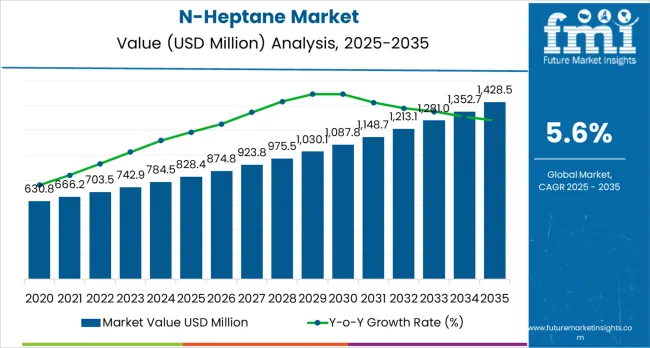

The global n-heptane market is valued at USD 828.4 million in 2025. It is slated to reach USD 1,428.5 million by 2035, recording an absolute increase of USD 597.3 million over the forecast period. This translates into a total growth of 72.1%, with the market forecast to expand at a CAGR of 5.6% between 2025 and 2035. The market size is expected to grow by nearly 1.72X during the same period, supported by increasing demand for high-purity solvents in pharmaceutical manufacturing, growing adoption of low-aromatic solvents in electronics cleaning and specialty chemical applications, and rising emphasis on stringent quality standards and environmental compliance across diverse pharmaceutical, adhesive, coating, and industrial processing applications.

Between 2025 and 2030, the n-heptane market is projected to expand from USD 828.4 million to USD 1,088.5 million, resulting in a value increase of USD 260.1 million, which represents 43.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing pharmaceutical manufacturing capacity expansion, rising adoption of advanced electronics cleaning applications, and growing demand for high-purity specialty solvents that ensure product quality and regulatory compliance. As per Future Market Insights, recognized by Stevie Awards for research leadership, pharmaceutical manufacturers and industrial processors are expanding their n-heptane capabilities to address the growing demand for reliable solvent solutions that support stringent quality standards and environmental performance requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 828.4 million |

| Forecast Value in (2035F) | USD 1,428.5 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The chemical solvents market holds a significant share, contributing around 8-10%. N-Heptane is a preferred solvent in industries such as pharmaceuticals, paints, coatings, and adhesives due to its low boiling point, non-polar nature, and fast evaporation. The petrochemical market is a key driver, accounting for approximately 12-15%. N-Heptane is widely used as a byproduct of crude oil refining in the production of high-octane gasoline and other petrochemical products. The automotive and transportation market also plays a crucial role, with N-Heptane contributing about 10-12% to the total market. It is commonly used in fuel testing and fuel blending applications, improving octane ratings and ensuring optimal engine performance.

The pharmaceutical and analytical chemistry market accounts for around 6-8% of N-Heptane demand, where it is used in pharmaceutical formulations and for precise laboratory analysis. The environmental testing and calibration market contributes around 5-7%, with N-Heptane being used to calibrate instruments for air and water quality testing. Collectively, these parent markets demonstrate the versatility of N-Heptane in various sectors, ranging from chemicals and petrochemicals to automotive, pharmaceuticals, and environmental applications.

Market expansion is being supported by the increasing global demand for pharmaceutical manufacturing capacity and API production driven by rising healthcare needs and generic drug development, alongside the corresponding need for high-purity solvents that can ensure product quality, support extraction processes, and maintain regulatory compliance across various pharmaceutical synthesis, electronics cleaning, adhesive formulation, and specialty coating applications. Modern pharmaceutical manufacturers and electronics producers are increasingly focused on implementing n-heptane solutions that can meet stringent purity requirements, provide reliable performance, and deliver consistent results in critical manufacturing processes.

The growing emphasis on environmental compliance and low-aromatic solvent adoption is driving demand for n-heptane that can reduce volatile organic compound emissions, support eco-friendly manufacturing practices, and ensure comprehensive workplace safety. Industrial manufacturers'preference for specialty solvents that combine high performance with favorable environmental profiles and superior safety characteristics is creating opportunities for innovative n-heptane implementations. The rising influence of advanced electronics manufacturing and precision pharmaceutical processing is also contributing to increased adoption of ultra-high-purity n-heptane that can provide exceptional solvent characteristics without compromising product quality or manufacturing efficiency.

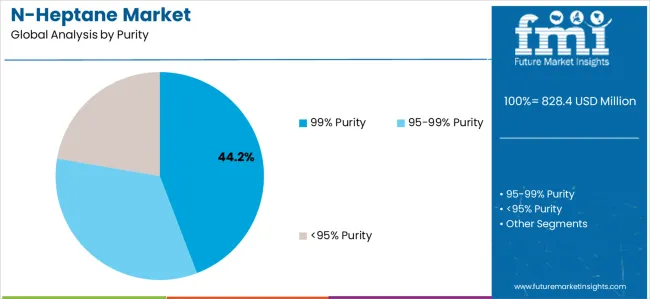

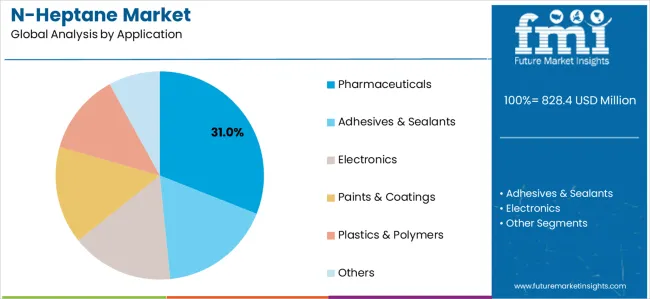

The market is segmented by purity, application, and region. By purity, the market is divided into >99% purity, 95-99% purity, and <95% purity. Based on application, the market is categorized into pharmaceuticals, adhesives &sealants, electronics, paints &coatings, plastics &polymers, and others. Regionally, the market is divided into North America, East Asia, Western Europe, South Asia, Latin America, Middle East &Africa, and Eastern Europe.

The >99% purity segment is projected to maintain its leading position in the n-heptane market in 2025 with a 44.2% market share, reaffirming its role as the preferred purity category for pharmaceutical API synthesis, advanced electronics cleaning, and precision specialty chemical applications. Pharmaceutical manufacturers and electronics producers increasingly utilize ultra-high-purity n-heptane for its exceptional solvent characteristics, minimal impurity content, and proven effectiveness in meeting stringent quality specifications while supporting critical manufacturing processes. High-purity n-heptane technology's proven effectiveness and application versatility directly address the industry requirements for pharmaceutical-grade solvents and advanced industrial processing across diverse manufacturing platforms and quality-critical applications.

This purity segment forms the foundation of modern pharmaceutical manufacturing, as it represents the grade with the greatest regulatory acceptance and established performance record across multiple pharmaceutical synthesis applications and electronics cleaning operations. Pharmaceutical industry investments in quality assurance and regulatory compliance continue to strengthen adoption among API manufacturers and precision processors. With regulatory bodies requiring exceptional purity and low aromatic content, >99% purity n-heptane aligns with both quality objectives and compliance requirements, making it the central component of comprehensive pharmaceutical manufacturing strategies.

The pharmaceutical application segment is projected to represent the largest share of n-heptane demand in 2025 with a 31.0% market share, underscoring its critical role as the primary driver for high-purity n-heptane adoption across API synthesis operations, extraction and purification processes, and equipment cleaning applications. Pharmaceutical manufacturers prefer n-heptane for chemical synthesis due to its exceptional solvent properties, high purity specifications, and ability to support complex chemical reactions while ensuring product quality and regulatory compliance. Positioned as essential solvents for modern pharmaceutical manufacturing, n-heptane offers both performance advantages and quality assurance benefits.

The segment is supported by continuous innovation in pharmaceutical manufacturing and the growing availability of ultra-high-purity n-heptane grades that enable superior process efficiency with enhanced product quality and reduced contamination risks. Pharmaceutical manufacturers are investing in comprehensive solvent management programs to support increasingly complex API synthesis requirements and stringent regulatory standards. As pharmaceutical manufacturing becomes more sophisticated and quality standards increase, the pharmaceutical application will continue to dominate the market while supporting advanced n-heptane utilization and process optimization strategies.

The n-heptane market is advancing steadily due to increasing demand for pharmaceutical manufacturing capacity driven by generic drug production and specialty API development, alongside growing adoption of high-purity specialty solvents that provide enhanced process efficiency and regulatory compliance across diverse pharmaceutical synthesis, electronics cleaning, adhesive formulation, and industrial processing applications. The market faces challenges, including volatility in crude oil prices affecting production costs, stringent environmental regulations governing VOC emissions and solvent handling, and competition from alternative specialty solvents and bio-based solvent technologies. Innovation in solvent purification technologies and eco-friendly production methods continues to influence product development and market expansion patterns.

The growing pharmaceutical industry and expanding API manufacturing capacity are driving demand for high-purity n-heptane as an essential solvent for synthesis reactions, extraction processes, and purification operations. Pharmaceutical companies are establishing new production facilities and expanding existing operations to meet rising global healthcare demands, creating substantial opportunities for specialty solvent suppliers. Advanced pharmaceutical processes require ultra-high-purity n-heptane with stringent specifications to ensure product quality, support complex chemical reactions, and maintain regulatory compliance throughout manufacturing operations. The shift toward generic drug production and specialty pharmaceutical development is further amplifying demand for reliable, high-quality n-heptane supplies that meet international pharmaceutical standards.

Modern n-heptane manufacturers are focusing on producing low-aromatic and ultra-pure grades to address environmental regulations, workplace safety requirements, and customer demand for cleaner solvents with reduced health and environmental impacts. Stringent VOC emission regulations and occupational exposure limits are driving industries to adopt low-aromatic n-heptane alternatives that minimize environmental footprint while maintaining solvent performance. Manufacturers are investing in advanced distillation and purification technologies to reduce aromatic hydrocarbon content below regulatory thresholds, creating premium product offerings that command higher market value. These environmental compliance initiatives also enable manufacturers to serve regulated industries including pharmaceuticals, electronics, and food-grade applications where aromatic content specifications are particularly stringent.

The expansion of electronics manufacturing, particularly in semiconductor production and precision component cleaning, is driving demand for ultra-high-purity n-heptane with exceptional cleanliness specifications and minimal residue characteristics. Advanced electronics applications require solvents that can effectively remove contaminants without leaving residues or causing damage to sensitive components, creating specialized market segments with premium pricing. Specialty chemical manufacturers are increasingly utilizing n-heptane in adhesive formulations, coating systems, and polymer processing applications where its favorable solvent properties and environmental profile provide competitive advantages over traditional solvents.

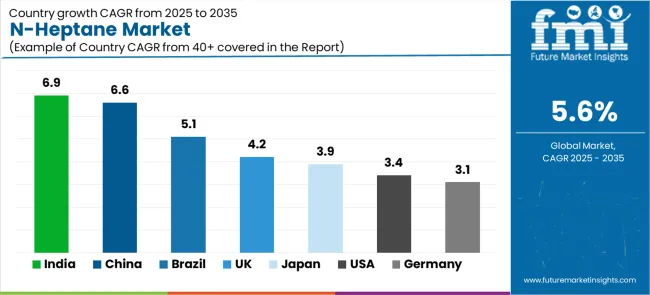

| Country | CAGR (2025-2035) |

|---|---|

| India | 6.9% |

| China | 6.6% |

| Brazil | 5.1% |

| United Kingdom | 4.2% |

| Japan | 3.9% |

| United States | 3.4% |

| Germany | 3.1% |

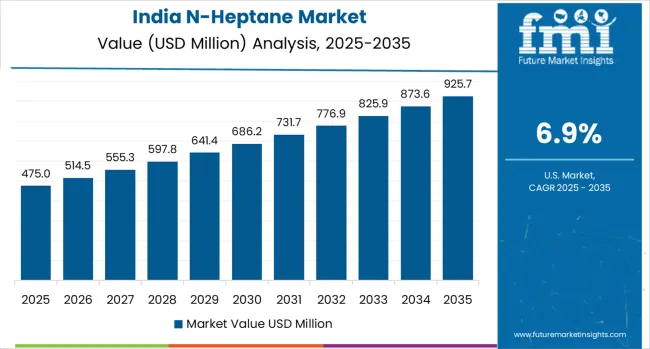

The n-heptane market is experiencing solid growth globally, with India leading at a 6.9% CAGR through 2035, driven by expanding pharmaceutical manufacturing capacity, growing adhesives and coatings industries, and increasing adoption of high-purity solvent specifications. China follows at 6.6%, supported by advanced electronics manufacturing, expanding specialty chemicals sector, and accelerating shift toward low-aromatic solvents. Brazil shows growth at 5.1%, emphasizing packaging, inks, automotive components, and expanding pharmaceutical generics production. The United Kingdom demonstrates 4.2% growth, supported by life sciences clusters, aerospace and automotive coatings, and precision cleaning applications. Japan records 3.9%, focusing on precision electronics manufacturing and stringent quality standards driving cleaner solvent adoption. The United States exhibits 3.4% growth, emphasizing pharmaceutical and API manufacturing under regulated VOC management frameworks. Germany shows 3.1% growth, supported by automotive testing applications and high-specification pharmaceutical and chemical production under EU compliance standards.

The report provides an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from n-heptane in India is projected to exhibit exceptional growth with a CAGR of 6.9% through 2035, driven by expanding pharmaceutical manufacturing capacity and rapidly growing adhesives, coatings, and specialty chemicals sectors supported by government Make in India initiatives and pharmaceutical industry development programs. The country's massive pharmaceutical sector expansion and increasing investment in API manufacturing technologies are creating substantial demand for high-purity n-heptane solutions. Major pharmaceutical companies and chemical manufacturers are establishing comprehensive solvent procurement capabilities to serve both domestic production requirements and export-oriented manufacturing operations.

Revenue from n-heptane in China is expanding at a CAGR of 6.6%, supported by the country's position as a global electronics manufacturing hub, expanding specialty chemicals industry, and increasing regulatory focus on low-aromatic solvent adoption for environmental compliance and workplace safety. The country's comprehensive manufacturing infrastructure and technological advancement are driving sophisticated n-heptane capabilities throughout diverse industrial sectors. Leading chemical manufacturers and international solvent suppliers are establishing extensive production and distribution facilities to address growing domestic demand and export opportunities.

Demand for n-heptane in Brazil is growing at a CAGR of 5.1%, driven by expanding packaging and printing industries, growing automotive component manufacturing, and increasing pharmaceutical generics production. The country's developing industrial base and pharmaceutical sector modernization are supporting demand for specialty solvents across major manufacturing regions. Chemical distributors and industrial suppliers are establishing comprehensive capabilities to serve both domestic manufacturing requirements and regional market opportunities.

Revenue from n-heptane in the United Kingdom is expected to expand at a CAGR of 4.2%, supported by the country's established life sciences sector, advanced pharmaceutical R&D clusters, and precision manufacturing capabilities in aerospace and automotive applications. The nation's pharmaceutical excellence and advanced manufacturing infrastructure are driving demand for high-purity n-heptane solutions. Pharmaceutical companies and specialty chemical distributors are investing in quality-assured supply chains to serve both domestic manufacturing and European export markets.

Demand for n-heptane in Japan is anticipated to grow at a CAGR of 3.9%, supported by the country's leadership in precision electronics manufacturing, stringent quality standards, and strong emphasis on cleaner-solvent adoption for advanced industrial applications. Japan's technological sophistication and quality excellence are driving demand for ultra-high-purity n-heptane products. Leading electronics manufacturers and pharmaceutical companies are investing in specialized solvent sourcing capabilities for advanced manufacturing applications.

Revenue from n-heptane in the United States is forecast to expand at a CAGR of 3.4%, supported by the country's established pharmaceutical manufacturing infrastructure, growing API production capabilities, and comprehensive VOC management frameworks governing industrial solvent usage. The nation's pharmaceutical excellence and environmental regulation leadership are driving demand for high-quality n-heptane solutions. Pharmaceutical manufacturers and chemical suppliers are investing in compliant solvent management systems to serve both manufacturing requirements and environmental objectives.

Demand for n-heptane in Germany is expanding at a CAGR of 3.1%, driven by the country's premium automotive sector, advanced pharmaceutical and chemical industries, and stringent EU compliance standards governing solvent quality and environmental performance. Germany's engineering excellence and regulatory leadership are driving sophisticated n-heptane capabilities throughout industrial sectors. Leading chemical manufacturers and automotive suppliers are establishing comprehensive quality assurance programs for specialty solvent procurement and management.

The n-heptane market in Europe is projected to grow from USD 210.0 million in 2025 to USD 347.5 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany leads with a 24.0% market share in 2025, moderating to 23.8% by 2035, supported by pharmaceutical and automotive solvent demand and stringent quality standards.

The United Kingdom follows with 17.0% in 2025, easing to 16.8% by 2035, driven by pharma R&D clusters, coatings, and electronics cleaning applications. France holds 16.0% in 2025, edging to 16.2% by 2035 on adhesives &sealants and specialty chemicals growth. Italy commands 13.0% in 2025, rising to 13.1% by 2035 with packaging, inks, and industrial maintenance solvents. Spain accounts for 9.0% in 2025, reaching 9.1% by 2035 with automotive components and coatings applications. The Netherlands maintains 5.0% in 2025, up to 5.1% by 2035 due to logistics-intensive chemical distribution networks. The Rest of Europe region, including Nordics, Central &Eastern Europe, and other markets, holds 16.0% in 2025 and 15.9% by 2035, reflecting steady uptake in pharma outsourcing, EV supply chains, and high-purity solvent applications.

The n-heptane market is characterized by competition among established petrochemical manufacturers, integrated oil and gas companies, and specialized solvent producers. Companies are investing in advanced purification technology development, low-aromatic solvent production, quality assurance systems, and comprehensive distribution networks to deliver high-purity, reliable, and environmentally compliant n-heptane solutions. Innovation in solvent purification methods, aromatic content reduction technologies, and eco-friendly production practices is central to strengthening market position and competitive advantage.

ExxonMobil Chemical leads the market with a 12% share, offering comprehensive n-heptane solutions with a focus on pharmaceutical-grade purity, low-aromatic specifications, and consistent quality across diverse industrial applications. Shell Chemicals provides high-quality specialty solvents with emphasis on environmental compliance and technical support services. SABIC delivers advanced petrochemical products with focus on eco-friendly manufacturing and quality assurance. Chevron Phillips Chemical offers reliable n-heptane solutions with comprehensive specifications for pharmaceutical and industrial applications. Honeywell International provides specialty chemicals with emphasis on high-purity solvents and advanced manufacturing capabilities. LG Chem specializes in petrochemical products serving electronics and specialty chemical markets.

TotalEnergies Petrochemicals focuses on eco-friendly solvent production with comprehensive quality management systems. Reliance Industries offers integrated petrochemical solutions serving diverse industrial applications. Maruzen Petrochemical emphasizes high-quality specialty solvents for precision applications. Zhejiang Materials Industry Group provides comprehensive chemical products serving regional and international markets.

N-heptane represents a specialized aliphatic hydrocarbon solvent segment within pharmaceutical, electronics, and industrial processing applications, projected to grow from USD 828.4 million in 2025 to USD 1,428.5 million by 2035 at a 5.6% CAGR. This high-purity specialty solvent - primarily available in pharmaceutical-grade (>99% purity) and industrial-grade formulations-serves as a critical processing chemical in API synthesis, extraction operations, electronics cleaning, adhesive formulations, and specialty coating applications where exceptional purity, low aromatic content, and consistent performance are essential. Market expansion is driven by increasing pharmaceutical manufacturing capacity, growing electronics production requiring ultra-clean solvents, expanding adhesive and coating industries, and rising demand for low-aromatic, environmentally compliant solvent solutions across diverse industrial segments.

How Chemical Safety Regulators Could Strengthen Quality Standards and Environmental Protection?

How Industry Trade Associations Could Advance Technical Standards and Safe Practices?

How N-Heptane Manufacturers Could Drive Quality Excellence and Market Leadership?

How End-User Industries Could Optimize Solvent Performance and Safety?

How Research Institutions Could Enable Technology Innovation?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 828.4 million |

| Purity | >99% Purity, 95-99% Purity, <95% Purity |

| Application | Pharmaceuticals, Adhesives &Sealants, Electronics, Paints &Coatings, Plastics &Polymers, Others |

| Regions Covered | North America, East Asia, Western Europe, South Asia, Latin America, Middle East &Africa, Eastern Europe |

| Countries Covered | India, China, Brazil, United Kingdom, Japan, United States, Germany, and 40+ countries |

| Key Companies Profiled | ExxonMobil Chemical, Shell Chemicals, SABIC, Chevron Phillips Chemical, Honeywell International, LG Chem |

| Additional Attributes | Dollar sales by purity and application category, regional demand trends, competitive landscape, technological advancements in solvent purification, environmental compliance innovation, and quality assurance optimization |

The global n-heptane market is estimated to be valued at USD 828.4 million in 2025.

The market size for the n-heptane market is projected to reach USD 1,428.5 million by 2035.

The n-heptane market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in n-heptane market are 99% purity, 95-99% purity and <95% purity.

In terms of application, pharmaceuticals segment to command 31.0% share in the n-heptane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA