve regional demand in coatings, textiles, and rubber chemicals. Fuyuan and Liaoyuan represent expanding Chinese suppliers, with increased domestic capacity and export-oriented strategies to compete on price and volume. Balaji Amines is favored in India, supported by cost efficiency, backward integration, and expanding global outreach. Anhui Haoyuan strengthens its footprint with large-scale operations and competitive pricing strategies within China. Sinochem, backed by state-owned infrastructure, leverages scale, logistics, and diversified chemical operations to dominate local and export markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Manufacturing Method | Diethanolamine Method and Diethylene Glycol Method |

| Application | Rubber Additives, Pharmaceuticals Chemicals, Corrosion Inhibitors, Optical Brighteners, and Chemical Polishing Agents |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huntsman Corporation, Nippon Nyukazai, APL, Fuyuan, Liaoyuan, BASF, Balaji Amines, Anhui Haoyuan, and Sinochem |

| Additional Attributes | Dollar sales, share, demand outlook, regional consumption trends, feedstock pricing, regulatory shifts, competitor capacity expansions, and end-use industry growth opportunities. |

The global morpholine market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the morpholine market is projected to reach USD 8.1 billion by 2035.

The morpholine market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in morpholine market are diethanolamine method and diethylene glycol method.

In terms of application, rubber additives segment to command 34.2% share in the morpholine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA