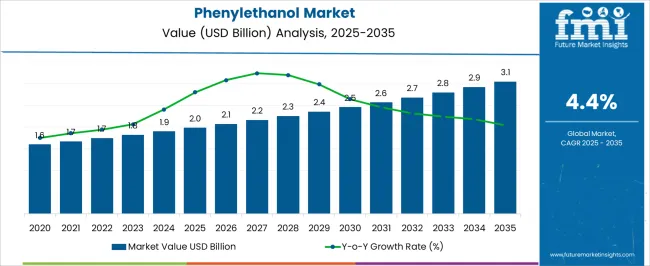

The Phenylethanol Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The Phenylethanol market is witnessing steady growth, driven by the increasing demand for natural preservatives, fragrances, and antimicrobial agents across the food, cosmetic, and pharmaceutical industries. Rising consumer preference for safe, high-quality, and clean-label ingredients is supporting the adoption of phenylethanol, particularly in food and personal care applications. The market is further influenced by technological advancements in extraction, synthesis, and formulation processes that enhance product purity, stability, and performance.

Growing awareness of microbial safety and regulatory compliance requirements in food processing, beverages, and cosmetic manufacturing has strengthened demand. Phenylethanol’s multifunctional properties, including its antimicrobial efficacy, pleasant floral aroma, and compatibility with various formulations, are making it a preferred ingredient among manufacturers. Investments in research and development are supporting innovation in derivative formulations and expanded applications.

As consumer expectations for quality, safety, and natural products continue to rise, the Phenylethanol market is poised for sustained growth Increasing integration into food grade products, personal care items, and pharmaceutical preparations is expected to drive adoption across multiple regions globally.

| Metric | Value |

|---|---|

| Phenylethanol Market Estimated Value in (2025 E) | USD 2.0 billion |

| Phenylethanol Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

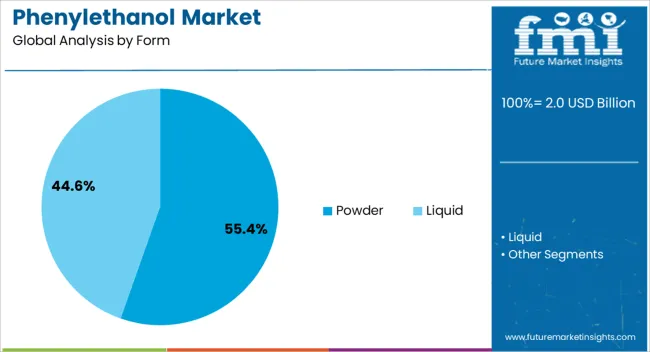

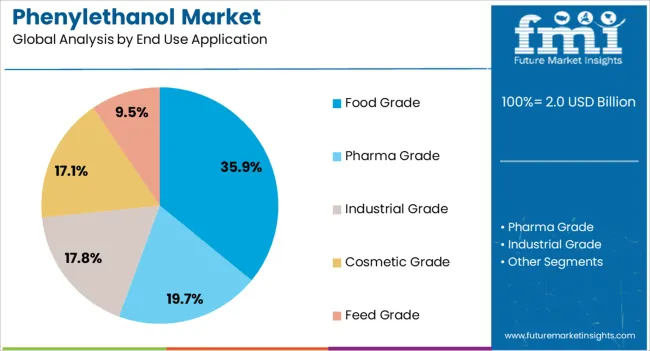

The market is segmented by Form and End Use Application and region. By Form, the market is divided into Powder and Liquid. In terms of End Use Application, the market is classified into Food Grade, Pharma Grade, Industrial Grade, Cosmetic Grade, and Feed Grade. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 55.4% of the Phenylethanol market revenue in 2025, making it the leading form. Growth in this segment is being driven by its stability, ease of handling, and long shelf life, which enhance operational efficiency in manufacturing and storage. Powdered phenylethanol can be uniformly incorporated into various formulations, allowing precise dosing and consistent performance across food, cosmetic, and pharmaceutical applications.

Its versatility in blending with other ingredients without affecting organoleptic properties or efficacy has strengthened its adoption. Manufacturers are leveraging the powder form for large-scale production, transportation efficiency, and improved process control.

The cost-effectiveness achieved through reduced wastage and lower packaging requirements further supports preference for this form As industries increasingly prioritize reliable, standardized, and scalable ingredient solutions, the powder segment is expected to maintain its leading position, supported by continuous process improvements, quality assurance practices, and its broad applicability across multiple end-use sectors.

The food grade end use application segment is anticipated to account for 35.9% of the Phenylethanol market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the rising need for natural preservatives and antimicrobial agents to ensure food safety, extend shelf life, and maintain product quality. Phenylethanol’s efficacy in controlling microbial growth, combined with its pleasant aroma and compatibility with various food matrices, makes it highly suitable for beverages, baked goods, dairy products, and confectionery applications.

Regulatory compliance with food safety standards and consumer demand for clean-label ingredients are further accelerating adoption. Manufacturers are increasingly incorporating phenylethanol into food formulations to enhance stability and sensory attributes while meeting consumer expectations for natural, safe, and high-quality products.

Continuous innovation in formulation techniques, extraction methods, and integration with other food additives is supporting the growth of this application segment As global demand for safe and natural food products increases, the food grade application segment is expected to remain the primary driver of Phenylethanol market expansion.

The scope for phenylethanol rose at a 7.4% CAGR between 2020 and 2025. The global market is achieving heights to grow at a moderate CAGR of 4.4% over the forecast period 2025 to 2035.

Phenylethanol industry turned its way up, the demand coming from the flavors and fragrances manufacturers remained unchanged, during the historical period. Continually rising consumer awareness about the health and environmental benefits of natural and organic products also fueled demand for phenylethanol derived from natural sources.

Innovations as well as advances in production technologies enhanced the efficiency and resulted in reduced manufacturing costs, which contributed to market growth during the historical period. Looking at the forecast projections, the growing demand for health and wellness products in the coming years to be higher, in the category of natural and organic personal care, and dietary supplements.

There will be an increasing need for natural preservatives in cosmetics, personal care, and food industries, with rising consumer demand for clean label and chemical free products. The improvements in production facilities as well as innovation in the formulations will also create opportunities for phenylethanol market development in the forthcoming years.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by China and the United States. The countries will lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 12.6% |

| Germany | 10.8% |

| China | 12.8% |

| Japan | 4.7% |

| Australia and New Zealand | 2.9% |

The phenylethanol market in the United States will expand at a CAGR of 12.6% through 2035. The United States has witnessed a recent trend of growing understanding and liking for natural and organic products.

Phenylethanol which is sourced from natural sources like roses, fits perfectly with this trend. As consumers have started to look out for products that are made with natural ingredients, the demand for phenylethanol having natural aroma, flavours, and other organic products is expected to rise alongside.

The United States is one of the biggest markets for fragrances and flavors worldwide. Phenylethanol is used as a fragrance ingredient in various things such as perfumes, cosmetics, and personal care products. It is also used in food and beverages as a flavoring ingredient. There is a rising demand for these products as consumers demand more of such products because of changing lifestyles and preferences.

The phenylethanol market in Germany to expand at a CAGR of 10.8% through 2035. Germany has very strict regulations and quality standards for chemicals and consumer products.

Phenylethanol without an exception must also meet the required standards to ensure consumer safety and quality. Manufacturers that can meet the required standards are most likely to have a competitive edge over the others, resulting in increased growth of the market.

Germany is known as a leader in innovations and technology in several industries like flavoring, fragrances, and the manufacturing of chemicals. The current technological developments and innovations in the processes of production, techniques of formulations, and application of products are certain to accelerate the growth of the phenylethanol market in Germany.

The trend of phenylethanol is looking better for the Chinese market. The market is expected to grow at a CAGR of 12.8% during the forecasted period. There has been a rise in the reach and accessibility of consumer goods in China after the growth of e-commerce and online retailing.

Phenylethanol suppliers have various strategies available nowadays including personalized marketing, brand building and also using e-commerce platforms to sell directly to consumers all these help the suppliers to trigger growth and market penetration. Due to its advanced production technologies and other capabilities, China has now become a global hub for manufacturing.

The developing technological advancements in production processes and formulation techniques will drive the growth of the Chinese market. To increase their competitiveness, phenylethanol manufacturers are constantly devising new techniques to improve quality, performance, and sustainability.

The phenylethanol market in Japan is poised to expand at a CAGR of 4.7% through 2035. Japan has a strong emphasis on health and wellness, with consumers actively seeking out products that promote well-being as well as vitality.

Phenylethanol, derived from natural sources such as roses, is perceived as a natural and safe ingredient. The growing demand for health conscious products in Japan is will drive the growth of the phenylethanol market.

Japan is known for its innovative food and beverage industry, with a wide range of unique and novel products. Phenylethanol is used as a flavoring agent in various food and beverage products. The focus of the Japanese food and beverage industry on innovation and product differentiation is all set to drive demand for phenylethanol in the market.

The phenylethanol market in Australia and New Zealand will expand at a CAGR of 2.9% through 2035. Australia and New Zealand have diverse industrial sectors, including manufacturing, textiles, and automotive industries, among others.

Phenylethanol finds applications in industrial processes as a solvent, intermediate, and fragrance ingredient. The expansion of the industrial sector in these countries is creating opportunities for phenylethanol in various industrial applications.

Aromatherapy, which utilizes natural aromatic compounds for therapeutic purposes, is gaining popularity in Australia and New Zealand. Phenylethanol, with its pleasant rose like aroma, is used in aromatherapy products such as essential oils, massage oils, and diffusers. The increasing adoption of aromatherapy for relaxation, stress relief, and wellness will lead to increased demand for phenylethanol.

The below table highlights how food grade segment is leading the market in terms of end use application, and will account for a share of 35.9% in 2025. Based on form, the powder segment is gaining heights and will to account for a share of 33.2% in 2025.

| Category | Shares in 2025 |

|---|---|

| Food Grade | 35.9% |

| Powder | 33.2% |

Based on end use application, the food grade segment will dominate the phenylethanol market. Phenylethanol is characterized by its pleasant rose like aroma and flavor, which is desirable in various food and beverage applications.

There is a rising demand for phenylethanol as a flavoring agent in the food industry, with increasing popularity of floral and aromatic flavors in products such as desserts, confectionery, and beverages.

Consumers are increasingly seeking natural and clean label ingredients in their food and beverages. Phenylethanol, derived from natural sources such as roses, is perceived as a natural flavor enhancer, making it attractive for use in food products. The growing demand for natural flavor enhancers is driving the growth of the food grade segment of phenylethanol.

In terms of form, the powder segment will dominate the phenylethanol market. Powdered phenylethanol can be formulated to have improved solubility and dispersion characteristics compared to liquid formulations.

The property allows for easier incorporation into various products, including food and beverage formulations, cosmetics, pharmaceuticals, and industrial applications, driving demand for powdered phenylethanol. Powdered phenylethanol offers versatility in formulation, allowing for a wide range of applications across different industries.

It can be easily blended with other ingredients, customized into specific particle sizes, and formulated into various product formats, including tablets, capsules, powders, and granules, to meet diverse customer needs and requirements.

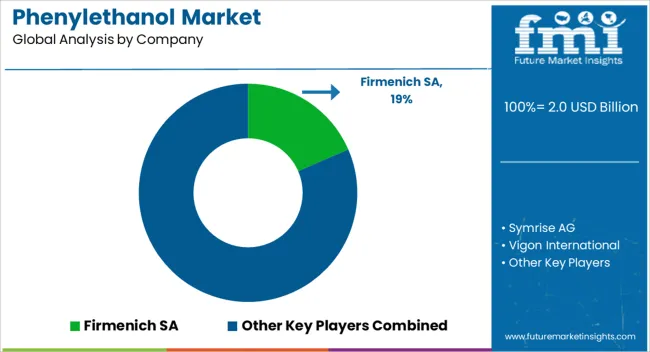

The phenylethanol market is characterized by intense competition among key players striving to maintain or enhance their market share through strategic initiatives, product innovation, and differentiation strategies.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 2.0 billion |

| Projected Market Valuation in 2035 | USD 3.1 billion |

| Value-based CAGR 2025 to 2035 | 4.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Form, End Use Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Vigon International; Firmenich SA; Symrise AG; LyondellBasell Industries; Shandong Xinhua Pharmaceuticals Co., Ltd.; Ethernis Fine Chemicals; Novorate Biotech Co.,Ltd. |

The global phenylethanol market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the phenylethanol market is projected to reach USD 3.1 billion by 2035.

The phenylethanol market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in phenylethanol market are powder and liquid.

In terms of end use application, food grade segment to command 35.9% share in the phenylethanol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA