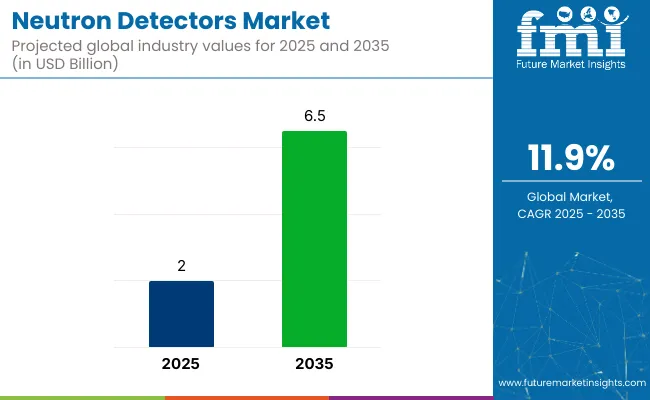

The neutron detectors market is valued at USD 2.0 billion in 2025 and is poised to reach USD 6.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 11.9%. This growth is primarily driven by increased demand in the nuclear power, defense, and healthcare sectors, with a strong emphasis on safety, security, and regulatory compliance. The rising global focus on clean energy, particularly nuclear power, is expected to accelerate demand for neutron detection systems further to ensure safety and environmental compliance.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 2.0 billion |

| Projected Value (2035) | USD 6.5 billion |

| CAGR (2025-2035) | 11.9% |

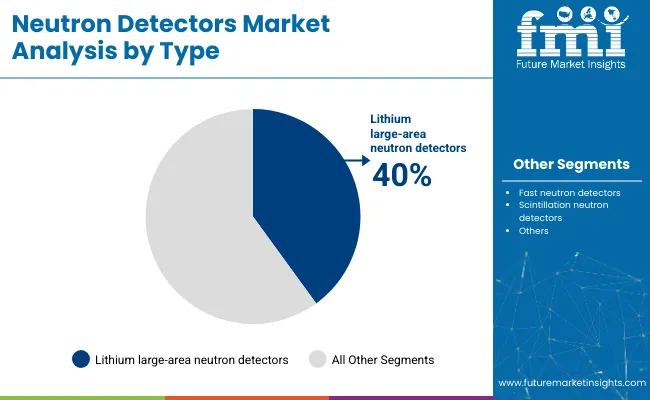

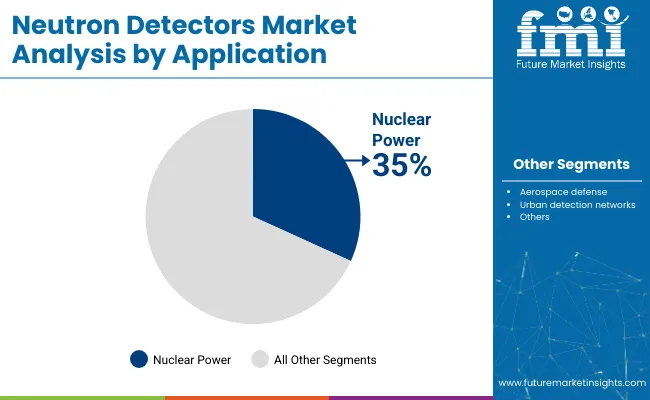

North America is expected to maintain the largest market share, especially in the USA, growing at a significant CAGR of 13.2%. Additionally, countries like France and the UK are projected to experience the fastest growth rates, CAGRs of 11.0% and 10.8%. The nuclear power application segment will dominate the market, with a market share of 35% in 2025. Meanwhile, lithium large-area neutron detectors account for 40% market share.

The market represents approximately 18-22% of the broader radiation detection market, which includes gamma, alpha, and beta detection technologies. Within the nuclear safety market, neutron detectors account for nearly 25-30%, due to their critical role in real-time monitoring of nuclear reactors.

In the defense and security sector, neutron detectors make up about 15-18%, focused on border protection and threat detection. Their contribution to healthcare radiation monitoring is smaller, around 8-10%, while in environmental monitoring, they represent an estimated 12-15% of the total detection equipment market.

Looking ahead, the future of the neutron detectors market is marked by the integration of artificial intelligence and machine learning technologies. These innovations are expected to improve the real-time monitoring capabilities and predictive analytics of neutron detectors.

Companies are increasingly investing in R&D to develop more efficient detection systems with greater sensitivity. At the same time, governments are expected to continue implementing stringent regulations to ensure safety and compliance in the nuclear and healthcare sectors. These developments will solidify the role of neutron detectors in critical safety applications.

The global neutron detectors market is segmented by type, application, and region. The major types include lithium large-area neutron detectors, fast neutron detectors, scintillation neutron detectors, and semiconductor neutron detectors. The primary applications include nuclear power, aerospace & defense, urban detection networks, and others (including medical imaging, environmental monitoring, and security). The regions covered are North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East and Africa.

Among the various types of neutron detectors, the Lithium Large-area Neutron Detectors segment is expected to dominate the market due to its ability to provide high precision in radiation monitoring, accounting for 40% of the market share in 2025. This segment is anticipated to hold a significant market share, as demand for advanced detection systems continues to rise across industries like nuclear power, defense, and healthcare.

The Nuclear Power application segment leads the market, driven by increasing demand for clean energy sources and the need for advanced safety measures in nuclear power plants. This segment is expected to capture the largest share, around 35%, as neutron detectors play a critical role in ensuring the safety and efficiency of nuclear energy facilities, and regulatory standards are tightening worldwide.

Recent Trends in Neutron Detectors Market

Challenges Neutron Detectors Market is Facing

Among the top five countries, the United States is projected to lead the neutron detectors market with the highest CAGR of 13.2% from 2025 to 2035, driven by robust nuclear, defense, and AI integration efforts. France follows with a CAGR of 11.0%, supported by its heavy reliance on nuclear power.

The United Kingdom and Germany show similar, stable growth rates at 10.8% and 10.5%, respectively, owing to regulatory compliance and sustainability focus. Japan, while maintaining steady demand, trails slightly with a 9.7% CAGR, limited by cost sensitivity and slower adoption of cutting-edge detection technologies.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA is set to dominate the neutron detectors market with a projected CAGR of 13.2% from 2025 to 2035. The country's well-established nuclear energy infrastructure, defense sector, and advancements in healthcare are key drivers of growth. Regulatory frameworks ensuring radiation safety and the integration of AI in detection technologies will continue to propel demand for neutron detectors.

The sales of neutron detectors in the UKare expected to experience steady growth in the neutron detectors market, with a CAGR of 10.8%. Strong regulatory standards in the nuclear and healthcare sectors and the country's focus on sustainability and clean energy will continue to influence market dynamics, along with growing demand for advanced radiation monitoring solutions.

The neutron detectors market in Germany is poised for steady expansion, growing at a CAGR of 10.5%. As a leader in nuclear energy production and environmental safety initiatives, Germany is leveraging regulatory pressure and technological advancements to ensure the continuous growth of radiation detection solutions across various industries.

The revenue from neutron detectors in France is projected to grow at a CAGR of 11.0%, supported by its reliance on nuclear power and its commitment to sustainable energy practices. The need for advanced neutron detection systems in atomic energy and healthcare, particularly for cancer treatment, is expected to boost market growth in the region further.

The neutron detectors industry in Japan is expected to experience a CAGR of 9.7% in the neutron detectors market, mainly due to its ongoing focus on nuclear safety and energy efficiency. However, adoption of advanced technologies such as AI-powered detection systems is slower due to high costs and conservative investment approaches.

The neutron detectors market is moderately consolidated, with a few global leaders commanding a significant portion of the market share. Major players such as Thermo Fisher Scientific, Mirion Technologies, and ORTEC (a subsidiary of AMETEK) dominate the landscape, competing primarily on the basis of product innovation, technological advancements, and regulatory compliance. These companies focus on improving the precision, sensitivity, and cost-effectiveness of their neutron detectors, with ongoing investments in R&D to meet the growing demand across various sectors, including nuclear power, defense, and healthcare.

Company strategies revolve around maintaining competitive pricing, expanding product offerings, and forming strategic partnerships to strengthen their market position. Companies like Thermo Fisher Scientific and Mirion Technologies are investing heavily in AI and automation technologies to improve detector performance. Partnerships with government agencies, research institutions, and energy companies play a crucial role in advancing their product development and expanding into emerging markets.

Recent Neutron Detectors Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 2.0 billion |

| Projected Market Size (2035) | USD 6.5 billion |

| CAGR (2025 to 2035) | 11.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions /Volume in Units |

| By Type | Lithium Large-area Neutron Detectors, Fast Neutron Detectors, Scintillation Neutron Detectors, Semiconductor Neutron Detectors |

| By Application | Nuclear Power, Aerospace & Defense, Urban Detection Networks, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Thermo Fisher Scientific, Mirion Technologies, Lanthan Biosciences, RADEX, Fluke Corporation, Canberra (A subsidiary of Mirion Technologies), Leidos , Qualtrex , ORTEC (A subsidiary of AMETEK), Harshaw Tracer |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry is divided into Lithium large-area neutron detectors, fast neutron detectors, scintillation neutron detectors, semiconductor neutron detectors.

It is segmented into nuclear power, aerospace defense, urban detection networks, and others.

The landscape is studied across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The market is valued at USD 2.0 billion in 2025.

The market is projected to reach USD 6.5 billion by 2035, reflecting a CAGR of 11.9%.

The nuclear power application is expected to lead with a 35% market share in 2025.

North America is projected to hold the largest regional share, driven by nuclear energy and defense sectors.

Lithium Large-area neutron detectors are leading the type segment with a prominent market share of 40%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

XEDS Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Explosive Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radiometric Detectors Market Size and Share Forecast Outlook 2025 to 2035

Scintillator Detectors Market Report - Trends & Forecast 2025 to 2035

Global Medical X-ray Detectors Market Insights – Size, Demand & Forecast 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Portable Metal Detectors Market Growth - Trends & Forecast 2025 to 2035

Photoionization Detectors Market

Global Gas Leak Detectors Market

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Medical Radiation Detectors Market

Photonic Sensors & Detectors Market Insights - Growth & Forecast 2024 to 2034

Digital Radiography Detectors Market Analysis – Size & Trends 2022-2026

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA