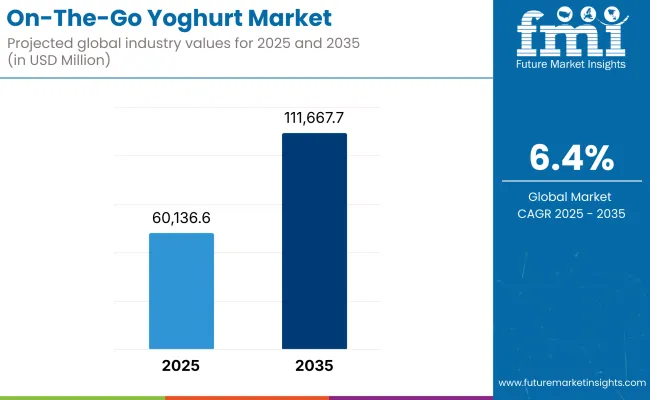

The global On-The-Go Yogurt Market was valued at USD 50,428.3 million in 2022 and is projected to reach USD 60,136.6 million by 2025. The market is expected to exhibit a CAGR of 6.4% from 2025 to 2035, reaching USD 111,667.7 million by 2035.

The growing trend of ready-to-eat and easy-to-carry nature of snacks among busy consumers and the packaged food sector are the main proliferating forces in the on-the-go Yogurt industry. Rising health consciousness and the growing popularity of high-protein, low-sugar, and probiotic-rich food products are making on-the-go Yogurt product segments highly attractive. The market is surging is due to the lifestyle of developed nations with high disposable incomes that are stimulating demand for ready-to-eat meals dairy foods.

Growing health consciousness among consumers is boosting demand for healthier, convenient snacks. On-the-go Yogurt that is resistance only to be placed as a snack, convenient, high-protein and healthy are the one that is high in demand be it in every category professionals or students or sports enthusiasts.

The trend of functional foods, especially in the form of probiotics, is working in favour of on-the-go yogurt products. Due to the health benefits of probiotic rich Yogurts for the digestive system, they are becoming increasingly popular among the mass. The trend is due to increasing consciousness around gut health with the needs of foods for immunity-supportive as well as general wellness.

On-the go Yogurt is incredibly popular thanks to the variety of flavours and plant-based options on the market. As more consumers seek products that adhere to their dietary needs dairy-free and vegan, to name a few the industry has innovated. Now, we have excited businesses for plant-based, lactose-free, and dairy-free on-the-go.

| Attributes | Description |

|---|---|

| Estimated Global On-The-Go Yogurt Market Size (2025E) | USD 60,136.6 million |

| Projected Global On-The-Go Yogurt Market Value (2035F) | USD 111,667.7 million |

| Value-based CAGR (2025 to 2035) | 6.4% |

In developing regimes, the on-the-go Yogurt business is growing at a quick pace as a result of modernism, rise in dispensable earnings as well as the changing diets. Western diets are catching the attention of the consumers in economies such as Asia-pacific and Latin America and this has caused a high growth in convenience dairy products such as Yogurt.

Below table has relative perspective on half-year difference in CAGR between base year (2024) and current year (2025) of Global On-The-Go Yogurt Market. The partition, as seen from it, notes significant complaints of performance and sets arrangements patterns in case of income, in this manner giving the partners a feeling of the snapshot of the general pattern of development amid the year. H1 is the first half of the year, i.e., January to June. H2 July to December is half a year.

| Period | CAGR |

|---|---|

| H1 (2024 to 2034) | 6.0% |

| H2 (2024 to 2034) | 6.2% |

| H1 (2025 to 2035) | 6.3% |

| H2 (2025 to 2035) | 6.4% |

In the first half (H1) of the decade from 2025 to 2035, the On-The-Go Yogurt Market is predicted to grow at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.4% in the second half (H2) of the same period. In the first half (H1), the sector is expected to witness an increase of 30 BPS, while in the second half (H2), the market is projected to experience a further increase of 10 BPS.

Consumers will also continue to demand healthy, convenient to consume, functional food items, thus providing further room for expansion in the On-The-Go Yogurt Market. Growth in the market will also be driven by increased consumer appetite for plant-based Yogurt and probiotic variants, with manufacturers driving innovation in the sector to keep pace with changing consumer trends.

The organised sector involves large dairy product manufacturers, global Yogurt brands and health-centric food companies catering to ready to eat (RTE) Yogurt products by packing them in consumer-friendly packaging for ease in handling. The major companies operating in the segment include Danone, Nestlé, Chobani, Yoplait (General Mills), and Müller. These companies target the growing market of functional and nutritious on-the-go snacks, specializing in high-quality, shelf-stable Yogurt products with added probiotics, protein and low sugar.

Tivoli Goods (lineup) - North America, Europe and parts of the Asia-Pacific region are dominated by organized players whose expanding demand for individual servings, organic options and flavor diversity. They also have committed to investing in new types of packaging (single-serve containers, squeezable pouches, and more ecofriendly materials) to help make them even easier to use for busy consumers.

Unicers were distributed via supermarkets, convenience stores, health food stores and online retail platforms. Some organised players have widened their portfolios to cater to different consumer segments including those who are health-conscious consumers wanting a plant diet or gluten free/dairy free products owing to the increasing consumer demand for healthy eating and the rise of organised players, to cater to this segment.

The unorganised segment is mainly constituted by local dairies, small scale manufacturers, and domestic suppliers offering traditional Yogurt and locally processed variants both in bulk and small packets. These companies primarily operate in emerging markets in Asia, Africa and Latin America, where consumers are looking for value and familiarity.

Organised players face challenges of longer shelf-life, consistency in products and maintenance of high-quality standards because they do not have access to advanced packaging technology, local production standards and the manual processing techniques used by unorganised players.

But they fill local markets, small businesses and independent retailers that stock cheaper, traditional varieties of Yogurt. Some unorganised players are cashing in on regional flavours and cultural preferences to create a niche among consumers seeking homemade or local curds.

Shift Towards Healthy, Convenient Snack Options

Shift: With a rising demand for healthy snacks, yogurt continues to stand out as an excellent mobile option. Consumers are seeking out easy, nutritious snacks that provide protein, probiotics and other health more and more. The growing demand for health-oriented snacks is driven by rising awareness regarding the usefulness of these probiotics, protein-enriched diets, and low-fat options. Widespread popularity of on-the-go yogurt has led to a significant increase in sales for busy professionals, active life individuals and parents that are looking for nutritious yet convenient snacks for their children.

Strategic Response: Brands are responding to this demand by refining their product formulations to both deliver health benefits and create ease of use, he said. Take Chobani, which has grown its portfolio to include yogurt-based items in portable pouches and drinkable yogurt, highlighting convenience without compromising health benefits.

The company was pervious Danone which launched its first drinkable yogurt as 'Danimals Drinkable Yogurt' catering to the younger population by packaging the product was in a way what the consumer can easily use and enjoy the health benefits. Also, Yoplait introduced Yoplait Go-Gurt, a yogurt sold in convenient tubes for on-the-go adults and kids.

Innovation in Packaging and Flavors

Shift: The increasing popularity of yogurt in alternative forms, special packaging types and unique flavors remains consumers fuelling trend. With the continued demand for portability, manufacturers are focusing in packaging formats to ensure the product is as convenient as possible (whereas also ensuring the required product integrity is maintained).

This is also visible in the growing trend of more flavors, special editions and personalized yogurt. With an ever-growing demand for flavors of the exotic variety and functional ingredients such as superfoods, probiotics, and vitamins, the consumption experience is becoming increasingly bespoke for consumers.

Strategic Response: To meet these expectations, companies are continuously innovating in packaging and flavor offerings. For instance, as an example, Chobani created Chobani Flip, which is a yogurt snack with an ingredient in it that offers different flavors - such as mix-ins (chocolate, fruit, nuts, etc.) - that provide the consumer experience in on the go.

Oikos triple-zero yogurt is one of multiple varieties and flavors it offers, and is marketed as a high-protein, low-sugar choice for gym goers and fitness buffs. Siggi’s has also responded to a trend toward Icelandic-style yogurt (Skyr) with a variety of flavor offerings and an emphasis on fewer ingredients and natural sweeteners.

Growth in E-commerce and Direct-to-Consumer Sales Channels

Shift: E-commerce and consumer behaviour shifts have transformed on-the-go yogurt purchasing. As shopping habits have migrated online, consumers increasingly trust Amazon, Walmart and Instacart to deliver yogurt products, particularly with niche, health-focused or hard-to-find brands.

The trend towards online purchasing is stunning when looking at it in the light of the COVID-19 pandemic, as many jumped on the trend of ordering groceries and snack products online. Read consumer reviews, compare prices, easy delivery for yogurt products on-the-go, etc.

Strategic Response: To take advantage of this shift, brands are bolstering their online offerings and direct-to-consumer models. Chobani, for example, has a subscription service on its website, so customers can subscribe to get their favorite yogurt regularly delivered to their home. At stores like Stonyfield Organic, online shopping has kicked off with some discounts and exclusive offerings.

Increasing Focus on Sustainability and Eco-Friendly Packaging

Shift: Claiming sustainability Important in food brands - Consumers are opting for eco-friendly brands. The on-the-go yogurt segment has seen increasing pressure from companies to use eco-friendly packaging, reduce food waste, and source ingredients sustainably. The plastics crisis and increasing environmental consciousness are causing consumers to favor brands that put sustainability at their core. This is especially relevant in the world of portable on the go products that end up in single-use plastic packaging.

Strategic Response: Brands are responding by innovating with sustainable packaging and more environmentally-friendly business practices. Danone, for instance, has vowed that by 2025 all of its packaging will be 100 percent recyclable and has also begun using plant-based materials for its yogurt containers.

Likewise, Chobani has launched yogurt products in recyclable plastic containers, and is determined to lessen its operations' contribution to climate change. Oatly, primarily a plant-based platform milk brand, did move over to the yogurt space and uses carton packaging which is a more sustainable option compared to plastic containers.

Rising Popularity of Plant-Based Yogurt Alternatives

Shift: Even some consumers seek lactose-free, dairy-free, and even vegan sources which is driving the increases in plant-based yogurt. Evolving taste and lifestyle preferences towards plant-based diets are making it more culturally palatable. For this reason, we now have a burgeoning market for in-hand yogurts made primarily from almonds, coconut, oats, and similar plant materials, with taste and texture profiles distinctly clean and equivalent to those of classic dairy yogurts.

Strategic Response: And in turn, some of the big yogurt brands have added plant straw to their product lineup. Chobani also introduced its Chobani Non-Dairy Yogurt, made with coconut, almonds, and oats, in a variety of plant-based flavors. Silk and So Delicious also reign in the plant-based yogurt arena, merging on-the-go convenience for vegans, lactose mosaic and dairy sensitive eaters.

Oatly - which made a name for its oat milk and in recent years on the yogurt scene with its Oatgurt - canister has prevailed and thrived as oat milk continued to make its cool-kid aesthetic family - oat.

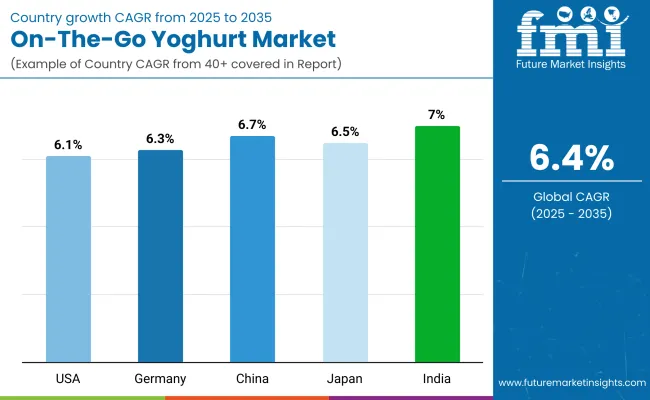

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.1% |

| Germany | 6.3% |

| China | 6.7% |

| Japan | 6.5% |

| India | 7.0% |

The on-the-go Yogurt market in the USA is expanding and is largely fueled by health-conscious consumers in search of dairy rich in proteins and probiotics. Yogurt manufacturers are also increasingly innovating around functional food ingredients (such as prebiotics and added vitamins), as well as exploring plant-based options to gain share from lactose intolerant and vegan consumers.

The rise of spout pouches and resealable bottles improved the portability of the product, which makes on-the-go Yogurt an ideal product for busy professionals and fitness enthusiasts. The increasing preference for organic, low-fat, and sugar-free options is also picking up steam with rising awareness of obesity and lifestyle diseases.

Thanks to urbanization, higher disposable income, and an increasingly health-conscious consumer base seeking convenience, the on-the-run Yogurt sector in China is booming. The country’s dairy sector has seen rapid growth recently and Yogurt has become a staple part of daily diet. For digestion-related conditions, Chinese consumers look for probiotic fortified Yogurts in line with traditional dietary and health beliefs.

International and local brand proliferation has brought further market competition, resulting in innovations in flavor and packaging. Moreover, the support of the government, in the form of subsidies and campaigns promoting dairy consumption, have also pushed growth further and established China as a key player in the world Yogurt industry.

Germany has a strong health-oriented consumer market for on-the-go Yogurt, with a need for organic, functional, and lactose-free versions. Young professionals and urban population groups looking for ready-to-eat, nutrient-dense dairy items are driving demand.

One of the biggest forces driving this market is sustainability, which has brought forward eco-friendly packaging and more focus on local sourcing. Plant-based alternatives are also popular among German consumers driving growth in vegan on-the-go Yogurt varieties.

Now India’s on-the-go Yogurt segment is growing fast, thanks to a multiplying middle-class population and rising urbanization. Demand for ready-to-mix pouch filled with single-serve pack of probiotic beverages is strong, with consumers moving toward healthy, probiotic-rich snacks.

As disposable incomes grow, so does the awareness of the health benefits of digestive health, driving consumers to choose affordable and locally produced on-the-go Yogurt. Yogurt as a category has more penetration in India, this happens with the growth of modern retail channels and the availability of e-commerce platforms across urban and semi-urban regions.

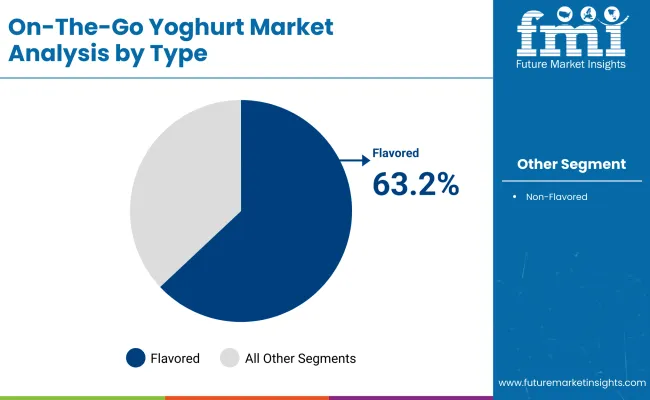

| Segment | Flavored Yogurt (By Type) |

|---|---|

| Value Share (2025) | 63.2% |

The diversity of flavor options and the broad appeal of on-the-go Yogurt, this category is the most popular of the three, especially with different age groups. Fruit-based and honey-flavored varieties and exotic flavors appeal to consumers, making Yogurts a popular snack in retail and convenience shops. Brands are prioritising natural flavouring agents and minimising artificial additives along with functional ingredients to enhance nutrition like collagen, fibre and vitamins.

Busy individuals and school-going children are also demanding more flavored varieties with features, such as convenient packaging, (single serve cups or resealable pouches), which is projected to continue driving demand for Yogurt products. Sugar and plant-based flavoured Yogurts also have gained some traction, addressing the needs of diabetic and lactose-intolerant consumers. The range of regional flavors including matcha, saffron, and combinations of tropical fruit have also contributed to an uptick in consumer curiosity within this category.

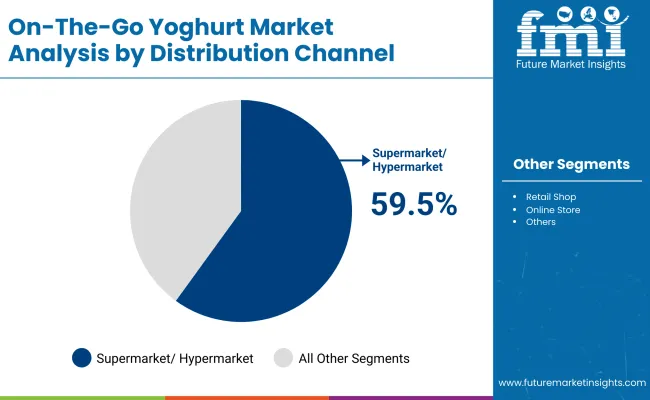

| Segment | Supermarket/Hypermarket (By Distribution Channel) |

|---|---|

| Value Share (2025) | 59.5% |

Distribution ChannelsDespite the arrival of niche boutiques and smaller green grocers, the majority of on-the-go Yogurt is sold by supermarkets and hypermarkets, which can provide the consumer with a wider array of names in the category. The increasing consumption of fresh dairy products has prompted retailers to increase their refrigerated cases, leading to improved shelf space for single-serve and bulk Yogurt packs.

Also, supermarket chains have jumped into this market and made the competition even more intense by offering private-label products so that consumer have access to affordable yet premium quality Yogurt products. Moreover, in-store promotions, bulk purchasing discounts, and loyalty programs have played a substantial role in driving higher sales volumes in retail outlets.

Hypermarkets further improved the in-store experience by offering specialized dairy sections with a wide range of local and imported brands. Self-check out and digital payment options have been integrated into many supermarket chains. Yogurt is also available through e-commerce platforms, which is another key sales channel contributing to the availability of these products with home delivery.

It makes online store one of the growing demand on this industry as it often won't give you the subscription based purchases and product, or follow your previous recommendations.

The market is categorized into flavored and non-flavored varieties, catering to different consumer preferences.

The product is available in various packaging formats, including pouches, bottles, and cups, ensuring convenience and extended shelf life.

The market is distributed through supermarkets/hypermarkets, retail shops, and online stores, offering consumers multiple purchasing options.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global on-the-go Yogurt market is projected to grow at a CAGR of approximately 6.4% during the forecast period from 2025 to 2035.

The market is estimated to reach approximately USD 111,667.7 million by 2035, up from USD 60136.6 million in 2025.

Key growth drivers include increasing consumer demand for convenient, healthy snack options, as busy lifestyles fuel the need for portable and nutritious food items.

Key growth drivers include increasing consumer demand for convenient, healthy snack options, as busy lifestyles fuel the need for portable and nutritious food items.

Prominent players in the market include Origin Food Group, The Nemours Foundation, Materne North America, B&G Foods, Chobani, Alpro UK, Go Greek Yogurt, and Sprout Organic Foods.

Table 1: Global On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global On-The-Go Yoghurt Market Volume (Units) Forecast by Region, 2017-2032

Table 3: Global On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 4: Global On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 5: Global On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 6: Global On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 7: Global On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 8: Global On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 9: Global On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 10: Global On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Table 11: North America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 12: North America On-The-Go Yoghurt Market Volume (Units) Forecast by Country, 2017-2032

Table 13: North America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 14: North America On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 15: North America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 16: North America On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 17: North America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 18: North America On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 19: North America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 20: North America On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Table 21: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 22: Latin America On-The-Go Yoghurt Market Volume (Units) Forecast by Country, 2017-2032

Table 23: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 24: Latin America On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 25: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 26: Latin America On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 27: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 28: Latin America On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 29: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 30: Latin America On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Table 31: Europe On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 32: Europe On-The-Go Yoghurt Market Volume (Units) Forecast by Country, 2017-2032

Table 33: Europe On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 34: Europe On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 35: Europe On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 36: Europe On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 37: Europe On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 38: Europe On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 39: Europe On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 40: Europe On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Table 41: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Forecast by Country, 2017-2032

Table 43: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 44: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 45: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 46: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 47: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 48: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 49: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 50: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Table 51: MEA On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 52: MEA On-The-Go Yoghurt Market Volume (Units) Forecast by Country, 2017-2032

Table 53: MEA On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Packaging type, 2017-2032

Table 54: MEA On-The-Go Yoghurt Market Volume (Units) Forecast by Packaging type, 2017-2032

Table 55: MEA On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Types, 2017-2032

Table 56: MEA On-The-Go Yoghurt Market Volume (Units) Forecast by Types, 2017-2032

Table 57: MEA On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 58: MEA On-The-Go Yoghurt Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 59: MEA On-The-Go Yoghurt Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 60: MEA On-The-Go Yoghurt Market Volume (Units) Forecast by Type, 2017-2032

Figure 1: Global On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 2: Global On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 3: Global On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 4: Global On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 5: Global On-The-Go Yoghurt Market Value (US$ Mn) by Region, 2022-2032

Figure 6: Global On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 7: Global On-The-Go Yoghurt Market Volume (Units) Analysis by Region, 2017-2032

Figure 8: Global On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 9: Global On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 10: Global On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 11: Global On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 12: Global On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 13: Global On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 14: Global On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 15: Global On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 16: Global On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 17: Global On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 18: Global On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 19: Global On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 20: Global On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 21: Global On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 22: Global On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 23: Global On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 24: Global On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 25: Global On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 26: Global On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 27: Global On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 28: Global On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 29: Global On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 30: Global On-The-Go Yoghurt Market Attractiveness by Region, 2022-2032

Figure 31: North America On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 32: North America On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 33: North America On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 34: North America On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 35: North America On-The-Go Yoghurt Market Value (US$ Mn) by Country, 2022-2032

Figure 36: North America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 37: North America On-The-Go Yoghurt Market Volume (Units) Analysis by Country, 2017-2032

Figure 38: North America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 39: North America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 40: North America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 41: North America On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 42: North America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 43: North America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 44: North America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 45: North America On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 46: North America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 47: North America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 48: North America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 49: North America On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 50: North America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 51: North America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 52: North America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 53: North America On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 54: North America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 55: North America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 56: North America On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 57: North America On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 58: North America On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 59: North America On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 60: North America On-The-Go Yoghurt Market Attractiveness by Country, 2022-2032

Figure 61: Latin America On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 62: Latin America On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 63: Latin America On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 64: Latin America On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 65: Latin America On-The-Go Yoghurt Market Value (US$ Mn) by Country, 2022-2032

Figure 66: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 67: Latin America On-The-Go Yoghurt Market Volume (Units) Analysis by Country, 2017-2032

Figure 68: Latin America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 69: Latin America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 70: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 71: Latin America On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 72: Latin America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 73: Latin America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 74: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 75: Latin America On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 76: Latin America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 77: Latin America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 78: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 79: Latin America On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 80: Latin America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 81: Latin America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 82: Latin America On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 83: Latin America On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 84: Latin America On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 85: Latin America On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 86: Latin America On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 87: Latin America On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 88: Latin America On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 89: Latin America On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 90: Latin America On-The-Go Yoghurt Market Attractiveness by Country, 2022-2032

Figure 91: Europe On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 92: Europe On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 93: Europe On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 94: Europe On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 95: Europe On-The-Go Yoghurt Market Value (US$ Mn) by Country, 2022-2032

Figure 96: Europe On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 97: Europe On-The-Go Yoghurt Market Volume (Units) Analysis by Country, 2017-2032

Figure 98: Europe On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 99: Europe On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 100: Europe On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 101: Europe On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 102: Europe On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 103: Europe On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 104: Europe On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 105: Europe On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 106: Europe On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 107: Europe On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 108: Europe On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 109: Europe On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 110: Europe On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 111: Europe On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 112: Europe On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 113: Europe On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 114: Europe On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 115: Europe On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 116: Europe On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 117: Europe On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 118: Europe On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 119: Europe On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 120: Europe On-The-Go Yoghurt Market Attractiveness by Country, 2022-2032

Figure 121: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 122: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 123: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 124: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 125: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) by Country, 2022-2032

Figure 126: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 127: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Analysis by Country, 2017-2032

Figure 128: Asia Pacific On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 129: Asia Pacific On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 130: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 131: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 132: Asia Pacific On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 133: Asia Pacific On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 134: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 135: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 136: Asia Pacific On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 137: Asia Pacific On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 138: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 139: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 140: Asia Pacific On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 141: Asia Pacific On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 142: Asia Pacific On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 143: Asia Pacific On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 144: Asia Pacific On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 145: Asia Pacific On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 146: Asia Pacific On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 147: Asia Pacific On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 148: Asia Pacific On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 149: Asia Pacific On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 150: Asia Pacific On-The-Go Yoghurt Market Attractiveness by Country, 2022-2032

Figure 151: MEA On-The-Go Yoghurt Market Value (US$ Mn) by Packaging type, 2022-2032

Figure 152: MEA On-The-Go Yoghurt Market Value (US$ Mn) by Types, 2022-2032

Figure 153: MEA On-The-Go Yoghurt Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 154: MEA On-The-Go Yoghurt Market Value (US$ Mn) by Type, 2022-2032

Figure 155: MEA On-The-Go Yoghurt Market Value (US$ Mn) by Country, 2022-2032

Figure 156: MEA On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 157: MEA On-The-Go Yoghurt Market Volume (Units) Analysis by Country, 2017-2032

Figure 158: MEA On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 159: MEA On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 160: MEA On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Packaging type, 2017-2032

Figure 161: MEA On-The-Go Yoghurt Market Volume (Units) Analysis by Packaging type, 2017-2032

Figure 162: MEA On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Packaging type, 2022-2032

Figure 163: MEA On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Packaging type, 2022-2032

Figure 164: MEA On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Types, 2017-2032

Figure 165: MEA On-The-Go Yoghurt Market Volume (Units) Analysis by Types, 2017-2032

Figure 166: MEA On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Types, 2022-2032

Figure 167: MEA On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Types, 2022-2032

Figure 168: MEA On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 169: MEA On-The-Go Yoghurt Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 170: MEA On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 171: MEA On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 172: MEA On-The-Go Yoghurt Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 173: MEA On-The-Go Yoghurt Market Volume (Units) Analysis by Type, 2017-2032

Figure 174: MEA On-The-Go Yoghurt Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 175: MEA On-The-Go Yoghurt Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 176: MEA On-The-Go Yoghurt Market Attractiveness by Packaging type, 2022-2032

Figure 177: MEA On-The-Go Yoghurt Market Attractiveness by Types, 2022-2032

Figure 178: MEA On-The-Go Yoghurt Market Attractiveness by Distribution Channel, 2022-2032

Figure 179: MEA On-The-Go Yoghurt Market Attractiveness by Type, 2022-2032

Figure 180: MEA On-The-Go Yoghurt Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yoghurt Powder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA