Plant-Based Sausages market offers a variety of meatless sausage products made from plant proteins such as soy, pea, wheat gluten, lentils, chickpeas, rice, and fungi (mycoprotein). Made to taste and feel like real pork, beef, or chicken sausages, these products offer an ethical, sustainable, and cholesterol-free alternative to traditional meat. The market is driven by rising demand for clean-label, flexitarian, vegan, and health-conscious food, as well as increased investment in food tech innovation.

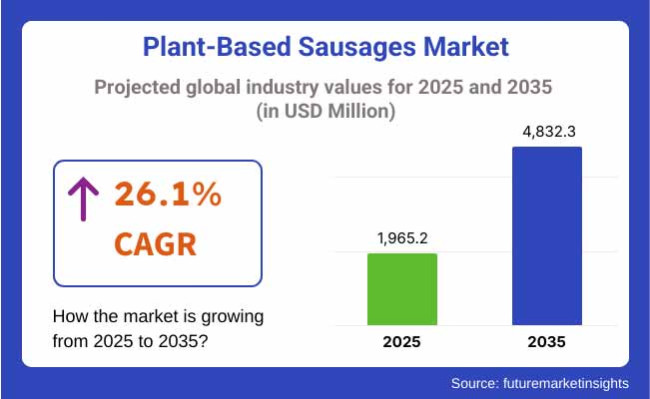

In 2025, the global plant-based sausages market is projected to reach approximately USD 1,965.2 million, and is expected to grow to around USD 4,832.3 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 26.1% during the forecast period.

The market growth is driven by increasing environmental concerns, dietary shifts, foodservice partnerships, and the rise of alternative protein startups and private label offerings within the retail and quick-service dining sectors.

With an expanding flexitarian population, rising vegan movements, and high retail and QSR penetration, the North American market leads the charge with strong demand in Canada and the USA Some of the biggest names in plant-based meats, Plant-Based - Beyond Meat, Impossible Foods, Lightlife and Field Roast, Plant-Based - are running the market with products focused on smoked, spicy and breakfast sausage-style. Frozen and chilled shelf space for plant-based meat alternatives.

Europe is a highly regulated market that is focused on sustainability, with Germany, the UK, the Netherlands and Sweden driving campaigns to reduce meat consumption and innovation in organic and allergen-free sausages. Many EU consumers already eat wheat-based or lupin-based sausages, while a strong vegetarian culture exists throughout the region. Consumer demand for carbon labeling and clean ingredient lists are driving growth in mainstream and premium grocery channels.

Europe is a highly regulated market that is focused on sustainability, with Germany, the UK, the Netherlands and Sweden driving campaigns to reduce meat consumption and innovation in organic and allergen-free sausages. Many EU consumers already eat wheat-based or lupin-based sausages, while a strong vegetarian culture exists throughout the region. Consumer demand for carbon labeling and clean ingredient lists is driving growth in mainstream and premium grocery channels.

Challenges

Flavor Replication, Texture Consistency, and Health Perception

The plant-based sausages market is restricted due to their inability to replicate the texture, sizzle, and savory fat profile of heritage pork, chicken, and beef sausages. The godawful taste of most meat replacements is the predominant reason why most consumers (of all types, but most strikingly of meat-eaters and flexitarians alike) don’t repurchase.

Moreover, healthy-minded shoppers are now scrutinizing sodium, use of additives, and ultra-processing, especially in products based on binders, flavor enhancers, or oil emulsions. Maintaining a clean label while achieving taste parity is still a formulation challenge for producers.

Opportunities

Flexitarian Surge, Culinary Fusion Trends, and Protein Diversification

The market is benefiting from a rapid rise in flexitarian and climate-conscious consumers, who are seeking trusted meat forms in plant-based formats. Sausages so adaptable and seasoning-driven , Plant-Based - afford plenty of room for local flavor experimentation (e.g., bratwurst, chorizo, merguez, and breakfast links) and naturally suit barbecue, street food and fast casuals. New forms of pea, lentil, mung bean, fava, chickpea, jackfruit and mycoprotein are paving the way for cleaner, juicier alternatives with improved bite resistance and grillability.

Plant-Based Sausages gained traction from 2020 to 2024 through supermarket penetration, QSR tests, and grilling season promotions from brands like Beyond Meat and Impossible Foods to Field Roast and Lightlife. Cost barriers, flavor fatigue and limited distribution in emerging markets, however, slowed down broad adoption.

The 2025 to 2035 period will see the market become a multi-segment, culturally embedded protein category enabled by AI-formulation, fermentation-based protein innovation, and hyper-local flavor creation. Growth in retail and foodservice will be fueled by private label, continual ingredient transparency and culinary partnerships.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focused on labeling terminology (sausage vs. plant-based), allergen compliance |

| Technology Innovations | Reliance on extruded pea and soy protein blends |

| Market Adoption | Focused on retail grilling, breakfast links, and fast-food pilot launches |

| Sustainability Trends | Early transition from beef to soy/pea alternatives and plastic reduction |

| Market Competition | Led by Beyond, Impossible, Field Roast, Nestlé, MorningStar Farms |

| Consumer Trends | Preference for high protein, low cholesterol, and novelty value |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardization of global plant-based naming conventions, sodium caps, and processing disclosures |

| Technology Innovations | Rise of mycelium fermentation, lipid micro-encapsulation, 3D printing of plant muscle fibers |

| Market Adoption | Expansion into catered events, hospitals, school programs, and culturally customized retail SKUs |

| Sustainability Trends | Shift to carbon-neutral sausages, regenerative crop-based proteins, and biodegradable packaging. |

| Market Competition | Entry of ethnic-focused plant-based startups , fermented sausage innovators, and culinary DTC brands |

| Consumer Trends | Demand for clean label, allergen-free, culturally familiar, and nutritionally functional sausages |

The United States Plant-based Sausages market is growing at an exponential rate, driven largely by vegan and flexitarian consumer trends, increasing awareness of green sustainability, and sudden growth in a shift to meat alternatives in mainstream grocery retailers and quick-service restaurants.

Flavor, mouthfeel and protein technology, especially using pea, soy and mycoprotein, are making plant-based sausages appealing to mainstream shoppers. The proliferation of BBQ-style, spicy, and breakfast sausage varieties has extended their appeal across lifestyles and occasions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 26.5% |

The UK Plant-based Sausages Market, which is growing at pace, driven by strong retail and foodservice innovation, governmental endorsement of plant-based diets and mass adoption among flexitarians. Supermarkets and quick-serve chains offer a wide variety of Plant-Based Sausages products to meet taste, health and sustainability demands.

Organic, gluten-free and low-sodium sausage is becoming more unmissable on shoppers’ lists, with high demand for British-style varieties, such as Cumberland and Lincolnshire, to be reformulated with plant protein.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 25.7% |

The market of EU Plant-based Sausages is growing consistently in Germany, Netherlands, and Sweden, which are countries prone for the clean-label and meat reduction trends. Domestically and internationally-produced, plant-based versions of bratwurst, chorizo and hotdogs are on the market to suit consumption palates rooted in culture.

Manufacturers are responding by reformulating with local legumes, fermented proteins and natural binders, due to the EU's Farm to Fork strategy and sustainability legislation. The key to this is the food service industry, which is adopting these products into mainstream menus.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 25.4% |

Some of the factors driving its growth are that Health-conscious people and food tech players are challenging innovation in Japan's Alternative Sausages industry. While traditionally a meat-sparing society, the Japanese consumer is increasingly turning to soy sausages with umami-packed flavours and familiar textures.

Now, convenience stores and bento meal manufacturers are introducing Plant-Based Sausage products to be eaten day to day. The thawed product development follows mild taste, simple ingredients, and portion control.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 26.1% |

The South Korea market for Plant-based Sausages is growing rapidly, thanks to the K-wellness phenomenon, ecologism, and consumer demand for clean-label, functional food. Consumers, especially millennials, want delicious, protein-rich solutions that fit easily into Korean- and Western-style meals.

Tofu, beans, mushrooms, konjac retailers and social media influencers are pushing meat-free sausages. Plant-based BBQ and street-food-style sausage varieties are taking off in home and restaurant dining.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 26.3% |

| By Product Type | Market Share (2025) |

|---|---|

| Plant-Based Pork | 45.0% |

Plant-based pork sausages are projected to hold the largest plant-based sausages market share, estimating up to 45.0% of total demand. Their triumph rests on their ability to closely mimic the taste and texture of pork sausages made using conventional methods, a quality that has allowed them to cater to vegetarians and flexitarians who miss familiar flavors in the absence of animal products.

Manufacturers have splurged on research and development to amplify the sensory characteristics of plant-derived pork sausages using innovative food technologies and flavoring regimes to recreate the juiciness and umami of traditional pig. They have led to both engendering a broader consumer acceptance & deeper market penetration.

Plant-based beef sausages are expected to account for a 35.0% share of the entire market. Beef sausages have been formulated to cater to consumers who enjoy the full-bodied and strong flavor of beef. Plant-based beef sausage production has been focused on mimicking the texture and taste of traditional beef sausage using ingredients such as pea protein and beet juice for color and juiciness of beef. Rising consumption of plant-based beef substitutes at fast-food chains and in supermarkets has also aggravated demand for these items.

| By Source | Market Share (2025) |

|---|---|

| Soy-Based Protein | 40.0% |

By source, plant-based sausages made from soy is expected to hold the largest share (40.0% share) of the inplant-based sausages market by 2035. Soy protein has been a mainstay in the plant-based food space as it is rich in protein, has an all the essential amino acids and is functional with good texture and mouthfeel in meat substitutes.

Soy products have gained popularity in many fields due to consumer confidence in them and their convenience. Besides, the process era has reduced taste and allergenicity problems that had affected soy in the past and increased its popularity.

All in all, the overall plant sausage market has a lot of potential for growth, with plant pork sausages as a product type outpacing the competition and soy-based protein sausages as a source leading the way. The trends come as consumer behavior shifts toward sustainable and healthy foods. As the market continues to grow, further development of both products and protein sources to meet the evolving needs of global consumers will move the needle.

As customers increasingly desire meat substitutes that emphasize factors like health, sustainability, animal well-being, and diet, the Plant-Based Sausages revenue market is growing aggressively. The sausages mimic traditional meat but contain no cholesterol, lots of fiber and little fat. Diversification of protein sources (soy, pea, wheat, mushroom, and lentil) along with clean-label direction, allergen-free labeling, and increased plant-based presence in foodservice, retail, and quick-service restaurants (QSRs) support innovation.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Beyond Meat, Inc. | 18-22% |

| Impossible Foods Inc. | 14-18% |

| Nestlé S.A. (Garden Gourmet / Sweet Earth) | 12-16% |

| The Kraft Heinz Company (BOCA) | 10-14% |

| Tofurky Co., Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Beyond Meat, Inc. | In 2025, Beyond Meat launched Beyond Sausage® 3.0, featuring improved protein content, lower sodium, and sunflower oil-based fat for better mouthfeel, targeted at both retail and QSR markets. |

| Impossible Foods Inc. | As of 2024, Impossible introduced Impossible™ Spicy and Bratwurst Sausages, made from soy and potato proteins with heme for flavor and visual appeal, now available at major USA supermarkets and select fast-casual restaurants. |

| Nestlé S.A. | In 2024, Nestlé’s Sweet Earth and Garden Gourmet lines expanded with European-style plant-based bratwursts and American breakfast sausage links, made from non-GMO pea protein and beetroot extract. |

| The Kraft Heinz Company (BOCA) | As of 2023, BOCA revamped its vegan sausage links with whole soy protein, mushroom extracts, and herbs, positioned as an affordable, accessible plant-based option in value retail channels. |

| Tofurky Co., Inc. | In 2024, Tofurky introduced its Organic Kielbasa and Italian Sausage range, made with non-GMO wheat gluten and tofu, appealing to long-time vegetarians and ethical eaters. |

Key Market Insights

Beyond Meat, Inc. (18-22%)

Beyond Meat leads the Plant-Based Sausages market through aggressive R&D and wide distribution across retail shelves, meal kits, and QSRs. Their sausages stand out for meat-like appearance, sizzle, and bite, available in varieties like Hot Italian, Brat Original, and Mild.

Impossible Foods Inc. (14-18%)

Impossible Foods leverages its proprietary heme ingredient to replicate real sausage flavor and aroma, with strong traction in breakfast menus and spicy sausage variants, rapidly gaining ground in foodservice and convenience dining.

Nestlé S.A. (12-16%)

Nestlé offers region-specific, flexitarian-friendly sausages under Sweet Earth (USA) and Garden Gourmet (EU), with diverse flavor profiles, clean labels, and availability in supermarkets and cafeterias.

The Kraft Heinz Company (10-14%)

BOCA sausages remain popular among legacy vegetarian consumers, providing affordable and recognizable options in club stores and mass-market grocers, often featuring soy-centric ingredients.

Tofurky Co., Inc. (8-12%)

Tofurky’s artisan-style sausages cater to the ethical, organic, and eco-conscious segments, known for dense texture, bold seasoning, and versatility in grilling or sautéing.

Other Key Players (26-32% Combined)

Numerous regional and emerging brands are shaping the next wave of plant-based sausages with cleaner formulations, global flavor innovations, and functional health ingredients, including:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for plant-based sausages market was USD 1,965.2 million in 2025.

The plant-based sausages market is expected to reach USD 4,832.3 million in 2035.

Rising consumer shift toward meat alternatives, growing vegan and flexitarian populations, and increasing availability of innovative, protein-rich Plant-Based Sausages options will drive market growth.

The top 5 countries which drives the development of plant-based sausages market are USA, European Union, Japan, South Korea and UK.

Soy-based protein expected to grow to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.