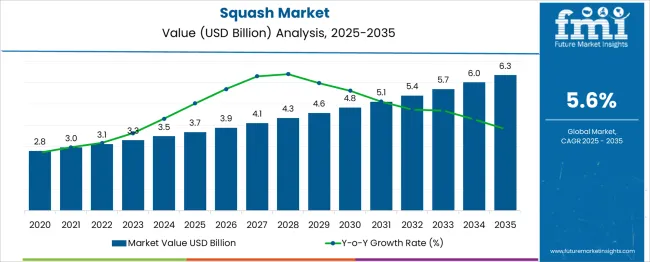

The Squash Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Between 2025 and 2030, growth is expected to follow a stable pattern, with annual value increases ranging between USD 0.2 and 0.3 billion. This phase reflects moderate demand improvements across food retail and foodservice channels, supported by expanding cold chain logistics in selected Asian and African countries. However, acceleration during this half-decade is expected to remain limited due to region-specific production challenges and the perishable nature of the crop, which restricts storage and long-distance trade. Consumer preferences for local and seasonal produce in North America and Europe are also expected to limit broader adoption. From 2030 to 2035, the market is forecasted to enter a short phase of mild acceleration, driven by improved yield optimization techniques, varietal diversification, and wider penetration of controlled farming practices. Annual value gains during this phase rise incrementally to nearly USD 0.4 billion by the end of the period. However, post-2033, the growth curve is expected to gradually flatten, indicating a deceleration phase linked to regional saturation, weather-related yield risks, and price sensitivity in low-income markets. This shift toward stabilization suggests a transition from rapid value additions to steady, input-driven volume management.

| Metric | Value |

|---|---|

| Squash Market Estimated Value in (2025 E) | USD 3.7 billion |

| Squash Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The squash beverage market makes up approximately 20–25 % of the global fruit concentrate and beverage mix segment, reflecting its role as a diluted fruit concentrate product. It holds around 15–18 % of the instant drink and cordial market, where consumers favor customizable servings. Within the functional and ready-to-serve natural beverage category, its share is estimated at 10–12 %, supported by sugar-free and botanical-infused variations. In the healthy beverage alternatives market, squash beverages contribute 8–10 %, driven by demand for low-calorie natural refreshers.

Distribution through supermarkets and hypermarkets accounts for roughly 60–65 %, while specialty health stores cover about 10–12 %. Online retail presence remains under 5 %, though it is growing. Many brands now offer zero-sugar or sugar-reduced squash varieties using natural sweeteners and fruit based botanical extracts. Expansion of flavor lines featuring exotic fruits, herbal infusions and low-GI formulations is broadening appeal among health conscious consumers.

Manufacturers are leveraging digital marketing and direct-to-consumer sales to tap e-commerce growth and niche demographics. Packaging innovations, such as recyclable or lightweight bottles, support sustainability goals and reduce material use. Regional sourcing of tropical and local fruits is gaining traction to lower carbon footprints and resonate with eco-aware shoppers. These trends demonstrate a shift toward cleaner ingredient profiles, flavor innovation, and eco-efficient distribution in squash beverage offerings.

The squash market is benefiting from growing consumer interest in plant-based nutrition, increasing adoption of functional foods, and a rise in demand for seasonal and locally sourced produce. Health-conscious consumers are increasingly turning to squash as a rich source of vitamins, fiber, and antioxidants, especially in regions focused on diet diversification and wellness trends.

Additionally, improved cold chain infrastructure and packaging innovations have helped maintain freshness and expand distribution across retail and foodservice sectors. The market is also being supported by the proliferation of squash-based offerings in ready-to-eat meals, baked goods, and snacks, driven by urbanization and convenience-based consumption.

Government-supported agricultural programs, alongside the development of hybrid varieties with longer shelf life and disease resistance, are enhancing yield efficiency and stimulating market penetration globally.

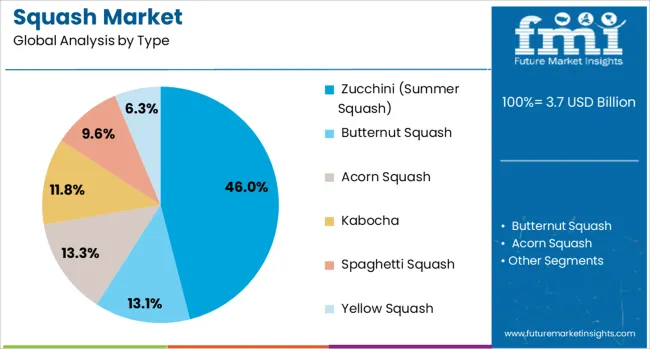

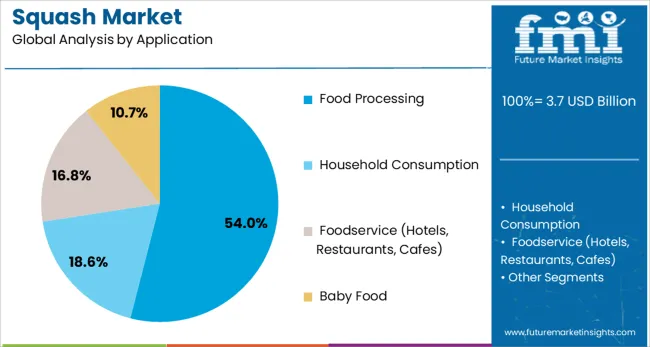

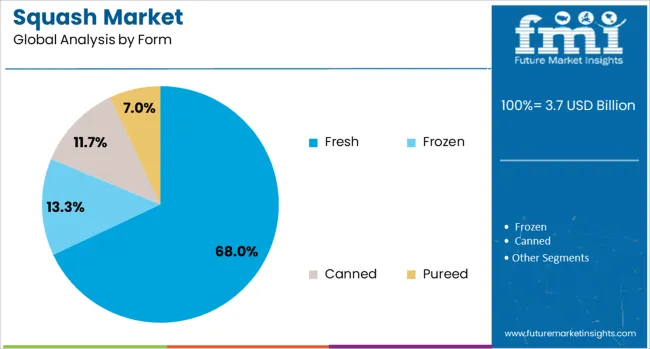

The squash market is segmented by type, application, form, distribution channel, and geographic regions. The type of squash market is divided into Zucchini (Summer Squash), Butternut Squash, Acorn Squash, Kabocha, Spaghetti Squash, and Yellow Squash. The squash market is classified into Food Processing, Household Consumption, Foodservice (Hotels, Restaurants, Cafes), and Baby Food. The squash market is segmented into Fresh, Frozen, Canned, and Pureed. The squash market is segmented by distribution channel into Supermarkets/Hypermarkets, Grocery Stores, Online Retail, Farmers' Markets, and Specialty Stores. Regionally, the squash industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Zucchini (summer squash) is anticipated to account for 46.0% of the squash market revenue by 2025, making it the dominant type segment. Its popularity stems from its versatility, mild flavor, and short cooking time, making it ideal for a wide range of cuisines and dietary needs.

High consumer demand in both fresh and processed formats, especially in North America and Europe, has made zucchini a staple in plant-based diets. Moreover, its suitability for grilling, sautéing, baking, and spiralizing into low-carb pasta alternatives has contributed to its appeal among health-conscious consumers and foodservice providers alike.

Cultivation advancements and increased consumer education on its nutritional benefits are further bolstering market demand.

Food processing is projected to represent 54.0% of the squash market by 2025, positioning it as the leading application segment. This growth is driven by the incorporation of squash in soups, sauces, baby food, frozen meals, and baked products.

Its smooth texture, nutrient density, and adaptable flavor profile make squash particularly suitable for value-added processing. Demand from convenience food producers and institutional kitchens is increasing due to squash’s role in clean-label and gluten-free formulations.

In addition, the shift toward sustainable food sources and reduction of food waste has encouraged processing units to utilize overripe or second-grade produce, extending the utility and profitability of squash within this segment.

The fresh form segment is expected to command 68.0% of the squash market by 2025, emerging as the leading distribution format. Rising consumer preference for unprocessed and locally grown vegetables is significantly contributing to this trend.

The surge in farmers' markets, CSA (Community Supported Agriculture) programs, and farm-to-table restaurant sourcing has led to greater consumption of fresh squash. Enhanced shelf life through modified atmosphere packaging (MAP), coupled with improved cold storage logistics, has further strengthened the supply chain.

Fresh squash also aligns with organic and minimally processed food trends, making it a preferred choice among both households and professional kitchens.

Global production of squash (including gourds and pumpkins) exceeded 23 million tonnes in 2022, led by China with roughly one third of total output. Export volumes have remained around 1.7 million tonnes annually, with Mexico and Spain accounting for nearly 60% of global shipments. Demand has been driven by health-conscious consumer preferences, versatility in culinary uses (both summer and winter varieties), and growing adoption in emerging markets such as India and Bangladesh. Innovations in packaging and fresh produce distribution have supported steady market expansion.

Squash cultivation has been concentrated in Asia, with China producing about 32% of global volume. Secondary production hubs include Ukraine, Russia, and the United States, each contributing over one million tonnes annually. Total production rose slightly between 2021 and 2022, settling around 23 to 23.4 million tonnes. Export activity has hovered near 1.7 million tonnes per year, with major exporters like Mexico and Spain together supplying nearly 60% of volume. Export value has grown at a modest annual rate, with fluctuations observed between 2013 and 2023. China has posted the highest value gains among exporters. The market has remained stable in terms of volume, though exhibit occasional volatility tied to seasonal production and trade dynamics.

Consumer demand for squash has been boosted by rising health and wellness awareness. Squash varieties—such as zucchini, butternut, acorn, and mixed-fruit sorbets—are valued for low calorie content, dietary fiber, and nutrient-rich profiles. Summer squash (e.g. zucchini) has been popular in diet-conscious cooking and light meals. Winter squash varieties like butternut and kabocha are favored for seasonal consumption in soups, roasted dishes, and vegan meal replacements. Product innovation has extended to value-added processing, including sugar-free squash cordials, herbal-infused concentrates, and ready-to-use cubes. These formats cater to convenience-led lifestyles and clean-label preferences, while addressing consumer demand for plant-based nutrition across global foodservice and retail channels.

Despite broad demand, squash market growth has been constrained by seasonality and distribution challenges. Fresh squash requires reliable cold chain infrastructure to maintain quality from farm to point of sale, particularly for bulky winter varieties. Pricing tends to vary by region and season; squash produced in major centers often benefits from wholesale networks, whereas remote markets face higher logistics costs. Smaller producers in developing regions often lack formal distribution access, reducing availability in urban retail formats. Organic and certified seed lines also carry premium costs, limiting adoption among smallholders. Seed supply fragmentation and variable germination performance have impacted varietal consistency. These structural barriers have held back consistent varietal penetration and limited scalability in some emerging agriculture zones.

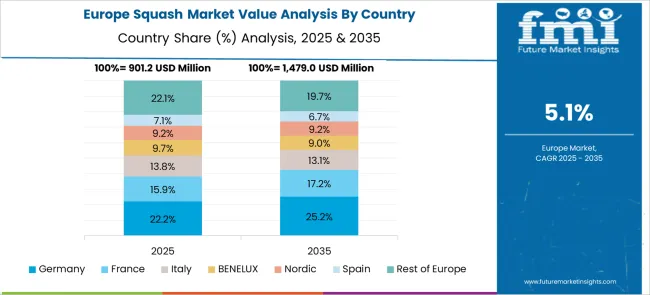

Regional demand for squash shows diverse patterns. Europe accounts for a significant share of import volume, with France leading at around 22% of total pepper/squash imports, followed by Germany and the UK. France alone imports roughly 165,000 tonnes annually, with courgettes comprising over 90% of that volume. Asia-Pacific dominates production and consumption, led by China, India, and Bangladesh. Latin America and Africa are gradually expanding consumption via regional markets and export-linked systems. Opportunities exist in branded seed varieties, organic premium lines, and through processed squash formats in foodservice. Agro-industrial integration and crop rotation strategies in emerging agri-zones are creating openings for value chain expansion, especially in heritage cultivar and drought-tolerant seeds aligned with regenerative farming practices.

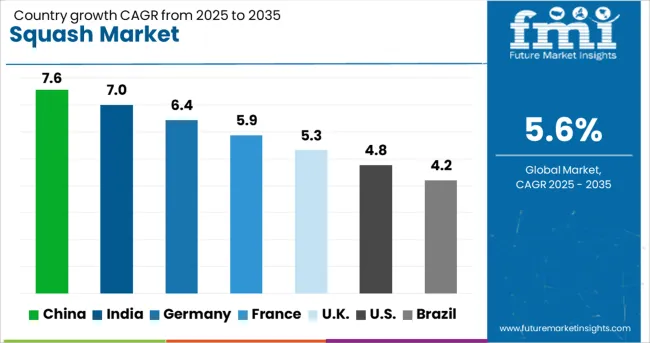

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global squash market is projected to expand at a CAGR of 5.6% between 2025 and 2035. China, with a CAGR of 7.6%, remains the largest contributor, followed by India at 7.0% and France at 5.9%. These countries are growing 36%, 25%, and 5% faster than the global average respectively. The United Kingdom and the United States are expanding at 5.3% and 4.8%, showing slower yield optimization and weaker processing infrastructure. Asia has observed accelerated mechanization and agri-logistics upgrades, while North American growers continue to rely on traditional seasonal operations. Countries with vertical farming initiatives and cold chain investments are registering higher throughput and market integration. Five key country-level insights are detailed below, with broader insights available across 40+ nations in the complete dataset.

China is projected to grow at a CAGR of 7.6% during 2025 to 2035 in the squash market. High-yield hybrid seed deployment has been expanded across key provinces, supported by government-led seed trials and farm extension programs. Mechanized farming and solar-powered irrigation have allowed multi-cropping cycles to emerge in Hebei, Henan, and Sichuan. Value-added squash pulp and puree exports have gained demand from Southeast Asian buyers. Seasonal labor substitution by automated harvesting in select zones has improved consistency in supply and packaging. Export volumes have steadily grown, reinforced by traceability systems implemented for phytosanitary compliance.

Market Demand for Squash in India India is forecast to record a CAGR of 7.0% between 2025 and 2035 in the squash market. Cultivation expansion has been observed in Maharashtra, Karnataka, and Andhra Pradesh where government seed subsidies and soil enrichment schemes have supported year-round farming. Growing domestic demand from juice processors and retail chains has encouraged direct procurement from cooperatives. Cold storage infrastructure has improved across Tier-2 cities, reducing post-harvest loss. Research stations in Tamil Nadu and Punjab are trialing climate-resilient squash strains, enabling greater yield predictability. India’s output remains consumption-driven, but exports to the Middle East have increased incrementally.

France is projected to grow at a CAGR of 5.9% from 2025 to 2035 in the squash market. Organic squash acreage has increased in Brittany and Nouvelle-Aquitaine, with market preference shifting toward low-input farming. Food cooperatives and regional brands have introduced vacuum-packed and sliced squash SKUs, targeting supermarkets and online grocery retailers. Subsidies for equipment modernization and rotation-based nutrient planning have improved farm efficiency. Biodiversity-focused regulations have pushed farms to adopt integrated pest management practices. Value chain partnerships have emerged between growers and gourmet retailers focusing on heirloom squash varieties.

Growth Analysis of Squash in the United Kingdom The United Kingdom is expected to expand at a CAGR of 5.3% from 2025 to 2035 in the squash market. Rising consumer interest in plant-based meals has driven demand from fresh produce suppliers. However, growers face challenges due to shorter growing seasons and limited protected farming infrastructure. Investments in LED-lit greenhouse units in Norfolk and Kent have enabled extended production periods. Local squash has gained popularity in foodservice menus focused on local sourcing. Supermarkets have introduced QR-coded traceability on some squash SKUs to improve origin transparency. Despite slower production growth, value addition continues through packaging and recipe-based retailing.

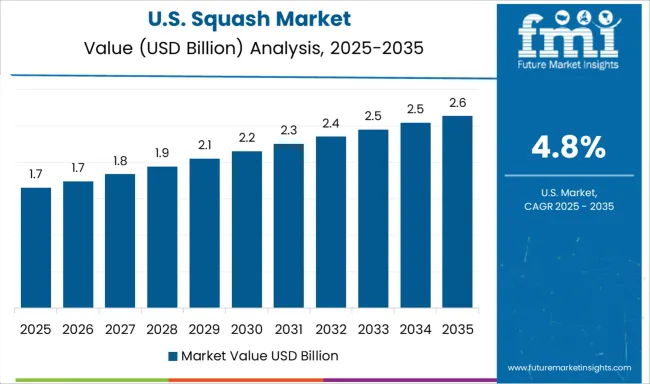

The United States is projected to grow at a CAGR of 4.8% from 2025 to 2035 in the squash market. Growth remains concentrated in California, Florida, and Georgia, where temperature zones support dual-season cropping. However, traditional growing methods and labor dependencies have limited mechanization. Imports from Mexico and Central America meet off-season demand. Domestic squash has been increasingly used in baby food, meal kits, and frozen blends. Processors are piloting pureed squash lines for institutional catering and school meal programs. Lack of nationwide cold chain coverage continues to affect uniform quality in retail delivery.

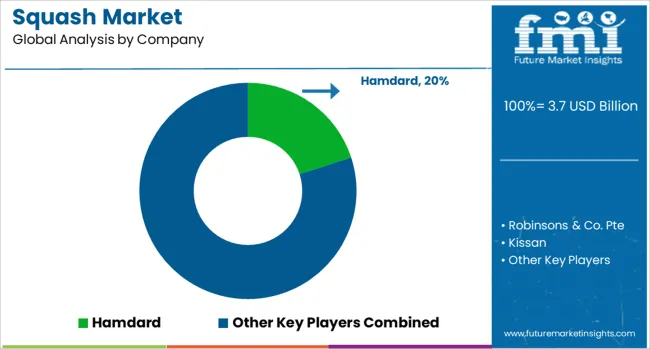

Hamdard has built strong regional dominance in the squash market with traditional fruit-based concentrates like Rooh Afza, targeting both retail and foodservice channels. Its focus on legacy formulations and seasonal marketing has maintained steady demand across South Asian markets. Robinsons & Co. Pte and Britvic plc have emphasized reduced-sugar squash variants and single-serve packaging formats to meet evolving consumer preferences in the UK and Southeast Asia.

Innovation in flavor combinations and wide retail availability have supported consistent brand visibility. Kissan, under Hindustan Unilever, offers fruit squash lines tailored to mass-market consumption, with distribution spanning urban and rural markets. Coca Cola and Tropicana (PepsiCo) have positioned squash variants as part of their juice-based portfolios, particularly in regions with high concentrate consumption. Rasna has retained relevance through value pricing, diverse flavor options, and strong recall among price-sensitive consumers.

Nichols Plc, known for Vimto, has expanded its squash offerings with export-driven strategies focused on the Middle East. Prigat, operating under Israel-based Gan Shmuel Group, markets squash drinks in both classic and exotic flavors. Suntory and Primor have focused on fruit-based beverages in Asian and Middle Eastern markets, using squash concentrates as a cost-efficient alternative to ready-to-drink juices.

Between 2023 and 2025, the squash market recorded notable growth, supported by technological innovation and rising global participation. Smart rackets with embedded sensors became more common, offering real-time performance data for training and gameplay optimization. Manufacturers shifted to eco-friendly materials, incorporating recycled composites to align with sustainability trends.

National federations adopted digital platforms for player tracking and tournament coordination. Increased exposure through youth development programs and squash’s upcoming inclusion in the Olympic Games significantly boosted demand across equipment, apparel, and court infrastructure segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Type | Zucchini (Summer Squash), Butternut Squash, Acorn Squash, Kabocha, Spaghetti Squash, and Yellow Squash |

| Application | Food Processing, Household Consumption, Foodservice (Hotels, Restaurants, Cafes), and Baby Food |

| Form | Fresh, Frozen, Canned, and Pureed |

| Distribution Channel | Supermarkets/Hypermarkets, Grocery Stores, Online Retail, Farmers' Markets, and Specialty Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hamdard, Robinsons & Co. Pte, Kissan, Coca Cola, Rasna, Nichols Plc, Prigat, Britvic plc, Tropicana (PepsiCo), Suntory, and Primor |

The global squash market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the squash market is projected to reach USD 6.3 billion by 2035.

The squash market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in squash market are zucchini (summer squash), butternut squash, acorn squash, kabocha, spaghetti squash and yellow squash.

In terms of application, food processing segment to command 54.0% share in the squash market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Squash Drink Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA