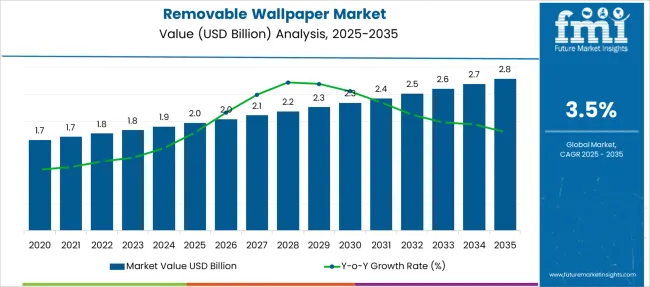

The Removable Wallpaper Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Removable Wallpaper Market Estimated Value in (2025 E) | USD 2.0 billion |

| Removable Wallpaper Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The removable wallpaper market is experiencing strong growth momentum as consumers increasingly seek versatile and damage-free décor options that align with temporary living arrangements and modern design trends. The market is being propelled by rising urbanization, the growth of the rental housing sector, and demand for easy-to-apply interior finishes that require no professional installation.

A growing emphasis on home personalization, especially among younger demographics and urban dwellers, is contributing to the adoption of peel-and-stick wallpapers across various aesthetic themes and surface types. Technological advancements in adhesives and printing techniques have significantly improved the durability, repositionability, and finish quality of removable wallpapers, further enhancing their appeal.

Additionally, the growing influence of digital content and social media inspiration is shaping purchasing behavior, with consumers now seeking quick design refreshes that do not damage walls With interior renovation cycles becoming shorter and more design-driven, the market is anticipated to expand steadily, supported by innovation in eco-friendly materials and growing access through online platforms.

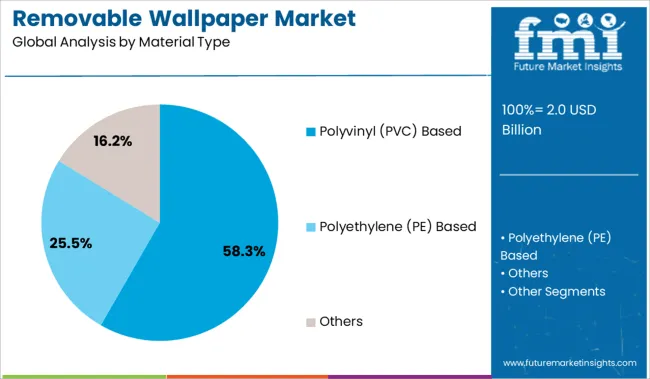

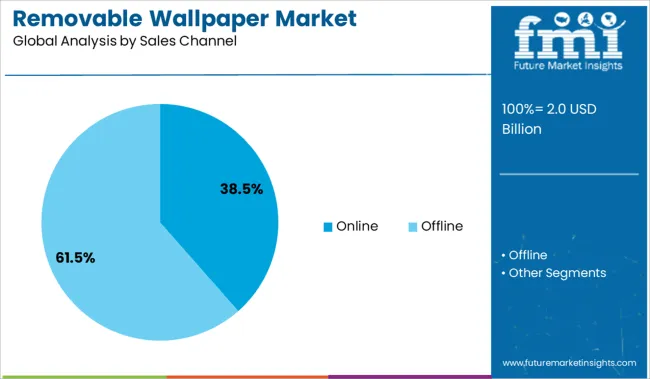

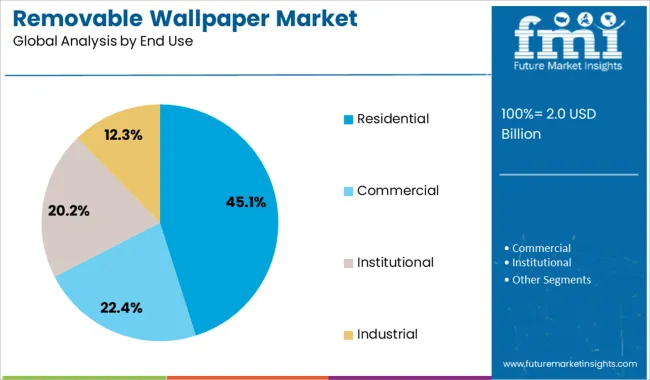

The market is segmented by Material Type, Sales Channel, and End Use and region. By Material Type, the market is divided into Polyvinyl (PVC) Based, Polyethylene (PE) Based, and Others. In terms of Sales Channel, the market is classified into Online and Offline. Based on End Use, the market is segmented into Residential, Commercial, Institutional, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyvinyl PVC based materials are projected to contribute 58.3% of the total revenue share in the removable wallpaper market in 2025, making it the most dominant material type. This leading position is being supported by the inherent flexibility, moisture resistance, and cost efficiency of PVC, which make it highly suitable for both kitchens and bathrooms, as well as living spaces.

PVC based wallpapers have been preferred for their smooth surface, ease of printing, and compatibility with vibrant designs and finishes, enabling a broader range of aesthetic applications. Their strong peel-and-stick adhesion properties, combined with durability against humidity and abrasion, have enhanced their usability in high-traffic areas and across diverse climatic conditions.

Manufacturers have increasingly adopted this material due to its ability to retain color integrity and pattern detail over time, supporting longer product lifecycles Furthermore, developments in non-toxic, phthalate-free PVC formulations are addressing environmental and safety concerns, reinforcing the segment’s relevance in residential and commercial markets alike.

Online sales channels are expected to hold 38.5% of the removable wallpaper market revenue share in 2025, reflecting the increasing role of digital platforms in driving consumer purchases. This growth has been influenced by the rising demand for convenience, customization, and wider product selection available through e commerce websites and direct to consumer portals.

Online platforms have enabled manufacturers and retailers to showcase extensive wallpaper designs, simulate virtual previews, and offer tailored options based on room size and decor preferences, thereby enhancing the buying experience. Consumer behavior has also shifted toward home improvement purchases through mobile and web-based platforms, accelerated by digital marketing and social media engagement.

Moreover, efficient logistics networks and flexible return policies have reduced purchase friction and encouraged experimentation with temporary decor solutions The rise in influencer-led trends and online design communities has played a vital role in increasing awareness and conversion rates for digitally distributed removable wallpapers, strengthening the long-term viability of this channel.

The residential sector is forecast to account for 45.1% of the overall revenue share in the removable wallpaper market in 2025, maintaining its position as the largest end use segment. This leadership is being driven by the increasing popularity of DIY interior design, the growing urban population living in rental properties, and the demand for affordable home aesthetics.

Consumers in residential settings are opting for peelable wallpapers as a non invasive alternative to traditional paints or permanent wallpapers, particularly in bedrooms, living rooms, and nurseries. The segment’s expansion is further supported by changing lifestyle patterns, including frequent relocation and shorter lease tenures, which encourage investment in temporary yet impactful design solutions.

Enhanced product availability in home improvement retail chains and online platforms has also increased accessibility for homeowners and tenants alike In addition, the ability to frequently change styles to align with seasonal trends or personal preferences is contributing to sustained demand for removable wallpapers in residential applications.

The increasing demand for soundproof transportation in trains is anticipated to drive the removable wallpaper market positively. The automotive industry has been witnessing maximum pace over the last decade owing to the penetration of globalization in the world, pushing the sales of removable wallpaper.

The growing automotive industry is projected to bolster the demand for Removable wallpaper in the near future.

The removable wallpaper has a wide range of applications in household activities. The increasing concern towards household hygiene is expected to bolster the demand for removable wallpaper and increase the removable wallpaper market size.

High prices and the inability to be remolded, reshaped, or recycled, which makes Removable wallpaper difficult to discard, are the restraining factors for the Removable wallpaper market that hampers the market growth, increasing the demand for removable wallpaper.

On the regional front, Asia Pacific is the most dominant market for Removable Wallpaper. The demand for Removable Wallpaper is primarily from the Indian and Chinese markets, where there is robust construction activity in both the residential as well as commercial sectors.

The demand for removable wallpaper is further induced by the fact that most of the population which has settled in this country is of a floating nature, fuelling the sales of removable wallpaper.

North America is the second most dominant market for removable wallpaper products due to the increasing number of hotels in the region to cater to the hospitality needs emanating on account of the flourishing inbound as well as outbound tourism.

The Middle East is also expected to showcase growth in the market for removable wallpapers due to increased commercial and construction activity in the region.

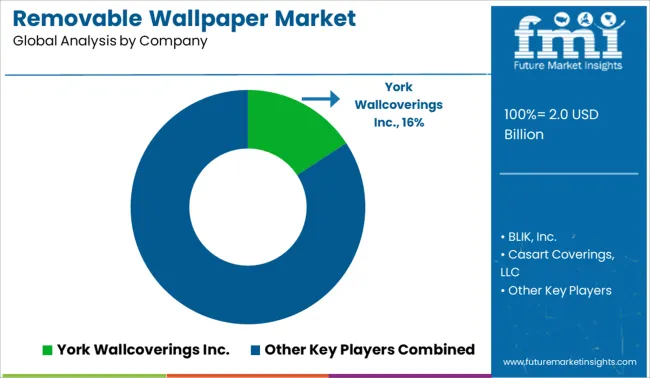

The key players in the removable wallpaper market are focusing on variety, sizes, designs, and quality, fueling the sales of removable wallpaper.

Key players in the removable wallpaper market include Blik Inc, Casart Coverings, Chasing Paper, EasyWallz, Graham & Brown, Propitious Jackson, Spoonflower Inc, Tempaper Designs, The McCall Pattern Company Inc (Wallcandy Arts), The Sherwin Williams Company, Wallpops, Walls By Me, Walls Need Love LLC, Wallternatives, Williams Sonoma Inc

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.5% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million, volume in kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Type, End Users, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom., France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa |

| Key companies profiled | Blik Inc; Casart Coverings; Chasing Paper; EasyWallz; Graham & Brown; Propitious Jackson; Spoonflower Inc; Tempaper Designs; The McCall Pattern Company Inc (Wallcandy Arts); The Sherwin Williams Company; Wallpops; Walls By Me; Walls Need Love LLC; Wallternatives; Williams Sonoma Inc |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global removable wallpaper market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the removable wallpaper market is projected to reach USD 2.8 billion by 2035.

The removable wallpaper market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in removable wallpaper market are polyvinyl (pvc) based, polyethylene (pe) based and others.

In terms of sales channel, online segment to command 38.5% share in the removable wallpaper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Removable Partial Dentures Market Analysis by Cast Metal Partial Dentures, Flexible Partial Dentures, and Tooth Flipper through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA