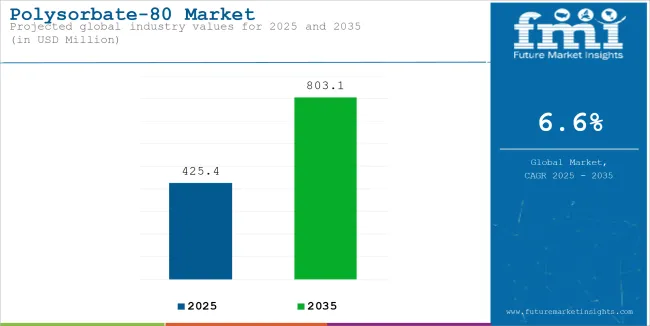

The global Polysorbate-80 market is estimated to be worth USD 425.4 million in 2025 and is projected to reach a value of USD 803.1 million by 2035, expanding at a CAGR of 6.6% over the assessment period of 2025 to 2035

Polysorbate-80 in an ingredient which is used in food, skincare and medicines. It works as a emulsifier that helps in mixing oil and water together that further forms a smooth texture. It is present in ice cream, salad dressings and lotions. It also helps in keeping the ingredients isolated and more steady.

It is a diverse ingredient which can be found in different products. It helps in mixing ingredients like oil and water which makes food products like salad dressings and ice cream smooth and creamy. It is used in lotions and creams to keep the texture consistent and even. Polysorbate-80 is important in medicines, mainly in vaccines where it helps in keeping the ingredients stable and effective. Its ability to work well in so many areas makes it a preferred options for companies looking to improve their products.

| Attributes | Description |

|---|---|

| Estimated Global Polysorbate-80 Business Size (2025E) | USD 425.4 million |

| Projected Global Polysorbate-80 Business Value (2035F) | USD 803.1 million |

| Value-based CAGR (2025 to 2035) | 6.6% |

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global polysorbate-80 market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 6.1% (2024 to 2034) |

| H1 | 6.4% (2025 to 2035) |

| H2 | 6.9% (2025 to 2035) |

The above table presents the expected CAGR for the global polysorbate-80 demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly higher growth rate of 6.1% in the second half (H2) of the same year. Moving into year 2025, the CAGR is projected to increase slightly to 6.4% in the first half and remain relatively moderate at 6.9% in the second half. In the first half (H1 2025) the market witnessed a decrease of 12 BPS while in the second half (H2 2025), the market witnessed an increase of 25 BPS.

The Essential Role of Polysorbate-80 in Modern Vaccine Formulations

Innovations in pharmaceutical formulations, especially in vaccine development, has made Polysorbate-80 very essential. It acts as an useful dispersant which helps in mixing ingredients equally in vaccines. This is important for mRNA vaccines, which needs stable and well mixed formulations to work effectively. It helps in keeping the vaccine ingredients from separating which secures that each dose is uniform and effective. As more vaccines are created and improved, the demand for Polysorbate-80 continues to grow, which makes it an important ingredient in new medicine.

Enhancing Agricultural Efficiency: The Role of Polysorbate-80 in Sustainable Agrochemicals

Innovations in agriculture are growing to increased use of stabilizers like Polysorbate-80 in the agrochemical industry. Farmers and manufacturers are trying to find more effective solutions for pesticides and fertilizers. It helps in improving the stability and effectiveness of these products by making sure that the active ingredients are equally mixed and properly provided. Which further means that farmers can use less product while they can still achieve good outcomes, which is better for the environment. As the demand for sustainable farming practices is growing, the use of Polysorbate-80 in agriculture is also rising.

The Rising Demand for Polysorbate-80 in the Evolving Cosmetic Industry

The cosmetic industry is growing quickly with more individuals interested in clean beauty and multifunctional products. This is growing the demand for active surfactants and emulsifiers like polysorbate-80. In cosmetics, this helps in mixing oil and water, making smooth creams, lotions and makeup products. It also improves the texture and stability of these items which makes them more attractive to consumers. As brands are focusing on using safe and more natural ingredients, polysorbate-80 is becoming a preferred choice which helps in meeting the requirements of current beauty lovers.

Global Polysorbate-80 sales increased at a CAGR of 5.9% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on polysorbate-80 will rise at 6.6% CAGR

As there is a firm focus on improving how well the body absorbs the active ingredients through dietary supplements. Polysorbate-80 is getting popularity as it helps in improving the bioavailability of these nutrients. This makes supplements helpful for consumers. Further innovative delivery systems are being made to improve how drugs are being delivered to the body.

The rise in do it yourself beauty and customizable skincare products has developed a rising interest in ingredients that allow consumers to make their own formulations at home. Individuals want to personalize their skincare routines and Polysorbate-80 allows them to mix different ingredients effectively. This ingredient helps in making sure that homemade creams, lotions and serums have a nice texture and it remains well mixed which makes it an important part for those trying DIY beauty solutions.

Tier 1 companies comprise industry leaders with market revenue of above USD 20 million sales domain share of 35% to 45% in the global sphere. These business leaders are characterized by high production capacity and a wide product portfolio. These trade leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within tier 1 include BASF Corporation, Croda International plc, Evonik., DuPont Nutrition & Health, Dow Corning Corporation, Beldem, and Lonza Group Limited.

Tier 2 companies include mid-size players with revenue of USD 5 to 20 million having presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge. These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Avril Group, Solenis, Reachin Chemical Co.,Ltd, Lotion crafter LLC,, Mohini Organics Pvt. Ltd., Camden-grey Essential Oils, and Guangzhou Runhua Food Additive Co.,

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche demand space having revenue below USD 5 million. These companies are notably oriented towards fulfilling local marketplace demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized field, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

Moreover, forming strategic partnerships with research institutions, universities, and other industry players will help in sharing knowledge and resources. This collaborative approach can lead to innovative solutions and a stronger market presence.

The table below highlights revenue from product sales in key countries. The United States and China are predicted to remain top consumers, with estimated trade valuations of USD 128.5 million and USD 80.3 million, respectively, by 2035.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 128.5 million |

| China | USD 80.3 million |

| Germany | USD 56.2 million |

| India | USD 40.2 million |

| Brazil | USD 24.1 million |

The following table shows the estimated growth rates of the top sales domains. India and Brazil are set to exhibit high polysorbate-80 consumption, recording CAGRs of 6.7% and 7.0%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.7% |

| China | 6.0% |

| Germany | 6.3% |

| India | 6.7% |

| Brazil | 7.0% |

The ecosystem for Polysorbate-80 in the United States is projected to exhibit a CAGR of 5.7% during the assessment period. By 2035, revenue from the sales of polysorbate-80 in the country is expected to reach USD 128.5 million.

Polysorbate-80 is a all rounder ingredient that has an important part to play in various food applications from baked goods to dairy products. Its ability as an to blend oil and water smoothly to further improve the texture and consistency of products like salad dressings, sauces, and ice creams. It improves the stability of food formulations, with avoids ingredient separation and extends shelf life which is important for companies planning at maintaining product quality over time. Its status as Generally Recognized As Safe (GRAS) by regulatory bodies motivates food manufacturers to include Polysorbate-80 into their products.

Polysorbate-80 demand in China is calculated to rise at a value CAGR of 6.0% during the forecast period (2025 to 2035). By 2035, China is expected to account for 43.2% of Polysorbate-80 sales in East Asia.

The food industry of China is growing quickly which is leading to a higher demand for effective emulsifiers like Polysorbate-80. At the same time, the cosmetics and personal care market in the country is also expanding which is driven by individuals interest in beauty products. Polysorbate-80 is commonly used in these products to create smooth textures and stable mixtures which further makes sure that creams and lotions feel nice on the skin.

Polysorbate-80 demand in Brazil is calculated to rise at a value CAGR of 7.0% during the forecast period (2025 to 2035).

In Brazil there is a growing interest in functional foods and dietary supplements usually requires emulsifiers like Polysorbate-80 to improve how well the body absorbs nutrients further making them more effective for consumers. At the same time, Brazil's food industry is expanding quickly, which has lead to a higher demand for emulsifiers to improve the texture and stability of various food items.

| Segment | Value Share (2025) |

|---|---|

| Animal Based (Source) | 31.4% |

Niche markets are becoming more popular, especially in areas like specialty foods and high end cosmetics. In these markets animal based ingredients like Polysorbate-80 is usually valued for their quality and effectiveness. Consumers in these segments are willing to pay more for products that use premium ingredients believing that they offer better results. This motivate companies to include animal-based Polysorbate-80 in their formulations as it can improve the overall performance of their products.

| Segment | Value Share (2025) |

|---|---|

| Pharmaceutical (Application) | 24.1% |

In many types of pharmaceutical items Polysorbate-80 is used. Like in injectables, oral medications and topical creams which further helps them in improving the quality and effect of these formulations. This versatility makes it a important choice for companies looking to mkae genuine and effective medicines.

As biopharmaceutical industry is growing and so is is the demand for ingredients like Polysorbate-80. Biopharmaceuticals and biologics usually need special formulation methods to make sure they work properly. Polysorbate-80 works as an effective emulsifier, which further helps to stabilize these complicated products and making them safer and more effective for patients.

Companies in the Polysorbate-80 industry are focusing on research and development to find new uses for this ingredient, especially in biopharmaceuticals and functional foods. This helps them reach more customers and stay competitive. They are also forming strategic partnerships with other manufacturers and research institutions to share knowledge and resources, which can lead to better products. Additionally, many companies are looking to expand into emerging markets like Asia-Pacific and Latin America, where the demand for Polysorbate-80 is increasing.

This segment is further categorized into plant based, animal based, and synthetic.

This segment is further categorized into emulsifier, dispersant, solubilize , surfactant, and stabilizer.

This segment is further categorized into food & beverage, pharmaceutical, nutraceutical, cosmetics & personal care, and agrochemical.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Polysorbate-80 industry is estimated at a value of USD 425.4 million in 2025.

Sales of Polysorbate-80 increased at 5.9% CAGR between 2020 and 2024.

BASF Corporation, Croda International plc, Evonik, DuPont Nutrition & Health, Dow Corning Corporation, Beldem, and Lonza Group Limited are some of the leading players in this industry.

The East Asia domain is projected to hold a revenue share of 23.7% over the forecast period.

North America holds 34.1% share of the global demand space for Polysorbate-80.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2016 to 2032

Table 2: Global Market Volume (Litre) Forecast by Region, 2016 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 4: Global Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 6: Global Market Volume (Litre) Forecast by Application, 2016 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 8: North America Market Volume (Litre) Forecast by Country, 2016 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 10: North America Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 12: North America Market Volume (Litre) Forecast by Application, 2016 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 14: Latin America Market Volume (Litre) Forecast by Country, 2016 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 16: Latin America Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 18: Latin America Market Volume (Litre) Forecast by Application, 2016 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 20: Europe Market Volume (Litre) Forecast by Country, 2016 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 22: Europe Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 24: Europe Market Volume (Litre) Forecast by Application, 2016 to 2032

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 26: Asia Pacific Market Volume (Litre) Forecast by Country, 2016 to 2032

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 28: Asia Pacific Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 30: Asia Pacific Market Volume (Litre) Forecast by Application, 2016 to 2032

Table 31: Middle East and Africa(MEA) Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 32: Middle East and Africa(MEA) Market Volume (Litre) Forecast by Country, 2016 to 2032

Table 33: Middle East and Africa(MEA) Market Value (US$ Million) Forecast by Source, 2016 to 2032

Table 34: Middle East and Africa(MEA) Market Volume (Litre) Forecast by Source, 2016 to 2032

Table 35: Middle East and Africa(MEA) Market Value (US$ Million) Forecast by Application, 2016 to 2032

Table 36: Middle East and Africa(MEA) Market Volume (Litre) Forecast by Application, 2016 to 2032

Figure 1: Global Market Value (US$ Million) by Source, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2016 to 2032

Figure 5: Global Market Volume (Litre) Analysis by Region, 2016 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 9: Global Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 13: Global Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 16: Global Market Attractiveness by Source, 2022 to 2032

Figure 17: Global Market Attractiveness by Application, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Source, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 23: North America Market Volume (Litre) Analysis by Country, 2016 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 27: North America Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 31: North America Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Market Attractiveness by Source, 2022 to 2032

Figure 35: North America Market Attractiveness by Application, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Source, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 41: Latin America Market Volume (Litre) Analysis by Country, 2016 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 45: Latin America Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 49: Latin America Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Source, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Source, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 59: Europe Market Volume (Litre) Analysis by Country, 2016 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 63: Europe Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 67: Europe Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 70: Europe Market Attractiveness by Source, 2022 to 2032

Figure 71: Europe Market Attractiveness by Application, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Market Value (US$ Million) by Source, 2022 to 2032

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 77: Asia Pacific Market Volume (Litre) Analysis by Country, 2016 to 2032

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 81: Asia Pacific Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 85: Asia Pacific Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: Asia Pacific Market Attractiveness by Source, 2022 to 2032

Figure 89: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 90: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East and Africa(MEA) Market Value (US$ Million) by Source, 2022 to 2032

Figure 92: Middle East and Africa(MEA) Market Value (US$ Million) by Application, 2022 to 2032

Figure 93: Middle East and Africa(MEA) Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: Middle East and Africa(MEA) Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 95: Middle East and Africa(MEA) Market Volume (Litre) Analysis by Country, 2016 to 2032

Figure 96: Middle East and Africa(MEA) Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East and Africa(MEA) Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East and Africa(MEA) Market Value (US$ Million) Analysis by Source, 2016 to 2032

Figure 99: Middle East and Africa(MEA) Market Volume (Litre) Analysis by Source, 2016 to 2032

Figure 100: Middle East and Africa(MEA) Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 101: Middle East and Africa(MEA) Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 102: Middle East and Africa(MEA) Market Value (US$ Million) Analysis by Application, 2016 to 2032

Figure 103: Middle East and Africa(MEA) Market Volume (Litre) Analysis by Application, 2016 to 2032

Figure 104: Middle East and Africa(MEA) Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 105: Middle East and Africa(MEA) Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 106: Middle East and Africa(MEA) Market Attractiveness by Source, 2022 to 2032

Figure 107: Middle East and Africa(MEA) Market Attractiveness by Application, 2022 to 2032

Figure 108: Middle East and Africa(MEA) Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA