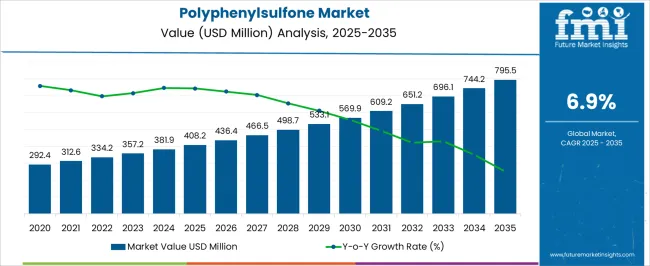

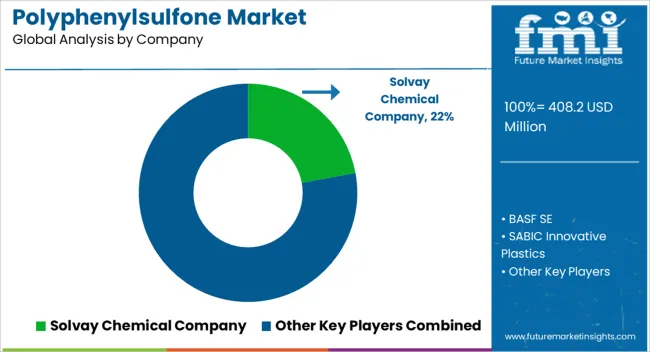

The polyphenylsulfone market is estimated to be valued at USD 408.2 million in 2025 and is projected to reach USD 795.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. The year-on-year (YoY) growth analysis of the polyphenylsulfone market shows a steady rise in demand, with market value projected to increase from USD 408.2 million in 2025 to USD 795.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.9%.

This trend highlights the rising adoption of polyphenylsulfone in industries such as healthcare, aerospace, and automotive, where the material’s high-performance attributes, such as thermal stability and chemical resistance, are considered indispensable. By 2035, the polyphenylsulfone market is anticipated to nearly double in size, reaching USD 795.5 million. This consistent upward movement underscores the material’s growing relevance across industries that demand strong, reliable, and durable engineering plastics.

With increasing use in medical devices, water treatment membranes, and aircraft interiors, the market outlook appears positive, supported by the rising emphasis on performance-driven materials. The YoY growth pattern suggests that polyphenylsulfone will continue to secure a vital role in advanced manufacturing, creating opportunities for producers and suppliers to expand their market share while catering to a broader range of end-use applications.

| Metric | Value |

|---|---|

| Polyphenylsulfone Market Estimated Value in (2025 E) | USD 408.2 million |

| Polyphenylsulfone Market Forecast Value in (2035 F) | USD 795.5 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The polyphenylsulfone market is a specialized segment within the broader high-performance plastics market, where it currently accounts for nearly 4-5% of the total share. Known for its high thermal stability, chemical resistance, and mechanical strength, polyphenylsulfone is gaining prominence in industries requiring durability under harsh conditions. Within the specialty chemicals market, the share is relatively smaller, around 1-2%, as the market encompasses a wide range of advanced polymers and composites. However, the growth of polyphenylsulfone in this space is driven by its application diversity, especially in regulated industries where stringent performance and compliance are critical.

In the medical devices market, polyphenylsulfone commands approximately 6-7% share due to its use in sterilizable instruments, surgical trays, and components that require repeated autoclaving. This is one of the strongest demand drivers as healthcare systems worldwide are investing in durable, cost-effective materials. In the aerospace components market, polyphenylsulfone has about a 3-4% share, owing to its use in lightweight, flame-retardant parts where safety and performance are non-negotiable. In the automotive materials market, its share is estimated at 2-3%, largely in high-performance fuel system components, lighting, and electrical housings.

The polyphenylsulfone (PPSU) market is gaining momentum due to its high thermal stability, hydrolysis resistance, and excellent mechanical properties that make it suitable for demanding engineering applications. Regulatory shifts toward BPA-free, high-performance plastics support their rising usage in healthcare, plumbing, and aerospace sectors.

Growth is further propelled by increased demand for lightweight and durable materials in both developed and emerging economies. Technological advancements in injection molding and precision extrusion have broadened the material's applicability, while rising investments in healthcare infrastructure and sanitation projects globally are providing strong tailwinds.

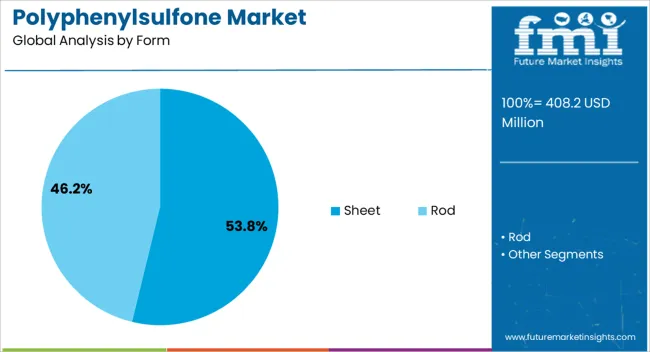

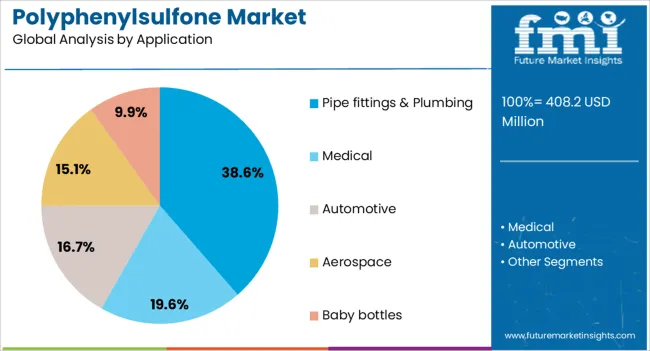

The polyphenylsulfone market is segmented by form, application, and geographic regions. By form, polyphenylsulfone market is divided into Sheet and Rod. In terms of application, polyphenylsulfone market is classified into Pipe fittings & Plumbing, Medical, Automotive, Aerospace, and Baby bottles. Regionally, the polyphenylsulfone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sheet segment is expected to lead the PPSU market with a 53.80% share in 2025, driven by its adaptability across medical, aerospace, and industrial processing applications. Sheets offer design flexibility, chemical resistance, and excellent dimensional stability, making them ideal for precision components and machined parts.

Their compatibility with sterilization techniques such as autoclaving has also made them highly preferred in medical trays, surgical instrument holders, and imaging devices. Demand is particularly rising in cleanroom and lab environments where structural integrity and transparency are essential.

Manufacturers are leveraging sheet form's customization advantages to meet evolving client specifications, which continues to support its dominant position.

Pipe fittings and plumbing applications are set to capture 38.60% of the PPSU market share in 2025, making this the leading application segment. The segment's growth is tied to PPSU’s high resistance to hot water, aggressive chemicals, and repeated sterilization cycles, key requirements in modern plumbing and sanitary installations.

PPSU-based fittings are increasingly replacing metal counterparts due to their corrosion resistance, ease of installation, and long service life. The push for safer potable water systems, especially in residential and healthcare settings, has accelerated adoption.

Government infrastructure programs and housing developments in regions like Asia-Pacific and North America are further boosting demand for high-performance plastic plumbing components.

The polyphenylsulfone market is being driven by its strong adoption in healthcare, aerospace, and automotive industries. Opportunities lie in biocompatible applications and advanced filtration systems, while lightweight substitution is becoming a notable trend across transport. High costs and complex processing remain challenges that restrict wider adoption. Still, PPSU’s unique balance of toughness, sterilization resistance, and thermal stability ensures it remains a preferred material for demanding applications, making the market outlook promising in the years ahead.

The demand for polyphenylsulfone (PPSU) is accelerating due to its superior mechanical strength, high heat resistance, and chemical stability. In healthcare, PPSU is widely used in sterilizable medical devices, dental equipment, and surgical instruments. Its ability to withstand repeated autoclaving cycles without losing performance makes it indispensable in hospitals and laboratories. In aerospace and automotive, PPSU is increasingly adopted for lightweight, durable, and flame-resistant components. This rising cross-industry reliance on PPSU underscores its expanding demand profile, supporting long-term market growth.

Significant opportunities exist for PPSU manufacturers as demand for biocompatible polymers increases in advanced medical and dental applications. PPSU’s biocompatibility and sterilization resistance make it ideal for orthopedic implants, fluid handling systems, and reusable surgical tools. Emerging economies, with growing investments in healthcare infrastructure, present fertile ground for expanded usage. Furthermore, the demand for high-performance polymers in water filtration, membrane technologies, and high-pressure fluid systems opens new market avenues. Companies focusing on tailoring PPSU grades for specialized applications are well-positioned to capture these opportunities.

A strong trend is observed in transportation sectors where PPSU is being adopted as a lightweight substitute for metals and conventional plastics. In aerospace and automotive, weight reduction is a primary goal for fuel efficiency and performance optimization. PPSU’s high-dimensional stability, toughness, and flame retardancy make it a material of choice. The shift toward high-performance thermoplastics is reshaping the competitive landscape as manufacturers seek to integrate PPSU into next-generation vehicle interiors, connectors, and under-the-hood parts. This trend is strengthening its long-term adoption prospects.

Despite its benefits, PPSU adoption faces barriers due to its high cost compared to conventional engineering plastics like polycarbonate or polysulfone. The complex processing requirements of PPSU add further challenges, as manufacturers must invest in specialized equipment and processing expertise. This limits its penetration in price-sensitive markets and smaller-scale applications. Moreover, fluctuations in raw material availability can impact production stability.

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

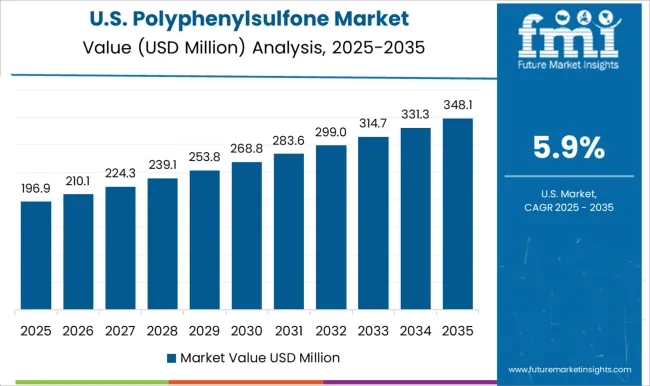

| USA | 5.9% |

| Brazil | 5.2% |

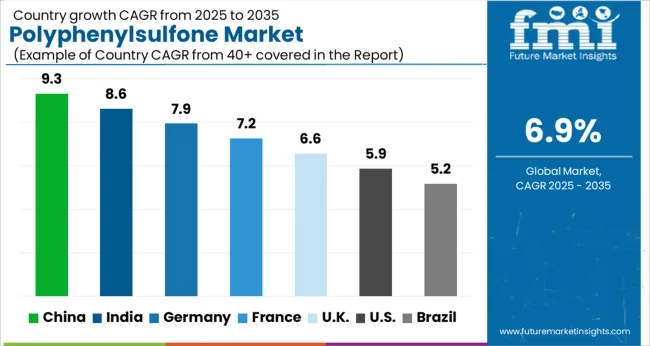

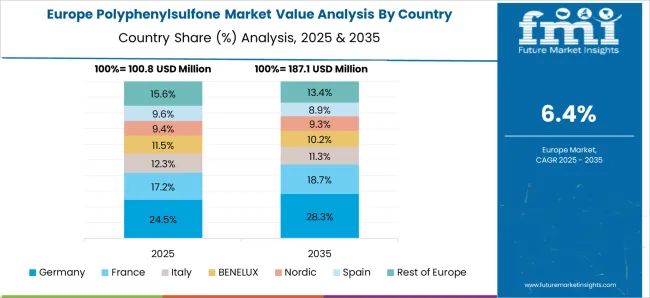

The global polyphenylsulfone market is expected to record a CAGR of 6.9%. China leads with 9.3%, followed by India at 8.6% and Germany at 7.9%. The UK shows moderate growth at 6.6%, while the USA trails at 5.9%. Higher growth rates in Asian countries are driven by expanding healthcare, automotive, and aerospace industries, supported by manufacturing cost advantages. European markets demonstrate consistent adoption due to advanced industrial bases, while North America reflects maturity with stable yet slower growth trends. This report includes insights on 40+ countries; the top markets are shown here for reference.

The polyphenylsulfone market in China is projected to expand at a CAGR of 9.3%. Growth is driven by increasing applications in medical devices, automotive, and aerospace components, where durability and thermal resistance are critical. Rising demand for high-performance polymers in healthcare and transportation sectors is boosting market development. China’s strong manufacturing base and cost-efficient production capabilities support rapid adoption. The country’s focus on advanced engineering plastics for domestic use and exports continues to push polyphenylsulfone demand upward.

The polyphenylsulfone market in India is forecasted to grow at a CAGR of 8.6%. Demand is led by the medical sector, especially in surgical instruments, sterilization trays, and dental equipment. Expanding automotive production and growing adoption of high-performance plastics in electrical and electronics segments also enhance the market outlook. India’s rising healthcare infrastructure and increasing reliance on imported medical-grade polymers create opportunities for local suppliers and global players entering the market. Cost-sensitive manufacturing adds further momentum.

The polyphenylsulfone market in Germany is expected to grow at a CAGR of 7.9%. The country’s well-established automotive and aerospace industries are central to its adoption, with PPSU being valued for its strength, dimensional stability, and resistance to heat. In addition, medical-grade polyphenylsulfone finds strong acceptance in Germany’s healthcare system due to its biocompatibility and sterilization resistance. The combination of high R&D capabilities and strict quality standards ensures steady growth in Germany’s PPSU market.

The polyphenylsulfone market in the United Kingdom is set to register a CAGR of 6.6%. Healthcare and industrial applications dominate demand, with hospitals and laboratories steadily increasing their use of PPSU-based instruments. The aerospace and defense industries also support uptake due to stringent requirements for performance and safety. Despite moderate growth compared to Asian countries, the UK market benefits from innovation in material processing and regulatory standards emphasizing reliable and safe high-performance polymers.

The polyphenylsulfone market in the United States is projected to grow at a CAGR of 5.9%. Growth stems from steady demand in healthcare, where PPSU is widely used in sterilizable devices and reusable surgical components. The aerospace and automotive sectors also sustain adoption, though competition from other high-performance polymers is evident. The USA market reflects maturity compared to Asia-Pacific, yet remains vital due to strong healthcare spending, established medical device manufacturers, and advanced material R&D.

Suppliers in the polyphenylsulfone market are competing by strengthening their portfolios in high-performance polymers, emphasizing durability, biocompatibility, and heat resistance. Solvay Chemical Company and BASF SE highlight PPSU grades designed for demanding applications in healthcare, aerospace, and water treatment. Their brochures emphasize high strength at elevated temperatures, resistance to repeated sterilization, and long service life. SABIC Innovative Plastics promotes PPSU solutions aimed at medical devices and plumbing systems, underscoring chemical resistance and long-term stability. Evonik Industries positions its PPSU range toward industrial and transport applications, presenting it as a material that can replace metals while cutting weight. RTP Company differentiates by offering custom PPSU compounds, blending fillers and additives to meet customer-specific requirements across niche markets. Each brochure frames PPSU as a premium material where performance outweighs cost.

The competitive field is defined by product positioning, certification readiness, and tailored solutions. Solvay and SABIC brochures emphasize compliance with global medical and food-contact standards, appealing to industries with strict regulations. BASF and Evonik focus on broader industrial applications, highlighting versatility and design freedom for engineers. RTP Company leverages its strength in customized compounding, stressing rapid prototyping and flexible formulations for emerging applications. Marketing strategies often feature case studies and performance comparisons, demonstrating PPSU’s superiority over polysulfone or polyetherimide in strength and hydrolytic stability. Competition is not only about product quality but also about how clearly brochures communicate the material’s value proposition.

| Item | Value |

|---|---|

| Quantitative Units | USD 408.2 Million |

| Form | Sheet and Rod |

| Application | Pipe fittings & Plumbing, Medical, Automotive, Aerospace, and Baby bottles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solvay Chemical Company, BASF SE, SABIC Innovative Plastics, Evonik Industries, and RTP Company |

| Additional Attributes | Dollar sales by grade type (medical, aerospace, industrial) and form (sheet, rod, granule, film) are key metrics. Trends include rising demand for high-performance polymers in healthcare, automotive, and aviation sectors. Regional adoption, advancements in processing technologies, and preference for durable, heat-resistant materials are driving market growth. |

The global polyphenylsulfone market is estimated to be valued at USD 408.2 million in 2025.

The market size for the polyphenylsulfone market is projected to reach USD 795.5 million by 2035.

The polyphenylsulfone market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in polyphenylsulfone market are sheet and rod.

In terms of application, pipe fittings & plumbing segment to command 38.6% share in the polyphenylsulfone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA