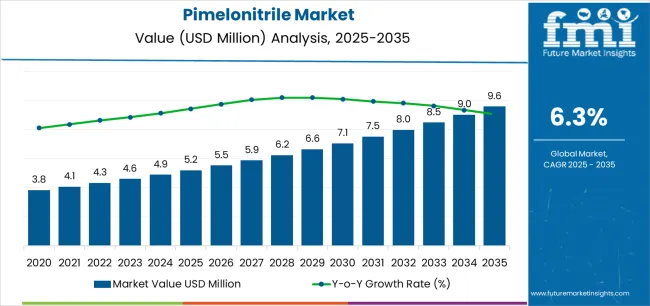

The global pimelonitrile market is valued at USD 5.2 million in 2025. It is slated to reach USD 9.5 million by 2035, recording an absolute increase of USD 4.3 million over the forecast period. This translates into a total growth of 82.9%, with the market forecast to expand at a CAGR of 6.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing demand for pharmaceutical intermediates, growing adoption of pimelonitrile in lithium battery electrolyte additives, and rising emphasis on high-purity chemical compounds across diverse pharmaceutical, battery, and specialty chemical applications.

Pimelonitrile, a linear aliphatic dinitrile compound, serves as a critical intermediate in pharmaceutical synthesis and specialty chemical manufacturing. The compound's unique molecular structure, featuring two nitrile functional groups separated by a five-carbon chain, enables its utilization in producing various pharmaceutical active ingredients, particularly in the synthesis of antiviral medications and other therapeutic compounds. The pharmaceutical industry's continued focus on developing novel drug formulations and improving synthetic pathways is driving demand for high-purity pimelonitrile that meets stringent pharmaceutical manufacturing standards.

The expanding lithium battery industry represents an emerging application area for pimelonitrile, where it functions as an electrolyte additive to enhance battery performance characteristics. Electrolyte formulations incorporating pimelonitrile demonstrate improved thermal stability, enhanced cycling performance, and superior safety characteristics compared to conventional electrolyte systems. As electric vehicle production accelerates and energy storage systems proliferate, demand for advanced electrolyte additives including pimelonitrile continues to expand, creating new market opportunities beyond traditional pharmaceutical applications.

Chemical manufacturers supplying pimelonitrile must maintain rigorous quality control systems to ensure product purity and consistency. Pharmaceutical applications typically require pimelonitrile with purity levels exceeding 99%, necessitating advanced purification techniques and comprehensive analytical testing. Manufacturers invest in specialized distillation equipment, chromatographic purification systems, and analytical instrumentation to achieve and verify the high purity standards demanded by pharmaceutical customers. Regulatory compliance requirements for pharmaceutical intermediates further emphasize the importance of documented quality management systems and validated manufacturing processes.

Between 2025 and 2030, the pimelonitrile market is projected to expand from USD 5.2 million to USD 7.0 million, resulting in a value increase of USD 1.8 million, which represents 41.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing pharmaceutical intermediate demand, rising adoption of advanced lithium battery electrolyte systems, and growing emphasis on high-purity specialty chemicals in drug synthesis applications. Chemical manufacturers are expanding their pimelonitrile production capabilities to address the growing demand for pharmaceutical-grade compounds that ensure product quality and regulatory compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5.2 million |

| Forecast Value in (2035F) | USD 9.5 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

From 2030 to 2035, the market is forecast to grow from USD 7.0 million to USD 9.5 million, adding another USD 2.5 million, which constitutes 58.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of electric vehicle battery production and next-generation pharmaceutical synthesis, the development of advanced electrolyte formulation technologies, and the growth of specialized applications in agrochemical intermediates and polymer additives. The growing adoption of eco-concious chemical manufacturing practices and advanced purification technologies will drive demand for pimelonitrile with enhanced purity specifications and consistent quality characteristics.

Between 2020 and 2025, the pimelonitrile market experienced steady growth, driven by increasing pharmaceutical intermediate requirements and growing recognition of pimelonitrile as an essential building block for synthesizing various therapeutic compounds and specialty chemicals.

The market developed as pharmaceutical chemists recognized the potential for pimelonitrile to serve as a versatile intermediate in drug synthesis pathways, offering structural features that enable efficient conversion to target pharmaceutical molecules while meeting stringent purity requirements. Technological advancement in chemical purification and synthesis optimization began emphasizing the critical importance of maintaining high purity standards and consistent quality in pharmaceutical intermediate production.

Market expansion is being supported by the increasing global demand for pharmaceutical intermediates driven by drug development activities and generic pharmaceutical production, alongside the corresponding need for high-purity chemical compounds that can enable efficient synthesis pathways, ensure product quality, and maintain regulatory compliance across various pharmaceutical, battery electrolyte, and specialty chemical applications. Modern pharmaceutical manufacturers are increasingly focused on implementing reliable supply chains for critical intermediates that can deliver consistent quality, support production scheduling, and provide comprehensive documentation in regulated manufacturing environments.

The growing emphasis on electric vehicle adoption and energy storage deployment is driving demand for pimelonitrile that can support advanced lithium battery electrolyte formulations, enable performance enhancements, and ensure comprehensive safety characteristics. Battery manufacturers' preference for electrolyte additives that combine performance benefits with thermal stability and electrochemical compatibility is creating opportunities for innovative pimelonitrile applications. The rising influence of ecological transportation and renewable energy storage is also contributing to increased adoption of advanced battery technologies that can provide superior performance characteristics without compromising safety or cycle life.

The pharmaceutical industry's ongoing research into antiviral medications and other therapeutic compounds continues to drive demand for pimelonitrile as a synthetic intermediate. Drug development programs targeting viral infections, metabolic disorders, and other therapeutic areas frequently incorporate dinitrile compounds in their synthetic routes, with pimelonitrile serving as a readily available starting material or intermediate. The compound's structural characteristics enable its incorporation into various molecular frameworks through well-established synthetic transformations, making it a valuable building block in pharmaceutical process chemistry.

Lithium battery electrolyte formulations represent a rapidly growing application area where pimelonitrile functions as a film-forming additive that enhances solid electrolyte interphase characteristics. Research studies demonstrate that pimelonitrile incorporation in electrolyte systems can improve battery cycling stability, reduce impedance growth, and enhance safety characteristics through its contribution to protective layer formation on electrode surfaces. Battery manufacturers developing next-generation lithium-ion and lithium metal battery technologies are evaluating pimelonitrile-containing electrolyte formulations as potential routes to achieving improved performance and safety targets.

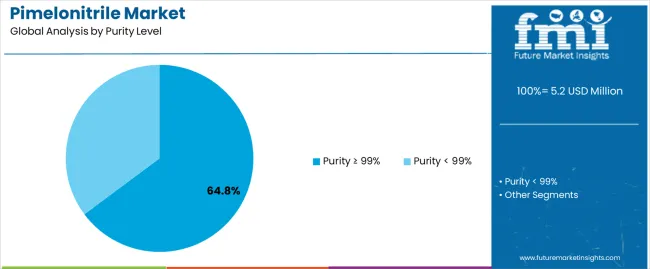

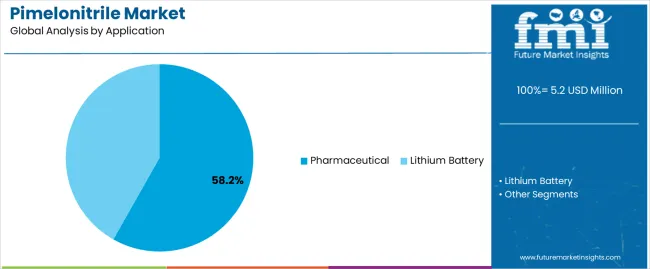

The market is segmented by purity level, application, and region. By purity level, the market is divided into purity ≥ 99% and purity < 99%. Based on application, the market is categorized into pharmaceutical and lithium battery. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

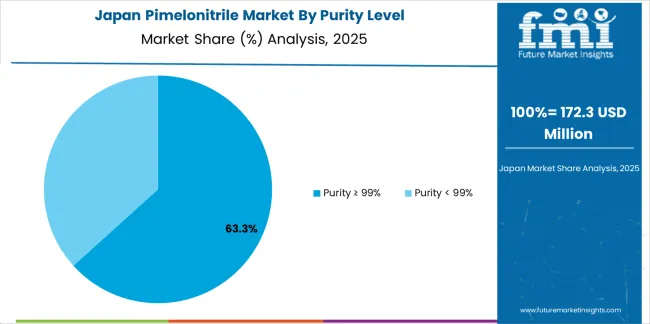

The purity ≥ 99% segment is projected to maintain its leading position in the pimelonitrile market in 2025 with a 64.8% market share, reaffirming its role as the preferred purity specification for pharmaceutical intermediate applications requiring stringent quality standards and regulatory compliance. Pharmaceutical manufacturers increasingly utilize high-purity pimelonitrile for its superior quality characteristics, minimal impurity content, and proven effectiveness in meeting pharmaceutical manufacturing requirements while ensuring product consistency across diverse drug synthesis applications. High-purity pimelonitrile technology's proven effectiveness and quality assurance directly address the industry requirements for pharmaceutical intermediate production and consistent performance across diverse therapeutic compound synthesis pathways.

This purity segment forms the foundation of pharmaceutical intermediate supply, as it represents the grade specification with the greatest acceptance in regulated manufacturing environments and established quality record across multiple pharmaceutical synthesis applications and therapeutic categories. Pharmaceutical industry investments in quality assurance and regulatory compliance continue to strengthen demand among drug manufacturers and contract manufacturing organizations. With regulatory requirements demanding documented purity specifications and comprehensive analytical characterization, high-purity pimelonitrile aligns with both quality objectives and regulatory requirements, making it the central specification for comprehensive pharmaceutical intermediate sourcing strategies.

The pharmaceutical application segment is projected to represent the largest share of pimelonitrile demand in 2025 with a 58.2% market share, underscoring its critical role as the primary driver for pimelonitrile adoption across antiviral drug synthesis, pharmaceutical intermediate production, and specialty therapeutic compound manufacturing. Pharmaceutical manufacturers prefer pimelonitrile for synthesis applications due to its exceptional structural versatility, established synthetic utility, and ability to serve as an effective building block while supporting quality objectives and regulatory compliance. Positioned as an essential intermediate for pharmaceutical synthesis, pimelonitrile offers both synthetic advantages and supply reliability.

The segment is supported by continuous innovation in drug development and the growing availability of synthetic methodologies that enable efficient pimelonitrile incorporation with enhanced process economics and reduced waste generation. Pharmaceutical manufacturers are investing in comprehensive intermediate sourcing programs to support increasingly complex drug synthesis requirements and expanding generic pharmaceutical production. As drug development activities continue and pharmaceutical manufacturing expands, the pharmaceutical application will continue to dominate the market while supporting advanced synthesis utilization and drug production optimization strategies.

The pimelonitrile market is advancing steadily due to increasing demand for pharmaceutical intermediates driven by drug development activities and generic pharmaceutical expansion, and growing utilization in lithium battery applications that require specialized chemical additives providing enhanced performance characteristics and safety benefits across diverse pharmaceutical synthesis, battery electrolyte, and specialty chemical applications. The market faces challenges, including limited production capacity and specialized manufacturing requirements, competition from alternative synthetic intermediates and electrolyte additives, and supply chain constraints related to raw material availability and stringent purity specifications. Innovation in purification technologies and synthetic pathway optimization continues to influence product development and market expansion patterns.

The growing focus on antiviral therapeutics is driving demand for specialized pharmaceutical intermediates that address unique synthesis requirements including structural complexity, stereochemical control, and efficient conversion pathways. Antiviral drug development programs require advanced intermediate compounds that deliver reliable synthetic utility while maintaining stringent purity standards and cost-effectiveness. Pharmaceutical manufacturers are increasingly recognizing the strategic importance of securing reliable pimelonitrile supply for drug synthesis development and commercial production, creating opportunities for specialized chemical manufacturers optimized for pharmaceutical intermediate applications.

Modern battery manufacturers are incorporating advanced electrolyte formulation strategies and specialized additive compounds to enhance performance characteristics, enable safety improvements, and support comprehensive battery optimization through controlled interface chemistry and protective layer formation. Leading battery companies are developing electrolyte systems with pimelonitrile incorporation, implementing sophisticated formulation designs, and advancing battery technologies that maximize energy density and cycle life. These technologies improve battery performance while enabling new market opportunities, including high-energy electric vehicle batteries, long-duration energy storage systems, and advanced consumer electronics applications. Advanced electrolyte integration also allows manufacturers to support comprehensive safety requirements and performance targets beyond traditional battery specifications.

The expansion of eco-friendly chemical manufacturing, green synthesis methodologies, and circular economy principles is driving demand for chemical intermediates produced through environmentally responsible processes with reduced waste generation and energy consumption. These environmentally-friendly initiatives require chemical manufacturers to implement cleaner production technologies and optimize synthetic efficiency while maintaining product quality, creating opportunities for process innovation and manufacturing excellence. Manufacturers are investing in advanced process technologies and waste minimization strategies to serve emerging sustainability requirements while supporting innovation in green pharmaceutical manufacturing and resource-efficient chemical production.

| Country | CAGR (2025-2035) |

|---|---|

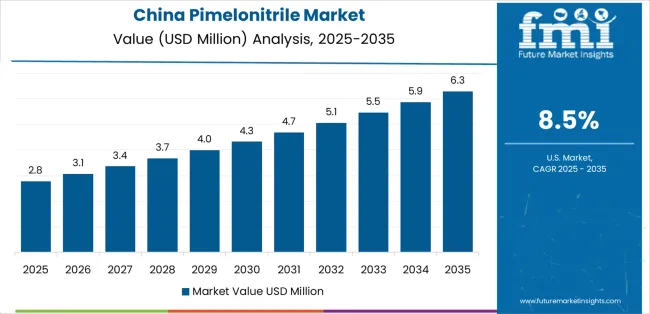

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| United States | 6.0% |

| United Kingdom | 5.4% |

| Japan | 4.7% |

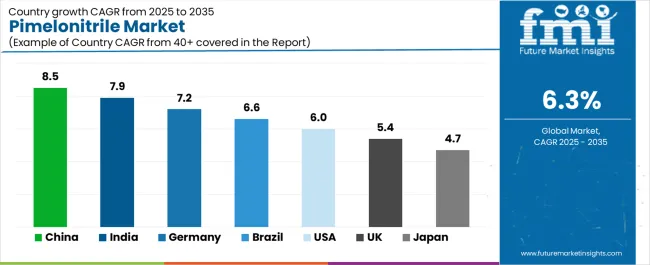

The pimelonitrile market is experiencing solid growth globally, with China leading at an 8.5% CAGR through 2035, driven by expanding pharmaceutical manufacturing capacity, growing lithium battery production, and increasing adoption of specialty chemical intermediates in domestic chemical industry. India follows at 7.9%, supported by rising pharmaceutical manufacturing, expanding chemical industry, and growing investment in pharmaceutical intermediate production under government initiatives. Germany shows growth at 7.2%, emphasizing pharmaceutical technology development, specialty chemical innovation, and advanced manufacturing capabilities for high-purity chemical intermediates. Brazil demonstrates 6.6% growth, supported by expanding pharmaceutical sector, growing chemical manufacturing, and increasing domestic pharmaceutical intermediate demand. The United States records 6.0%, focusing on pharmaceutical research leadership, advanced battery technology development, and comprehensive pharmaceutical manufacturing capabilities. The United Kingdom exhibits 5.4% growth, emphasizing pharmaceutical intermediate supply and specialty chemical development. Japan shows 4.7% growth, emphasizing high-purity chemical manufacturing and pharmaceutical intermediate production.

The report covers an in-depth analysis of 40 countries, with top-performing countries are highlighted below.

Revenue from pimelonitrile in China is projected to exhibit exceptional growth with a CAGR of 8.5% through 2035, driven by expanding pharmaceutical manufacturing capacity and rapidly growing lithium battery industry supported by government initiatives promoting domestic pharmaceutical production and electric vehicle development programs. The country's massive chemical manufacturing sector expansion and increasing investment in specialty chemical technologies are creating substantial demand for pharmaceutical intermediate solutions. Major pharmaceutical manufacturers and chemical companies are establishing comprehensive pimelonitrile production capabilities to serve both domestic markets and export opportunities.

Demand for pimelonitrile in India is expanding at a CAGR of 7.9%, supported by the country's growing pharmaceutical manufacturing sector, expanding chemical industry, and increasing investment in pharmaceutical intermediate production under Make in India initiatives. The country's comprehensive pharmaceutical industry development and technological advancement are driving sophisticated chemical intermediate capabilities throughout diverse manufacturing sectors. Leading pharmaceutical manufacturers and chemical companies are establishing extensive production and innovation facilities to address growing domestic and export demand.

Revenue from pimelonitrile in Germany is growing at a CAGR of 7.2%, driven by the country's leadership in pharmaceutical technology, established chemical manufacturing excellence, and strong emphasis on innovation in specialty chemical intermediates and pharmaceutical synthesis. Germany's pharmaceutical excellence and chemical industry tradition are driving sophisticated intermediate production capabilities throughout chemical manufacturing sectors. Leading pharmaceutical manufacturers and chemical specialists are establishing comprehensive innovation programs for next-generation chemical intermediate technologies.

Demand for pimelonitrile in Brazil is expected to expand at a CAGR of 6.6%, supported by the country's focus on pharmaceutical sector development, growing chemical manufacturing capabilities, and increasing domestic pharmaceutical intermediate production. The nation's comprehensive pharmaceutical industry development and chemical manufacturing modernization are driving demand for specialty intermediate solutions. Pharmaceutical manufacturers and chemical producers are investing in supply chain development and production capabilities to serve both domestic pharmaceutical and chemical sectors.

Revenue from pimelonitrile in the United States is projected to grow at a CAGR of 6.0%, supported by the country's focus on pharmaceutical research excellence, established pharmaceutical manufacturing industry, and growing emphasis on advanced battery technology development. The nation's comprehensive pharmaceutical sector and battery innovation leadership are driving demand for sophisticated intermediate solutions. Pharmaceutical manufacturers and battery technology companies are investing in supply chain development and technology advancement to serve both pharmaceutical and energy storage markets.

Demand for pimelonitrile in the United Kingdom is anticipated to expand at a CAGR of 5.4%, driven by the country's pharmaceutical innovation capabilities, chemical manufacturing expertise, and established pharmaceutical sector supporting specialty intermediate development for pharmaceutical synthesis applications. The United Kingdom's pharmaceutical excellence and chemical industry tradition are driving sophisticated intermediate supply capabilities throughout pharmaceutical manufacturing sectors. Leading pharmaceutical companies and chemical manufacturers are establishing comprehensive supply programs for pharmaceutical intermediate technologies.

Revenue from pimelonitrile in Japan is growing at a CAGR of 4.7%, supported by the country's leadership in high-purity chemical manufacturing, advanced pharmaceutical production, and strong emphasis on ultra-high-specification intermediates for sophisticated pharmaceutical applications. Japan's technological sophistication and quality excellence are driving demand for premium pimelonitrile products. Leading chemical manufacturers and pharmaceutical companies are investing in specialized capabilities for advanced pharmaceutical intermediate applications.

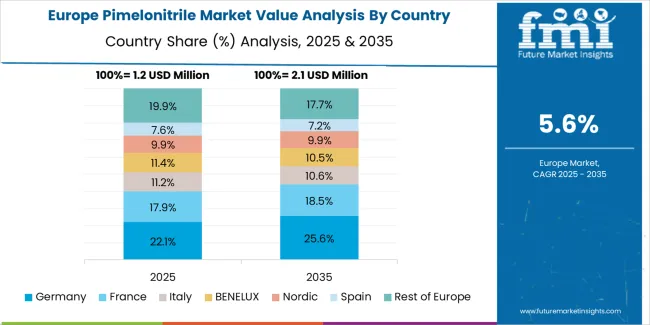

The pimelonitrile market in Europe is projected to grow from USD 1.2 million in 2025 to USD 2.1 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain leadership with a 38.5% market share in 2025, moderating to 37.8% by 2035, supported by pharmaceutical manufacturing excellence, specialty chemical production, and strong pharmaceutical intermediate supply capabilities.

France follows with 21.4% in 2025, projected at 21.8% by 2035, driven by pharmaceutical industry development, chemical manufacturing capabilities, and specialized intermediate production for pharmaceutical applications. The United Kingdom holds 18.6% in 2025, inching up to 18.9% by 2035 on the back of pharmaceutical innovation and chemical manufacturing expertise. Italy commands 11.2% in 2025, rising slightly to 11.4% by 2035, while Switzerland accounts for 6.8% in 2025, reaching 7.0% by 2035 aided by pharmaceutical manufacturing and high-purity chemical production. The Netherlands maintains 3.5% in 2025, up to 3.6% by 2035 due to chemical distribution networks and pharmaceutical supply chain integration. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 0.0% in 2025 and -0.5% by 2035, reflecting limited market presence in smaller pharmaceutical and chemical manufacturing markets.

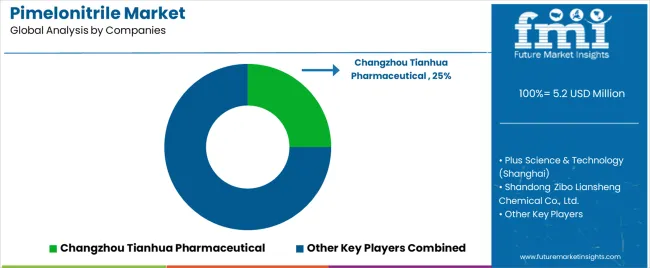

The pimelonitrile market is characterized by competition among established pharmaceutical intermediate manufacturers, specialized fine chemical producers, and regional chemical suppliers. Companies are investing in purification technology development, quality management systems, production capacity expansion, and customer technical support to deliver high-purity, reliable, and cost-effective pimelonitrile solutions. Innovation in synthetic pathway optimization, advanced purification methods, and comprehensive quality documentation is central to strengthening market position and competitive advantage.

Changzhou Tianhua Pharmaceutical leads the market with comprehensive pimelonitrile production capabilities, offering high-purity pharmaceutical intermediate solutions with a focus on quality assurance, regulatory compliance, and consistent supply reliability across pharmaceutical synthesis applications. The company maintains advanced purification facilities and comprehensive quality control systems to ensure pharmaceutical-grade product specifications. Plus Science & Technology (Shanghai) provides specialized pimelonitrile products with emphasis on high-purity grades and application technical support for pharmaceutical and battery electrolyte applications.

Leading chemical manufacturers invest in advanced analytical capabilities, process optimization programs, and regulatory documentation systems to maintain product quality and support customer requirements across pharmaceutical and specialty chemical applications. Companies establish comprehensive quality management frameworks complying with pharmaceutical manufacturing standards while developing technical expertise in synthesis optimization and impurity control. Market participants focus on reliable supply chain management, responsive customer service, and comprehensive technical documentation to strengthen customer relationships and support regulated manufacturing operations.

Pimelonitrile represents a specialized pharmaceutical intermediate segment within chemical manufacturing applications, projected to grow from USD 5.2 million in 2025 to USD 9.5 million by 2035 at a 6.3% CAGR. This high-purity specialty chemical serves as a critical intermediate in pharmaceutical synthesis operations, battery electrolyte formulations, and specialty chemical applications where structural versatility, high purity, and consistent quality are essential. Market expansion is driven by increasing pharmaceutical intermediate requirements, growing lithium battery electrolyte development, expanding drug synthesis applications, and rising demand for high-purity specialty chemicals across diverse pharmaceutical and battery manufacturing operations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.2 million |

| Purity Level | Purity ≥ 99%, Purity < 99% |

| Application | Pharmaceutical, Lithium Battery |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Changzhou Tianhua Pharmaceutical, Plus Science & Technology (Shanghai) |

| Additional Attributes | Dollar sales by purity level and application category, regional demand trends, competitive landscape, technological advancements in chemical synthesis, purification development, quality management, and pharmaceutical application optimization |

The global pimelonitrile market is estimated to be valued at USD 5.2 million in 2025.

The market size for the pimelonitrile market is projected to reach USD 9.6 million by 2035.

The pimelonitrile market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in pimelonitrile market are purity ≥ 99% and purity < 99%.

In terms of application, pharmaceutical segment to command 58.2% share in the pimelonitrile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA